Crowd Forecast News Report #249

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport07018.pdf

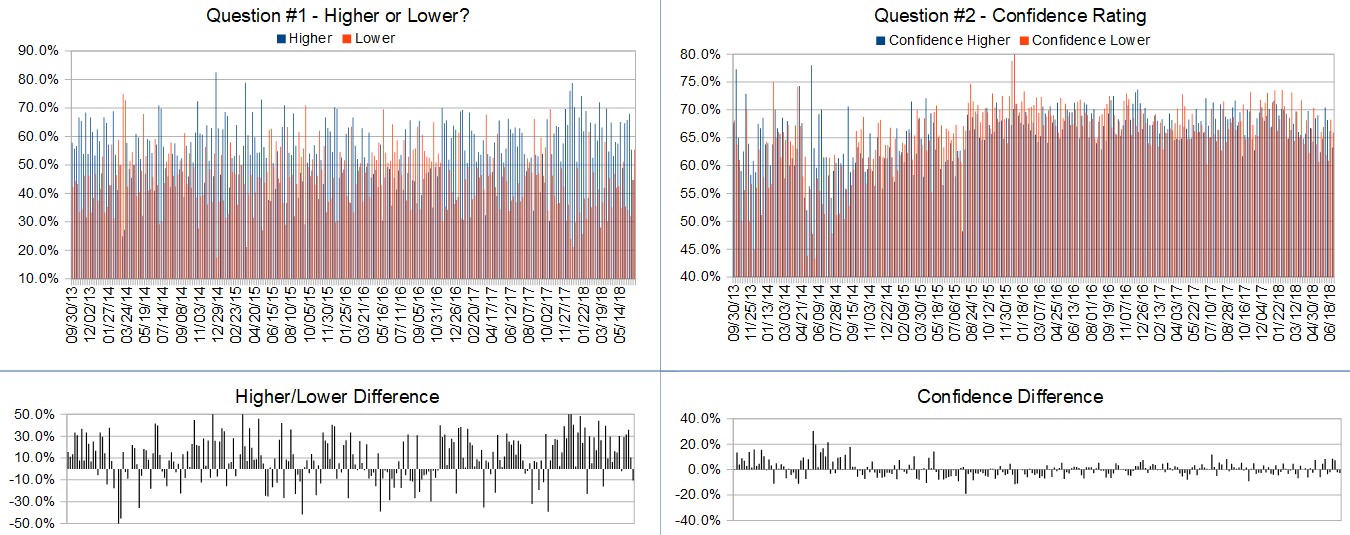

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 2nd to July 6th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 62.5%

Lower: 37.5%

Higher/Lower Difference: 25.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.3%

Average For “Higher” Responses: 62.6%

Average For “Lower” Responses: 69.7%

Higher/Lower Difference: -7.1%

Responses Submitted This Week: 44

26-Week Average Number of Responses: 49.2

TimingResearch Crowd Forecast Prediction: 59% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

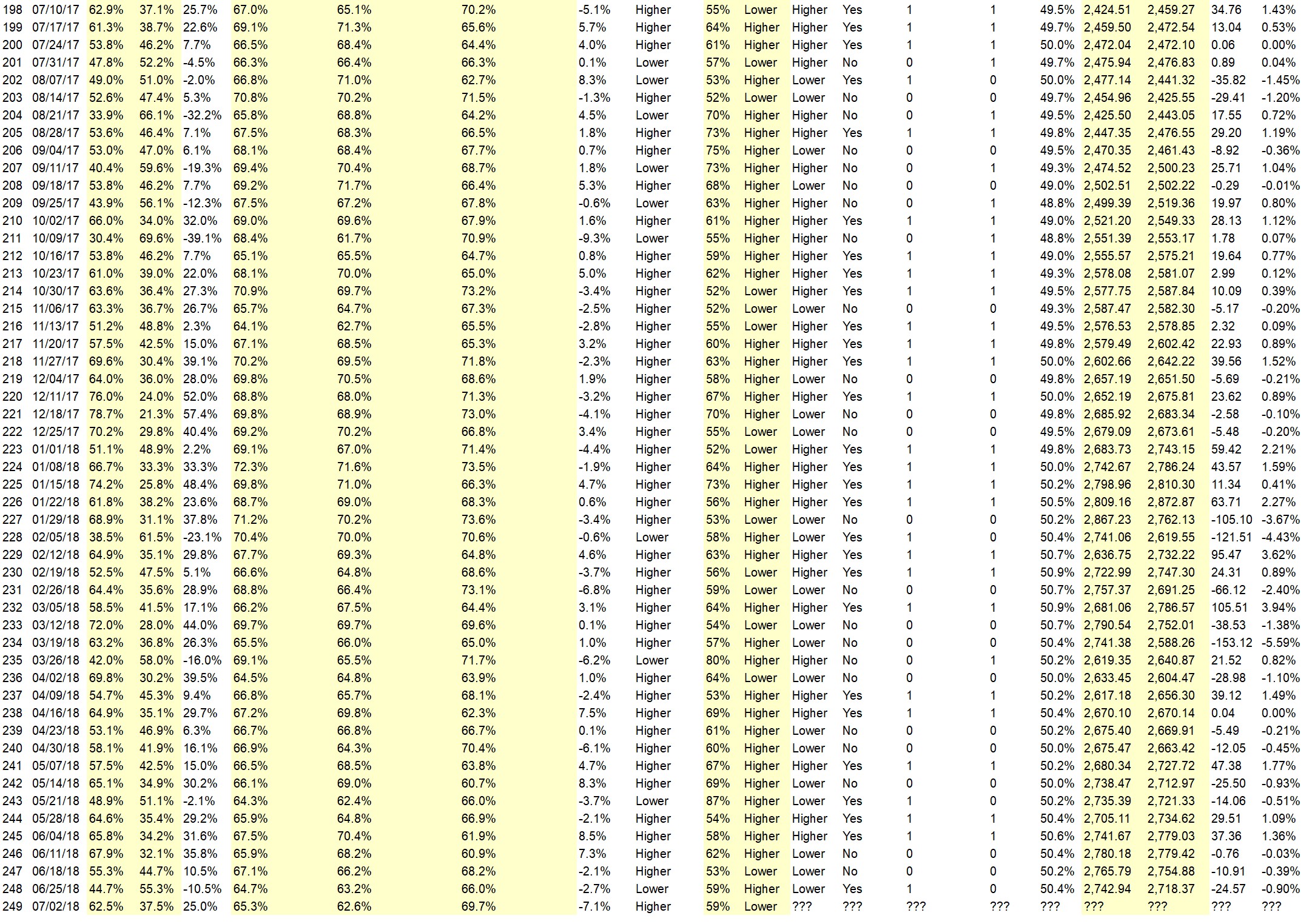

Details: Last week’s majority sentiment from the survey was 44.7% Higher, and the Crowd Forecast Indicator prediction was 59% Chance Higher; the S&P500 closed 0.90% Lower for the week. This week’s majority sentiment from the survey is 62.5% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 17 times in the previous 248 weeks, with the majority sentiment being correct 41% of the time, with an average S&P500 move of 0.65% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.4%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Holiday

• Commodities looked higher somewhat in corn maybe a little in terms of the future I guess

• Cosr

• start of the quarter, new money from mutual funds

• Funds buying to invest the new money coming in at the start of a new quarter

• Low Holiday Volume. Tame or absence of news on trade war.

• Good earnings ahead

• New tax laws are suppose to work for industries and for individuals. So more money going through market.

• Market’s will slide sideways as it’s a holiday week.

• Most investors are more sophisticated that they monitor specific trends of their own portfolio and known the likelihood of ups or downs barring incidental world problems..IT will be really up to keep the republican seats.Any deviant means those in power will all go out to flip hamburger at restaurants

• trump renegotiates the tariffs

• If Dow rises above 50dma we could see a new rally (?)

• Banks still own so many stocks.

“Lower” Respondent Answers:

• I believe there is a slight probability that markets remain at current levels or slightly lower until earnings kick into gear with some of the big banks reporting on Friday the 13th. I’m looking for the S&P to retest support again around 2700, before heading higher.

• Oil price rise

• When the market can go down 50 points in a day & go up 25 for a couple of days only to give it all back by the close, the sellers have the upper hand & down is the path of least resistance. The algos are playing with investors & the light trading that will take place during the 4th of July week will show daily volatility with little permanent upside. NFP may provide an added boost on Friday but this market action is definitely a “piss-you-off-market.” Possible serious upside is 2 weeks away.

• technical deterioration

• Politics.

• Holiday week

• The downside correction is occurring in the rotation out of the go-go stocks, the industrials and the FANG stocks.

• weak buying

• Two factors: (1) The financials are weak. After bank stocks gapped up on Fri morning following the stress test news, they declined badly into the close. (2) Funds have every reason the dump their tech winners after the end of the quarter.

• sell in may a big crash is coming

• Sell in June and go away?? LOL

Question #4a. What has been your BEST experience so far as a trader?

• When one of my companies was taken out by a merger.

• Profit

• Feel like I am in control, even though making money has been a challenge !!

• I have always beat all the indexes but this JUNE has been my waterloo.tariff retaliation

• Being disciplined enough to reverse an erroneous trade and re-submit with the original direction.

• I regard as something do like work. Not good experience.

• S ur ovine 40 years

• learning from a master trader

• Arbitraging indiviual stocks on bad news.

• Recently, my short of RHT into their earnings went well, as they declined 13%.

• Took profits in Preferred shares

• Making consistent profits.

• Make my profits by buying stock on upward momentum/trend.

• selling options

• Selling out-of-money puts on a down day.

• intraday trading – Equity cash management

• Trading NVDA.

• Learning from the Online Trading Academy about supply zones and demand zones where the real selling and buying take place . Also, selling puts at demand zones where I haven’t had a loss in 5 years. I do miss the big winners because I don’t buy at demand zones but that takes more courage my “bird-in-the-hand” put selling.

Question #4b. What has been your WORST experience so far as a trader?

• When Bethlehem Steel went bankrupt.

• Trades not working in my favor.

• Trade wars

• Having the broker reverse a trade based on a rule at the exchange where I would have been in profit had it been maintained.

• Blow up accounts. Lose money. Getting kicked off webinars because don’t keep paying money out my visa account. Some sites that have six people create accounts on mail servers and abuse me then close accounts so don’t see normal email.

• Getting subpar returns

• CHF crash really scared me

• Being unaware of a major news item or earnings report.

• My stocks suffered badly after the Sept 2001 terrorist attack on the World Trade Center & Pentagon.

• Fat. Gastar

• Big gap downs overnight.

• Losing a lot of money on speculative biotech stocks. Never again!

• futures

• Using fundamentals as a reason to sell.

• Trading BA.

• Investing with Chuck Hughes and following his trades. Also, being talked out of making investments by “market professionals” that went up dramatically afterwards and being talked into making investments by “market investments” that were big losers.

Question #5. Additional Comments/Questions/Suggestions?

• Hoping to get better success rate.

• I have learned not to pay attention to experts,and stay on the following sectors ( TECH,HEALTH,CONSUMER (STAPLES/DISCRETIONARY) don’t move out of those areas

• Gold bottoms. Seems to be too negative given the global risks. still target 1375.

• Please share your opinion about where S&P (SPY) and Nasdaq are headed. What do we expect in the short term till earning season starts.

• Way back to the Mayflower Compact, early settlers agreed to go by the will of the majority and our Constitution provides for that same principle. The LEFT is in violation of the Constitution by disavowing that principle. Obviously, the left must be ignorant or stupid or evil since they also object to peaceful assembly, quiet enjoyment and freedom of speech except for themselves. The left has embraced Fascism and anarchy as demonstrated by their behavior.

Join us for this week’s shows:

Crowd Forecast News Episode #187

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 2nd, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com

AYT will be off this week but back on July 10th!

Analyze Your Trade Episode #41

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 10th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com

– Christian Fromhertz of TribecaTradeGroup.com

– Jim Kenney of OptionProfessor.com

– Larry Gaines of PowerCycleTrading.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“