Crowd Forecast News Report #243

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can now read the full report in this post below.

Click here to download the full report: TRReport052018.pdf

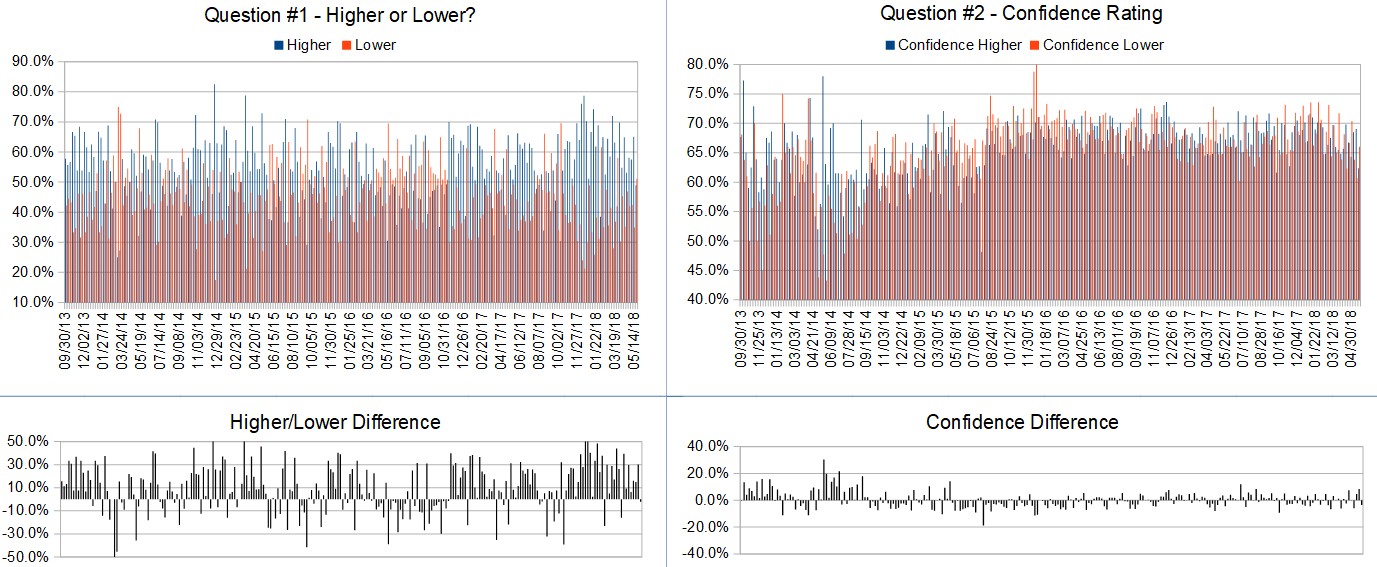

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 21st to May 25th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 48.9%

Lower: 51.1%

Higher/Lower Difference: -2.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.3%

Average For “Higher” Responses: 62.4%

Average For “Lower” Responses: 66.0%

Higher/Lower Difference:

Responses Submitted This Week: 49

26-Week Average Number of Responses: 50.3

TimingResearch Crowd Forecast Prediction: 87% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 65.1% Higher, and the Crowd Forecast Indicator prediction was 69% Chance Higher; the S&P500 closed 0.93% Lower for the week. This week’s majority sentiment from the survey is 51.1% Lower with a greater average confidence from those who responded Lower. Similar conditions have been observed 8 times in the previous 242 weeks, with the majority sentiment being correct 13% of the time, with an average S&P500 move of 0.88% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting an 87% Chance that the S&P500 is going to move Higher this coming week.

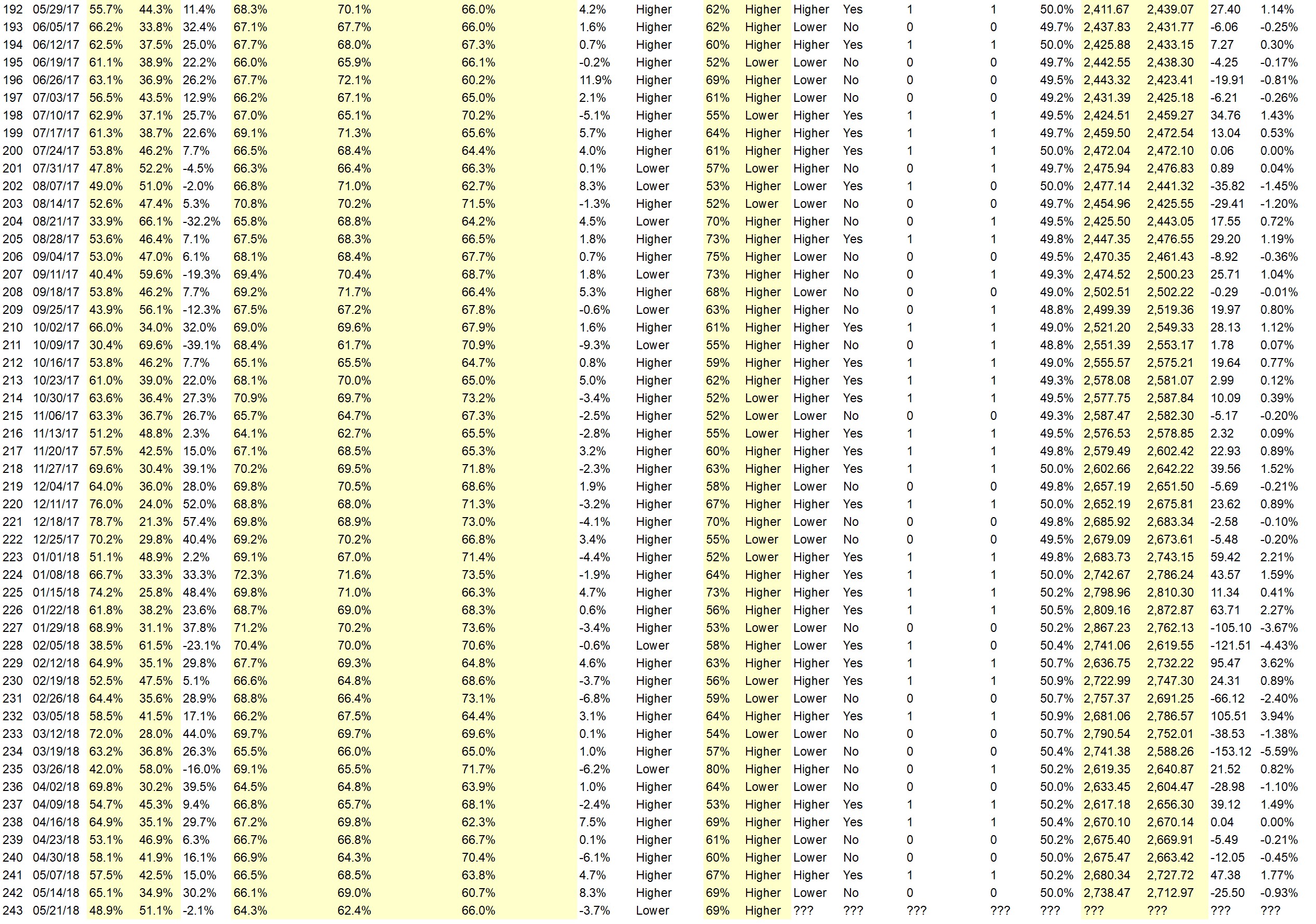

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.0%

Overall Sentiment 52-Week “Correct” Percentage: 51.0%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Looks like support possibly forming at this level after a breakout of triangle last week. It appears further upside is possible, even though markets becoming overbought.

• I think that dividends were good on Apple T 3M IBM and it helps support a buller Market maybe

• Pre-holiday short covering.

• general gring upward

• still buying

• The two previous weeks were strongly up, then small consolidation down. Q1 earnings up about 26% from Q1-2017. So, have to lean toward the upside.

• A ponzi scheme works until it doesn’t

• its in a wedge formation

• No trade war.

• Chart shows beginnings of consolidation. Stochastics peaked.

• ww

“Lower” Respondent Answers:

• Possible unfavorable news out of washington

• POlitical unrest end of earnings may down to 50ma

• Jim Grants analysis on interest rates and the FED

• —Tariff & trade wars —Political mayhem caused by stupidity

• Spy looks weak, as if it wants to retest recent lows.

• top of trend channel

• increasing debt and uncertainty.

• SPX failed to break above the trend line and hold its high and go higher this week. Instead it went lower. Interest rates are rising along with the price of oil suggesting inflation and higher interest rates to follow. Geopolitical events could be market movers this week but I think the the market will be dull planning for the Memorial Day holiday. Rotation to the RUT looks to continue and the market will have to wait for second quarter earnings to get excited again.

• sim

• General feeling is that we are drifting and generally down.

• Sell in May and Go away. Government in DC does not appear to know what it is doing and inflation increasing.

• Trend and market phase.

• The downside correction will not be complete until there is a selling climax. Just get me out.

• The market was muted this week. Not much movement in the Dow and S&P. I think investors are cautious as to what China trade and North Korea are going to do. Looks like the old adage; the markets don’t like uncertainty. Should be a slow week with little movement next week.

• It will make a low but then go higher highs

• sentiment and gain over this year..

Question #4. Please suggest a question that you’d like to see in the future on this survey. It could be a general trading-related question, a future event prediction question, something news related, or anything else you’d like to see other traders answer.

• what have you learned from back testing the main indexes

• More questions on foreign economies

• You high profit traders, what methods work for you?

• Describe some of the worst mistakes you’ve ever made trading. What are missed opportunities that still bother you today? What is the most money that you have lost in one day for your own account? What is the most money that you have made in one day for your own account? What great trade did you make once that you would like to have made over and over again if you could? What are your one-year, five-year, and 10-year percentage returns? How large an account is necessary to trade with your service?

• How can the federal debt issue be resolved?

• Does financial media have a buy side bias for stocks?

• “Sell in May & go away “—–comment for 2018 —–Seasonality & sector rotation. —–BP says oil to drop to $30 —–Others say to rise to $90 What tea-leaves do the above folk use ?

• I haven’t seen the results to previous questions. If the results are posted somewhere, please provide where the results are posted in the survey. (Perhaps in parenthesis at the end of the question… (“See results at ” or some such.)

• How much do you think the S&P is influenced by international and political events?

• best commission considerations for day traders, swing traders or options traders ; trade small and trade often commissions considerations

Question #5. Additional Comments/Questions/Suggestions?

• Neutral should also be an option. I would have said flat to slightly lower.

• nothing is 10% can traders give a percentage likelihood for their predictions

• mercado livre

• The illegal and embarrassing actions of the FBI and Justice Department need to be uncovered before the DEMS take the House, which if that happens, the corruption will be lost to history and the coup will have prevailed.

Join us for this week’s shows:

The Crowd Forecast News show is off for the next two weeks but please join us for Analyze Your Trade!

Analyze Your Trade Episode #35

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, May 22nd, 2018

– 4:30PM ET (1:30PM PT)

Guests:

– Jim Kenney of OptionProfessor.com

– Fausto Pugliese of CyberTradingUniversity.com

– Todd Mitchell of TradingConceptsInc.com

Moderator:

– Dean Jenkins of FollowMeTrades.com

Partner Offer:

500% Returns on a daily basis?

It doesn’t seem real, but this breakthrough strategy is primed to deliver blockbuster trades directly to your inbox.

See how it works here!