Crowd Forecast News Report #278

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport012118.pdf

ADVERTISEMENT

Many former TimingResearch show guests and other trading experts will be speaking at the biggest and best online-only Wealth365 Summit taking place January 21-26th. Speakers have agreed to make sure to focus on actionable content and real wealth education during the presentations to make sure your time is well spent with us. This is the biggest online-only wealth show in the world so don’t miss out. It’s where you need to be to kick of 2019 right!

Click HERE to learn more and register!

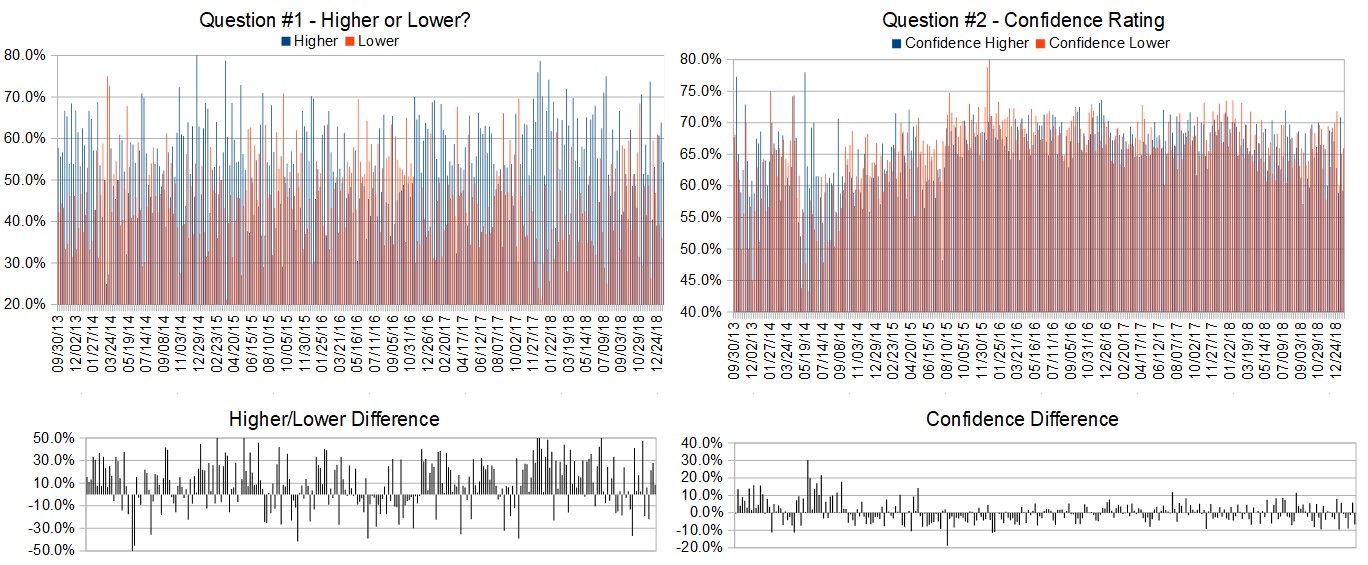

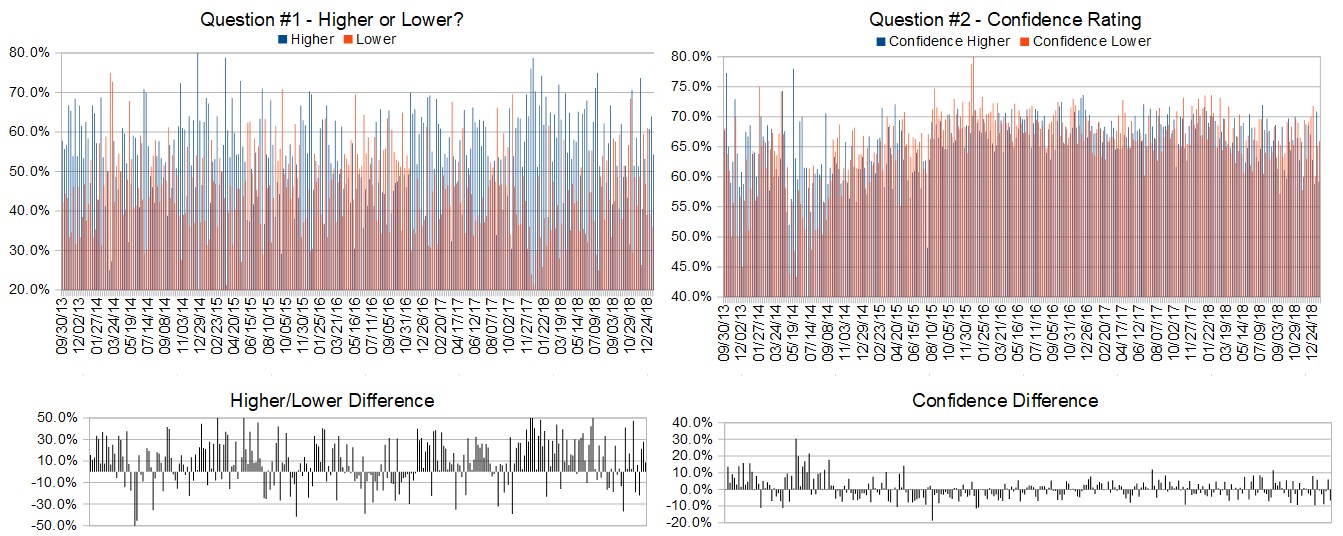

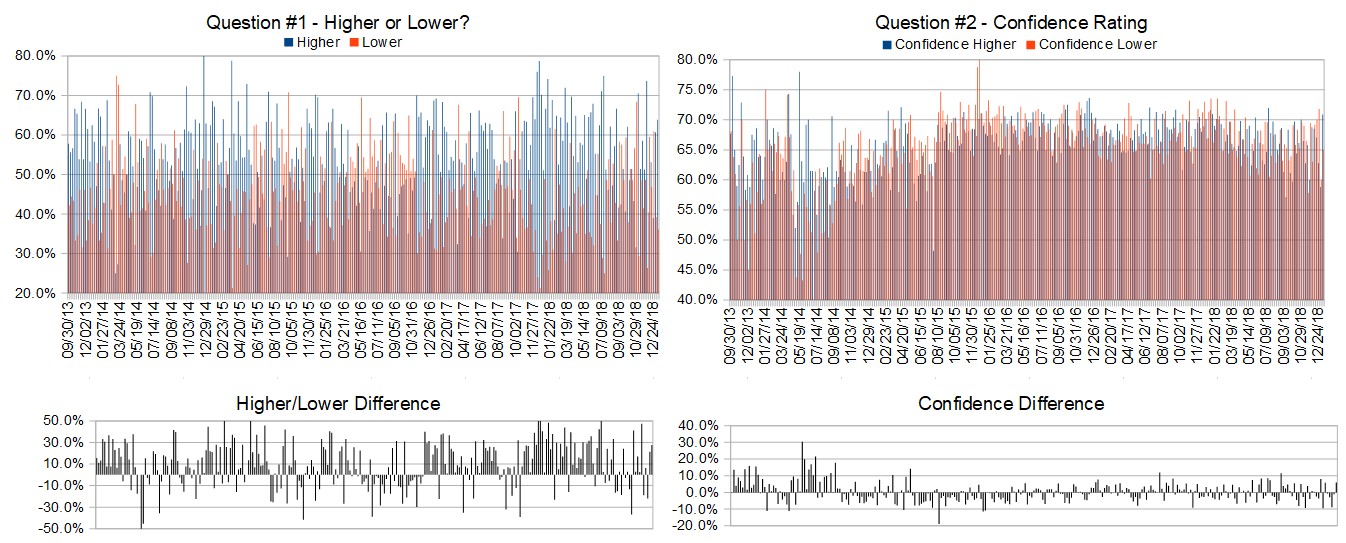

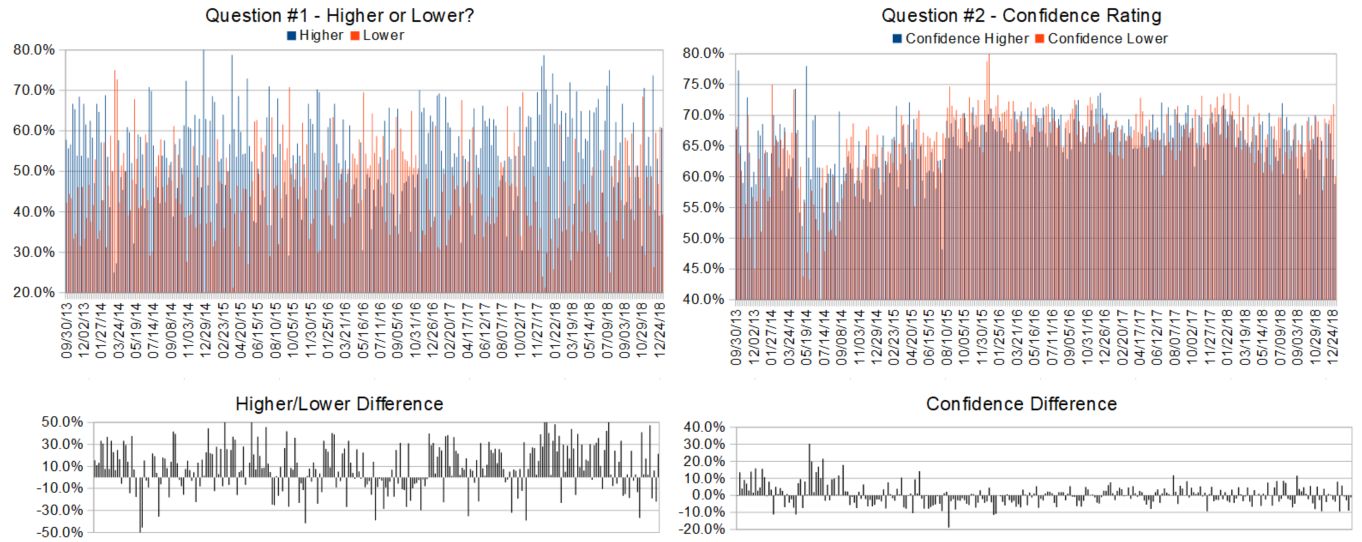

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (January 22nd to 25th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.6%

Lower: 42.4%

Higher/Lower Difference: 15.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.9%

Average For “Higher” Responses: 63.2%

Average For “Lower” Responses: 67.1%

Higher/Lower Difference: -4.0%

Responses Submitted This Week: 42.6

52-Week Average Number of Responses: 34

TimingResearch Crowd Forecast Prediction: 52% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

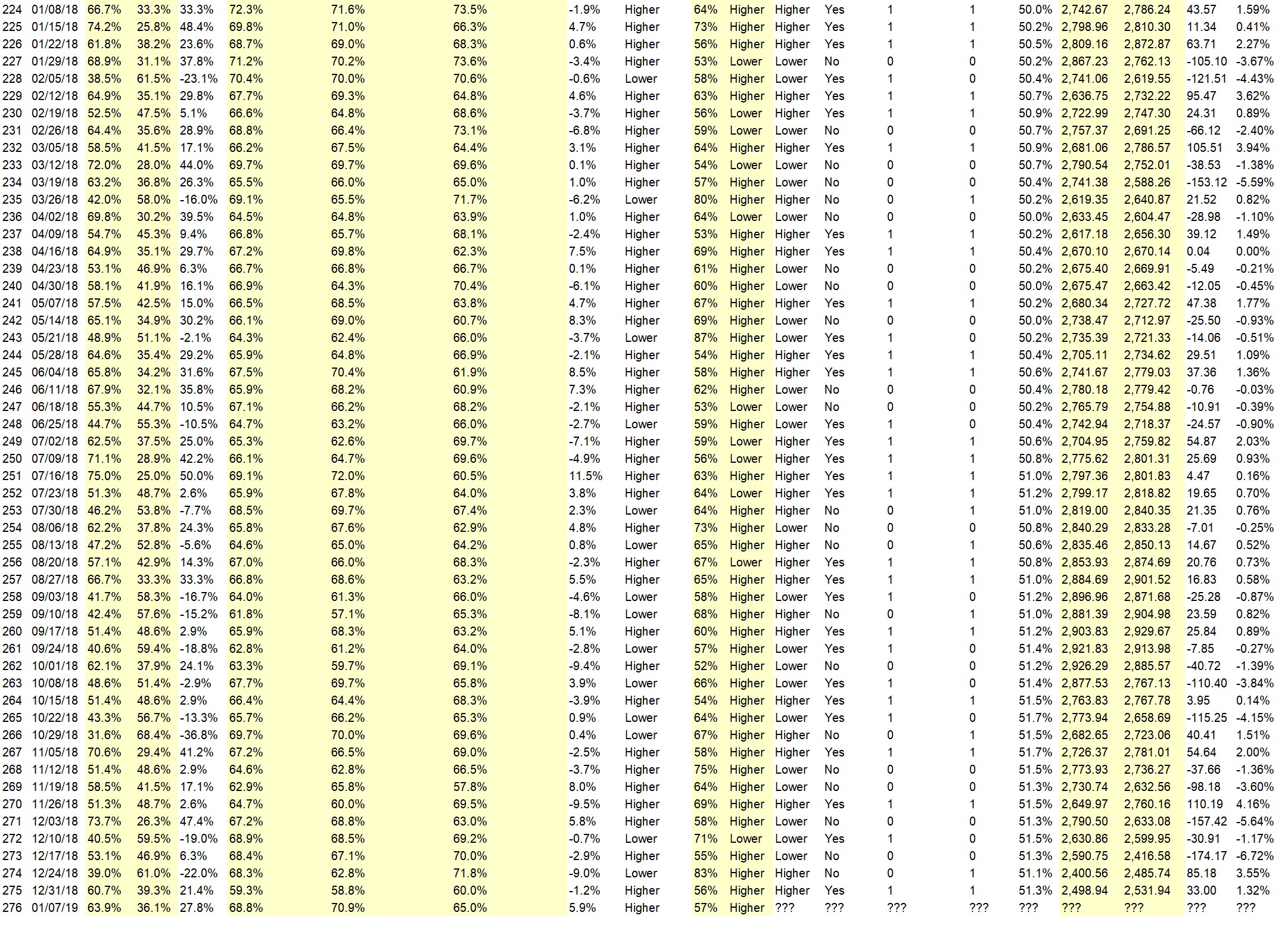

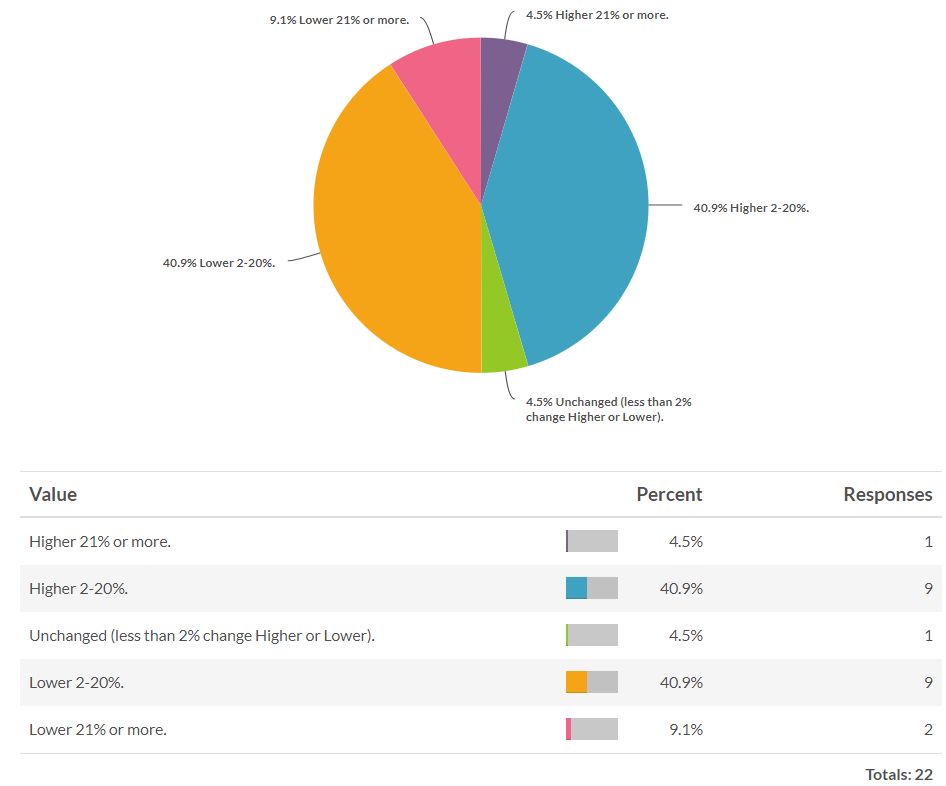

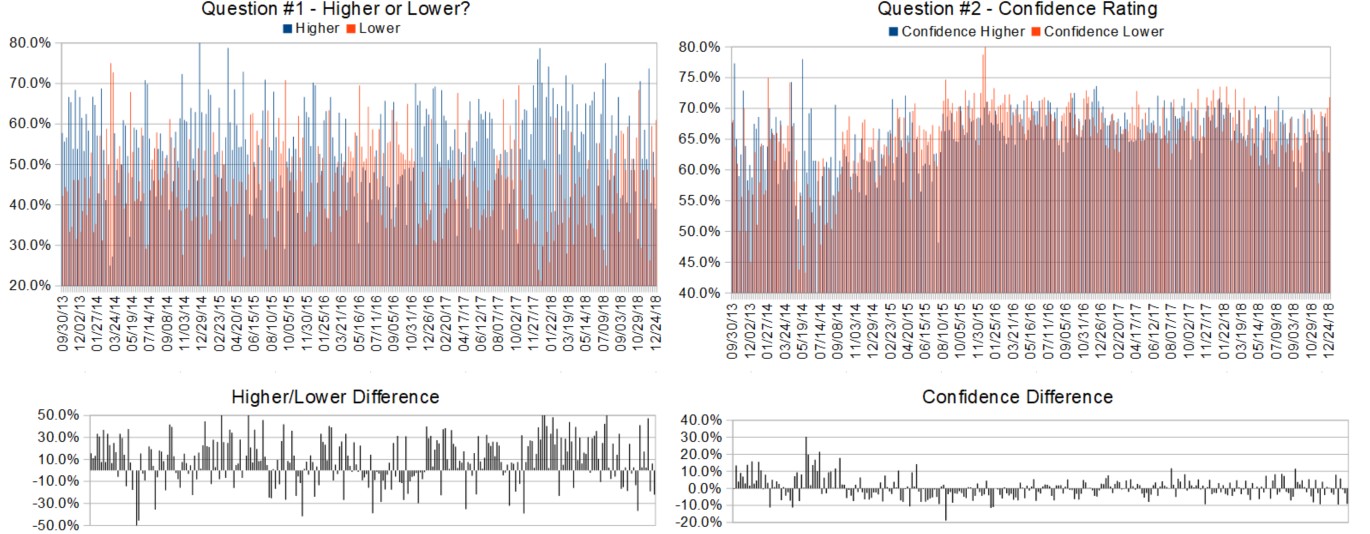

Details: Last week’s majority sentiment from the survey was 54.3% Higher, and the Crowd Forecast Indicator prediction was 53% Chance Higher; the S&P500 closed 3.50% Higher for the week. This week’s majority sentiment from the survey is 57.6% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 29 times in the previous 277 weeks, with the majority sentiment being correct only 48% of the time and with an average S&P500 move of 0.47% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 52% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

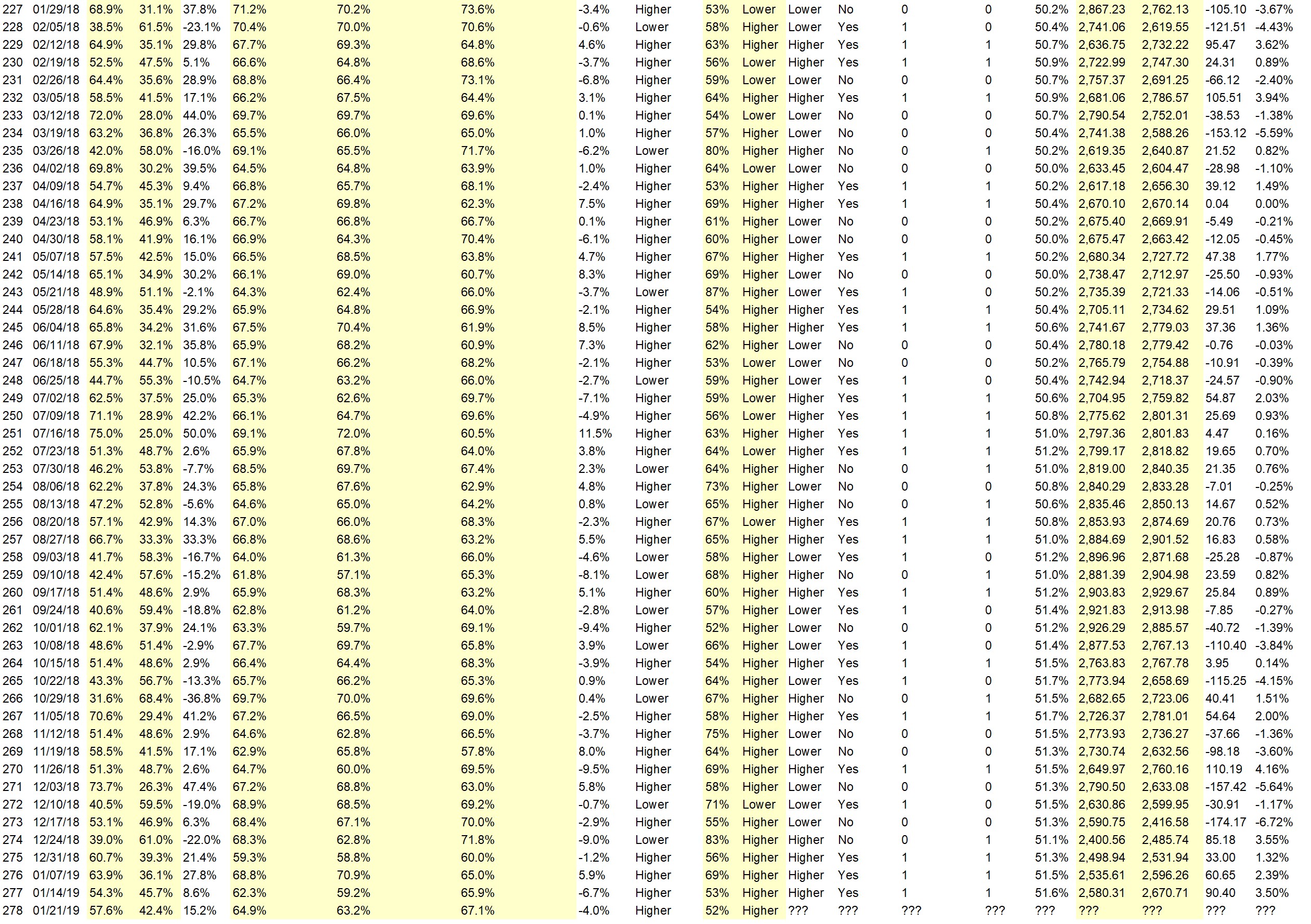

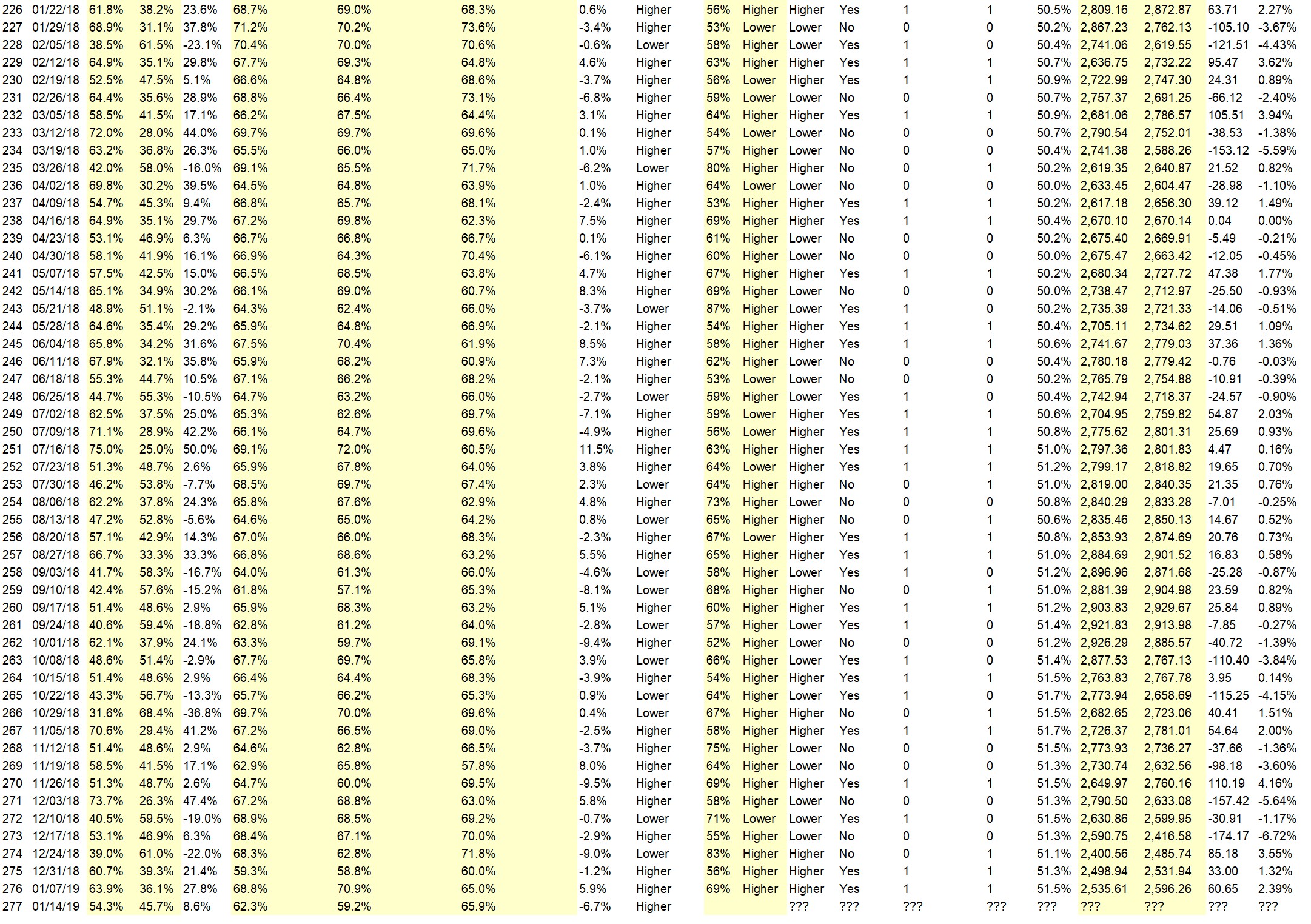

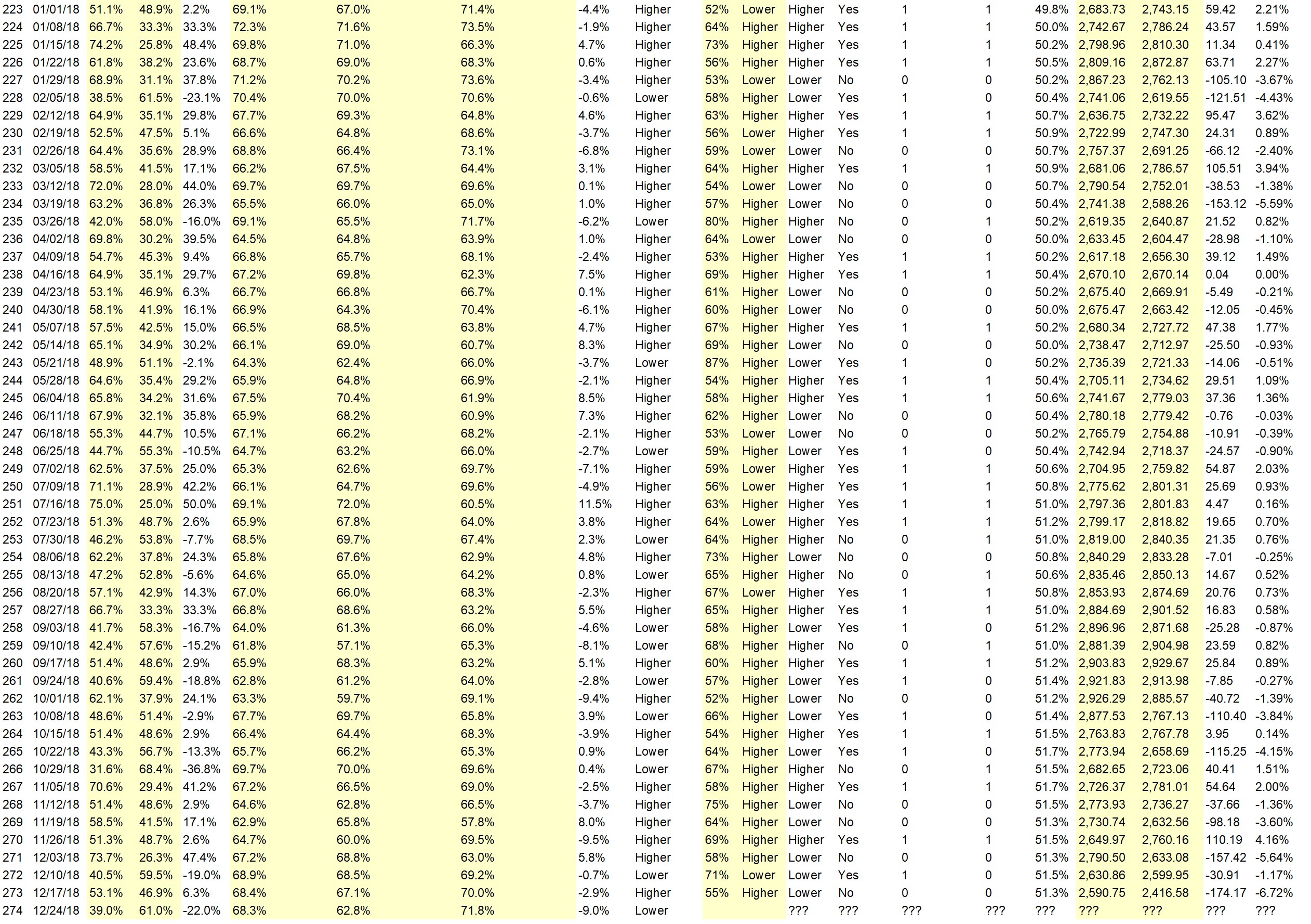

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.6%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Post holiday euphoria, maybe.

• Earnings

• INDICATORS

• January effect

• up trend

• Todays performance.

• Going with continuation of the recent uptrend. Some resistance at 2730; strong resistance at 2800-10.

• Economic outlook.

“Lower” Respondent Answers:

• Political behaviors from the executive and legislative branches are becoming detrimental to the economy and the trust of investors. The working class is going through lots of stress with lower income and cos of living increasingly expanding to areas previously stable; instead of one job nowadays 1 FT and 1 PT. Medical and other work benefits increasingly more expensive and often no longer available with their jobs.- America slowing become a third world economy!!!

• Market has been straight up for several days and the earnings reports were not impressive.

• A Stansberry Research email suggests a pullback, possibly a retest of the Dec. 24th lows before the uptrend continues. Market Trend Signal gave a general market “sell” signal on Dec. 21st. This is only the 5th “sell” signal in the last 20 years! The prior “buy” signal was on June 8th, 2016!

• due for a correction

• Markets need a bit of rest from the dramatic rally from the December lows.

• exhaustion of momentum

• Resistance levels will hold and downside action will follow.

• Al Brooks analysis. Its over for the S&P

• It has been up non stop with two very tiny Pullbacks but market needs to have some selling to remain sane n to entice buyers

• Too many up days

• RSI hour and Hour 4 Are up high with room to drift lower.

• Too much uncertainty. This recent upmove is climactic and therefore unsustainable.

ADVERTISEMENT

Many former TimingResearch show guests and other trading experts will be speaking at the biggest and best online-only Wealth365 Summit taking place January 21-26th. Speakers have agreed to make sure to focus on actionable content and real wealth education during the presentations to make sure your time is well spent with us. This is the biggest online-only wealth show in the world so don’t miss out. It’s where you need to be to kick of 2019 right!

Click HERE to learn more and register!

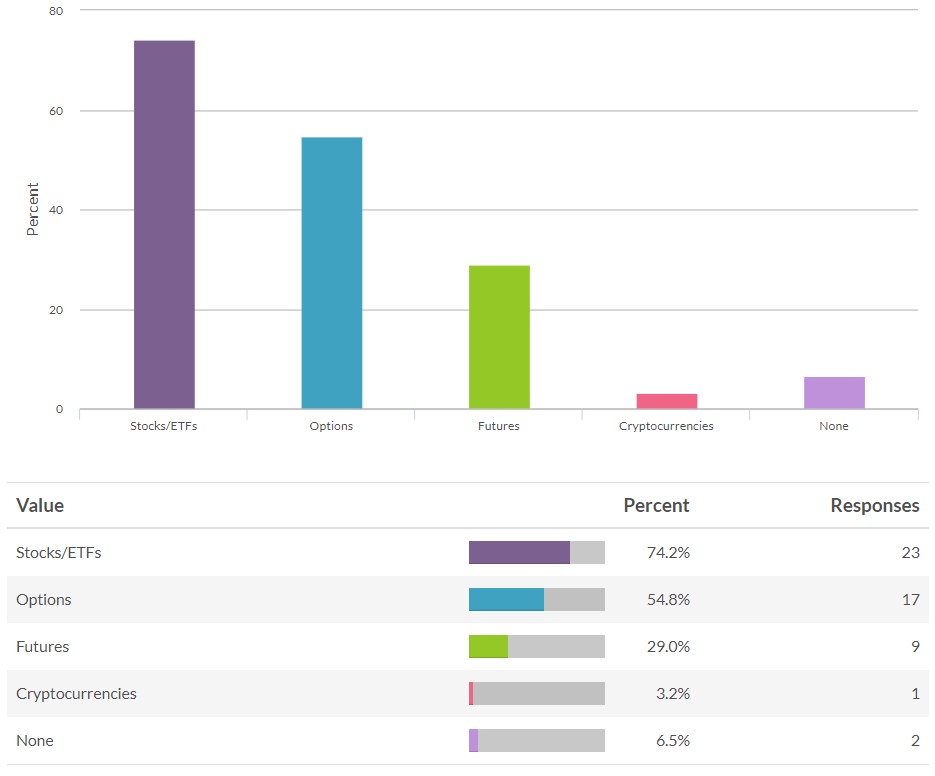

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on January 28th.)

• The value if multilateral free trade.

• When you sell put or call options how many days to expiration one should place the orders in general (no earnings play)?

• How effective is Elliot Wave Theory?

• Market timing and finding long term trends on all Time Frames

• Why and How Short term traders and investors are made to lose almost always. 2. How to trade or invest with majority of transactions by algos.

• How safe is to invest in foreign markets that are more aggressive than ours? How to limit the impact of taxation; federal and state levels? Could we have or have access to a good investment template/ strategies to have whether new or savvy investor.

Question #5. Additional Comments/Questions/Suggestions?

• I like the experts showing the chart during the discussion, for it’s much easier to understand the point of view. Thank you very much.

• Big question is Can small short term traders and investors stay and continue fight with computer trading? I think most small investors and traders will not be able to win against the 70% of trades done by comupters

• What would America be in the next 10 years ? How do we change our priorities in regard to educating our children instead of expending our money keeping people in prison? ( FYI: USA spend on average child education $9,000/yr while keeping 1 person in prison $58,000/yr- Is this a smart way to invest in our future as a nation?

Join us for this week’s shows:

Crowd Forecast News Episode #211

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 28th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com

– John Thomas of MadHedgeFundTrader.com

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #62

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 29th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– TBA

ADVERTISEMENT

Many former TimingResearch show guests and other trading experts will be speaking at the biggest and best online-only Wealth365 Summit taking place January 21-26th. Speakers have agreed to make sure to focus on actionable content and real wealth education during the presentations to make sure your time is well spent with us. This is the biggest online-only wealth show in the world so don’t miss out. It’s where you need to be to kick of 2019 right!