- Home

- Crowd Forecast News Reports

Crowd Forecast News Report #342

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport041220.pdf

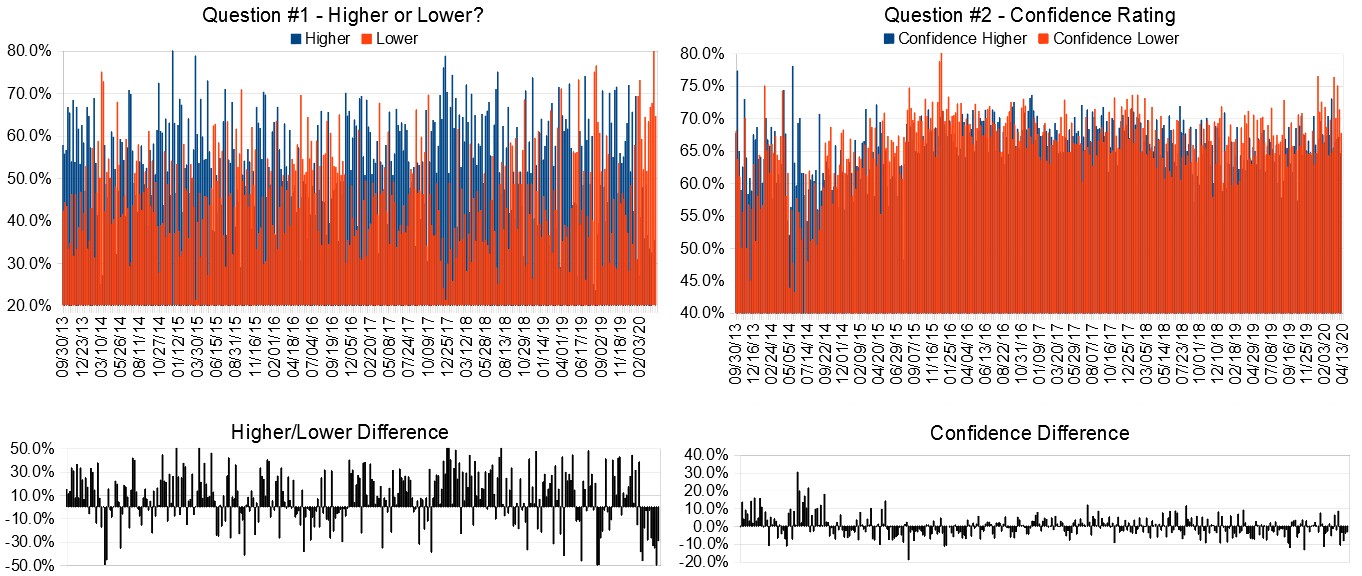

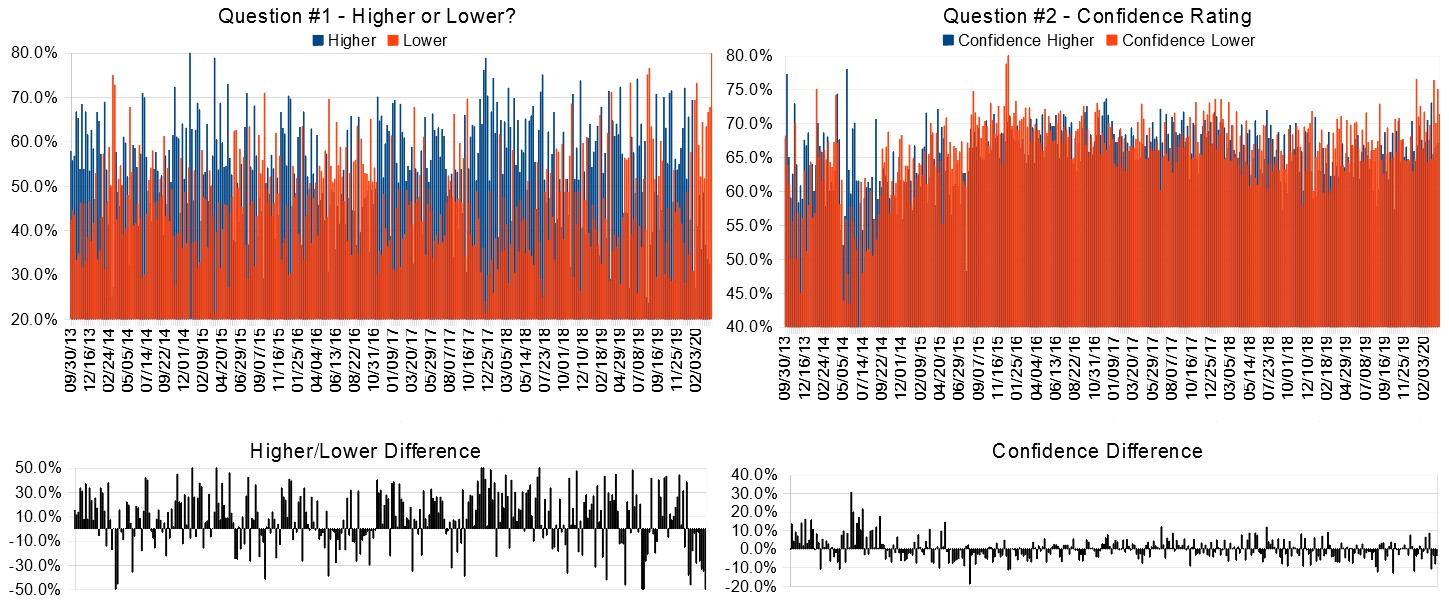

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 13th to 17th)?

Higher: 48.1%

Lower: 51.9%

Higher/Lower Difference: -3.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.9%

Average For “Higher” Responses: 65.8%

Average For “Lower” Responses: 75.7%

Higher/Lower Difference: -9.9%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 31.7

TimingResearch Crowd Forecast Prediction: 67% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 64.5% predicting Lower, and the Crowd Forecast Indicator prediction was 57% chance Higher; the S&P500 closed 8.20% Higher for the week. This week’s majority sentiment from the survey is 51.9% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 21 times in the previous 341 weeks, with the majority sentiment (Lower) being correct 33% of the time and with an average S&P500 move of 0.33% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Higher this coming week.

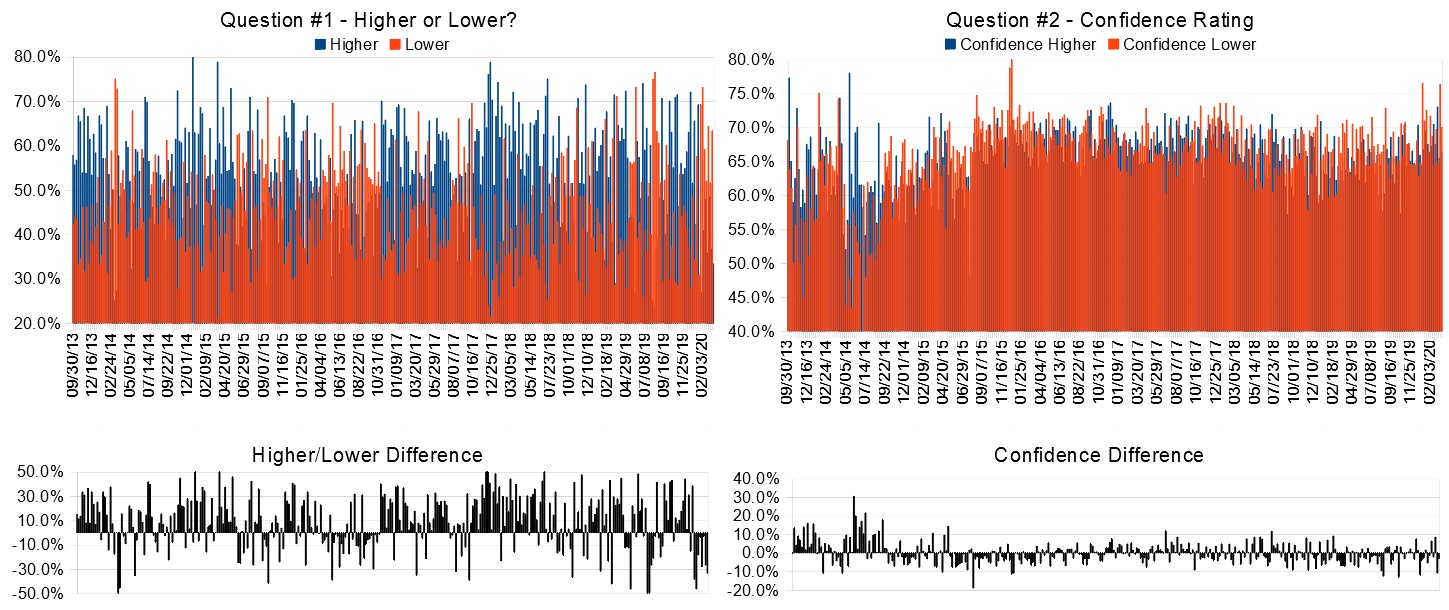

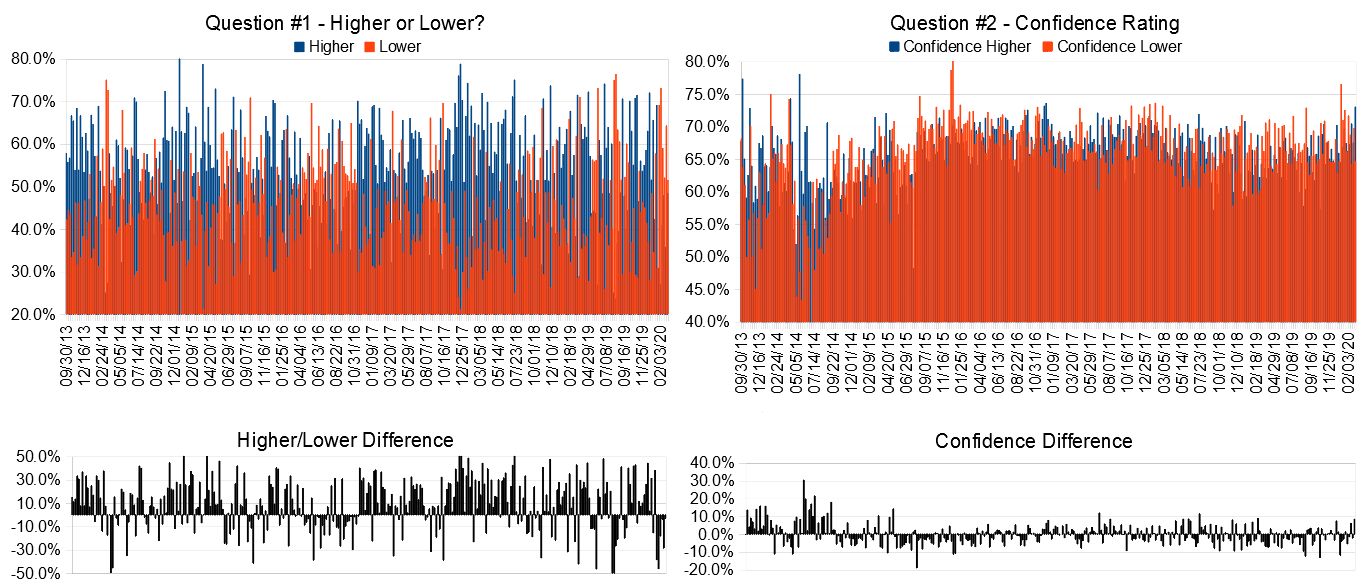

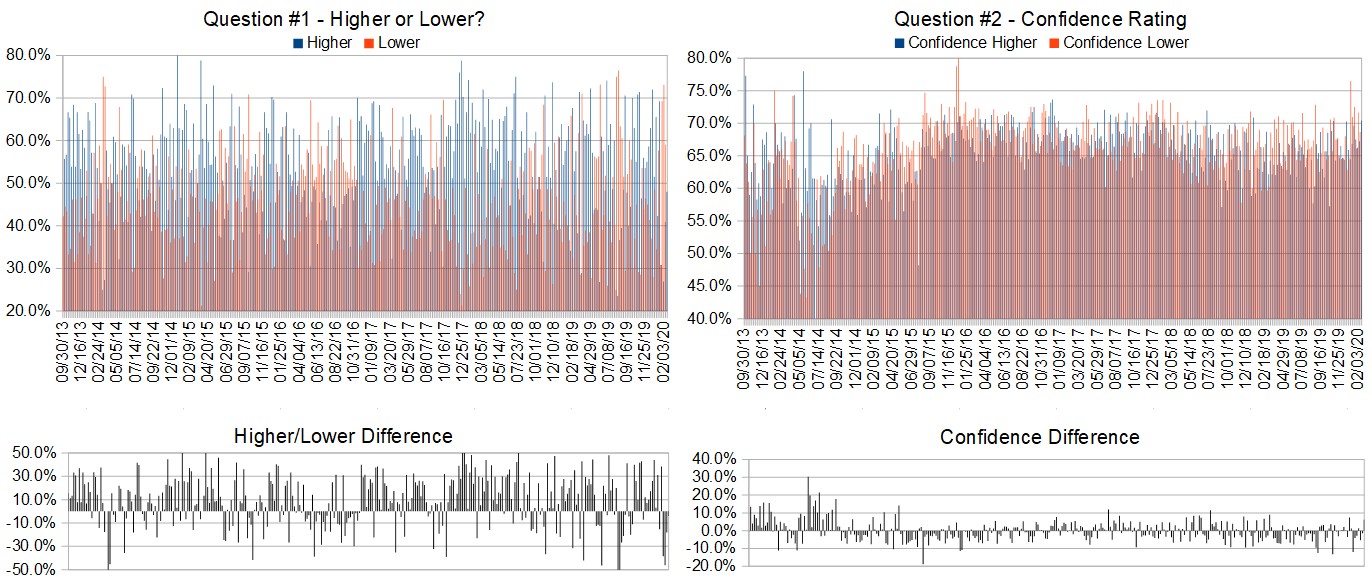

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

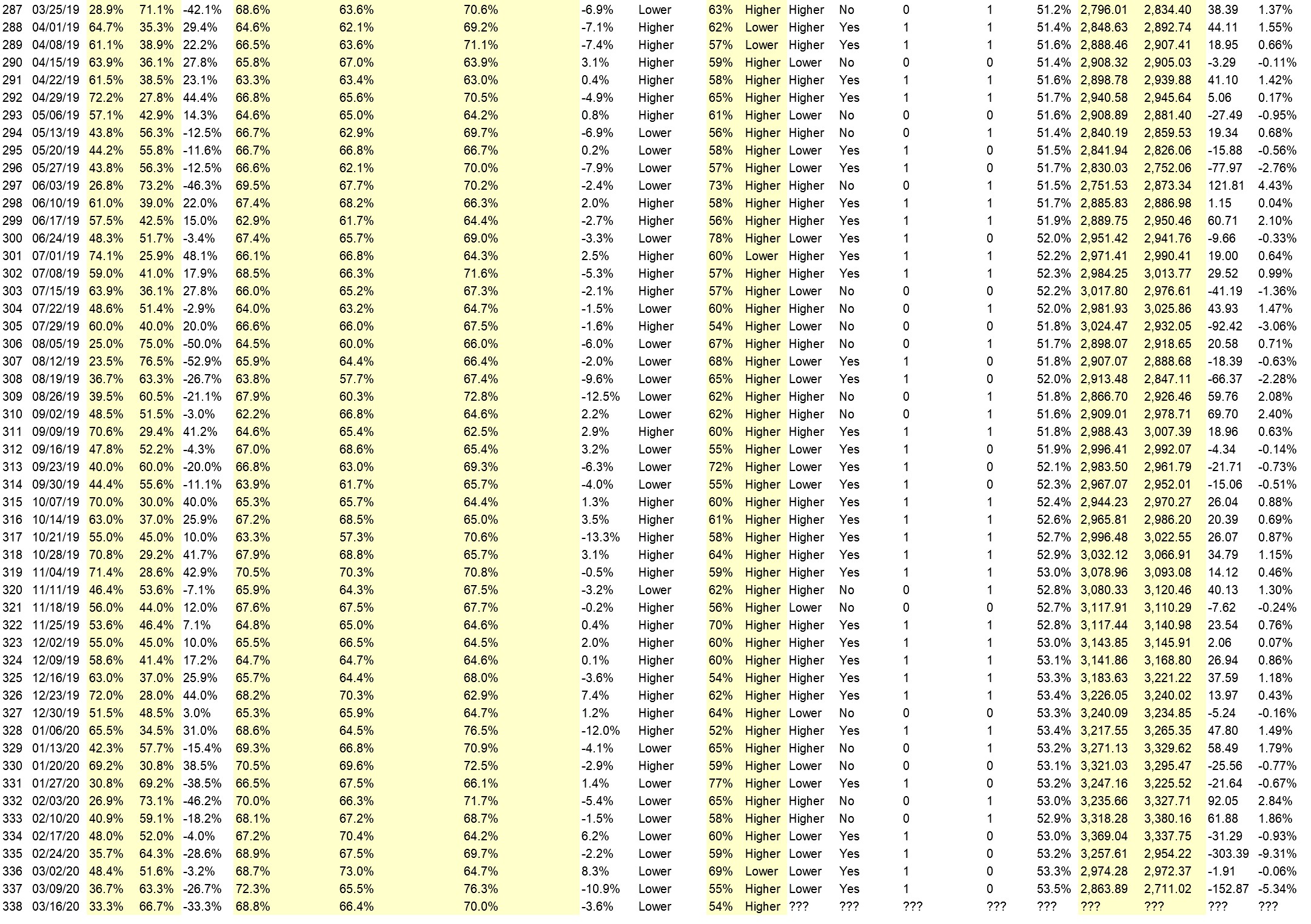

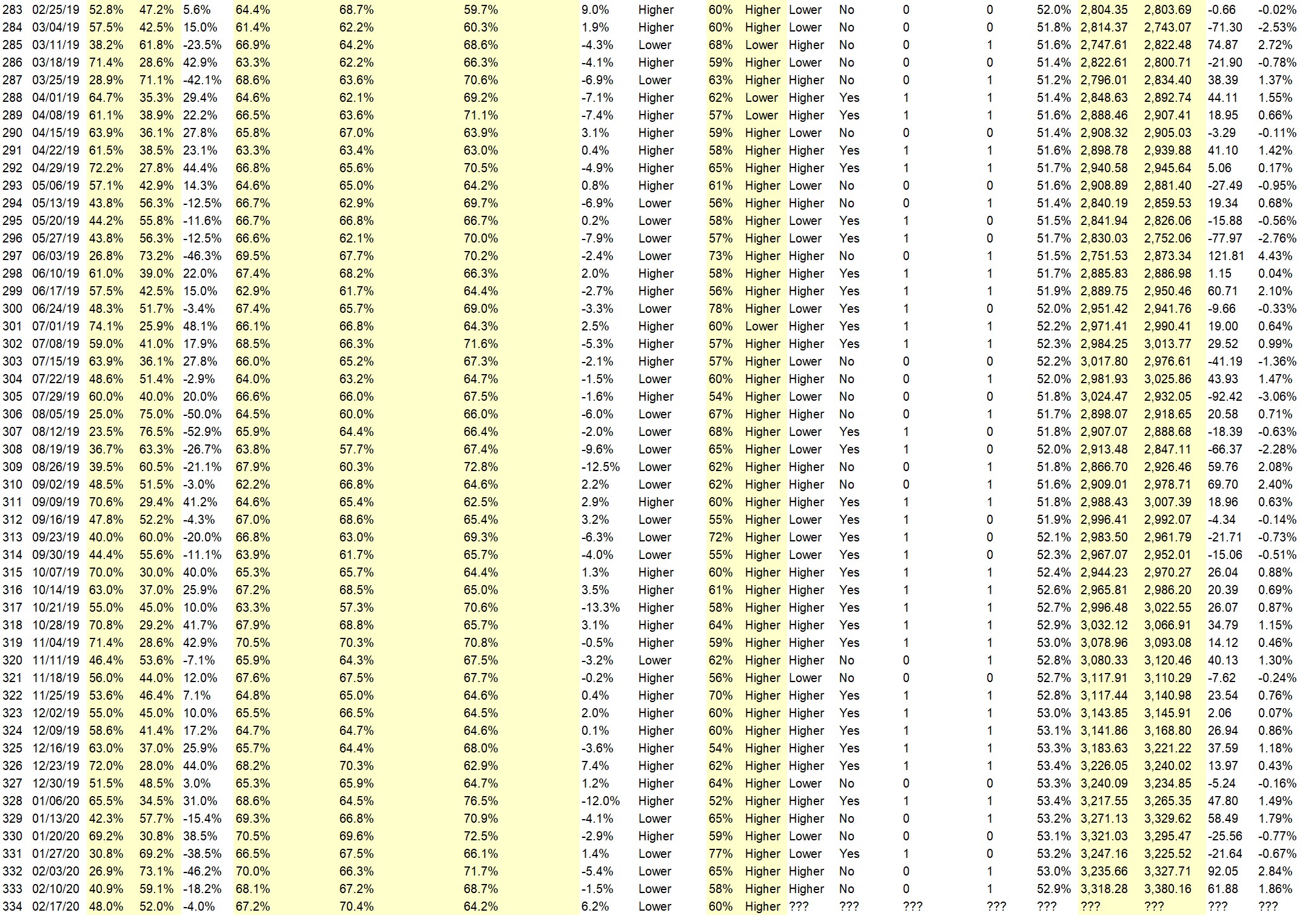

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I’m assuming Pelosi and Shumer stay off the bottle and for once work with congress regarding the PPP.

• liquidity infusion by the FED

• The Market has had enough of the Hong Kong Flue, it is time to move on.

• Good news on CV

• Momentum is climbing

• The major bank stocks rallied on Thursday because of the Fed, but also in front of earnings. I am going with this momentum, looking for the financial sector to keep the S&P from falling, and for the S&P to move up to the next Fibonnaci level.

• they are pumping another $2.3 trillion into the market

• Pre holiday trade pattern until wednesday then sideways or down

• Don’t Fight the FED

“Lower” Respondent Answers:

• price pattern

• poor earnings

• CORONA

• This a dcb which is now becoming frothy.

• catch those last sellers trying to get even

• Reaching time and price area for reversal.

• Nothing but bad news. Until the virus is resolved, the market will head down. High Unemployment, no business growth at all. Earnings will be disappointing.

• technical analysis

[AD] PDF: 7 Risk Management Strategies

Question #4. Have you changed your trading or investing strategies over the last couple months to cope with the increased volatility? If so, how?

• reducing exposure, trading more options than stock, tightening stop losses

• No, I day trade the spi options.

• no still in cash

• yes rebalanced portfolio

• Listen more, talk less and support the DOW!

• More LEAPS

• 10% buys

• Reduced the size of orders to 20-50% and doubled, tripled the size of my stops.

• Yes I have been buying stocks

• yes, small trade take profit before they disapear

• Yes, mostly trading the micro e-mini’s.

• yes have sold almost everything

• Prepared for decline Feb 24 by buying puts early March

• No , 30% invested since Jan.2020

• yes. MYOB

Question #5. Additional Comments/Questions/Suggestions?

• I hope the Dems go to HELL.

• the virus will continue take earnings down. this could last up to a year.

• It is time for the people of North America to mask up and back to work, enough is enough! President Donald Trump will lead this great American endeavor and all Americans will follow. Canada will follow the southern neighbor recovery and the HK flue will dissipate, through Europe.

• Stupid mistakes earlier this year. This decline helped me achieve almost 300% appreciation. Bear rally caught me off guard because I did not believe my own charts and lost 20% of my gains.

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

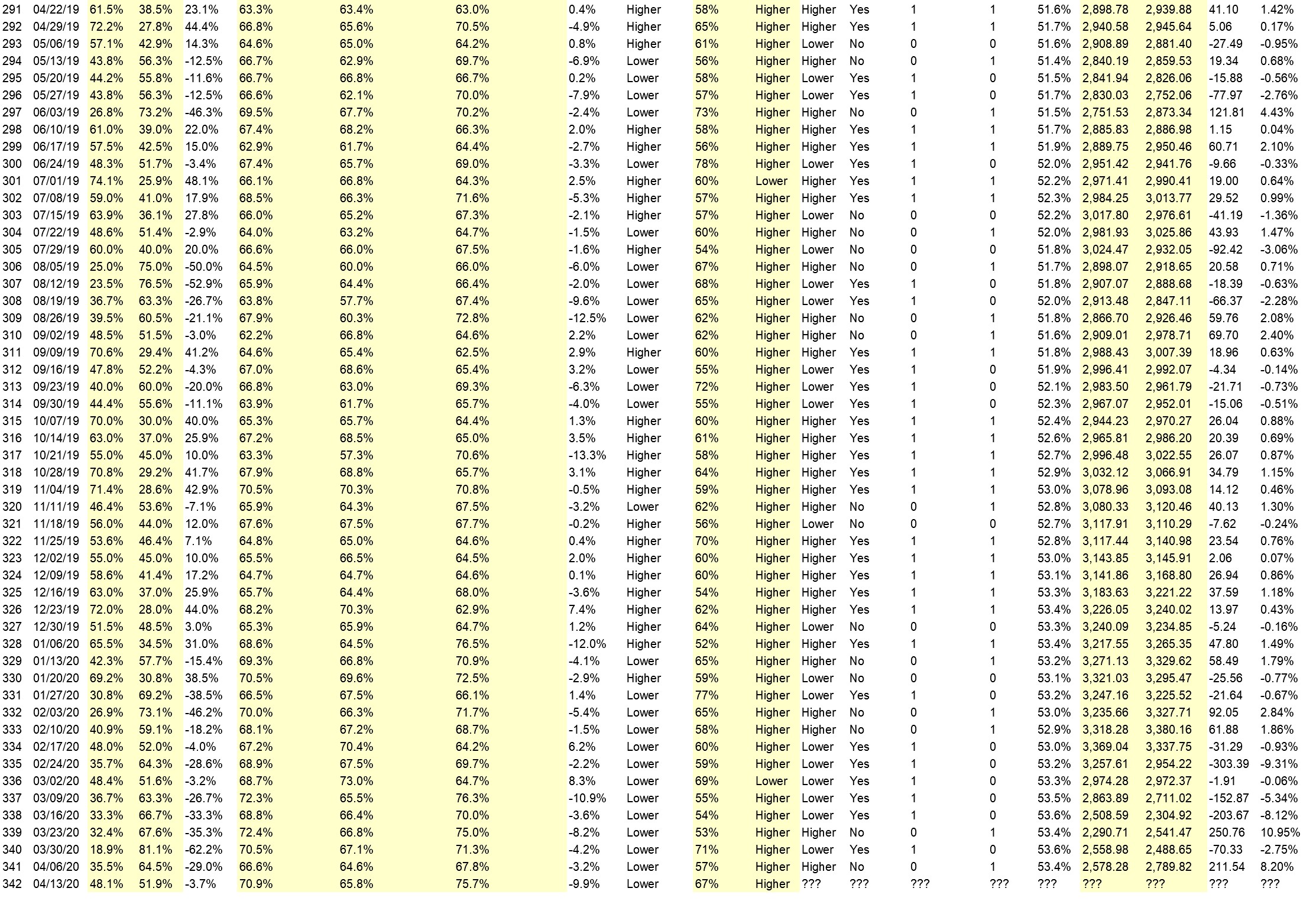

Crowd Forecast News Report #341

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport040520.pdf

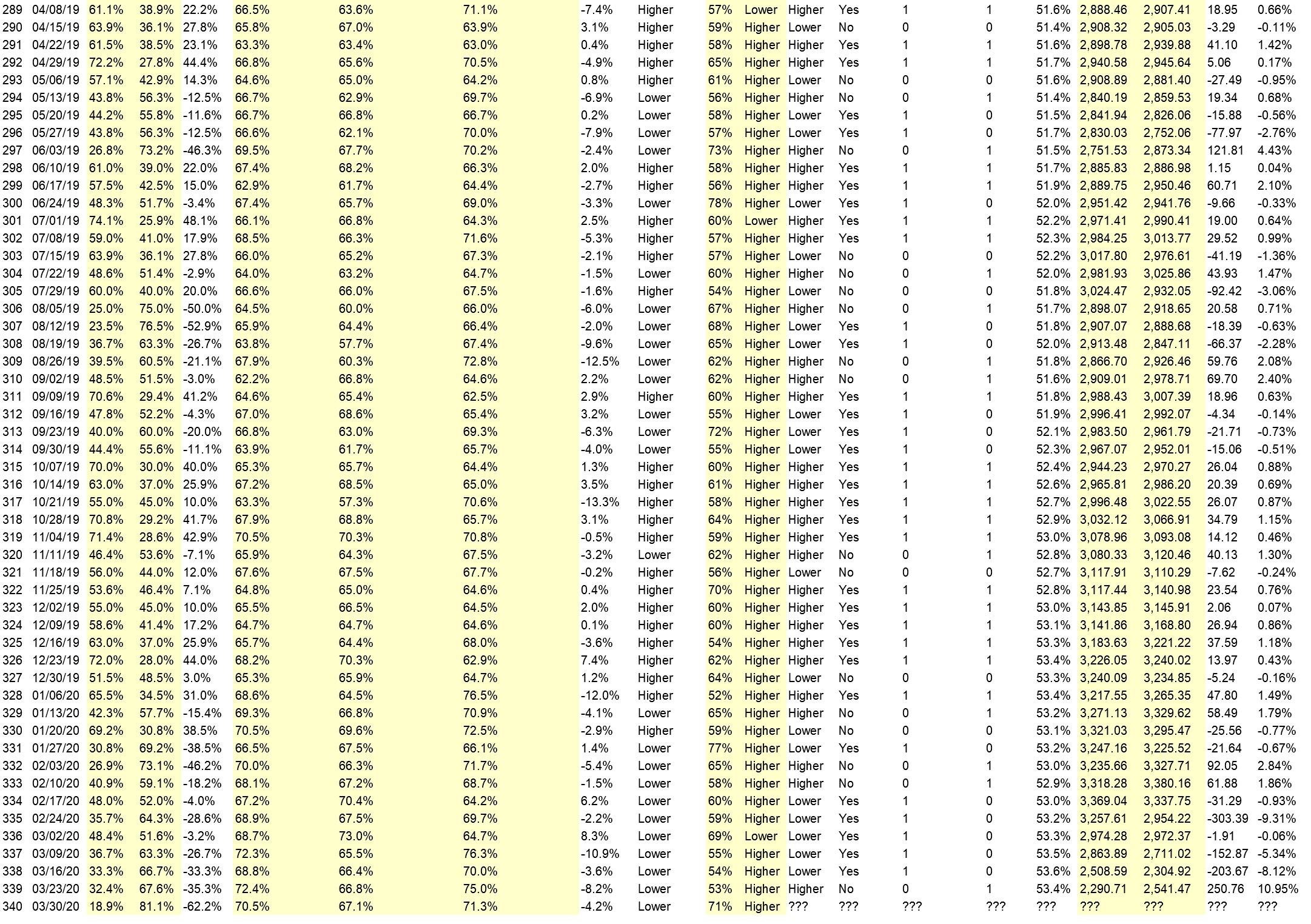

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 6th to 10th)?

Higher: 35.5%

Lower: 64.5%

Higher/Lower Difference: -29.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.6%

Average For “Higher” Responses: 64.6%

Average For “Lower” Responses: 67.8%

Higher/Lower Difference: -3.2%

Responses Submitted This Week: 31

52-Week Average Number of Responses: 31.8

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 81.1% predicting Lower, and the Crowd Forecast Indicator prediction was 71% chance Higher; the S&P500 closed 2.75% Lower for the week. This week’s majority sentiment from the survey is 64.5% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 28 times in the previous 340 weeks, with the majority sentiment (Lower) being correct 43% of the time and with an average S&P500 move of 0.10% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

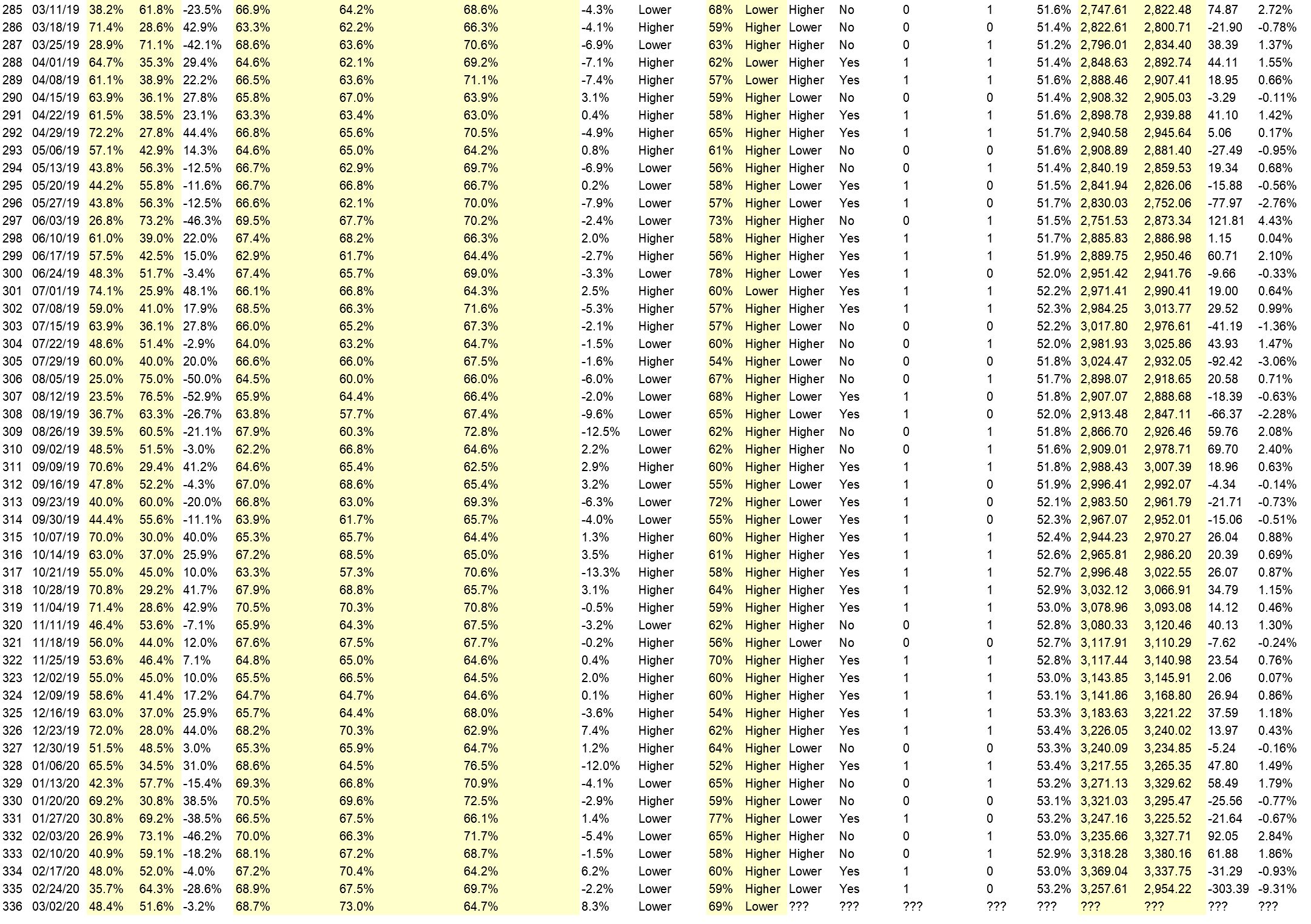

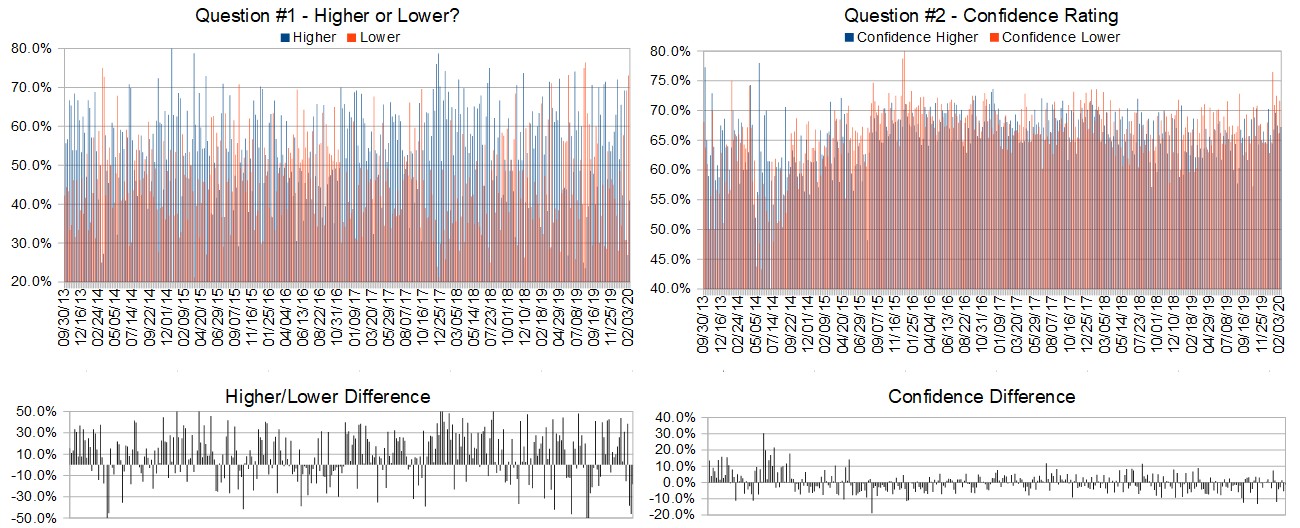

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.6%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Moved up after touching support

• When I say lower, it goes higher so I think it will go higher.

• the corona rate is begining to flaten out

• The OPEC oil issue will probably be worked out, which the market will like this week. Unemployment, debt, bankruptcies are big issues, but may hold off for another time to do their damage.

• because it dropped by more than 20% this week, there for a its due for a correction upwards but then it will drop a lot more mid week onwards

• The chines will have no choice but let it go to fix

“Lower” Respondent Answers:

• in a depression

• Fib retracement

• we are losing the battle with the virus

• The economy shut down.

• because there is a possible Head and shoulder pattern in the weekly chart

• People are trading in fear. This is a good time to find buys with many stocks bottomed out.

• Well, maybe the China Flue numbers growth in USA..

• accelerating corona cases

• Continued coronavirus bad news

• Curves are gradually flattening.

• too many companies shut down, too many people are out of work

• Most of the financial information shows greater negativity each week of this “stay in place” order.

• Can’t see direction but bias toward down.

• It is too early to say the market S&P 500 has hit a bottom. Who knows what Trump will say next?

• Trend is still down

[AD] PDF: 7 Risk Management Strategies

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• bottom line number

• i use advanced trading software

• look at charts, and indexes

• I enter the “history” of each stock periodically to see how I’m doing. On a daily basis I compare my accounts with the results of the major markets–was I higher or lower then they are?

• Gains and losses

• I write down my trades in an excel spreadsheet

• Normal market TSE

• Spreadsheet

• I use excell spreadsheet..

• several

• Analyzing Moving Averages and On Balance Volume

• I am a Stockcharts subscriber and have investments with TD Webbroker . I watch the market a;; day.

• p&L

Question #5. Additional Comments/Questions/Suggestions?

• what is your predictions?

• the 900 point drop after the stimulis was a pie in the face

• Don’t scare so many of popple

• Thankful for this platform. I value everyone’s opinion. God Bless Canada and USA!!

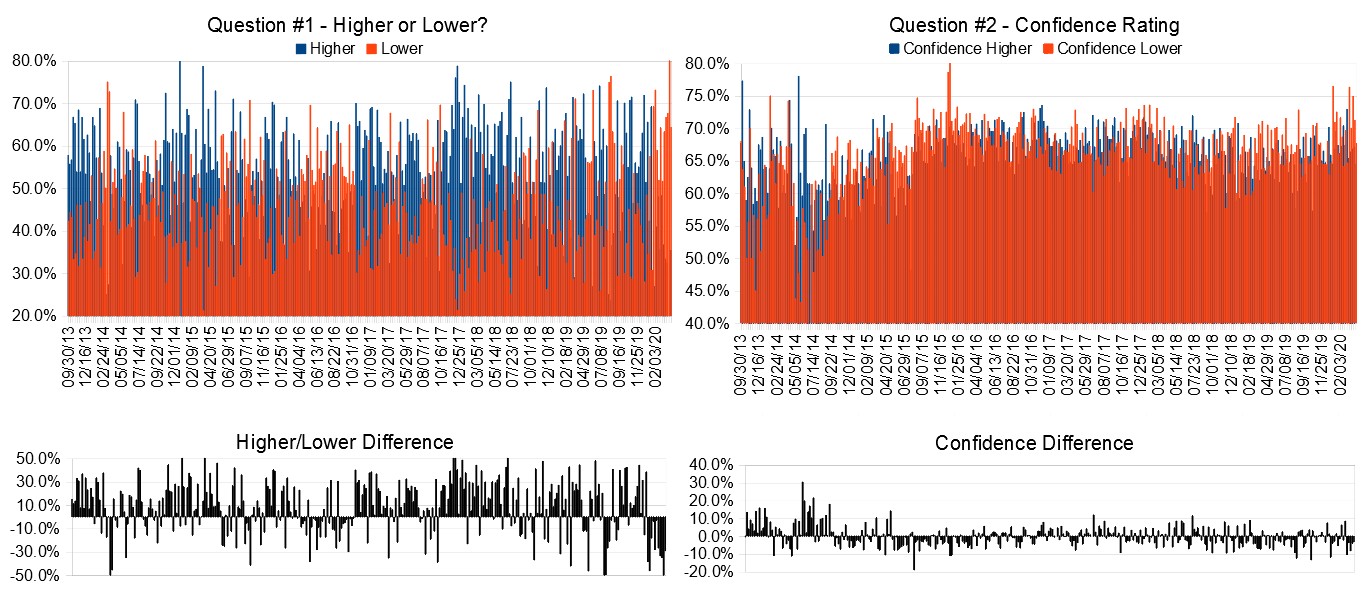

Crowd Forecast News Report #340

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport032920.pdf

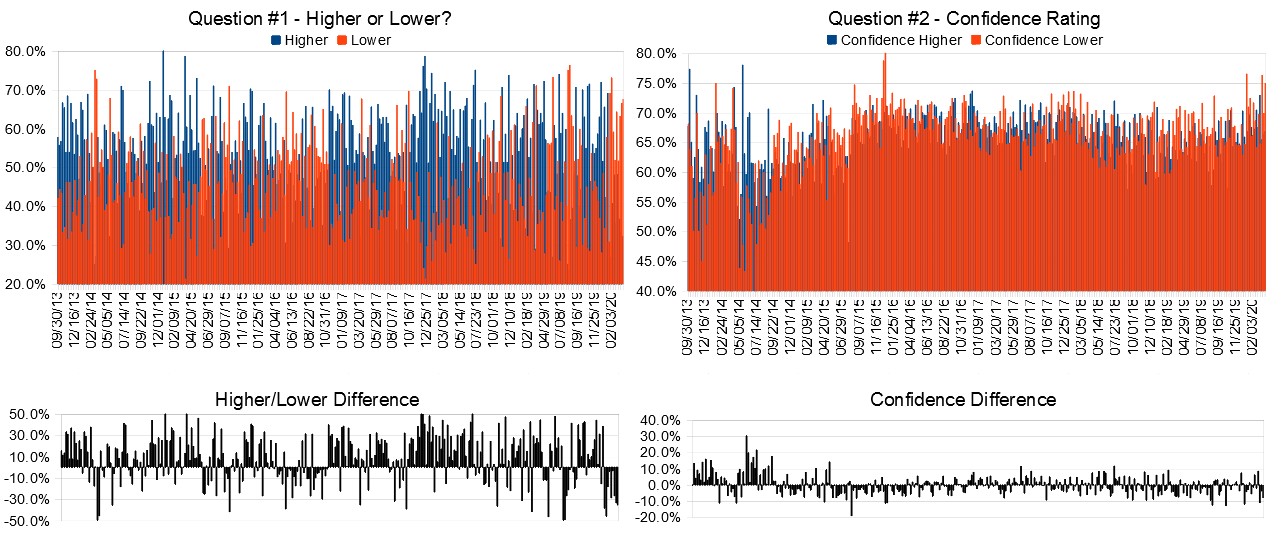

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 30th to April 3rd)?

Higher: 18.9%

Lower: 81.1%

Higher/Lower Difference: -62.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.5%

Average For “Higher” Responses: 67.1%

Average For “Lower” Responses: 71.3%

Higher/Lower Difference: -4.2%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 32.0

TimingResearch Crowd Forecast Prediction: 71% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 66.6% predicting Lower, and the Crowd Forecast Indicator prediction was 53% chance Higher; the S&P500 closed 10.95% Higher for the week. This week’s majority sentiment from the survey is 81.1% predicting Lower (largest portion ever in the history of this experiment of respondents predicting lower) with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 7 times in the previous 339 weeks, with the majority sentiment (Lower) being correct 29% of the time and with an average S&P500 move of 1.21% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 71% Chance that the S&P500 is going to move Higher this coming week.

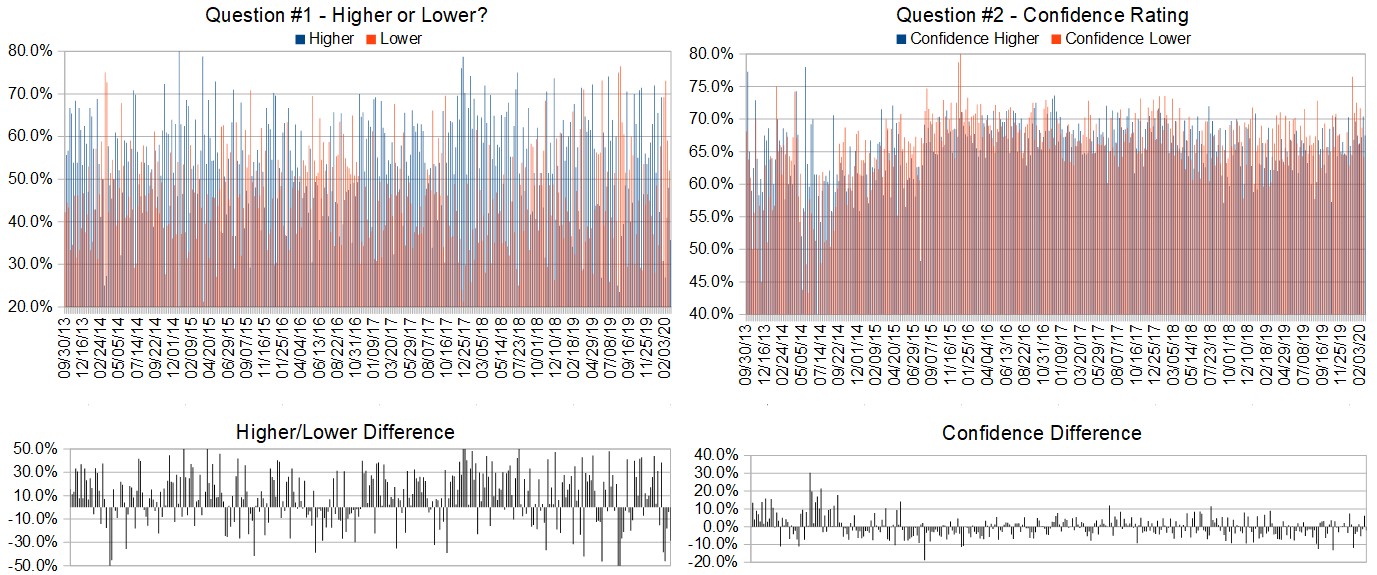

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

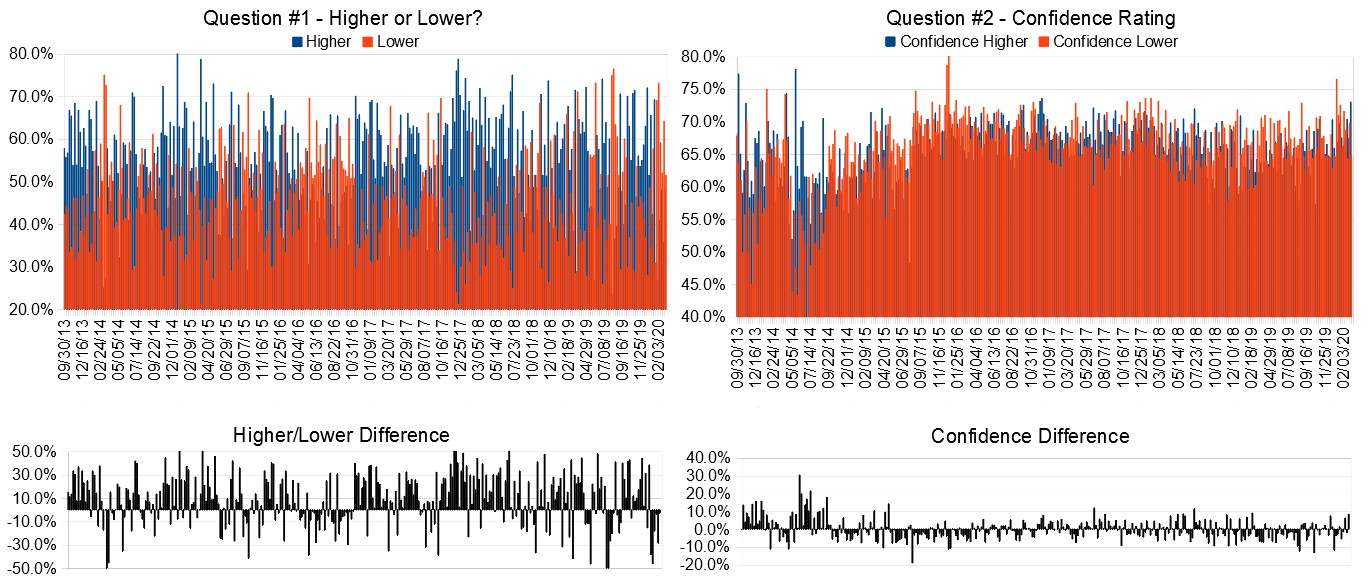

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Still Hasn’t bottomed out in the markets.

• Testing increases, curves flatten in many countries.

• over sold markets. initial selling from pent up panic over the weekend shaking out weaklings followed up by some disciplined money moving back in.

• Choppy market, end of quarter.

“Lower” Respondent Answers:

• test the low

• ….?

• All the feds good news is out. What we have is just the bad until we can get a hold of this and it starts to turn around. Italy is still getting worse with almost 1,000 per day dead. Do we really think we are out of it and will be back to work soon. Not me. I think we have an another 6 weeks to go at least . What do you think that is going to do to the market.

• It should rally a little bit in response to the 2 Trillion$ stimulus then start to stutter with the new unemployment numbers!!

• COVID-19 and his economic consequences

• China Flue spread

• Stimulus completed, bounce last week, and conditions getting worse.

• Corona virus spreading and it will panicking people again.

• bear market now

• We are not yet out of the virus condition

• Lower low coming

• While some stocks may have a lower price point, I believe the uncertainty will cause buyers to hold onto their wallets

• may not stay low but this will have to find a bottom by back and forth by the bulls vs bears and then in summer when the bankruptcies begin to pick up momentum will pick thru whats left

• Corona Virus

• 1. pelosi holdout and wanting another round of giveaways 2. worse actions on isolating areas to keep some from running elsewhere because the cat is out of the bag 3. economy and covid are both raising expectations too much.

• Technicals, COVID, no solution to COVID, COVID lockdowns, full economic impact yet to be felt, no basing yet, too much uncertainty.

• corona virus

• Corona virus worsens in US and globally. Market hasn’t completely priced in businesses being closed through May or longer yet

• More coronavirus, fewer jobs, less spending, heading to bankruptcies and GDP decline.

• Bear trend to continue

• More virus bad news in usa

[AD] PDF: 7 Risk Management Strategies

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• NONE WORK so I am wondering if I will ever use them again

• Position then scaling

• 10% buys for each position, not predicting bottom

• atm for long term investing its scaling in.

• protective puts

• don t trade anymore

• Today usually 20% maximum into the market at a time as volatility rules market size. If there’s great buying, i’ll go full in and full out. Scaling is something I am considering.

• Position size in percent of amount trading.

• buy puts on good companies when I feel strongly the market will go down

• Raising cash as bottom not in yet

• All of the above.

• trending before mid-afternoon and late afternoon.

• Any.I am going only to clear trades.

• Position size, ATR trailing stops

• Position size, scaling in, still holding lots of cash

• …./

• I’m still working small, and not often at the moment. // The swings are very dramatic for this newer trader.

• position size and maintaining cash position.

• all of the above

• trade futures

Question #5. Additional Comments/Questions/Suggestions?

• Very grateful for this platform and the opportunity to learn and speak, thank you. I believe Prime Minister of Canada Mr. Justin Trudeau and the President of United States of America Mr. Donald Trump are doing a great job, outstanding in their respective posts given the current situation! I will add here Mr. Trump is the best American leader and the USA Economy was robust leading the world until this China Flue hit. This is a war and Mr. Trump will lead us out of it, “Mr. Trump shines of light” and will lead us all to victory and push the economy back to its feet! God Bless AMERICA and God Bless CANADA !!!

• even the chinese do not have the border and reverse border rules down correctlyso they may will get another spike.

• Need to start by investing in companies that can successfully run virtually. Some of Big Tech will be winners depending on their business model

• …now…we are suffer is to know the barrier that shuts each of as away…./ no jobs/ no treatment/ support is to late/ and too many ” WILD” greed people …..

• Thanks for all your insights!!

[AD] PDF: 7 Risk Management Strategies

Join us for this week’s shows:

Crowd Forecast News Episode #258

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, March 30th, 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

Analyze Your Trade Episode #121

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, March 31st, 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #12: Tech Wizards 2020 Conference

Date and Time: Thursday-Friday, April 2nd-3rd, 9AM-9PM ET

Presenters: We have over a dozen awesome presentations on the schedule for this event. Click the link below to get the full schedule.

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

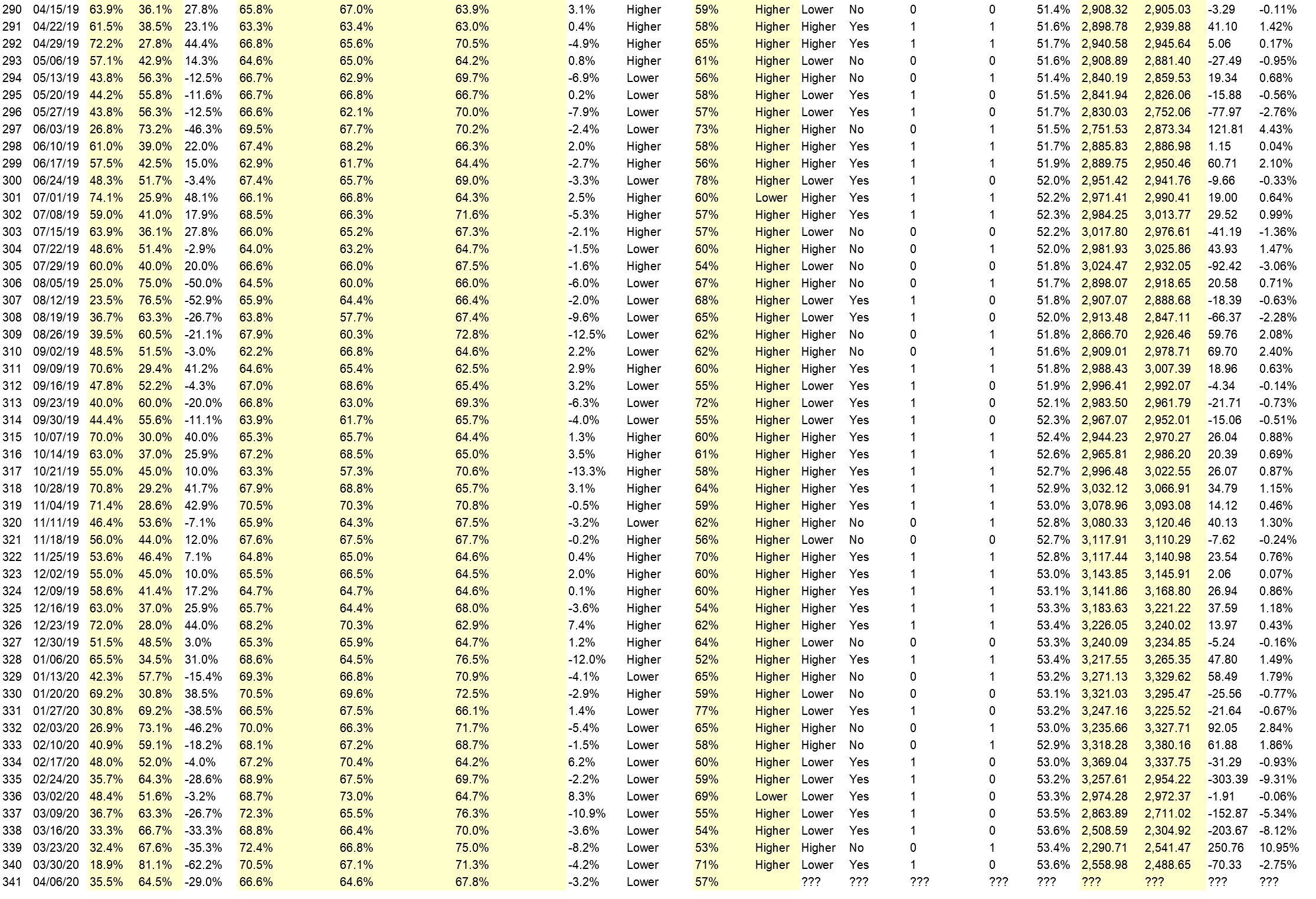

Crowd Forecast News Report #339

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport032220b.pdf

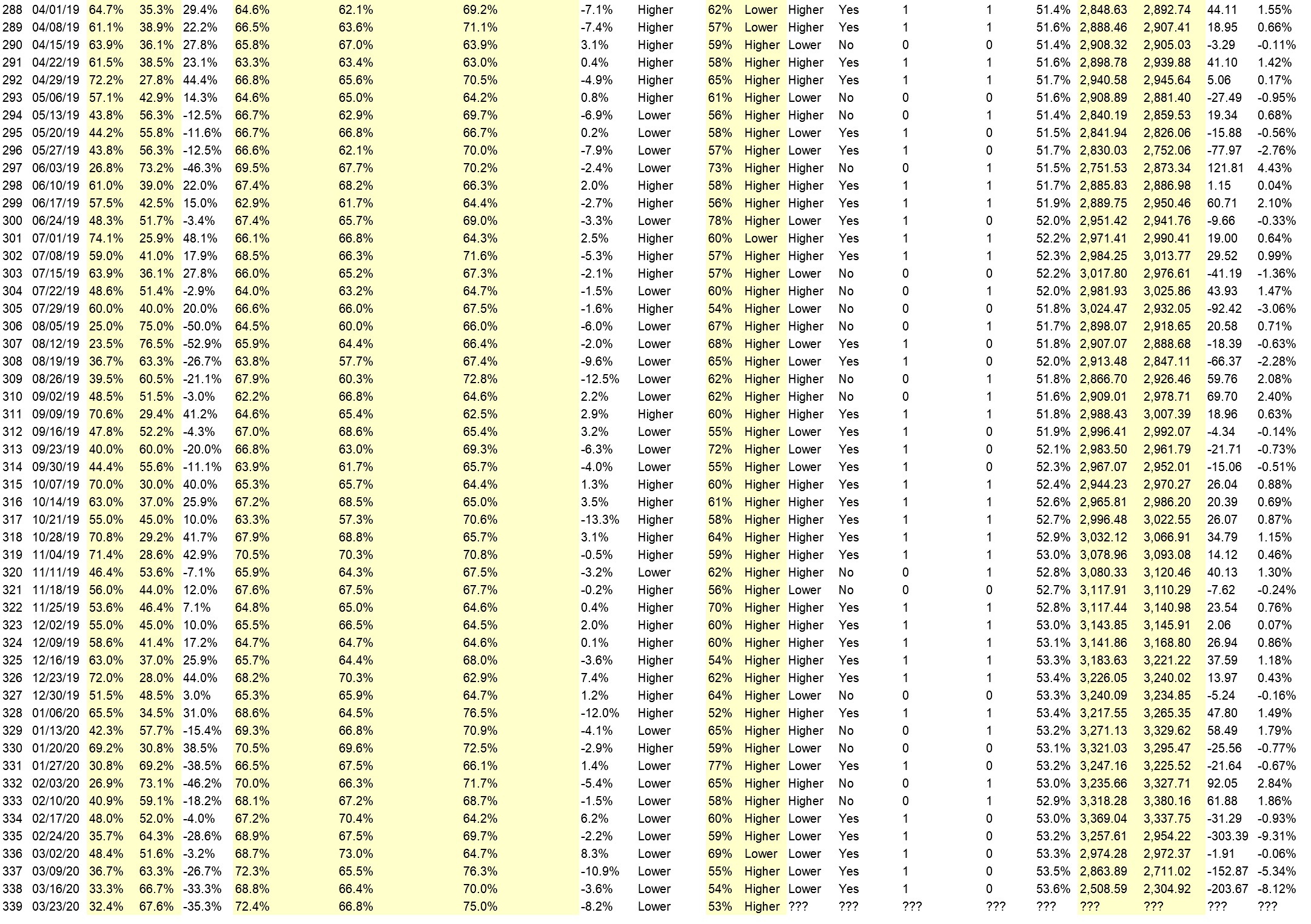

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 23rd to 27th)?

Higher: 32.4%

Lower: 67.6%

Higher/Lower Difference: -35.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 72.4%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 75.0%

Higher/Lower Difference: -8.2%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 32.0

TimingResearch Crowd Forecast Prediction: 53% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 66.7% predicting Lower, and the Crowd Forecast Indicator prediction was 54% chance Higher; the S&P500 closed 8.12% Lower for the week. This week’s majority sentiment from the survey is 67.6% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 49 times in the previous 338 weeks, with the majority sentiment (Lower) being correct 47% of the time and with an average S&P500 move of 0.04% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 53% Chance that the S&P500 is going to move Higher this coming week.

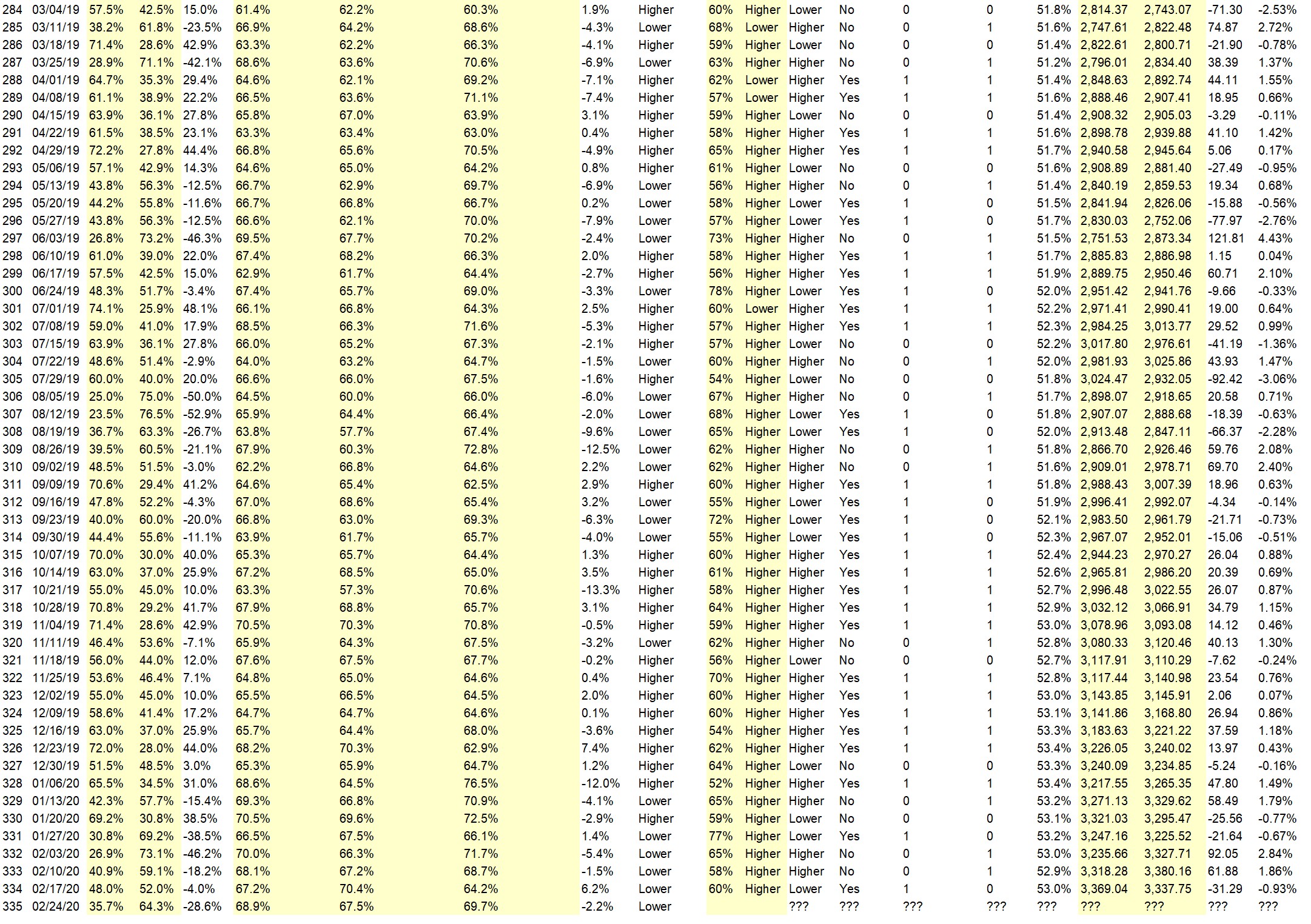

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

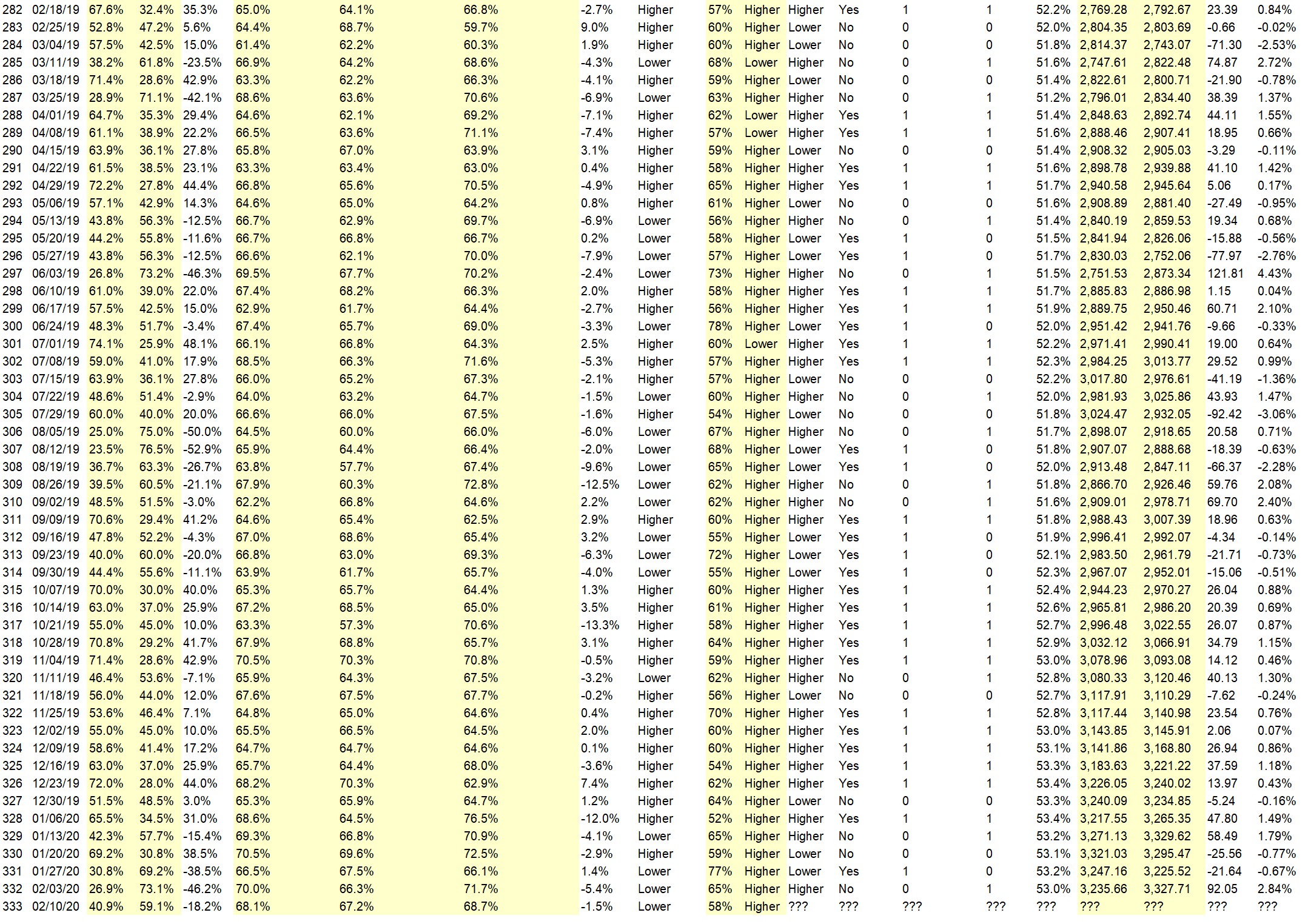

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.6%

Overall Sentiment 52-Week “Correct” Percentage: 66.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Things will start to calm down

• it is due for a rebound after that big sell off

• I believe after a slower start to the week, I’m hoping that the oil market will start to pick up, carrying other equities with it.

• Overdue bouncback

• With the relief packet issued by federal government, confidence in economy is growing and this should take market upwards.

• We are near all time lows.

“Lower” Respondent Answers:

• Developing financial & social implications of CV.19.

• covi19

• Because the price action pattern is still bearish and also the volume is still above 20MA. The lower probability is because the little money flow divergence

• China Flue

• Virus test results still increasing Too much stress incredit markets

• the friday activity was absolutely brutal.

• worsening coronavirus environment

• market is in a huge bubble

• lack of leadership at the executive branch.

• Accumulation going on but in the very early innings of a turnaround alot more down days ahead

• coronavirus hasn’t been priced into the market yet

• coronavirus

• Bad news, no recovery

• The unemployment rate is expected to increase, as businesses face increasing financial pressures, as the coronavirus pandemic continues into another week.

• Monday will open down. Just not sure there will be anything to push the market back up.

• S&P 500 is on a PE of 17 and Corona virus is going to cut earnings to zero

• oil in a downward move as well as US100 … corona virus Big Airlines may go to bankruptcy … and from a technical point of view no support is seen… and the cash dollar will remain the king … any intervention from the FED may change the view.

• Fear of COVID 19. Then the disruption of products and services to escalate

• High. Vix index

• COvid-19 STORY and thin non-liquid market conditions

[AD] PDF: 7 Risk Management Strategies

Question #4. What are your top questions for trading experts about current market conditions and how to trade over the next few weeks?

• Knowing the bottom has been put in

• average down or wait for a bottom?

• The fact I quit trading because of Forex brokerage houses scam and fraud and many of my friends got scammed including me

• How do you idiots keep your jobs?

• What do you consider the priorities for selecting shares in the immediate future ?

• why didn’t you guys issue a sell recommendation before then during the selloff? and HOW exactly do you idiots keep your jobs?

• what will you be looking for as the signs of capitulation?

• What stock are hedges against further downside of the Doe and S&P?

• How to trade volatility for next few weeks?

• how would you trade bond ETF’s?

• have you ever seen a financial crisis like this before?

• How to stop shorting the markets?

• none

• Is the market becoming a faster moving entity?, due to all the different factors – algo’s, AI, etc. /// does the little guy stand a chance?

• Well the big question is where is the bottom, are we close to it???

Question #5. Additional Comments/Questions/Suggestions?

• Thank you … Wishing you a great time ahead

• when is the crisis, to the markets, going to end?

• Self isolate

• I heard one commentator mention that what used to take weeks to develop in the markets, now only takes hours. // Is this a valid statement?

Join us for this week’s shows:

Crowd Forecast News Episode #257

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, March 23rd, 1PM ET (10AM PT)

Moderator and Guests:

– Anka Metcalf of TradeOutLoud.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #120

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, March 24th, 2020, 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #12

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday-Friday, April 2nd-3rd, 2020, 9AM ET-TBA

Moderator and Guests:

– TBA

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #338

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport031520.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 16th to 20th)?

Higher: 33.3%

Lower: 66.7%

Higher/Lower Difference: -33.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.8%

Average For “Higher” Responses: 66.4%

Average For “Lower” Responses: 70.0%

Higher/Lower Difference: -3.6%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 32.1

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.3% predicting Lower, and the Crowd Forecast Indicator prediction was 55% chance Higher; the S&P500 closed 5.34% Lower for the week. This week’s majority sentiment from the survey is 66.7% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 48 times in the previous 337 weeks, with the majority sentiment (Lower) being correct 46% of the time and with an average S&P500 move of 0.13% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 54% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

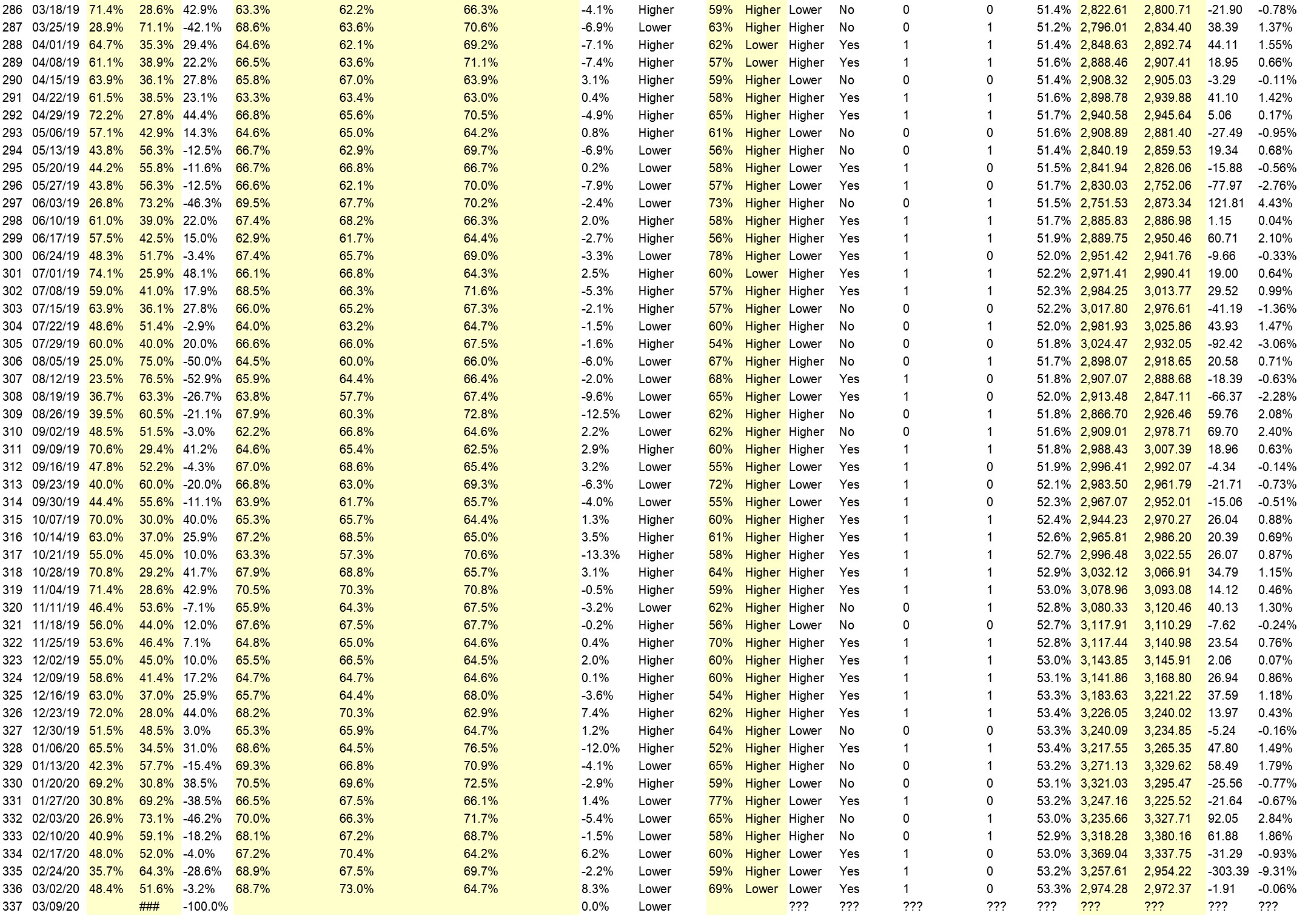

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.5%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• We are now down pretty far.

• Bounce !!

• stability

• Market is due for a rebound.

• Charts

• Interest Rate Cut

• dead cat bounce

“Lower” Respondent Answers:

• Could go either way here Big money flowed back into the Market Friday and thats building a bottom

• anything can happen now but don’t care big money flowed right back into the market on Friday why/ because Thursday was capitulation

• Business shut down. Reduce commerce, adversity not totally accounted for.

• Corona fall will continue

• companies are shutting down with the virus

• greater outbreak of coronavirus

• Friday’s late rally is making things look rosy for the S&P for now, but it’s probably counter-trend. Fed actions won’t slow the virus or provide test kits. Possibly dismal corporate earnings reports next month are not priced in to this market.

• China Flue, its effects and residual impacts. I believe given the fact where we are and what were faced with, we will trend lower and move sideways in general terms, consolidation. This is true, and really depends on if people self isolate until this passes, partially in all effected countries. This I believe will transpire as we come to the realization we have to put on our “big boy pants” and save the market, these small, medium and large cap companies require our support. What do I mean by this, we must stop shorting everything and help these companies. Yes, the market may drift lower, however its up to us traders to “float the boat”. What was interesting is these bio-tech companies who want to test people for the china flue or other companies R&D creating vaccinations everyone pulled out on later in the week. Why?? Reverse the thought process and we will help these companies. Like the United States President Mr. Donald Trump, Canadian Prime Minister Mr. Justin Trudeau and other leaders are doing with the financial packages to help, we as traders must do our part as well. STOP SHORTING and help stabilize the markets!!

• Corona virus is still growing in the US

• Margin calls will cause more selling, the Fed actions will not be strong enough to overcome the markets’ skepticism.

• Not sure how anyone could be going LONG at this point … just too much unknown unknowns out there. Once there is containment, or a vaccine, or travel bans lifted why would anyone be going LONG?

• There is no support right now to hold it

• Expect 1 – 2 days higher before turning lower for the week. This is a bear trend, so any positive movement is only going to be a retracement.

• Continuation of Virus driven trend

• there are more bad news to come and more next next week option exp on Fri.

• The virus is killing this market and the Federal Government is not helping

• Marriot emailed me that it is a world epidemic

• Fear is still in the markets

[AD] PDF: 7 Risk Management Strategies

Question #4. What trading software/platform(s) do you use to execute your trades?

• none TD has no longer offered me a trading platform I’m not going to stay with the brokerages that charge commission much longer

• Fidelity

• none TD withdrew the platform that was my last one and it was years ago

• Td Ameritrade

• Schwab, TD Ameritrade

• Fidessa and IB

• Charles Schwab

• thinkorswim,tastytrade

• TOS

• E-Trade

• TC 2000, Think & Swim, ITRADE and RBC Direct Investing.

• TOS

• TradeStation

• Interactive Broker

• NinjaTrader 8.

• I have special software

• ToS

• Spreadbet/CFD

• Think or Swim

• TOS

Question #5. Additional Comments/Questions/Suggestions?

• we are living through history

• I certainly appreciate the opportunity to express my thoughts on the subject matter, thank you. I do not Facebook,. Twitter, etc., however I am grateful to all those who created this platform where I can express my thoughts from time to time. I do appreciate anyone who has ever traded stocks as we all learn from each other, thank you again.

• Sell on rebounds

Join us for these events:

Crowd Forecast News Episode #256

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, March 16th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Michael Filighera of LogicalSignals.com

– John Thomas of MadHedgeFundTrader.com

– Jim the Option Professor of OptionProfessor.com (moderator)

Analyze Your Trade Episode #118

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, March 17th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Mike Pisani of SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders Event #12

Date and Time:

– Thursday-Friday, April 2nd-3rd, 2020

– Times TBA

Moderator and Guests:

– TBA

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #337

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport030820.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 9th to 13th)?

Higher: 36.7%

Lower: 63.3%

Higher/Lower Difference: -26.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 72.3%

Average For “Higher” Responses: 65.5%

Average For “Lower” Responses: 76.3%

Higher/Lower Difference: -10.9%

Responses Submitted This Week: 30

52-Week Average Number of Responses: 32.3

TimingResearch Crowd Forecast Prediction: 55% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.6% predicting Lower, and the Crowd Forecast Indicator prediction was 69% chance Higher; the S&P500 closed 0.06% Lower for the week. This week’s majority sentiment from the survey is 63.3% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 47 times in the previous 336 weeks, with the majority sentiment (Lower) being correct 45% of the time and with an average S&P500 move of 0.24% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 55% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.3%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• fears ease

• Friday last hour int0 cl0se

• Fridays close

• ready for a small bounce then down further.

• Market appears to have retested the bottom this Friday (March 06, 2020) and recovered into closing. I believe the recent market correction was initiated due to the Corona-virus (Covid-19) becoming a global pandemic.

• The s&p can only go so low before a bounce back. Only an opinion…

“Lower” Respondent Answers:

• China flue & loss of containment in Europe

• greetings from Coronavirus – impacting industry supply-chains, travel, airlines und many more …

• The fool US president, corona virus, and drain on consumer buying power resulting form excess concentration of wealth in too few hands.

• an increase in infections and deaths going to take the mkts lower

• In daily vision it’s poised for an upside, but if you look at a weekly chart it’s not poised for a weekly bounce. My 70% chance it’s because statistically it could bounce after having a retest of the lows, however the Corona Virus pandemic it’s still a risk and it’s not going away soon.

• While I was a little surprised with some of the upswings after the hudge down days, I am not yet convinced that the selling pacic of the corona virus is over. For this reason I voted down for the week but with a low conviction as we watch this new threat progress. Not to make light of this situation but I plan to stay calm and use this time as a buying oppertunity.

• Downward trend

• Last weel performance

• broke major trend line

• production slow down china, corona virus global,

• The Fed lowering rates did not cause a rally, so what will? COVID-19 will continue to spread, with travel & crowd gatherings curtailed more; supply chains in trouble. Economies to be hurt for an extended time.

• Virus fear

• covid is out of control

• collapse in oil prices

• corona

• The news is bad

[AD] PDF: 7 Risk Management Strategies

Question #4. What sort of hedging or portfolio protection strategies do you implement in your trading?

• Great question! Something i must work on.

• puts

• buying put spreads

• selling premium

• stops

• I only do speculative trading, however just buying gold or implementing covered calls should be enough.

• We will sometime place a collar on a long term position. I will also trade an underlying that is non-correlated to my open positions and finally we do use inverse TFs from time to time.

• 0

• Buying puts.

• puts

• puts

• gold

• 0

• Sell cash covered puts with low delta rather than buy stock

• emini’s bought and sold.

• I use Collar as a hedging strategy.

• go to cash

• option

• SPX puts

• Try to do a few points and sell after a 2% loss.

• None

Question #5. Additional Comments/Questions/Suggestions?

• Italy has a mortality rate of 26% of those severely infected. Since Italy is an 1st world country, how can China’s numbers be correct, given the fact it hit there 1st and China living conditions are inadequate compared to Italy? This is far worse than shown! Withn two months i believe they’ll be growing issues on every continent.

• Nobody I mean nobody can predict the stock market….only the cheaters.

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #336

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport030120.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 2nd to 6th)?

Higher: 48.4%

Lower: 51.6%

Higher/Lower Difference: -3.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.7%

Average For “Higher” Responses: 73.0%

Average For “Lower” Responses: 64.7%

Higher/Lower Difference: 8.3%

Responses Submitted This Week: 31

52-Week Average Number of Responses: 32.4

TimingResearch Crowd Forecast Prediction: 69% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 64.3% predicting Lower, and the Crowd Forecast Indicator prediction was 59% chance Higher; the S&P500 closed -9.31% Lower for the week. This week’s majority sentiment from the survey is 51.6% predicting Lower with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 16 times in the previous 335 weeks, with the majority sentiment (Lower) being correct 69% of the time and with an average S&P500 move of 0.50% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 69% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.2%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Bounce after record falls, maybe supported by the Fed.

• I think it correct higher from the positive close on friday.

• Friday reversal of oversold market

• History

• The decline was to fast and bearish sentiment increased

• Bounce off last week

• Too much fear last week. Fed will step in when needed.

• Bounce back time

• I think spy going to307.53

• Just a rebound after a huge, almost panic drop.

• The market is over sold and due to a rebound.

“Lower” Respondent Answers:

• Viruses

• More Corona Virus worries

• The recent down move has had a lot of momentum, suggesting to me that there’s more downside left. Most market analysts are expecting a bounce; so the bounce could be of short duration, then sold into. The virus effects should significantly slow growth in China, with this growth effect likely spreading elsewhere.

• this did a lot of damage this week so yes we can bounce for 2-4 days and then come down again.

• High volatility at this level until a lower strong support will be formed. Virus’ news and fed interference will give the tempo. It’s interesting to see whether a V respond, like 2018, will be developed. I’m not so optimistic on that.

• coronavirus

• I believe the virus accelerated the great recession that will occur in less than 12 months due to the extraction of consumer wealth to the rich much like it did with Robber Barons of the 1920’s resulting in the depression of 1929. Next could be a pull back in the market decline. Therefore, I have only 55% chance the market will be up next week.

• Coronavirus

• CoronaVirus

• Mainly the China flue and some reporting on future effects thereof. One magnifier, the media! The last 2 months seems to be reporting of pullback, etc.. I noticed this intensified 2 weeks ago.. However, the flue is a issue for sure..

• People are starting to freak out about the Coronavirus and it’s growing numbers and fist death here in the US. Slowdown will hopefully be brief. Hoping for an early spring because it’s harder for viruses to continue.

[AD] PDF: 7 Risk Management Strategies

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week for the next Synergy Traders event, but back on March 9th.)

• Actions to take under unusual conditions such as the Crono virus problem.

• How to trade futures.

• The way the billionaire’s hold the consumer wealth causing a slow in business activity.

• recession proof portfolio

• Will the Fed rescue the market?

• don’t know

• what & how to trade bear markets

• Favorite indicators and how you use them

• Day trading Futures.

• market internals

• Provide real working systems

Question #5. Additional Comments/Questions/Suggestions?

• spy not finish going down look to 283.75

• So here we are today, if we are not closing the North American boarders for a month of so, then we must prepare. This I suggest the most effected will be the larger metro areas where people seem to be living on the streets. Large numbers such as 5,000 plus.. If we remember the New Orleans floods, there was 1 weeks notice and as we know the response and support critically failed in many ways, in the aftermath the state did the best it could and we all now this! Yes we know you did…. RE: This China flue, USA, Canada and other countries “NOW have time to prepare” the larger areas where the street masses are. If this fails, the hospitals will be over-run, and all will be taxed to beyond the fullest extent…. It is time for the provinces, states, city’s to prepare to help those who will be in need. Those who are wealthy, please step up and take the lead, you already know what to do, show yourself what you are :)

• what about TESLA, APPLE & FAANG-Stocks? All crashing down? How far??

CFN and AYT are off this week so you can join us for this instead:

Synergy Traders #11 — Women Teach Trading and Investing: Opportunities for Everyone in Today’s Markets: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Monday-Thursday, March 1st-5th, 2020

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #335

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport022320.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 24th to 28th)?

Higher: 35.7%

Lower: 64.3%

Higher/Lower Difference: -28.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.9%

Average For “Higher” Responses: 67.5%

Average For “Lower” Responses: 69.7%

Higher/Lower Difference: -2.2%

Responses Submitted This Week: 30

52-Week Average Number of Responses: 32.6

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 52.0% predicting Lower, and the Crowd Forecast Indicator prediction was 58% chance Higher; the S&P500 closed 0.93% Lower for the week. This week’s majority sentiment from the survey is 64.3% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 68 times in the previous 334 weeks, with the majority sentiment (Lower) being correct only 41% of the time and with an average S&P500 move of 0.37% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Than you very much for this question yes it work like that due t to the way the market move

• FOMC

• qe

• LT Trend

“Lower” Respondent Answers:

• I think the initial reaction to the corona virus was over quickly. Now we will enter a period of time where the market will be reacting to the economic effects of virus on the economy of several countries, especially the Chinese economy. While I try to remain optimistic, I have reserved some cash for bargain hunting, hedged some positions we wish to keep and allow more “room” in our put writing for a possible correction

• Many overbought stacks, some correction needed.

• markets are still wary of the impact of the corona virus

• vires

• People are concerned – that few in China will be allowed to go to their jobs in factories, producing their plastic pieces, etc. /// Maybe the world can apply some pressure to install scrubbers on factory smoke stacks, and implement humane work conditions for the masses. Pipe dreams allowed. /// Can the playing field ever be leveled?

• FED just won’t cut the virus is getting worse but there is nothing positive to boost the market when even low interest rates no longer prevent money from flowing out of the market / lower FED won’t lower and 30 year low on interest rates is no longer preventing an outflow of money from the markets

• China Flue totally out of control in China! Percentages getting higher, ratios moving up, not good!

• uncertainty

• Continue Friday’s reverse.

• corona sickness in more countries

• technicals + post Op-expiration

• Consolidation !

• The market is losing momentum. Virus headlines continue. More earnings reports to weigh on the market.

• With the coronavirus situation looking more like a pandemic, with numerous negative consequences, I can’t think of a reason to buy the market at this level. The S&P drop in July-Aug 2019 was 7%. The current drop has justification to be at least as much.

• Corona Virus finallt taking its toll

[AD] PDF: 7 Risk Management Strategies

Question #4. What indicator influences your trading the most?

• I resist being an “indicator addict” but I do follow the common things we all know that industry people use such a 200 day M/A and shorter term M/A crossovers.

• bull/bear markets

• vwap

• interest rates dow

• MAs

• it is Forex trading

• earnings

• interest rates

• Support/resistance levels, MACD.

• In order: Price Action, Candlestick, Volume, EMA.

• Volume.

• Price action.

• Japaneese Candlesticks in the United States

• China’s manipulated market imploding in on itself. World events move too fast now, the GOV can’t control things much longer. No one will be at the Olympics – not even the athletes. The world’s spotlight is shining brightly on a flawed model, and the will of the people & progress can’t be held behind a curtain much longer. Alright, political rant is over >> have a great week guys.

• sma.

Question #5. Additional Comments/Questions/Suggestions?

• Thank you very much for this Thank you john peterson

• China Flue major spread in Italy. Raises concerns, eventually effect all of Europe. North American borders must tighten to NO travel beyond oceans!

• China is a few years away from big change.

Join us for this week’s shows:

Crowd Forecast News Episode #254: This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, February 24th, 2020, 1PM ET (10AM PT)

Lineup for this Episode:

– Melissa Armo of TheStockSwoosh.com (first time guest!)

– Marina Villatoro of TheTraderChick.com

– Mercedes Van Essen of MentalStrategiesForTraders.com

– Anka Metcalf of TradeOutLoud.com (moderator)

Analyze Your Trade Episode #115 (special episode): When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 15 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 24th, 2020, 4PM ET (1PM PT)

Lineup for this Episode:

– Jim Kenney of OptionProfessor.com (moderator)

– John Thomas of MadHedgeFundTrader.com

Analyze Your Trade Episode #116: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 15 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 25th, 2020, 4PM ET (1PM PT)

Lineup for this Episode:

– Jeffrey Gibby of MetaStock.com (first time guest!)

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders Event #11 — “Women Teach Trading and Investing: Opportunities for Everyone in Today’s Markets”: Join us for this huge week-long event. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time: Monday-Friday, March 2nd-6th, 2020, 4PM ET (1PM PT)

Moderator and Guests: Full schedule to be announced: Over 20 women financial professions and educators have confirmed to participate.

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #334

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport021720.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (February 18th to 21st)?

Higher: 48.0%

Lower: 52.0%

Higher/Lower Difference: -4.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.2%

Average For “Higher” Responses: 70.4%

Average For “Lower” Responses: 64.2%

Higher/Lower Difference: 6.2%

Responses Submitted This Week: 25

52-Week Average Number of Responses: 32.7

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 59.1% predicting Lower, and the Crowd Forecast Indicator prediction was 58% chance Higher; the S&P500 closed 1.86% Higher for the week. This week’s majority sentiment from the survey is 52.0% predicting Lower with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 42 times in the previous 333 weeks, with the majority sentiment (Lower) being correct only 40% of the time and with an average S&P500 move of 0.02% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.9%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Continued “not QE 4” repo injection by the Fed, lowered VIX and buy the dip remain in force. AAII bullish numbers still low.

• LT trend

• FOMC

• S P TOP IS 338 12 THE NXT TOP IS 340.525

• I think they can go as far as to 90%to 95%

• China markets are up and U.S. markets ignore coronavirus spreading.

• The trend up continues

“Lower” Respondent Answers:

• Short week and extremely stretched having in mind the current scenario.

• The run up has been too fast. There needs to be a slow down to give pause before the blow-off can continue.

• Stochastics peaking. A quiet week then down.

• Market is losing momentum. More earnings reports to weigh on the market.

• Fed must loosen

• seesaw stage in the market has begun FED must lower but might not

• China Flue, wider spread and effecting Asian businesses stronger than expected. Limited North American citizen exposure and better health care systems than abroad.

• Markets moved up to fast.

• Mexican beer ;o)

• because the fed and the pboc are going to prop the market up. totally lost reality.

• consolidation

• The coronavirus is gaining steam, which can reverse the market’s upward movement; starting any day now.

[AD] PDF: 7 Risk Management Strategies

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week the market holiday, but back on February 24th.)

• no opinion

• bank statements

• Where are commodities headed, chart wise. Oil, is there a future?

• none

• When will supply chain disruptions affect equity markets?

• None

• How to trade futures? When is the best time of the day to trade futures? How to trade futures overnight?

• NONE

• Yes if course we would like to know how fast and incredible future for S&P500 as we maybe surprise of.

Question #5. Additional Comments/Questions/Suggestions?

• Re: China flue. Tighten North American borders while giving medical expertise to Asian countries. Fast track medical research and cure.

• I hope the best for the company as i hope forward will be ever

Join us for this week’s shows:

Analyze Your Trade Episode #114: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 18th, 4PM ET (1PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] PDF: 7 Risk Management Strategies

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #333

[AD] PDF: 7 Risk Management StrategiesThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport020920.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 10th to 14th)?

Higher: 40.9%

Lower: 59.1%

Higher/Lower Difference: -18.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.1%

Average For “Higher” Responses: 67.2%

Average For “Lower” Responses: 68.7%

Higher/Lower Difference: -1.5%

Responses Submitted This Week: 24

52-Week Average Number of Responses: 32.9

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 73.1% predicting Lower, and the Crowd Forecast Indicator prediction was 65% chance Higher; the S&P500 closed 2.84% Higher for the week. This week’s majority sentiment from the survey is 59.1% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 67 times in the previous 332 weeks, with the majority sentiment (Lower) being correct only 42% of the time and with an average S&P500 move of 0.35% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 7 Risk Management Strategies

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• LT trend

• President Trump the greatest president since JFK now can focus more on the Nation. He has the greatest team and family support I’ve ever seen in all my years in business. The people of the nation has SEEN THROUGH the lies and deception by the other party. This man’s energy and vision drives the economy and stock markets to new heights and everyone wants onboard… The China v. flue is a issue effecting markets to a degree and of course short sellers as well.

• Trend still up

• historical

“Lower” Respondent Answers:

• Overpriced

• Corona Virus

• N0t enough money flowing in to keep market propped up

• Money flowing out of market

• 3 bar reversal on daily chart.

• just a retrace rally now back to spx 3226

• Coruna Virus and its toll on Chinese manufacturing output for at least the 1st half of 2020

• Investors can be expected to take profits in light of the market being overbought combined with the chance that the coronavirus is more serious than most people think it is. Chinese factories, shipping, and tourism abroad are being affected.

• The market is overbought and international concerns will hurt and the Democratic primary in NH