Crowd Forecast News Report #292

AD: 5 Experts Share Their Best Money Making Strategies

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport042819.pdf

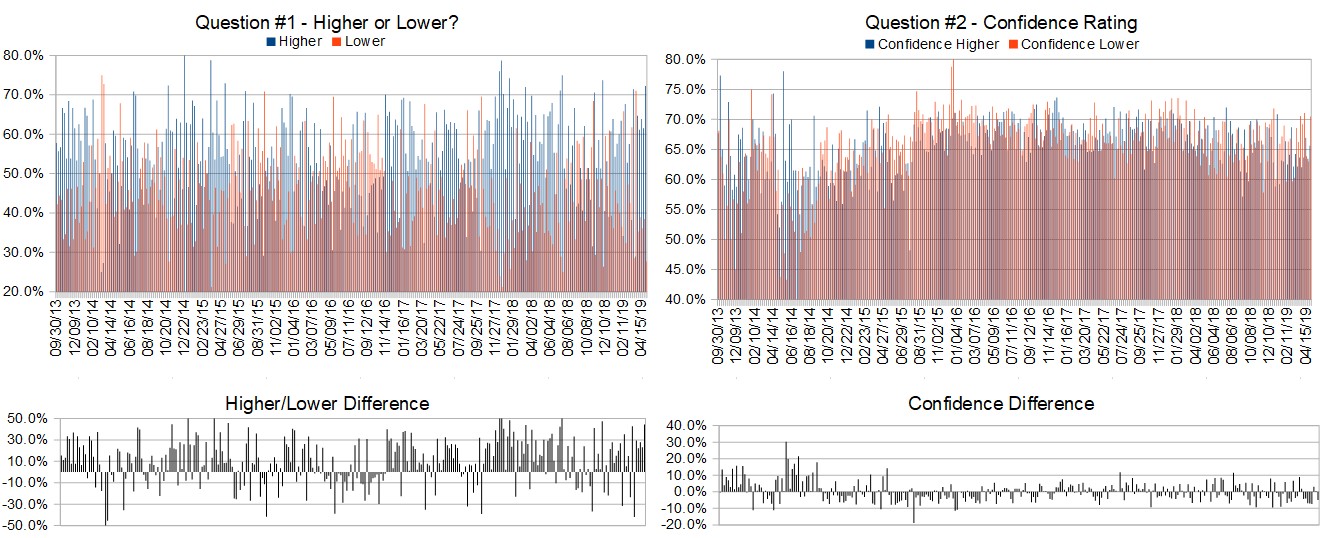

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 29th to May 3rd)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 72.2%

Lower: 27.8%

Higher/Lower Difference: 44.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.8%

Average For “Higher” Responses: 65.6%

Average For “Lower” Responses: 70.5%

Higher/Lower Difference: -4.9%

Responses Submitted This Week: 37

52-Week Average Number of Responses: 39.6

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 61.5% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 1.42% Higher for the week. This week’s majority sentiment from the survey is 72.2% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 20 times in the previous 291 weeks, with the majority sentiment (Higher) being correct 65% of the time and with an average S&P500 move of 0.09% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: 5 Experts Share Their Best Money Making Strategies

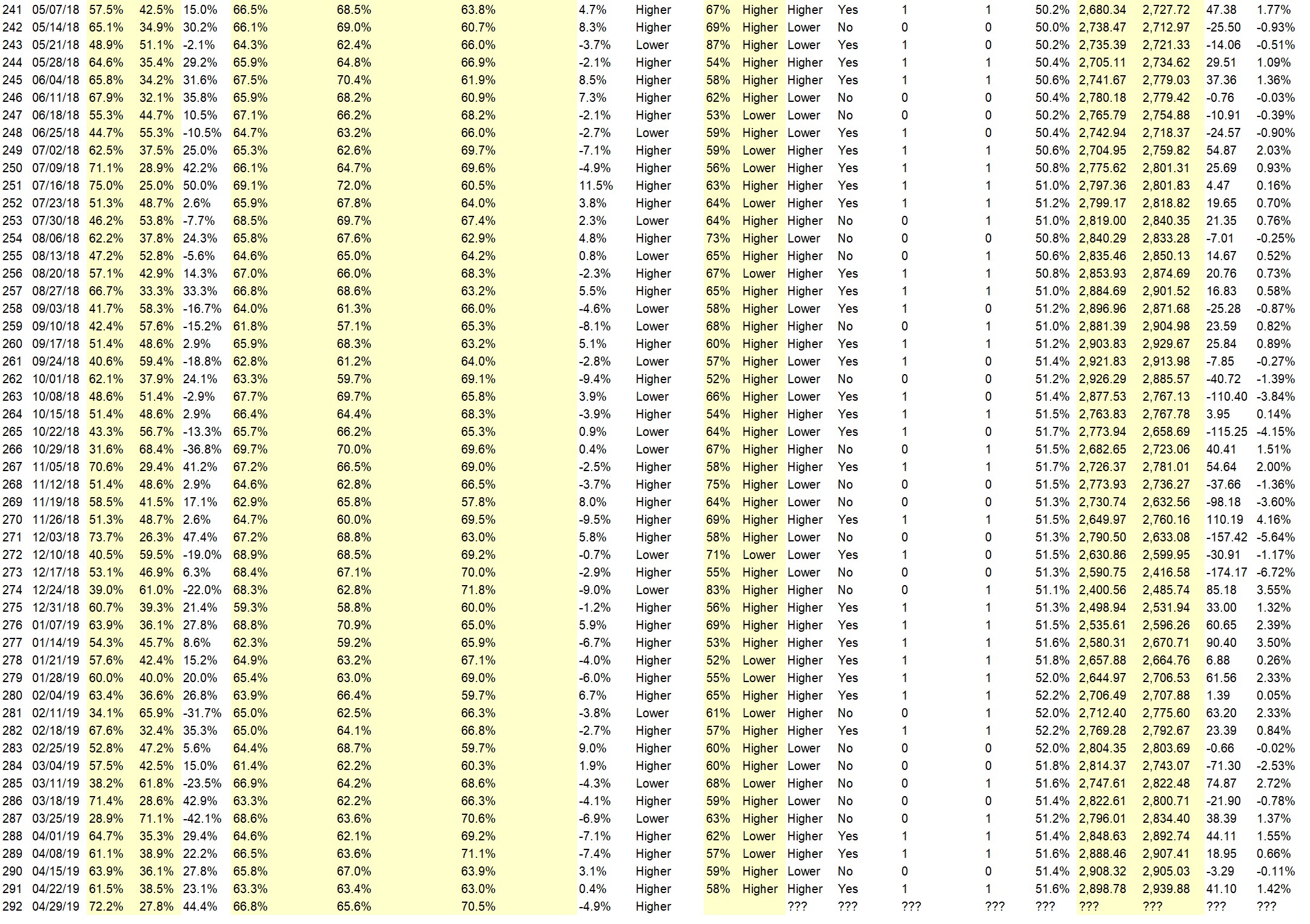

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.6%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Momentum

• trend

• breakout

• Better earnings

• Banking is still reasonably OK and the China/U.S. trade deal seams to be moving forward.

• The trend is still higher

• We are in wave B. By FB retrac. wave B will be minim. 127% of wave A. That is, the SP will reach the 3100 in the short term

• Market closed at all time high

• Momentum

• Usually new highs all around hit the same week to suck in other longs before a correction. Statistically higher first week of May as well. New highs will undoubtedly bring choruses of “Sell in May doesn’t work anymore” just before a drop!

• more good earnings reports

• Positive results from Earnings season

• The market has been reacting positively to recent earnings/revenue reports. The upward trend is likely to continue.

• Still best six months of year historically

• MO & Earnings

• Earnings push the S&P up a bit

• Trend up continues

• Trend continues

• earnings still to come

“Lower” Respondent Answers:

• Selloffs in individual stocks continues

• stocks selling off individually

• Overbought

• 80% of double tops as in s/p..dow qqq,,usually sends them back down

• waiting to start wave 4

• The market remains overbought and needs a downside correction. More earnings reports are due this week.

• IWM nonconfirmation

• People can’t continue to be irrational forever.

AD: 5 Experts Share Their Best Money Making Strategies

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• PFE, GM, MRK, MA, COP, BP, QCOM, CVS and a few others.

• technical analysis-1-yr daily chart

• broker stats

• Just the chart appearance itself, moving average crossovers, sometimes the VIX gives indication of market direction.

• Stop loss. First hour tracking. Periodic visual checkups during the day. Plus I read market related info about five to six hours a day. My goal is to keep my head in the market flow without giving in to emotional basis.

• Equity curve

• P&L

• Fibonacci distribution to help me decide when to buy & sell. Sell on way up & buy on way down

• move avg

• Net worth tracking

• watch news track stocks I read your poll results i think it shows the crowd and the crowd is wrong at market tops this is nearing a market top

• read

• Download trade info and track using python.

• Account balance monitor. Win/loss ratio

• Fundemantal

• P/L and overall account value. Critical look at trades and what happened afterwards–did I stave off more losses? Leave too much on the table? Try to be objective without beating myself up…easier said than done!

• Price & Profits

• Notebook

Question #5. Additional Comments/Questions/Suggestions?

• above

• To ALL new traders. Trade small and trade often! Do post trade examination of every trade.

• sell gold

Join us for this week’s shows:

Crowd Forecast News Episode #222

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, April 29th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Mark Sachs of RightLineTrading.com

– Jake Bernstein of Trade-Futures.com (first time guest!)

Analyze Your Trade Episode #75

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, April 30th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Bryan Klindworth of AlphaShark.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

AD: 5 Experts Share Their Best Money Making Strategies