Crowd Forecast News Report #262

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport093018.pdf

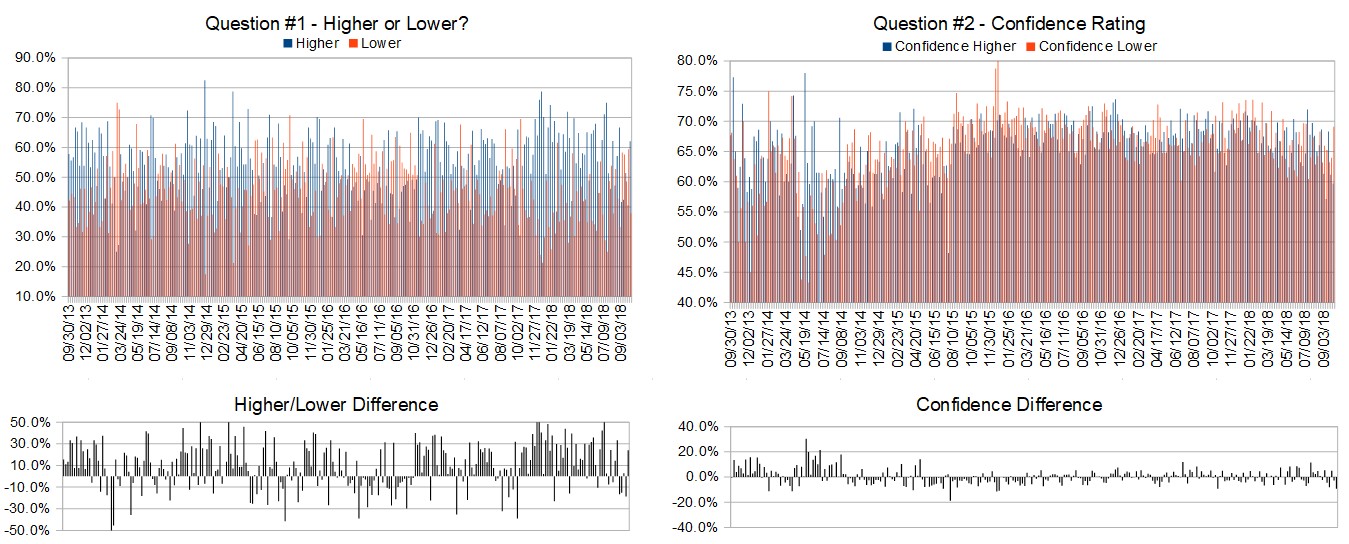

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 1st to October 5th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 62.1%

Lower: 37.9%

Higher/Lower Difference: 24.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.3%

Average For “Higher” Responses: 59.7%

Average For “Lower” Responses: 69.1%

Higher/Lower Difference: -9.4%

Responses Submitted This Week: 31

52-Week Average Number of Responses: 46.8

TimingResearch Crowd Forecast Prediction: 52% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

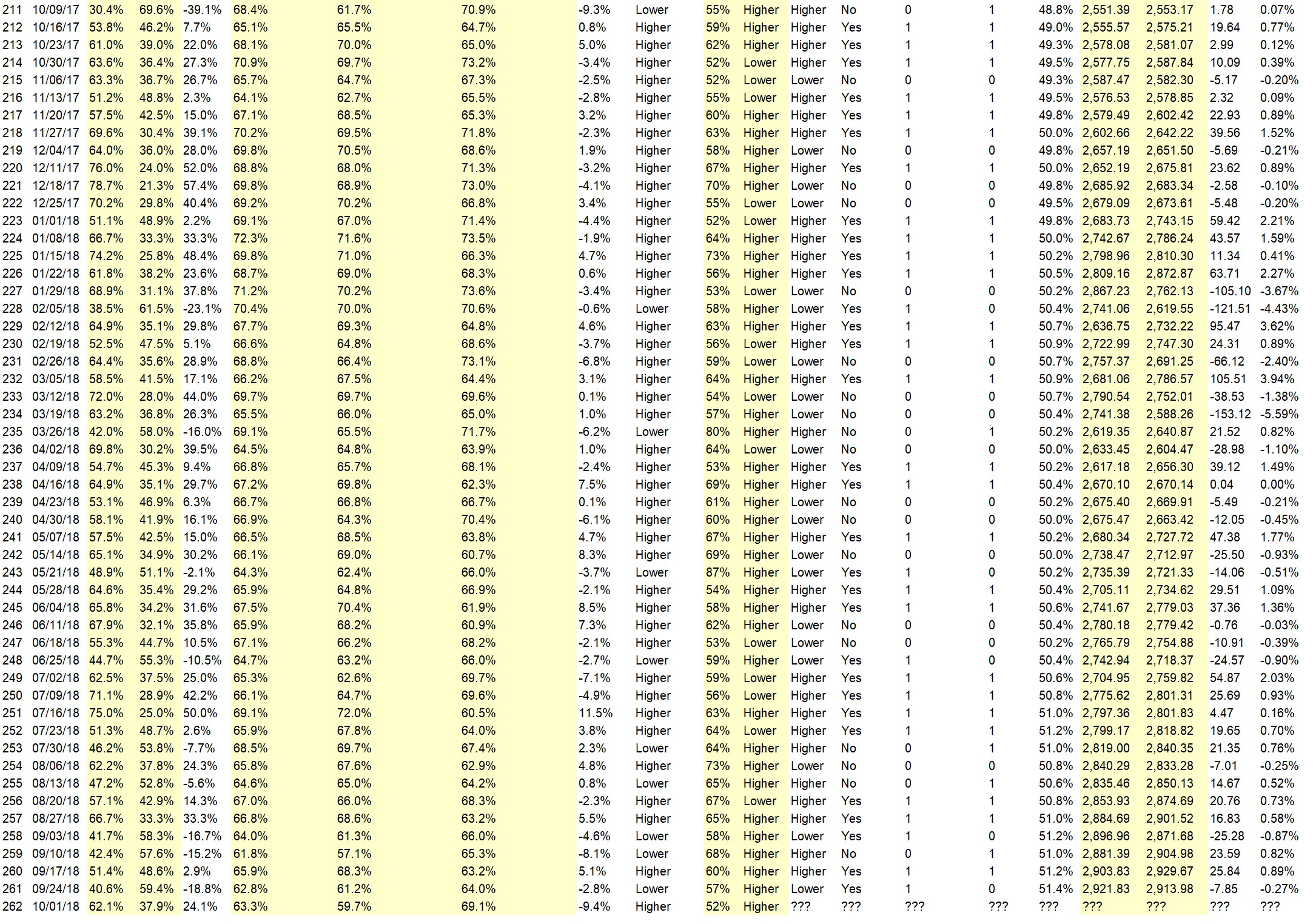

Details: Last week’s majority sentiment from the survey was 40.6% Higher, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 0.27% Lower for the week. This week’s majority sentiment from the survey is 62.1% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 77 times in the previous 261 weeks, with the majority sentiment being correct 52% of the time, but with an average S&P500 move of 0.12% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 52% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.4%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I like Donald

• It’s a bull market!

• Bounce off of daily 20 period EMA & higher low.

• 50 d ma and 20 day ma up, at bottom of upward channel

• Holding the 50% retracement long in the S&P at $2905

• Mid-term elections.

• history.

• still buying

• The S&P was in consolidation the previous week, which provides a good setup for a rise this week. Also, a nice GDP increase and good earnings expectations should help.

• Elliott wave pattern.

• Large volume trades show more selling. Low volume trades still show buying. I don’t know whether “the top” is in yet, but I’m sure not going to buy the dips.

“Lower” Respondent Answers:

• Overbought markets. 3rd qtr ended – sellers should return.

• Tariffs

• Current white administration is bringing too much controversy and distrust

• Due to the Presidents nonsense position size

• Its ending pullback in all my s tocks

• Tarriffs!

Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• position size, stops, sometimes scaling

• I try to keep position sizes of relatively the same size.

• Mental stops

• I don’t know

• start small, 8% loss stops, take off profits 35%

• Scaling in.

• Daily loss limit, weekly loss limit, # of stops per day.

• Position size

• Position size, stops, market direction.

• Scaling

• stops

• Proper stops, no scaling, support & resistance, use of trailing stops if trending

• Position sizing used with various strategies. All in all out also used depending on strategy used. Stops are very important and honoring them is critical in maintaining risk management.

• position size

• Algorithmic

Question #5. Additional Comments/Questions/Suggestions?

• seasonality is against my answers.

• Is there a better and close too 100% certainty to read the market in the USA??

Join us for this week’s shows:

Crowd Forecast News Episode #198

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, October 1st, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Tim Racette of EminiMind.com (first time guest!)

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

– Norman Hallett of TheDisciplinedTrader.com

– John Thomas of MadHedgeFundTrader.com

– Neil Batho of TraderReview.net

Analyze Your Trade Episode #51

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 2nd, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Christian Fromhertz of TribecaTradeGroup.com

– Hima Reddy of HimaReddy.com

Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.