Crowd Forecast News Report #248

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport062418.pdf

The following video is a brief explanation of this week’s report, you can also listen to this as an audio-only podcast through iTunes, Podbean, Stitcher, Spotify, TuneIn, Google Play Music, or Blubrry.

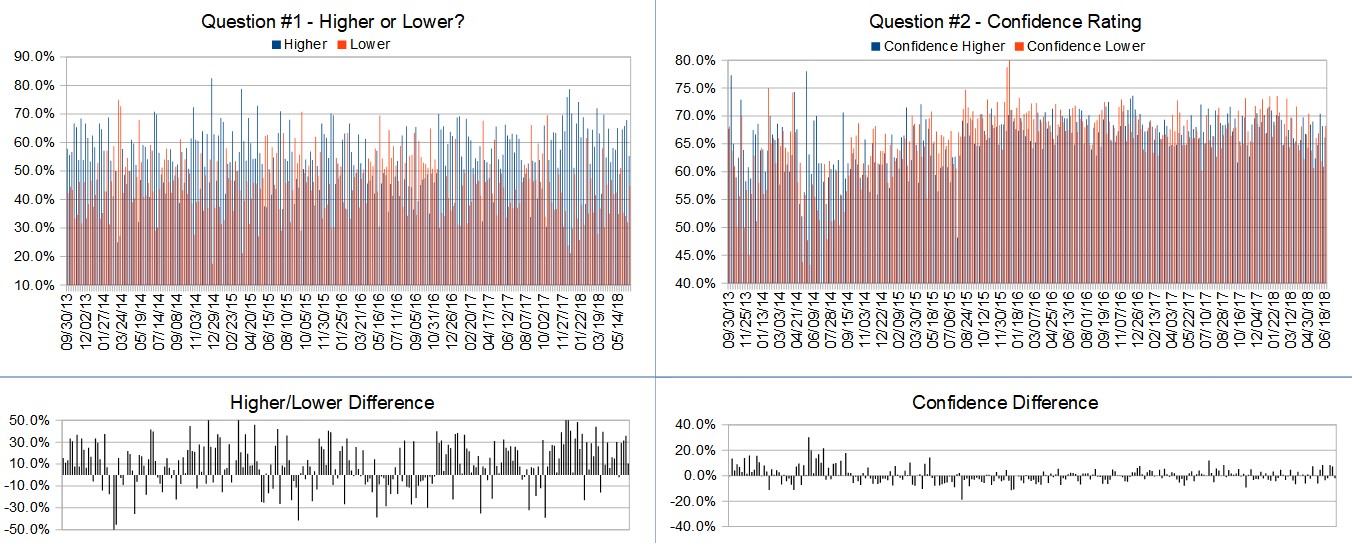

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 25th to June 29th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 44.7%

Lower: 55.3%

Higher/Lower Difference: -10.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.7%

Average For “Higher” Responses: 63.2%

Average For “Lower” Responses: 66.0%

Higher/Lower Difference: -2.7%

Responses Submitted This Week: 41

26-Week Average Number of Responses: 49.5

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

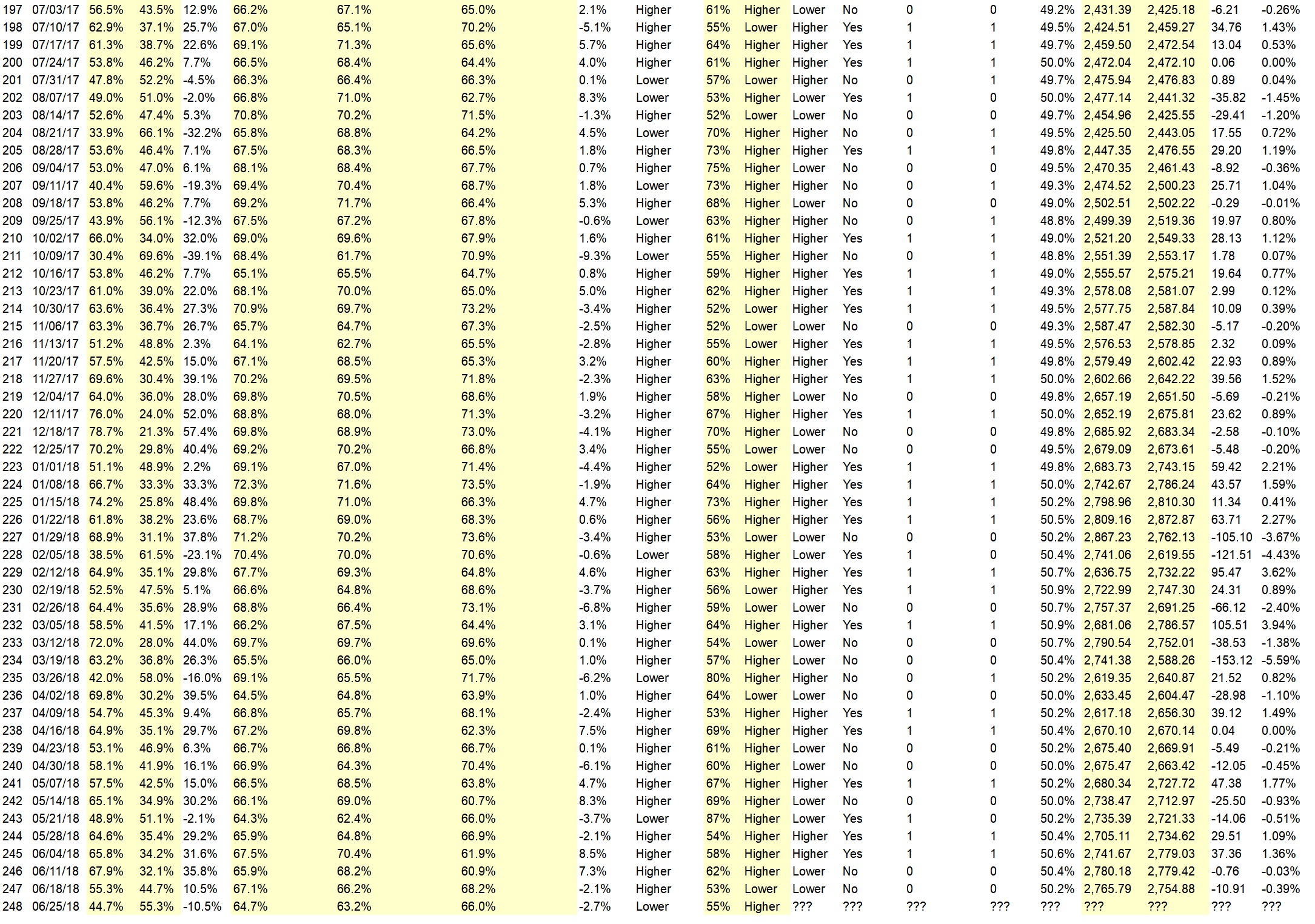

Details: Last week’s majority sentiment from the survey was 55.3% Higher, and the Crowd Forecast Indicator prediction was 53% Chance Lower; the S&P500 closed 0.39% Lower for the week. This week’s majority sentiment from the survey is 55.3% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 44 times in the previous 247 weeks, with the majority sentiment being correct 59% of the time, with an average S&P500 move of 0.17% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.2%

Overall Sentiment 52-Week “Correct” Percentage: 52.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Good economic indicators like gross national product could go up with Donald Trump in office

• Traditional end of quarter window dressing especially after the down week last week.

• Seasonality and technical

• Am the proverbial monkey throw’g the dart. Look who is steering the world-ship ! Someone w/ the impulse control of a two-year old.

• Elliott

• history

• It’s the trend

• still buying

• risk back on? Draghi forever?

• At bottom of ascending channel

“Lower” Respondent Answers:

• Expecting continued profit taking at end of strong earnings this quarter & before the beginning of next quarter’s earning reports. Also: – S&P 500 closing below or at its 20d ema for the last two days – Summation indexes for the S&P 500, NASDAQ, NYSE, & DOW all turning lower – Negative divergence on the NYSE AD Line index

• Downtrend continues. About over per stochastics.

• tarrifs

• It’s only the FAANGs that are holding up the market while tariffs are pulling it down for now. With favorable trade talks, the market will respond well but good news is not at hand nor will it be until we get closer to the elections. Even if earnings, 3 weeks away, are good, the response will be muted by forward guidance prospects since CEO’s will be happy to blame their conservative guidance on trade talks in case they don’t meet expectations. It’s always safe to blame someone else if you can.

• Adjusting of accounts for end of quarter. Uncertainty about effect of tariffs.

• SPY is nearing oversold territory

• Trump Tariffs – Fed removing liquidity

• political turmoil

• The market is overbought and due for a downside correction.

• The S&P in June couldn’t reach up to the March high before starting to fall. There’s no upward momentum. Then there are trade wars with the USA versus China, EU, Canada, and Mexico. Doesn’t look promising.

• Dow moving below 12 week EMA

• dead cat Friday poor momentum

• The environment is such that not much buying interest. Sell the highs perhaps the best deal. Most likely a low may be made on Wed Thur.

• on going trade conflict US with rest of the world

Question #4. What are the most important trading or investing-related lessons you have learned so far in 2018?

• risk management. if you account is in the ‘black ‘ you still in the trading game.

• Make a profit in cash

• In the world of options, research simple, not- too many legged options; practice in sim-trade on TOS, If a strategy is profitable, use it often along w/ proper position sizing.

• sell premium see value of covered writes / poor man covered calls

• the value of options

• Protect your positions. Limit losses.

• management of existing positions is more important than finding new positions

• If it goes your way increase position.

• There are a lot of traps out there; be careful.

• The power / ability to identify & effectively trade high reward-to-risk opportunities (always committing to planned stop losses & profit targets), with proper position sizing has been paramount to my success so far this year.

• No major bad news

• Be careful.

• Ignore the news

• portfolio protrection

• For intraday focused day traders one must look at longer time frames or you lose all and everything. Medium and longer term projections, guidance is critical to not get burnt.

• Trade small and take profits often.

• Tight well defined stops below strong support levels.

• make no assumptions

• Don’t over trade so you can be ready to take advantage of a correction and swings low when they happen. The FAANGs should have their own index and not be included in any other index since they disproportionately screw the appearance of any index of which they are a part. Don’t believe anyone who says to sell FB or avoid FB when it shows weakness.

Question #5. Additional Comments/Questions/Suggestions?

• Thank you for kind survey and hope more people can benefit from your good intent and great project, May you all be successful and content dear friends.

• One tweet makes a difference in today’s price, but otherwise economy great. Fear is still low but rising some.

• When I was a child, the editorial portion of the news occupied a very small part of the news. Today, the editorial portion of the news takes up almost all of the news with very few actual facts being presented. The worst difference is that the editorial portion of the today’s news is presented as though it is fact instead of editorial points of view. Mark Twain said, “If you don’t read the newspaper, you’re uninformed. If you do read the newspaper, you’re misinformed.” It’s even worse today!

Join us for this week’s shows:

Crowd Forecast News Episode #186

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 25th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com

– Jim Kenney of OptionProfessor.com

– Glenn Thompson of PacificTradingAcademy.com

– Lance Ippolito of AlphaShark.com & TradingCoachLance.com

Analyze Your Trade Episode #40

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 26th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Oliver Schmalholz of NewsQuantified.com

– Larry Gaines of PowerCycleTrading.com

– Steven Place of InvestingWithOptions.com

– Roy Swanson of SteadyTrader.com

Partner Offer: