0

[AD] eBook:

2026 is going to be different (Here is the map!)

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport070620.pdf

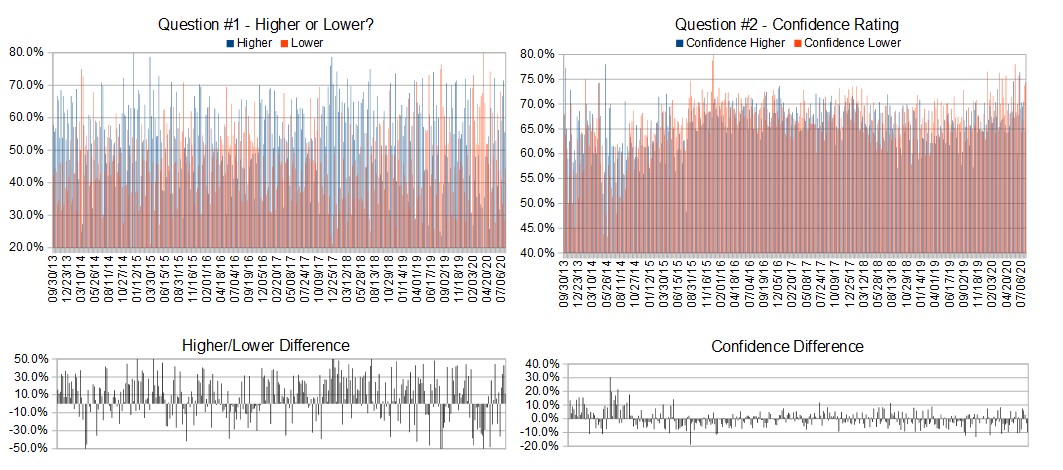

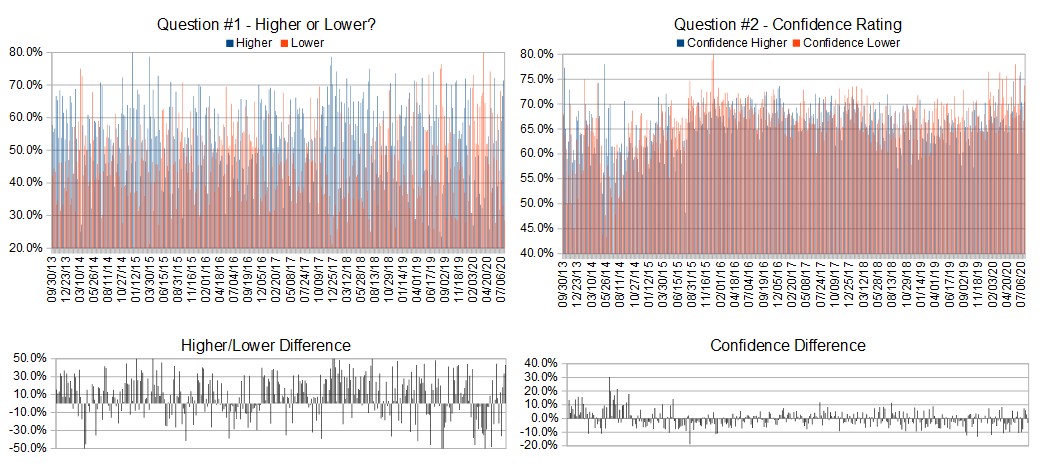

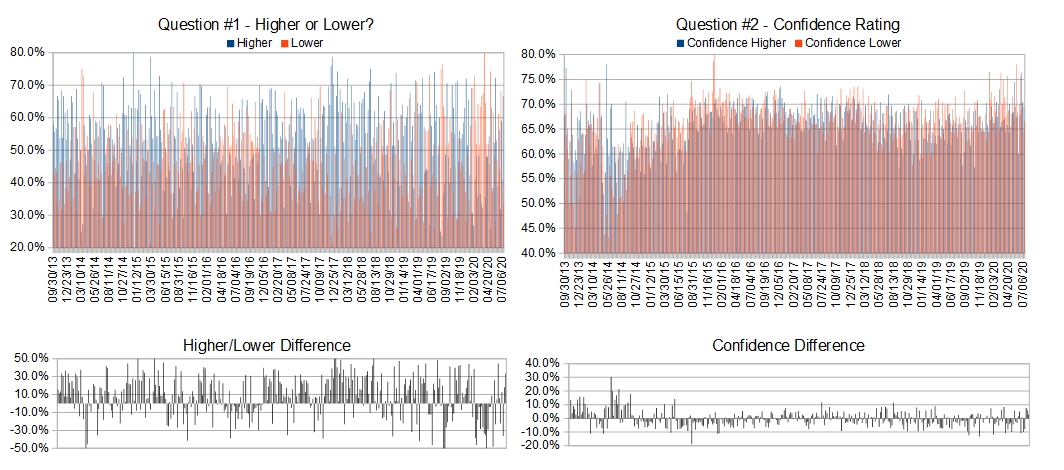

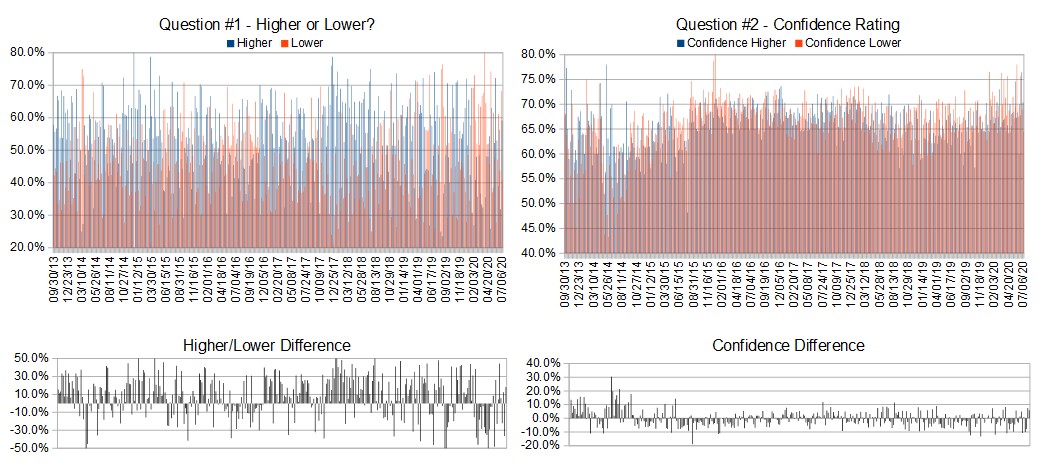

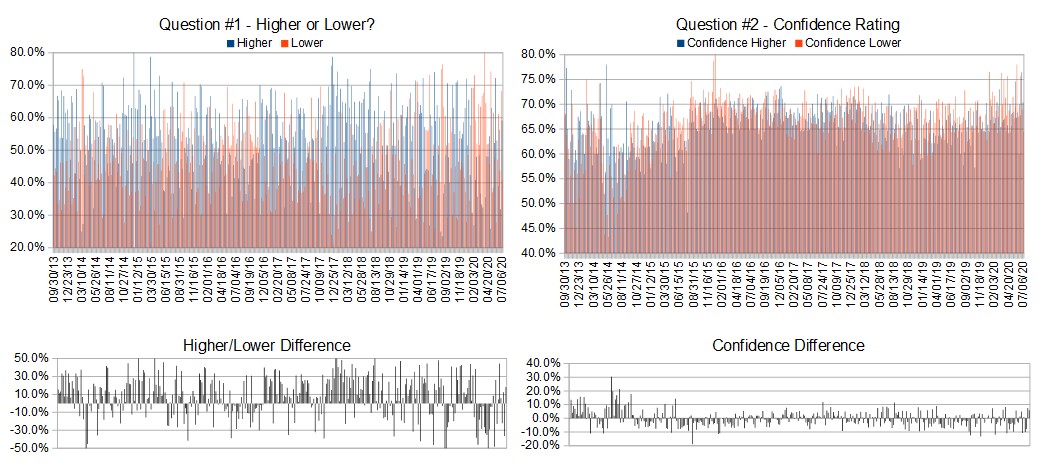

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 6th-10th)?

Higher: 59.1%

Lower: 40.9%

Higher/Lower Difference: 18.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.0%

Average For “Higher” Responses: 70.4%

Average For “Lower” Responses: 64.4%

Higher/Lower Difference: 5.9%

Responses Submitted This Week: 22

52-Week Average Number of Responses: 28.9

TimingResearch Crowd Forecast Prediction: 62% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

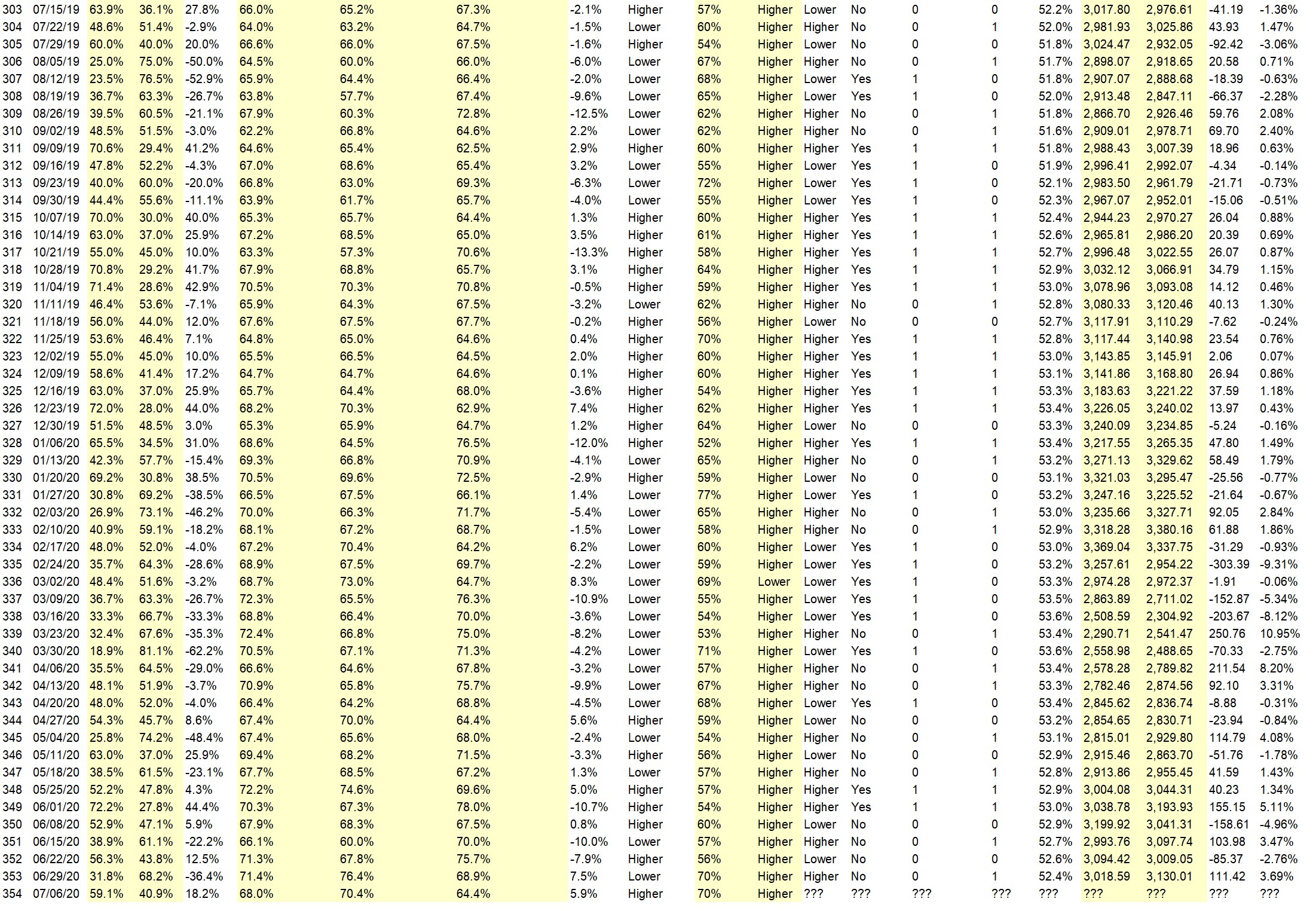

Details: Last week’s majority sentiment from the survey was 68.2% predicting Lower, and the Crowd Forecast Indicator prediction was 70% chance Higher; the S&P500 closed 3.69% Higher for the week. This week’s majority sentiment from the survey is 59.1% predicting Higher but with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 87 times in the previous 353 weeks, with the majority sentiment (Higher) being correct 62% of the time and with an average S&P500 move of 0.20% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 62% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook:

2026 is going to be different (Here is the map!)

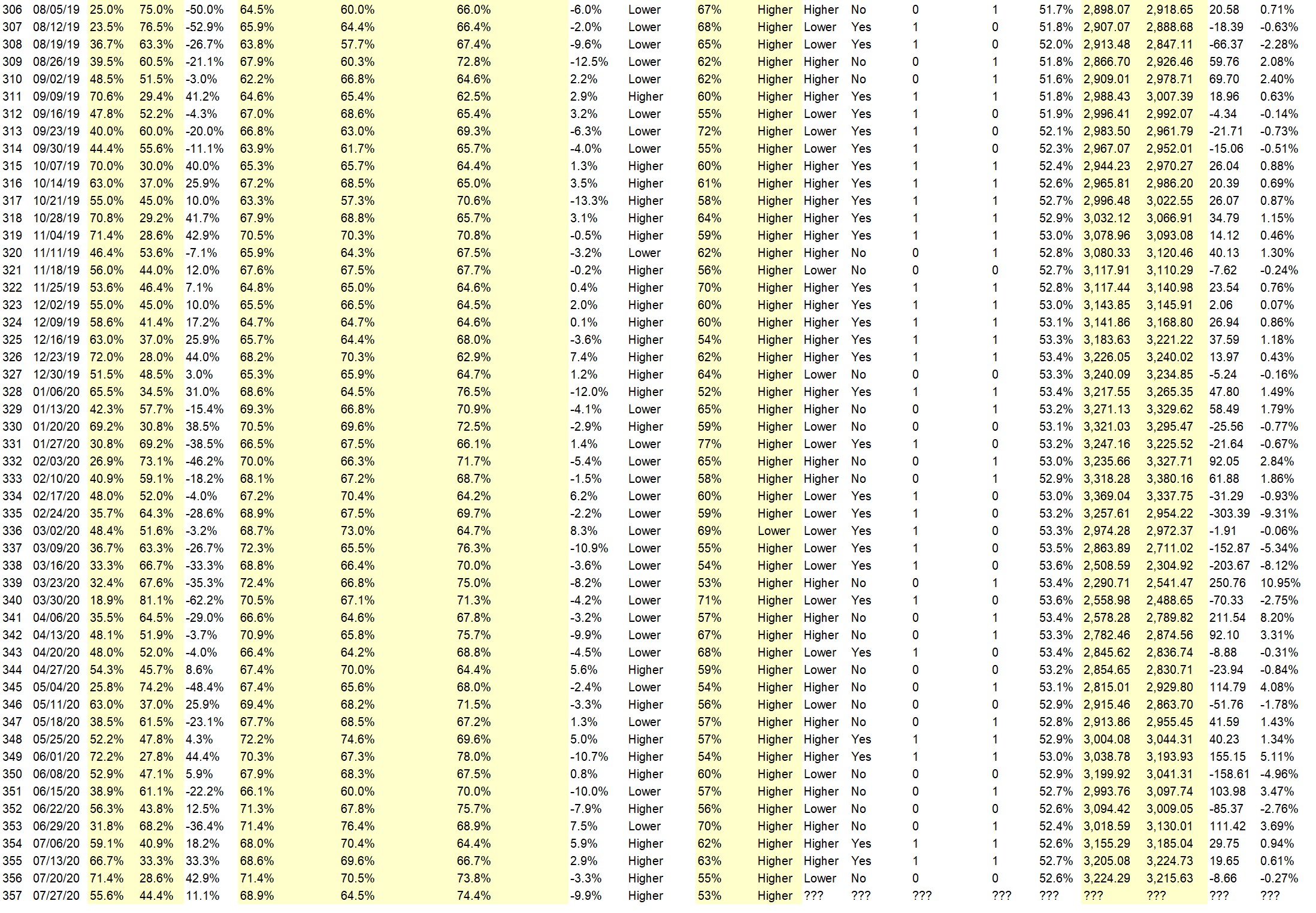

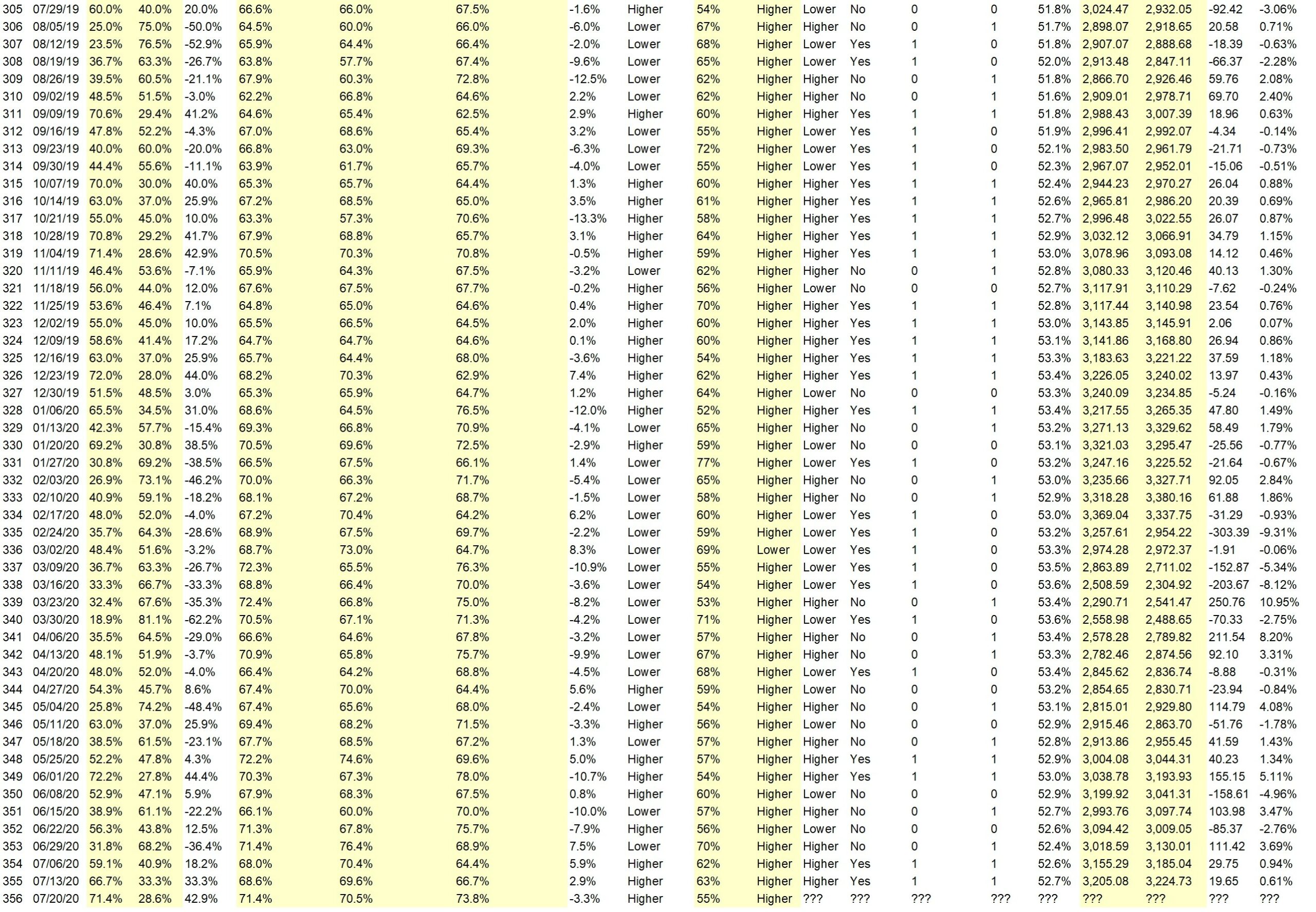

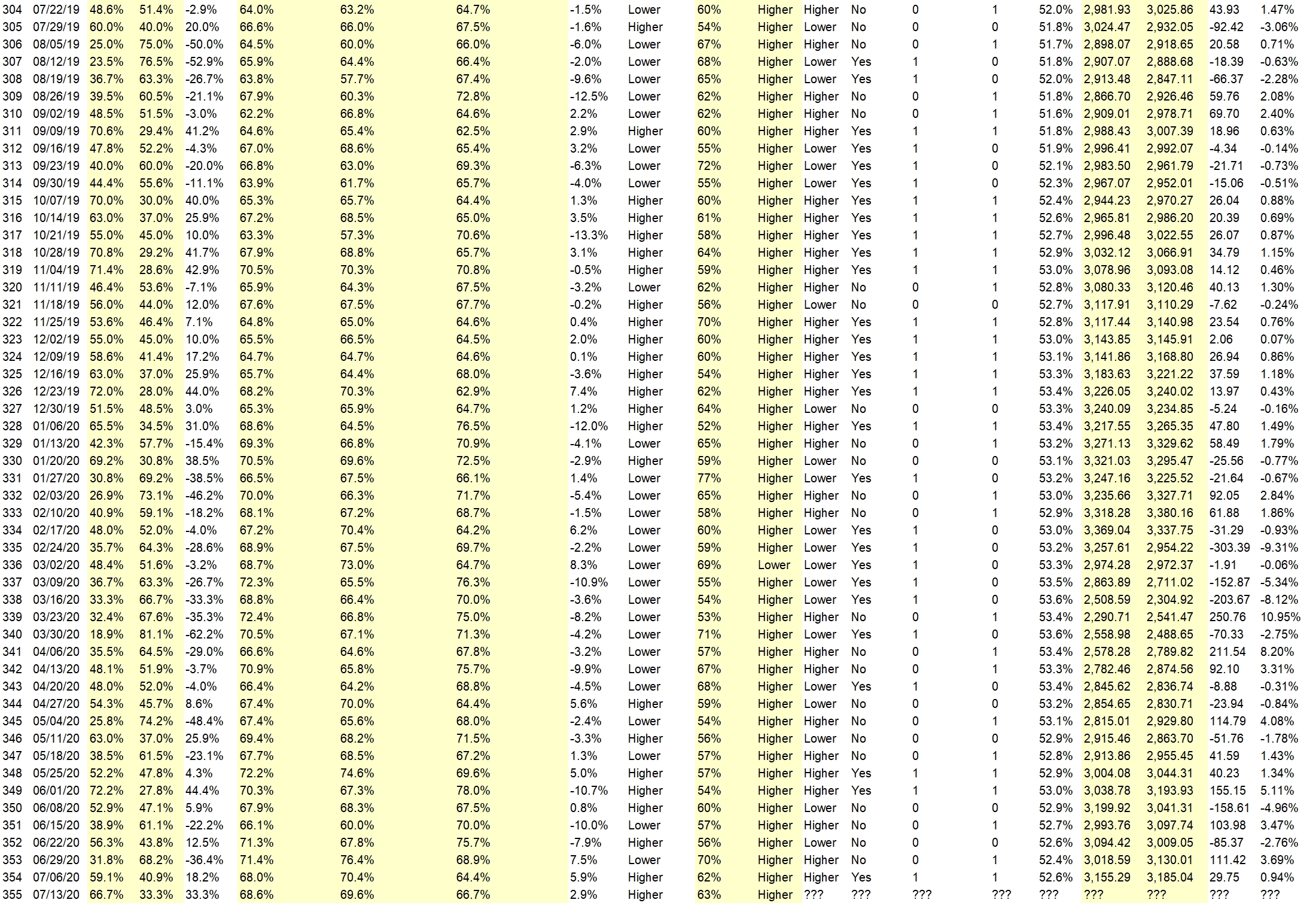

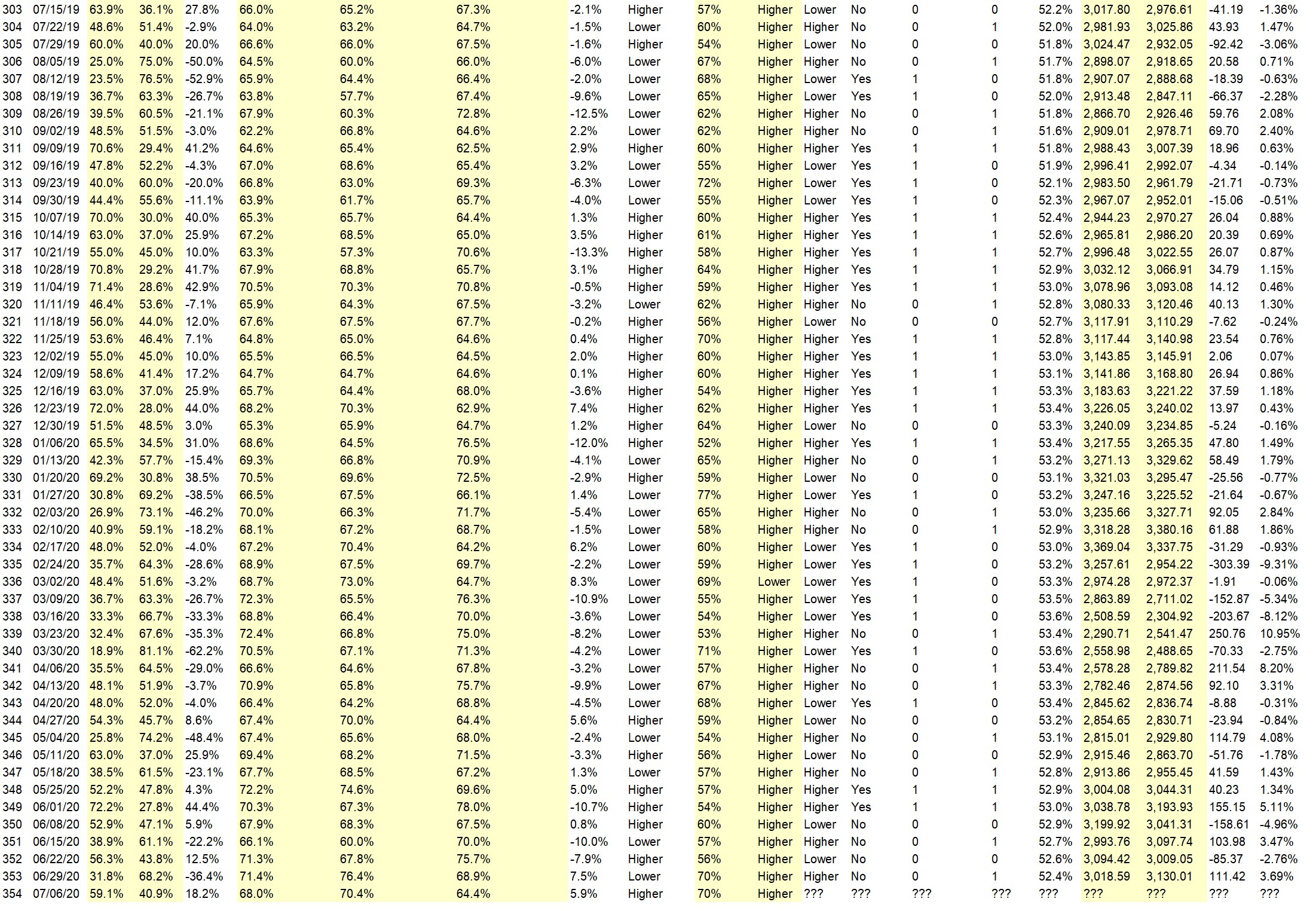

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.4%

Overall Sentiment 52-Week “Correct” Percentage: 52.9%

Overall Sentiment 12-Week “Correct” Percentage: 27.3%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Because of the new IPO’s going public.

• Good unemployment report. Low mortality rate though recent Covid-19 cases surge.

• Historical Early Summer Rally,

• The markets are doing well reaching highs again even through the fear of the public

• The probability seems to favor continuity, with Fed-induced liquidity still an important factor. The market has mostly been hitting upper Bollinger Bands; which sits at about 3220; so that could be the next resistance.

• reverse head and shoulders on DJIA may lead the S&P500.

• All tech stocks are all time high, It may pull back 1-2% and moves to new high.

• good stats All around.

• Elliott waves

“Lower” Respondent Answers:

• Corona virus

• Profit taking as we go into a lower cycle.

• technical

[AD] eBook:

2026 is going to be different (Here is the map!)

Question #4. What styles of trading or methodologies have you had the most success with?

• Binaries and Forex.

• Trend trading

• Reading the charts and technical analysis.

• Seasonal Technical analysis Jake Bernstein Analysys

• Swing trading

• Morning rallies via NASDAQ futures. Short term only

• Moving averages with pivot points

• swing trading

• trading genuine Breakouts of long term price range (R&D: 7 yrs)

Question #5. Additional Comments/Questions/Suggestions?

• none at this time.

• Since 1928 only two bear market rallies have retested lows. 2000 & 1957. Unless the economy is totally shut down again this will not happen. Plenty of funny money poured in by the FED. Don’t fight the FED.

• This is a very difficult time in the market, but the NQs almost always rally up until 10 am est.

Join us for this week’s shows:

Crowd Forecast News Episode #269

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 6th, 1PM ET (10AM PT)

Moderator and Guests:

– Erik Gebhard of Altavest.com

– Amelia Bourdeau of MarketCompassLLC.com

– The Option Professor of OptionProfessor.com (moderator)

Click here to find out more!

Analyze Your Trade Episode #131

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 7th, 4PM ET (1PM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– The Option Professor of OptionProfessor.com (moderator)

Click here to find out more!

[AD] eBook:

2026 is going to be different (Here is the map!)

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies