Crowd Forecast News Report #266

Partner Offer: Do you need more capital to trade? Get funded in as little as 15 days, click here.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport102818.pdf

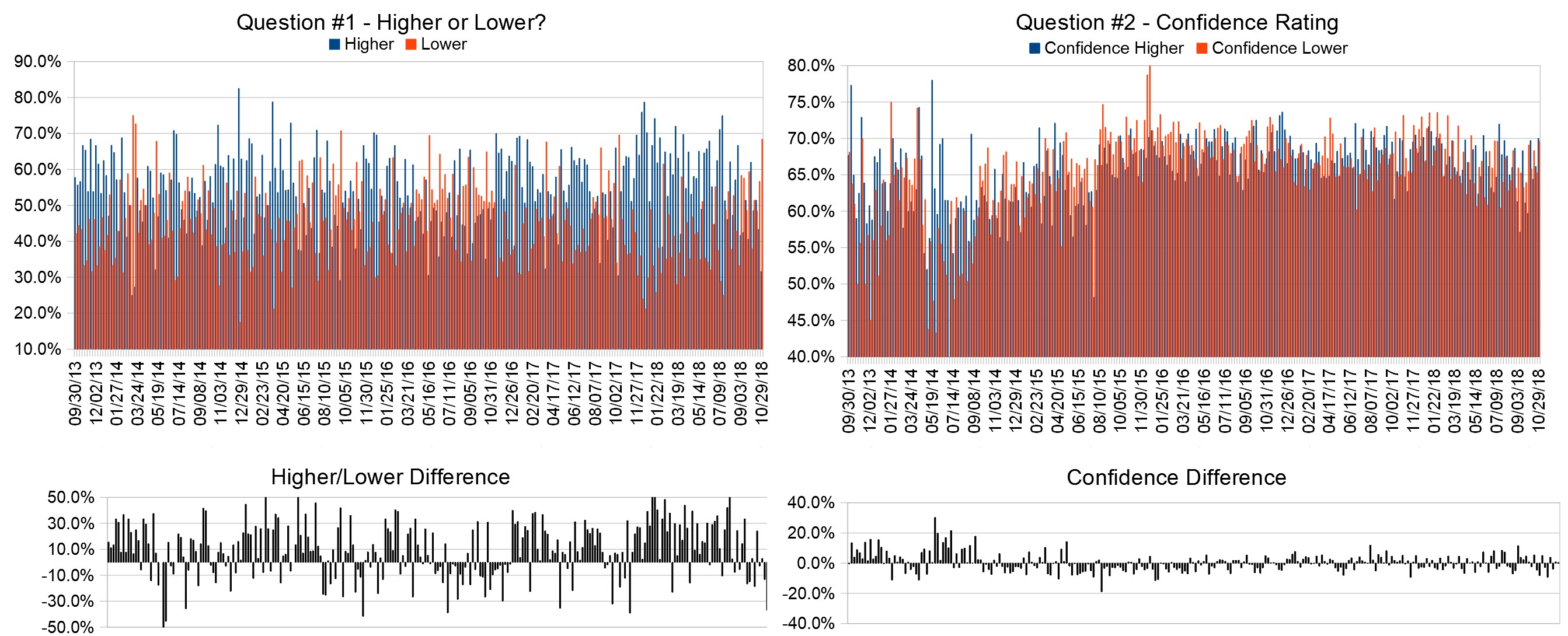

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 29th to November 2nd)?

Higher: 31.6%

Lower: 68.4%

Higher/Lower Difference: -36.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 69.7%

Average For “Higher” Responses: 70.0%

Average For “Lower” Responses: 69.6%

Higher/Lower Difference: 0.4%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 45.8

TimingResearch Crowd Forecast Prediction: 67% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 56.7% Lower, and the Crowd Forecast Indicator prediction was 64% Chance Higher; the S&P500 closed 4.15% Lower for the week. This week’s majority sentiment from the survey is 68.4% Lower with a greater average confidence from those who responded Higher. Similar conditions have been observed 9 times in the previous 265 weeks, with the majority sentiment being correct 33% of the time, and with an average S&P500 move of 0.19% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

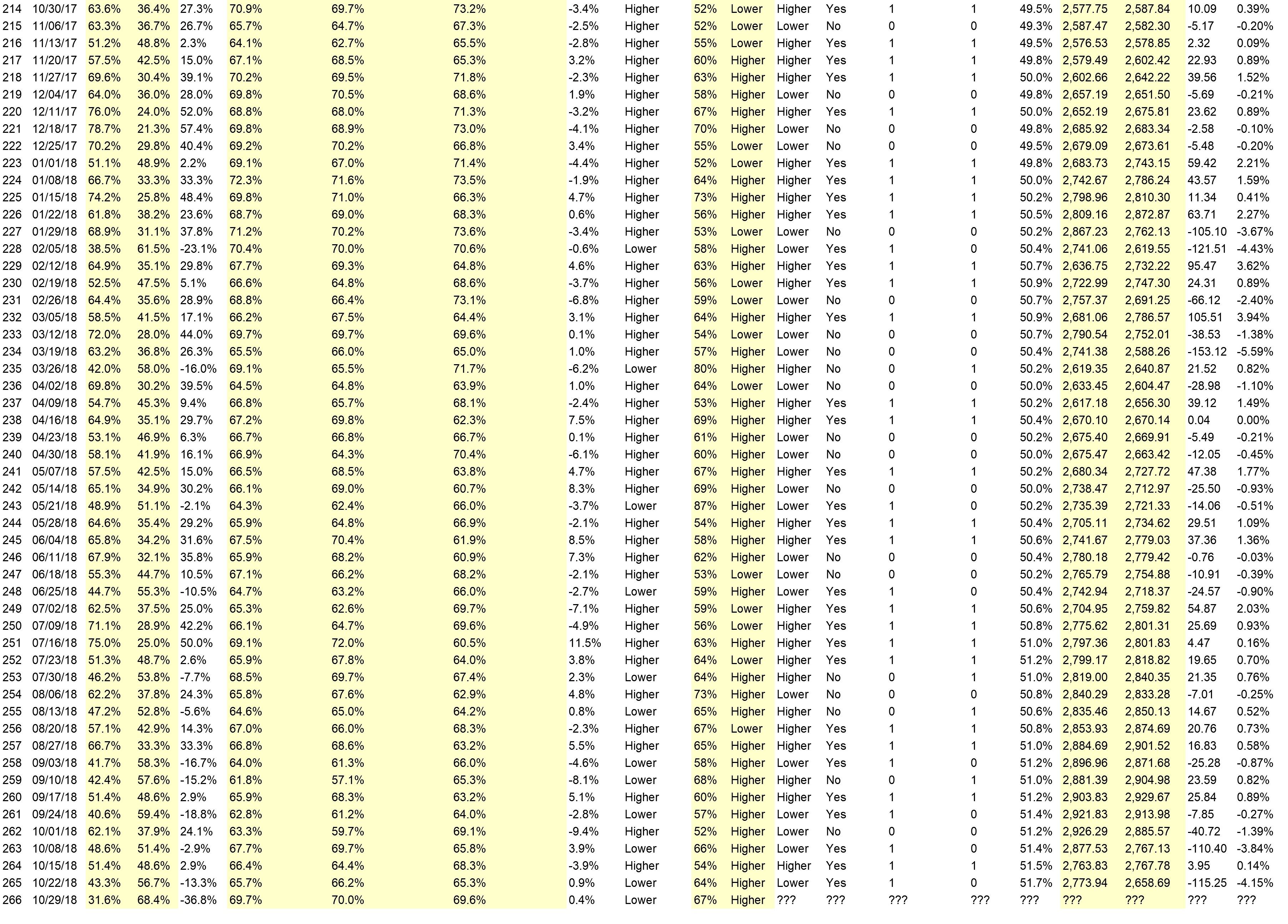

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Market is very oversold and need to rebound.

• good earnings

• Over Sold Bounce / Positive Economic News

• No T.A . Just monkeys throwing darts. And the teeter-totter rhythm since there doesn’t seem to be rhyme but no reason to the market.Not to point fingers, but the mkt might be mimicking the chaotic behaviour of the powers that be ?

• Mid-term Elections

• October ends midweek

• oversold and SC rally brewing

• dead cat bounce

• Markets will front run the elections tax cut continuation trade deals and consumer confidence and Euro GB Italy resolutions

“Lower” Respondent Answers:

• It has had 2 dips and i beleive it is over priced.

• The stock market is always going up and down all the time

• Market instability of late predicts a break to the downside soon.

• wave

• Trend is still down & quidance will weigh on future earnings due to tariff concerns & trade war with China ….then gov’t deficits will take the spotlight at some point next year

• We’re in a down trend

• The markets remain in the beginning stages of a larger correction.

• Trump’s Trade War. China will not capitulate like wimpy Canada and Mexico.

• The downside correction continues as moving averages have been violated. Market will continue the downward path until the public says “just get me out”.

• The forces that have trimmed the market this month are still in play. Next support appears to be about 2565, a pivot seen in Nov 2017, Feb & Apr 2018.

• elliott wave prognosis and sentiment

• Unknowns on the world stage are still dominant. Even strong Earnings are not changing the trend for the moment. Stock Prices are soon Ready for the end-year Rally.

• Declining trend increased by quarterly earnings failing to ignite market PLUS mid-term election uncertainty.

• historical drop this time of year

• seems to be selling ahead to make an impact on the election

• MACD, momentum, fear

Partner Offer:

Did you ever think that becoming a professional trader is out of reach? Think again.

Click here to learn how.

TopstepTrader has funded more than 1,800 traders just like you with live trading capital. They take all the risk. You keep the first $5,000 in profits and 80% thereafter.

Question #4. Have you ever, or do you currently, use any type of auto-trading execution with your trading strategies?

• no

• no

• no

• No & no

• No.

• Have tried auto trading with no success.

• No

• No. Trade news and trend.

• no

• Yes, I use auto trading algorithms written specially for trading my strategies.

• Yes

• yes

• No.

• Yes

• rising interest rates and oil, oil has pulled back, but combination will pull down markets.

• no

• No

• no

• no

• yes

• Yes I do.

Question #5. Additional Comments/Questions/Suggestions?

• i’m just getting started

• I would like to know if any auto trades work.

• I only trade options, hardly no stocks, less risk, trade tactics on down, up and sideways,

• please email survey results and list associated comments too, without names of who is saying. …so bullish reasons give, etc thank you

• 80% of the S&P 500 stocks down 10% or more

Join us for this week’s shows:

Crowd Forecast News Episode #201

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, October 29th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com (moderator)

– Jim Kenney of OptionProfessor.com

– Roy Swanson of SteadyTrader.com

– Damon Pavlatos of FuturePathTrading.com

Analyze Your Trade Episode #

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 30th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Larry Gaines of PowerCycleTrading.com

Partner Offer:

Did you ever think that becoming a professional trader is out of reach? Think again.

Click here to learn how.

TopstepTrader has funded more than 1,800 traders just like you with live trading capital. They take all the risk. You keep the first $5,000 in profits and 80% thereafter.