- Home

- Archive: August, 2018

Analyze Your Trade Episode #47

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Jim Kenney of OptionProfessor.com

– Michael Filighera of LogicalSignals.com (moderator)

– Christian Fromhertz of TribecaTradeGroup.com

Episode Timeline:

0:00 – Introductions.

3:30 – MU

10:40 – T

15:50 – IBM

23:10 – JD

28:30 – NVDA

39:10 – IWM (and new highs discussion)

55:30 – PGTI

1:00:40 – Closing statements.

Guest Special Offers:

From Christian: Ger your first month of Elite Trader Package for $7.99

From Jim: You can get comprehensive Option education here.

Other Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT0828118

Crowd Forecast News Episode #194

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the stocks submitted by people who registered to view this episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

– Damon Pavlatos of FuturePathTrading.com

– Dave Landry of DaveLandry.com

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

7:10 – Questions #1, #2, and #3; Higher or Lower? Confidence? Why?

39:50 – Question #4; Which trading platform or broker do you like the best for executing your

trades?

46:50 – Trade ideas of the week and closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Dave: $100 Reusable Promo Code-Good For All Products At DaveLandry.com

From Mike: Follow @OptionsMike on Twitter. And Get News Trade Alerts Daily!

From Damon: Email [email protected] for a link to Damon’s next webinar

From Jim: Get the most recent episode of his new video series

From Neil: Reliable Indicators That Actually Work

Other Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN082718

Crowd Forecast News Report #257

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport082618.pdf

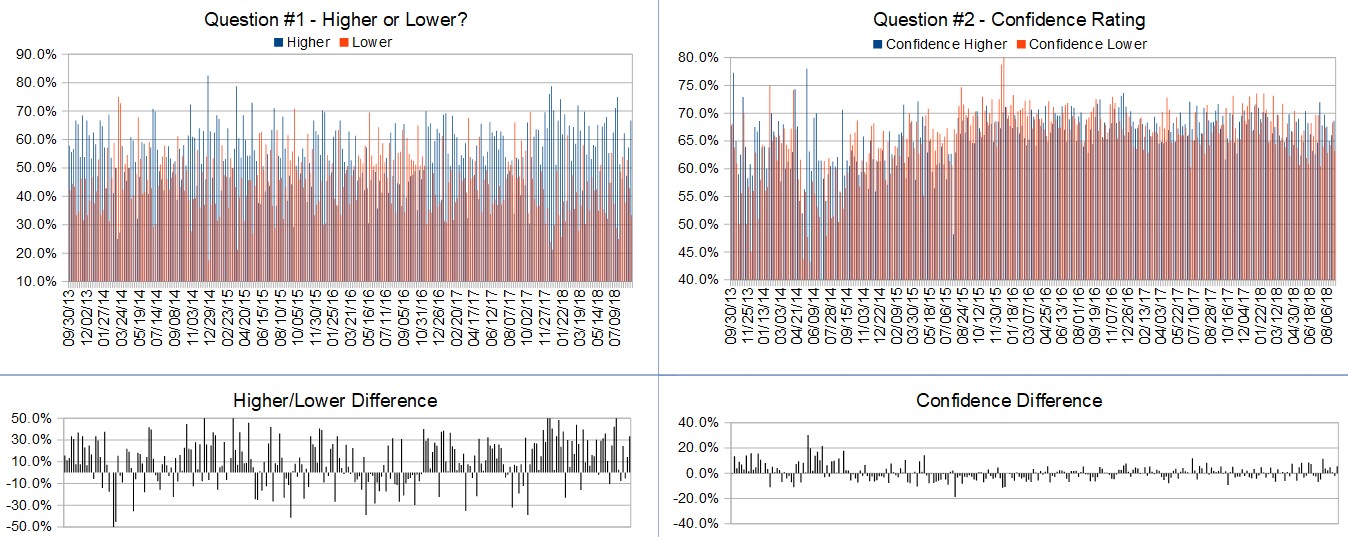

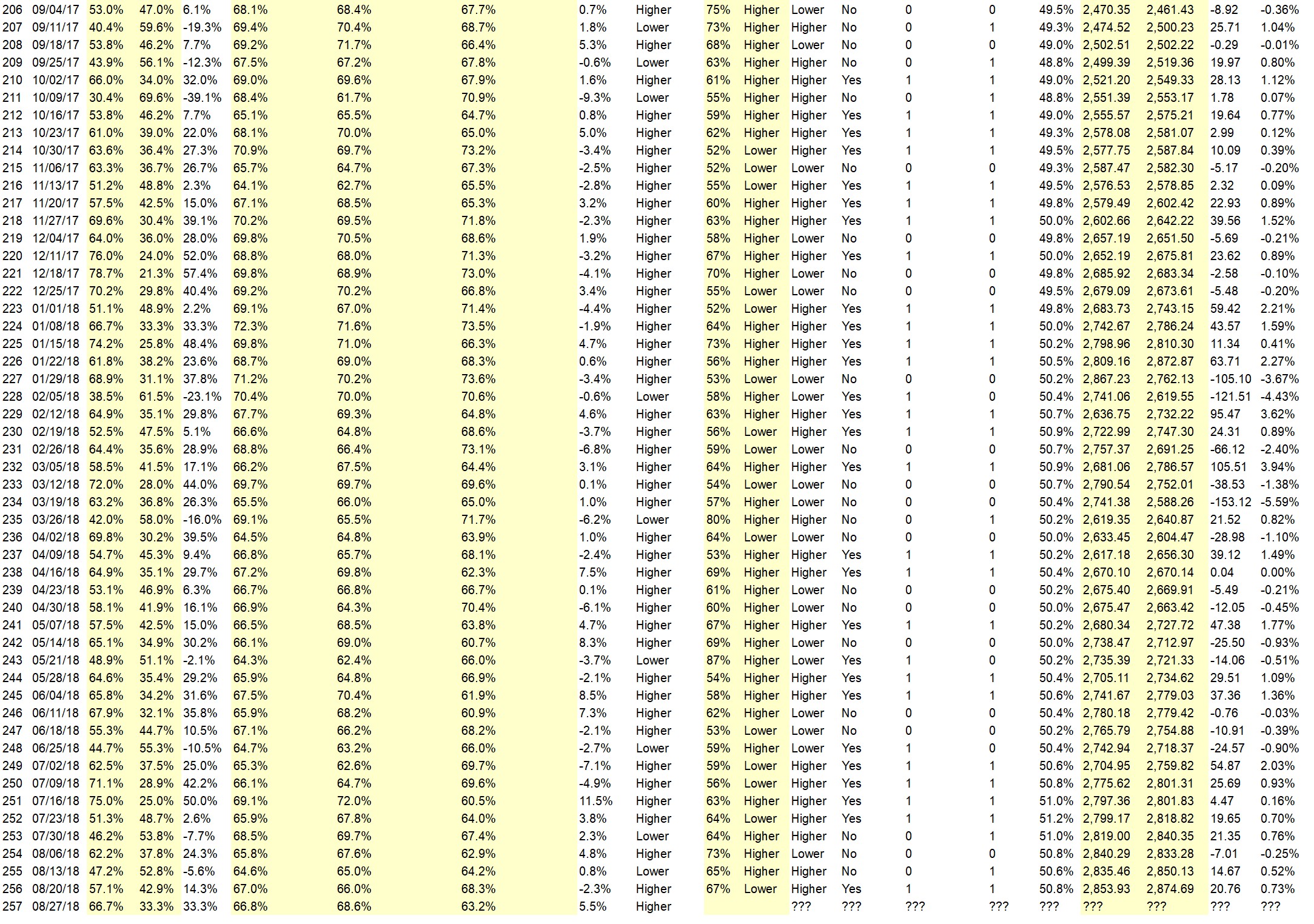

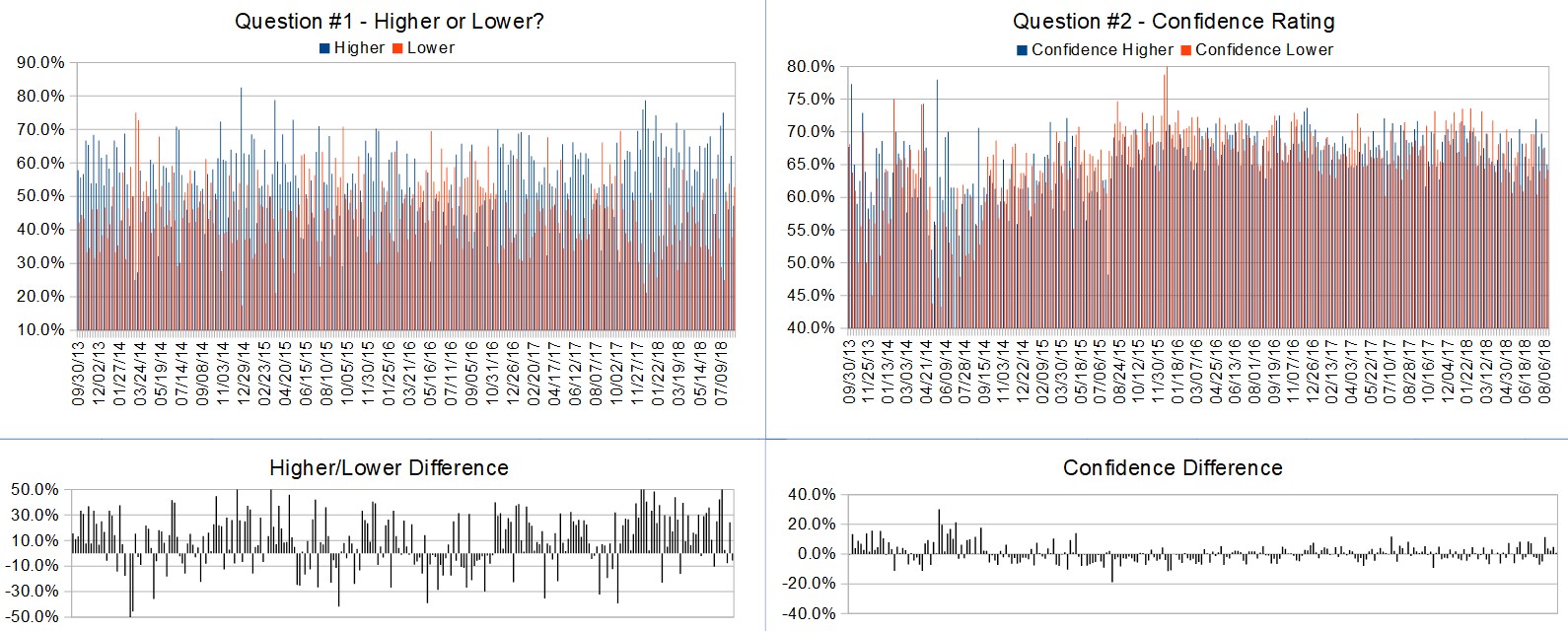

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 27th to August 31st)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 66.7%

Lower: 33.3%

Higher/Lower Difference: 33.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.8%

Average For “Higher” Responses: 68.6%

Average For “Lower” Responses: 63.2%

Higher/Lower Difference: 5.5%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 48.7

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 57.1% Higher, and the Crowd Forecast Indicator prediction was 67% Chance Lower; the S&P500 closed 0.73% Higher for the week. This week’s majority sentiment from the survey is 66.7% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 20 times in the previous 256 weeks, with the majority sentiment being correct 65% of the time, with an average S&P500 move of 0.28% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

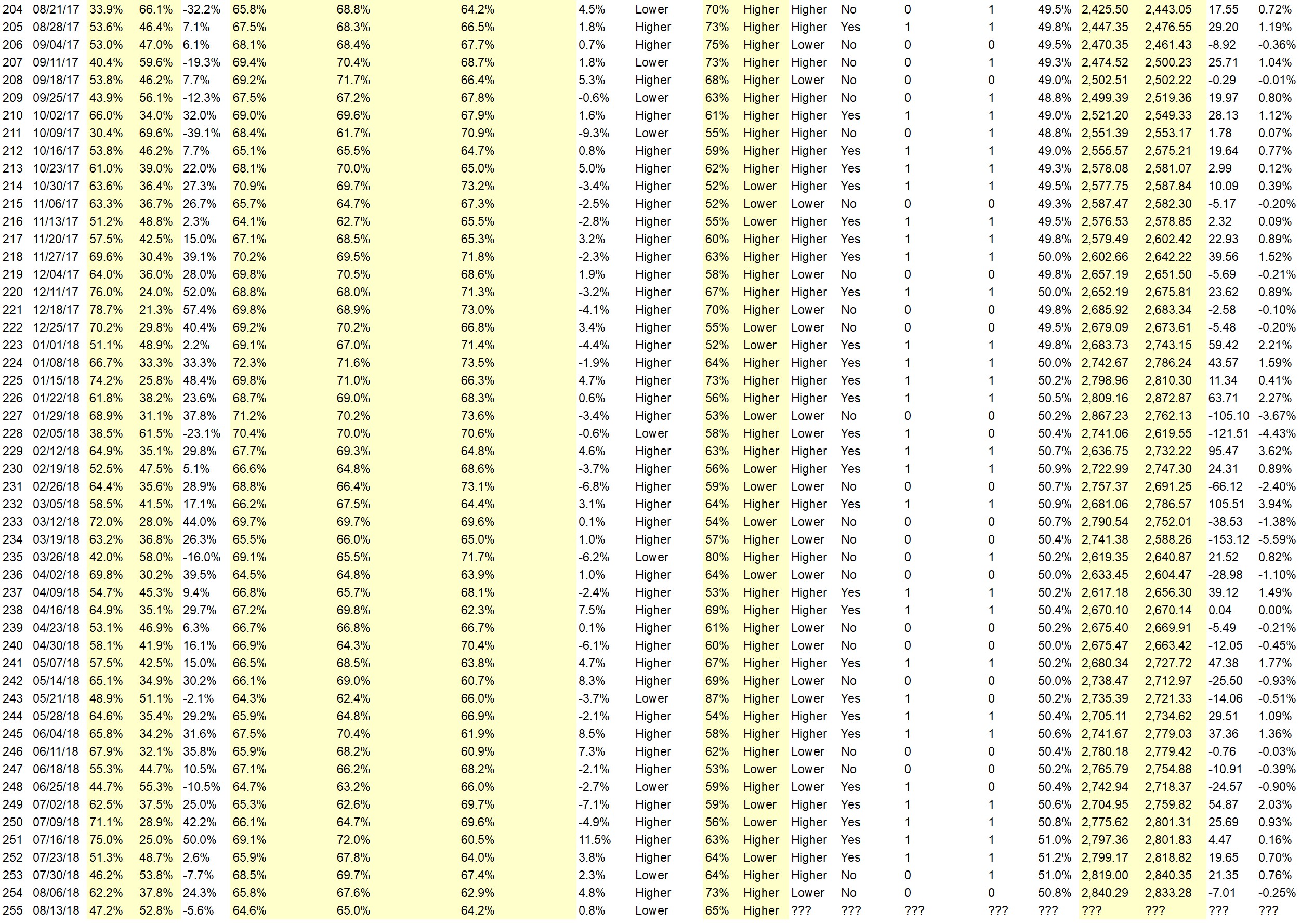

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 66.8%

Overall Sentiment 52-Week “Correct” Percentage: 68.6%

Overall Sentiment 12-Week “Correct” Percentage: 63.2%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Donald Trump ideas maybe help

• going with the trend

• In this final week of AUG, institutions will be re-balancing & window dressing their portfolios & SPX will grind higher to confirm the breakout & anticipate 1st week of Sept trading and 7 Sept NFP. With so many predicting a down Aug & an annual correction in Sept/Oct, the market is bound to go up instead. Seasonal predictions have turned out to be crap & if they happen, they are very temporary. I like all the talk about recession and fear. That is very bullish. USA will win the trade war!

• Weed stocks will continue to push it up

• Risky not to buy

• All the industry indexes are positives :-)

• Momentum and seasonality.

• dovish fed talk

• trending

• Last week, dips were being bought, especially on Friday. Looks like the up move will continue.

• The market (SPX) has broken out of the ATH resistance. Now the path of least resistance is higher into 2900 area.

• This week

• Its toppy folks!

“Lower” Respondent Answers:

• Not good at working out where market goes

• Trade debate, political uncertainty, vacations

• I think that the global situation with chinese tariffs and Iran and Turkey are all coming to a head.

• A topping formation is almost forming a slide down is due any day, likely Tue or even Monday.

• SEP..

• Back to school positive action. Retail traders can only help the continued momentum. Previous gold bottom ended up being a basement to a sub basement. The yellow metal may once again start its wall of worry rise even though Powell and crew say inflation is tame.

Question #4. Which trading platform or broker do you like the best for executing your trades?

• fidelity

• Stocks to trade platform Etrade for a broker

• TOS but it’s not the bat you use, it’s the person using the bat. It’s not the cost of the commissions, it’s the positions and money management for your trades that should be the focus. JPM may start commission free trades but how many errors are you going to make learning a new platform?

• TD

• Yours

• Profit able one if possible

• Interactive Brokers

• TOS

• Trade Station

• TD

• TD

• E*Trade

• There are lot of good trading platforms such as StreetSmart Edge (Schwab), Trade Station, Think or Swim, etc. It is up to a trader to chose his trading platform.

• tastyworks

• IG Index ans Saxo bank

• Ninjatrader Firetip of Ironbeam

• none they all have weaknesses that marginalize strengths

• Tastyworks.

Question #5. Additional Comments/Questions/Suggestions?

• A candidate can legally contribute unlimited amounts of his own money for his own election campaign even to obtain NDA’s. Trumps payments to the kiss and tellers are totally legal. If the DEM’s take the House, impeachment will not be brought and if brought will fail in the House and if passed will fail in the Senate. The DEM’s are afraid that Trump is too successful. Tariffs are tough to endure but his actions are the right ones. Shame on all his predecessors who were too cowardly to do it.

• Oil surprisingly keeping a lid even though ability to withstand supply disruption is tight.

• I like your great survey and I request you to expand to more real traders to get their views.

Join us for this week’s shows:

Crowd Forecast News Episode #194

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 27th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

– Damon Pavlatos of FuturePathTrading.com

Analyze Your Trade Episode #47

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 28th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com (moderator)

– Christian Fromhertz of TribecaTradeGroup.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Analyze Your Trade Episode #46

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Jim Kenney of OptionProfessor.com

Episode Timeline:

0:00 – Introductions.

2:20 – INTC

5:40 – AMZN

8:50 – AMD

11:50 – XOM

15:00 – NFLX

17:50 – MRO

20:30 – FB

24:20 – AAPL

27:10 – MU

30:40 – CGC

34:40 – CSX

38:00 – JPM

43:30 – WCHN

46:10 – PPA

49:20 – PLAY

52:20 – Closing statements.

Guest Special Offers:

From Jim: You can get comprehensive Option education here.

Other Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT0821118

Crowd Forecast News Episode #193

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the stocks submitted by people who registered to view this episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Norman Hallett of TheDisciplinedTrader.com (first time guest!)

– Lee Harris of EmojiTrading.com (first time guest!)

– Damon Pavlatos of FuturePathTrading.com (first time guest!)

– Dave Landry of DaveLandry.com (moderator)

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

11:10 – Questions #1, #2, and #3; Higher or Lower? Confidence? Why?

36:00 – Question #4;

53:40 – Trade ideas of the week.

1:00:30 – Closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Lee: Watch the EmojiTrading videos

From Norman: The Disciplined Trader Mastery Program (Free Trial)

From Damon: Email [email protected] for a link to Damon’s next webinar

From Dave: $100 Reusable Promo Code-Good For All Products At DaveLandry.com

Other Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN082018

Crowd Forecast News Report #256

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081918.pdf

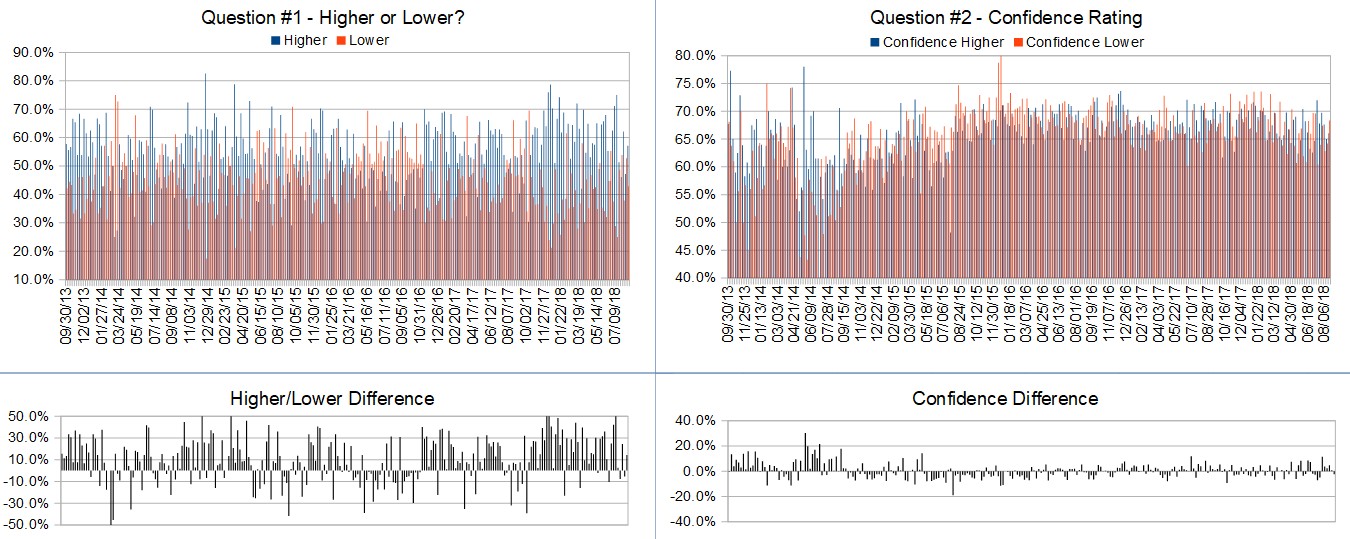

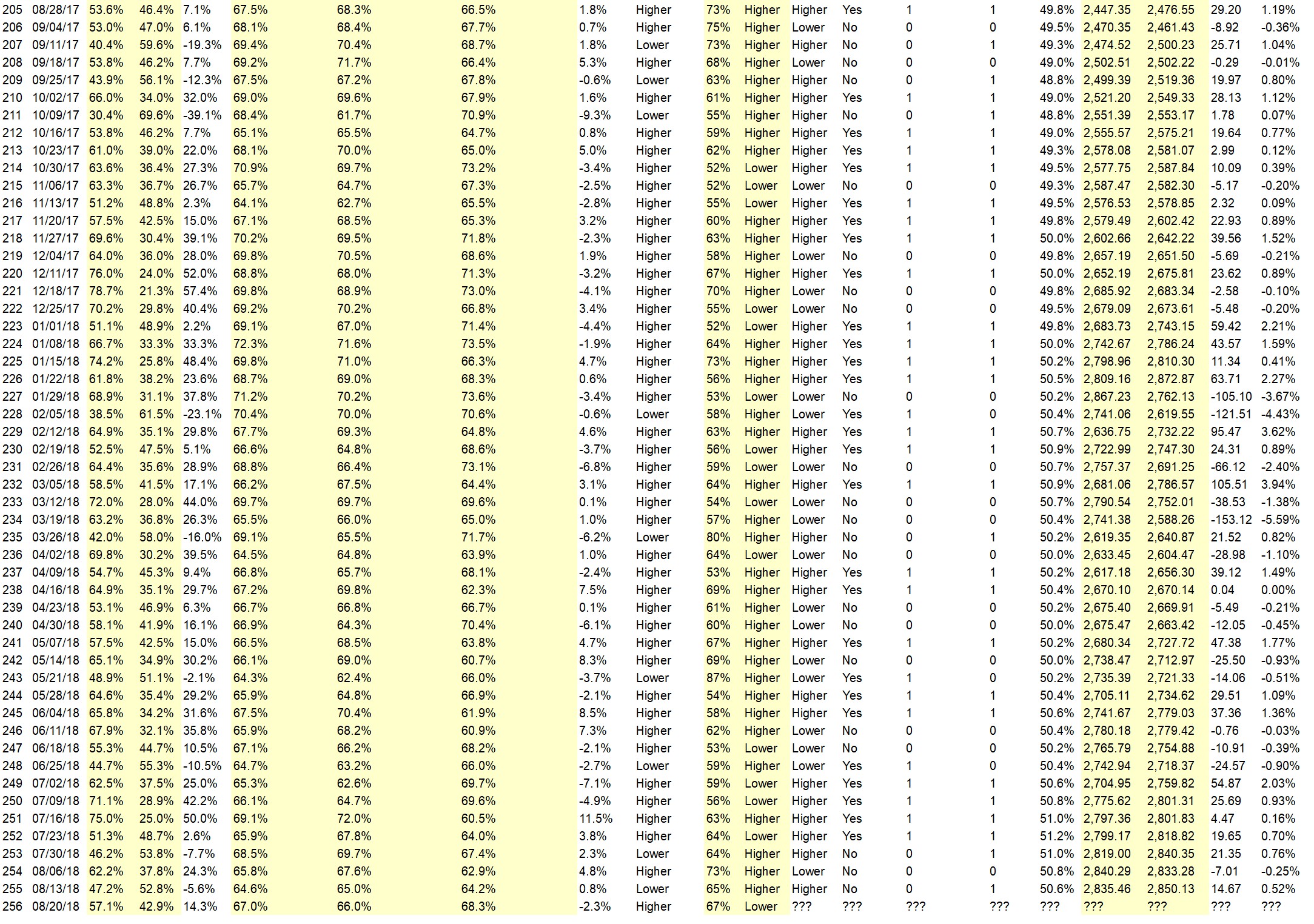

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 20th to August 24th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.1%

Lower: 42.9%

Higher/Lower Difference: 14.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.0%

Average For “Higher” Responses: 66.0%

Average For “Lower” Responses: 68.3%

Higher/Lower Difference: -2.3%

Responses Submitted This Week: 44

52-Week Average Number of Responses: 49.1

TimingResearch Crowd Forecast Prediction: 67% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 52.8% Lower, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 0.52% Higher for the week. This week’s majority sentiment from the survey is 57.1% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 9 times in the previous 255 weeks, with the majority sentiment being correct 33% of the time, with an average S&P500 move of 0.63% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• momentum still there

• put call ratio

• trade talks usa and china

• Traders Commitment

• positive news on trade sparks test of new high.

• Momentum Economic growth Trade parity with China

• Contrarian view

• The declines have been lessening.

• still buying

• Tarriff will be negated

• I think it will be another slow week for stocks.

• We are not seeing lack of demand at highs over the past few weeks.

• bargain before September

• Pivotal week? Lower by weekend?

• I can’t help wondering if it’s manipulated. After all, banks buy stocks don’t they.

“Lower” Respondent Answers:

• Resistance should be looked at as a possibility as more selling pressure than buying could happen maybe

• I have bad record and lost money. This makes me last person should say where market is going.

• Tariffs

• topping out in Wave 2

• slowing momentum and global uncertainty

• yes

• still within the “Sell in May and go away” period

• Elliott wave 4

• The downside correction in most major stocks continues. The FANG stocks are showing major technical problems.

• The S&P is near an all-time high. ButTech stocks are weak; retail stocks have been strong, but have no reason to move higher.

• No upside left

• dead cat bounce this week

• seasonal drop

• Trade talks will not produce results

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• don’t get too greedy

• Profit

• Total zero. Don’t think.. Just price is king

• Patience

• confidence in what they are doing and listen to no one else when you have your plan that works

• learn how to loose

• patience, discipline and managing risk

• yes

• patience

• Patience & Consistency

• patience

• Fearlessness, apathy, resiliency

• Let go of loses Do not let loses control your emotions Don’t try to get even with a stock you just a lot money trading

• Flexability.

• Discipline is key—-stick to the plan that your system dictates.

• Don’t get emotionally attached to a stock or sector.

• Read Traders Kryptonite for answers

• Watch the earnings

• calm focus

• Discipline of sticking to a trading plan, avoiding overtrading and taking losses at predetermined levels or in response to a change in sentiment.

• patient

• education, not psyche, is what makes a trader

• Patience and clear thinking. Decisiveness.

• Set buy and sells and stick with them

• Gotta keep your sense of humour. Don’t trade if you’ve just had an argument with your mom — even if you think you’ve put it out of your mind.

Question #5. Additional Comments/Questions/Suggestions?

• buy American

Join us for this week’s shows:

Crowd Forecast News Episode #193

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 20th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Norman Hallett of TheDisciplinedTrader.com (first time guest!)

– Lee Harris of EmojiTrading.com (first time guest!)

– Damon Pavlatos of FuturePathTrading.com (first time guest!)

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #46

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 21st, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Jim Kenney of OptionProfessor.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Analyze Your Trade Episode #45

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

– Anka Metcalf of TradeOutLoud.com

– Christian Fromhertz of TribecaTradeGroup.com

Episode Timeline:

0:00 – Introductions.

6:40 – DPW (and additional cryptocurrency discussion)

14:10 – T

17:50 – WYNN

26:20 – GDX

32:20 – IWM

40:30 – WTW

44:30 – JD

52:00 – NVDA

56:30 – SQ

1:00:10 – Individual trade ideas.

1:07:40 – Closing statements.

Guest Special Offers:

From Anka: Subscribe to Anka’s weekly videos on YouTube

From Christian: Ger your first month of Elite Trader Package for $7.99

From Matt: Get The Market SITREP (Situation Report) In Your Inbox Every Trading Day

Other Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT0814118

Crowd Forecast News Episode #192

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the stocks submitted by people who registered to view this episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Dave Landry of DaveLandry.com (moderator)

– Jim Kenney of OptionProfessor.com

– Lance Ippolito of AlphaShark.com & TradingCoachLance.com

– Neil Batho of TraderReview.net

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

7:40 – Questions #1 & #2; Higher or Lower? Confidence?

10:40 – Question #3; Why?

18:20 – Question #4; One system or multiple?

27:50 – Trade ideas of the week.

35:40 – DY options trade discussion and closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Dave: $100 Reusable Promo Code-Good For All Products At DaveLandry.com

From Jim: You can get comprehensive Option education here.

From Lance: Follow on Twitter @LanceIppolito

Other Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN081318

Crowd Forecast News Report #255

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081218.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 13th to August 17th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 47.2%

Lower: 52.8%

Higher/Lower Difference: -5.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.6%

Average For “Higher” Responses: 65.0%

Average For “Lower” Responses: 64.2%

Higher/Lower Difference: 0.8%

Responses Submitted This Week: 39

52-Week Average Number of Responses: 49.4

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 62.2% Higher, and the Crowd Forecast Indicator prediction was 73% Chance Higher; the S&P500 closed 0.25% Lower for the week. This week’s majority sentiment from the survey is 52.8% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 34 times in the previous 254 weeks, with the majority sentiment being correct 65% of the time, with an average S&P500 move of 0.17% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.8%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I’m not good on market direction.

• There is a law ? rule ? that the direction the market is in , it is MOST LIKELY to stay in that direction.

• I think stocks will remain close to unchanged as it was this week. About 0.34% higher. Too many geopolitical events in the world to rock the market. And August is usually a very slow month for stocks. I look for better things in September and October.

• The past couple days S&P took a slight pullback so Next week will rally up

• Economic job indicators are ok still maybe alittle or not really bad now

• The S&P500 & other major indices are holding their support & 10/20d ema levels during pullbacks. This, along with strong earnings continuing to be reported, lead me to look for continued strength in the markets.

• S&P 500 Looks like a test of all time high is coming.

• Uptrend has been too powerful to end so quickly. This recent pullback is just a pullback in an uptrend.

• Trend is your friend oil on the way up. Gold Joins in.

“Lower” Respondent Answers:

• Market peaked out

• Volatility, foreign markets

• fridays selloff

• Elliott Wave 4

• late summer doldrums

• Tariffs

• falling momentum

• Turkish Lira issues impacting European banks Increasing trade tensions

• Earnings calls are over. Interest rates are rising. Yield curve is inverting. Trade and shooting wars are in the air. Hardly a time to invest.

• more than likely world events will push mkt down…

• The downside correction will continue. The institutional favorites and looking to top out. Retail stocks should show weakness this week.

• Reality returning to the overvalued tech sector.

• History of the market

• Price may be high by mid week but it should then sell and be down at close of the week

Question #4. Which do you think is best, trading one methodology or system all the time or trading multiple strategies that adapt to the markets? Why?

• Multiple strategies to mitigate the risk

• You need as some one that makes lots money. That is not me.

• trend following works for me

• the 2nd. That way you are always trading with the trend direction.

• multiple

• multiple strategies that best fit the current market conditions

• A stop loss

• Adapt to market or be swallowed up in losses.

• I think it’s best to trade one methodology that adapts to the markets. :-)

• Sentiment from headlines

• Multiple strategies. Attempting to trade against the prevailing trend is most often like holding back the tide.

• The latter. There should be a different strategy for an uptrend and a different strategy for a downtrend. Because one is not simply the mirror image of the other. Markets behave differently in uptrends than in downtrends. For example, V bottoms are common but we don’t see V tops very often. Instead we see rounded tops.

• Adapt to market. You have to trade what the market gives you.

• multiple strategies, because if the set up is not right for one, maybe it’ll be right for others…

• Multiple strategies. Markets CHANGE!

• I still believe in trading one methodology/system but one that does adapt to the markets gyrations.

• Option trading

• Subject to time frame and style of trading.

Question #5. Additional Comments/Questions/Suggestions?

• None

Join us for this week’s shows:

Crowd Forecast News Episode #192

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 13th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Dave Landry of DaveLandry.com (moderator)

– Jim Kenney of OptionProfessor.com

– Lance Ippolito of AlphaShark.com & TradingCoachLance.com

Analyze Your Trade Episode #45

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 14th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

– Anka Metcalf of TradeOutLoud.com

– Christian Fromhertz of TribecaTradeGroup.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Analyze Your Trade Episode #44

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Larry Gaines of PowerCycleTrading.com

Episode Timeline (click the times below to watch that segment on YouTube):

0:00 – Introductions.

4:00 – XOM

6:30 – TSLA

11:40 – AMD

14:00 – AVEO

18:10 – FB

24:40 – IBM

26:50 – Individual trade ideas for the week.

40:40 – CDE

46:00 – MOV

48:10 – MU

50:30 – GE

53:10 – SAGE

56:20 – Closing statements.

Guest Special Offers:

From Dean: “Beyond the Noise” FREE Weekly Newsletter

From Larry: 7 Step Directional Trading Profits Formula Interactive Webinar

Other Partner Offer:

While SHOP dropped less than 6% that day, Jeff was able to show his members how he made over 70%, or a whopping $41,400 from that move. He’s putting his money where his mouth is.

Click here to learn more.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT0807118