Crowd Forecast News Report #333

[AD] Report: 12 Pro Traders (Favorite Stocks for Right Now)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport020920.pdf

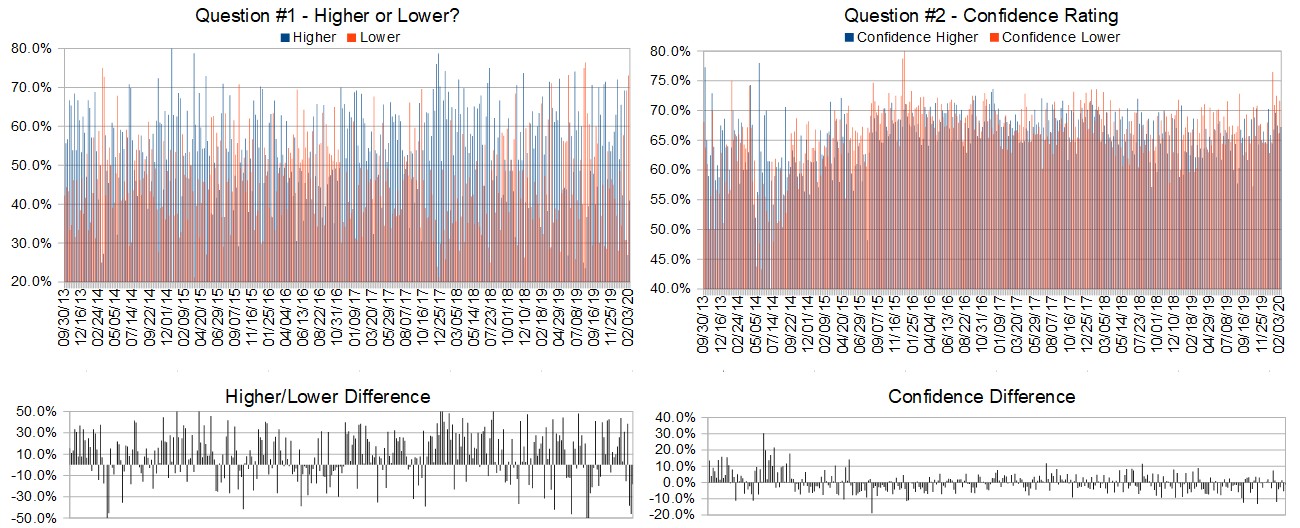

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 10th to 14th)?

Higher: 40.9%

Lower: 59.1%

Higher/Lower Difference: -18.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.1%

Average For “Higher” Responses: 67.2%

Average For “Lower” Responses: 68.7%

Higher/Lower Difference: -1.5%

Responses Submitted This Week: 24

52-Week Average Number of Responses: 32.9

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

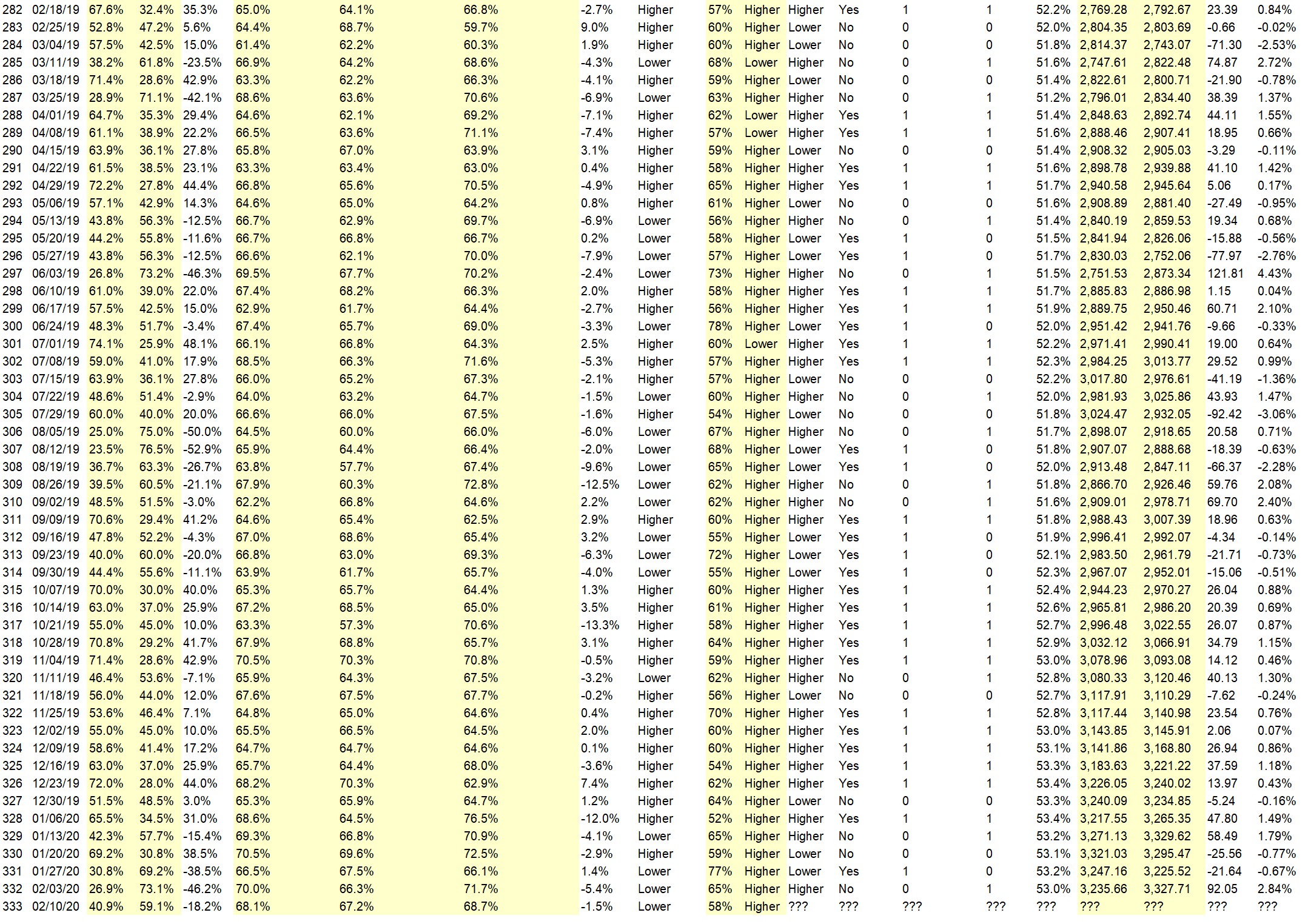

Details: Last week’s majority sentiment from the survey was 73.1% predicting Lower, and the Crowd Forecast Indicator prediction was 65% chance Higher; the S&P500 closed 2.84% Higher for the week. This week’s majority sentiment from the survey is 59.1% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 67 times in the previous 332 weeks, with the majority sentiment (Lower) being correct only 42% of the time and with an average S&P500 move of 0.35% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: 12 Pro Traders (Favorite Stocks for Right Now)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• LT trend

• President Trump the greatest president since JFK now can focus more on the Nation. He has the greatest team and family support I’ve ever seen in all my years in business. The people of the nation has SEEN THROUGH the lies and deception by the other party. This man’s energy and vision drives the economy and stock markets to new heights and everyone wants onboard… The China v. flue is a issue effecting markets to a degree and of course short sellers as well.

• Trend still up

• historical

“Lower” Respondent Answers:

• Overpriced

• Corona Virus

• N0t enough money flowing in to keep market propped up

• Money flowing out of market

• 3 bar reversal on daily chart.

• just a retrace rally now back to spx 3226

• Coruna Virus and its toll on Chinese manufacturing output for at least the 1st half of 2020

• Investors can be expected to take profits in light of the market being overbought combined with the chance that the coronavirus is more serious than most people think it is. Chinese factories, shipping, and tourism abroad are being affected.

• The market is overbought and international concerns will hurt and the Democratic primary in NH

• Caronavirus effect and fear. Next few days slightly bearish anyway.

• Market momentum has turned down. Additional Earnings reports will pressure the market.

• Although the Fed is continuing with QE 4, there are indications from other economies that they are seeing the effects of the shutdowns in China which is affecting the supply chain. There is fear beginning to creep into the markets.

• Cororavirus

[AD] Report: 12 Pro Traders (Favorite Stocks for Right Now)

Question #4. What methods or techniques do you use to overcome the emotional aspects of trading?

• Redistribute some wealth to masses from the top 8% to stimulate demand and relieve national debt.

• rules

• None sell is the only way to get out of pain

• Sell

• Key numbers, price action, reduce computer time.

• “Scotch on the Rocks”!!

• meditation

• Try to stay rational

• Be calm enough to learn not to jump at sudden moves in stocks, as they may be reversed unexpectedly.

• Stop, take a breath and only act if a greater benefit is seen.

• I have mental stops for my positions and hedges with options.

• study

• Stopse

Question #5. Additional Comments/Questions/Suggestions?

• Make the public know that wealth distribution will increase demand and improve the economy.

• All from a Canadian Perspective.

• Overall bullish but some pause or correction healthy.

Join us for this week’s shows:

Crowd Forecast News Episode #253: This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, February 9th, 2020, 1PM ET (10AM PT)

Lineup for this Episode:

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #112: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 11th, 2020, 4PM ET (1PM PT)

Lineup for this Episode:

– Harry Boxer of TheTechTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders Event #11 — Women Teach Trading and Investing: Opportunities to Profit in Today’s Markets: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 11th, 2020, 4PM ET (1PM PT)

Lineup for this Episode:

– Full schedule to be announced: Over 20 women financial professions and educators have confirmed to participate and we’re expecting the final lineup to be 25-40.

[AD] Report: 12 Pro Traders (Favorite Stocks for Right Now)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies