- Home

- Crowd Forecast News Reports

Crowd Forecast News Report #304

AD: Revealed: How To Identify Market Moves Up To 3 Days In Advance.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport072119.pdf

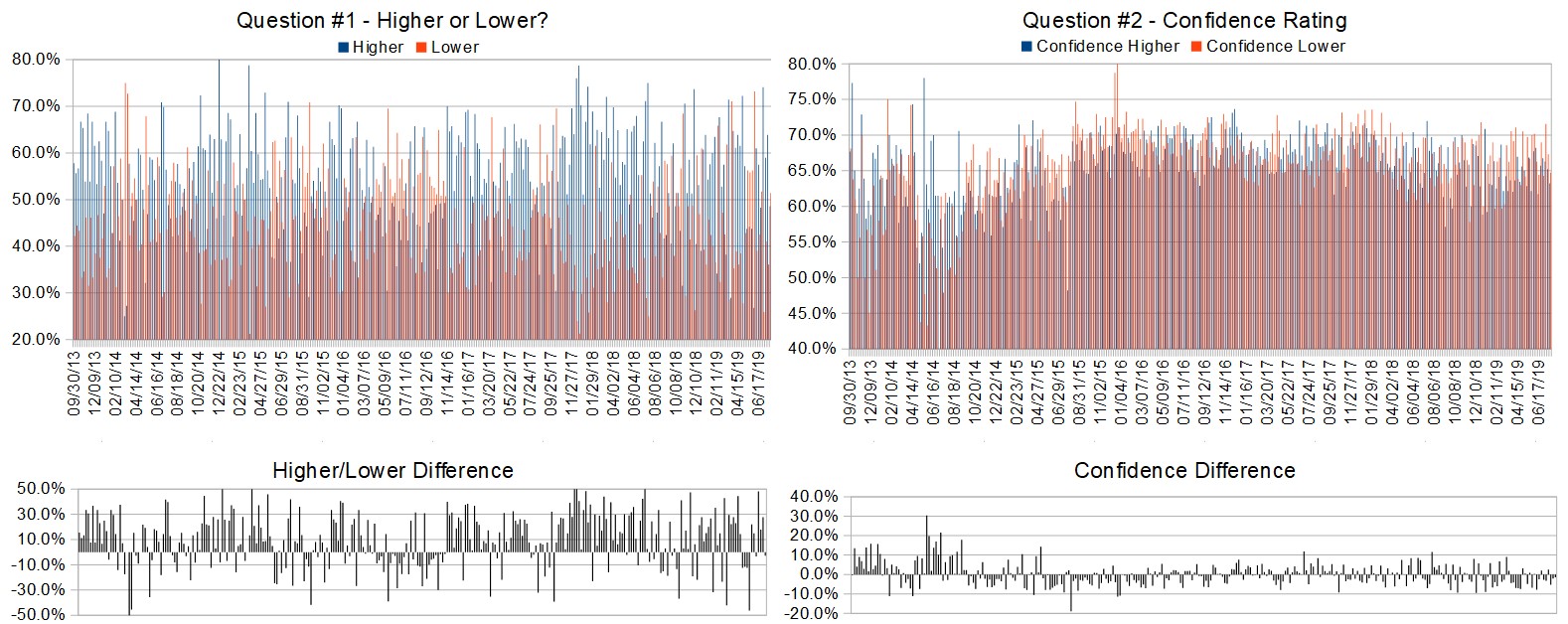

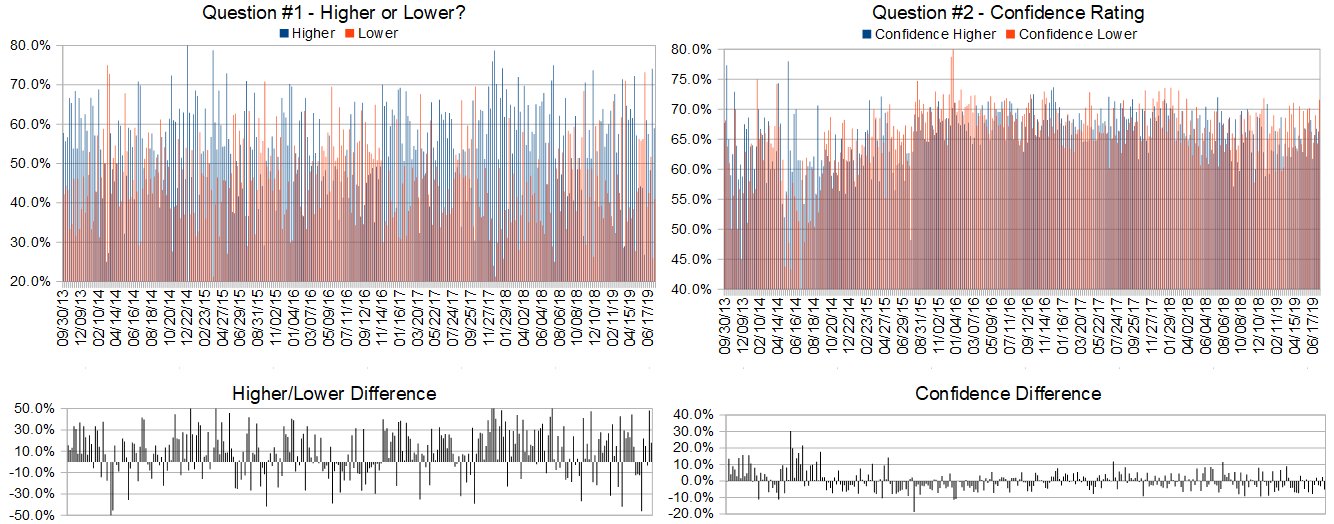

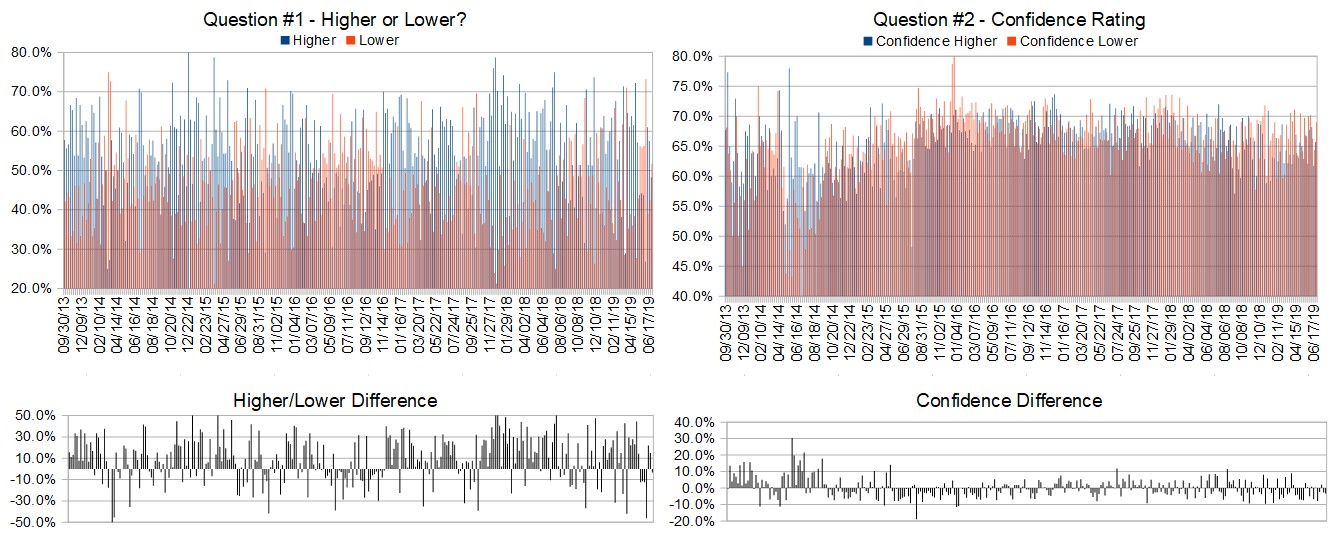

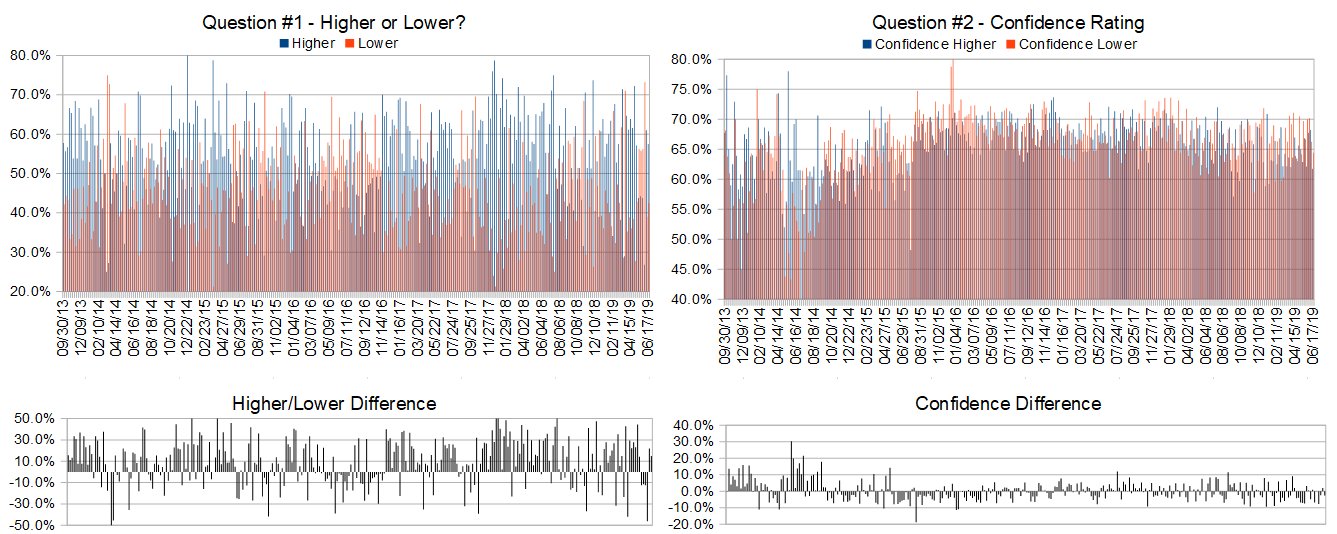

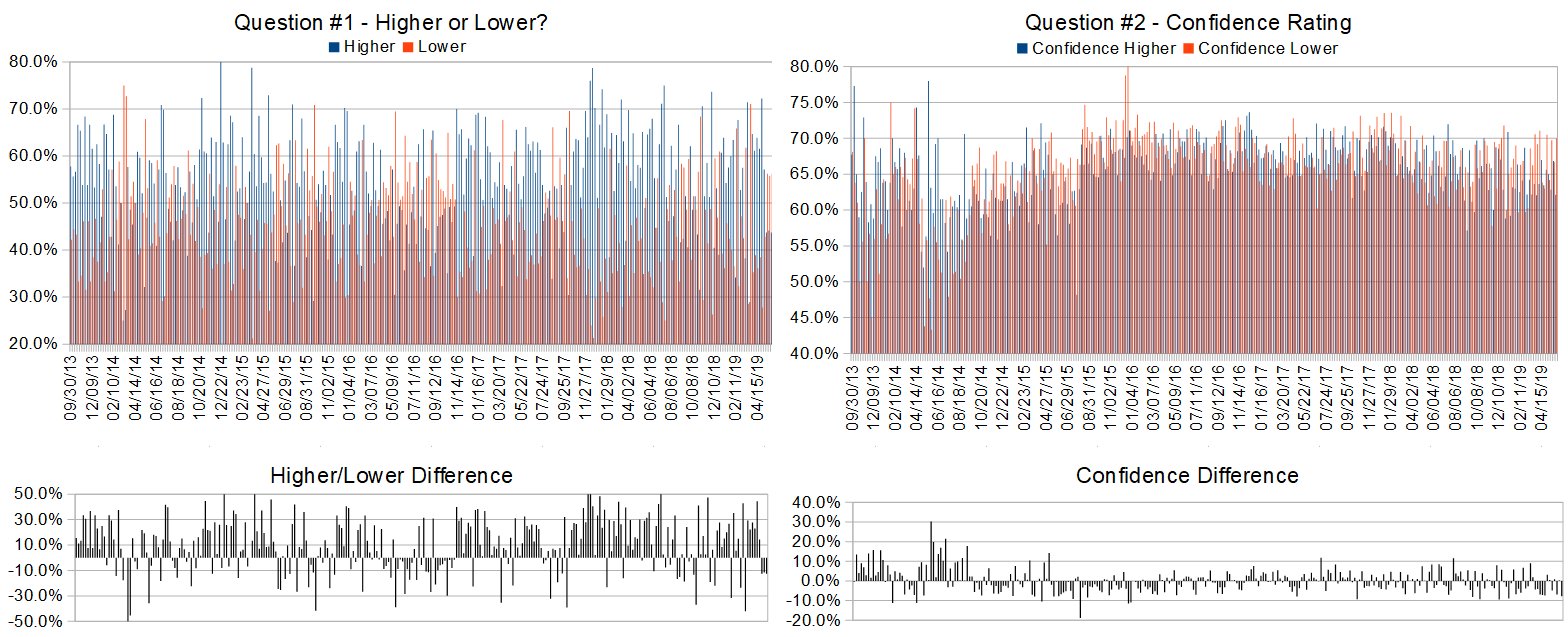

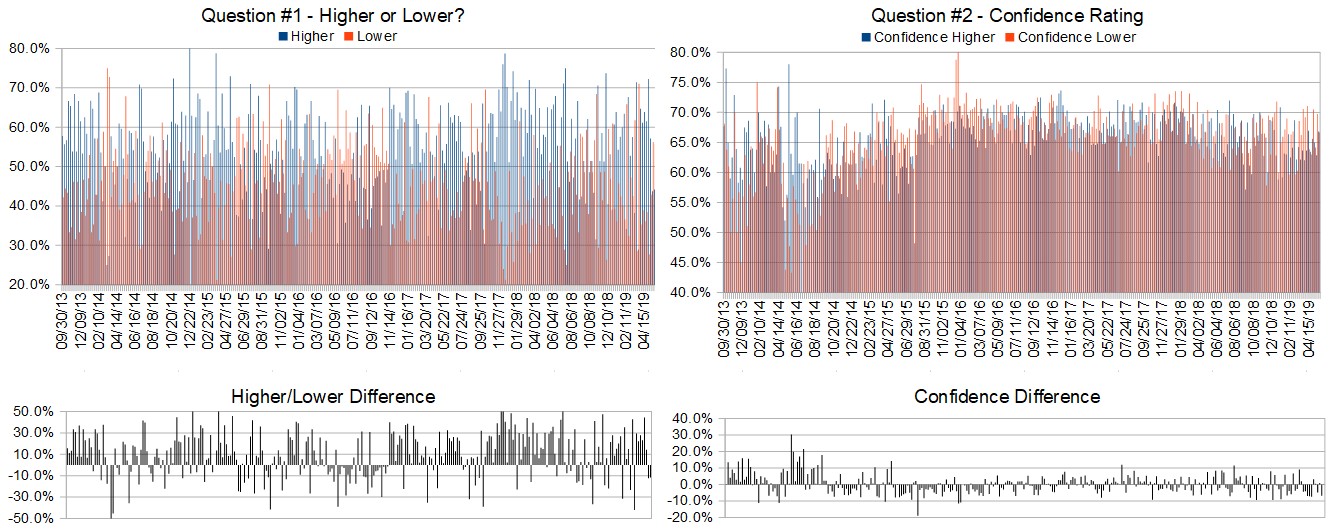

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 22nd to 26th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 48.6%

Lower: 51.4%

Higher/Lower Difference: -2.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.0%

Average For “Higher” Responses: 63.2%

Average For “Lower” Responses: 64.7%

Higher/Lower Difference: -1.5%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 37.3

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.9% Higher, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 1.36% Lower for the week. This week’s majority sentiment from the survey is 51.4% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 20 times in the previous 303 weeks, with the majority sentiment (Lower) being correct only 40% of the time and with an average S&P500 move of 0.07% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

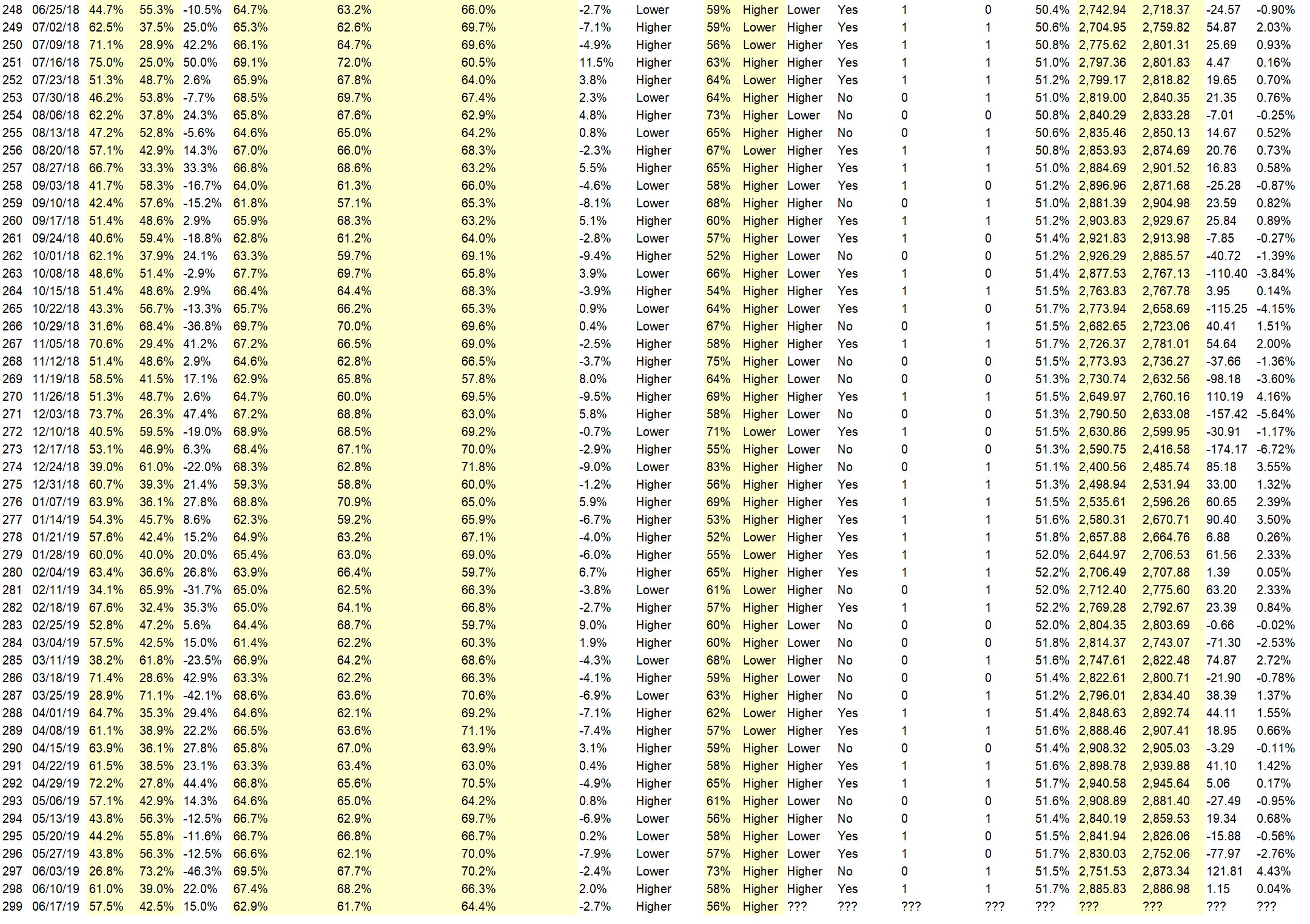

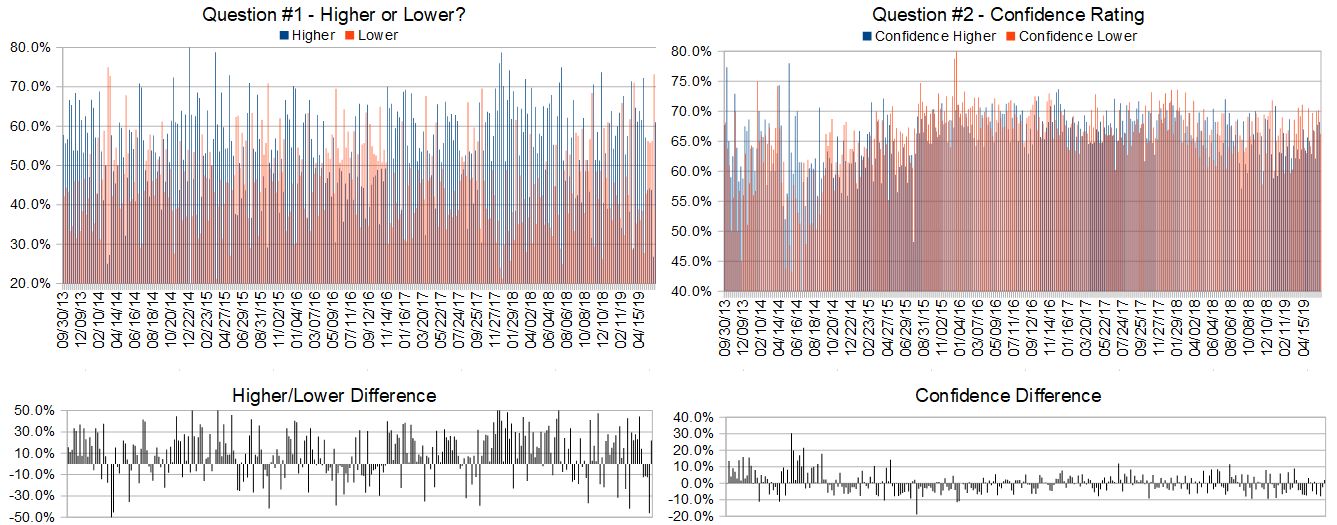

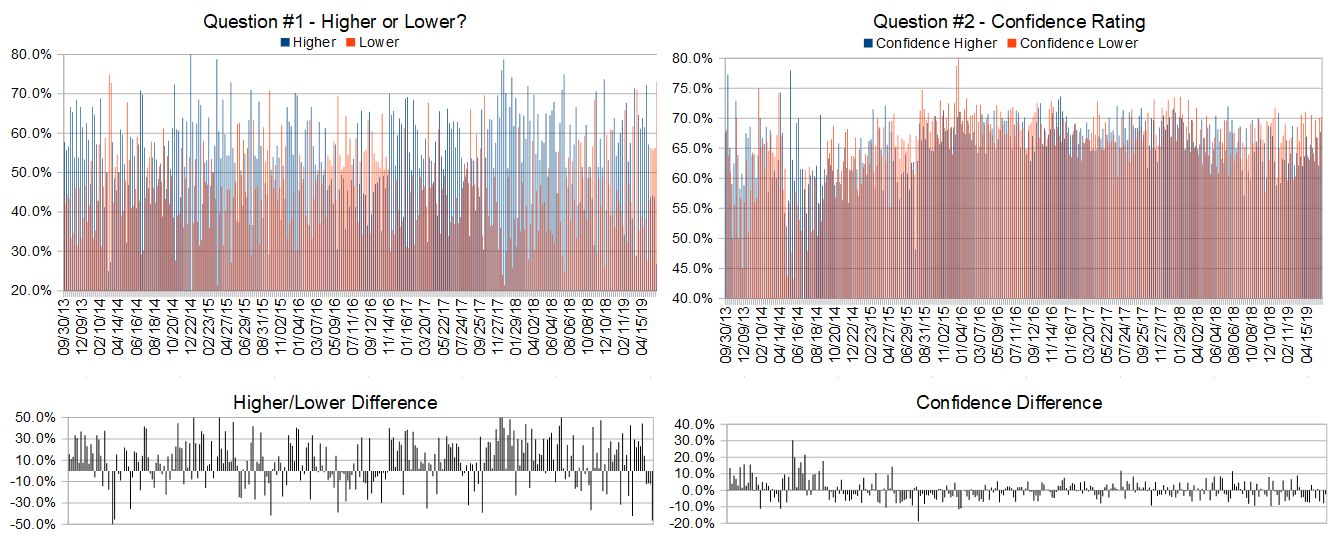

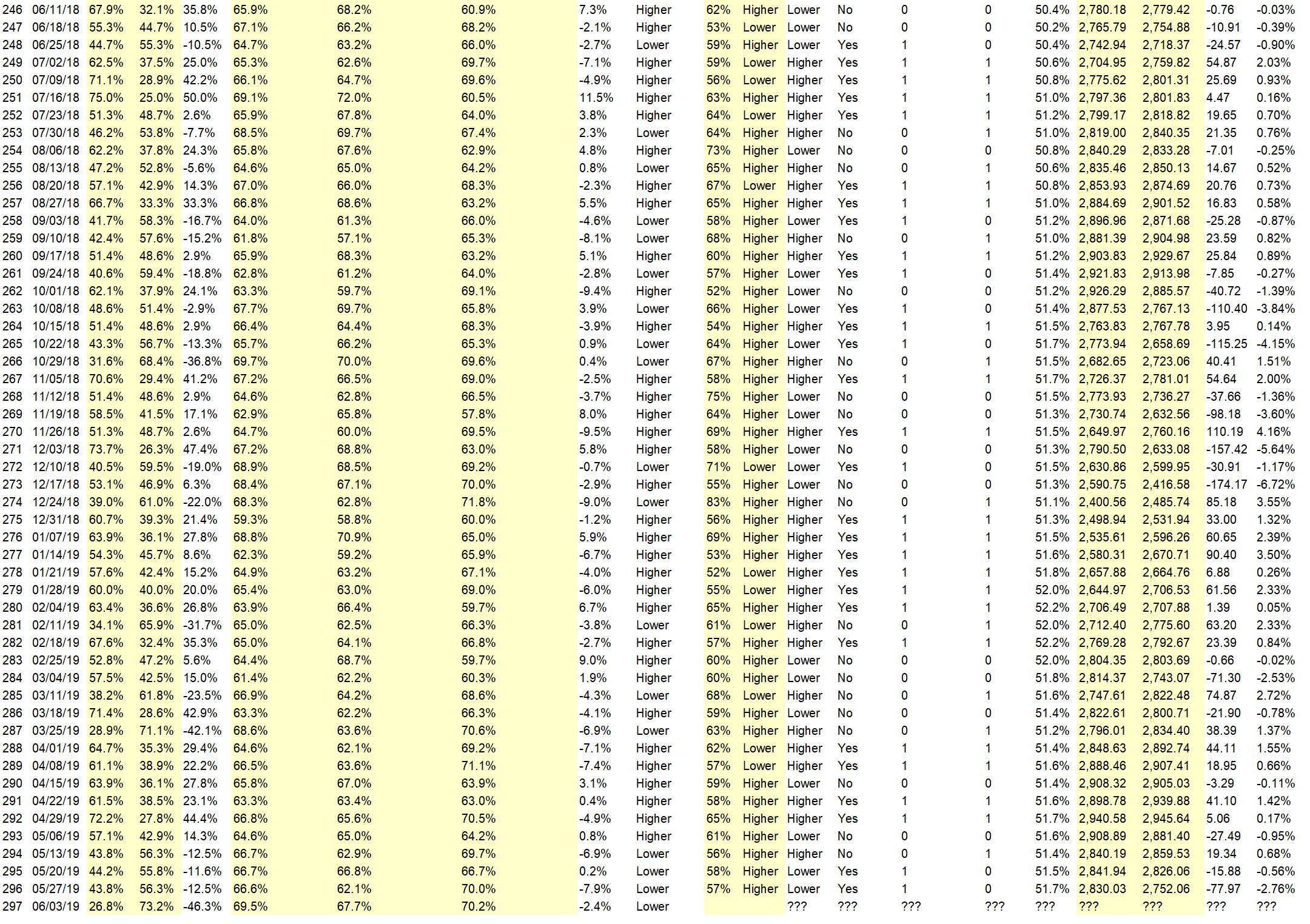

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: How to arbitrage value vs time.

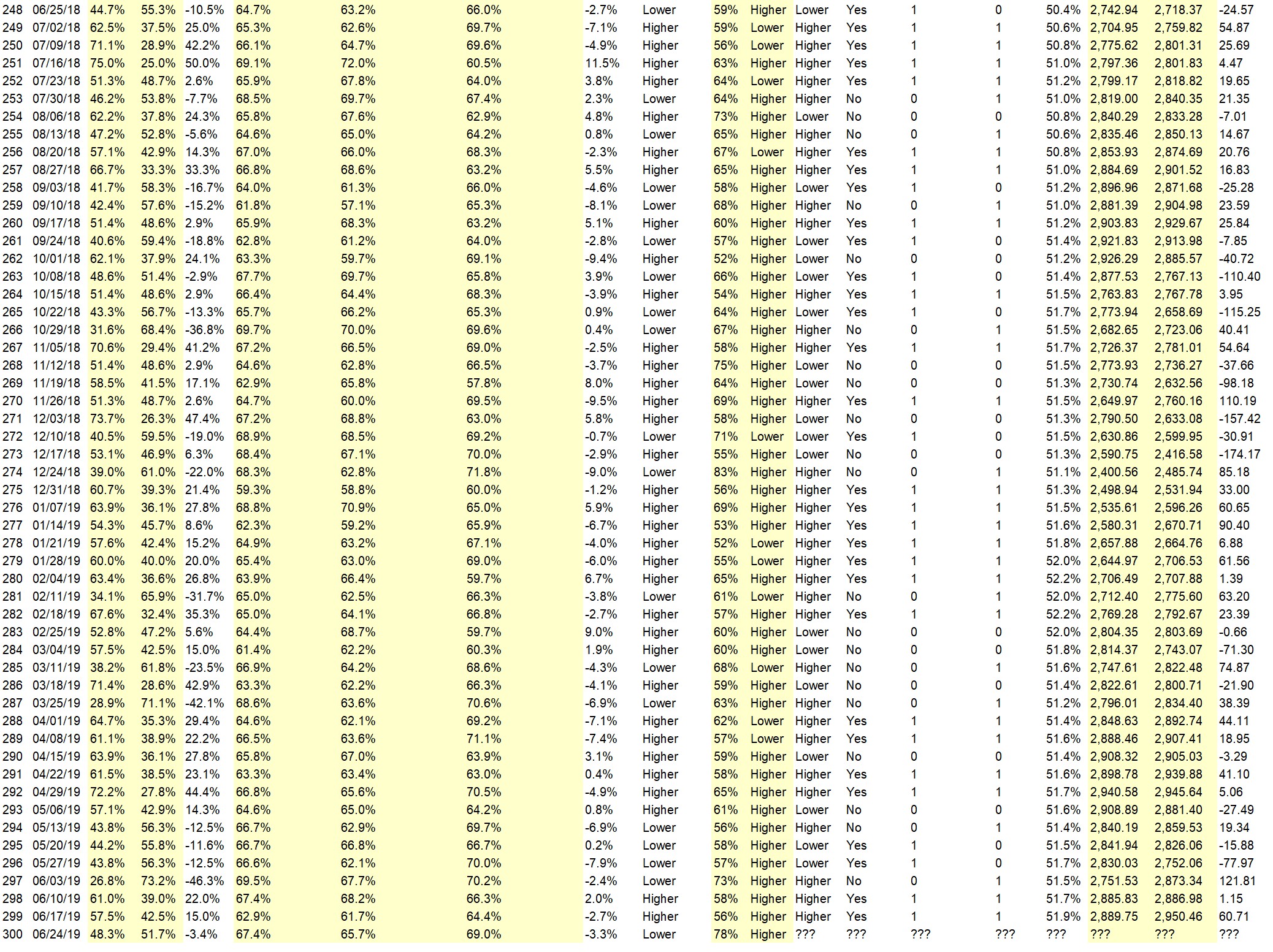

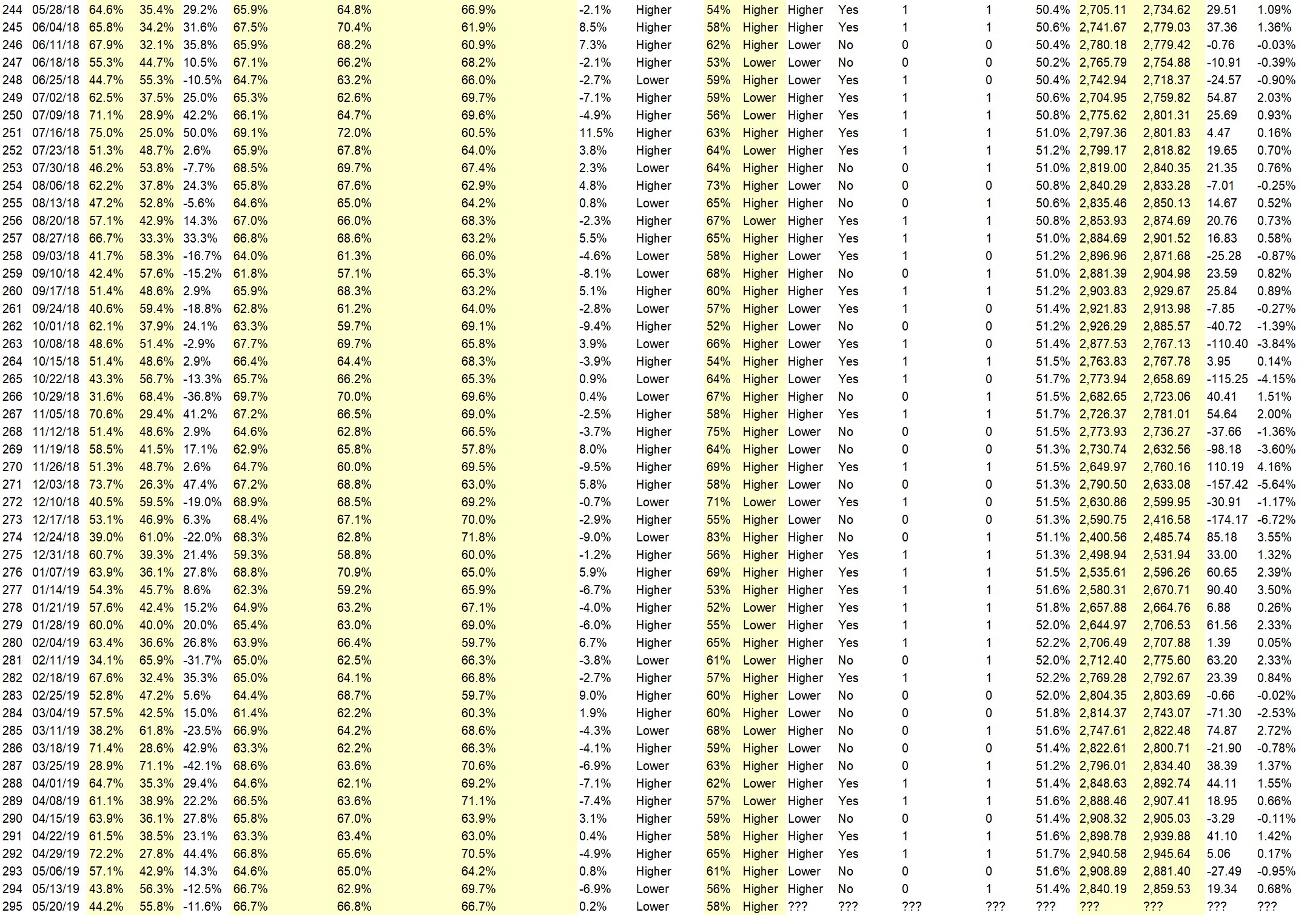

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.2%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• It is the end of the month which is positive for the market, but everything will hinge on the GDP number Friday and if the Fed will cut interest rates. If GDP is low, rates are cut and the market will go up, the opposite is true if GDP is strong.

• extreme low along still trending mkt

• earnings season

• Not sure. Suspect rangebound week.

• Buy the dip Traders/investors push S&P to new high

• Gut feeling

• history

• will go higher into the fed

• trend is up

• Rebound from Friday and positive earnings

“Lower” Respondent Answers:

• Complacent waning volume

• Hurricane barry maybe

• Earnings

• Price did not break the top trend line (wave D in megaphone)

• retracement from highs

• Problems with Iran

• wave 5 may be done

• The market remains overbought and needs some backing and filling to be healthy.

• Summer doldrums

• Your guess is as good as mine-

• World economy. We are at the edge. Anything can happen with Iran – etc and people are becoming more aware of possibilities of rate stagnation and even increase end of July.

• topping fotmation

AD: Revealed: How To Identify Market Moves Up To 3 Days In Advance.

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• Your guess is as good as mine. One of the reasons I don’t participate on a regular basis, is that trying to ” read the market , even 10 minutes into the future ” is an exquisite exercise in futility. The world is better off without a leader, since all we do is wander around aimlessly into the weeds.

• accept losses

• discipline

• a probability mindset

• Know when to get in and out before placing trades and stay in size according to small percentage of capital for his market.

• Take losses

• Taking losses

• Discipline

• Patience, Discipline, Consistency

• Stress profit motive.

• Stick to a plan

• Not to react with fear

• calm

• Patience

• Patience

• calmness

• Believe what I do and wait patiently for my opportunity

Question #5. Additional Comments/Questions/Suggestions?

• No. Have a great week-end.

• Discuss volatility and the importance of understanding the vixx

Join us for this week’s shows:

Crowd Forecast News Episode #231

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 22nd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Bennett McDowell of TradersCoach.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #86

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 23rd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Christian Fromhertz of TribecaTradeGroup.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

AD: 40 page Sector Report.

Crowd Forecast News Report #303

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport071419.pdf

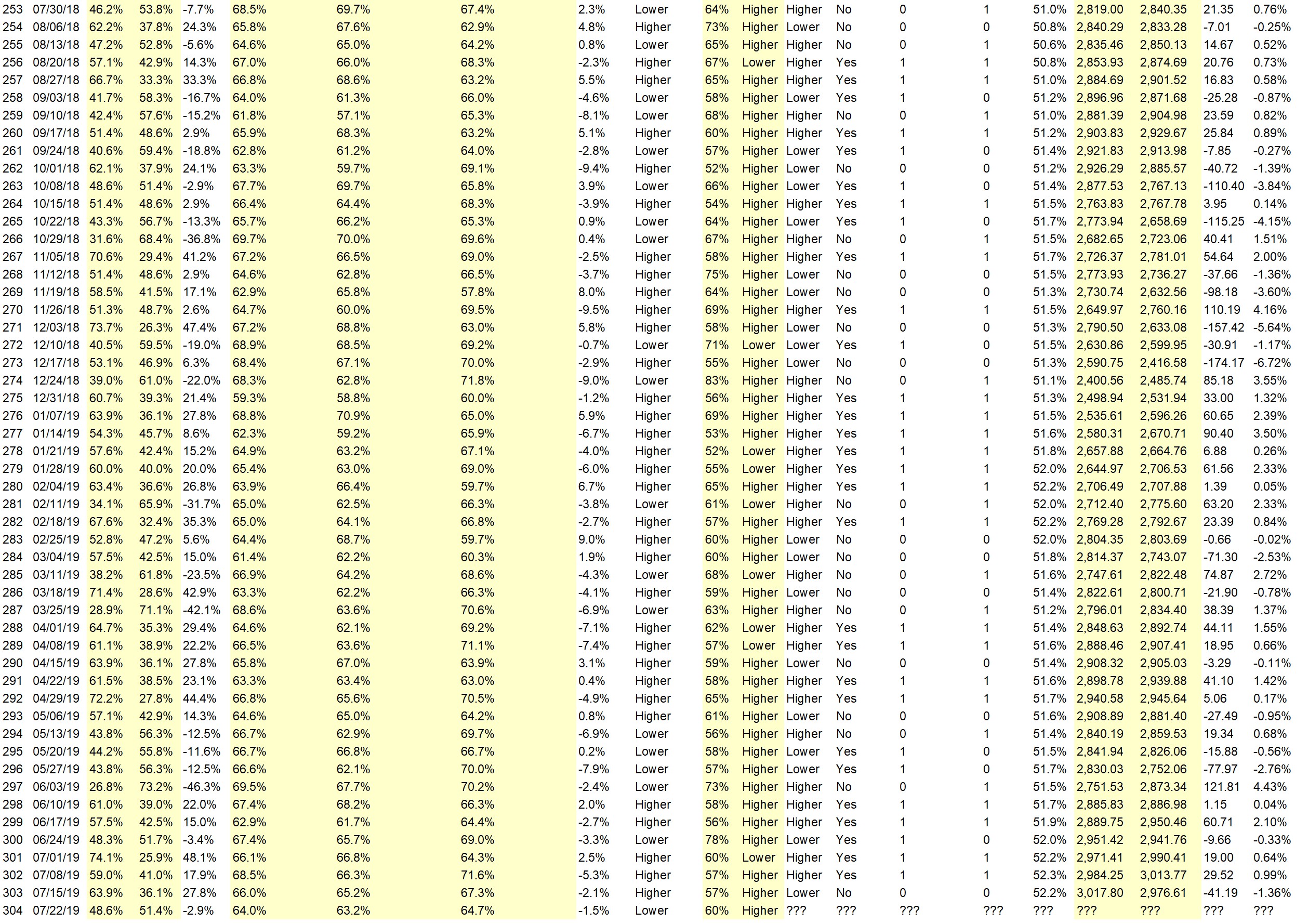

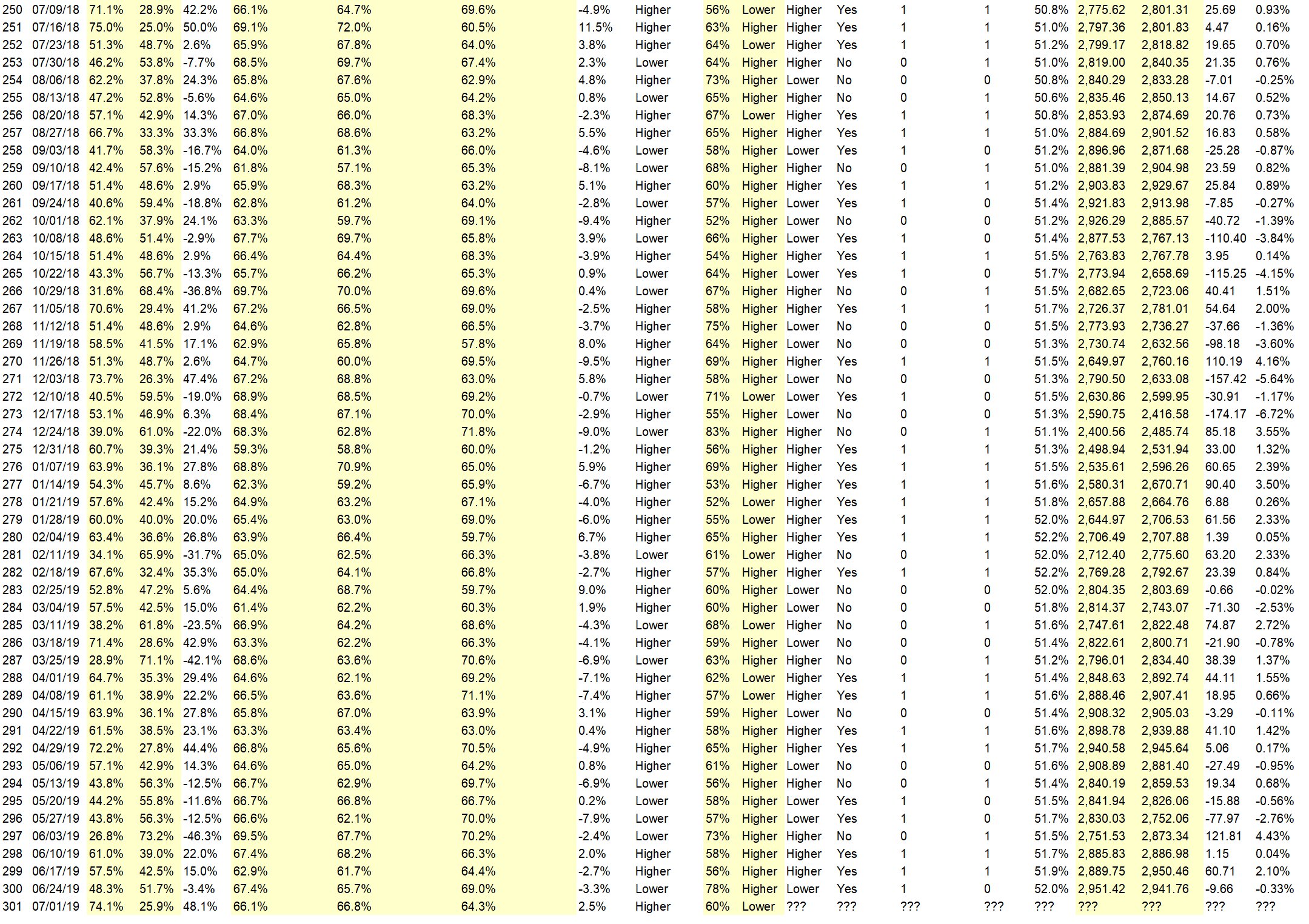

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 15th to 19th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.9%

Lower: 36.1%

Higher/Lower Difference: 27.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.0%

Average For “Higher” Responses: 65.2%

Average For “Lower” Responses: 67.3%

Higher/Lower Difference: -2.1%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 37.3

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 59.0% Higher, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 0.99% Higher for the week. This week’s majority sentiment from the survey is 63.9% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 42 times in the previous 302 weeks, with the majority sentiment (Higher) being correct 57% of the time and with an average S&P500 move of 0.14% Lower (rare instance where it more frequently moves Higher but the average of all moves is Lower) for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.3%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• ma 7, ma14 both up. but bars momentum is losing. So higher high is more likely, but may not be able to last till Friday (hence probability = 55% only)

• Trend

• Tariffs issue settled r

• The growing optimism of the public and the anticipated increase in available income generated by tax cuts. There could be a fear of missing out syndrome forming.

• interest rate cut

• The possibility of lower interest rates will make the stock market skyrocket.

• momentum

• Fed week ….

• wave 5 may not be finished — target SPY above 304.13 by 31 July

• history

• With the help of the FOMC’s stance on interest rates, expecting the market to grind some higher.

• Beginning of earnings and companies that report early usually do ok

• breakout at new highs

• new highs

• Earnings week

• Breakout

• large institutions are buying

“Lower” Respondent Answers:

• it coukd fir a new resistance line maybe that is more selling than buying maybe i guess

• Small caps are not moving higher with large cap stocks

• This week has been a poor performer historically

• seasonallity

• because everyone says the market is going higher,

• The market continues to be overbought. The market needs to back and fill to be healthy.

• The drunken orgy continues to a blow off top 1k more points up, Euphoria will take the market to even higher highs

• I don’t really expect it to go lower anymore. But I’m short calls, so just hoping that my answer can influence reality.

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week for Wealth365, but back on July 22nd.)

• Impact of gold on the market. Brexit repercussions. Repatriation of American jobs.

• Forecasting options time decay

• protect principal/

• Leverage etfs

• Need to know which are good Stocks to trade options for.

• Market Sentiment, Fund Flows,

• profit

• tarriffs

Question #5. Additional Comments/Questions/Suggestions?

• waar with Iran how will affect us

Both shows are off this coming week so you can attend Wealth365 instead!

Wealth365 is the largest free online trading and investment conference in the world. Join us and discover the best tips & strategies, directly from celebrity personalities, financial advisers, champion traders, and business thought leaders.

The TimingResearch shows will be back on July 22nd…

Crowd Forecast News Episode #231

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 22nd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Analyze Your Trade Episode #86

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 23rd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.

Crowd Forecast News Report #302

AD: Secrets Of The Elite – Traders That Never Lose.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport070719.pdf

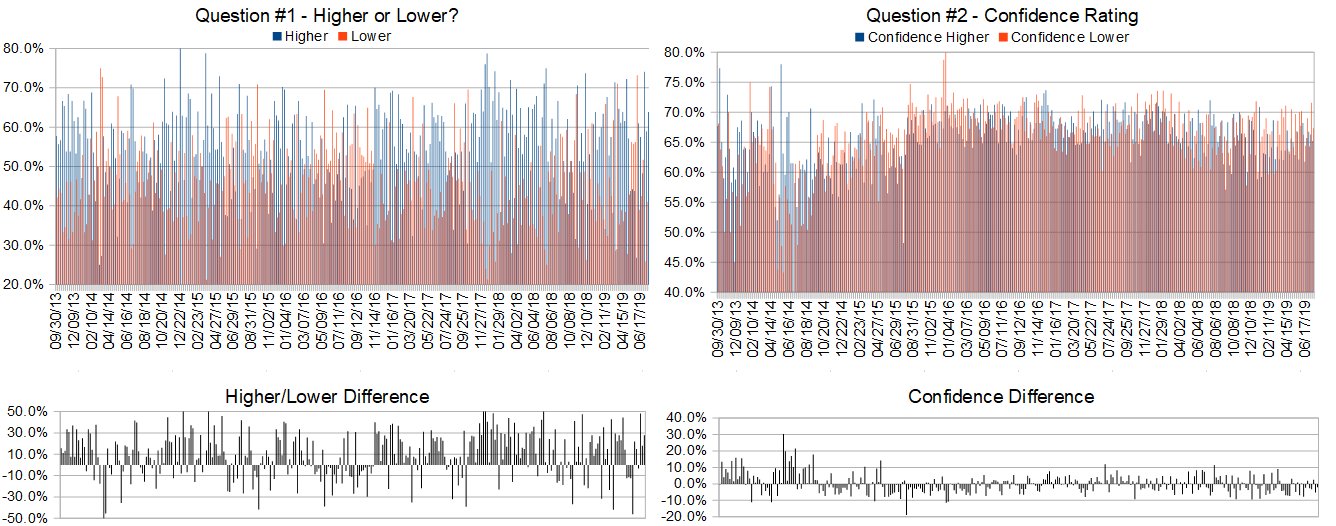

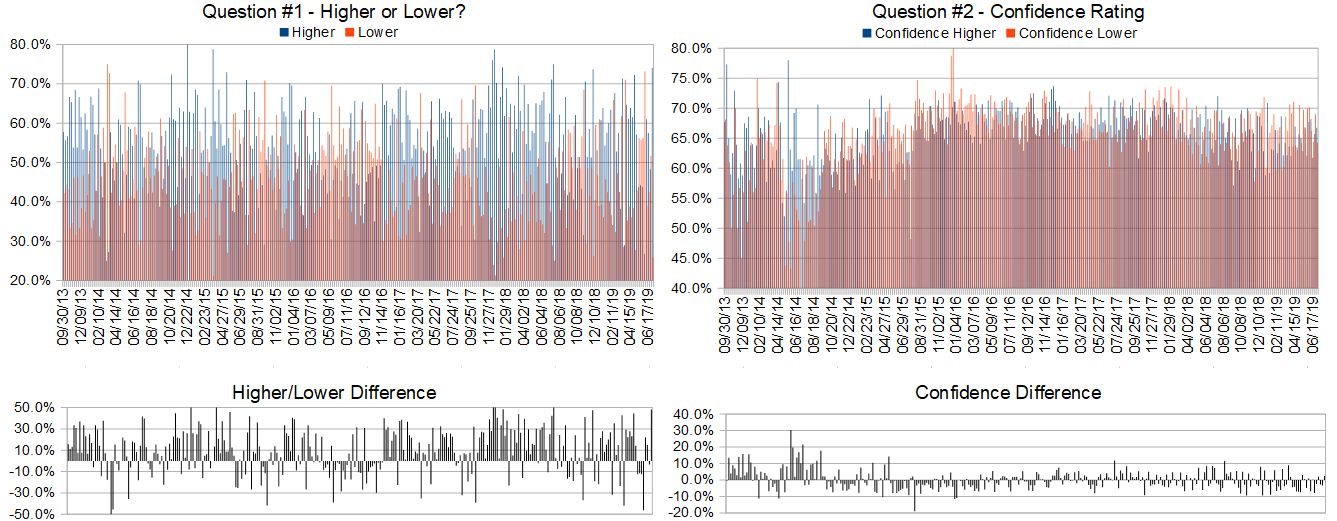

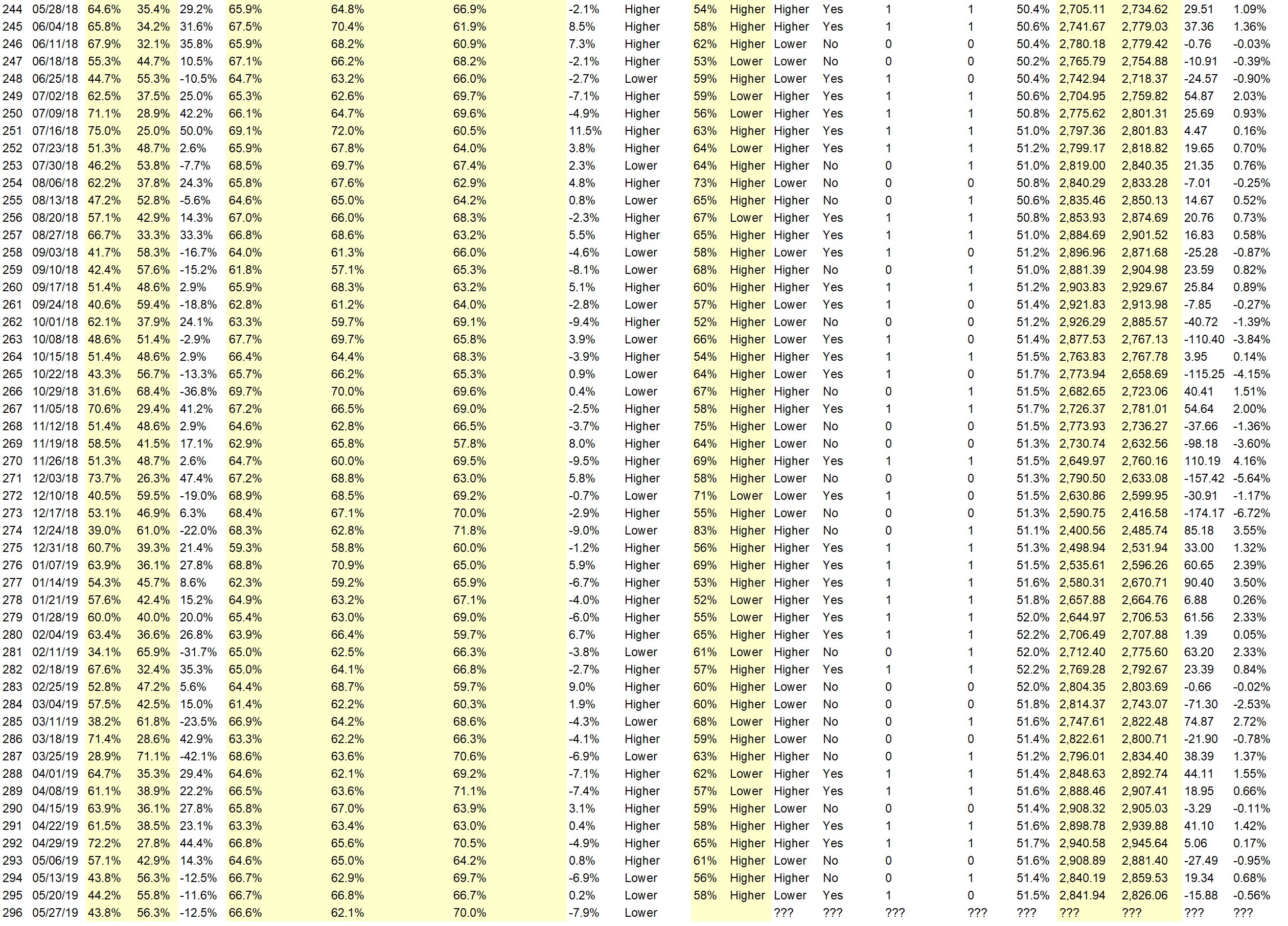

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 8th to 12th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 59.0%

Lower: 41.0%

Higher/Lower Difference: 17.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.5%

Average For “Higher” Responses: 66.3%

Average For “Lower” Responses: 71.6%

Higher/Lower Difference: -5.3%

Responses Submitted This Week: 43

52-Week Average Number of Responses: 37.5

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 74.1% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Lower; the S&P500 closed 0.64% Higher for the week. This week’s majority sentiment from the survey is 59.0% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 14 times in the previous 301 weeks, with the majority sentiment (Higher) being correct 57% of the time and with an average S&P500 move of 0.21% Lower (rare instance where it more frequently moves Higher but the average of all moves is Lower) for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: Secrets Of The Elite – Traders That Never Lose.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• fed cutting rates

• Trump is popular

• The general market usually goes up after july 4

• new highs

• low volume + markets higher on no bad news

• Market melt up on FOMO crowd

• A tweet will move the Mkt higher- it s part of the 2020 election. POTUS feels the economy is his biggest ” bag of tricks.”

• accommodative Fed

• Optimistic view of the Fed cutting interest rates.

• wave 4 continues

• The market held on strong last week. Fed funds rate futures project at least 2 upcoming rate cuts this year. With this, momentum likely to carry market higher.

• Earnings reports

• Just a bullish environment prevailing.

• new highs and trend still up

“Lower” Respondent Answers:

• The profit taking from the holiday run up, coupled with growing fears from overseas.

• Earnings soft

• the price is on the top trend line of megafon

• Chart

• 3,000 mark

• Historically worst six months

• No fed cut this x

• Wave 1 and 2 are set in place. If the one hour RSI can not recover long again, this will be the start of a continuation lower.

• VIX re-entered lower Bollinger band IWM, KRE, XRT not confirming new highs

AD: Secrets Of The Elite – Traders That Never Lose.

Question #4. What indicator influences your trading the most?

• Chart paiierns

• seasonality

• MACD

• 3xSt-RCI

• Interest rates

• — volatility — technical trending — tweets –macro /global ecnomy –fomc -Powell speaks Jul 11

• rsi

• MA, CCI

• MAs

• i dont uae them i use fundamental news most llike bankruptcy

• Interest rates

• Futures

• keltner channel

• Stock prices, although I do like to look at the RSI occasionally.

• Price

• The NYSE tick

• RSIOMA Multi-time Frame.

• Sentiment indicators. I go here for a quick look: https://money.cnn.com/data/fear-and-greed/

• DMI

• Support/Resistance levels; Channels; Bollinger bands.

• News

• Fib

Question #5. Additional Comments/Questions/Suggestions?

• Comment on ” volume ” “O.I. ( open interest “) ” price ” as variables when trading options.

• i want my profits

• Learn a system and trust it.

AD: Secrets Of The Elite – Traders That Never Lose.

Join us for this week’s shows:

Crowd Forecast News Episode #230

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 8th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Erik Gebhard of Altavest.com (first time guest!)

– Jake Bernstein of Trade-Futures.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #85

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 9th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Larry Gaines of PowerCycleTrading.com

– Jim Kenney of OptionProfessor.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Anka Metcalf of TradeOutLoud.com (moderator)

AD: Secrets Of The Elite – Traders That Never Lose.

Crowd Forecast News Report #301

AD: Need more capital to trade? Click for Futures or Forex.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport063019.pdf

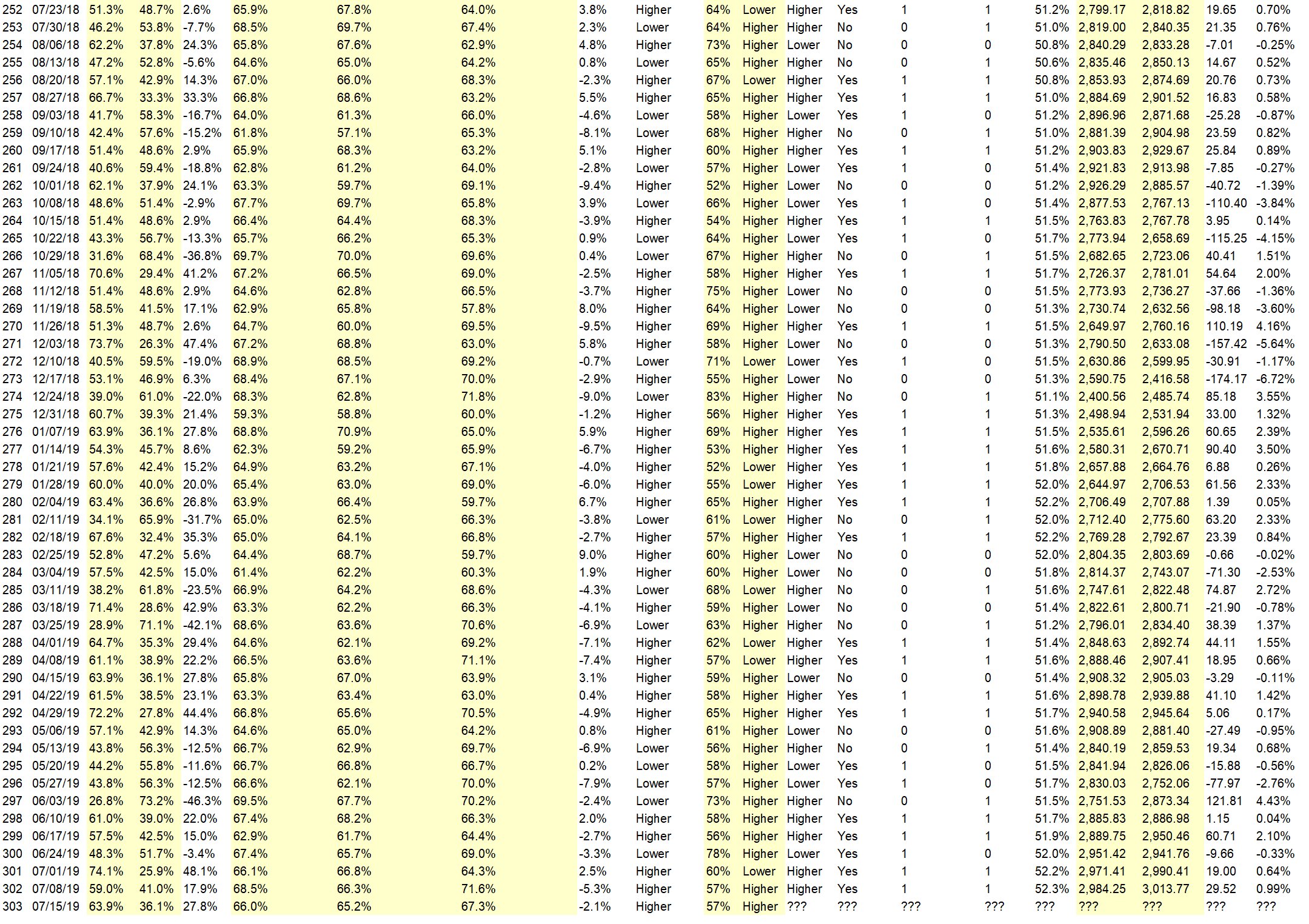

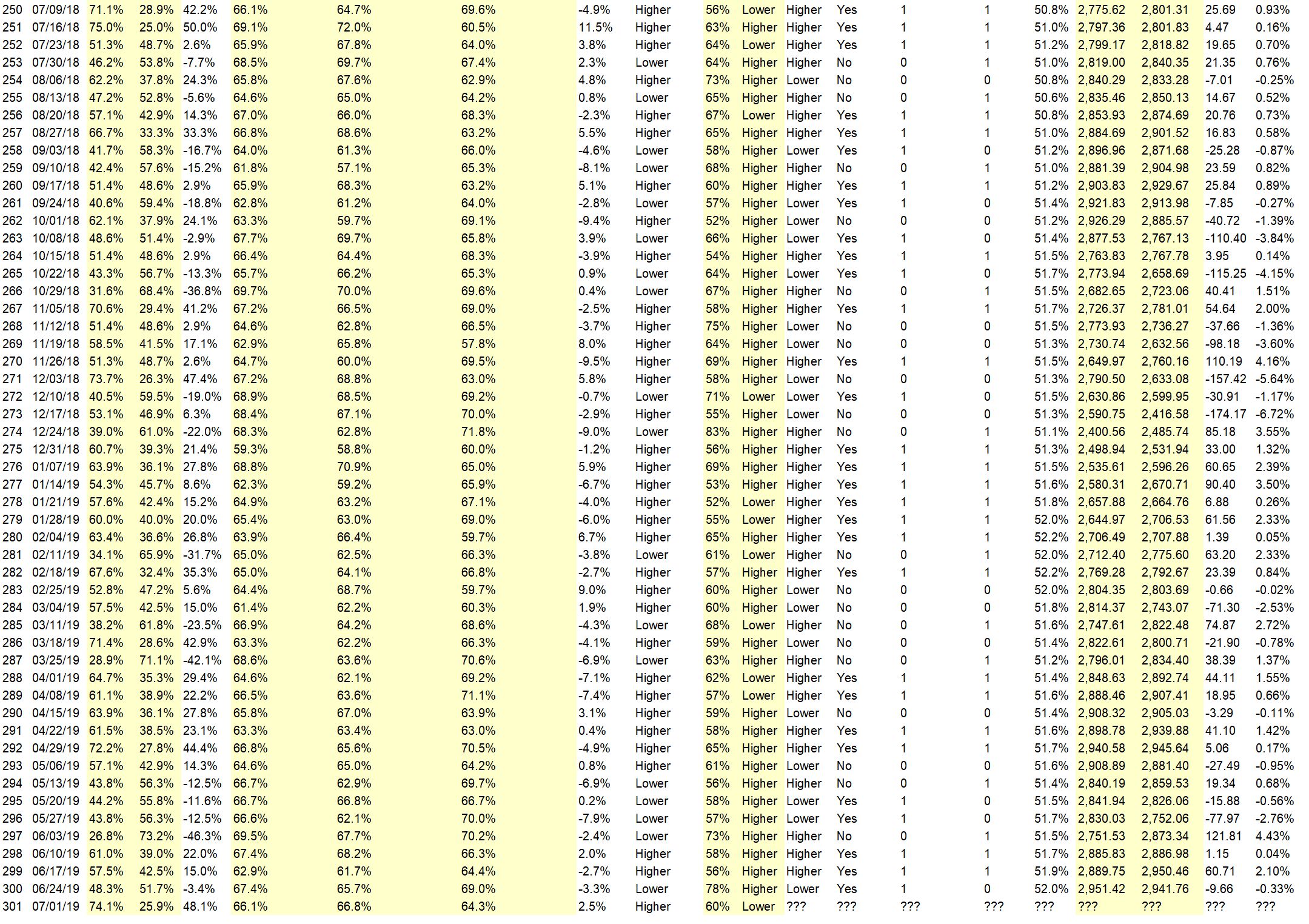

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 1st to 5th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 74.1%

Lower: 25.9%

Higher/Lower Difference: 48.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.1%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 64.3%

Higher/Lower Difference: 2.5%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 37.6

TimingResearch Crowd Forecast Prediction: 60% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.7% Lower, and the Crowd Forecast Indicator prediction was 78% Chance Higher; the S&P500 closed 0.33% Lower for the week. This week’s majority sentiment from the survey is 74.1% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 15 times in the previous 300 weeks, with the majority sentiment (Higher) being correct only 40% of the time and with an average S&P500 move of 0.32% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• China resolution, first of the month and new disposable income coming into the markets. Institutions speculating on the effects of the G-20 meeting.

• wave 5 is still finishing

• new highs coming

• China

• We closed up 40 points last week after a pullback so higher, and the RSI is long.

• continue uptrend until it ends

• Trade talks

• history

• improved momentum

• Trump announcing his bid for the Race

• Holiday trading adjustments

• There’s room to move up to 3000 in the near-term. The US-China trade talks will probably drag on, and therefore not cause the market to drop.

• Talks

• China deal, positive week for next week usually, to much negative sentiment readings

“Lower” Respondent Answers:

• the falling interest rates are causing the herd to panic

• No direction for Trump/China deal

• Panic setting in the herd

• 4th of July Holidays, progress on the Trade Talks somewhat stalled

AD: Need more capital to trade? Click for Futures or Forex.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on July 8th.)

• the market direction

• Oil, uranium, hemp/cbd.

• Market direction

• Dividend stocks

• Not sure, I will think of some…………..

• Trading Systems that have a proven ‘Edge’

• Forecast the future

• momentum analysis and second derivative

• profit

• Indicators that really work

Question #5. Additional Comments/Questions/Suggestions?

• Keep playing the game………………

CFN is off this week but back on July 8th, AYT will be back on July 2nd.

Crowd Forecast News Episode #230

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 8th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Erik Gebhard of Altavest.com (first time guest!)

– Jake Bernstein of Trade-Futures.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #84

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 2nd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Crowd Forecast News Report #300

AD: The perfect pullback trade (free to download today).

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport062319.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 24th to 28th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 48.3%

Lower: 51.7%

Higher/Lower Difference: -3.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 65.7%

Average For “Lower” Responses: 69.0%

Higher/Lower Difference: -3.3%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 38.0

TimingResearch Crowd Forecast Prediction: 78% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 57.5% Higher, and the Crowd Forecast Indicator prediction was 56% Chance Higher; the S&P500 closed 2.10% Higher for the week. This week’s majority sentiment from the survey is 51.7% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 9 times in the previous 299 weeks, with the majority sentiment (Lower) being correct 22% of the time and with an average S&P500 move of 0.73% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 78% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: The perfect pullback trade (free to download today).

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.9%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Due to the China/US trade war, SPY will go higher

• wave 5 ends in July

• short squeeze

• No reversal yet. Market trading the good news.

• option friday expiration over. short term down then up without macro news

• all time highs broken

• MO & optimism re China trade deal

• RSI on daily H4 and H1 are motoring long in sync. Daily does show divergence but could continue to the end of the month.

“Lower” Respondent Answers:

• Look of the chart – climactic top needs downside correction.

• Once the DTrump and Pres Xi talks are over and DTrump stops tweeting manipulatively motivated predictions that rarely ever occur , I believe the recent gains will begin to fall away. I do not expect a crash but as the reality sets in surrounding the phenom of DTrump tweets done to cause the market to go up, eventually the emperor will be exposed as “having no clothes”/substance. Once this takes root, the market, much of its upward momentum being unwarranted, is likely to readjust downward

• Failure of agreement of trade war at g30

• overbought

• After this week, we are due for a consolidation !

• weakening momentum

• Market held up correction occurs as summer sets in

• contrarian

• Market tippy 1 more FED rate cut keeping market up temporarily

• Negatives – Inverted yield curve, tariff wars, S&P earnings vs. previous quarter may be negative. G20 summit coming up – not expecting much,

• Market is overbought and looking tired. Some downside action is needed.

AD: The perfect pullback trade (free to download today).

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• Subjective journalling and lots of what-if scenarios with PC-SPAN.

• The stock market in general

• my brain

• recordkeeping

• factor spreadsheets

• Check the balance.

• Cash amounts up or down. stocks option activity. Trade war news. black swan events

• p&l

• Track positions daily make improvements. In record keeping

• Daily follow market

• P & L

• A custom weighted multi-timeframe RSI with BB’s and a couple of MA’s

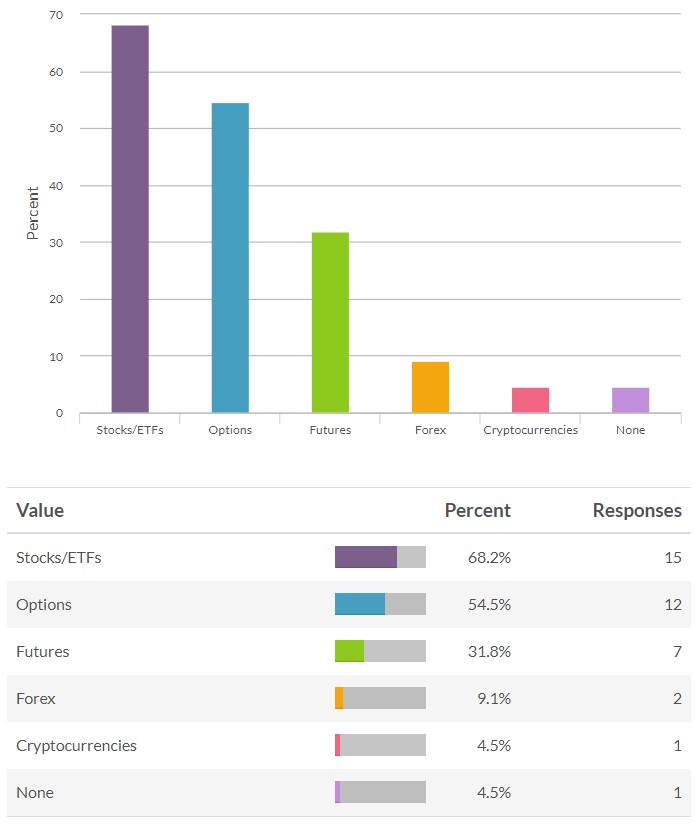

BONUS: Which of the following have you traded with real money so far this year? (check any that apply)

Question #5. Additional Comments/Questions/Suggestions?

• I say the stock market has a lot of up room (compared to Dec 2018) left before the bottom falls out.

• look out below

• credit spreads

• Never give up on your trading, learning it and get good at it.

AD: The perfect pullback trade (free to download today).

Join us for this week’s shows:

Crowd Forecast News Episode #229

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 24th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Bennett McDowell of TradersCoach.com

– Sam Bourgi of TradingGods.net

– Jake Bernstein of Trade-Futures.com

– Anka Metcalf of TradeOutLoud.com (moderator)

Analyze Your Trade Episode #83

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 25th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Michael Filighera of LogicalSignals.com

AD: The perfect pullback trade (free to download today).

Crowd Forecast News Report #299

AD: Thursday: How To Beat The Market Investing Just Once A Week.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061619.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 17th to 21st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.5%

Lower: 42.5%

Higher/Lower Difference: 15.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.9%

Average For “Higher” Responses: 61.7%

Average For “Lower” Responses: 64.4%

Higher/Lower Difference: -2.7%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 38.2

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 61.0% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.04% Higher for the week. This week’s majority sentiment from the survey is 57.5% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 61 times in the previous 298 weeks, with the majority sentiment (Higher) being correct 56% of the time and with an average S&P500 move of 0.06% Lower (the market moved Higher more frequently but the average of all moves was Lower) for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• fomc maybe

• Everything depends on the Fed this week!

• Seasonal trends, perceived oil disruption, and just intuition..

• World conflict

• The uptrend resumes anew after a horrible month of May.

• Price is above 50 SMA on day chart. Top price before 7 weeks is very near

• I think the U.S./China tariff deal will have positive signs of a deal.

• FOMC meeting

• Possibility of reduced interest rates and china trade deal.

• Holding pattern with upward bias

• wave 5 continues into July

• because profits were higher than thought.

• Iran, China, Mexico?????

• reversion

• momentum and hopefully dirth of new negatives

“Lower” Respondent Answers:

• China & iran

• Fed disappoint the market, unrest in Middle East.

• iran

• received email stating 2 reasons why S&P could drop 250 points from reliable source.

• Seek the rate news on Wednesday

• sideways to lower move in slow summer market

• The market has lost momentum. The path of least resistance should be down.

• It looks like the tariffs will hang around more. Also, only a 20% chance that the Fed cuts rates this week, according to the Fed funds futures.

• Good news priced in FED stalling

• Can’t break resistance, slowing momentum

• Range Bound now

• new high new low divergence

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• Wiege board

• position sizing and stops

• Scaling in and taking profits when a position hits at least 100%. Usually take about a quarter of the position in profits and let the rest ride.

• Ak

• All

• Position size and scaling.

• stops, position size

• 2% of size acc.

• set stops

• Stability.

• Limits in buying and selling

• position size

• Set St0ps

• Position size – usually about equal for each stock.

• scaling both ways

• trend, sma 3 and 10, MACD, 1/10 of protfolio its a 10% stop lost. Or daily moving average.

• I use time of day a lot for position sizing, (e.g. bank openings and bank closings) Then I also very often take 1. st profit after 3-4 pips (scaling out)

• short term moving average: 10 days, 15 days depending on fund volatility.

Question #5. Additional Comments/Questions/Suggestions?

• June strong July flat Aug. Down on DOW

• Yeah herd stampede last week they get picked 0ff this week

Join us for this week’s shows:

Crowd Forecast News Episode #228

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 17th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Michael Guess of DayTradeSafe.com

– Andrew Keene of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #82

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 18th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

Crowd Forecast News Report #298

AD: Download Now: Resource Market Millionaire eBook.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060919b.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 10th to 14th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 61.0%

Lower: 39.0%

Higher/Lower Difference: 22.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 68.2%

Average For “Lower” Responses: 66.3%

Higher/Lower Difference: 2.0%

Responses Submitted This Week: 41

52-Week Average Number of Responses: 38.2

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 73.2% Lower, and the Crowd Forecast Indicator prediction was 73% Chance Higher; the S&P500 closed 4.43% Higher for the week. This week’s majority sentiment from the survey is 61.0% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 60 times in the previous 297 weeks, with the majority sentiment (Higher) being correct 58% of the time and with an average S&P500 move of 0.09% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Chart

• wave 5 is real

• I think this is a big short squeeze and its gathering up a lot of retail traders in the uptrend

• Judging from what I’m seeing, investors are anxious, after a dismal May. Institutional investors are starting to get into the market.

• Trade deal with Mexico seem to be moving forward and possibility of future cuts in interest rates.

• up in a “B” wave

• Momentum

• weekly close was strong, possibly a sell the news events

• A quick return to 50 SMA on the daily chart indicates a slight correction at the beginning of the week and then a 50 SMA on the daily chart

• Regained 200 and 50 dma in 1 week. That means this week we will see the rise stall after going higher. Then possible fall for summer swoon.

• Elliott Wave pattern.

• Trade concerns are fading for now.

• Because president trump did not tariff the Mexicans

• Removal of the uncertainty of Mexico tariffs

• relief rally

“Lower” Respondent Answers:

• Tariffs with China and

• Closed below the High; Profit taking and possible bad news over the weekend

• Mr Trump

• Market top absorbed money

• Friday’s rally was exhaustive. Recent lows need to be retested.

• trend is down and DCB over

• up one week, down the next

• series of higher highs, now a regression

• Sell the news

• China

• I’m going with the Oct-Nov 2018 pattern. If that pattern continues, a top was reached on Fri; and the next leg is down.

• resistance levels

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Question #4. What type(s) of trading do you specialize in or focus on? How did you come to that decision?

• Selling credit sreads

• SPY Options Based on chart

• Only Options

• Long term. And swing trading

• Emini S&P 500 index far-out-of-the-money option selling. So I don’t really care market direction.

• trying to decide ..mainly doing options cause of small account size

• Primarily stocks, but have some gold and muni’s.

• Forex. Moves most.

• day trading (income) and position holding (retirement)

• futures. Believe last week was a corrective move.

• Stocks and options. I have some training in options trading.

• stocks, less complex.

• options, less capital

• Intraday trading.

• Quick trades in stocks that have risen or fell due to circumstance, not fundamentals. They sharply reverse then resume their trend.

• Day trading futures. I came to this decision primarily because of market volatility producing larger overnight moves.

• Charts. Follow the price movement

• Very short term with get out trades ready to go prior to initiating trade

• Options

• Options and swing .trading . options I chose because of the lower risk and swing trading because sometimes you can’t use options

• Swing trading; 2-10 days. With my job, I can’t do intraday.

• patterns, price action

• spreads slow but safer

Question #5. Additional Comments/Questions/Suggestions?

• Market will go up and then down

• can you resend out webinar replays?? wasn’t able to attend live session

TimingResearch response: All TimingResearch shows are publicly available immediately after recording on the TimingResearch.com homepage and the TimingResearch YouTube account. I also send an email out with the archive link 2 hours after recording each episode to everyone who is subscribed to the newsletter.

• Am anxious to have our politicos approve the use of marijuana on a national basis. I believe this would unlock untold fortunes, while powering the economy higher.

• None.

• Can we tell from charts when major short selling is happening to a stock; are there any indications that are different to or distinguishable from regular sell offs.

• I think the “SS” by the house this week in an attempt to prove our President Trump obstructed a crime the Mueller report said he didn’t commit, will pull this overbought market lower

• Nothing comes to mind,

Join us for this week’s shows:

Crowd Forecast News Episode #227

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 10th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– John Thomas of MadHedgeFundTrader.com

– Norman Hallett of TheDisciplinedTrader.com (moderator)

Analyze Your Trade Episode #81

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 11th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Bryan Klindworth of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Crowd Forecast News Report #297

AD: Download Now: Resource Market Millionaire eBook.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060219.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 3rd to 7th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 26.8%

Lower: 73.2%

Higher/Lower Difference: -46.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 69.5%

Average For “Higher” Responses: 67.7%

Average For “Lower” Responses: 70.2%

Higher/Lower Difference: -2.4%

Responses Submitted This Week: 46

52-Week Average Number of Responses: 38.5

TimingResearch Crowd Forecast Prediction: 73% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 56.3% Lower, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 2.76% Lower for the week. This week’s majority sentiment from the survey is 73.2% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 11 times in the previous 296 weeks, with the majority sentiment (Lower) being correct 27% of the time and with an average S&P500 move of 0.53% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 73% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• support line may be I think I guess maybe I guess

• Beginning of the month and new money should be hitting the stock market proportionately. We might even get some millennials involved.

• Surprise announcement of a trade deal with China

• Dead cat bounce

• because ts the right thing to do given that the chinese haven’t started a war yet.

• waiting for w4down to finish

• technicals and Put/Call ratio

• Momentum is bearish but there is a probability of a minor spike keeping the indices around 200 sub or above.

• I think the trade between USA-China will reach a small agreement

“Lower” Respondent Answers:

• new tariffs on Mexico, continuing tariffs on China No new news on economy.

• trump

• crowd follow,

• Fridays epic selloff

• I sold my SDS last week near resistance, so of course the S&P will tank this week! LOL

• continue wave 2 down

• technical analysis

• momentum

• orderly correction to 200dma , pricing in rate cuts in dec/2019,bond market pricing it in. Crude big drop also adding to correction ,mexico,best to stand aside and wait for reversal .

• Mexico tariffs.

• The downside correction will continue. Major support lines are being broken.

• If the market acts like it did in Oct 2018, a rebound can come soon. But more likely IMO, with Mexico, China, yield curve inverting, and no infrastructure bill, this market moves downward more like in Jan 2016 and Dec 2018.

• Fib levels show retacement down to december lows, until market turn around

• chart analysis, support levels

• Impulsive POTUS. NO PLANS

• Your kidding? Fridays drop

• Slowing world economy

• Trend is down, trade wars

• Breaching support. Key weekly indicators show lower. Bonds increasing from institution cash.

• New terrific vs. Mexico.

• major support broken internals, momentum weak

• Market doesn’t like uncertainty and there’s SO much of it now.

• Mr Trump

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Question #4. What methods or techniques do you use to overcome the emotional aspects of trading?

• That is my biggest issue

• Mood

• I use stops and market timing

• what emotion ?

• Use physical stops

• Keeping my eye on long range objectives, scaling out of positions as the opportunities presents them.

• i haven’t figured a way to not be emotionaly involved in my trades as of yet

• Fibanacia

• Sit it out.

• entry/exit rules

• technicals.

• Stop loss on profits no losses

• Donchian channels and different periodic cycles

• Set lost at the daily movement average and the moment trend

• patterns, price action, correlations, options behavior.

• perspective, patience

• Haven’t found one yet. Any suggestions?

• Are you kidding? I’m very happy when a trade is profitable, and quite disappointed when a trade hits my stop. This is in spite of the risk/reward stuff which is supposed to keep me unemotional because I know that statistically, overall, my method should be profitable. I just accept that cannot keep emotions out of it.

• fixed stops

• fixed stops

• Still wrestle with them. 50/100/200 day MA.

• journaling

• algotrading

• Still trying after 20 years…Rely more on charts, money management, and separating trading from investments.

• Take some time, examine several charts before making a move.

• Try to follow a proven system but at end we succumb and fall to emotional flares.

• Talk with friends

Question #5. Additional Comments/Questions/Suggestions?

• No technical data looks positive

• this is a great survey

• What is the best to find stocks that are trending up? With over 12000 stocks seems impossible.

• Market wants to go higher but it’s being news driven down by Trump.

• Trading is no longer productive unless we have a real plan on certain time frames.

Join us for this week’s shows:

Crowd Forecast News Episode #226

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 3rd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

– Dave Landry of DaveLandry.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #80

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 4th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jerremy Newsome of RealLifeTrading.com

– Michael Filighera of LogicalSignals.com (moderator)

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Crowd Forecast News Report #296

AD: Download Now: Resource Market Millionaire eBook.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport052719.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 28th to 31st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 43.8%

Lower: 56.3%

Higher/Lower Difference: -12.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.6%

Average For “Higher” Responses: 62.1%

Average For “Lower” Responses: 70.0%

Higher/Lower Difference: -7.9%

Responses Submitted This Week: 33

52-Week Average Number of Responses: 38.4

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 55.8% Lower, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.56% Lower for the week. This week’s majority sentiment from the survey is 56.3% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 37 times in the previous 295 weeks, with the majority sentiment (Lower) being correct 43% of the time and with an average S&P500 move of 0.30% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Antiabrotion law signed by Bryant here

• We are due for a bounce!!!

• high demand of the security traded

• seasonal peak ends in May

• China trade agreement signed!

• wave 4 – unless not

• I think there is a bounce up after the last correction

• Really— not even 50%.

• momentum

“Lower” Respondent Answers:

• bearish head & shoulders pattern

• Sucker rally pestering 0ut

• All of the above

• Sell Cross over of the 10,20 EMA, VIX going up during the rise of the SPX (happens only before big drops), before Trump blew the Dow Futures (+200) into -500 at a highly risky point on May 5th and Trump getting crazier as the investigations keep piling up.

• lot of uncertainty ,spx toggling around 2800 long time ,,see downside to 2776-200dma

• China’s new tarriffs

• There’s no buoyancy in the market, other than in defensive areas such as utilities, REITs, & gold. Inverted yield situation deteriorating, which suggests slower growth ahead.

• Historically worst six months of the year

• Bonds tanked the economic recovery ran its course

• The chart has done a topping pattern, and fundamentals are deteriorating.

• Trend turning to down

• Tariff talk.

• Down below 50dma and at 200dma. I think it pushes below 200da for a time…

Partner Offer:

Fausto Pugliese, ex-SOES bandit and CEO of Cyber Trading University wants to prove to you that he and his students can reach their daily trading goals in less than 2 hours of trading each day!

This Thursday, May 30th at 12:00 pm ET, Fausto Pugliese is teaching a free class called “How to Make a Full-Time Income as a Part-Time Trader (in any market condition)”

TAP HERE to RSVP for this FREE webinar!

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on June 3rd.)

• rading plan

• No

• Quit jaw-boning. Get on with it.

• Review 1929, 2007 and now along woth the Political Parites which were in power during each Crash

• which stocks are market makers likely to push this week?

• How high will gold move in the coming months?

• How to stay invested and protect the portfolio

• risk analysis..

Question #5. Additional Comments/Questions/Suggestions?

• How is quantity important in trade

• None…..

• which sector is due for a push?

Join us for this week’s shows:

Crowd Forecast News Episode #226

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 3rd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Analyze Your Trade Episode #79

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, May 28th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Michael Filighera of LogicalSignals.com (moderator)

Partner Offer:

Fausto Pugliese, ex-SOES bandit and CEO of Cyber Trading University wants to prove to you that he and his students can reach their daily trading goals in less than 2 hours of trading each day!

This Thursday, May 30th at 12:00 pm ET, Fausto Pugliese is teaching a free class called “How to Make a Full-Time Income as a Part-Time Trader (in any market condition)”

Crowd Forecast News Report #295

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport051919b.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 20th to 24th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 44.2%

Lower: 55.8%

Higher/Lower Difference: -11.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.7%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 66.7%

Higher/Lower Difference: 0.2%

Responses Submitted This Week: 45

52-Week Average Number of Responses: 38.8

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 56.3% Lower, and the Crowd Forecast Indicator prediction was 56% Chance Higher; the S&P500 closed 0.68% Higher for the week. This week’s majority sentiment from the survey is 55.8% Lower with a greater average confidence from those who responded Higher. Similar conditions have occurred 24 times in the previous 294 weeks, with the majority sentiment (Lower) being correct 42% of the time and with an average S&P500 move of 0.19% Lower for the week (this is a rare instance where the market went Higher more frequently but the average move of all similar instances was Lower). Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.4%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• NH-NL Index and the % of Negative investors.

• China trade relations will improve causing the markets to rebound. Consumer confidence will increase.

• The Iran situation is calming.

• Strong economy, foreign money moving to the US stocks.

• lt trend

• End of month computer buying/re-balancing

• tech will fill in HUAWEi ban

• Uptrend remains intact

• I believe Pres. Trump.will get us closer to.a deal w/China!

• Stable this past week, push higher for next !

• NAFTA and China

• trend is up

“Lower” Respondent Answers:

• 3M

• Trade war hype is overblown, but the media will still push it, making people trade on that. Anything that sounds like it could cause a Recession will be talked up, trying to cause a self-fulfilling prophecy. Market participants will react to some of this, causing volatility.

• China and the yuan

• suckers rally runs its course look at all the overconfidence

• “sell in May and go away”

• Trump’s lunacy

• looks like we are going to break below spx 2800–lower low,s lower hi,s .

• Tarriffs

• unclear elliott wave 4

• The downside correction started last week will continue.