Crowd Forecast News Report #251

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport071518.pdf

Audio explanation of this report is available in the following video as well as in podcast form through iTunes, Podbean, Stitcher, Spotify, and more.

Crowd Forecast News Report #251 Full Report:

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 16th to July 20th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 75.0%

Lower: 25.0%

Higher/Lower Difference: 50.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 69.1%

Average For “Higher” Responses: 72.0%

Average For “Lower” Responses: 60.5%

Higher/Lower Difference: 11.5%

Responses Submitted This Week: 47

26-Week Average Number of Responses: 48.4

TimingResearch Crowd Forecast Prediction: 63% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 71.1% Higher, and the Crowd Forecast Indicator prediction was 56% Chance Lower; the S&P500 closed 0.93% Higher for the week. This week’s majority sentiment from the survey is 75.0% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 19 times in the previous 250 weeks, with the majority sentiment being correct 63% of the time, with an average S&P500 move of 0.29% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 63% Chance that the S&P500 is going to move Higher this coming week.

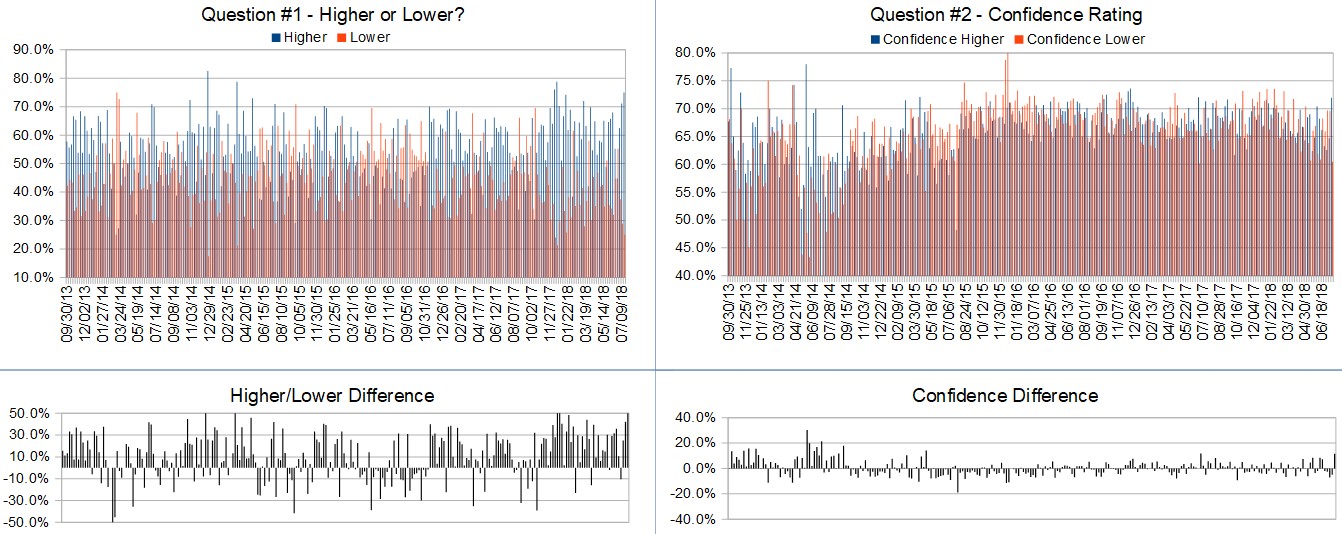

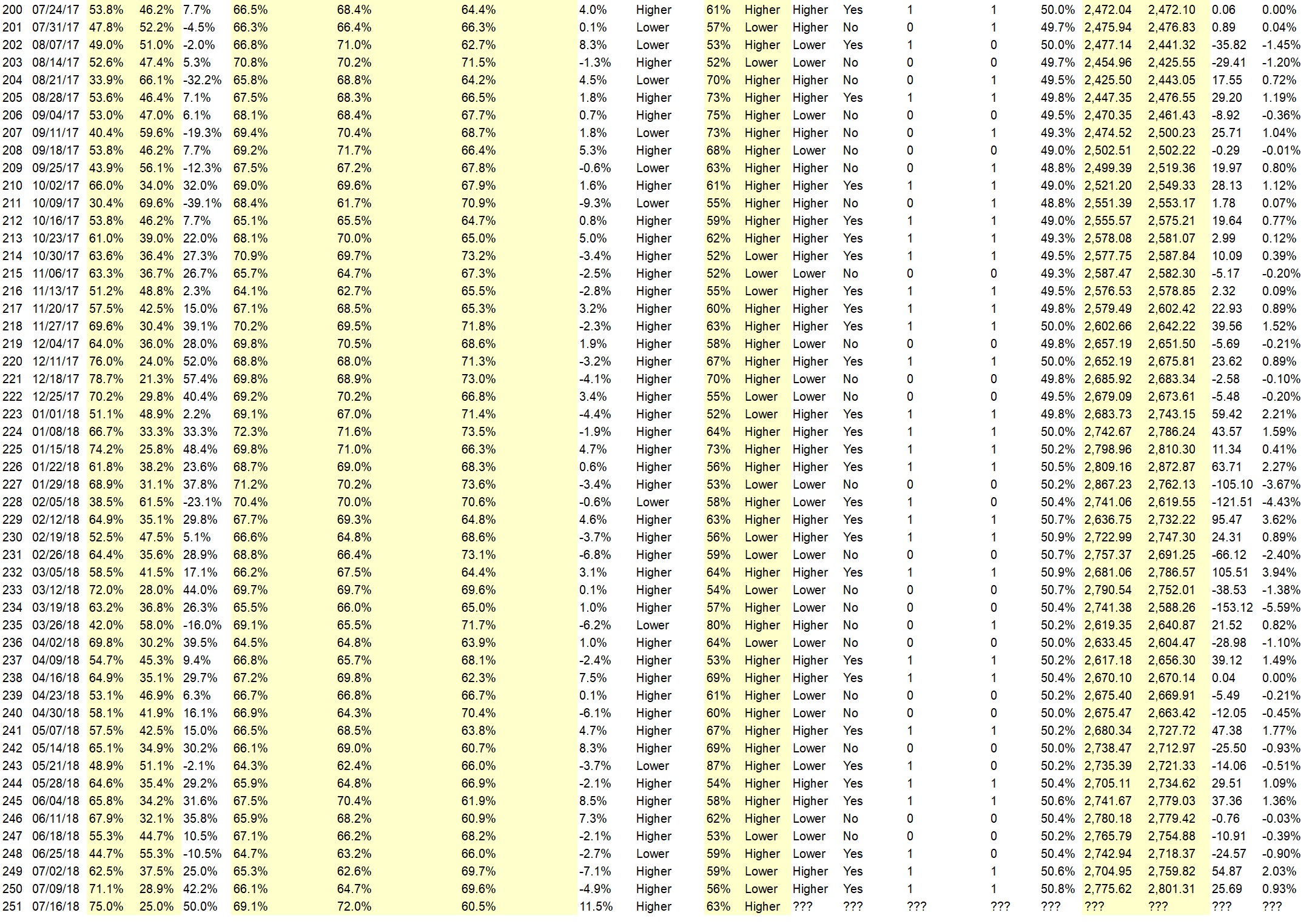

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.8%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• bull market

• Breakout

• Good 3M price today to 201.50$ is a leader in the past of strength in stocks on the Dow Jones Indistrial Average or others

• long term bullish unless its breakdown 50 day moving average support. Monthly advance /decline is tilted towards the advance

• Tariffs and trade concerns will disturb the trend until uncertainty subsides but the trend is up as long as earnings satisfy & the outlook is carefully worded in a positive direction. But for trade uncertainty, the market would be up at least another 10% or more so the market is counting on an outcome that is not negative. Sadly, the FAANG’s are disproportionately screwing the market up but if rotation occurs & if the Financials participate, we will see dynamically positive action sometime soon.

• Indexes run higher a bit longer but most gains are made. Market may correct by midweek on.

• Economic optimism will continue in the third quarter

• break above the MAs

• Lower taxes

• good earnings reports

• Momentum and OPEX

• The economy is good and getting better.

• still buying

• The dip in the S&P during the week was shallow; and buyers swooped in. Tech stock momentum is strong. This market wants to go higher.

• The market seems to have digested the news about additional tariffs against China. It did rally from its support off of 2690 last week. Unless this administration announces additional tariffs, the stocks should be moderately higher at the end of the week. Earnings are likely to have some positive impact.

• I think the market will move higher in response to higher earnings. Most companies in the S&P 500 should beat estimates.

• MOMO

• Earnings Tech momentum

• Flations of all kinds together. Consumer down, it commodity up. Gold goes down to a base. Oil marches higher as sanctions kicking in . Eventually, really the growth story will solidify. Markets already anticipating it. Thus ES moves higher. Higher on the week end is my assessment with over 80% confidence.

• It’s the EverReady Bunny.

“Lower” Respondent Answers:

• Tough call for me this week. Mixed signals; but appearing short term overbought. Looking for NFLX earnings to disappoint; but MSFT to beat. Therefore leaning towards unchanged to just slightly lower.

• Markets have topped

• tariffs

• Political rhetoric.

• The downside correction will continue until the public says just get me out.

• much uncertainty over trade wars/tariffs

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on July 23rd.)

• Why/when will the market breakdown( effect of trade tariffs, inflation 10 year treasury interest rate, bull run of 10 years is the longest

• I like profit in cash

• money management

• Funding. Are there any real funding firms out there for ES futures traders? Or do they all involve paying for an expensive course first?

• High probability trading

• Use of covered calls to generate race he in higher moving markets. Strangles?

• Market reaction to news events.

• technical indicators

• Hedging ones portfolio

• I have no questions about the people I do not consider as experts in any case !!!

• dividends and monthly income

• I would like to know your team’s thoughts on the long term effects of Trump’s trade war and tariffs might have on US economy.

• List the indicators that are 80% reliable if any. Without an 80% edge, flipping a coin is just as good.

Question #5. Additional Comments/Questions/Suggestions?

• keep’ em coming

• This crowd forecast survey is a great idea!

• My call For Hire gold is being delayed but I still anticipate it moving higher before the beginning of the 4th quarter

• It’s difficult enough to predict the move in the market from Friday’s close to Friday’s close but it is a fool’s errand to predict Friday’s close from Monday’s unknown open. This prediction format needs to be changed since anything can happen on Monday.

◦ TimingResearch Response: That would be interesting but ultimately useless since you can’t go back in time and put positions on before Friday’s close. Hypothetically, having a good prediction of what the market will do from Monday’s open to Friday’s close (in the future, relative to this report being published on Sundays) is the only way that this would be of any use to anyone. That’s what this experiment is trying to accomplish.

Join us for this week’s shows:

Crowd Forecast News Episode #189

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 23rd, 2018

– 1PM ET (10AM PT)

Lineup:

– Jim Kenney of OptionProfessor.com

– John Thomas of MadHedgeFundTrader.com

Analyze Your Trade Episode #42

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 24th, 2018

– 4:30PM ET (1:30PM PT)

Lineup:

– Larry Gaines of PowerCycleTrading.com

– Dean Jenkins of FollowMeTrades.com

Partner Offer:

Join me for the online-only Wealth365 Summit July 16th-21st where you’ll be exposed to more speakers, new topics and hundreds of thousands of dollars worth of free prizes from top wealth experts.