0

AD: There Will Be Blood, There Will Be Profits.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport101319.pdf

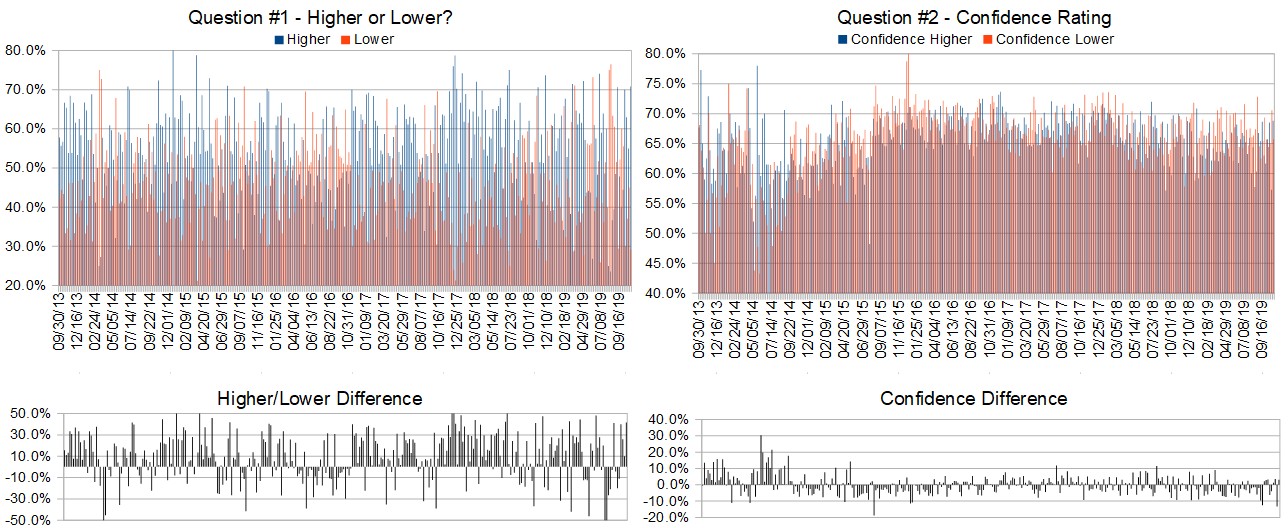

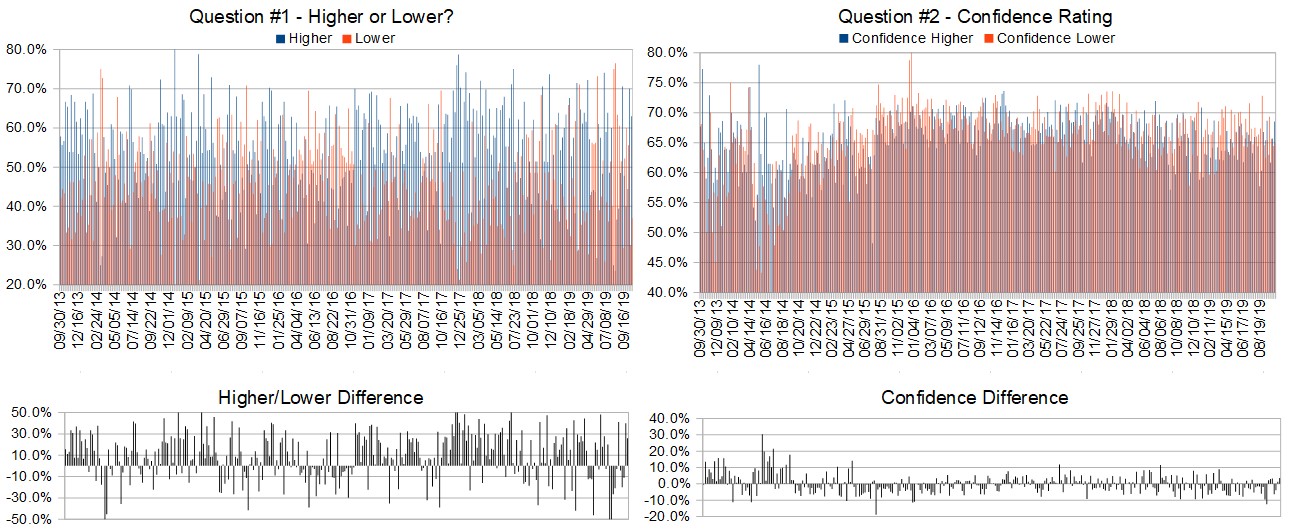

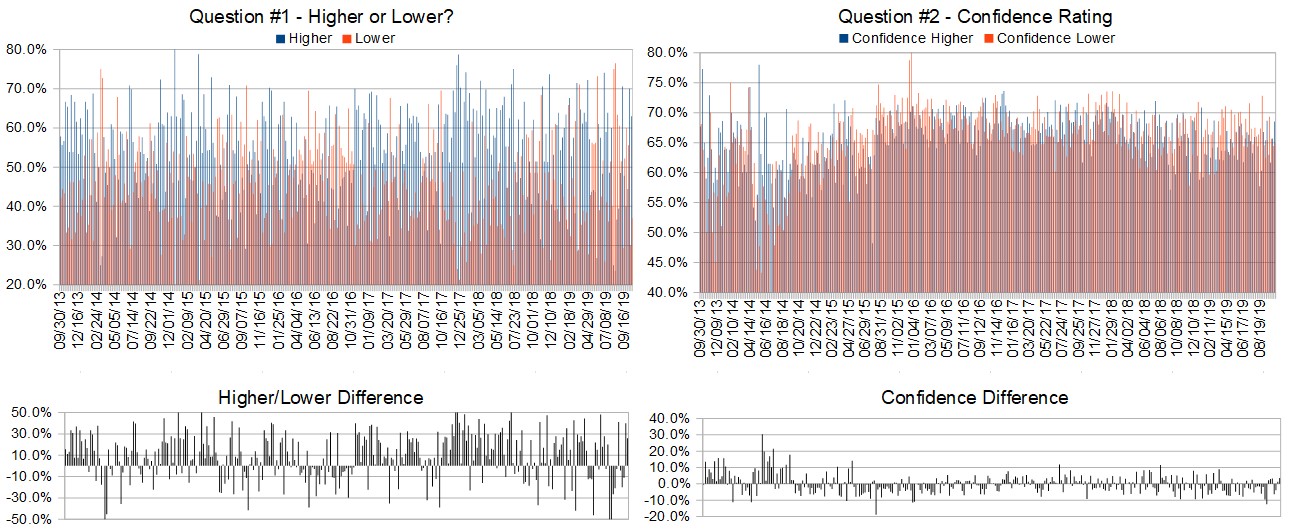

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 14th to 18th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.0%

Lower: 37.0%

Higher/Lower Difference: 25.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.2%

Average For “Higher” Responses: 68.5%

Average For “Lower” Responses: 65.0%

Higher/Lower Difference: 3.5%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 36.0

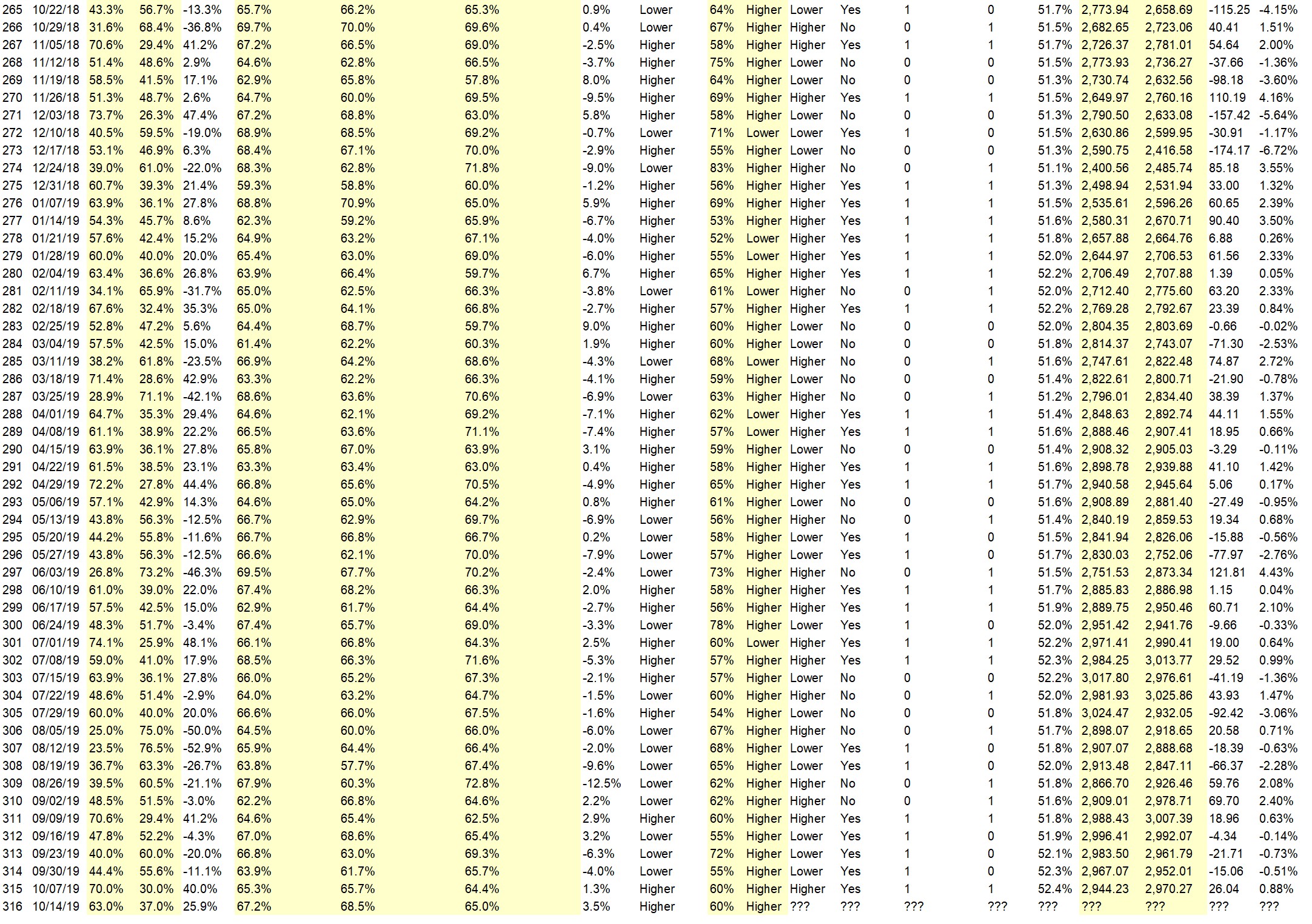

TimingResearch Crowd Forecast Prediction: 61% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

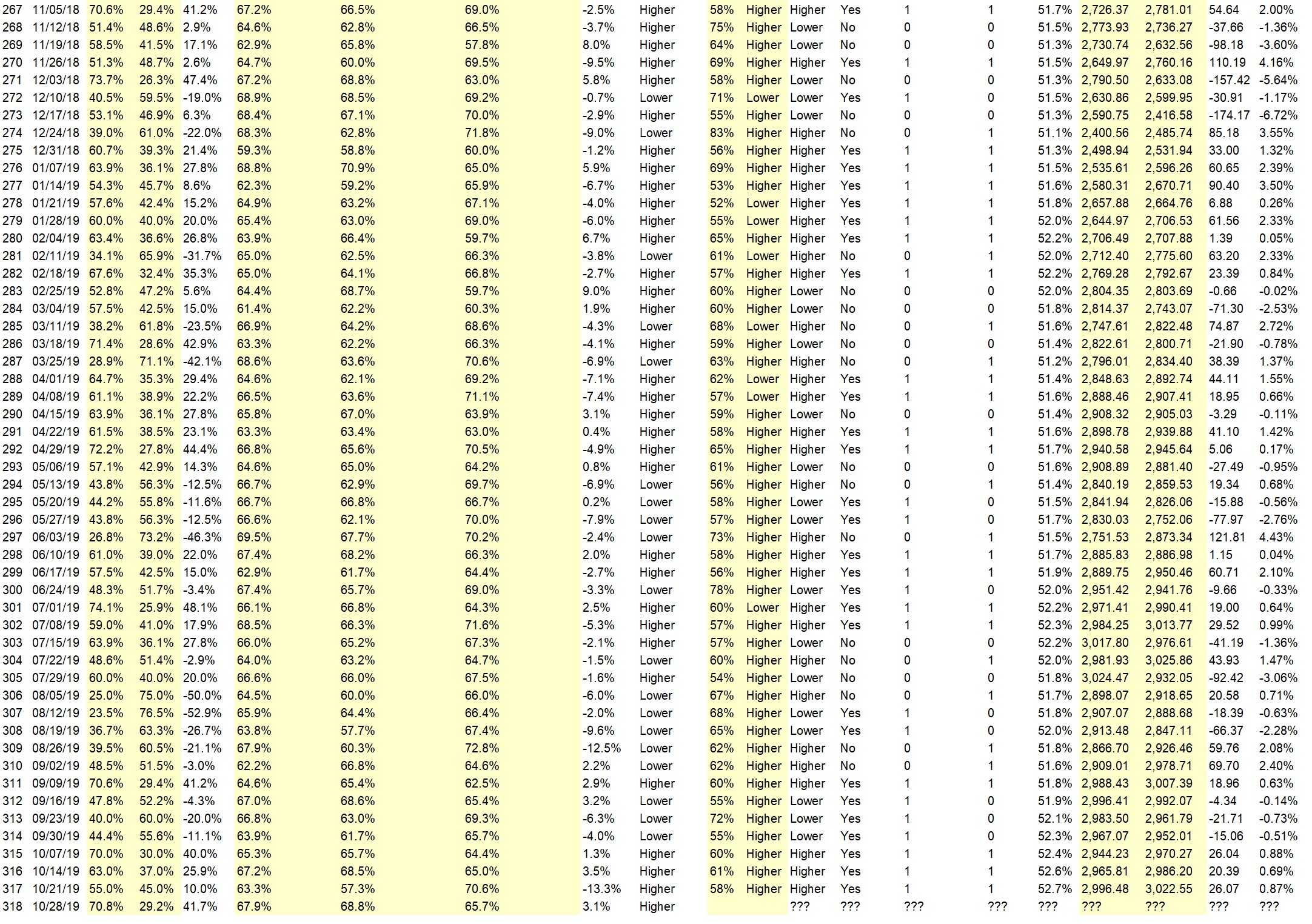

Details: Last week’s majority sentiment from the survey was 70.0% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.88% Higher for the week. This week’s majority sentiment from the survey is 63% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 64 times in the previous 315 weeks, with the majority sentiment (Higher) being correct 61% of the time and with an average S&P500 move of 0.12% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 61% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

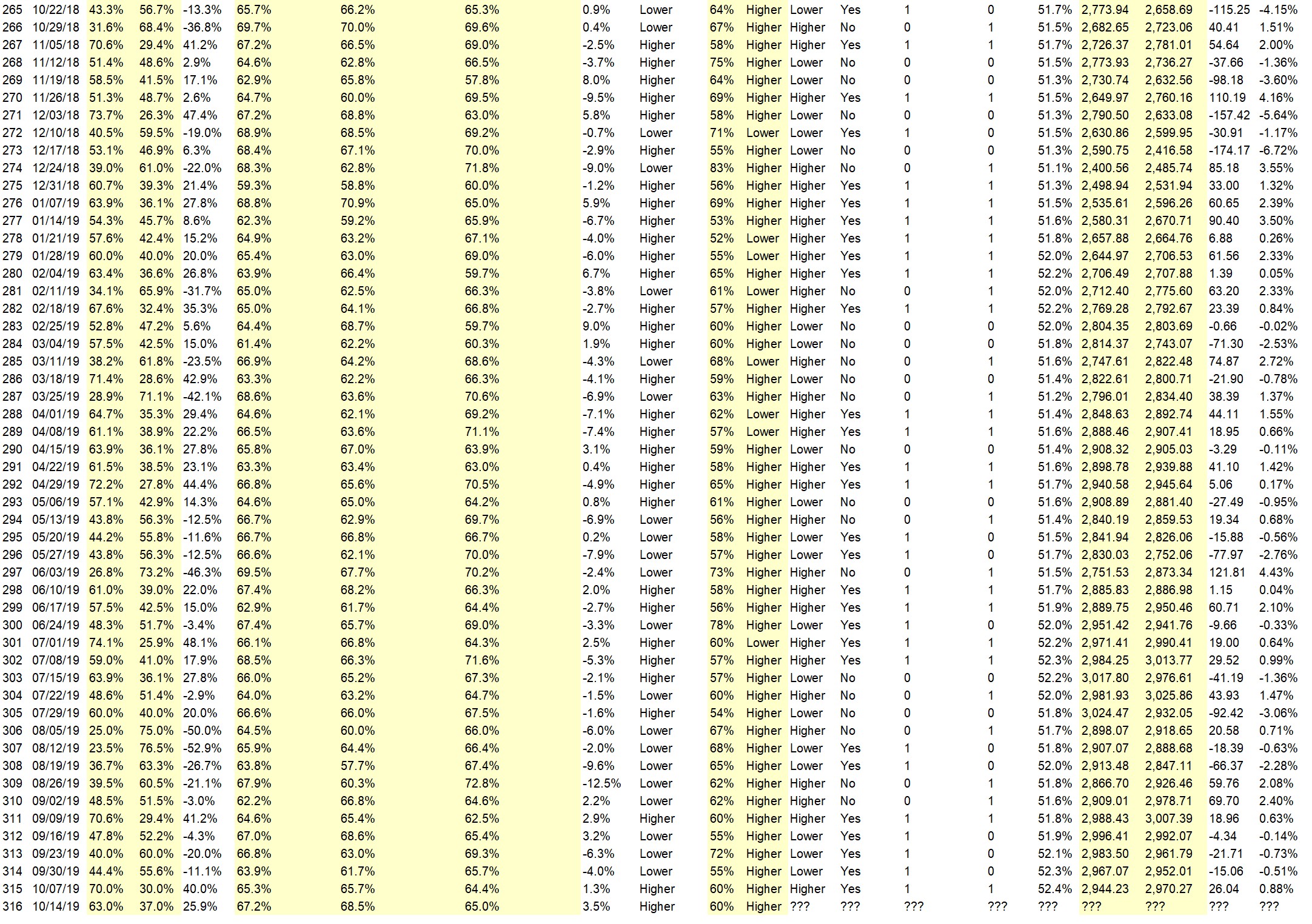

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.4%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Positive China, Inpeachment efforts dwindle

• Earnings, Brexit solution, breach of downtrend.

• Trade deal +ve news

• FED CUT Selloff cycle ended Friday NICE REBOUND

• market currently going up

• The weekly chart shows higher lows, indicating that the trend is still up. The market likes the current US-China trade talk situation — wouldn’t argue with that.

• Us / China agreement

• China trade

• momentum

“Lower” Respondent Answers:

• Trade, middle east Issues, macro economics

• U.S. and China trade deal did not yield any better things for U.S. China has to feed its people and has to buy agriculture products, only U.S. can satisfy China’s huge population’s needs, no other single country can do that. Besides, nothing is in writing. Before the trade war China was buying from the U.S.

• Price in

• While sentiment suggest higher I think technicals suggest lower

AD: There Will Be Blood, There Will Be Profits.

Question #4. What trading software/platform(s) do you use to execute your trades?

• Tastyworks, TOS

• TCC2000, RBC, I-Trade,

• I use TD Ameritrade and Fidelity. Good news for me this week: both now commission free. TD Ameritrde now charges $0.65 per contract plus a small penny fees.

• Tradestations

• Fidessa

• TD

• E-Trade

• Td ameritrade

• Infinity futures and TOS

• Fidelity, TS & Trading view

Question #5. Additional Comments/Questions/Suggestions?

• Gold & Silver stabilize & Rise. Modest Gains is stocks

No CFN show this week, join us for these other upcoming events on TimingResearch:

Analyze Your Trade Episode #98

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 15th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

Synergy Traders #4

For this event 5 amazing trading educators available to teach you about their top trading strategies. We are inviting you to spend the day learning top trading strategies from leading industry experts that will bring you closer to achieving your trading goals.

Date and Time:

– Monday, October 19th, 2019

– 10AM ET (7AM PT)

Lineup for this Episode:

– 10AM: Marina Villatoro of TheTraderChick.com

– 11AM: Mercedes Van Essen of MentalStrategiesForTraders.com

– 12PM: Michael Guess of DayTradeSafe.com

– 1PM: Neil Batho of TraderReview.net

– 2PM: Anka Metcalf of TradeOutLoud.com

Click here to find out more!

AD: There Will Be Blood, There Will Be Profits.