- Home

- Crowd Forecast News Reports

Crowd Forecast News Report #332

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport020220.pdf

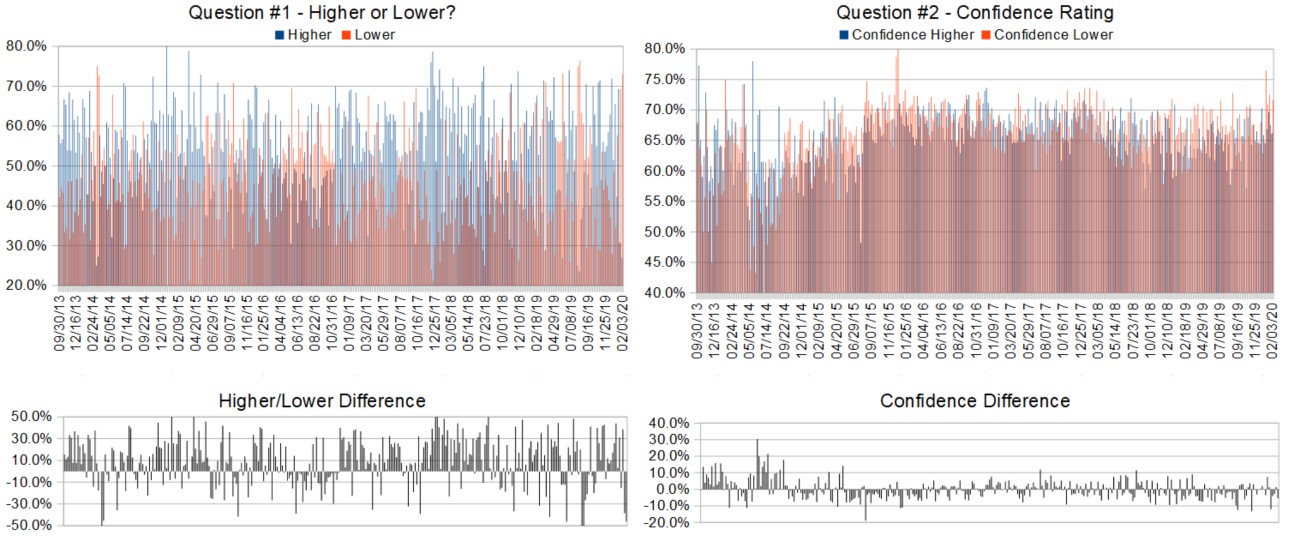

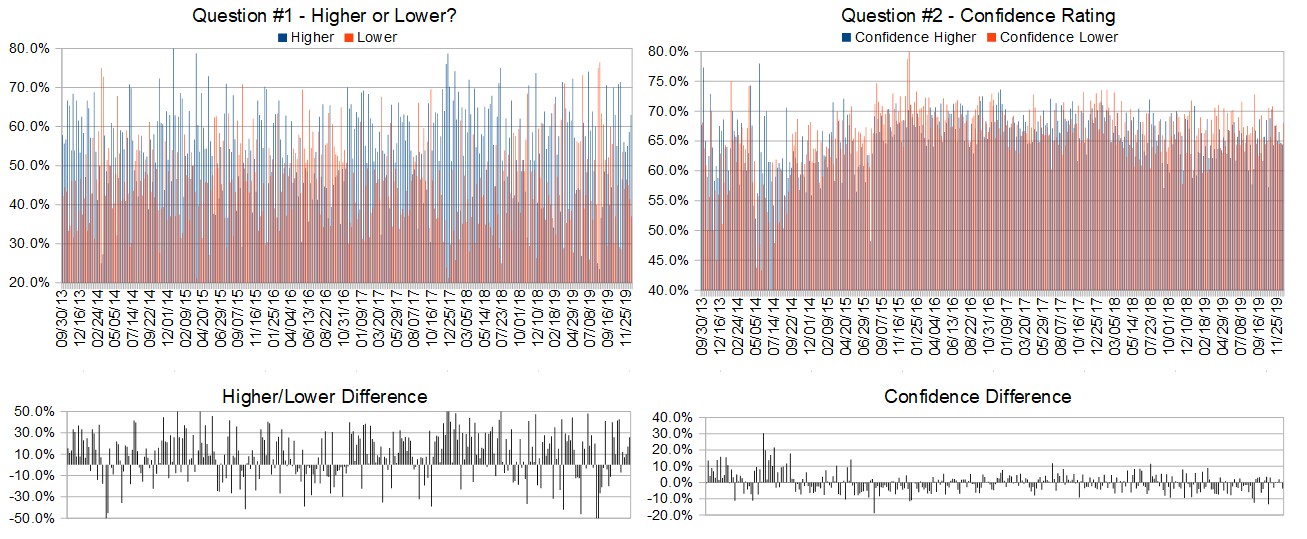

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 3rd to 7th)?

Higher: 26.9%

Lower: 73.1%

Higher/Lower Difference: -46.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.0%

Average For “Higher” Responses: 66.3%

Average For “Lower” Responses: 71.7%

Higher/Lower Difference: -5.4%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 33.3

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 69.2% predicting Lower, and the Crowd Forecast Indicator prediction was 77% chance Higher; the S&P500 closed 0.67% Lower for the week. This week’s majority sentiment from the survey is 73.1% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 26 times in the previous 331 weeks, with the majority sentiment (Lower) being correct only 35% of the time and with an average S&P500 move of 0.55% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

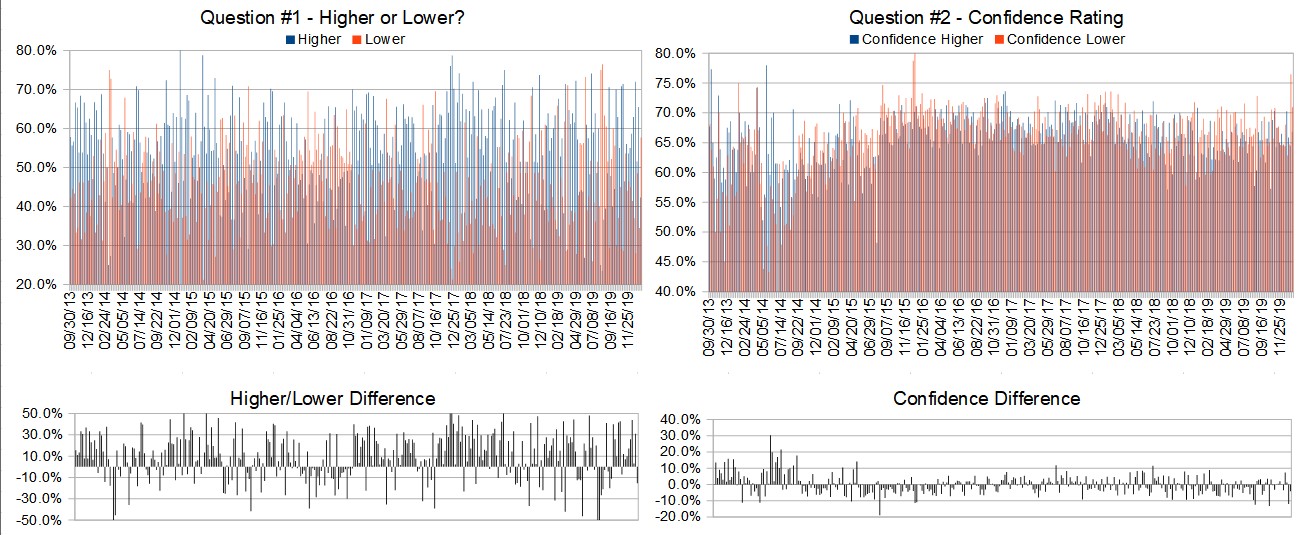

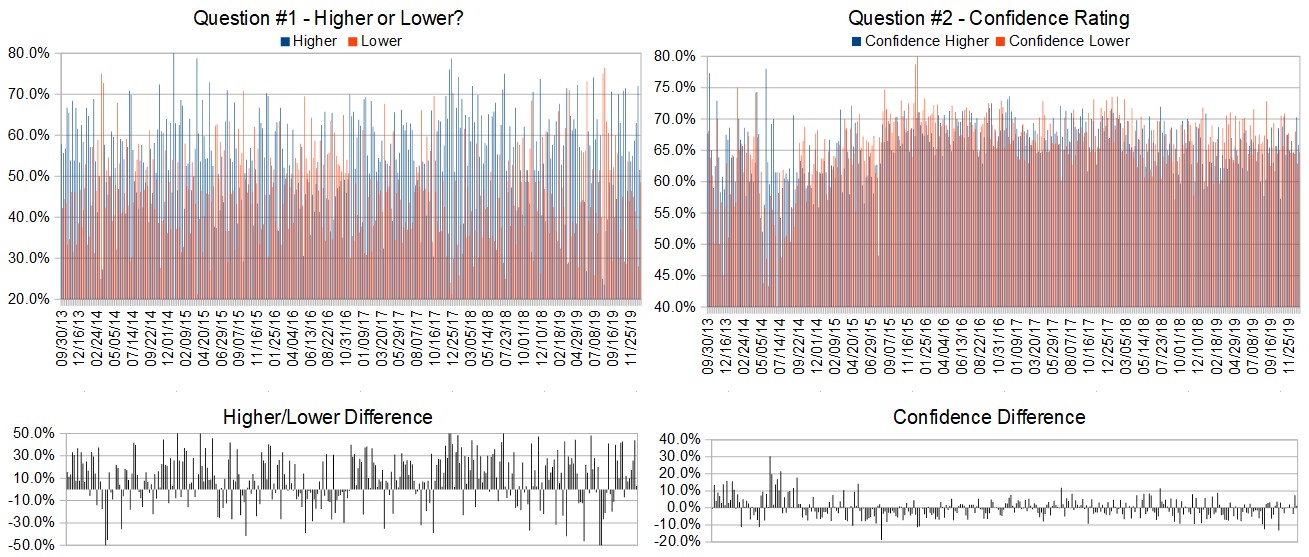

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

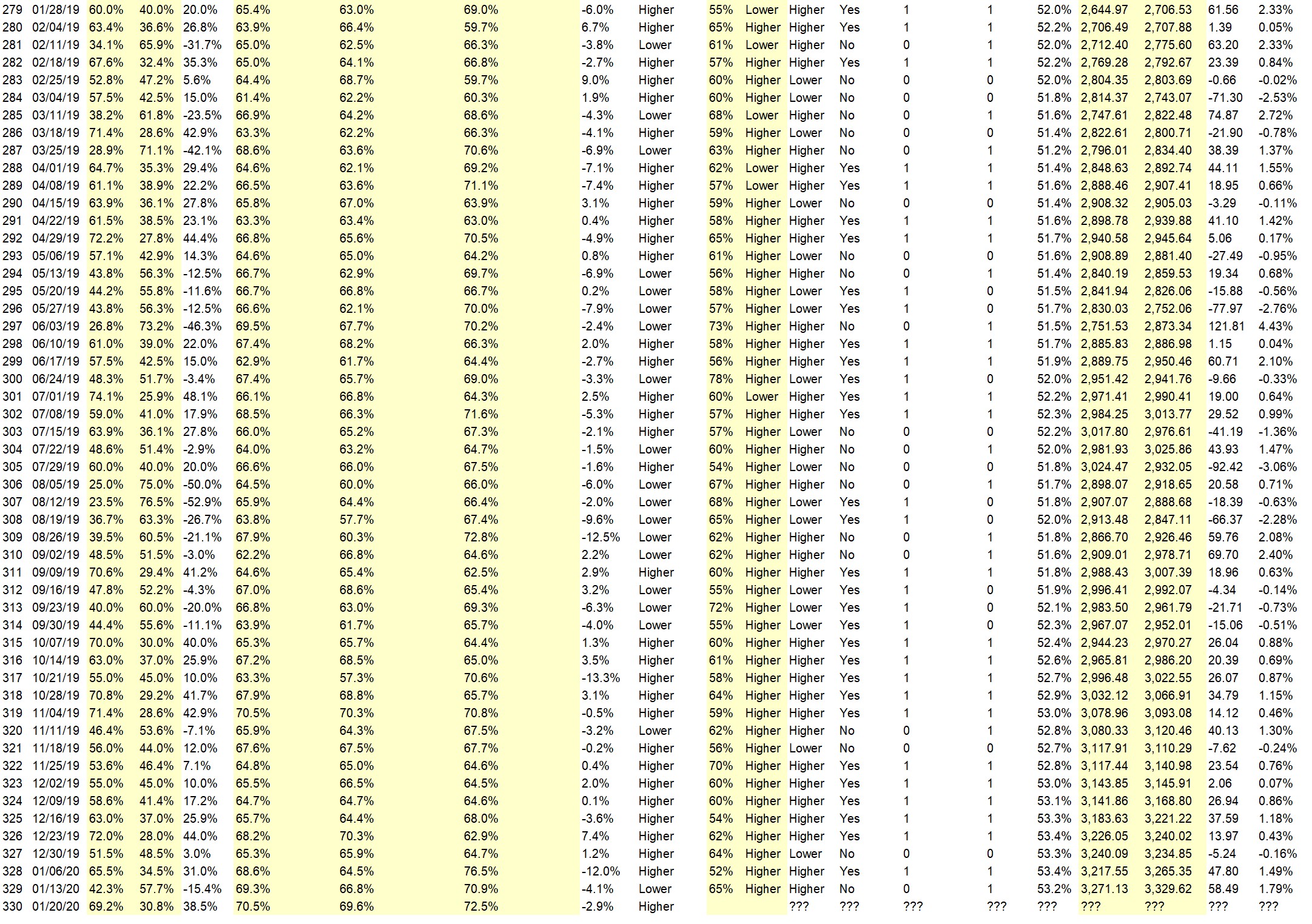

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.2%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• successfully tested weekly support

• history

• After a big loss on Friday, the powers to be will come out with some new revelation that all is better with the corona virus spread…markets will react and regain some of what was lost

• FOMC

• The slide is over this week.

• Mechanics – what goes down has to go up…

“Lower” Respondent Answers:

• Sentiment has turned bearish (short term)

• Corona virus takes its toll

• The china virus outbreak, january’s negative close at the year open line.

• China re-open financial market after new year’s close. China’s coronavirus has not been contained and the fear of spreading to the world is expanding.

• Coronavirus situation continues to get worse, with a long incubation period leading to uncertainty about containing it. This problem is expanding globally; and it’s too soon to think that it’s about to ease.

• Market is in downside correction. Additional Earnings reports and China to weigh on market.

• market due for another 5% decline

• Following Dow down through support

• coronavirus

• Corona virus Fear

• Well, who would have expected the developing situation involving Coronavirus but this could become the trigger for the onset of the next revession. That means either the stock markets take a sudden crash or a bear market could usher in this inevitable recession. You can never predict exactly when a recession will begin but with a capitalistic economy, you only have boom or bust periods. Capitalism has a way of being a violent economic philosophy, up or down. There is little middle ground. Until the inevitable downturn in the markets materializes, I am locked in the expectation that a downturn is coming. Fact is the markets have been acting irrational for sometime. The correction or crash is inevitable. I patiently wait.

• The needs been stampede awaiting a bottom chart formation / Market pullback to continue until CAPITULATION

• Based on S&P Global Market Intelligence

• January ended up down for the month because of Coronavirus and it will just get worse as the disease spreads.

• Short term trend

• Definitly the corona virus, threating global growth.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. What methods or techniques do you use to overcome the emotional aspects of trading?

• stops and MAs

• Chart analysis

• don’t watch news

• experience

• Check my rules

• Try to put the situation into perspective by viewing long term charts.

• I sell early.

• Moving Average

• Using references at specific key times of the day, pivot/ key numbers and price action & limit the time in front of the PC screen.

• Hedge all the positions

• NEED ONE

• technical signals

• CUSIP Number Treasury Auction Results

• patience

• Exersize walking

• i don’t have one…I wish I knew…I am looking for advice

• Placing a hard Stop

• a 100% rules based decisions.

Question #5. Additional Comments/Questions/Suggestions?

• Steuerliches Identifikationsnummer nach Ziffer 139b Abgabenordnung

• I´m not exactly confident on my market course, it could definitly go sideways or slightly hier. But friday´s close was definitly very significant to be bought.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Join us for this week’s shows:

Crowd Forecast News Episode #253

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, February 3rd, 1PM ET (10AM PT)

Lineup for this Episode:

– Jim Kenney of OptionProfessor.com

Analyze Your Trade Episode #112

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 4th, 4PM ET (1PM PT)

Lineup for this Episode:

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #331

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport012620.pdf

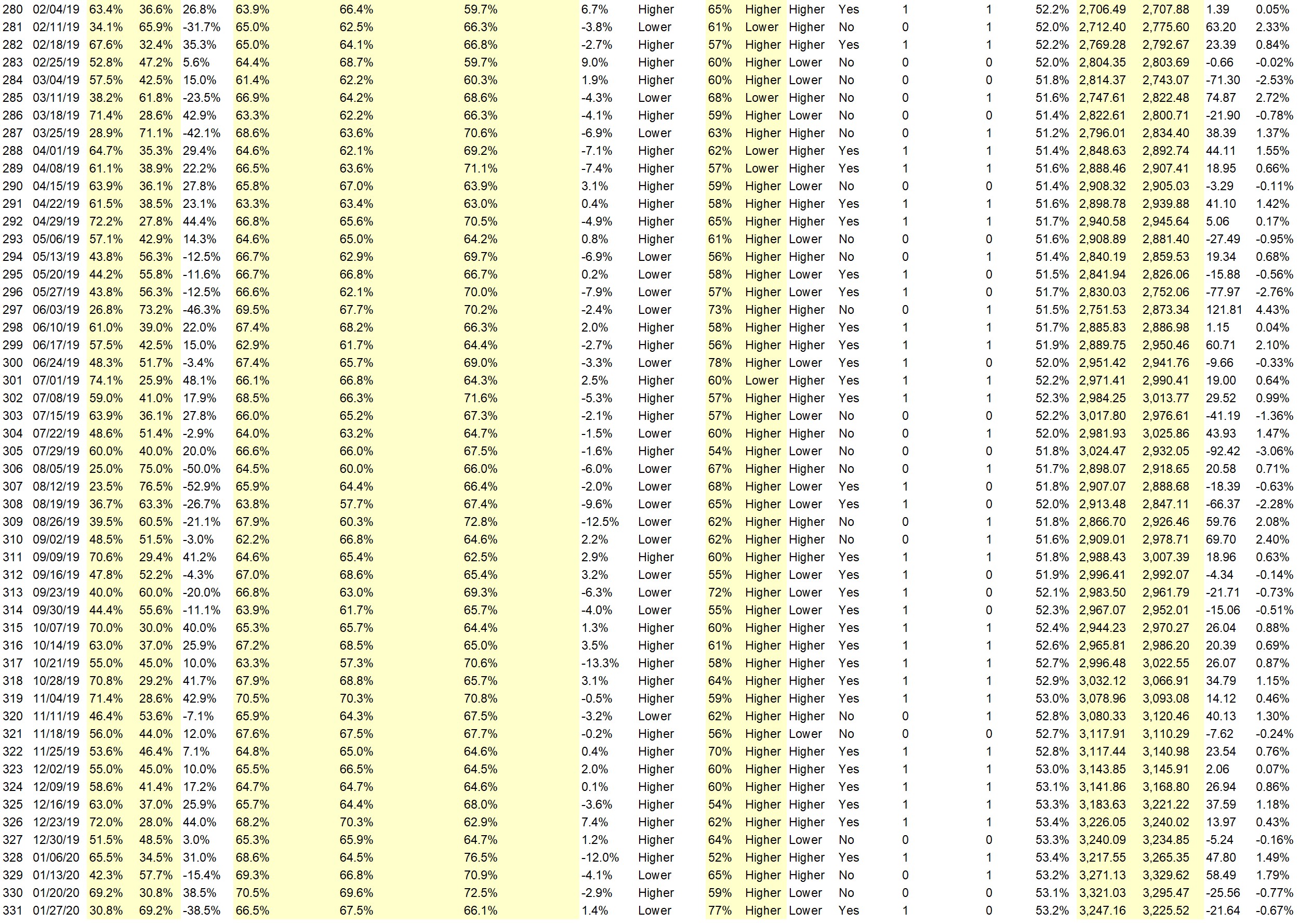

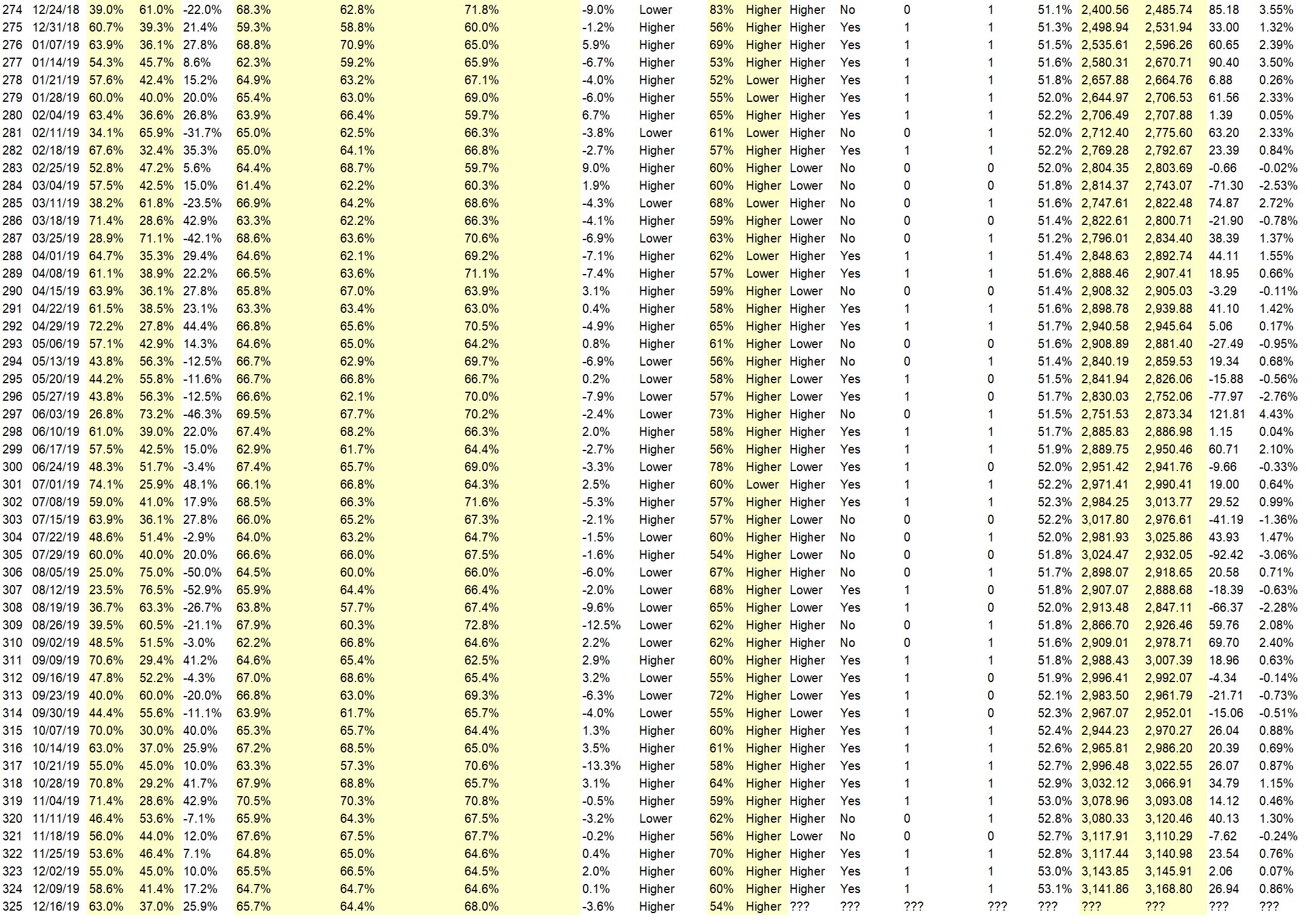

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 27th to 31st)?

Higher: 30.8%

Lower: 69.2%

Higher/Lower Difference: -38.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Responses Submitted This Week:

52-Week Average Number of Responses:

TimingResearch Crowd Forecast Prediction: 77% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 69.2% predicting Higher, and the Crowd Forecast Indicator prediction was 59% chance Higher; the S&P500 closed 0.77% Lower for the week. This week’s majority sentiment from the survey is 69.2% predicting Lower with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 13 times in the previous 330 weeks, with the majority sentiment (Higher) being correct 77% of the time but with an average S&P500 move of 0.47% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 77% Chance that the S&P500 is going to move Higher this coming week.

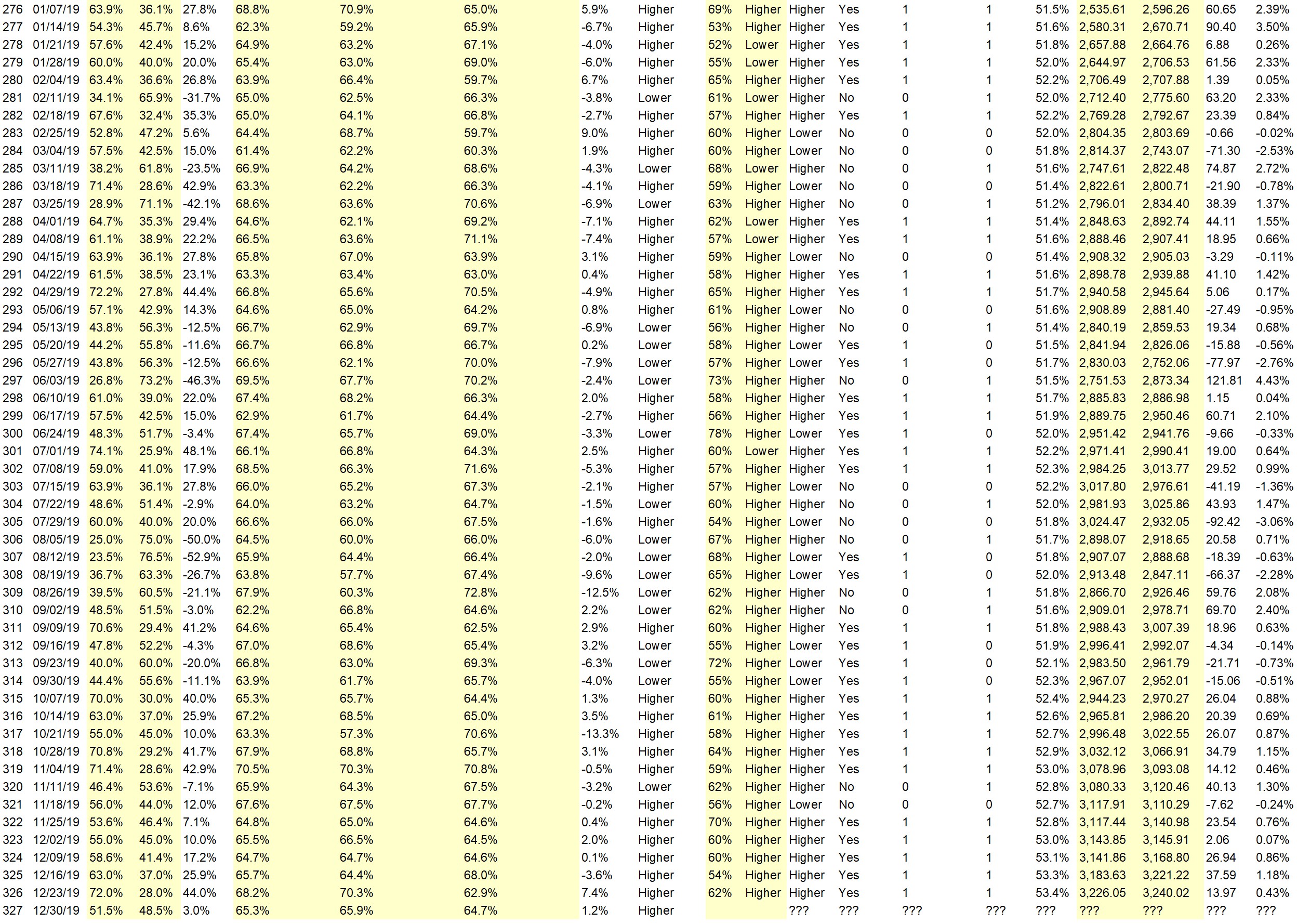

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

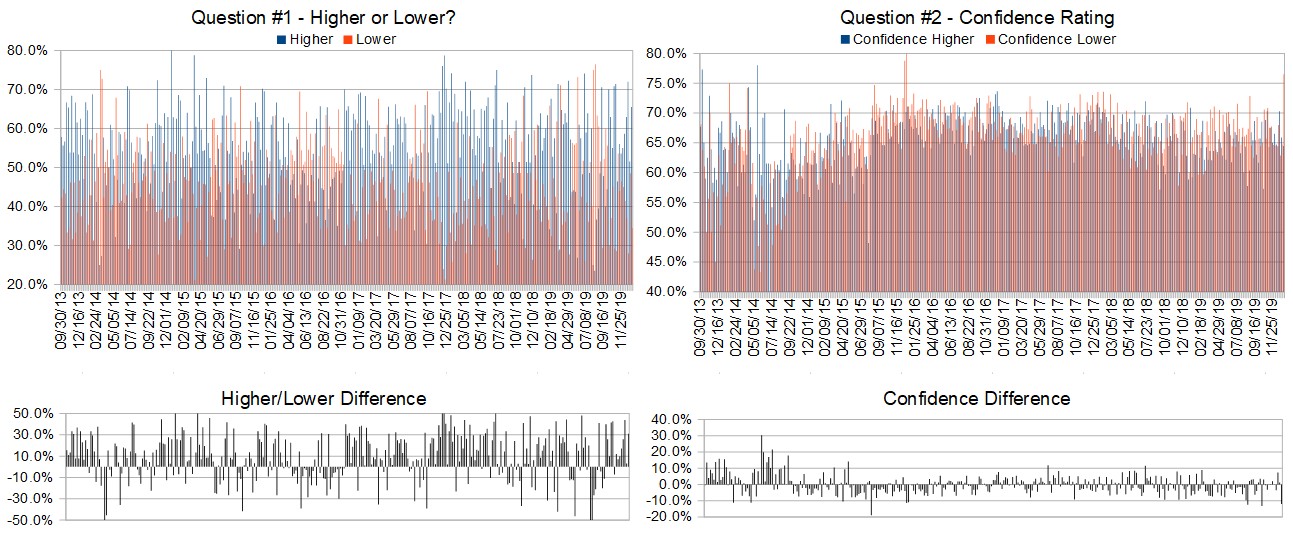

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.1%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• It follows the current trend.

• Large cap earnings will drive market to higher

• seasonality

• Long term trend

“Lower” Respondent Answers:

• Virus

• Corona virus slowing down the world for at least one quarter

• Corona Virus

• Chinese virus spread and fears. Market is due for a correction.

• That varse in Janpan

• Market has risen much more than justified based on corporate earnings. The last time that the market looked this overbought following a long leg up was in late Jan 2018; and then the market dropped hard.

• Big week for earnings disappointments. The virus continues to spread.

• Natural pullback

• Tda, tasty trade

• It’s that time of the year.

• Technical

• the China outbreak continues and will worsen

• Impeachment trail

• cause it closed deeper on Friday last week

• It’s time for a correction, if it goes lower by Friday than this week ending 24/1/20 then lower again.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. What procedures do you use for trade management?

• risk

• stops

• Stop Loss

• support / resistance

• Stop sell or buy back loss orders

• Usually about equal levels spread over several stocks.

• Trail using moving averages

• Stop loss

• I am still looking for a good trading-journal, that fits my needs…. I still did not find that. Then I need to grow a tiny account to a bigger one, which makes trade management possible. You need at least a few couple of thousand bucks to make tradde Management possibl, right? You can´t do that with a 1k-account. After reaching a mangable trade size of 2-3k then there is it makeable to hold on managemnet-rules as 1-2% max.risk per trade. For all that I still need a trading-journal to track my trades first…

• charts

• stops

• stops

• Volatility

Question #5. Additional Comments/Questions/Suggestions?

• none

Join us for this week’s shows:

Crowd Forecast News Episode #

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday,

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Analyze Your Trade Episode #

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday,

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #10

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday, January 11th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #330

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport012020.pdf

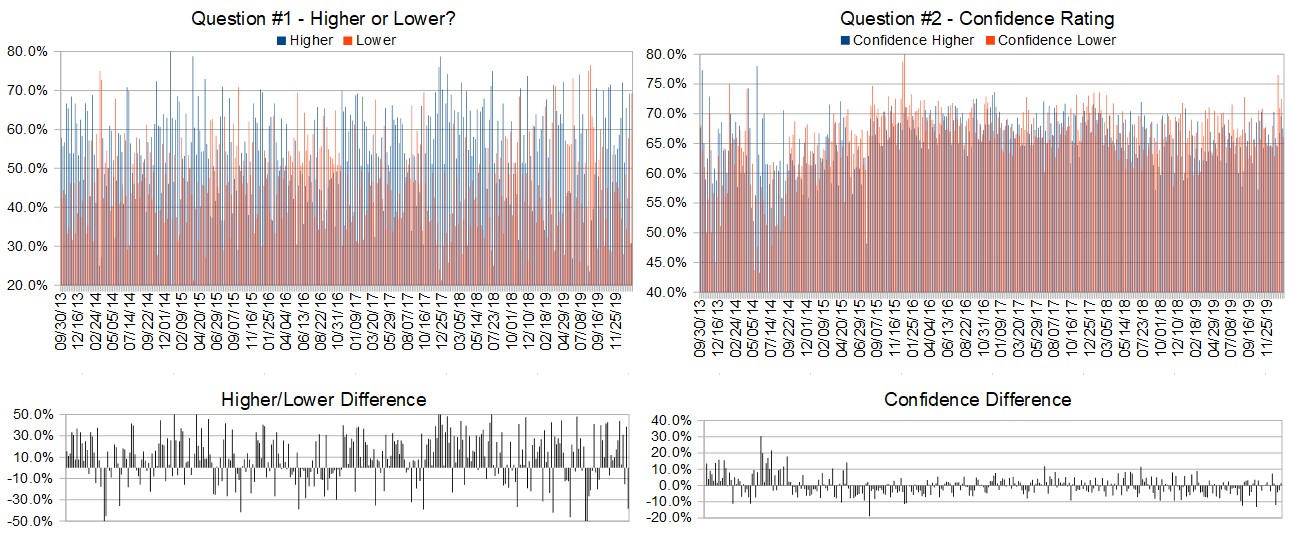

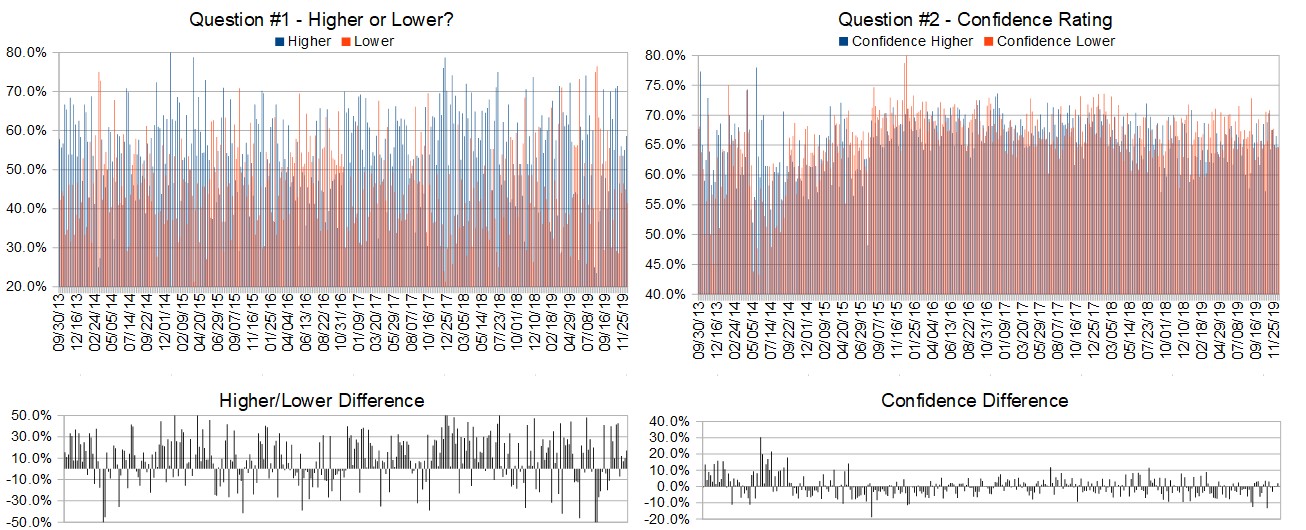

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (January 21st to 24th)?

Higher: 69.2%

Lower: 30.8%

Higher/Lower Difference: 38.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.5%

Average For “Higher” Responses: 69.6%

Average For “Lower” Responses: 72.5%

Higher/Lower Difference: -2.9%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 33.5

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 69.2% predicting Higher, and the Crowd Forecast Indicator prediction was 65% chance Higher; the S&P500 closed 1.79% Higher for the week. This week’s majority sentiment from the survey is 69.2% predicting Higher with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 34 times in the previous 329 weeks, with the majority sentiment (Higher) being correct 58.8% of the time but with an average S&P500 move of 0.002% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

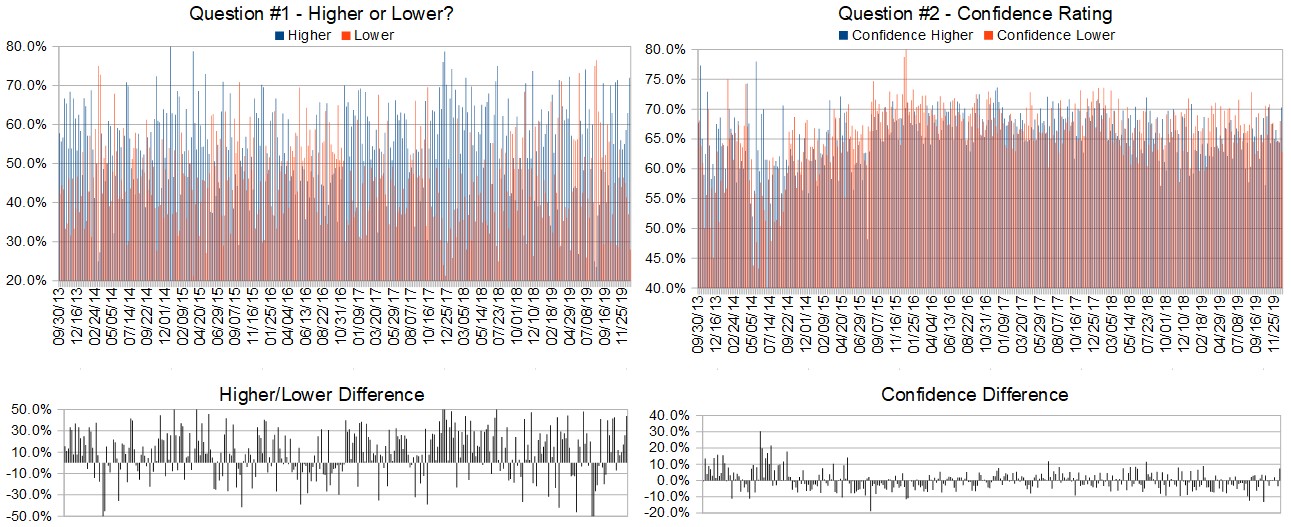

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.2%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• From a Canadian perspective, Donald Trump is President!!

• Fed announced continue purchase in repo market until April, lack of fear in the markets by continuation of buying the dips. Dumb money continues to flow in and FOMO.

• news is positive no surprises

• trend

• Trend is up this January. Trade deals have been signed between USA China mexico and canada.

• it is on a healthy uptrend with short wicks

• On the fence. Correction sometime?????

• Euphoric optimism

• Tariff’s resolved and impeachment resolved

• best six months of the year historically

• market heading for a meltup garbage stocks rallying huge upside then craaaaaaaaaaaaaaaaaaaaaash!!!!!!!!!!!!!

• momentum

• history

• Expecting favorable earnings to help maintain the uptrend for a bit longer.

• Good earnings reporting influences market.

• Breaking out to new highs, dips are bought

“Lower” Respondent Answers:

• Impeachment Trial Of the President of the United States starts and this ( may ) have an effect on the Markets , maybe !

• Market is overbought. Profit-taking to continue into earnings season.

• It’s up soo much. Probably consolidates her for awhile until it decides which direction it wants to move based on economic data. If numbers keep coming out positive then it will move higher. Technically it hasn’t broken any of my moving averages, so can’t say it will move higher.

• profit taking

• I know it will be higher as TRUMPs men mnuchin and his group is using Feds flood of cash to buy buy buy. They are destroying the market even though nobody real seems to be buying

• Market is short term overvalued driven by extreme complacency and greed on part of the traders. Hence, the market is overdue for a pullback or at least consolidation.

• Correction coming

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week, but back on January 27th.)

• A honest discussion on how the very small option trader can win

• Good trading strategies.

• gold,facebook,tesla

• Monthly income with options

• What is a melt-up

• Topics about option programs such as calendar spreads, iron condor options, diagonal spreads,delta neutral portfolios.

• How high will debt have to grow before it will start affecting the markets and government policies?Cannabis and Cannabis related Stocks – Talk to the CEO’s , Company Leaders – which way are they going to go ? – Predictions with a possible another 15 States may go Legal in 2020 ?

• How to trade gap on S&P500 (SPY) or E mini. Thanks.

• How they destroy the US markets by never letting it to be natural free flowing market.

• rotation

Question #5. Additional Comments/Questions/Suggestions?

• The last stock episode was very good. Harry Boxer explained very clearly and I would like to see him more.

• I am becoming so tired of US markets that i will rather move to another country and open CFD accounts to do trading with other instruments that are NOT USA manipulated

Join us for this week’s shows:

Crowd Forecast News Episode #252

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 27th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Analyze Your Trade Episode #110

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 28th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #10

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Friday-Saturday, Jan 31-Feb 1st, 2020

– TBA

Moderator and Guests:

– TBA

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #329

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport011220.pdf

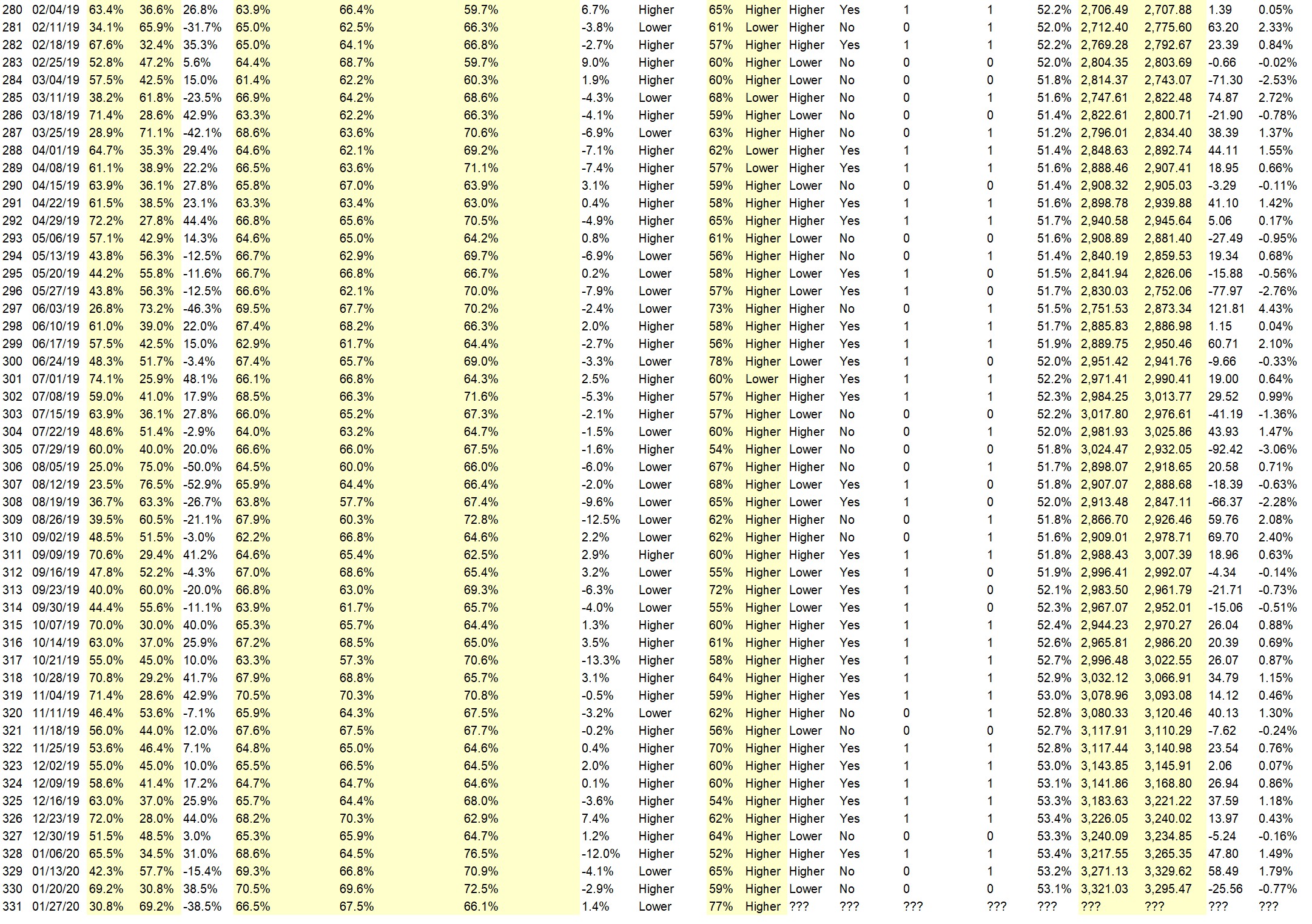

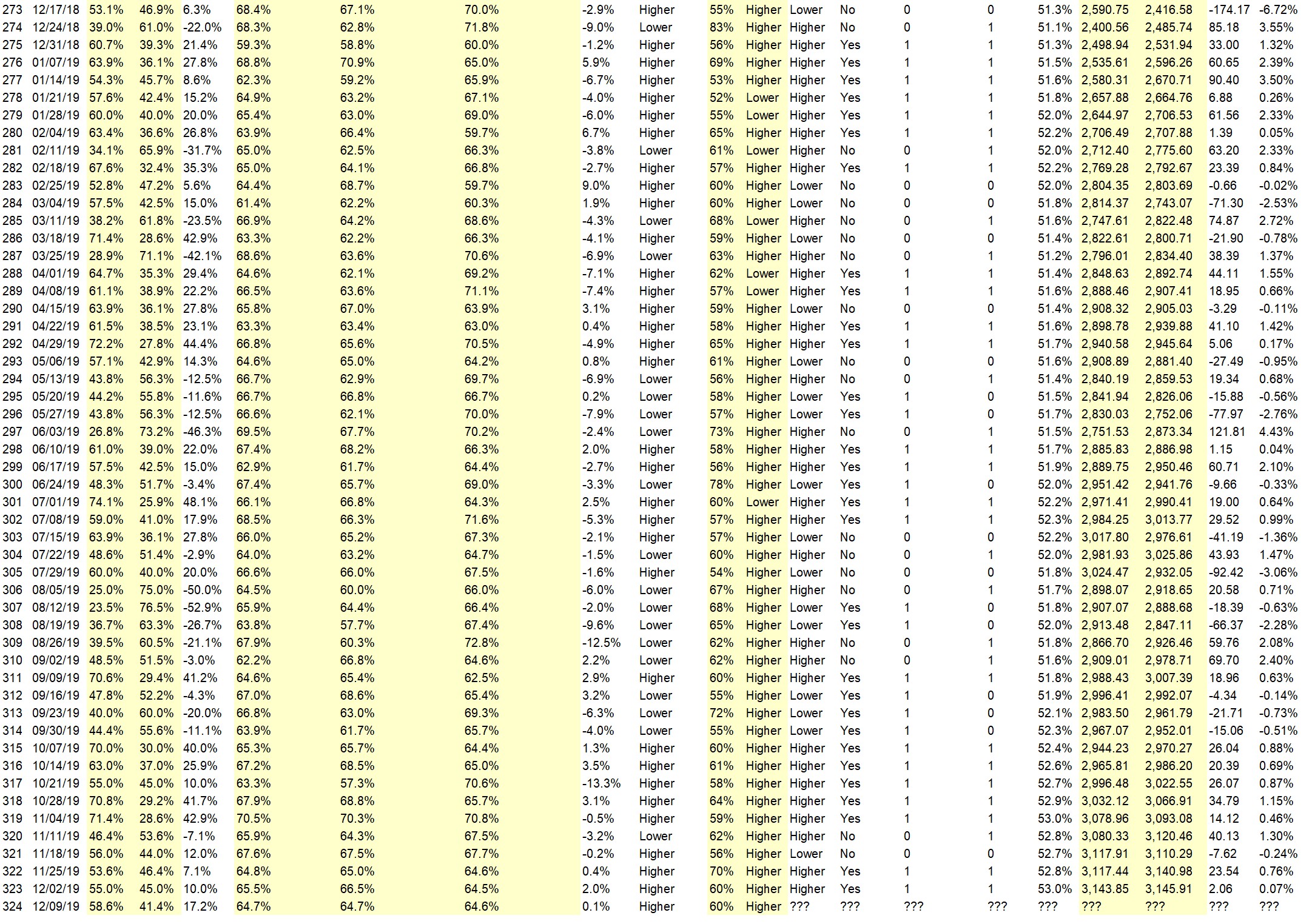

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 13th to 17th)?

Higher: 42.3%

Lower: 57.7%

Higher/Lower Difference: -15.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 69.3%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 70.9%

Higher/Lower Difference: -4.1%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 33.3

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 65.5% predicting Higher, and the Crowd Forecast Indicator prediction was 52% chance Higher; the S&P500 closed 1.49% Higher for the week. This week’s majority sentiment from the survey is 57.7% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 31 times in the previous 328 weeks, with the majority sentiment (Lower) being correct only 35% of the time but with an average S&P500 move of 0.47% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• well — wave 5 still continues

• Seems to be general direction.

• Earnings and nobody fears the markets overseas

• Historically best six months of year

• 1/15 U.S. and China are signing the Phase I agreement.

“Lower” Respondent Answers:

• Re-bound from good week

• Index taking a rest maybe needs to go sideways for a while

• long overdue

• The S&P has been at the upper Bollinger band the most recent 2 days. Looking for a pullback to the 50 day moving avg at 3220 or below.

• Too many stocks topping out

• Profit-taking in front of earnings season.

• slowing economy

• Market reached a short term peak last thursday. Earnings likely to be weaker than expected

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• Great Question.

• Notebook

• p/l

• New worth

• I keep track of which trades yield positive results and which negative. Then I can gravitate to the more successful types of trades, and avoid the others.

• Quarterly review

• watching growth of management teams

Question #5. Additional Comments/Questions/Suggestions?

• none

Join us for this week’s shows:

Crowd Forecast News Episode #251

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 13th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Anka Metcalf of TradeOutLoud.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #109

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 14th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Harry Boxer of TheTechTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders Event #10

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Friday-Saturday, Jan 31st-Feb 1st, 2020

– 10AM-3PM ET (both days)

Moderator and Guests:

– TBA

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #328

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport010520.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 6th to 10th)?

Higher: 65.5%

Lower: 34.5%

Higher/Lower Difference: 31.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.6%

Average For “Higher” Responses: 64.5%

Average For “Lower” Responses: 76.5%

Higher/Lower Difference: -12.0%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 33.5

TimingResearch Crowd Forecast Prediction: 52% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.5% predicting Higher, and the Crowd Forecast Indicator prediction was 64% chance Higher; the S&P500 closed 0.16% Lower for the week. This week’s majority sentiment from the survey is 65.5% predicting Higher with a much greater average confidence from those who are predicting Lower. Similar conditions have occurred 25 times in the previous 327 weeks, with the majority sentiment (Higher) being correct only 52% of the time but with an average S&P500 move of 0.51% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 52% Chance that the S&P500 is going to move Higher this coming week.

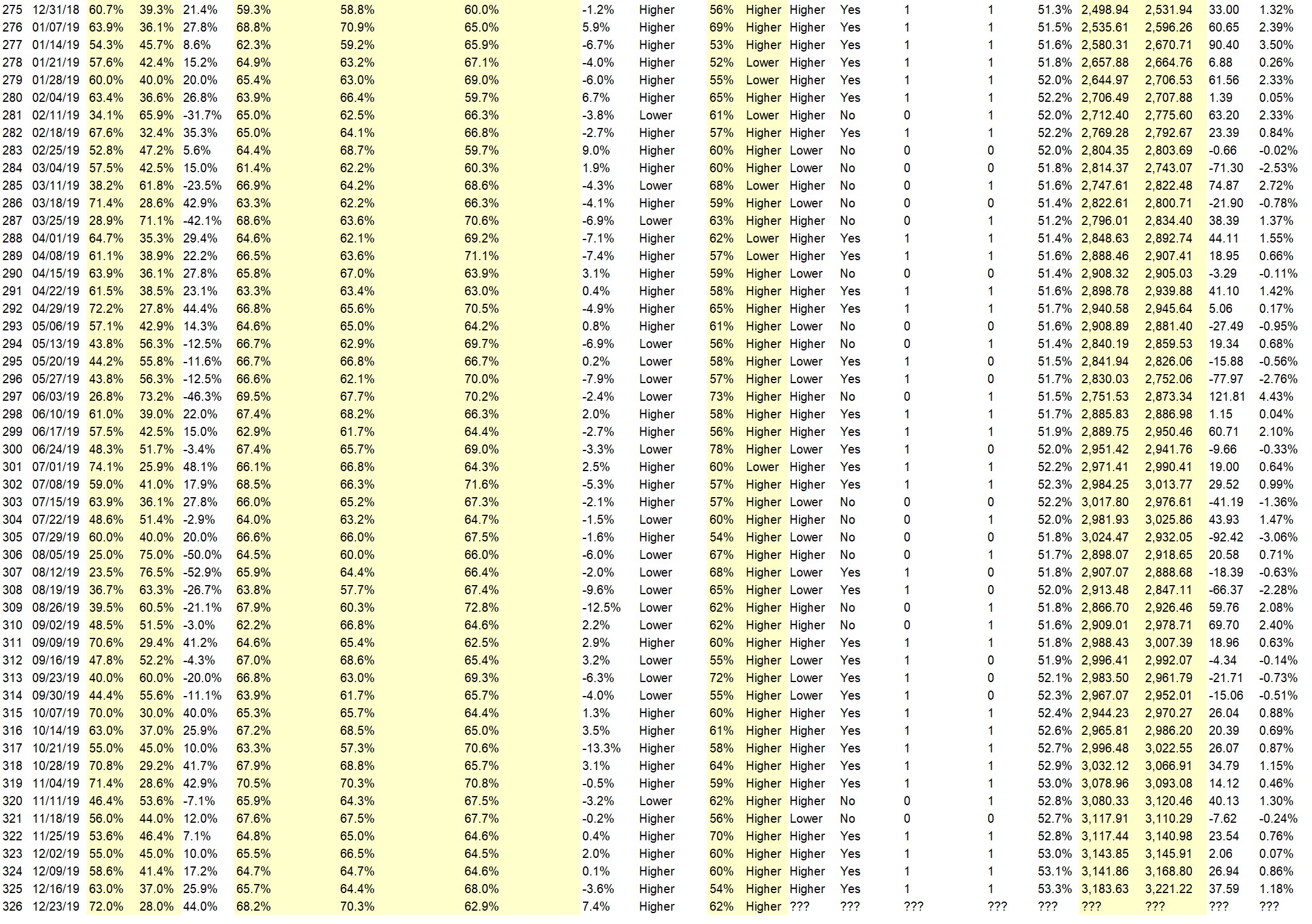

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

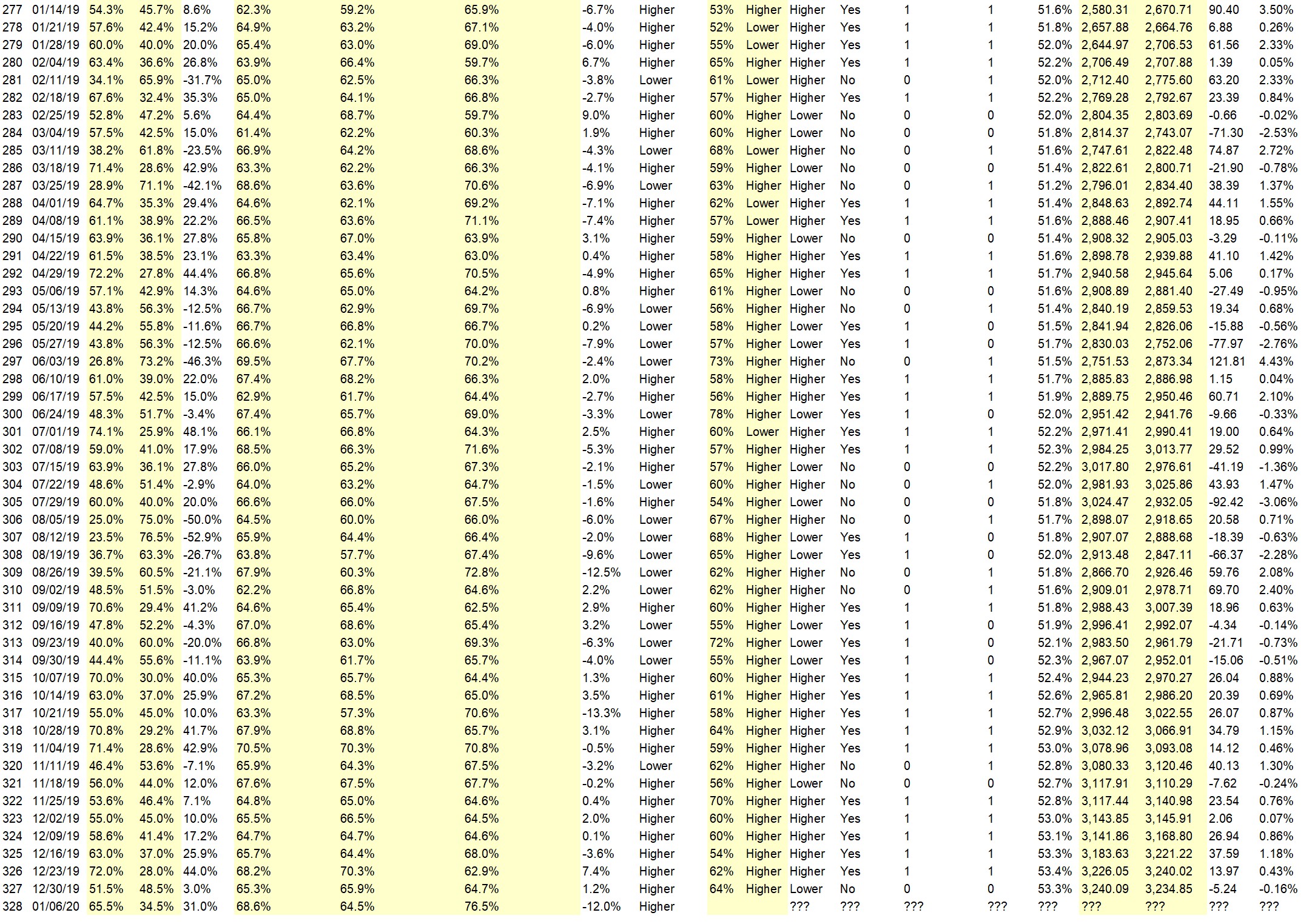

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.3%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Most indicators are positive and I believe that the Iran issue will not be a factor since it didn’t effect the market this last Friday.

• trend

• The general direction up to elections is higher. However Brexit, China-trade and other possibilities with countries may create choppy waves. Professional and institutional traders are back from vacations so they’ll be looking for the next big buys.

• Best six months of year historically

• Trump is in the White House!

• I think the Sp500 needs to be high

• 5G

• wave 5 still continues

• The world will understand that we are not the same country Obama ruined, but rather one “that does what it says it will do.”

• Technicals

• Jan affect

• rebound

“Lower” Respondent Answers:

• Trend up continues

• MiddleEasturest

• conflict with Iran

• Threats from Iran and other middle eastern terrorists create market uncertainty. Perhaps a retaliatory strike against the US or allies ratchets up the possibility of a more heated conflict.

• tension in golf

• Unease with geopolitical situation re: Iraq/Iran/USA

• Trend in US D0llar d0wn

• Iran and weak nations complaining.

• It was a fine leg up from early October to very recently. Now, it’s time for some retracing, given all the uncertainty, an appropriate time for profit-taking, and a MACD negative divergence.

• world in turmile

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. Which trading platforms or brokers do you like the best for executing your trades?

• I like platforms better

• tastyworks,thikorswim

• Schwab

• Fidessa platform, my broker is ADMISI

• TradeStation

• Think ir swim

• ThinkOrSwim

• etrade

• Fidelity and TOS

• They ALL aren’t good

• TD AMERITRADE

• TOS

• TC2000

• Any of the discount brokers, as I am trying to learn the ropes. // Big names have to get nimble … the pace of trading is accelerating exponentially as the civilized world becomes more fragmented. Soon, the crypto’s will overtake the establishment ,, and they all will suffer. // The day of the fat cat is coming to a close >> I’m guessing within 10 months you’ll see an answer emerge.

• E-Trade

Question #5. Additional Comments/Questions/Suggestions?

• I think the trades is going to be good

• Will be an exciting 1st week i suspect :)

• I predict a new breed of criminal is developing, and they no longer wear white collared shirts. Though, those criminals do still exist > they will be forced to submit, once nobody is interested in their game anymore. /// We are changing fields/venues >> and the old guard is not invited. Glad they could skim our billions while it was working, but now nobody wants to listen to their bought politicians. // Just read where John McAffee wants to put jerseys on them, representing the corporations they are beholden to >> just like Nascar does. I think this all hilarious >> and I hope someone read through this diatribe for the fun of it. // In reality, I don’t think there’s 40 years left ..we’ve spoiled what was given to us, all in the name of pride and greed. Thanks!!

We’re back to the normal schedule of shows for the next few weeks! Join us for these upcoming TimingResearch events:

Crowd Forecast News Episode #250

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 6th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Neil Batho of TraderReview.net

Analyze Your Trade Episode #108

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 7th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Anka Metcalf of TradeOutLoud.com

Synergy Traders Event #9

Join us for this event. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time:

– Saturday, January 11th, 2020

– 9AM-3PM ET (6AM-12PM PT)

Moderator and Guests:

– 9AM ET: Harry Boxer of TheTechTrader.com

– 10AM ET: Price Headley of BigTrends.com

– 11AM ET: Mark Sachs of RightLineTrading.com

– 12PM ET: Andrew Keene of AlphaShark.com

– 1PM ET: Jim Kenney of OptionProfessor.com

– 2PM ET: Anka Metcalf of TradeOutLoud.com

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #327

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport122919.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 30th to January 3rd)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 51.5%

Lower: 48.5%

Higher/Lower Difference: 3.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Responses Submitted This Week: 33

52-Week Average Number of Responses: 33.7

TimingResearch Crowd Forecast Prediction: 64% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 72.0% predicting Higher, and the Crowd Forecast Indicator prediction was 62% chance Higher; the S&P500 closed 0.43% Higher for the week. This week’s majority sentiment from the survey is 51.5% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 75 times in the previous 326 weeks, with the majority sentiment (Higher) being correct 64% of the time and with an average S&P500 move of 0.37% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 64% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Trend/Santa rally continues

• seasonality

• “Things” are looking good.

• Follows the trend.

• momentum

• Historically best six months of the year

• holidays

• Year end, New Year

• Seasonality

• wave 5 still continues

• New Normal and the FOMC actions

• Solid uptrend currently…

• Trend

“Lower” Respondent Answers:

• Tax gain selling into new year

• The market looked tired on Friday. Expecting profit taking as we transition into the new year.

• Tax loss selling and profit taking will dominate this week.

• nbr is now off the air wishing this bull market the best of goodbyes

• Nightly Business Report went 0f2f the air Friday

• friday closing finished in the red so i think it will be a pullback for this coming week

• End of year harvesting.

• year end tax sell off

• its time for a pull back .the volume is going down

• Rose too much, too fast, during last several trading days. Market will take a pause here for a few days to consolidate.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The CFN show is off for one more week, but back on Jan 6th.)

• value stocks

• gold

• Profits

• Best stocks for 2020.

• Put option use

• The effect of the US-China trade relationship on the market.

• market timing

• How to use news events to profit.

Question #5. Additional Comments/Questions/Suggestions?

• none

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Join us for this week’s shows:

Analyze Your Trade Episode #107 (first TR show of the year!)

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday, January 2nd, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Crowd Forecast News Report #326

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport122219.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 23rd to 27th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 72.0%

Lower: 28.0%

Higher/Lower Difference: 44.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.2%

Average For “Higher” Responses: 70.3%

Average For “Lower” Responses: 62.9%

Higher/Lower Difference: 7.4%

Responses Submitted This Week: 26

52-Week Average Number of Responses: 33.6

TimingResearch Crowd Forecast Prediction: 62% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.0% Higher, and the Crowd Forecast Indicator prediction was 54% Chance Higher; the S&P500 closed 1.18% Higher for the week. This week’s majority sentiment from the survey is 72.0% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 29 times in the previous 325 weeks, with the majority sentiment (Higher) being correct 62% of the time and with an average S&P500 move of 0.05% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 62% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.3%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• momentum, economy, trump, indicators

• President Trump is doing an awesome job and the markets recognize it! Prime Minister Trudeau is holding Canada up with a second leadership win, thank you Canadians! Mexico signed the agreement for North American trade, positive news!

• Short week and Santa rally

• Year end movement

• traditional light trade and up week

• wave 5 continues

• bullish

• The S&P continues upward due to decent earnings, the Fed expanding the balance sheet, and GDP at +2.1% (not bad). S&P is near the top Bollinger Band, so looking for sideways to upward movement this week.

• tariff resolution/holidays

• EOM vs. EOY seasonal effects

• Best six months of year historically

“Lower” Respondent Answers:

• Low volume

• Holidays

• Short week

• Shorter week

• Tax loss selling and profit taking will dominate the trading this week.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The CFN show is off for 2 weeks, but back on Jan 6th.)

• tom sosnoff

• Talk about trading platforms, who prefers what type, what is recommended and why. Which is best for individual and institutional investors and why.

• spy moves next week

• option income

• China Trump relations.

• Macd use

Question #5. Additional Comments/Questions/Suggestions?

• The markets will head higher into the election US 2020 election. Trump will win in 2020 and yet again the markets will soar to new all time highs again, and again and again! Longer term, Brexit will work and after the exit. The British people will be happy will drive up markets again! China will come around and deal a better deal for their own growth potential. Hello 2020 here we come!!

• Warlike circumstances in Asia.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Join us for this week’s shows:

Crowd Forecast News Episode #250

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 6th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Analyze Your Trade Episode #107

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday, January 2nd, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders Event #9

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday, January 11th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Crowd Forecast News Episode #249

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)Watch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– John Thomas of MadHedgeFundTrader.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

CFN121619

Crowd Forecast News Report #325

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport121519.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 16-20th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.0%

Lower: 37.0%

Higher/Lower Difference: 25.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.7%

Average For “Higher” Responses: 64.4%

Average For “Lower” Responses: 68.0%

Higher/Lower Difference: -3.6%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 33.9

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 58.6% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.86% Higher for the week. This week’s majority sentiment from the survey is 63.0% predicting Higher with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 39 times in the previous 324 weeks, with the majority sentiment (Higher) being correct 54% of the time but with an average S&P500 move of 0.20% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 54% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• At this point in time (12;15pm) All reports indicate strong economy is still doing well & China reports hold on tariffs on autos & more.

• Less volatility

• year-end rally continues

• Best six months of year historically

• wave 5 continues

• End of year mark up.

• Tariff s and holiday

• Historic.

• Looks like US-China tariffs are being reduced, with the tough negotiations with China being put off. “Buy the dip” is still the operative phrase.

• trend continues

“Lower” Respondent Answers:

• Market will chop around a bit, sideways, then lower by weekends end. People tired of Brexit slow process and EU, the people want change and favour the exit!

• Phase one of the China deal is behind us

• reversion to the mean

• Fear-Greed Index is again showing extreme greed.

• Digestion of gains

• Profit taking and tax loss selling will dominate the trading this week.

• Nothing to move higher. China deal still unsigned and could not happen. Market gets time to analyze how little is in the China deal.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. If you could go back in time and give your 18-year-old self some financial advice, what would it be?

• Lol, buy Apple, McDonalds, Suncor and GE!!

• Save More

• buy fixed dollar amount of the S&P500 index on a monthly basis

• Buy a house with a rental apt.

• Save

• buy the spy-re-invest dividends and put 200.00 month as new money into market along the way.. from 1990–spy-351–to today spy-3700–10x return on your money 29 yrs ..so, 1million in 1990—10 million today dec-2019

• save

• You mean if I could tell the future to an 18 yr old all those years ago? Buy and hold, except during 1987, 2000-2003, 2007-2009, and 2020.

• Invest in growth stocks

• Research before you buy stocks

• Glad you worked for the NYSE at 18 !!!!

• Trade options as a Market Maker.

• Have enough patience to take the time to make sure that you understand what the market or you favorite sector is doing.

• Major in economics

Question #5. Additional Comments/Questions/Suggestions?

• Holidays are here, wishing all institutional and individual investors great blessings today and the coming weeks!

Join us for this week’s shows:

Crowd Forecast News Episode #249

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 16th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– John Thomas of MadHedgeFundTrader.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #106

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 17th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Crowd Forecast News Report #324

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport120819.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 9th to 13th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 58.6%

Lower: 41.4%

Higher/Lower Difference: 17.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.7%

Average For “Higher” Responses: 64.7%

Average For “Lower” Responses: 64.6%

Higher/Lower Difference: 0.1%

Responses Submitted This Week: 33

52-Week Average Number of Responses: 34.0

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 55.0% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.07% Higher for the week. This week’s majority sentiment from the survey is 58.6% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 45 times in the previous 323 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.26% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• President Trump putting Americans to work!

• year-end rally

• Best six months of the year historically

• still finishing wave 5

• Last week finished on a upswing >> but last year saw me lose 25% in the last week. // I’m becoming “Bah, humbug” when Christmas is on the horizon.

• liquidity reelection

• Unemployment

• historic.

• The robust jobs report should prompt the market to continue up, perhaps at a steeper climb.

• Earnings and Momentum

• fundamentals

• Correction over and into the Santa Rally

“Lower” Respondent Answers:

• The economy in all stats is receding. The trade war will end with no winners, only losers. The job numbers are up, because 300,000 people are reaching the age 65 every month. The number of jobs is down over 25,000 each month. The wages are up because of the increases in the minimum wages. The stock market is up only because of stock buybacks by the companies.

• china will not make a deal that is acceptable

• Resistance

• It will always go up as FED and Treasury are supporting trump so that his calls and longs make billions for him plus to show of his treacherous popularity. Whatever we do this market is bound to forever go up and Trump n his billionaiore team is making a billion per week out of all. All our views or tech readings are worthless now. Trump is making his fortunes while he shows off how big he is. Fed is pumping billions each day so what stand shorts stand>

• Needs a 2nd leg down before a final new high, and then a collapse.

• Profit taking and tax loss selling will dominate the market.

• Global monetary issues.

AD: [Workshop] 16 Hour Jump Trades.

Question #4. What indicator influences your trading the most?

• interest rates / fed actions / jim grant

• RSI

• moving average, news

• 200 sma

• moving averages-trends

• RSI + MACD

• RSI

• 50 day moving average EMA maybe i guess i think sometimed

• Price Action

• Trend lines, Channels, Bollinger bands.

• Chart patterns

• Just using.price action with VWAP

• Volume

• The trend of the top 20 stocks is driving the market upwards … Most stocks are actually struggling this year. //// I prefer to look at volume as my leading indicator (sometimes!!)

Question #5. Additional Comments/Questions/Suggestions?

• Profit

• “Go President Trump Go!!”

• With tariffs set to rise on Dec 15, I will get out of longs by Friday and wait

• Totally manipulated unnatural market bound to crush anyone

• I just enjoy your information, and it seems to be quite timely.

Join us for this week’s shows:

Crowd Forecast News Episode #248

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 9th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Dan Passarelli of MarketTakerMentoring.com

– Mike Pisani of SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #105

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 10th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)