- Home

- Archive: May, 2020

Crowd Forecast News Report #349

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport053120.pdf

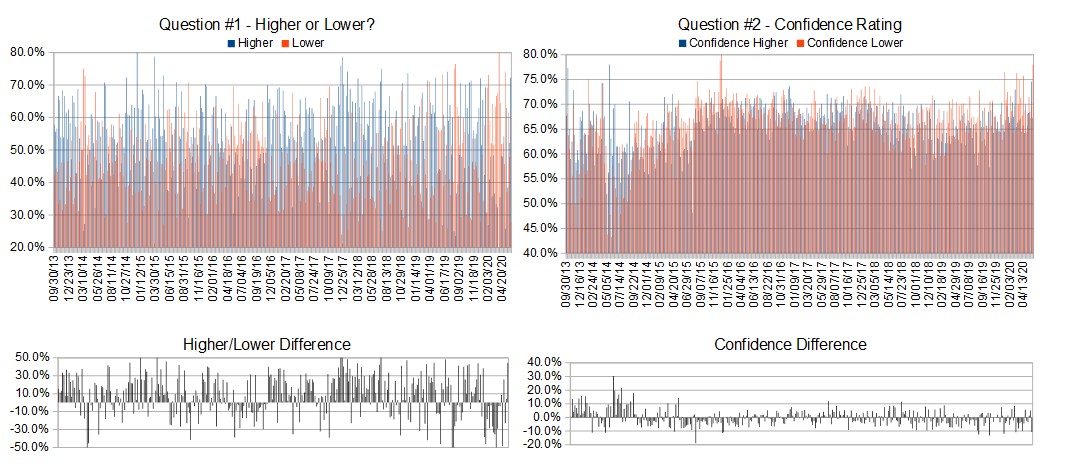

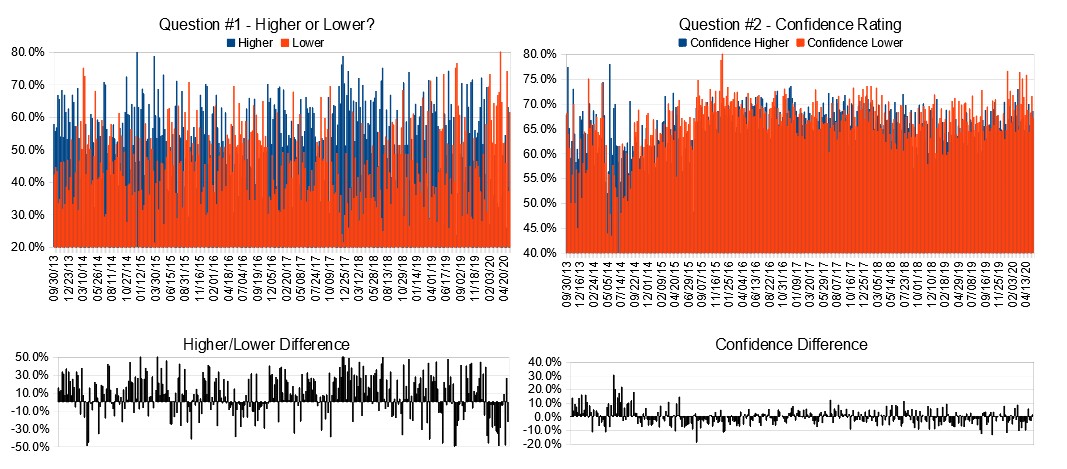

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 1st-5th)?

Higher: 72.2%

Lower: 27.8%

Higher/Lower Difference: 44.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.3%

Average For “Higher” Responses: 67.3%

Average For “Lower” Responses: 78.0%

Higher/Lower Difference: -10.7%

Responses Submitted This Week: 19

52-Week Average Number of Responses: 30.5

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

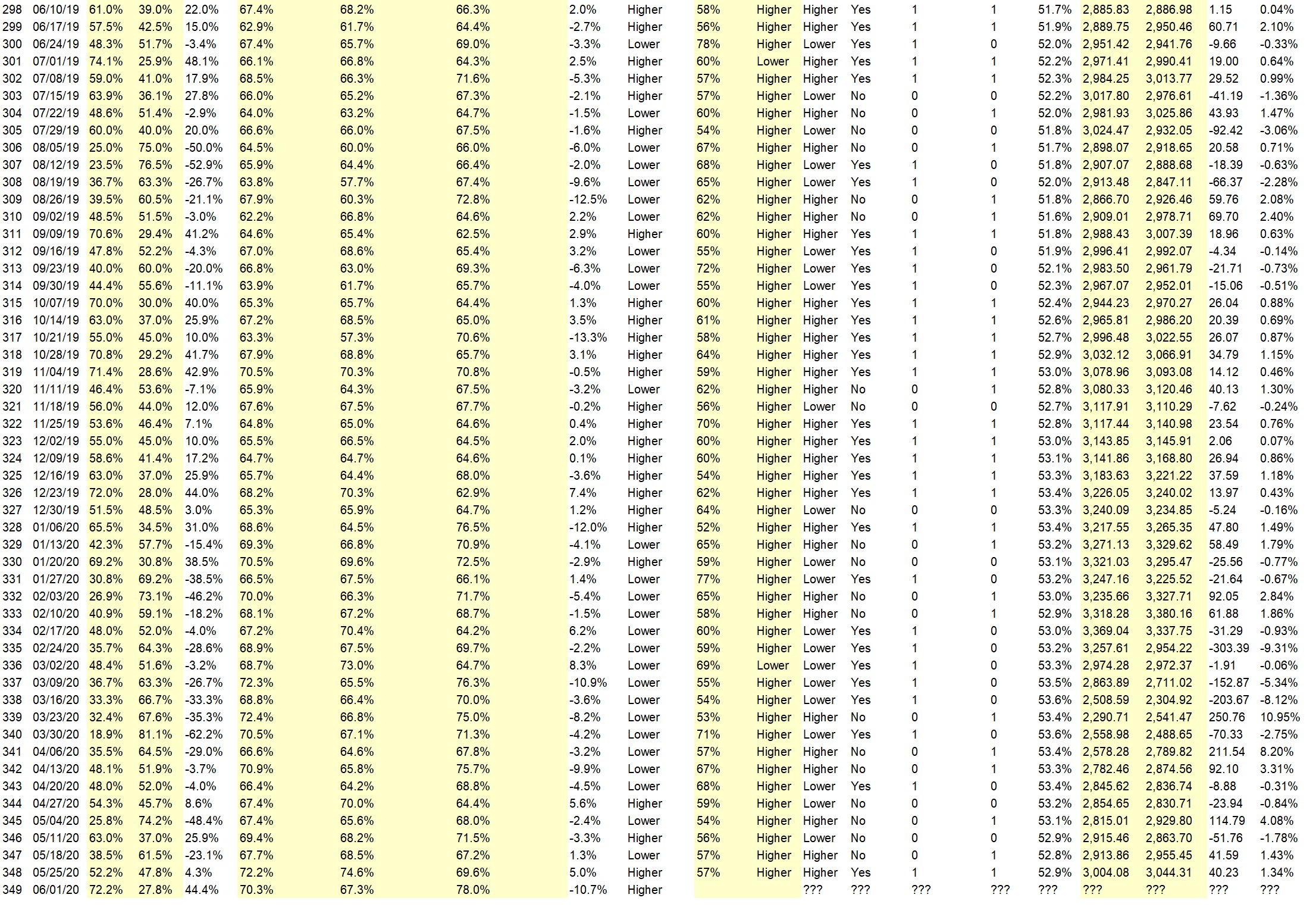

Details: Last week’s majority sentiment from the survey was 52.2% predicting Higher, and the Crowd Forecast Indicator prediction was 57% chance Higher; the S&P500 closed 1.34% Higher for the week. This week’s majority sentiment from the survey is 72.2% predicting Higher (highest percentage in almost a year) but with a much greater average confidence from those who are predicting Lower. Similar conditions have occurred 41 times in the previous 348 weeks, with the majority sentiment (Higher) being correct 57% of the time but with an average S&P500 move of 0.24% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 54% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

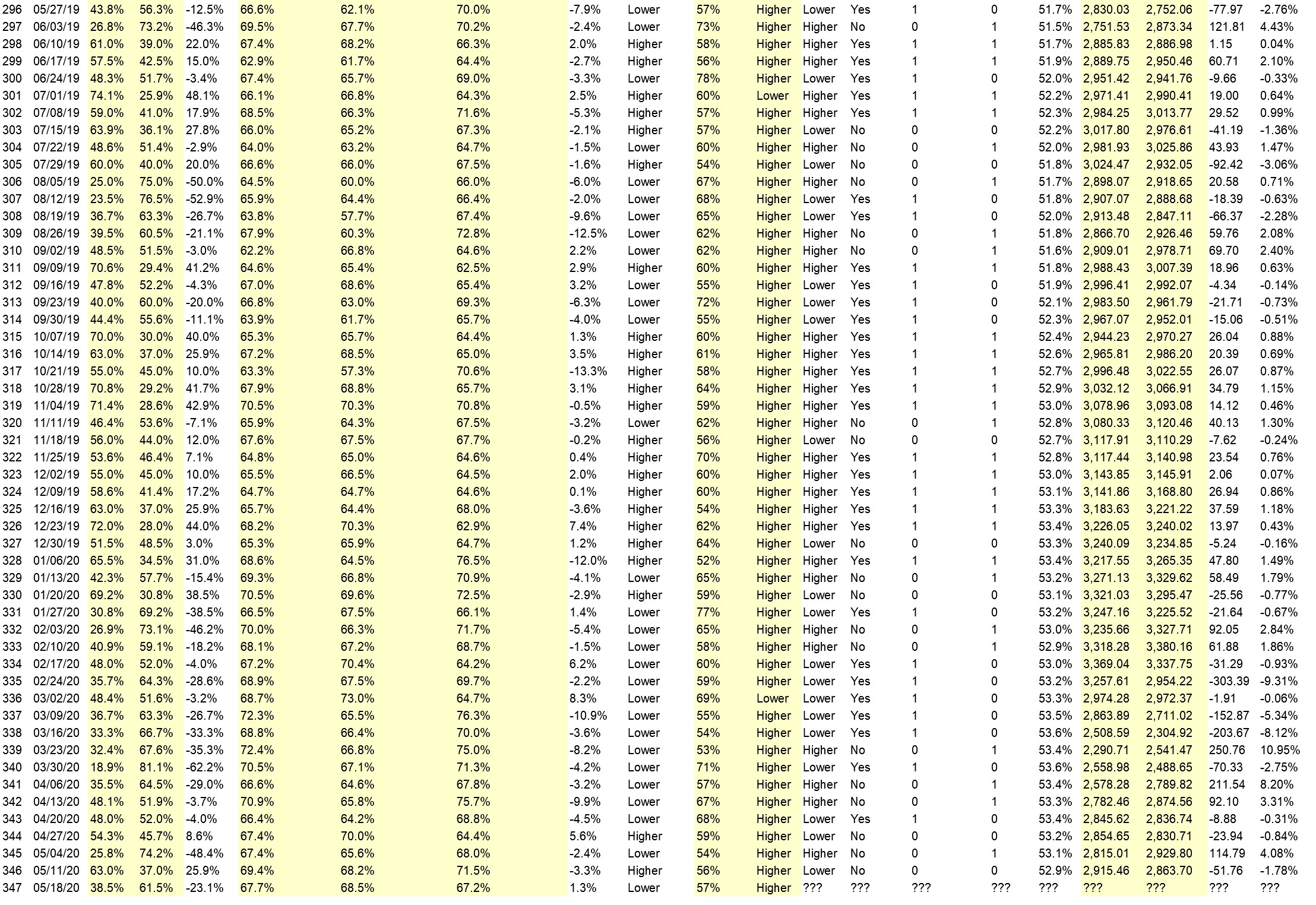

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.9%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Price action

• Trend

• Price is above 200 DMA. VIX go down.

• Things getting going in many states

• Well, we’ve came this far on stimulus, what’s the issue? With economy opening up and those provinces, states , countries 1st to do so will benefit most. Of course those countries who kept operating are already farther ahead!!

• increasing positive momentum

• Momentum

• business is re-opening

• next week will be up

“Lower” Respondent Answers:

• riots and more business closing

• The S&P hit it’s high last week on 5/28 a the top of a Bollinger band and at a resistance level. A dip from there should be probable. Also, the US-China trade uncertainty could discourage investors form buying equities.

• Unrest spreading, COVID-19 cases up due to not distance during memorial weekend, and market needs a breath.

• Cyclical reason

[AD] PDF: 10 Strategies for Success

Question #4. What indicator influences your trading the most?

• trend

• RSI

• I’m simple Most time don’t have any indicators on charts. Just price Bar charts

• Support/resistance levels and Bollinger bands

• MACD

• macd

• MA, CCI

• Look to left; Price Action; volume action; CCI and Market Sediment

• MACD, weekly, daily, 30 minute chart.

Question #5. Additional Comments/Questions/Suggestions?

• none

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #127

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– The Option Professor of OptionProfessor.com

Symbols discussed today: MSFT, AAPL, ZM, AMD, BA, GLD, CRM, PAYC, SQ, NVDA, SMH, MMM, FB, ISRG, SPY

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #348

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport052520.pdf

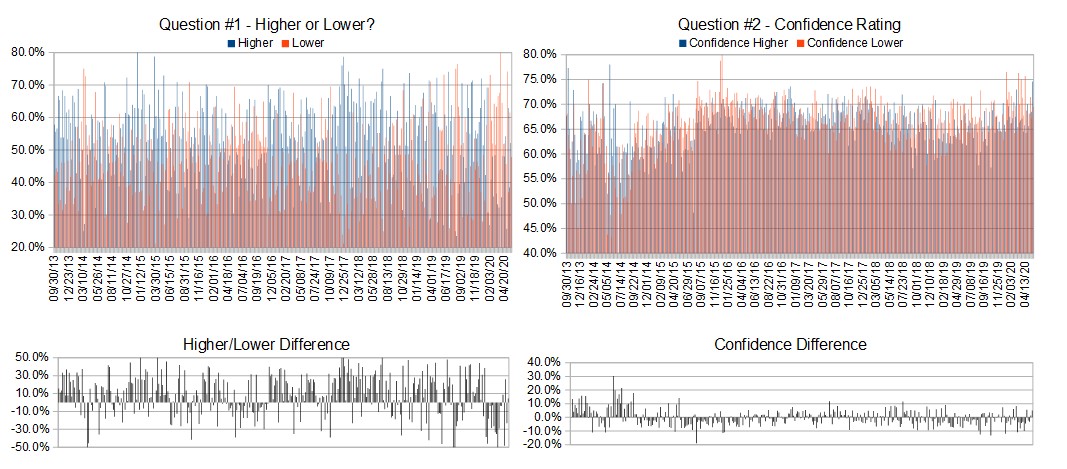

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (May 26th to 29th)?

Higher: 52.2%

Lower: 47.8%

Higher/Lower Difference: 4.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 72.2%

Average For “Higher” Responses: 74.6%

Average For “Lower” Responses: 69.6%

Higher/Lower Difference: 5.0%

Responses Submitted This Week: 24

52-Week Average Number of Responses: 31.1

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

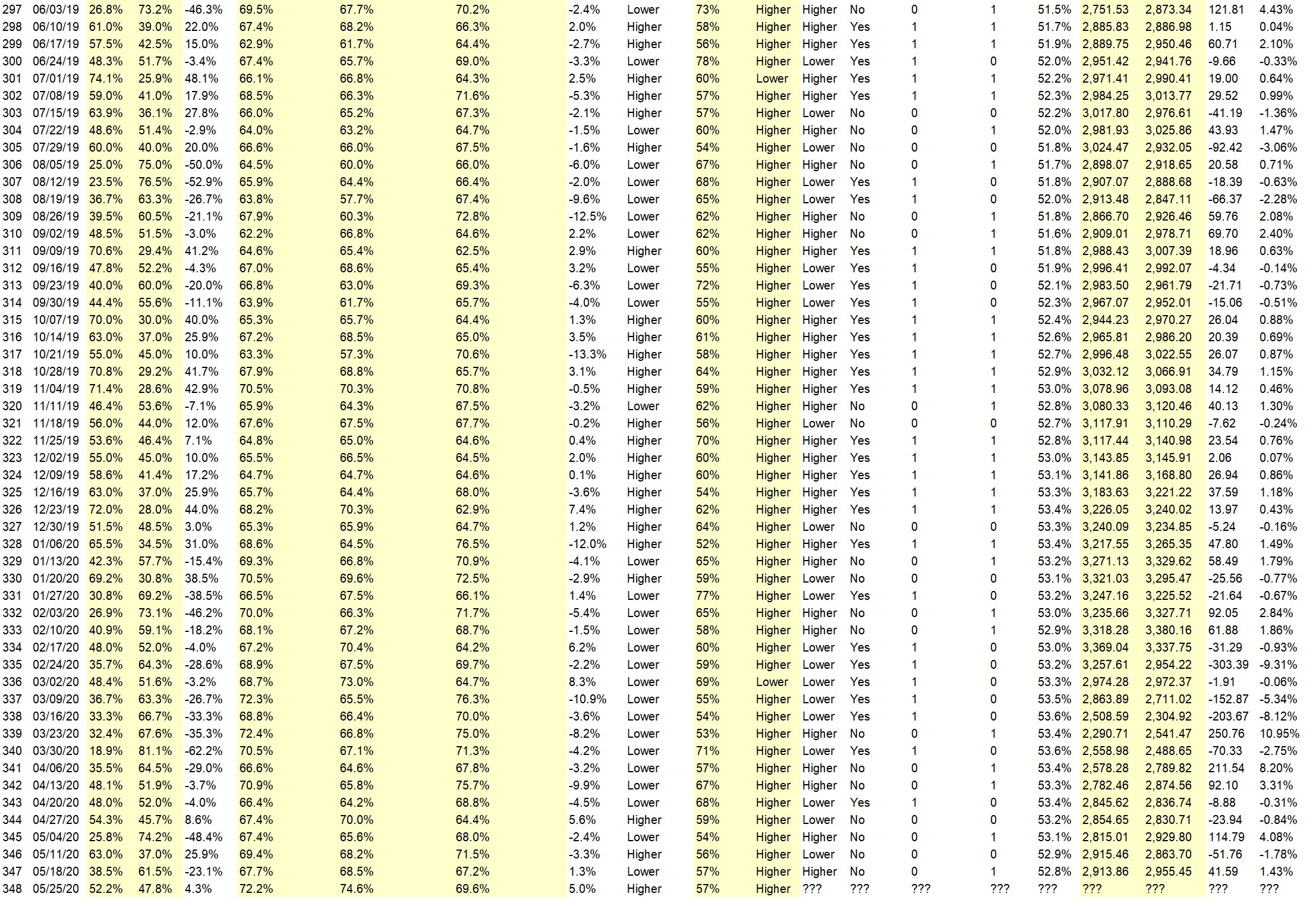

Details: Last week’s majority sentiment from the survey was 61.5% predicting Lower, and the Crowd Forecast Indicator prediction was 57% chance Higher; the S&P500 closed 1.43% Higher for the week. This week’s majority sentiment from the survey is 52.2% predicting Higher with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 30 times in the previous 347 weeks, with the majority sentiment (Higher) being correct 57% of the time and with an average S&P500 move of 0.51% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.8%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Why not, American unemployment may reach over 30%, consumer spending super low, Fed printing money, so why wouldn’t the market go higher? Either way, were gonna be alright!!

• FED loosening Don’t fight the FED

• More states opening

• Current trend still up, but depending on certain resistance levels, we could go up, then down – also if “the idiot” ratchets up the fight with China…etc.

• S&P weekly chart points up and MACD Histogram turned positive.

• The S&P reached a new May high this past week; and is holding up well near that level. This suggests that the S&P will probably reach higher, maybe to 3060 before it turns down.

• Everything is starting to open up again

“Lower” Respondent Answers:

• I’m expecting some sort of bad COVID news soon

• We are range bound now so been up last week and down now.

• I think is a resistant level is reaching around 3000 s&p it will bound back lower at some point. Will see,,,,,,,,

• Earnings season over, reality kicks in.

• gdp’s announcment.

• FOMC Kaplan is talking of remedies economivally maybe i think i guess some maybe

[AD] PDF: 10 Strategies for Success

Question #4. On May 19-21 TimingResearch and TradeOutLoud hosted 3 days of presentations with each day covering a different topic; STOCKS/OPTIONS on Tuesday, FOREX on Wednesday, FUTURES on Thursday. What other specific financial-related topics would you like to see covered in an all-day series of lectures like this? (btw The CFN show is off this coming week for the market holiday but back on June 1st)

• Talk about mechanical systems that work 90% of the time, is there such a system for stocks?

• FUTURES Options on Futures

• Market inside info. Like, who’s doing most of the pre & post market buying? Why do options have such a hard time going up, versus how EASY they can and do go down? Just this past week, a couple of my Netflix positions that don’t expire until June 19 & May 29th respectively, went down substantially (20%) with only a $1.61 move lower in the stock price. At the time that was a small fraction of 1%, since it was trading at $445 or so Why are earnings numbers all over the place? I’ve seen various “consensus” numbers on the same security, so obviously it’s not always a consensus. Further, after earnings report, I can look at Yahoo finance or TD Ameritrade and find one article saying the company beat earnings or rev, and another saying the opposite. What gives? And WHO decides that, in some cases, no matter how good the numbers (earnings, revenues, and outlook), the stock price is going down, even with a low PE stock, even without a recent run up in price, etc. I would like to know WHO is manipulating the market. I can guess, and I can surely guess why, but I’d like details. Unusual option activity – WHO are the players making some of these huge bets? Hedge funds? Billionaires? The JP Morgan’s of the world? Foreign players? It would be nice to know “what is really going on” in regards to all of these scenarios and more.

• I was looking forward to FUTURES, but disappointed. Jack gave a very good presentation, but won’t be able to use. I would like to see more FUTURES presentation tailored to small investors and teaching how to trade micros, more hands on type.

• profits using stop loss sell orders

Question #5. Additional Comments/Questions/Suggestions?

• Thank you for this platform, this is a great area to exchange ideas and thoughts, so thank you again! Mr. Donald Trump is the Best President since JFK!! Heaven and Earth support Mr. Trump 😇. Thank you Mr. President for the light you bring to the planet!! God Bless America and God Bless Mr. Trump!!

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Synergy Traders #13, Day 3, Futures – Kick Start Your Summer Trading

[AD] PDF: 10 Strategies for SuccessThis event was created by TradeOutLoud.com and TimingResearch.com and these presentations were recorded on Thursday, May 21st, 2020.

This post is the Futures Day, scroll down for the archive or select one of the other days here:

Day 1 – Stocks/Options (click here)

Day 2 – Forex (click here)

Presentation: ST #13.21: Two Types of Momentum That Will Explode Your Trading Results with Norman Hallett of TheDisciplinedTrader.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.22: Removing the Human Factor is Not Total When Day Trading Futures with Michael Filighera of LogicalSignals.com

Offer: email [email protected] with the subject: “Free Trial”

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.23: How to Day Trade the E-mini S&P Futures Using Fib Retracments with Tim Racette of EminiMind.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.24: Not Your Mama’s Momentum: How to Profit In Any Market on Any Time Frame with Hima Reddy of HimaReddy.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.25: Day Trading Futures with Order Flow with George Papazov of TRADEPRO Academy

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.26: Generate an Income Trading Futures The First 2 Hours at the New York Trading Session Open with Anka Metcalf of TradeOutLoud.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.27: What Does Success Mean in Futures Trading? with John Hoagland of TopstepTrader.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.28: The Next Six Big Moves And Why with Jake Bernstein of Trade-Futures.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.29: Day and Swing Trading the S&P 500 Using the Micro E-mini Stock Index Futures with Carley Garner of DeCarleyTrading.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.30: Understanding Market Language to Spot High Probability Trades with Technical Analysis with Marina Villatoro of TheTraderChick.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

[AD] PDF: 10 Strategies for Success

Synergy Traders #13, Day 2, Forex – Kick Start Your Summer Trading

[AD] PDF: 10 Strategies for SuccessThis event was created by TradeOutLoud.com and TimingResearch.com and these presentations were recorded on Wednesday, May 20th, 2020.

This post is the Forex Day, scroll down for the archive or select one of the otherd days here:

Day 1 – Stocks/Options (click here)

Day 3 – Futures (click here)

Presentation: ST #13.11: How Shifting My Mindset About “Losing” Turned Me Into A Profitable Trader with Valerie Fox of ConsistentFXProfits.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.12: How To Easily Gain Your Edge In Forex Trading with Brian Stickney of MakeMoneyFromYourLaptop.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.13: The Asian Breakout Strategy with Kyle Kinne of Ninjacators.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.14: Forex Market: Dealing with Uncertainty with Amelia Bourdeau of MarketCompassLLC.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.15: Live Market Analysis Using Supply & Demand with Simon Klein of TradeSmart4x.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

[AD] PDF: 10 Strategies for Success

Presentation: ST #13.16: Live Market Scanner for MT4 – MT4Professional Scanner with Randy Lindsey of MT4Professional.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.17: Making Friends With Your Losses with Yaniv Elbaz of The5er

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.18: Controlling Risk in Your Trading with Jeff Wecker of GlobalFXTradingGroup.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.19: Accurate MACD Trading Strategy with Casey Stubbs of TradingStrategyGuides.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.20: Ignore Naysayers, Fibonacci Tools Give You the Edge You Need with Toni Hansen of ToniHansen.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

[AD] PDF: 10 Strategies for Success

Synergy Traders #13, Day 1, Stocks/Options – Kick Start Your Summer Trading

[AD] PDF: 10 Strategies for SuccessThis event was created by TradeOutLoud.com and TimingResearch.com and these presentations were recorded on Tuesday, May 19th, 2020.

This post is the Stocks/Options Day, scroll down for the archive or select one of the other days here:

Day 2 – Forex (click here)

Day 3 – Futures (click here)

Presentation: ST #13.01: Understand Yourself, Understand Your Trading with Julie & Adrian Manz of TraderInsight.com

Offer: text “open” to 310-299-9148

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.02: Using Volatility to Inform Options Strategy Selection with Sean McLaughlin of AllStarCharts.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.03: The Buying Opportunity of the Century with John Thomas of MadHedgeFundTrader.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.04: Trading The Pandemic: How To Consistently Profit in Today’s Volatile Markets with Fausto Pugliese of CyberTradingUniversity.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.05: Trading The Deathstar with E. Matthew “Whiz” Buckley of TopGunOptions.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

[AD] PDF: 10 Strategies for Success

Presentation: ST #13.06: Chase, Swing and Trend Trading with Options with Samantha LaDuc of LaDucTrading.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.07: Predicting Favorable Outcomes For Options Trades with Matt Choi of CertusTrading.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.08: What to AVOID During a Market Drop in order to Generate a Serious Investment Income with A.J. Brown of TradingTrainer.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.09: Option Professor Market Update with The Option Professor of OptionProfessor.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Presentation: ST #13.10: Swing Into Profits Trading 10 Min Per Day Trading Stocks And ETFs with Anka Metcalf of TradeOutLoud.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

[AD] PDF: 10 Strategies for Success

Crowd Forecast News Episode #264

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Anka Metcalf of TradeOutLoud.com

– Amelia Bourdeau of MarketCompassLLC.com

– Samantha LaDuc of LaDucTrading.com

– Tim Racette of EminiMind.com

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #347

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport051720.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 18th to 22nd)?

Higher: 38.5%

Lower: 61.5%

Higher/Lower Difference: -23.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.7%

Average For “Higher” Responses: 68.5%

Average For “Lower” Responses: 67.2%

Higher/Lower Difference: 1.3%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 31.2

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.0% predicting Higher, and the Crowd Forecast Indicator prediction was 56% chance Higher; the S&P500 closed 1.78% Lower for the week. This week’s majority sentiment from the survey is 63.0% predicting Higher with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 44 times in the previous 346 weeks, with the majority sentiment (Lower) being correct 43% of the time and with an average S&P500 move of 0.002% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.9%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Hello so thenks for all person I am okay and I am care one I am always thinking world the peoples good life coming everyday. All the best

• With the Feds throwing another 3 trillion to everyone, it has to go up.

• irrational exuberance

• Positive Governance opens up states fir business!

• People are starting back to work

• The herd is running

“Lower” Respondent Answers:

• Actually the market should flatten here

• Bearish engulfing on SPX daily.

• We are range bound now

• MGI

• In the daily chart we can see a Head and Shoulders pattern that just breakout the neck line with a negative divergence in MACD and high voloume

• China tension.

• The S&P has been in a trading range the last few weeks with momentum retreating. Financials & retail doing poorly. It’s about time for the S&P to roll over.

• candles formed a chart-pattern that signals the market wants to go down

• Technical analysis

• 1. Correction of recent rally is at serious low.

• Last big week of earnings and no really good news expected. Market beginning to pullback.

• news on the virus, bank failures due to non-payment of rent and mortgages

[AD] PDF: 10 Strategies for Success

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• I watch the financial news daily

• If I hit my targets.

• P&L

• Market profile

• Hey so thenks for you I am going to my conditions Is good no problem.

• Daily charting and advisory services.

• Portfolio value.

• chart-analytics & guidance from analysts

• Excel spreadsheet

• I have backdate testing

• Plots

• Basic resistence and support charting. Evaluate a consensus of TV “talking heads” experts dialogue.

• %winning trades and $balance

Question #5. Additional Comments/Questions/Suggestions?

• Hello so thenks for everyone all the best

• The markets should be in the dumper, but the Fed and and govt orgs are running the show. Kind of weird though-every time another 3-4 million people are laid off, the markets spike up!

• President Donald Trump Best President since JFK!!

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #126

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Jake Bernstein of Trade-Futures.com

– The Option Professor of OptionProfessor.com (moderator)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies