- Home

- Crowd Forecast News Reports

Crowd Forecast News Report #323

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport120119.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 2nd to 6th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 55.0%

Lower: 45.0%

Higher/Lower Difference: 10.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.5%

Average For “Higher” Responses: 66.5%

Average For “Lower” Responses: 64.5%

Higher/Lower Difference: 2.0%

Responses Submitted This Week: 20

52-Week Average Number of Responses: 34.2

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 53.6% Higher, and the Crowd Forecast Indicator prediction was 70% Chance Higher; the S&P500 closed 0.76% Higher for the week. This week’s majority sentiment from the survey is 55.0% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 52 times in the previous 322 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.24% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

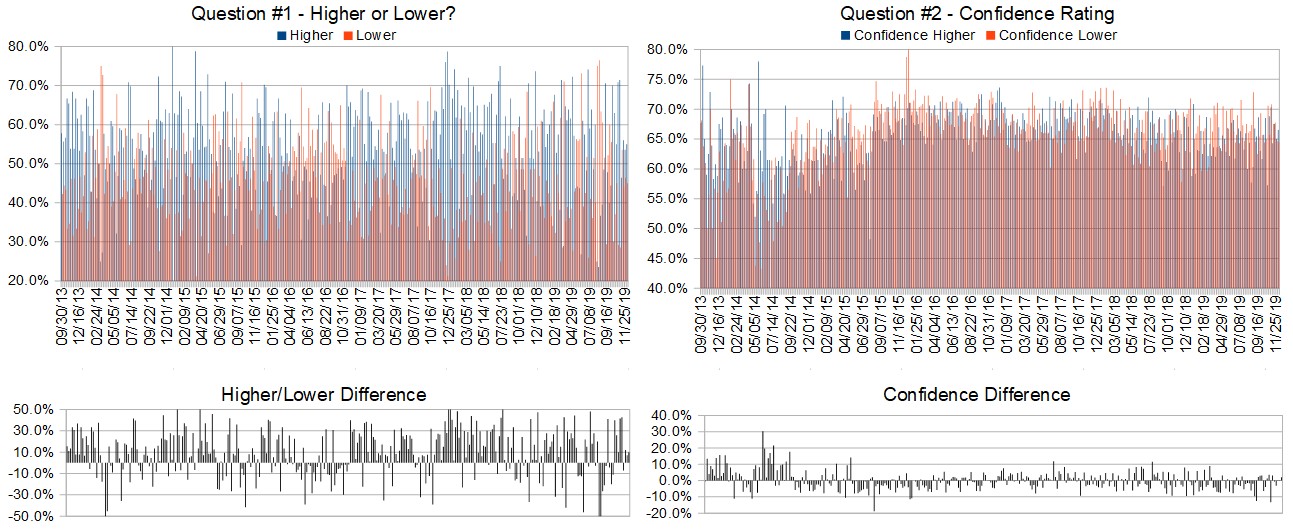

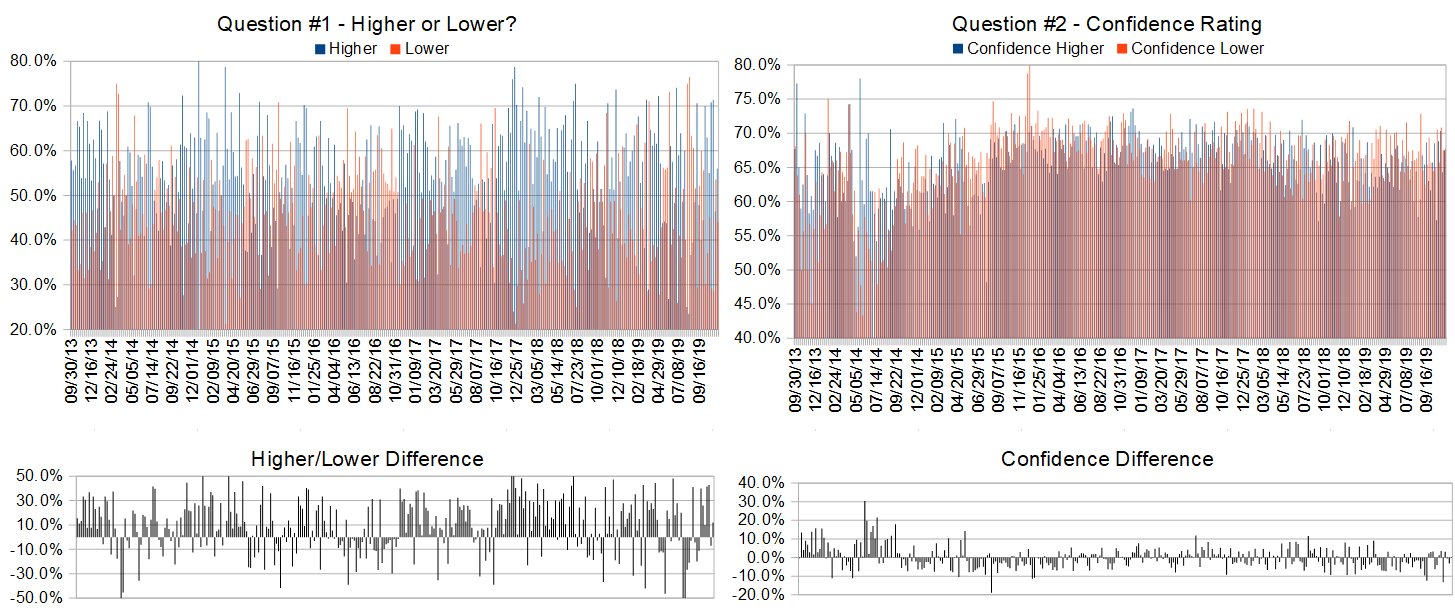

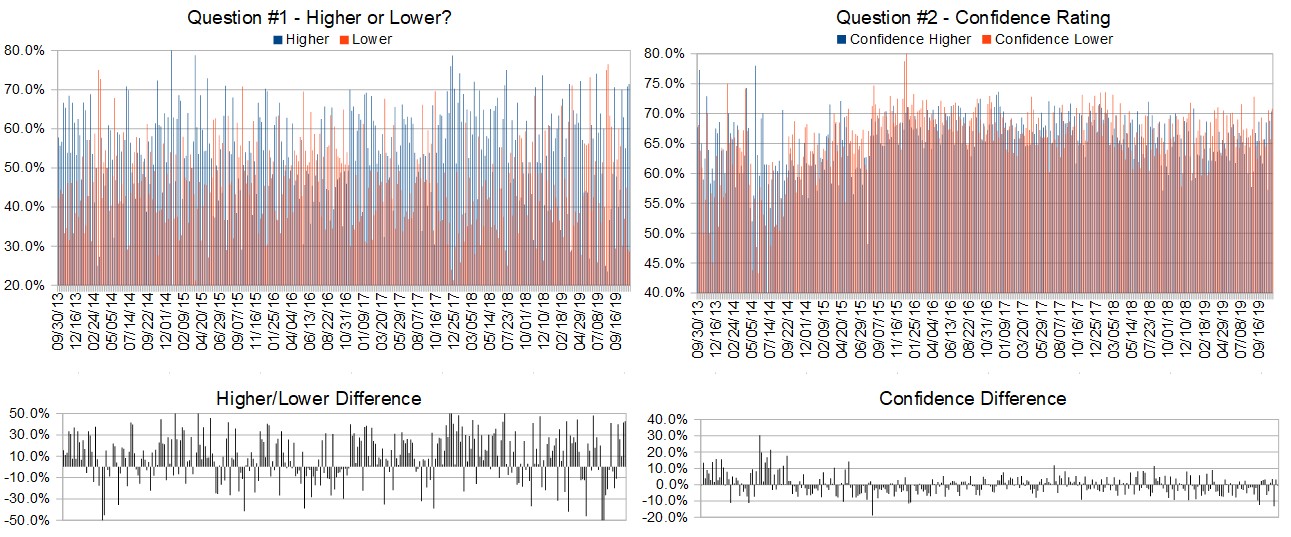

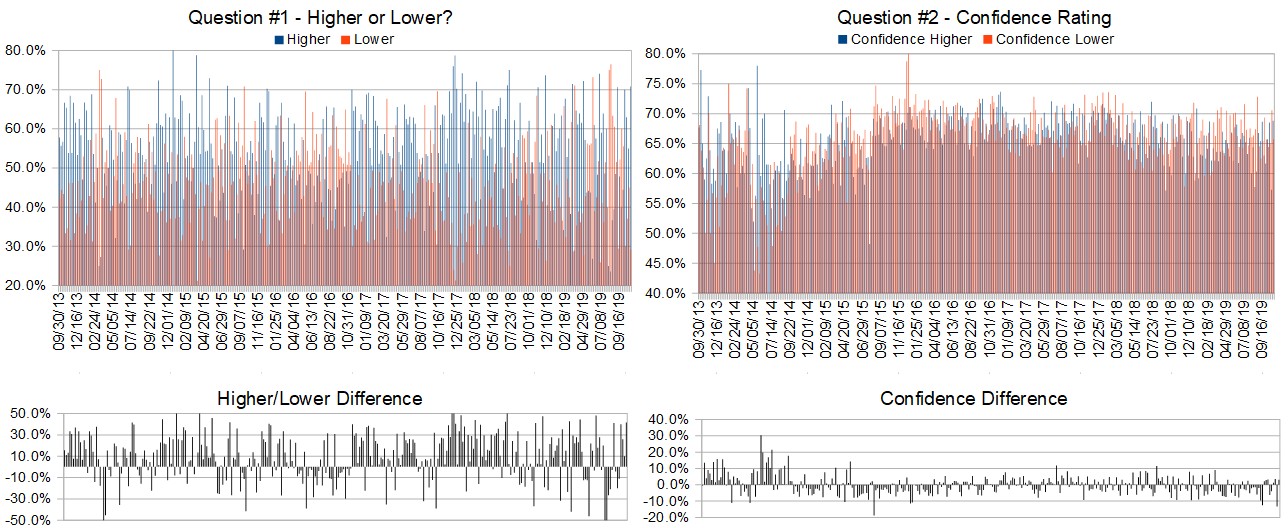

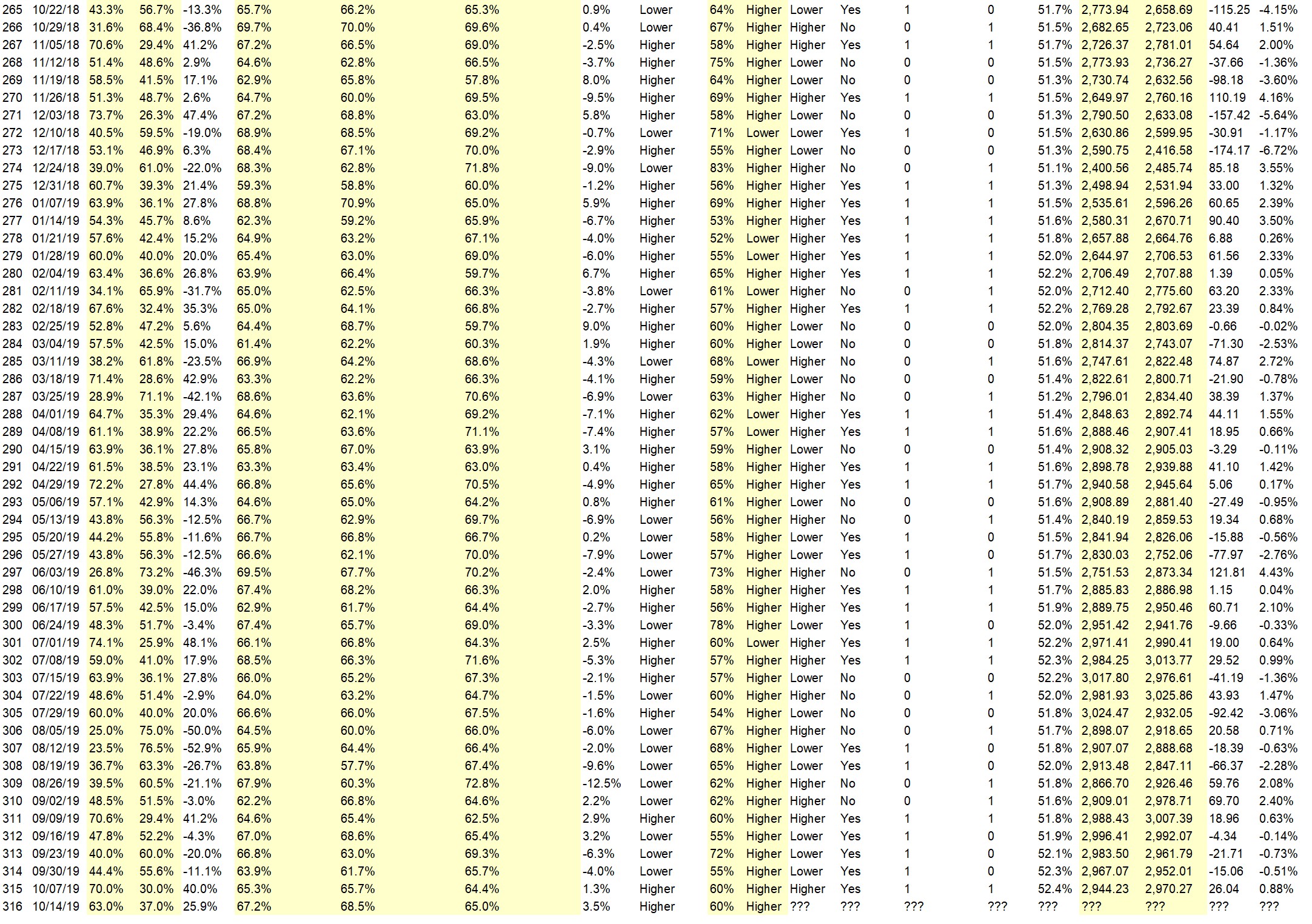

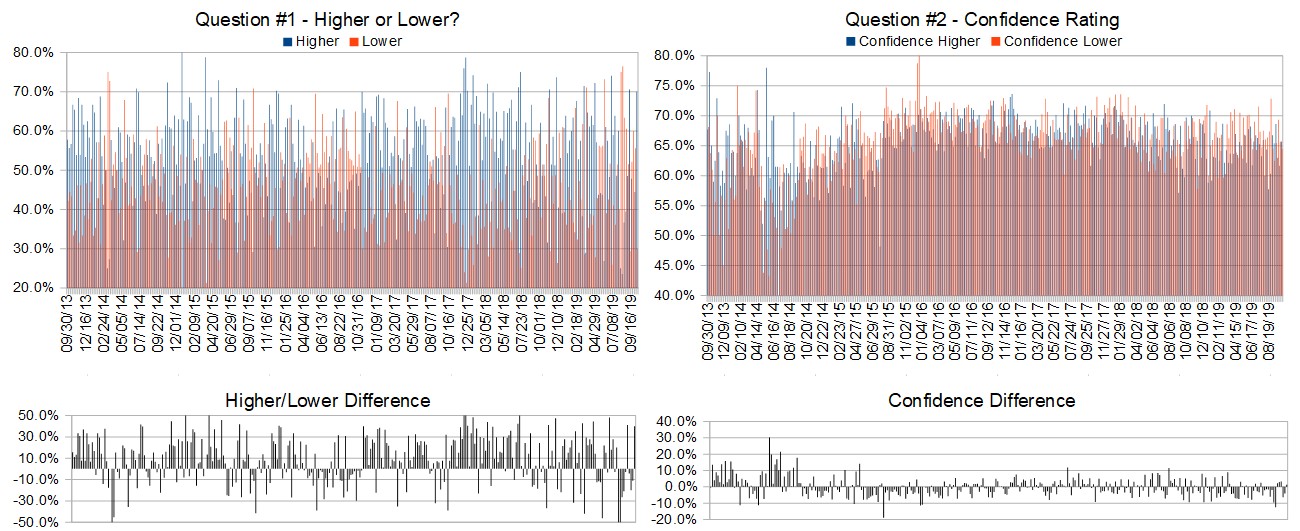

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.8%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Rally for the next three weeks !!

• trend

• The Federal Reserve mentioned a new normal’ I think maybe is ok i guess maybe

• This weekend NOV 30 2019 is of course, as usual, pivotal, we must see what global factor does what, and some more concrete metrics of the Friday and Saturday shopping results, Friday evening Beijing reported rather increased productivity numbers, out of the high 49 area, now at the 54 area, of course is it real, so let’s say it is, that’s a positive, however other corner of mouth calls the resolution ‘meddling’ while millions are cordoned into the electroperimeter up in the NW as if its just fine, and we have magnificent citizens walking together in HK with their held high USA Flags, a rather amazing tribute to just how blessed we are, and held in such esteem, while our Beijing leaning candiodates promote Fidel style ‘progressive_ism, a rather OxyMoronic as two photos would go together HK with flags of USA and BS EW etc calls to conduct financial vasectomies on those such as Leon Cooperman who grew up as a plain simple kid in Brooklyn and used smarts to build his multibillion company, he took the ‘buffet giving pledge’ many years ago and has given hundreds of millions already, and yet he and similar are decried as selfish… uh the total opposite of selfish is the thankful corporation creators that bring wonderful jobs and develop and refine the best products and services anywhere… ….so, in perspective, we see what next.. if we get more of same as full month, its continuation flow a go.

• Build on momentum.

• End of year tax loss selling

• Historical.

• Consumer Spending

“Lower” Respondent Answers:

• We need a retrace this wk

• end of year tax loss selling and portfolio rebalancing to continue

• 3 bar reversal

• China noise

• S&P at top of 10-month channel, as seen in early May & late July, suggesting that a decline is on tap.

• Trend has moved to sideways. China talks stall over Hong Kong.

AD: Don’t risk your capital! Trade with other people’s money.

Question #4. Who or what first inspired you to become a trader?

• money,unfortunately I didn’t make any

• Money!

• Larry Williams

• to get a part time job.

• My father.

• Mom

• My dad r.i.p. had little to invest and yet found a way to do so, although he hadn’t learned of other than buy and hold into the pain zones.. still I always saw the value of and experienced the tremendous success of real solid corporations that could and did bring value to all of our lives.

• Stupidity I believed all you crooked bastards and it has cost me over $100K

• Losses

• I’ve always liked playing with numbers and patterns. At first, it was paper-trading.

• Dont remember

• Jim Slate

• I’m retired/something to do.

• 40 years ago when I was 14 I seen advertisement :Invest for Success”, consisted of Cassettes and book. I saved my paper route money and bough it. Today I’m trading more than I was 10 or 20 years ago.

Question #5. Additional Comments/Questions/Suggestions?

• Think Gold & Silver will move one way or another for sure this week!

• How about SEND US A LINK OF ALL you collect : the comments and the poll data and let us see the results and read the other comments like such as I have submitted. HOWEVER POST THEM ALL AS ANONYMOUS, I PREFER MY FULL PRIVACY, Please.

TimingResearch Response: Thanks! That’s exactly what we’ve been doing for over 6 years with this project! Hope you enjoy the info.

Join us for this week’s shows:

Crowd Forecast News Episode #247

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 2nd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #104

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 3rd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Harry Boxer of TheTechTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders Event #8

Join us for this event. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time:

– Saturday, December 7th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Crowd Forecast News Report #322

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport112419.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 25th to 29th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 53.6%

Lower: 46.4%

Higher/Lower Difference: 7.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.8%

Average For “Higher” Responses: 65.0%

Average For “Lower” Responses: 64.6%

Higher/Lower Difference: 0.4%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 34.6

TimingResearch Crowd Forecast Prediction: 70% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 53.6% Higher, and the Crowd Forecast Indicator prediction was 56% Chance Higher; the S&P500 closed 0.24% Lower for the week. This week’s majority sentiment from the survey is 53.6% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 20 times in the previous 321 weeks, with the majority sentiment (Higher) being correct 70% of the time and with an average S&P500 move of 0.66% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 70% Chance that the S&P500 is going to move Higher this coming week.

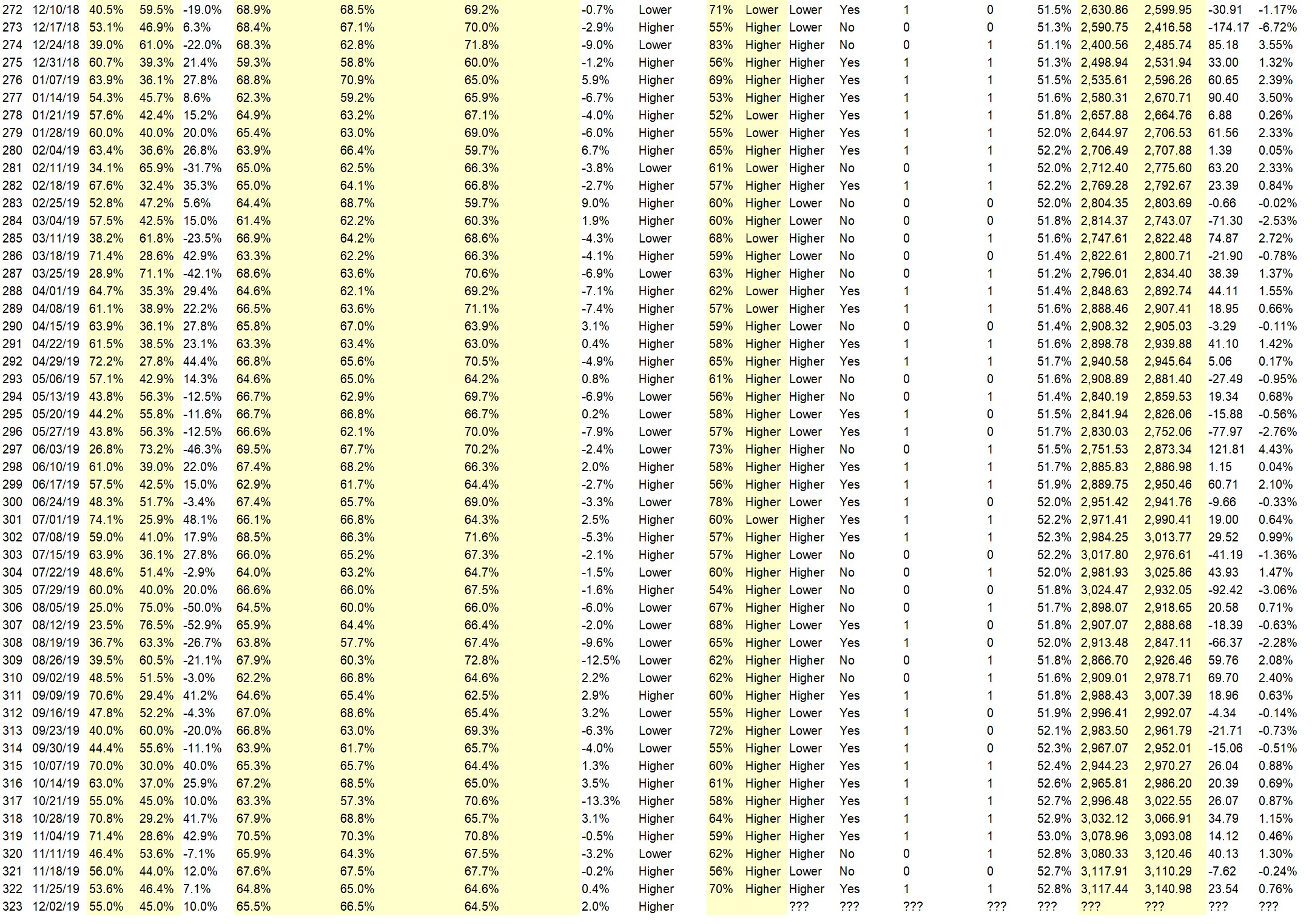

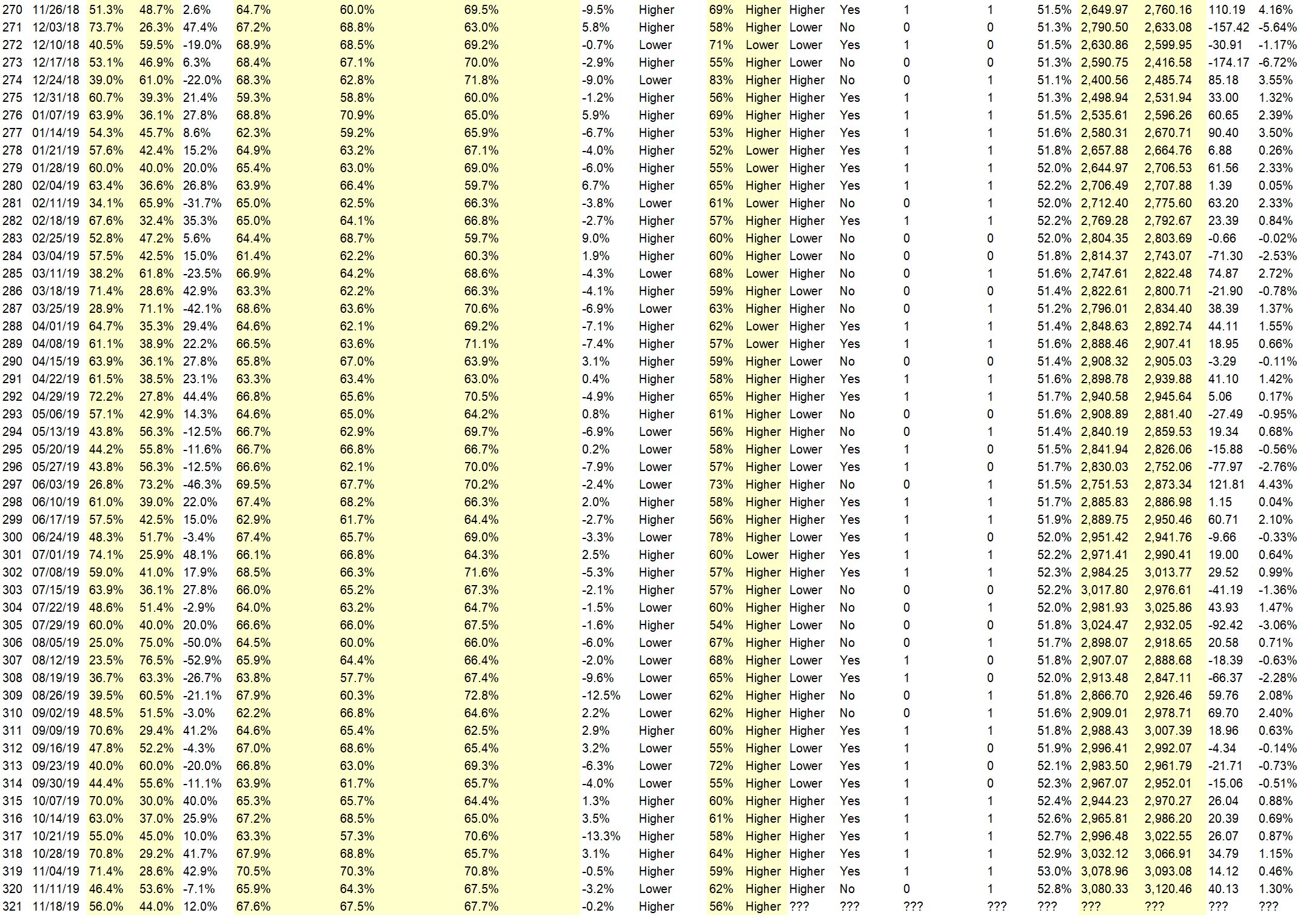

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: eBook: The Options Answer.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.7%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• History.

• holidays

• End year

• The S&P stayed above its 20-day MA this past week on a small dip; and it looks like that dip is being bought. The market has been up on 75% of Thanksgiving weeks since 1945.

• Holiday effect

• Stable market

• Best six months of year historically

• Short week

“Lower” Respondent Answers:

• this market is propped up by low interest rates when that ends it will crash worse than 2008

• propped up by artificially low interest rates farther from inflationary recovey but not falling into a recession either

• short holiday week, traders do not want to hold a lot over long-term weekend

• market heading to support3071..3031

• 6 mo stochastic falling

• Mkt needs a pull back before it continues up into the Xmas rally.

• orderly retrace in the uptrend

• Trade talks stall in reaction to Hong Kong bill passage

• Looks like ending diagonal on daily and on weekly.

• Trade concerns

AD: eBook: The Options Answer.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week, but back on December 2nd.)

• brokers fees

• Fundemantal

• auto trading

• Psychology, psychology, psychology

• Selling put options

Question #5. Additional Comments/Questions/Suggestions?

• Gotta keep sense of humour and stops in place and realize that nobody really knows ANYthing, especially myself.

Both shows are off next week, we have arranged this event for you instead:

Synergy Traders #7 – Black Friday and Cyber Monday Trading Strategies

Join us on Monday starting at 12PM ET. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time:

– Monday, November 25th, 2019

– 1PM ET (10AM PT)

Lineup for this Episode:

– 12PM ET: John Thomas of MadHedgeFundTrader.com

– 1PM ET: Simon Klein of TradeSmart4x.com

– 2PM ET: Anka Metcalf of TradeOutLoud.com

– 3PM ET: Brian Miller of OptimizedTrading.com

– 4PM ET: Bryan Klindworth of AlphaShark.com

AD: eBook: The Options Answer.

Crowd Forecast News Report #321

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport111719.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 18th to 22nd)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 56.0%

Lower: 44.0%

Higher/Lower Difference: 12.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.6%

Average For “Higher” Responses: 67.5%

Average For “Lower” Responses: 67.7%

Higher/Lower Difference: -0.2%

Responses Submitted This Week: 26

52-Week Average Number of Responses: 34.9

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 46.4% Higher, and the Crowd Forecast Indicator prediction was 62% Chance Higher; the S&P500 closed 1.30% Higher for the week. This week’s majority sentiment from the survey is 56.0% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 52 times in the previous 321 weeks, with the majority sentiment (Higher) being correct 56% of the time and with an average S&P500 move of 0.10% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

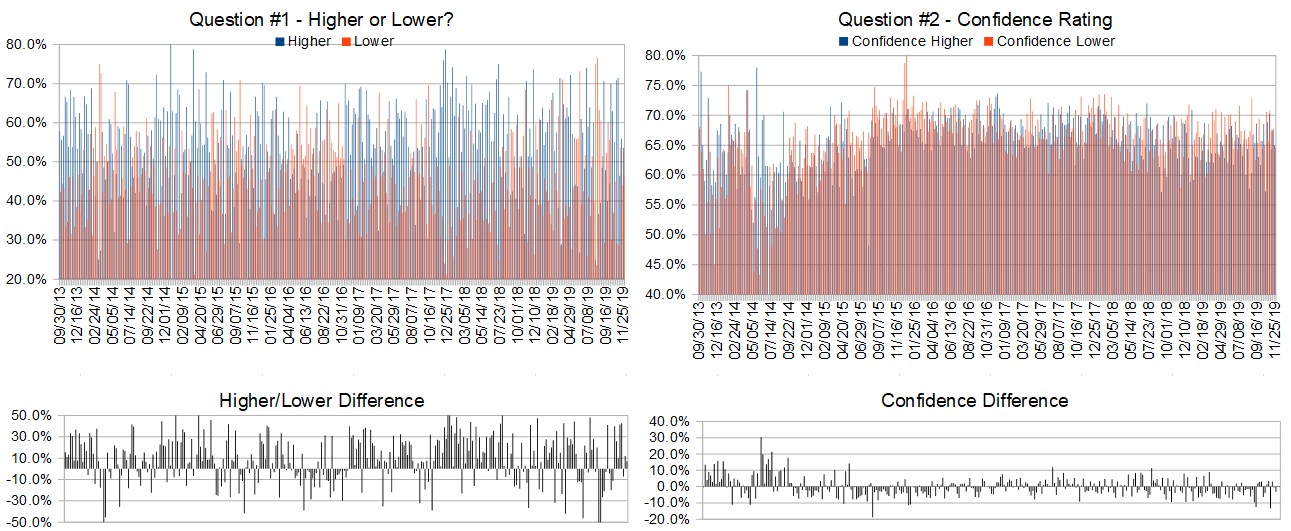

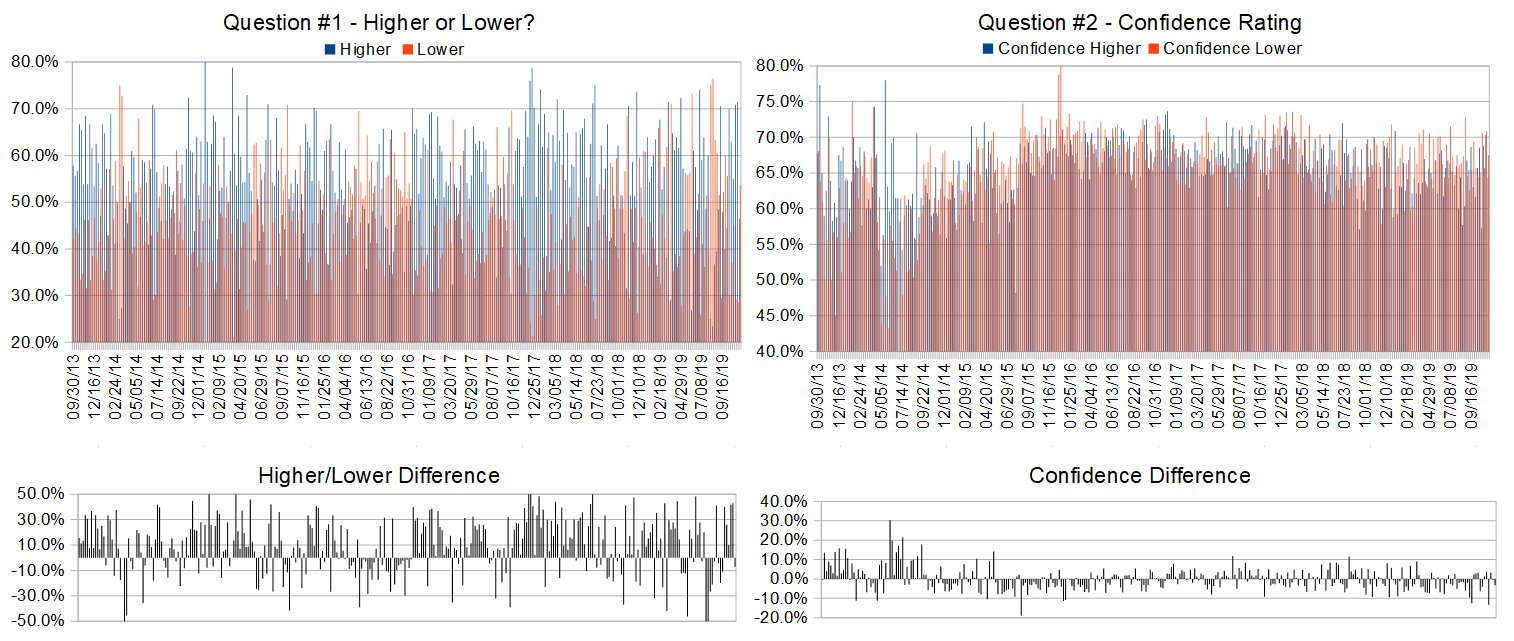

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.8%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

AD: The Market Map: A Simple Roadmap to Anticipate Market Direction

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Good economic news !

• trend is still up and no sign of a correction yet

• still finishing wave 5

• trend

• seasonnal time for higher stock market

• seasonal conditions, holiday shopping

• Law of physics, a body in motion tends to remain in motion. In this case UP. Not too confident that all is well in the economy and I trade with caution unless we build a solid base at these market levels and then blast off. So, the transd is UP until it is NOT!

“Lower” Respondent Answers:

• We are ready for a reverion, to men,,way hi 9% above 50dma,,

• Flat to down a lot of volume came into DIS this week profit taking inevitable

• Continued overbought up to and including the monthly charts, rising on declining momentum, pundits are running out of solid credible reasons for a continued rally.

• market to enter a holding pattern to much dumb money sploshing around 4x normal volume on DIS on an upday signals major top in that stock and the rest of the market

• since I’m long, it must be going lower

• The S&P is approaching its upper Bollinger band at about 3126; and it tends to fall back when it hits it.

• Hopium will fade again when people start to realize that China trade rumors are just rumors being foisted on the american public by Trump and his lying co-conspirators. Read China’s word . They will not enter into an agreement without a release of all tariffs.

• Market is losing upside momentum. Earnings reports are coming to an end except for retail.

AD: The Market Map: A Simple Roadmap to Anticipate Market Direction

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• 8% stop loss—

• Stops

• Position sizing is critical and always honor your “hard” stop.

• position sizing and stops

• stops

• position size

• I set position sizes carefully, and exit losing trades more quickly than in earlier years.

• Good solid rules that I have developed over the years.

• trailing stop

• enter consumer discretionary spending companies

• My trade management depends on what type of trade I am in. Options are given a lot of room to work given that they are already very limited risk. Sometimes a stop on a new stock or ETF position as I scale into it and build a position. Some things I follow have a natural cycle and I will never take them off, selling options for income. Unless I see something very bad in the wind and accumulated profits are fast disappearing, my “forever stocks” are a hold until they are not.

Question #5. Additional Comments/Questions/Suggestions?

• none

Join us for this week’s shows:

Crowd Forecast News Episode #246

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, November 18th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #103

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, November 19th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Felix Frey of OptionsGeek.com

– Jim Kenney of OptionProfessor.com (moderator)

AD: The Market Map: A Simple Roadmap to Anticipate Market Direction

Crowd Forecast News Report #320

AD: 4 Trading Days Every Week Don’t Matter!

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport111019.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 11th to November 15th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 46.4%

Lower: 53.6%

Higher/Lower Difference: -7.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.9%

Average For “Higher” Responses: 64.3%

Average For “Lower” Responses: 67.5%

Higher/Lower Difference: -3.2%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 35.2

TimingResearch Crowd Forecast Prediction: 62% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 71.4% Higher, and the Crowd Forecast Indicator prediction was 59% Chance Higher; the S&P500 closed 0.46% Higher for the week. This week’s majority sentiment from the survey is 53.6% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 21 times in the previous 319 weeks, with the majority sentiment (Lower) being correct 38% of the time and with an average S&P500 move of 0.14% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 62% Chance that the S&P500 is going to move Higher this coming week.

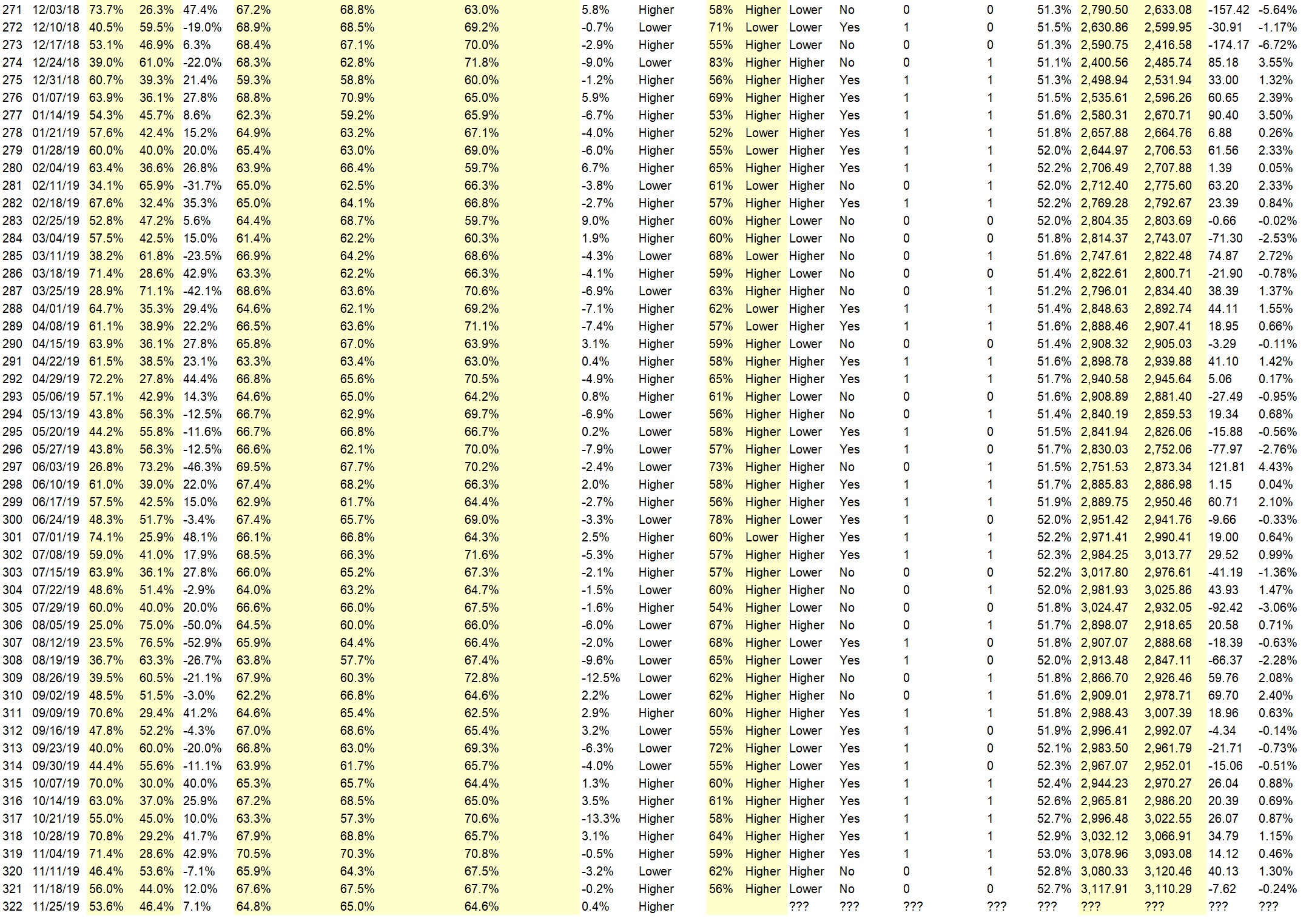

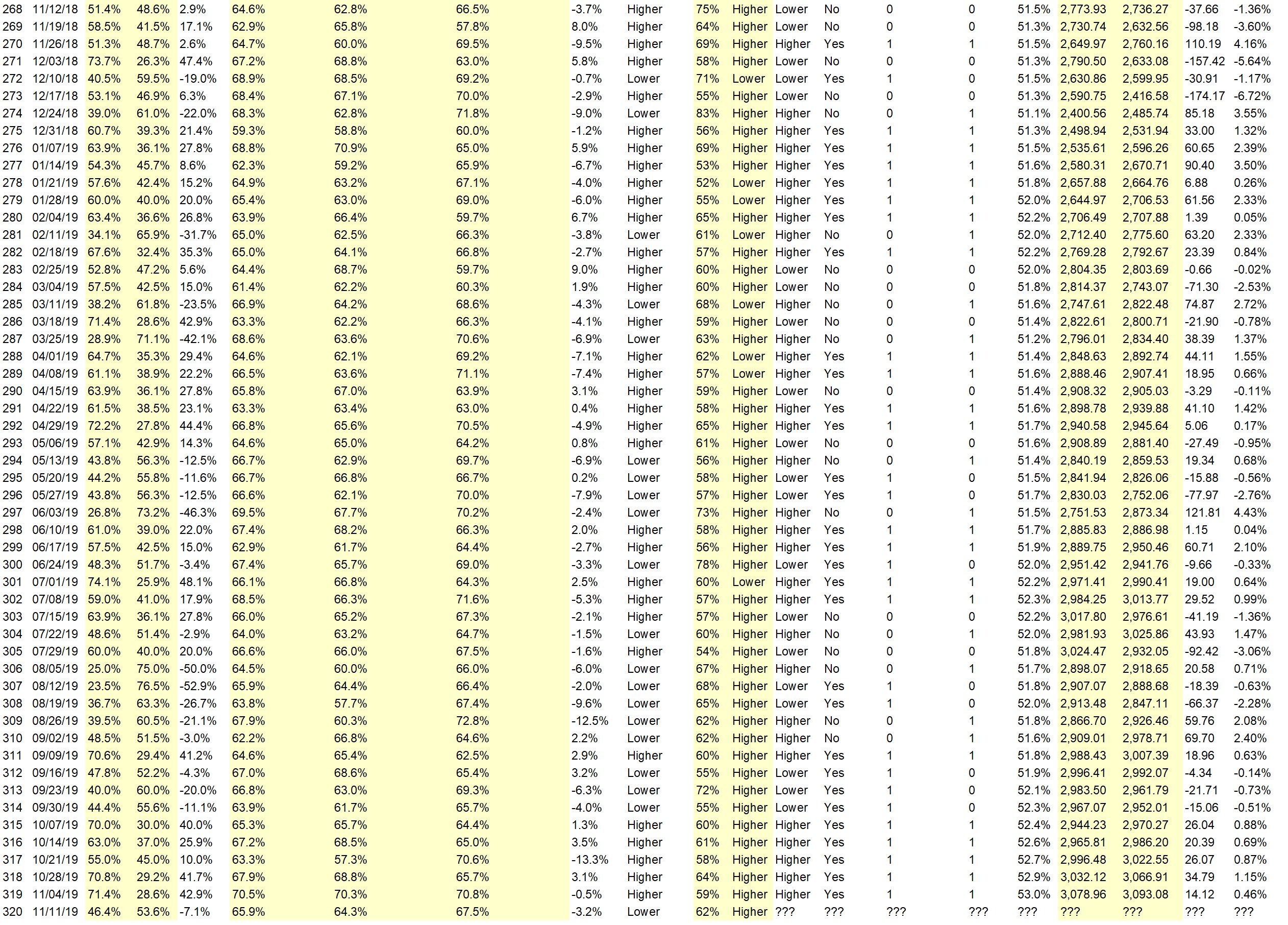

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: 4 Trading Days Every Week Don’t Matter!

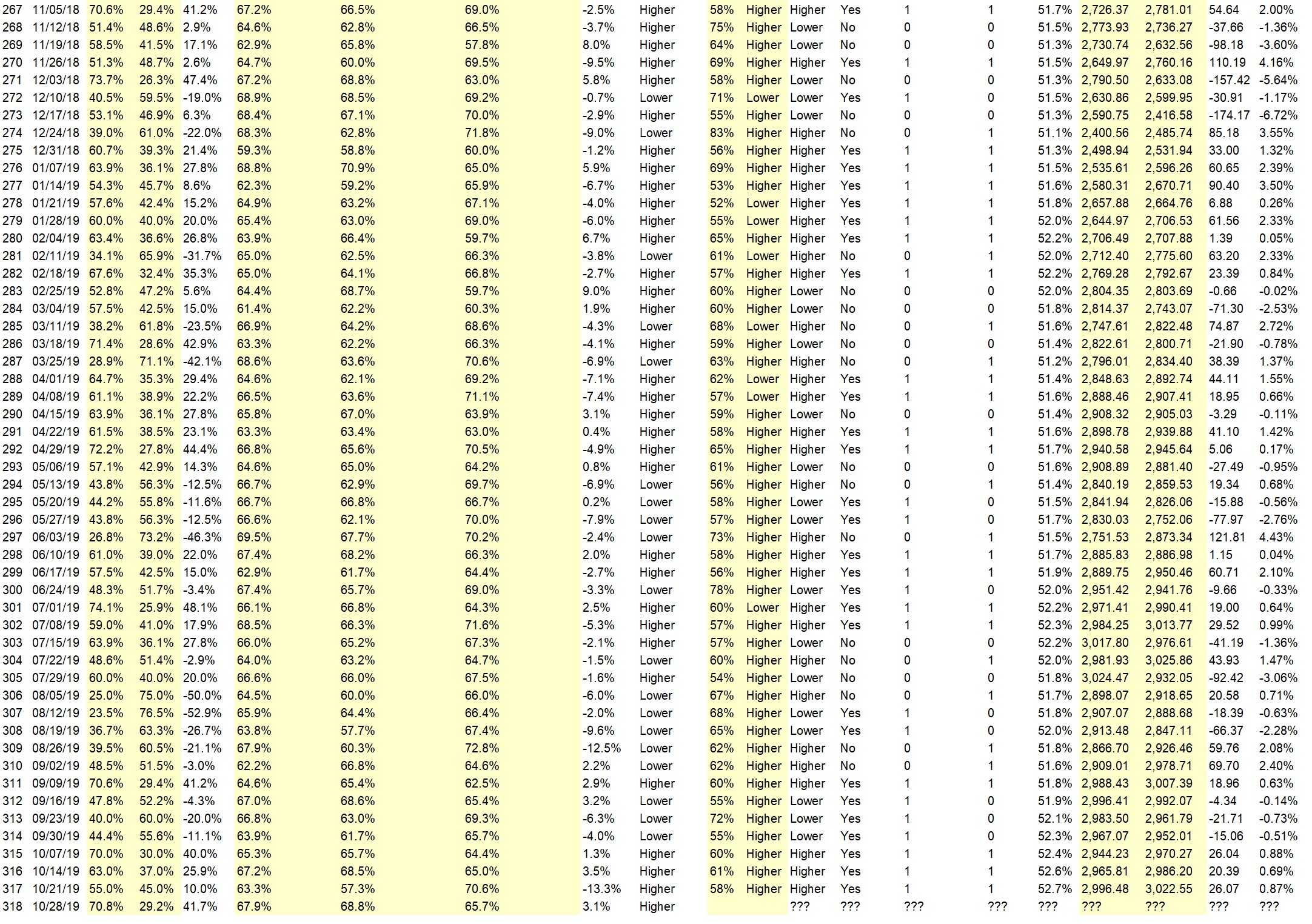

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 65.9%

Overall Sentiment 52-Week “Correct” Percentage: 64.3%

Overall Sentiment 12-Week “Correct” Percentage: 67.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• trend

• Toppy, Market tippy FEd d0ne l00sening

• Chart and seasonality

• TARIFFS

• Option Expirations Week

• The market is melting up because of FOMO and many companies reporting better than expected earnings and forward guidance. I also think we’ll continue to melt up thru the end of the year with 3300 S&P in sight.

• The trend continues

“Lower” Respondent Answers:

• The market may have a resistance

• Reversion to the mean of the trend

• China, Iran, Fed

• momentum is starting to roll over. Earnings reports are slowing down.

• Overbought, overvalued, low volumes, and reduced momentum.

• WE AR 5+% ABOVE 50DMA ==usually an area to be cautious of drop or pullback

• We all know it will only be up as long as trump keeps playing his china story. I still think it must go down and lower than this week

• Because of impeachment hearings

• No reason – that’s why my confidence is only 50%. More specifically – there are SO many fundamental as well as technical reasons – but none of those reasons have stopped the uptrend yet.

• Momentum from last week to be reversed.

• The S&P has reached its top trend line and Bollinger band top. It may move up a bit, but heavy resistance at 3100; so downward it should go.

AD: 4 Trading Days Every Week Don’t Matter!

Question #4. Which trading platforms or brokers do you like the best for executing your trades?

• Tradestation

• Interactive Brokers Pro

• Ninja.

• TD Ameritrade

• I use Fidessa and ADMIS(UK)

• tda,tastyworks

• schwab

• Interactive Brokers

• E-Trade

• Schwab. TD Ameritrade

• TradeStation

• None I want to ✔ Lightspeed

• I do not know

• ThinkorSwim for options – Ninjatrader for futures.

• TD Ameritrade

• I like e*trade

• I’ld like to know

Question #5. Additional Comments/Questions/Suggestions?

• Useless equity markets totally manipulated with flood of free money that was never printed nor has any value.

Join us for this week’s shows:

Crowd Forecast News Episode #245

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, November 11th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Sam Bourgi of TradingGods.net

– Jake Wujastyk of TrendSpider.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #102

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, November 12th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Steven Brooks of StevenBrooks.co

– Jim Kenney of OptionProfessor.com (moderator)

AD: 4 Trading Days Every Week Don’t Matter!

Crowd Forecast News Report #319

AD: Don’t risk your capital! Trade with other people’s money.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport110319.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 4th to November 8th)?

Higher: 71.4%

Lower: 28.6%

Higher/Lower Difference: 42.9%

The order of possible responses to this question on the survey were randomized for each viewer.)

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.5%

Average For “Higher” Responses: 70.3%

Average For “Lower” Responses: 70.8%

Higher/Lower Difference: -0.5%

Responses Submitted This Week: 22

52-Week Average Number of Responses: 35.3

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 70.8% Higher, and the Crowd Forecast Indicator prediction was 64% Chance Higher; the S&P500 closed 1.15% Higher for the week. This week’s majority sentiment from the survey is 71.4% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 32 times in the previous 318 weeks, with the majority sentiment (Higher) being correct 59% of the time and with an average S&P500 move of 0.16% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.9%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Employment strong

• daily AND weekly Elliott waves – still arriving at targets for wave 5 finish

• momentum

• QE and positive earnings will attract investors.

• new highs

• Friday’s move up looks like it could lead to more of a breakout from the congestion around 3000. Also, The Fed looks like they will pause on lowering interest rates, suggesting that they think that the economy will do better than expected.

• trend

• Gearing up for holiday season

“Lower” Respondent Answers:

• Market overbought needs a breather

AD: Don’t risk your capital! Trade with other people’s money.

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• When you find out let me know.

• Manage stressEmployment

• Discipline and mental clarity

• patience

• Disciplined approach.

• Don’t get tied to a losing position, hoping against hope, that the direction will reverse.

• Attention and patience

• Mental toughness with emotions breakdown.

Question #5. Additional Comments/Questions/Suggestions?

• Donald Trump greatest President since JFK!! Go Donald GO!!

Join us for this week’s shows:

Crowd Forecast News Episode #244

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, November 4th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Erik Gebhard of Altavest.com

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #101

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, November 5th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

AD: Don’t risk your capital! Trade with other people’s money.

Crowd Forecast News Episode #243

AD: Cancel your plans Tuesday night, watch this instead.

Watch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

AD: Cancel your plans Tuesday night, watch this instead.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN102819

Crowd Forecast News Report #318

AD: Cancel your plans Tuesday night, watch this instead.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport102719.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 28th to November 1st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 70.8%

Lower: 29.2%

Higher/Lower Difference: 41.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.9%

Average For “Higher” Responses: 68.8%

Average For “Lower” Responses: 65.7%

Higher/Lower Difference: 3.1%

Responses Submitted This Week: 24

52-Week Average Number of Responses: 35.6

TimingResearch Crowd Forecast Prediction: 64% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 55.0% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.87% Higher for the week. This week’s majority sentiment from the survey is 70.8% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 83 times in the previous 317 weeks, with the majority sentiment (Higher) being correct 64% of the time and with an average S&P500 move of 0.30% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 64% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: Cancel your plans Tuesday night, watch this instead.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.7%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Phone

• Better economic news

• breaking out

• Companies beating earnings expectations.

• trend

• Earnings were higher

• timing, seasonality, people are too bearish

• The market rose last week, which was an important week for earnings. So, the odds this coming week are for continuation of the uptrend.

• Momentum, chart pattern

• Trump wont let it sink

• Earnings

• Market has rebounded from every bad news imaginable

• seasonalities

• Market has rebounded from every type of bad news

“Lower” Respondent Answers:

• At the top and feel growth in earnings and cap spending will slw

AD: Cancel your plans Tuesday night, watch this instead.

Question #4. What indicator influences your trading the most?

• Right now yield curve

• moving averages

• Stocks above 200 MA.

• Momentum

• RSI

• RSI 14 daily and weekly

• Bollinger bands; MACD

• 5…50…200 EMA

• RSI

• DJIA

• none

• DJIA

• overall there are many red flags

Question #5. Additional Comments/Questions/Suggestions?

• FOMO is in play

Join us for this week’s shows:

Crowd Forecast News Episode #243

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, October 28th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Norman Hallett of TheDisciplinedTrader.com

– Jake Bernstein of Trade-Futures.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #100

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 29th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com

– Jim Kenney of OptionProfessor.com (moderator)

AD: Cancel your plans Tuesday night, watch this instead.

Crowd Forecast News Report #317

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport102019.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 21st to 25th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 55.0%

Lower: 45.0%

Higher/Lower Difference: 10.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.3%

Average For “Higher” Responses: 57.3%

Average For “Lower” Responses: 70.6%

Higher/Lower Difference: -13.3%

Responses Submitted This Week: 22

52-Week Average Number of Responses: 35.8

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.0% Higher, and the Crowd Forecast Indicator prediction was 61% Chance Higher; the S&P500 closed 0.73% Lower for the week. This week’s majority sentiment from the survey is 55% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 24 times in the previous 316 weeks, with the majority sentiment (Higher) being correct 58% of the time and with an average S&P500 move of 0.28% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

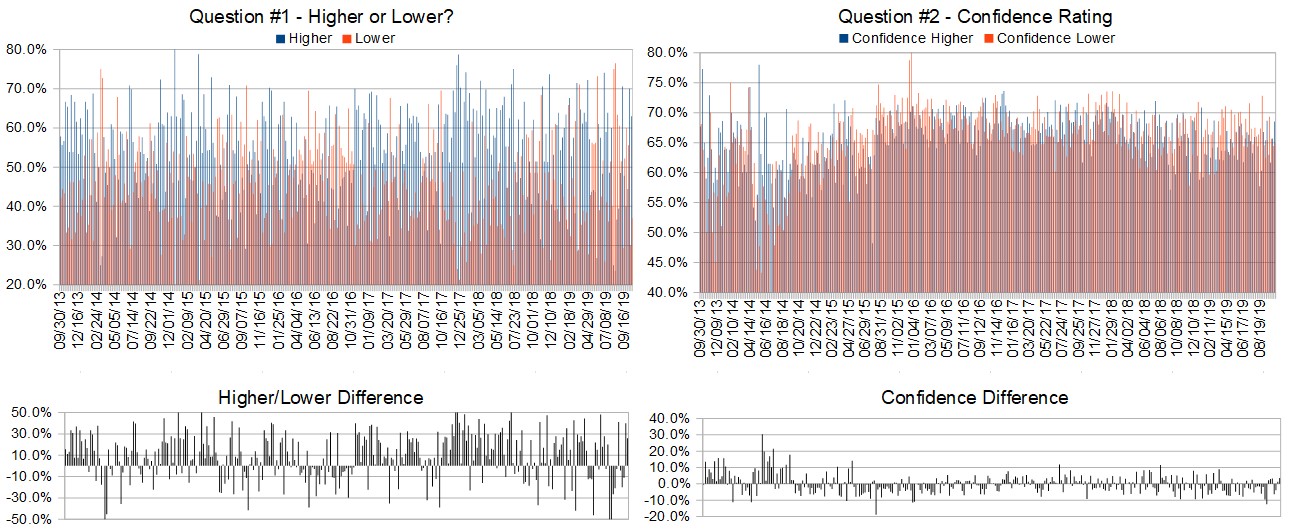

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.6%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

xxxxxxxxxxxxx

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

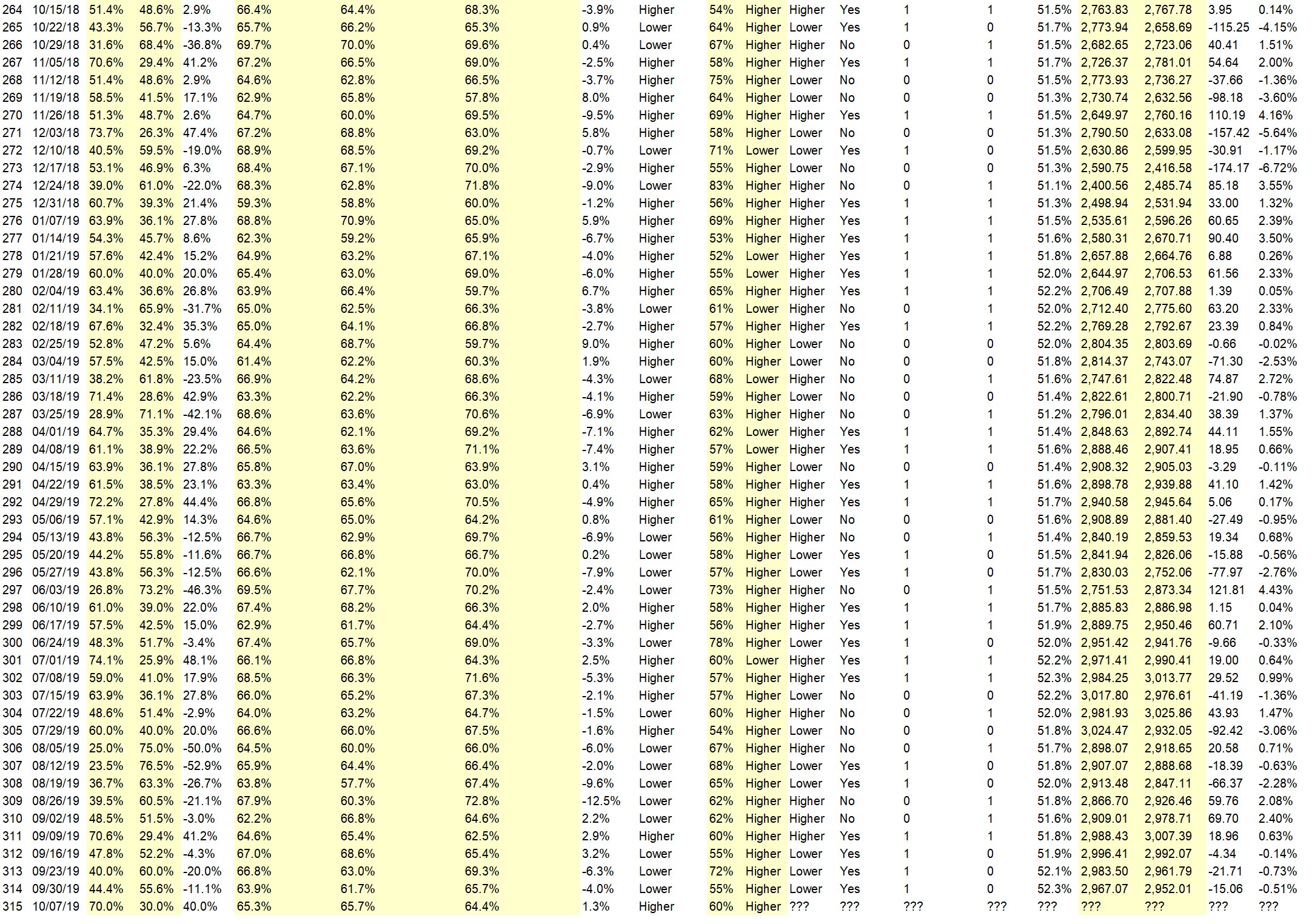

Crowd Forecast News Report #316

AD: There Will Be Blood, There Will Be Profits.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport101319.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 14th to 18th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.0%

Lower: 37.0%

Higher/Lower Difference: 25.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.2%

Average For “Higher” Responses: 68.5%

Average For “Lower” Responses: 65.0%

Higher/Lower Difference: 3.5%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 36.0

TimingResearch Crowd Forecast Prediction: 61% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 70.0% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.88% Higher for the week. This week’s majority sentiment from the survey is 63% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 64 times in the previous 315 weeks, with the majority sentiment (Higher) being correct 61% of the time and with an average S&P500 move of 0.12% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 61% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.4%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Positive China, Inpeachment efforts dwindle

• Earnings, Brexit solution, breach of downtrend.

• Trade deal +ve news

• FED CUT Selloff cycle ended Friday NICE REBOUND

• market currently going up

• The weekly chart shows higher lows, indicating that the trend is still up. The market likes the current US-China trade talk situation — wouldn’t argue with that.

• Us / China agreement

• China trade

• momentum

“Lower” Respondent Answers:

• Trade, middle east Issues, macro economics

• U.S. and China trade deal did not yield any better things for U.S. China has to feed its people and has to buy agriculture products, only U.S. can satisfy China’s huge population’s needs, no other single country can do that. Besides, nothing is in writing. Before the trade war China was buying from the U.S.

• Price in

• While sentiment suggest higher I think technicals suggest lower

AD: There Will Be Blood, There Will Be Profits.

Question #4. What trading software/platform(s) do you use to execute your trades?

• Tastyworks, TOS

• TCC2000, RBC, I-Trade,

• I use TD Ameritrade and Fidelity. Good news for me this week: both now commission free. TD Ameritrde now charges $0.65 per contract plus a small penny fees.

• Tradestations

• Fidessa

• TD

• E-Trade

• Td ameritrade

• Infinity futures and TOS

• Fidelity, TS & Trading view

Question #5. Additional Comments/Questions/Suggestions?

• Gold & Silver stabilize & Rise. Modest Gains is stocks

No CFN show this week, join us for these other upcoming events on TimingResearch:

Analyze Your Trade Episode #98

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 15th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders #4

For this event 5 amazing trading educators available to teach you about their top trading strategies. We are inviting you to spend the day learning top trading strategies from leading industry experts that will bring you closer to achieving your trading goals.

Date and Time:

– Monday, October 19th, 2019

– 10AM ET (7AM PT)

Lineup for this Episode:

– 10AM: Marina Villatoro of TheTraderChick.com

– 11AM: Mercedes Van Essen of MentalStrategiesForTraders.com

– 12PM: Michael Guess of DayTradeSafe.com

– 1PM: Neil Batho of TraderReview.net

– 2PM: Anka Metcalf of TradeOutLoud.com

AD: There Will Be Blood, There Will Be Profits.

Crowd Forecast News Report #315

AD: Need more capital to trade? Click for Futures or Forex.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport100619.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 7th to 11th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 70.0%

Lower: 30.0%

Higher/Lower Difference: 40.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.3%

Average For “Higher” Responses: 65.7%

Average For “Lower” Responses: 64.4%

Higher/Lower Difference: 1.3%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 36.2

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 55.6% Lower, and the Crowd Forecast Indicator prediction was 72% Chance Higher; the S&P500 closed 0.73% Lower for the week. This week’s majority sentiment from the survey is 70% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 63 times in the previous 314 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.10% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.3%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• The market seems to be trending higher. Economy still good. Optimism about China trade deal.

• Buyers will respond to lower prices from this week. Unless there’s bad political/trade news over the weekend.

• The US jobs report was a good sign and lowering interest rates might factor in a higher S&P500 but not confident…

• because is been that way for last 4 months

• Fed lowers soon puts floor under the market

• seasonality

• summer is over, stocks going higher

• We closed out of the consolidation ranges from last Couple of weeks to the upside. I feel that buyers will come into the market in anticipation of the China USA trade talks that will ultimately fail.

• China deal anticipation

• The S&P has a hammer on the weekly chart, suggesting an upward move.

• Recent bottoming and turnaround in stochastics on 1,3,and 6 mo charts.

• Good news for the week !

• chart formation.

• Positive signs that a resolution to the China Trade war is near

• Good economic news

• It could be big low by Fri but they may still push up for a day or two or keep it still in highs.

“Lower” Respondent Answers:

• it will be sideways

• S&P still topping out so higher chance of it going lower

• Macro Economics, USA is Good, however other countries EU monetary banking issues, IE., Interest rates. China seems slowing, other countries following suit. USA is strongest with Trump in Power, USA will prosper is these times.

AD: Need more capital to trade? Click for Futures or Forex.

Question #4. What type(s) of trading do you specialize in or focus on? How did you come to that decision?

• Wide interests at this point. Long-term equity positions, forex, and I’ve just started trading options.

• Options on ETFs, exspectations for economic growth are falling.

• Options

• Ling term & swing

• reversal trades

• options, more defined risk

• Investing, swing and day, Retirement, occasions and salary

• Options

• Futures day trade time frames. Investments long terms as well which I don’t focus on as much as they are investments not trades

• Selling covered calls on good stocks. Based on experience

• Swing trading stocks – works for me as a part-time trader.

• Overbought/oversold conditions. Best chance for trend following.

• SPY

• Stocks. However I do follow Bonds, EFT. tec.. I see commentaries of many people and seems most are in agreement.

• I like options.

• Trading E-mini

• Value

• Futures scalping

Question #5. Additional Comments/Questions/Suggestions?

• I would like to learn spreads

• let s wait and see

• Gold has stabilized and will slowly rise, Silver following naturally…

• I’m open to suggestions on how to trade options profitably.

• Switching to commodities from indices gradually as index is riskier whereas commodities are perhaps going to be interesting now on

Join us for this week’s shows:

Crowd Forecast News Episode #241

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, October 7th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #97

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 8th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com

– Jim Kenney of OptionProfessor.com (moderator)