Crowd Forecast News Report #334

[AD] eBook: NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven MarketsThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport021720.pdf

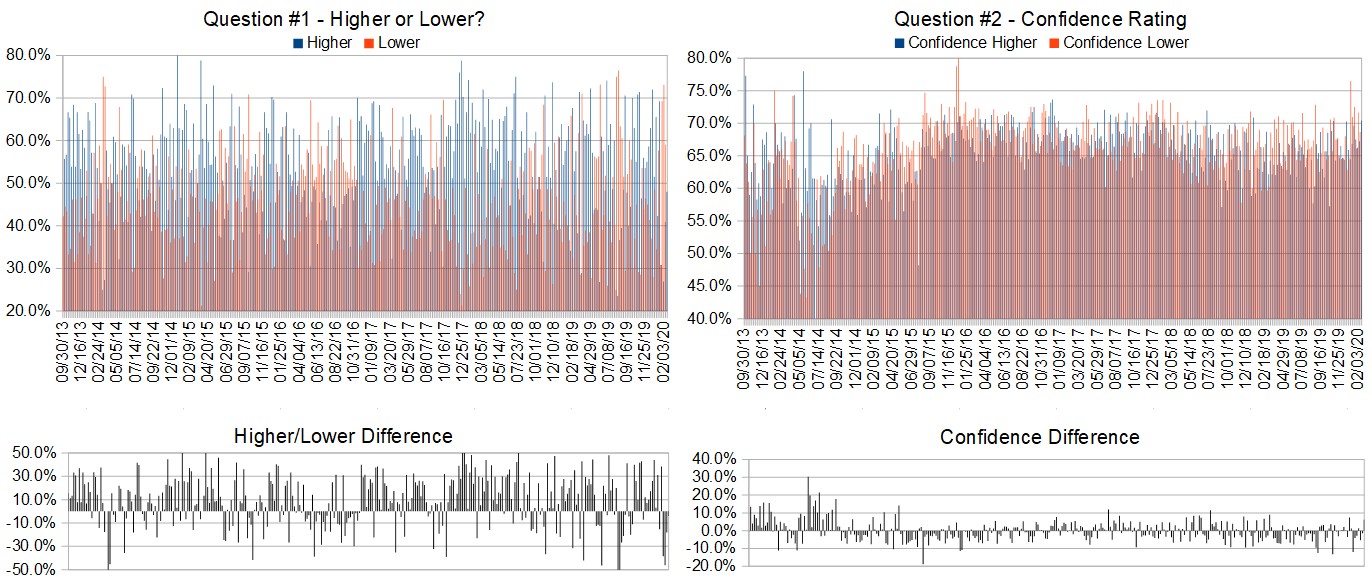

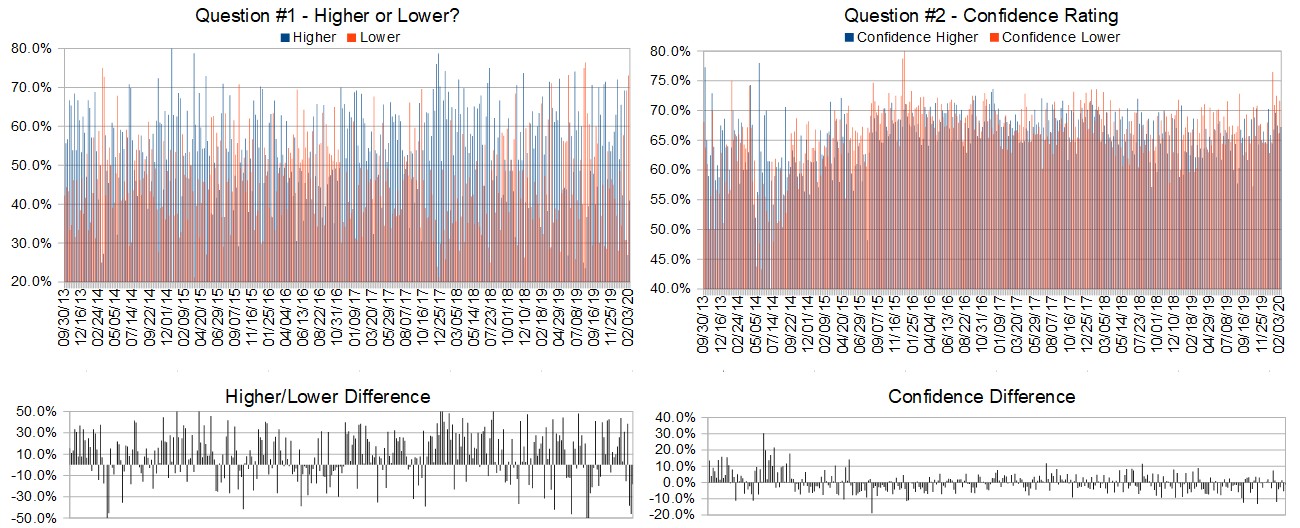

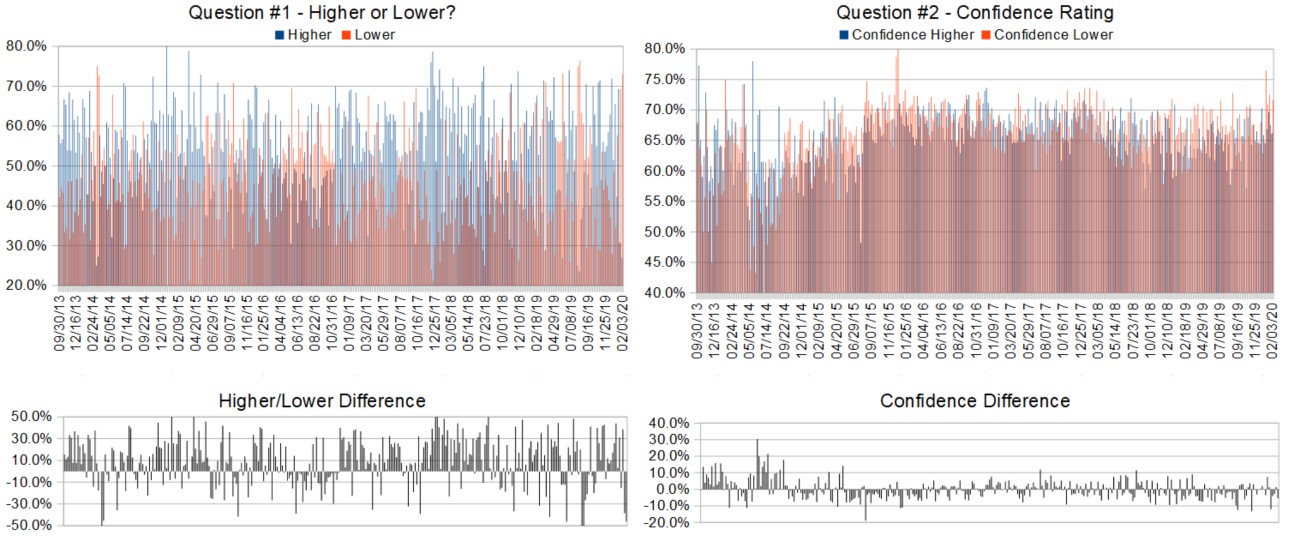

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (February 18th to 21st)?

Higher: 48.0%

Lower: 52.0%

Higher/Lower Difference: -4.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.2%

Average For “Higher” Responses: 70.4%

Average For “Lower” Responses: 64.2%

Higher/Lower Difference: 6.2%

Responses Submitted This Week: 25

52-Week Average Number of Responses: 32.7

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 59.1% predicting Lower, and the Crowd Forecast Indicator prediction was 58% chance Higher; the S&P500 closed 1.86% Higher for the week. This week’s majority sentiment from the survey is 52.0% predicting Lower with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 42 times in the previous 333 weeks, with the majority sentiment (Lower) being correct only 40% of the time and with an average S&P500 move of 0.02% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

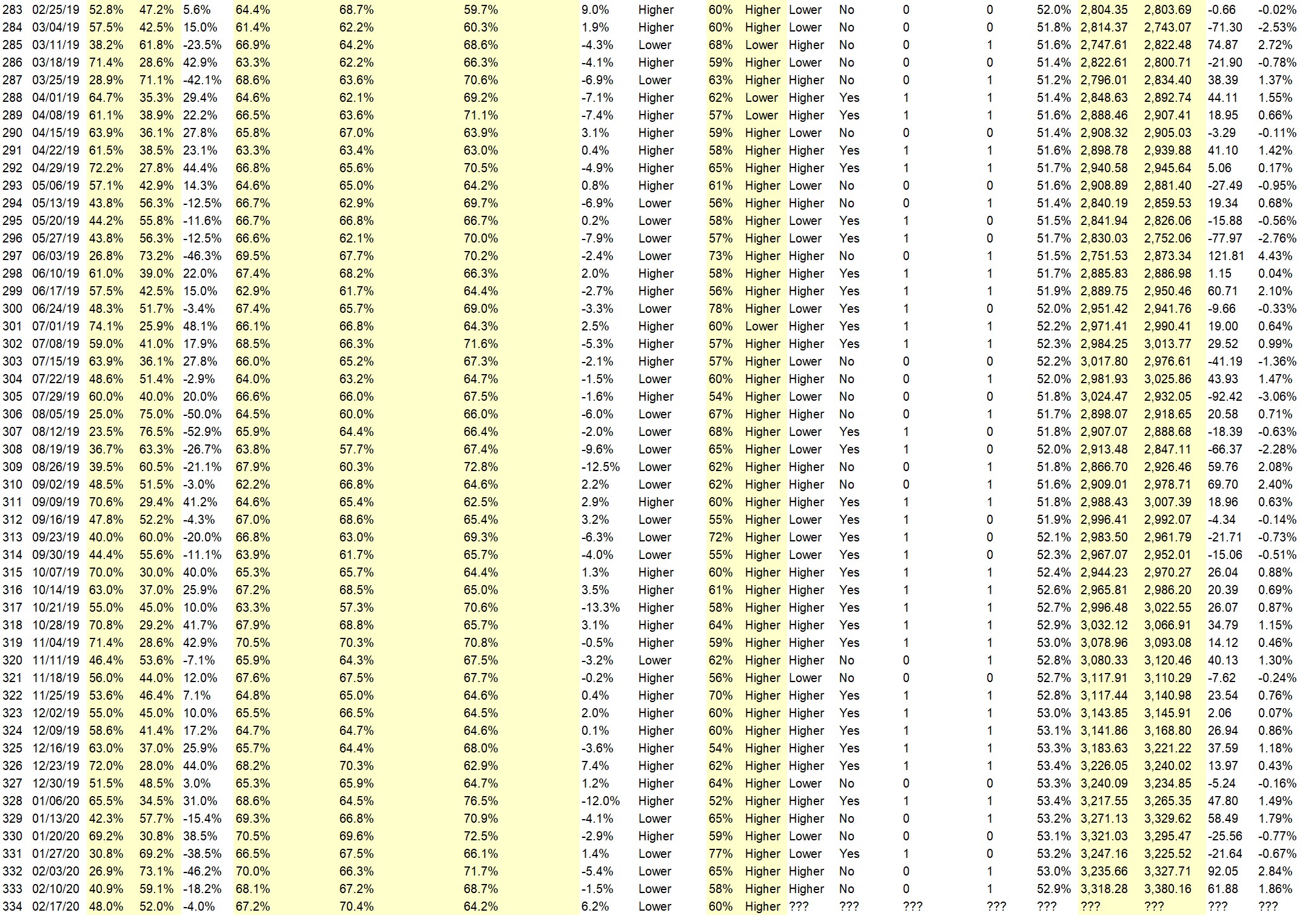

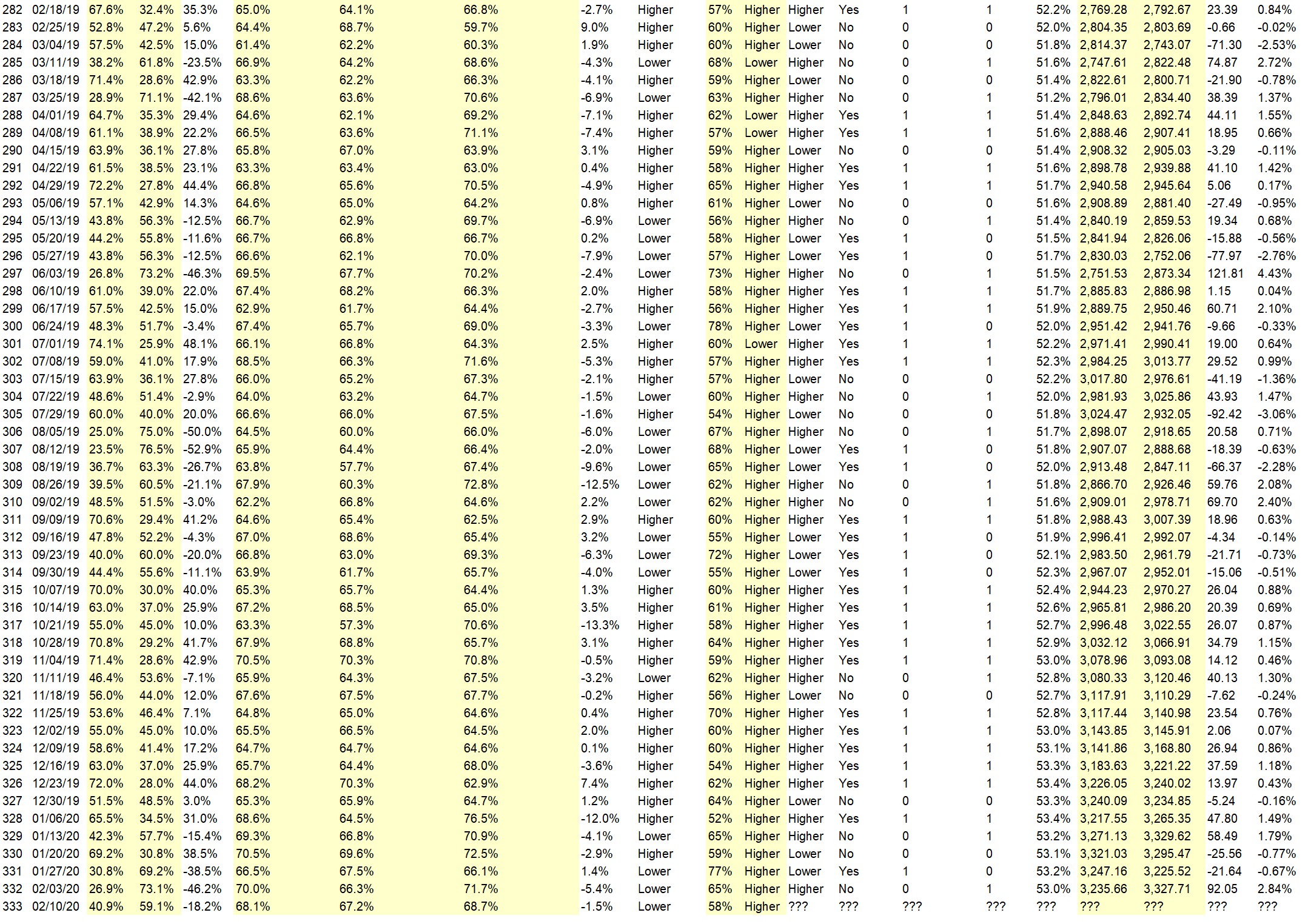

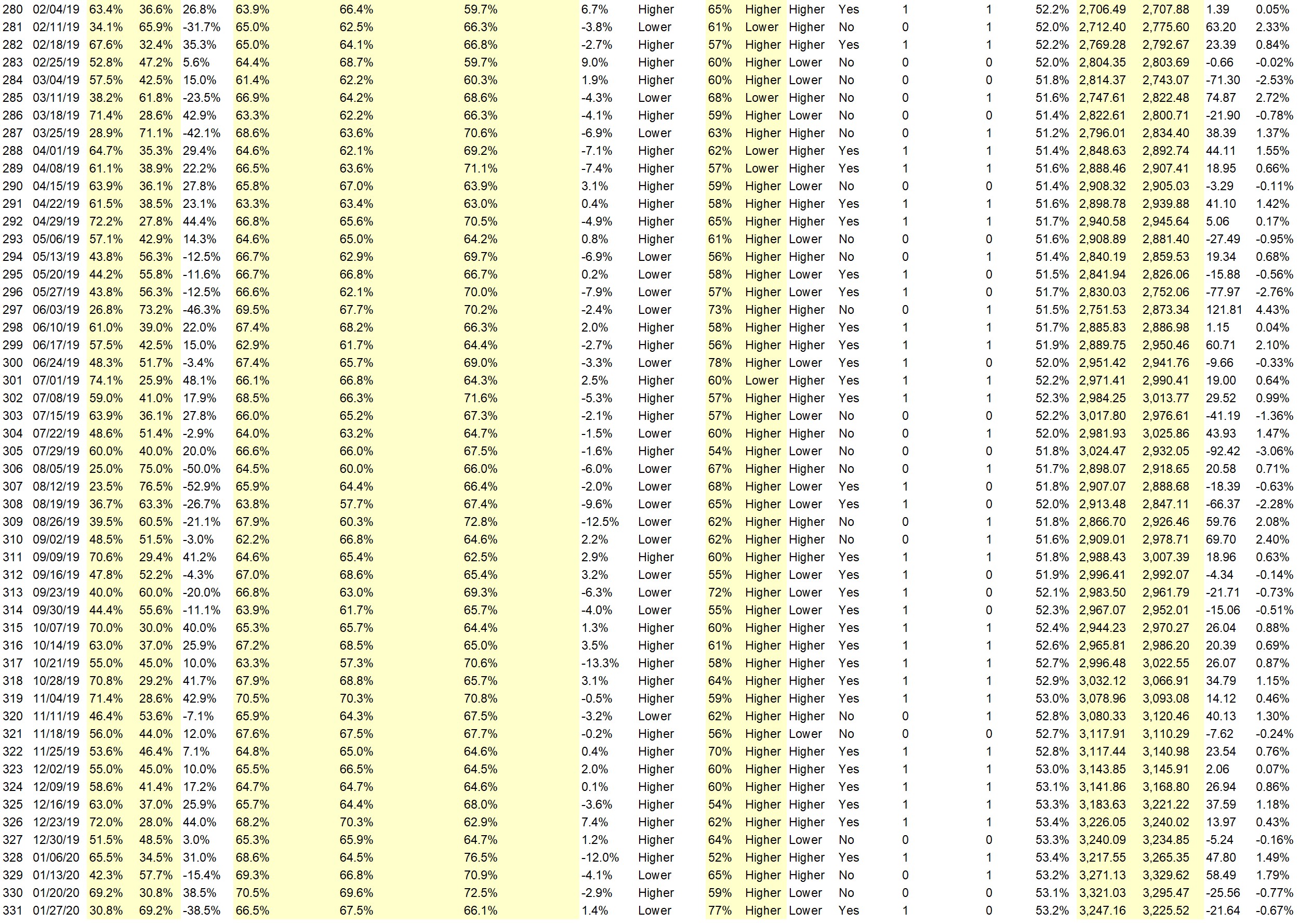

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.9%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Continued “not QE 4” repo injection by the Fed, lowered VIX and buy the dip remain in force. AAII bullish numbers still low.

• LT trend

• FOMC

• S P TOP IS 338 12 THE NXT TOP IS 340.525

• I think they can go as far as to 90%to 95%

• China markets are up and U.S. markets ignore coronavirus spreading.

• The trend up continues

“Lower” Respondent Answers:

• Short week and extremely stretched having in mind the current scenario.

• The run up has been too fast. There needs to be a slow down to give pause before the blow-off can continue.

• Stochastics peaking. A quiet week then down.

• Market is losing momentum. More earnings reports to weigh on the market.

• Fed must loosen

• seesaw stage in the market has begun FED must lower but might not

• China Flue, wider spread and effecting Asian businesses stronger than expected. Limited North American citizen exposure and better health care systems than abroad.

• Markets moved up to fast.

• Mexican beer ;o)

• because the fed and the pboc are going to prop the market up. totally lost reality.

• consolidation

• The coronavirus is gaining steam, which can reverse the market’s upward movement; starting any day now.

[AD] eBook: NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week the market holiday, but back on February 24th.)

• no opinion

• bank statements

• Where are commodities headed, chart wise. Oil, is there a future?

• none

• When will supply chain disruptions affect equity markets?

• None

• How to trade futures? When is the best time of the day to trade futures? How to trade futures overnight?

• NONE

• Yes if course we would like to know how fast and incredible future for S&P500 as we maybe surprise of.

Question #5. Additional Comments/Questions/Suggestions?

• Re: China flue. Tighten North American borders while giving medical expertise to Asian countries. Fast track medical research and cure.

• I hope the best for the company as i hope forward will be ever

Join us for this week’s shows:

Analyze Your Trade Episode #114: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 18th, 4PM ET (1PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] eBook: NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies