- Home

- Archive: August, 2020

Synergy Traders #18: Favorite Indicators

[AD] PDF: 10 Strategies for SuccessThis event was created by TradeOutLoud.com and TimingResearch.com and these presentations were recorded on Monday, August 31st, 2020. All of these presentations cover Favorite Indicators of the presenters.

Synergy Traders #18.01: Golden Reversal Line with Kyle Kinne of Ninjacators.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.02: Learn To Day Trade Futures with Sean Kozak of NSTradingAcademy.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18:03: Favorite Indicators with John Nyaradi of TradingGods.net

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.04: Mojo Day Trading Favorite Indicators with ProTrader Mike of MojoDayTrading.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.05: Four Powerful Rules for Trading Any Chart & Any Timeframe with Doc Severson of ReadySet.trade

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.06: How to Find Profitable Turning Points in The Market with Steven Place of InvestingWithOptions.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

[AD] PDF: 10 Strategies for Success

Synergy Traders #18.07: How to Target Gains of Up To +300% with $1 Options with Price Headley of BigTrends.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.08: Trading the Death Star – the ONLY Stock You MUST Own with E. Matthew “Whiz” Buckley of TopGunOptions.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.09: Following Into Profits Using The Only Indicator Institutional Traders Use with Anka Metcalf of TradeOutLoud.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #Synergy Traders #18.10: Using Technical Tools to Create Algo Trade Strategies with John Person of PersonsPlanet.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.11: Catching The Yearend Rally with John Thomas of MadHedgeFundTrader.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #18.12: Cocktail Hour (Panel Discussion) with Anka, John, and Steven

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

BONUS: Chart Analysis with Anka Metcalf

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

[AD] PDF: 10 Strategies for Success

Crowd Forecast News Report #362

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport083120.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close?

Higher: 80.0%

Lower: 20.0%

Higher/Lower Difference: 60.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 72.3%

Average For “Higher” Responses: 72.5%

Average For “Lower” Responses: 71.7%

Higher/Lower Difference: 0.8%

Responses Submitted This Week: 15

52-Week Average Number of Responses: 26.0

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 75.0% predicting Higher, and the Crowd Forecast Indicator prediction was 58% chance Higher; the S&P500 closed 2.63% Higher for the week. This week’s majority sentiment from the survey is 80.0% predicting Higher and with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 37 times in the previous 361 weeks, with the majority sentiment (Higher) being correct 59% of the time and with an average S&P500 move of 0.03% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

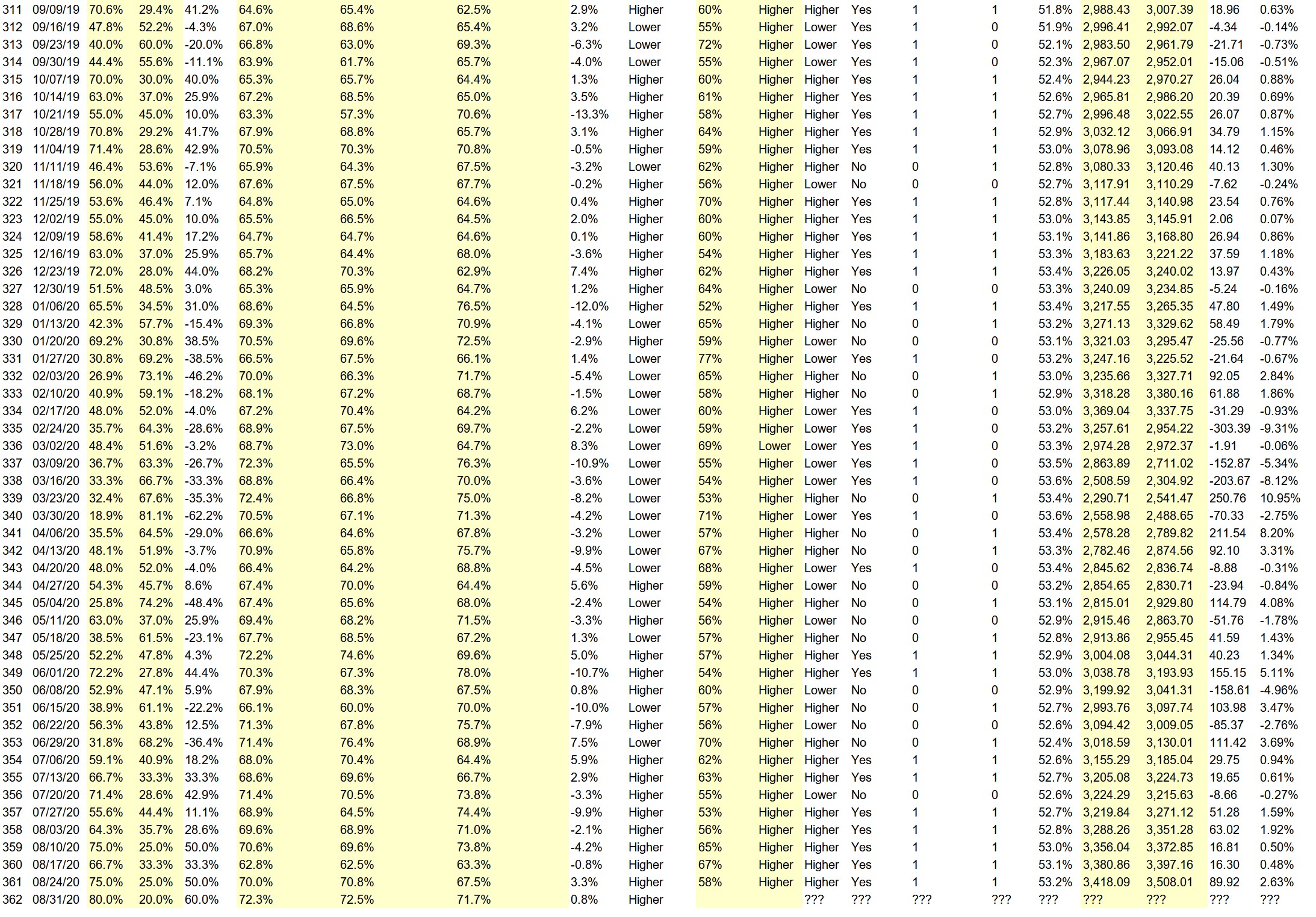

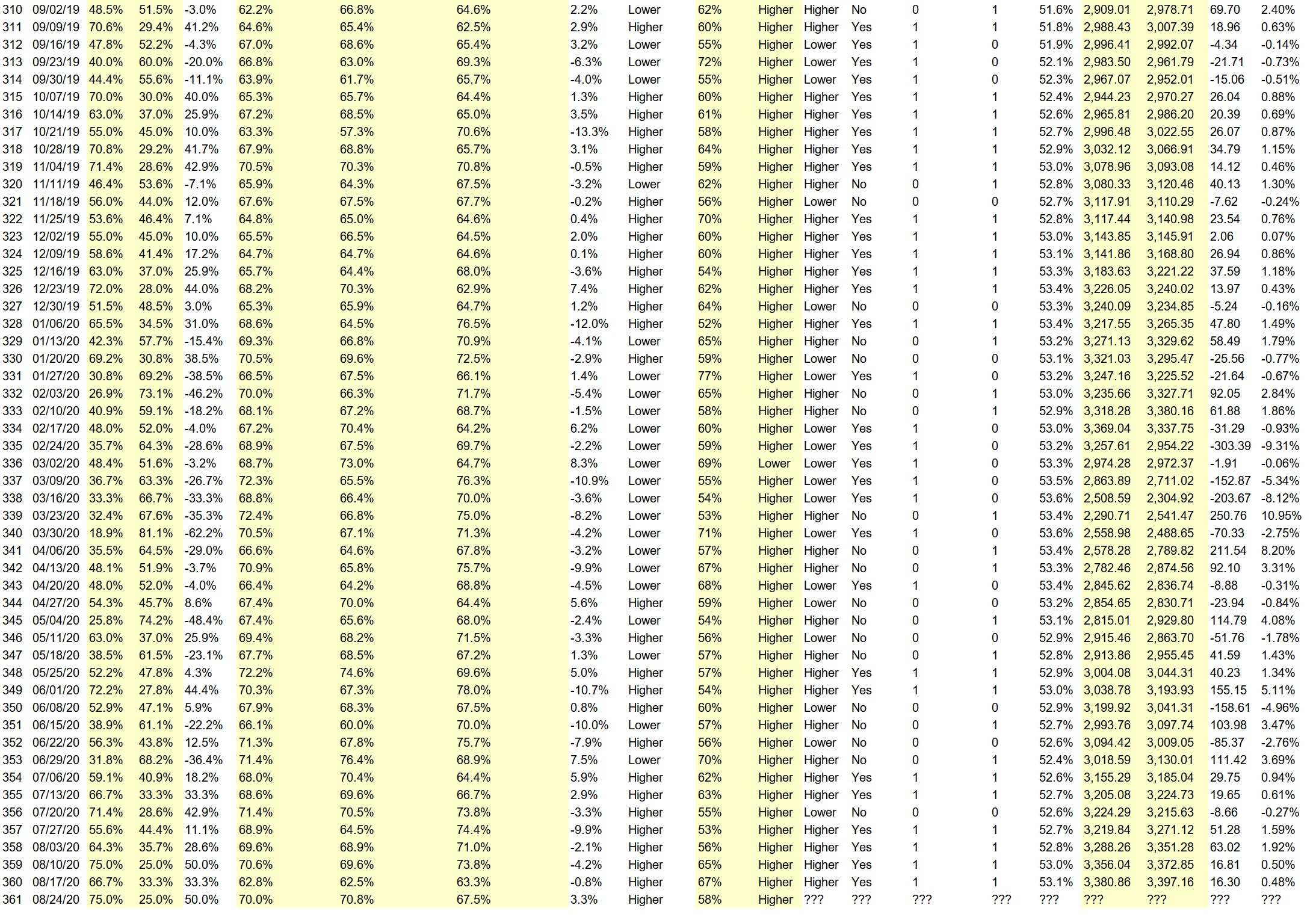

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.2%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Trend

• Split in AAP and TSLA will enable investor to buy more shares.Means more volume/demand and hence it will go up. It depend deal of TIK TAK that will jack the market more with an increase in Walmart and Microsoft stock prices.

• Philips curve gone

• Trend is still up

• It looks like by the end of the year the price will go to 4150 according to EW. So far, the trend is behaving like a perpetual mobile.

• Everything is going well. More good news than bad

• Election soon

• good till the election

• Trump is pulling in more votes n the polls with the Senate Red map

“Lower” Respondent Answers:

• S&P at 3500 should be the short-term resistance level; looking for an orderly pullback.

• Divergence

[AD] PDF: 10 Strategies for Success

Question #4. What topic(s) would you most like to learn about related to trading or investing?

• Inside trading and hoe it effects.

• New stocks

• Psychology

• VHF trading lacks human weaknesses, so no known strategy can be applied against it.

• Interest rates

• options stategies

• Profit

Question #5. Additional Comments/Questions/Suggestions?

• Very soon or lator TSLA will burst as it has hardly any big no of cars and nothing so fast to come in market.Prices are being pushed up

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #137

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– The Option Professor of OptionProfessor.com (moderator)

Symbols discussed today: TSLA, MSFT, YY, ILMN, PINS, AAPL, NVDA, SQ, T

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #361

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport082420.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close?

Higher: 75.0%

Lower: 25.0%

Higher/Lower Difference: 50.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.0%

Average For “Higher” Responses: 70.8%

Average For “Lower” Responses: 67.5%

Higher/Lower Difference: 3.3%

Responses Submitted This Week: 15

52-Week Average Number of Responses: 26.4

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 66.7% predicting Higher, and the Crowd Forecast Indicator prediction was 65% chance Higher; the S&P500 closed 0.50% Higher for the week. This week’s majority sentiment from the survey is 75.0% predicting Higher and with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 36 times in the previous 360 weeks, with the majority sentiment (Higher) being correct 58% of the time but with an average S&P500 move of 0.04% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

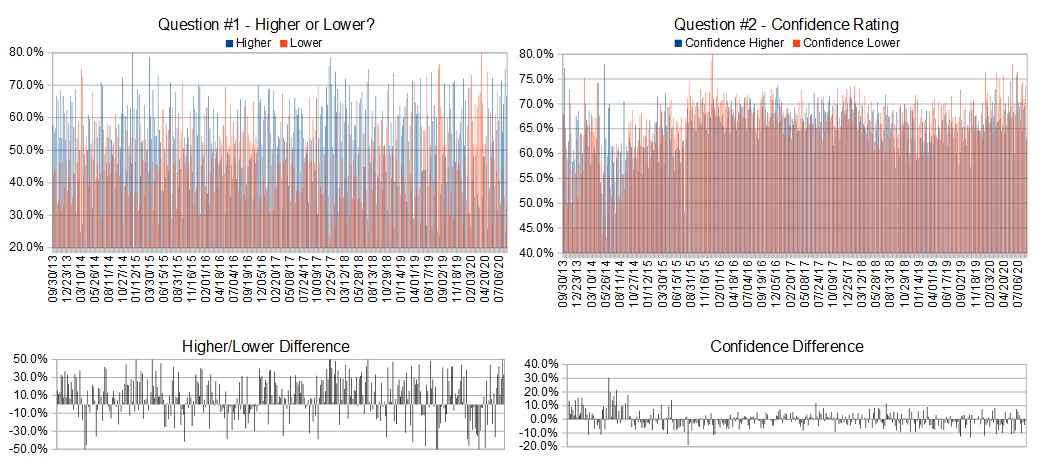

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.1%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Low confidence due to divergence in rates of change with SPY, IWM, QQQ Positive 40B monthly into Treasuries Positive COT Commercials buying Eminis and have been so for some time

Negative Very high sentiment by Small Trader. Usually small trader is wrong short term

• End of the month trading, more news is going to be released that will bump the markets higher

• The 20 and 50 MAE keep going up away from 200 MAE

• Irrational exuberance

• The bull is running until the election

• Trend

• Luquidity. News. Momentum.

• Optimism. Enthusiasm of APPL and TSLA stock split. Last week of August and lots of money needs to be invested in the market since interest rate is so low.

• The trend continues

“Lower” Respondent Answers:

• Lower Breath and negative volume

• The S&P appears to have stalled near the 3400 area. Also the latest leg of the advance is now long enough where a trace back is to be expected.

[AD] PDF: 10 Strategies for Success

Question #4. What topic(s) would you most like to learn about related to trading or investing?

• currency exchange

• forecasting

• Psychology

• How to trade futures and how to use TOS tool for futures trading.

• Vix. Commodities.

• How find stocks with high momentum.

Question #5. Additional Comments/Questions/Suggestions?

• I don’t pay attention to the COVID madness. I do not believe the commercials for the most part do either.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Weekend Reading (August 22nd)

Improve your trading skills this weekend by accessing any of the 6 educational eBooks listed below…

But first, a reminder, if you haven’t watched the videos from Thursday’s event, you can also expand your knowledge with the 9 archive videos from Synergy Traders #17: Day Trading Strategies, available here.

Access all of these eBooks now:

▶ Top Down Trading: Trade the Right Stock in the Right Sector

Find the right stock, no matter what the market conditions are. Great traders focus on trend following, not trend commanding.

▶ How To Make Your First $1000 With This Options Strategy

Chief Trading Instructor reveals an unusual method to profit every 21 days. Plus Exclusive Access To The One Trade Challenge presentation.

▶ Catching the Crash – How to Create Great Risk Reward Options Trading Ideas

Insightful eBook loaded with trading ideas, results, and a simple process used by the Top 1%. See the trade that made 2,100% in only 10 days.

▶ 5 Secret Trading Strategies To Win Every Day In The Market

Bryan Bottarelli has taken the strategies he learned in the Live Pit of the Chicago Options Exchange and revealed them in this easy to follow training manual.

▶ Elliott Wave Principle

Elliott Wave Principle is one of the most popular market analysis books ever published, “Still the Classic and Essential Text for Elliott Wave Trading”

▶ How Options Are Used To Hedge Upside And Downside Risk

This eBook provides substantial insight into how professional options traders think about risk to profit in all market conditions.

Synergy Traders #17: Day Trading Strategies

[AD] PDF: 10 Strategies for Success

This event was created by TradeOutLoud.com and TimingResearch.com and these presentations were recorded on Thursday, August 20th, 2020. All of these presentations cover Day Trading.

Synergy Traders #17.01: Option Professor Market Update with The Option Professor of OptionProfessor.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.02: Day Trading Volatility & Momentum with Michael Filighera of LogicalSignals.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.03: Trading Rules That Can Help You Become A Consistent Day Trader with Steven Primo of ProTraderStrategies.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.04: 4 Steps to Simplify Your Day Trading and Understanding the Power of the BREAK OUT TRADE with Marina Villatoro of TheTraderChick.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.05: Trading The Pandemic: How to Consistently Profit in Today’s Volatile Market with Fausto Pugliese of CyberTradingUniversity.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.06: Day Trading Profit System with ProTrader Mike of MojoDayTrading.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.07: Generate an Income Trading 2 Hours / day at the New York Trading Session Open with Anka Metcalf of TradeOutLoud.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.08: Trading the Death Star: The ONLY Stock You MUST Own with E. Matthew “Whiz” Buckley of TopGunOptions.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Synergy Traders #17.09: High Probability Trade Ideas Using The VWAP And Just A Few Key Moving Averages with Craig Hill of ReadySet.trade

Offer: HERE

Slides: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Analyze Your Trade Episode #136

[AD] PDF: 10 Strategies for Success

Watch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Carley Garner of DeCarleyTrading.com

– The Option Professor of OptionProfessor.com (moderator)

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Episode #274

[AD] PDF: 10 Strategies for Success

Watch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Anka Metcalf of TradeOutLoud.com

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #360

[AD] PDF: 10 Strategies for Success

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081720.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 17th-21st)?

Higher: 66.7%

Lower: 33.3%

Higher/Lower Difference: 33.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.8%

Average For “Higher” Responses: 62.5%

Average For “Lower” Responses: 63.3%

Higher/Lower Difference: -0.8%

Responses Submitted This Week: 18

52-Week Average Number of Responses: 26.8

TimingResearch Crowd Forecast Prediction: 67% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 75.0% predicting Higher, and the Crowd Forecast Indicator prediction was 65% chance Higher; the S&P500 closed 0.50% Higher for the week. This week’s majority sentiment from the survey is 66.7% predicting Higher but with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 27 times in the previous 359 weeks, with the majority sentiment (Higher) being correct 67% of the time but with an average S&P500 move of 0.32% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

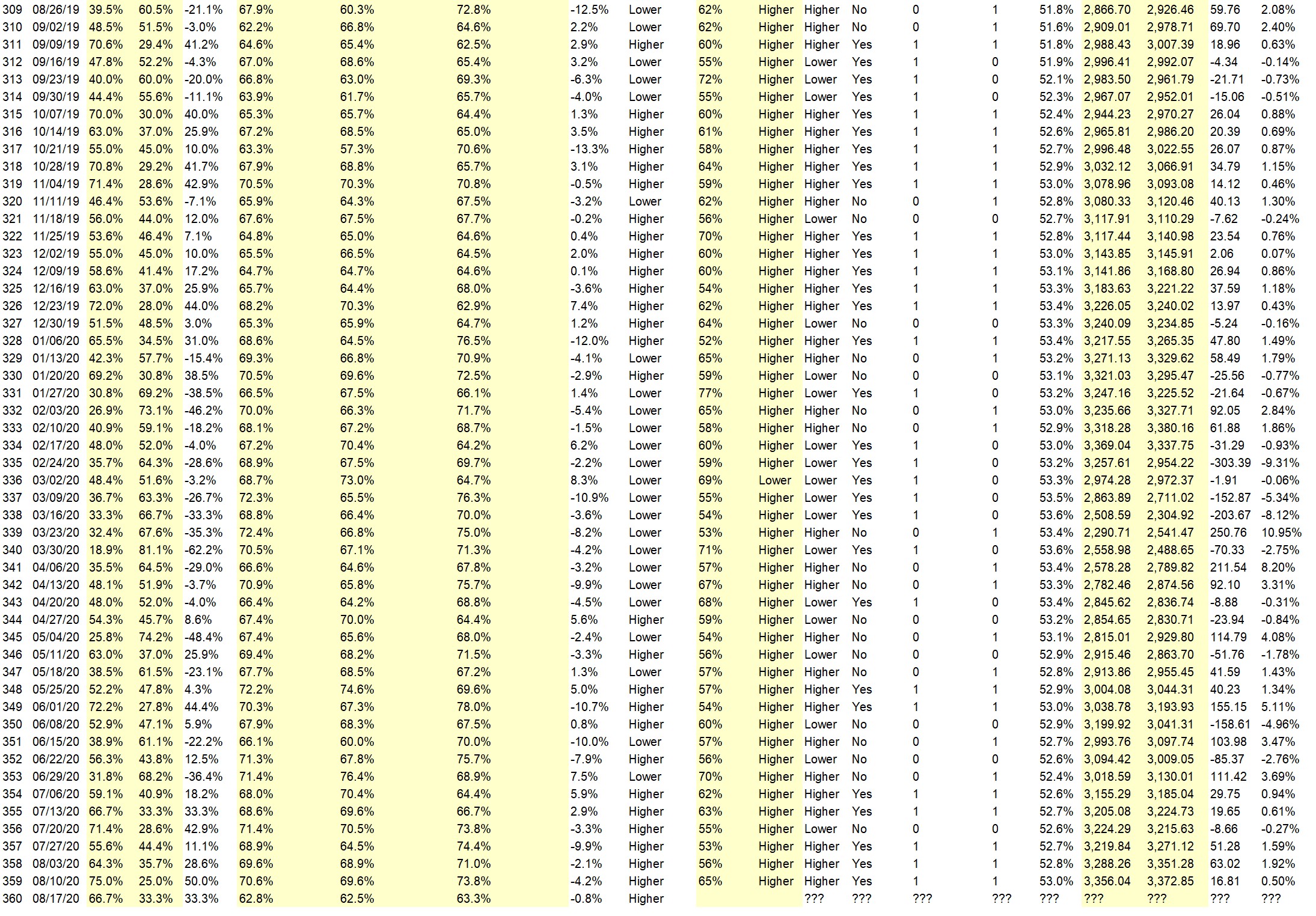

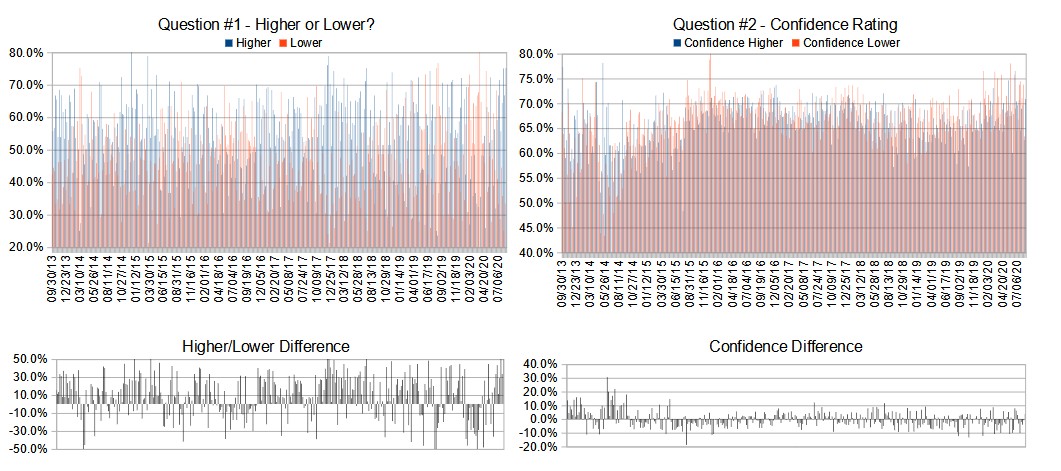

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• COVID-19 cases are going down; NY city is opening up and created HOPE; some students will go back to school and parents will spend some money for back to school; Biden has chosen running VP, etc. In another words, less bad news.

• Trend continues, there are too many bears out there.

• It’s a continuation of the upward trend; and that liquidity is still around.

• Trend

• The trend is up until it’s not. I remain cautiously bullish. Good news bites will keep this boat afloat. Some bad news and my thought is there will be a pullback

• COT still is a Net Purchase for S&P E minies NASDAQ Eminies have a lower net sell last week

“Lower” Respondent Answers:

• excessive exhuberance

• Justing getting too high given the problem with COVID and the wrecked economy. Can’t ignore this situation forever.

• Nothing shows a possible drop in prices but the weakness of the past two trading days leads me to vigilance

• 1. reasons, The covid-19 is effecting the economy. 2. The Market will recover too soon.

[AD] PDF: 10 Strategies for Success

Question #4. What would you most like to learn about related to trading?

• Trading Psychology

• How the hell do I make money?

• Overnight Trading-Options Strategies.

• Safe consistent income generation. I am semi-retired overseas and mostly work on cash flowing (inside tax advantaged IRAs) my stock and ETF holdings with covered calls. I also do some cash secured puts to earn and possibly accumulate new positions at a prices I like. I have not done any serious study on best timing methods for the sales. Should you simply sell ATM and walk away for the week? Is it better to sell options in blocks as the market moves to perhaps earn a bit more? For me, the best plan keeps it simple and as mechanical as possible.

• In a large amount of information that I gained from r.2009 telling me nothing is missing !?

• How to trade ES (E-mini), NQ, GC, ZB/ZN, and what are the characters of each

Question #5. Additional Comments/Questions/Suggestions?

• Mini-Market tradings.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Weekend Reading (August 15th)

Have some free time this weekend? Use it to learn something new! 5 great eBooks are available for immediate access…

But first, mark your calendar right now for this coming Thursday, August 20th, at 10AM ET. The Synergy Traders series will be back and focued on some of the best Day Trading Strategies that top trading experts can bring you, click here to learn more.

Access all of these eBooks now:

▶ How To Make Your First $1000 With This Options Strategy – Chief Trading Instructor reveals an unusual method to profit every 21 days. Plus Exclusive Access To The One Trade Challenge Webinar (Where you can learn all about the high potential “Super Trade” that could change your life!)

▶ Catching the Crash – How to Create Great Risk Reward Options Trading Ideas – Insightful eBook loaded with trading ideas, results, and a simple process used by the Top 1%. See the trade that made 2,100% in only 10 days.

▶ 5 Secret Trading Strategies To Win Every Day In The Market – Veteran trader Bryan Bottarelli has taken the strategies he learned in the Live Pit of the Chicago Options Exchange and revealed them in this easy to follow training manual.

▶ Elliott Wave Principle – Now in its 40th year, Elliott Wave Principle is one of the most popular market analysis books ever published. Amazon reviewers say, “Still the Classic and Essential Text for Elliott Wave Trading” and “This is the bible of the theory.”

▶ How Options Are Used To Hedge Upside And Downside Risk – The Option Professor is a graduate of Boston College and has well over 25 years experience teaching people how the option markets work, this eBook provides substantial insight into how professional options traders think about risk to profit in all market conditions.

[AD] PDF: 10 Strategies for Success