- Home

- Archive: November, 2018

Analyze Your Trade Episode #57

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Jerremy Newsome of RealLifeTrading.com (first time guest!)

– Larry Gaines of PowerCycleTrading.com

– Andrew Keene of AlphaShark.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

Episode Timeline:

0:00 – Introductions.

6:20 – MSFT

13:50 – CGC

20:30 – ADBE

26:00 – SQ

32:00 – CVX

41:10 – C

46:30 – AAPL

54:20 – Trade ideas of the week.

59:00 – Closing statements.

Guest Special Offers:

From Larry: How to Profit From Market Volatility Interactive Encore Event

From Matt: Download This Book Today To Learn How To Trade Options Profitably

From Andrew: Get News Trade Alerts Daily!

From Jerremy: Create an account today and learn how to trade the market!

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT112718

Crowd Forecast News Episode #205

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Jim Kenney of OptionProfessor.com

– Norman Hallett of TheDisciplinedTrader.com

– John Thomas of MadHedgeFundTrader.com

– Michael Filighera of LogicalSignals.com (moderator)

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

6:20 – Questions #1 and #2; S&P500 Higher or Lower? Confidence?

19:50 – Question #3; Why?

30:20 – Question #4; What sort of hedging or portfolio protection strategies do you implement in your trading or investing?

42:40 – Responses to report comments section about newsletters.

54:20 – Trade ideas for the week and closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

From Michael: Free Pass to Candlelight Trading Trade Room

From Norman: The Disciplined Trader Mastery Program (Free Trial)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN112618

Crowd Forecast News Report #270

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport112518.pdf

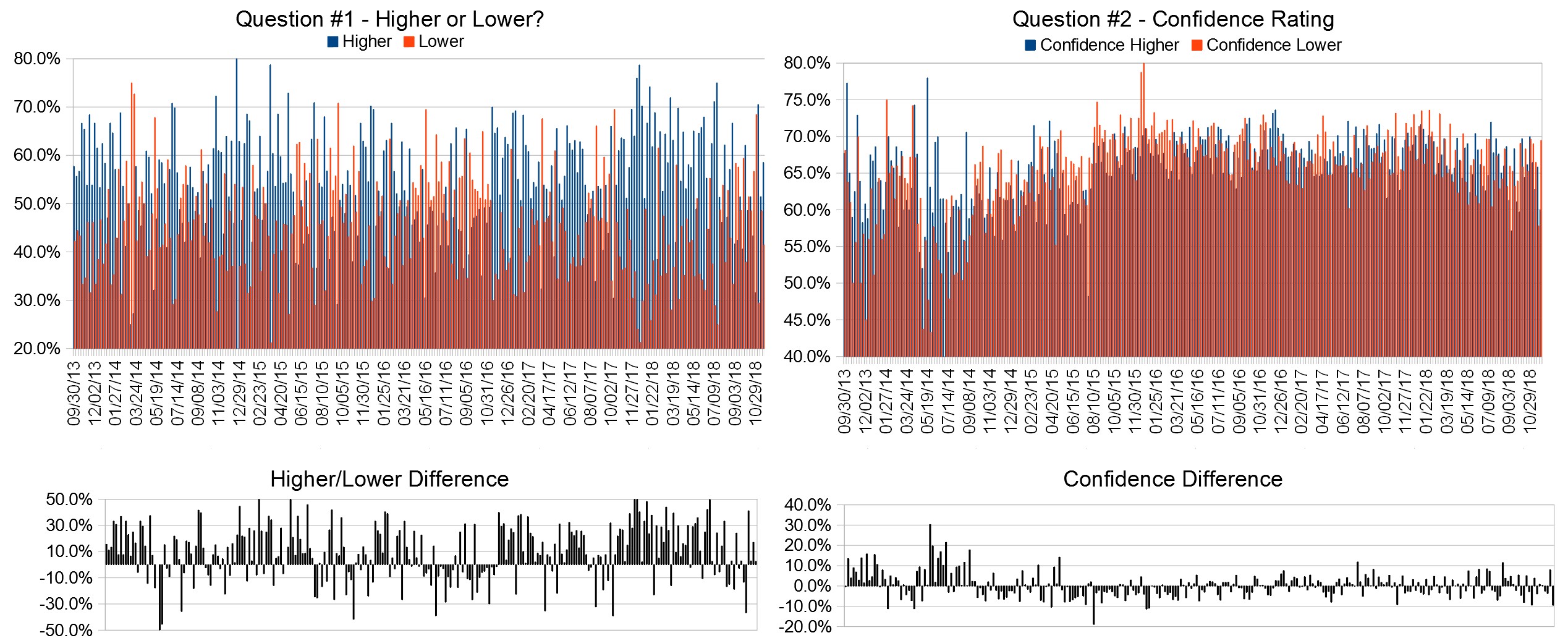

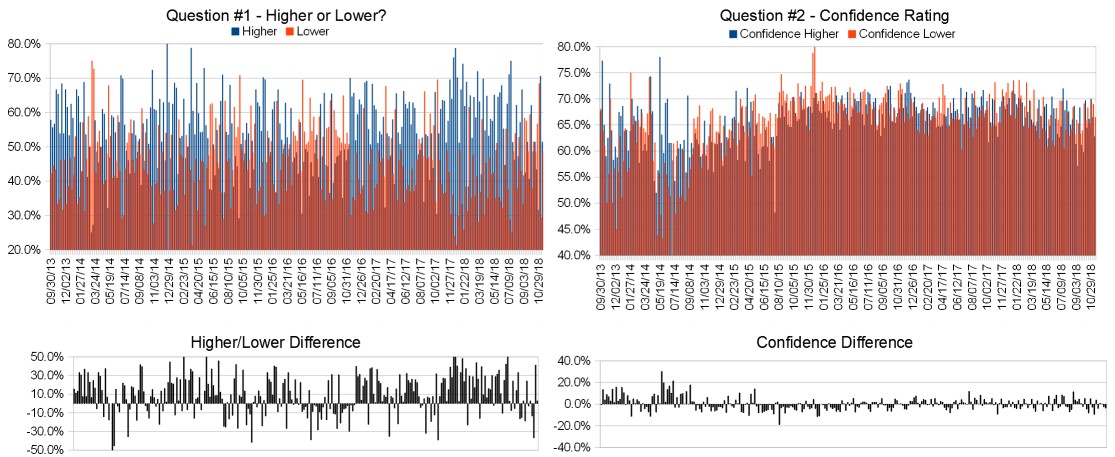

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 26th to 30th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 51.3%

Lower: 48.7%

Higher/Lower Difference: 2.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.7%

Average For “Higher” Responses: 60.0%

Average For “Lower” Responses: 69.5%

Higher/Lower Difference: -9.5%

Responses Submitted This Week: 41

52-Week Average Number of Responses: 45.1

TimingResearch Crowd Forecast Prediction: 69% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 58.5% Higher, and the Crowd Forecast Indicator prediction was 64% Chance Higher; the S&P500 closed 3.60% Lower for the week. This week’s majority sentiment from the survey is 51.3% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 13 times in the previous 269 weeks, with the majority sentiment being correct 69% of the time and with an average S&P500 move of 0.28% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 69% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

You Need This Woman In Your Life: The best part about Petra is not only can she locate and lock in reliable profits, she prides herself on eliminating risk and providing unparalleled educational services for her clients (learn more here).

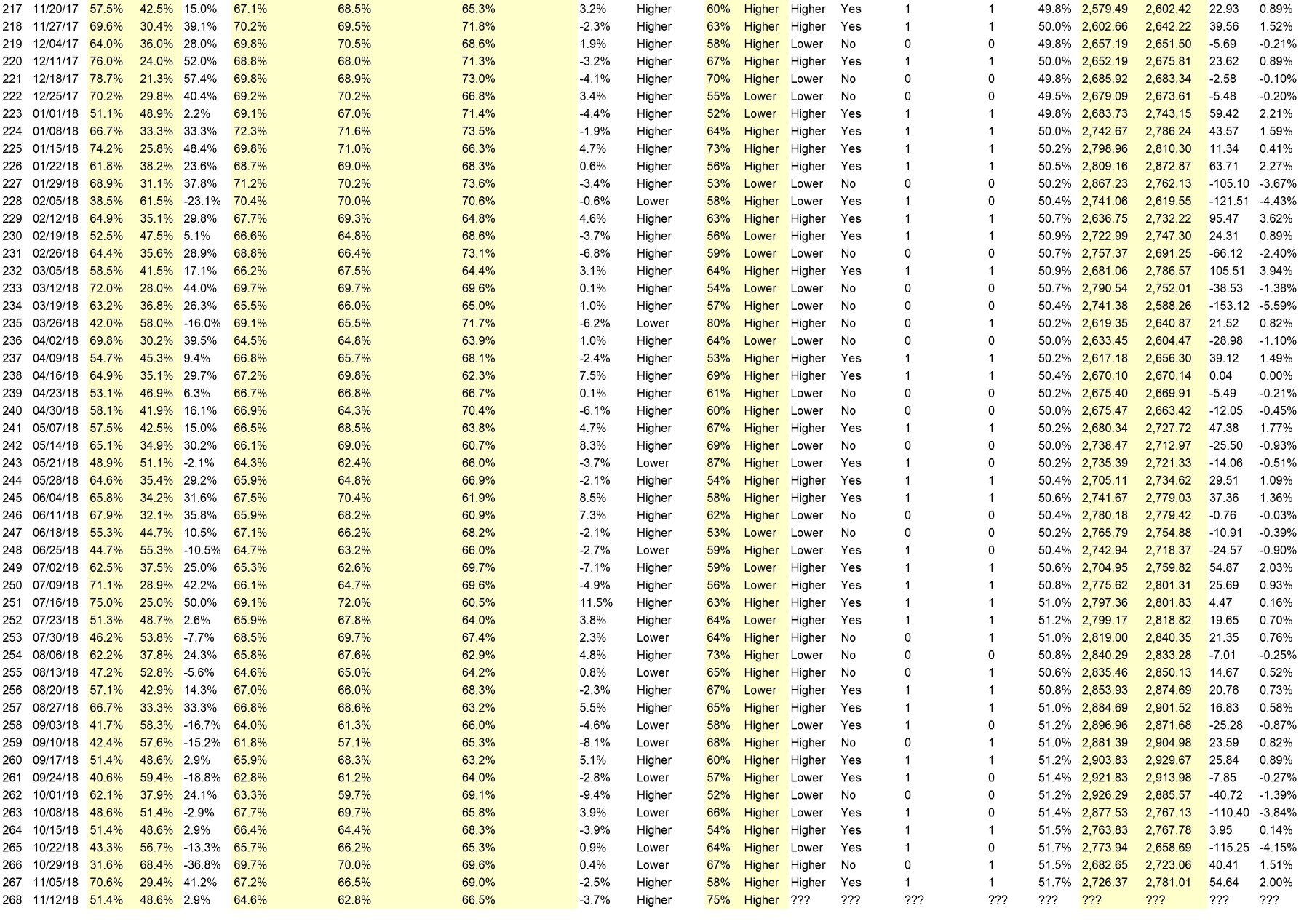

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.3%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Oil dropping is what some people like maybe

• Market Oversold

• toenadererig met china begin december

• Positive trade talks with China

• Oversold, Advance decline line, Accumulation distribution, COT index

• W shape

• over sold bounce

• dead cat bounce

• history

• oversold buy

• Oil stocks should get a deda cat bounce taking the S&P up

• Beginning of Santa Clause rally.

• Short term rally based on stochastics.

“Lower” Respondent Answers:

• Last week’s selloffs

• Market has been down trend for last three weeks and volitity high

• The index will probably test the February low 1530

• general feelings are negative

• Chart pattern in progress Tech sector will continue to see lower revised price targets

• rate of change growth metrics

• below the 200dma

• The downside correction continues until the public says “Just get me out”.

• The S&P tanked badly on Thanksgiving week (generally a plus week), and the FAANGS and financials show no desire to reverse up. The recent bounce pattern is that bounces are being sold.

• Trade concerns with China & G`20 meeting. Border confrontation

• year end selling, tax reasons also

Partner Offer:

You Need This Woman In Your Life: The best part about Petra is not only can she locate and lock in reliable profits, she prides herself on eliminating risk and providing unparalleled educational services for her clients (learn more here).

Question #4. What sort of hedging or portfolio protection strategies do you implement in your trading or investing?

• Covered Calls and Vertical Spreads

• monitor S&P very closely

• Puts

• went to cash

• Using options to hedge long term and core positions.

• buy the SQQQ——SH—–VXX CALLS—-SDS—SDOW—–Combination of these 5-10% of portfolio, 30% cash ,

• stop loss orders

• Covered calls

• Buy puts to hedge..

• Go preferred stocks etfs cefs

• However, I do not make any hedge.

• I close postns as my stops get hit

• VIXY

• cash optionality

• SDS Bull call spread out 2 weeks

• Short term put options on long positions

Question #5. Additional Comments/Questions/Suggestions?

• why are these newsetters telling us to buy and they the large investors, institutions, hedge funds are selling?

• keep up the good work.

• Looking forward to the webinar

• add inflation expectations

• Any credence to Raj call for 11/26 to be a swing low?

Join us for this week’s shows:

Crowd Forecast News Episode #205

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, November 26th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Norman Hallett of TheDisciplinedTrader.com

– John Thomas of MadHedgeFundTrader.com

– Michael Filighera of LogicalSignals.com (moderator)

Analyze Your Trade Episode #57

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, November 27th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Jerremy Newsome of RealLifeTrading.com (first time guest!)

– Larry Gaines of PowerCycleTrading.com

– Andrew Keene of AlphaShark.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

Partner Offer:

You Need This Woman In Your Life: The best part about Petra is not only can she locate and lock in reliable profits, she prides herself on eliminating risk and providing unparalleled educational services for her clients (learn more here).

Analyze Your Trade Episode #56

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

Episode Timeline:

0:00 – Introductions.

3:50 – CME

9:00 – X

13:10 – VXX

16:30 – FB

22:10 – GS

29:00 – PANW

33:30 – COST

39:30 – SEDG

41:00 – TLRY

43:00 – KEM

46:00 – TAL

50:10 – QQQ

53:30 – ISRG

56:10 – GOOG

1:00:00 – Closing statements.

Guest Special Offers:

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

From Neil: Enter Your Email for The Best ETF To Hold For the Next 10 Years Already up +20.41% in 2018

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

Other Partner Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals.

You’ll see how on this online training.

AYT112018

Crowd Forecast News Episode #204

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Larry Gaines of PowerCycleTrading.com

– John Hoagland of TopstepTrader.com

– Simon Klein of TradeSmart4x.com

– Michael Filighera of LogicalSignals.com (moderator)

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

8:40 – Question #1 and #2; Higher or Lower? Confidence?

16:40 – Question #3; Why?

29:00 – Which broker/platform is your favorite?

33:40 – Trade ideas of the week.

49:30 – Closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From John: Do you need more capital to trade? Get funded in as little as 15 days, click here.

From Larry: How to Profit From Market Volatility Interactive Encore Event

From Michael: Free Pass to Candlelight Trading Trade Room

From Simon: Build A Profitable Trading Strategy In 15 Mins

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN111918

Crowd Forecast News Report #269

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport111818.pdf

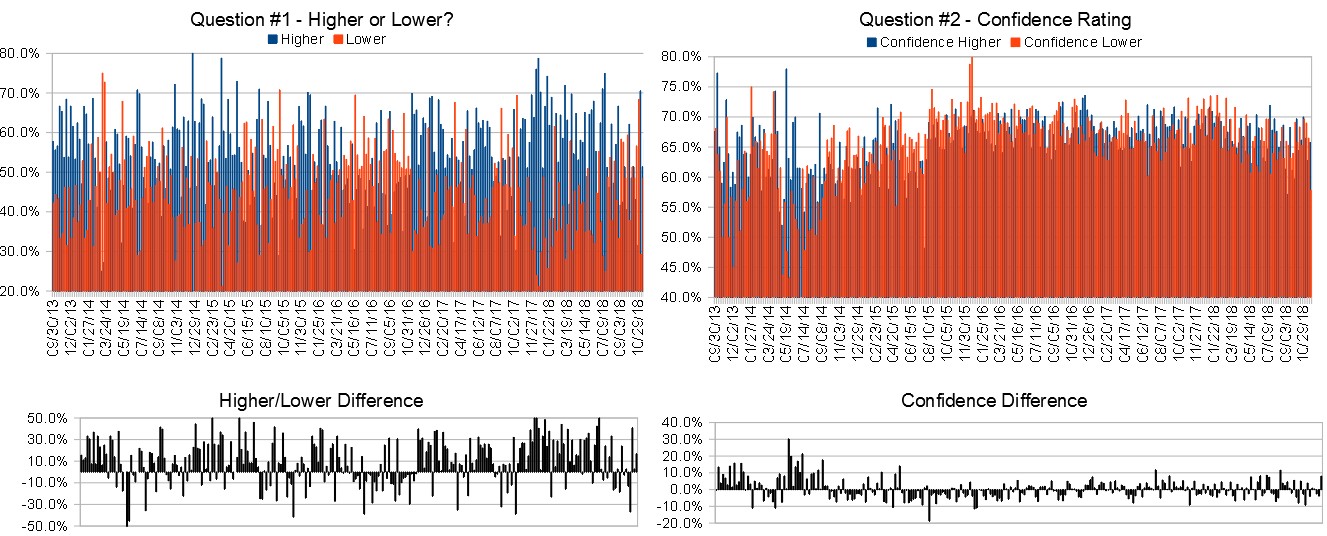

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 19th to 23rd)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 58.5%

Lower: 41.5%

Higher/Lower Difference: 17.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.9%

Average For “Higher” Responses: 65.8%

Average For “Lower” Responses: 57.8%

Higher/Lower Difference: 8.0%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 45.2

TimingResearch Crowd Forecast Prediction: 64% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.4% Higher, and the Crowd Forecast Indicator prediction was 75% Chance Higher; the S&P500 closed 1.36% Lower for the week. This week’s majority sentiment from the survey is 58.5% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 25 times in the previous 268 weeks, with the majority sentiment being correct 64% of the time and with an average S&P500 move of 0.33% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 64% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Gaps in technical charts of Dow, S&P and Nasdaq were filled on last Thursday. On economic fundamentals, US market should resume uptrend. Correction flushed out the froths. Market is very healthy now.

• Watching the chart and intuition

• The market is ripe for a rebound

• Sazonality

• Holidays

• Gut

• seasonal tendencies

• Thanksgiving week is usually an up week. The market held okay on Thurs & Fri, so some short-term upside is plausible.

• Best six months historically

• support

• higher low[week 11/2 compare to May ,April weeks]

• holiday seasonality

• pull back in an uptrend after the recent sell off low

• seasonality

• We need some sort of double top before the real bear market hits us.

“Lower” Respondent Answers:

• the COD are never right .

• I think we have passed a support level which is now resistance

• A trend has started.

• most traders off for the holiday week

• The downside correction will continue until the public says “just let me out”. Retail earnings and expectations should be a drag on the market.

• sellers in control

• Market seems range bound. Interest rate concerns.

• Market upswing runs out

• momentum weak

Partner Offer:

Did you ever think that becoming a professional trader is out of reach? Think again.

Click here to learn how.

TopstepTrader has funded more than 1,800 traders just like you with live trading capital. They take all the risk.

You keep the first $5,000 in profits and 80% thereafter.

Question #4. Which trading platform or broker do you like the best for executing your trades?

• thinkorswim

• Fidelity and TOS

• Trade Station

• Tradestation

• Using Charles Schwab now. Not entirely satisfied.

• Tradestation, Interactive brokers

• Tasty trade

• Interactive Brokers

• E-Trade

• ninja

• Sogo

• Ally.

• Fidessa my broker is ADM(UK)

• Tradestation

• TradeStation

• AMP – Ninja

• AMP and Sierra Charts

• ninja trader

Question #5. Additional Comments/Questions/Suggestions?

• I like that third party indications created for Think or Swim are better than when created for Tradestation

Join us for this week’s shows:

Crowd Forecast News Episode #204

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, November 19th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Larry Gaines of PowerCycleTrading.com

– John Hoagland of TopstepTrader.com

– Simon Klein of TradeSmart4x.com

– Michael Filighera of LogicalSignals.com (moderator)

Analyze Your Trade Episode #56

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, November 20th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

Partner Offer:

Did you ever think that becoming a professional trader is out of reach? Think again.

Click here to learn how.

TopstepTrader has funded more than 1,800 traders just like you with live trading capital. They take all the risk.

You keep the first $5,000 in profits and 80% thereafter.

Crowd Forecast News Episode #203

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Dave Landry of DaveLandry.com (moderator)

– John Thomas of MadHedgeFundTrader.com

– Jim Kenney of OptionProfessor.com

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

7:00 – Questions #1 and #2; Higher or Lower? Confidence?

18:10 – Question #3; Why?

39:20 – Question #4; Why are most traders not successful and consistent?

49:20 – Trade ideas of the week.

55:10 – Closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Dave: $100 Reusable Promo Code-Good For All Products At DaveLandry.com

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

Other Special Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals.

You’ll see how on this online training.

CFN111218

Crowd Forecast News Report #268

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport111118.pdf

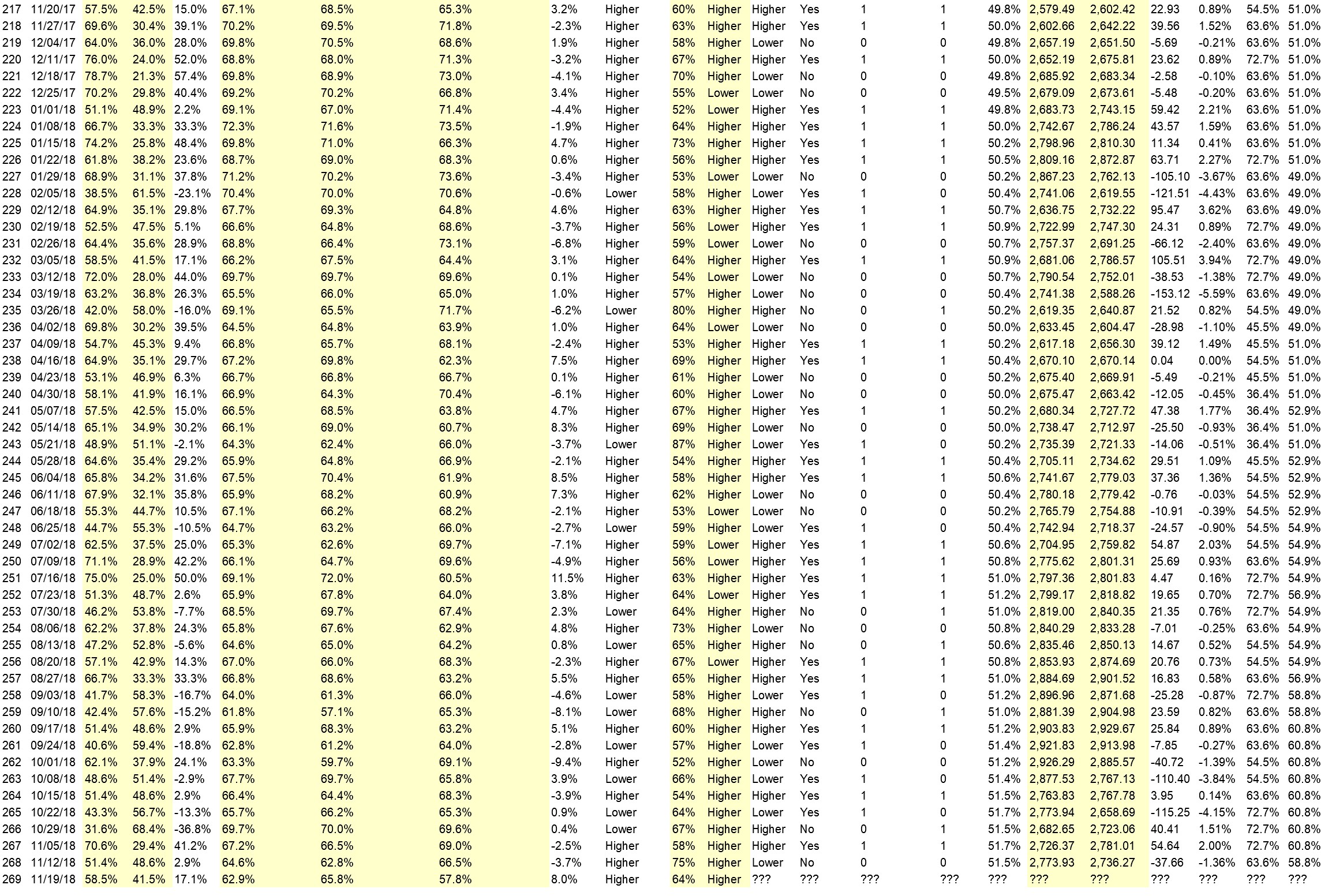

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 12th to 16th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 51.4%

Lower: 48.6%

Higher/Lower Difference: 2.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.6%

Average For “Higher” Responses: 62.8%

Average For “Lower” Responses: 66.5%

Higher/Lower Difference: -3.7%

Responses Submitted This Week: 37

52-Week Average Number of Responses: 45.2

TimingResearch Crowd Forecast Prediction: 75% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 70.6% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 2.00% Higher for the week. This week’s majority sentiment from the survey is 51.4% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 12 times in the previous 267 weeks, with the majority sentiment being correct 75% of the time and with an average S&P500 move of 0.41% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 75% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Wicker won

• Sazonality rebound with a bottom market situation.

• Earnings and holiday spending

• holidays

• Earnings reports.

• Seasonal …. strong month in November…. bullish overall ….

• Continued battle between bulls and bears, net up move into monthly expiration.

• history

• still buying

• Consumer confidence high Holiday spending will be up Possible trade agreement with China

• 2811 seems to be a good level for next week because of historical relevance of that level

“Lower” Respondent Answers:

• Current momentum downward will take some time to subside.

• Still in a down trend, below 50 SMA

• Mid-term elections are over, so seasonality factor is gone.

• spy below 277

• The downside correction continues until the public says “just get me out”.

• The S&P hit it’s weekly high on Thursday, then fell on Friday. This high was below the high of early October. This lower high suggests general market weakness. Concern about the Fed raising rates and tariffs is expected to continue.

• Feds next raise Wii send rates over 3%

• tariffs

• at resistance – sell rallies

• Elliot wave pattern

• Technicals turning over, plus a dearth of good news.

• The market was down last Thursday and Friday, Friday was bad.

Partner Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals.

You’ll see how on this online training.

Question #4. What do you think are the main reasons why most traders are not successful and consistent? What could the average trader do to improve consistency?

• need a rule set to follow that profits in up and down markets and most don’t have that.

• Protective put

• discipline –put stops in first-patience

• trade less often

• Emotion

• DK

• I am not a successful swing trader as my brain fools me into taking the better looking trades and not the 3/10 ones which usually work out :(

• short term thesis

• Jumping into trades too early (before enough evidence is in) is a common problem.

• Inconsistent practices plus no mechanism to handle small losses as part of a larger successful plan.

• Follow a plan.

• Not having trade plan, rules

• Bad strategy

• Jumping in and out at the wrong time, at too large a position. Traders can do better by paying attention to logic of market moves, e.g., when sellers and buyers exhaust themselves on down and up moves.

• Don’t have a trading plan and if they do they don’t follow it consistently.

• Traders are there worst enemy… by far …. plus too much CNBC

• Lack of discipline. Turn off CNBC/Bloomberg/StockTwits, etc. Trade to your plan.

Question #5. Additional Comments/Questions/Suggestions?

• Nothing noted

Join us for this week’s shows:

Crowd Forecast News Episode #203

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, November 12th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Dave Landry of DaveLandry.com (moderator)

– John Thomas of MadHedgeFundTrader.com

– Jim Kenney of OptionProfessor.com

AYT is off this week but will be back on 11/20!

Analyze Your Trade Episode #56

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, November 20th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– TBA

Partner Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals.

You’ll see how on this online training.

Analyze Your Trade Episode #55

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Michael Filighera of LogicalSignals.com

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

Episode Timeline:

0:00 – Introductions.

5:50 – AMD

13:10 – CRM

19:50 – SHOP

27:00 – MFC

45:00– AAPL

48:10 – MU

52:30 – LVS

55:50 – Closing statements.

Guest Special Offers:

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

From Michael: Free Pass to Candlelight Trading Trade Room

From Neil: Enter Your Email for The Best ETF To Hold For the Next 10 Years Already up +20.41% in 2018

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

Other Partner Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals.

You’ll see how on this online training.

AYT110618

Crowd Forecast News Episode #202

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Sean Kozak of NeuroStreet.com (first time guest!)

– Lee Harris of EmojiTrading.com

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

10:50 – Question #1; Higher or Lower?

12:30 – Questions #2 and #3; Confidence? Why?

39:50 – Question #4; What types of trading do you focus on and have you tried?

57:20 – Trade ideas for the week and closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Sean: “We Create Winning Traders!” Sign Up for Free Trade Room Guest Pass

From Lee: Emoji Trading Order Flow Suite Trial

From Rob: InvestiQuant’s IQ Swing Navigator is one of the most valuable, daily market briefings you can get.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

Other Special Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals.

You’ll see how on this online training.

CFN110518