0

[AD] eBook:

2026 is going to be different (Here is the map!)

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081720.pdf

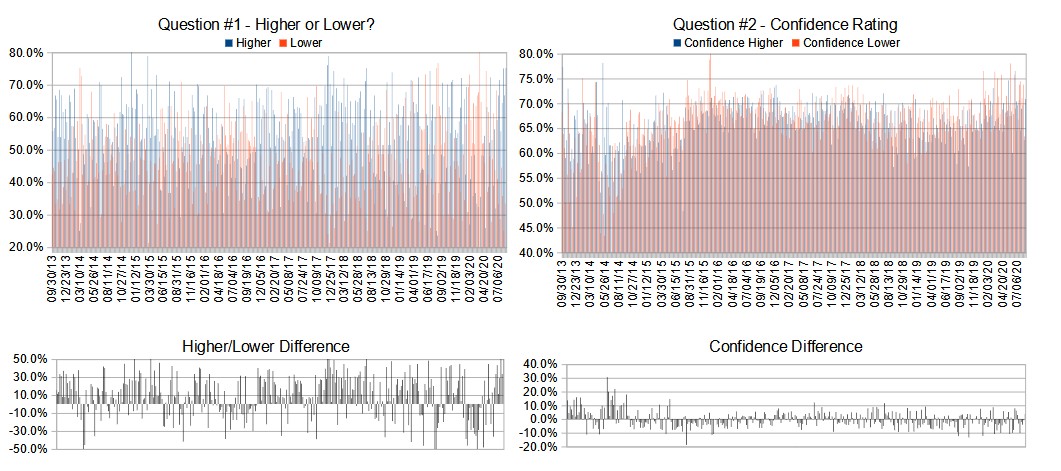

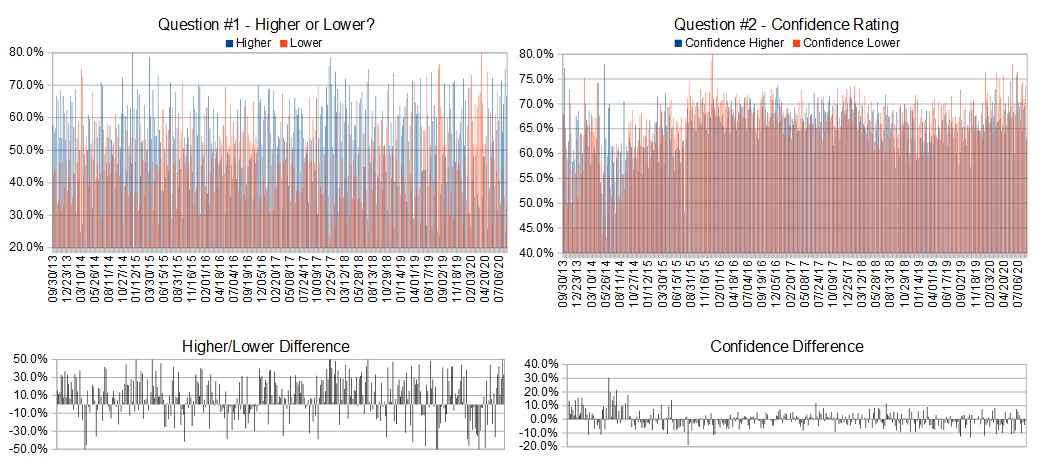

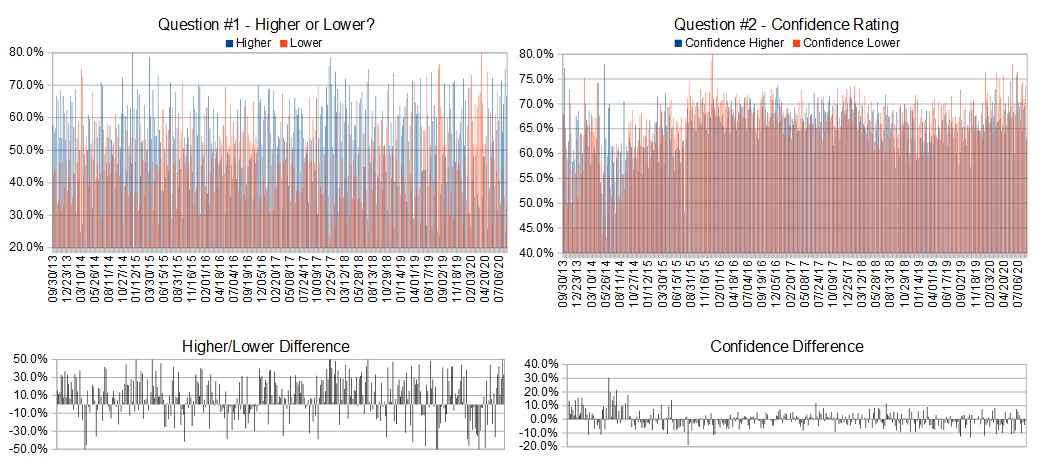

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 17th-21st)?

Higher: 66.7%

Lower: 33.3%

Higher/Lower Difference: 33.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.8%

Average For “Higher” Responses: 62.5%

Average For “Lower” Responses: 63.3%

Higher/Lower Difference: -0.8%

Responses Submitted This Week: 18

52-Week Average Number of Responses: 26.8

TimingResearch Crowd Forecast Prediction: 67% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 75.0% predicting Higher, and the Crowd Forecast Indicator prediction was 65% chance Higher; the S&P500 closed 0.50% Higher for the week. This week’s majority sentiment from the survey is 66.7% predicting Higher but with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 27 times in the previous 359 weeks, with the majority sentiment (Higher) being correct 67% of the time but with an average S&P500 move of 0.32% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook:

2026 is going to be different (Here is the map!)

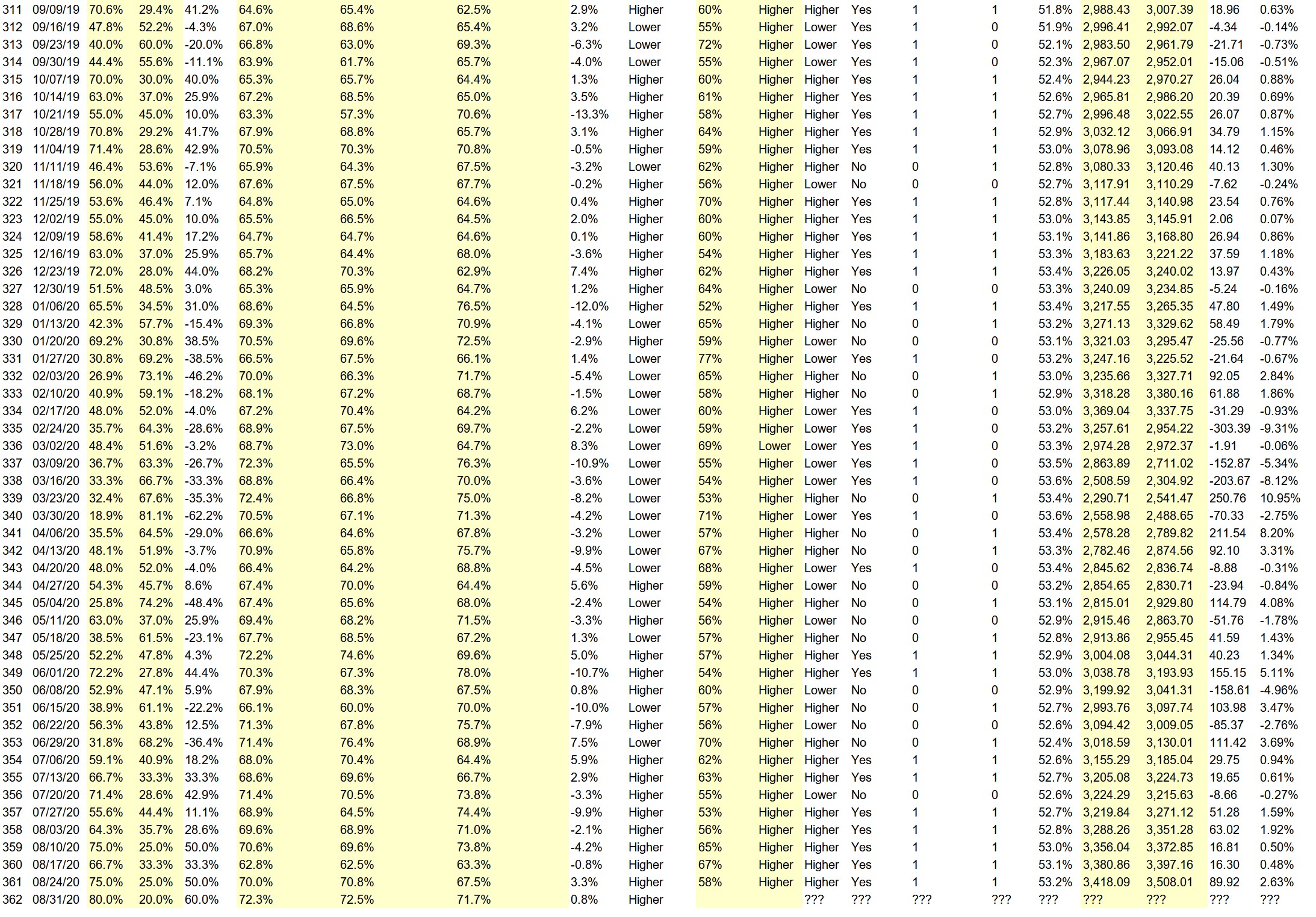

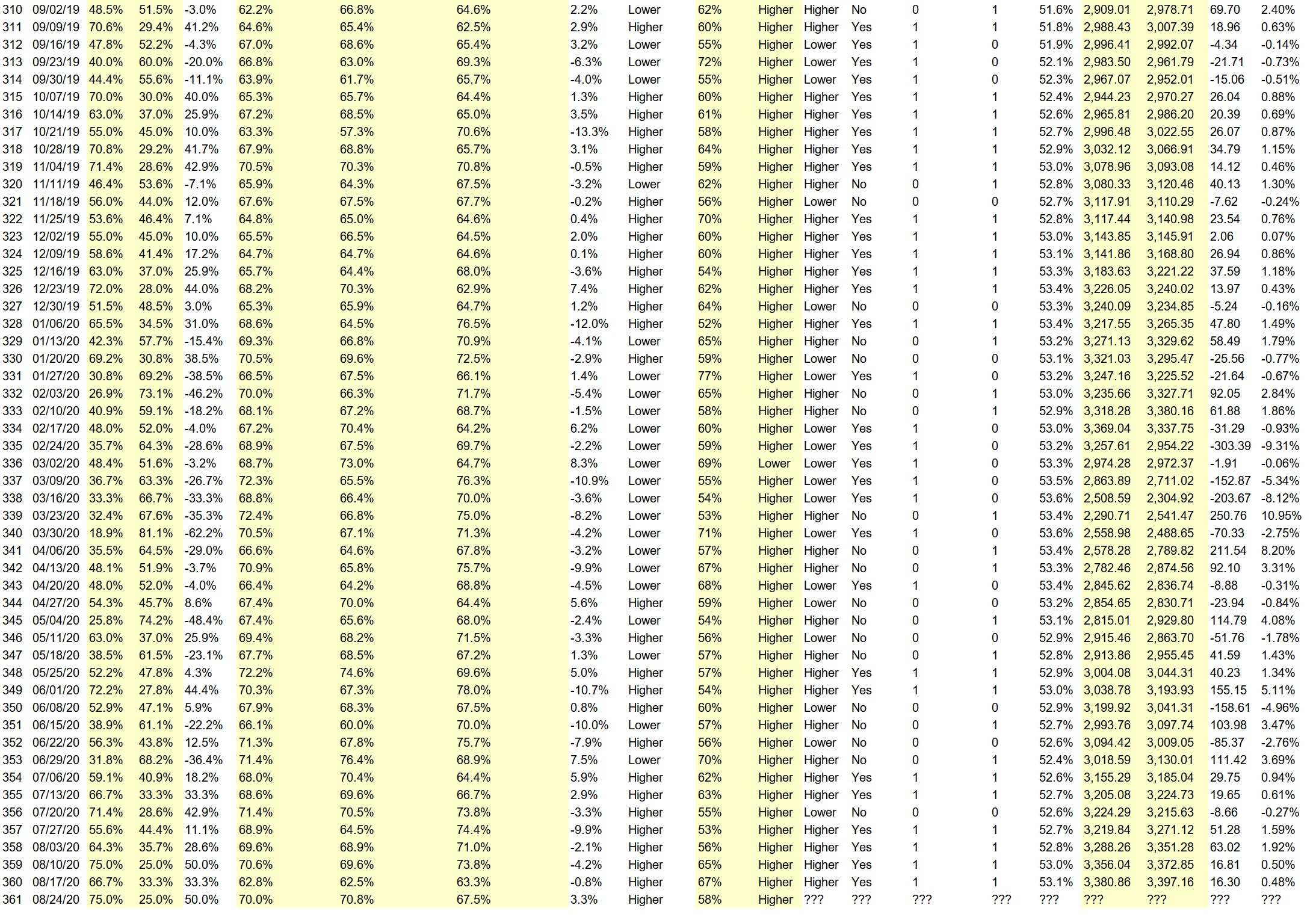

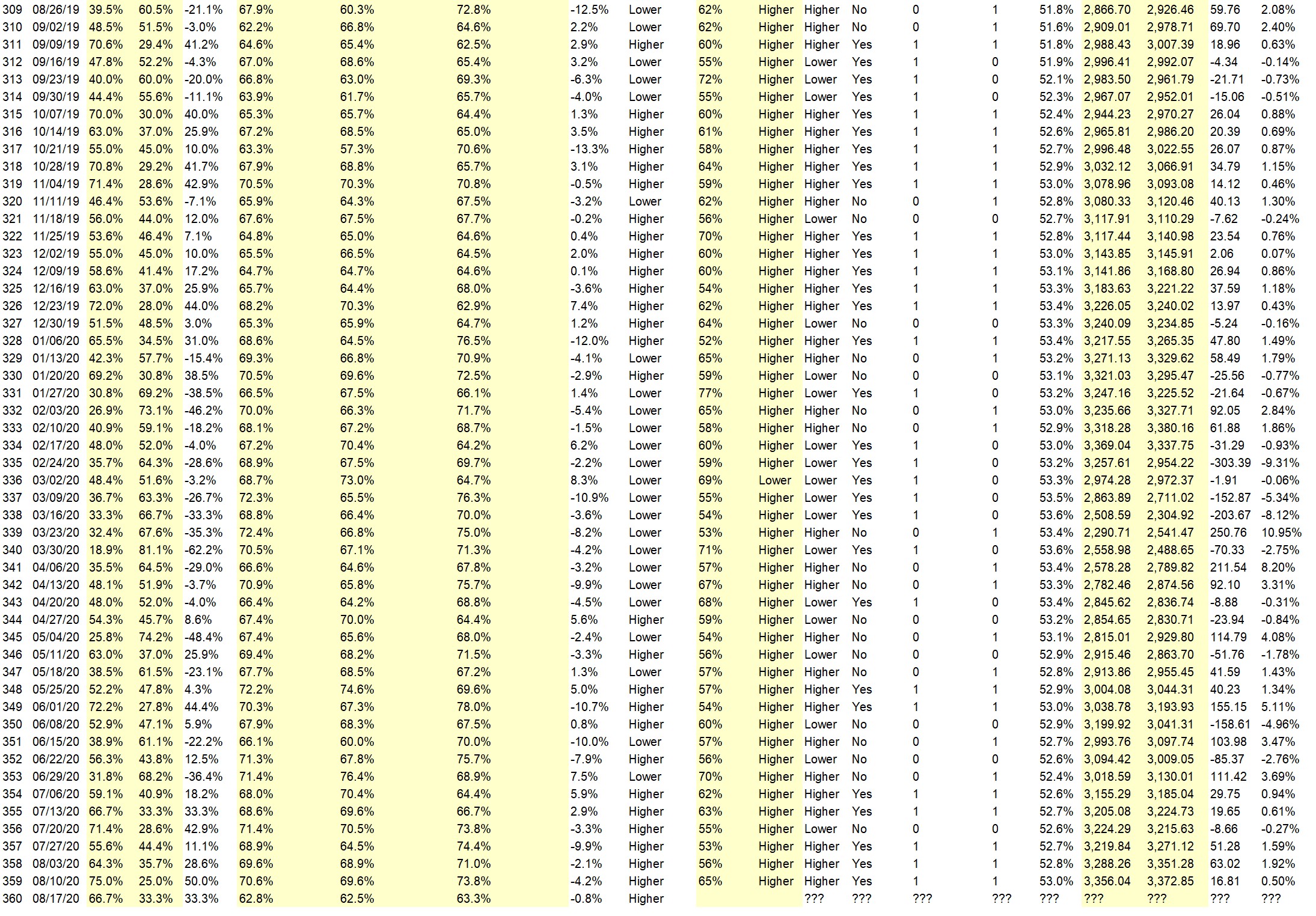

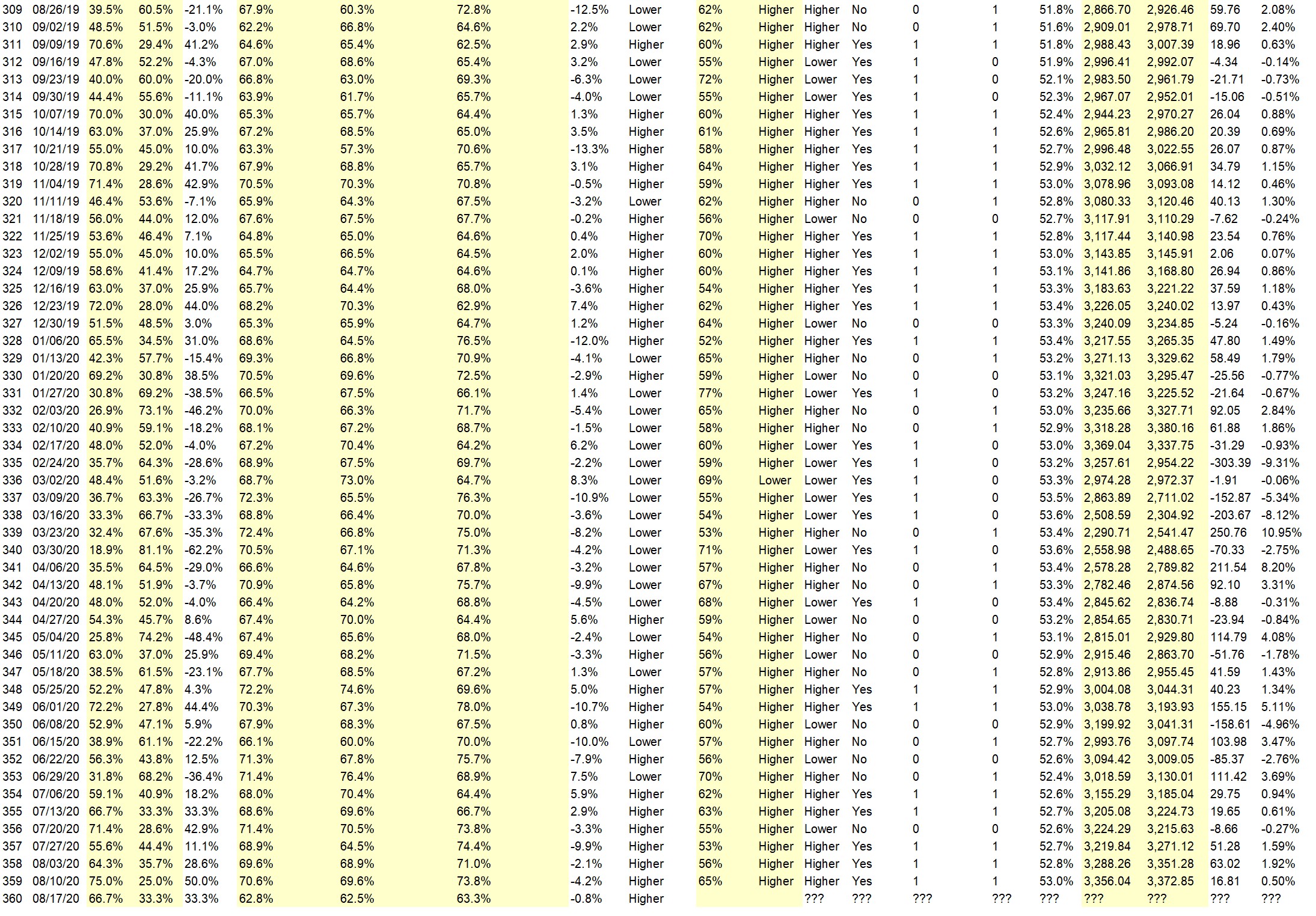

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• COVID-19 cases are going down; NY city is opening up and created HOPE; some students will go back to school and parents will spend some money for back to school; Biden has chosen running VP, etc. In another words, less bad news.

• Trend continues, there are too many bears out there.

• It’s a continuation of the upward trend; and that liquidity is still around.

• Trend

• The trend is up until it’s not. I remain cautiously bullish. Good news bites will keep this boat afloat. Some bad news and my thought is there will be a pullback

• COT still is a Net Purchase for S&P E minies NASDAQ Eminies have a lower net sell last week

“Lower” Respondent Answers:

• excessive exhuberance

• Justing getting too high given the problem with COVID and the wrecked economy. Can’t ignore this situation forever.

• Nothing shows a possible drop in prices but the weakness of the past two trading days leads me to vigilance

• 1. reasons, The covid-19 is effecting the economy. 2. The Market will recover too soon.

[AD] eBook:

2026 is going to be different (Here is the map!)

Question #4. What would you most like to learn about related to trading?

• Trading Psychology

• How the hell do I make money?

• Overnight Trading-Options Strategies.

• Safe consistent income generation. I am semi-retired overseas and mostly work on cash flowing (inside tax advantaged IRAs) my stock and ETF holdings with covered calls. I also do some cash secured puts to earn and possibly accumulate new positions at a prices I like. I have not done any serious study on best timing methods for the sales. Should you simply sell ATM and walk away for the week? Is it better to sell options in blocks as the market moves to perhaps earn a bit more? For me, the best plan keeps it simple and as mechanical as possible.

• In a large amount of information that I gained from r.2009 telling me nothing is missing !?

• How to trade ES (E-mini), NQ, GC, ZB/ZN, and what are the characters of each

Question #5. Additional Comments/Questions/Suggestions?

• Mini-Market tradings.

[AD] eBook:

2026 is going to be different (Here is the map!)

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies