Crowd Forecast News Report #328

[AD] • eBook: NVDA Options (Free Strategy Guide for Options Traders)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport010520.pdf

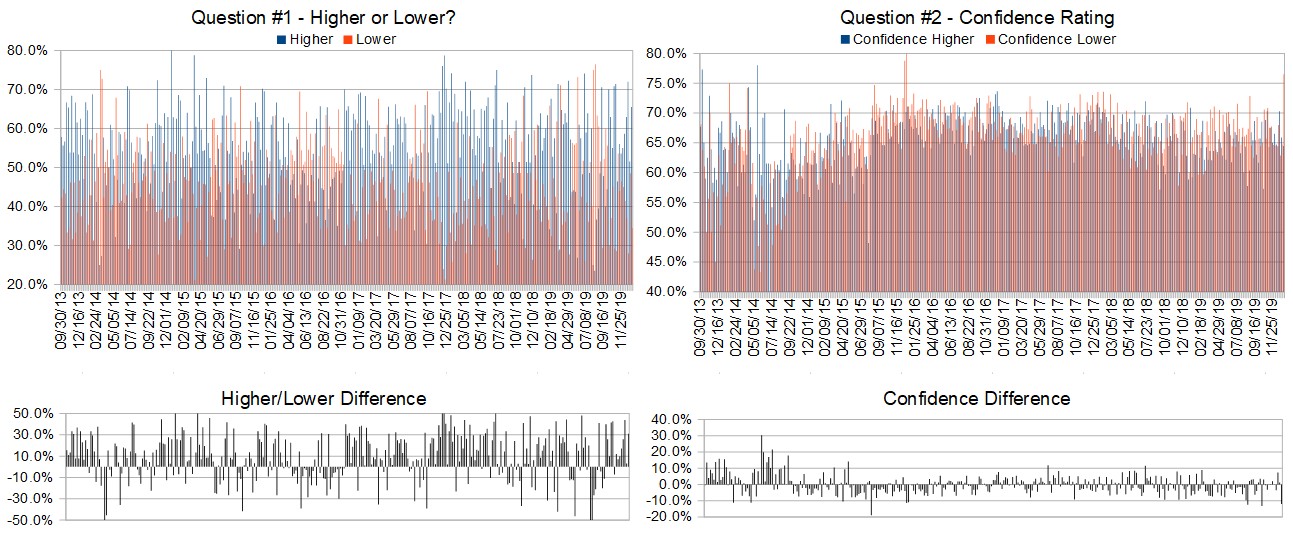

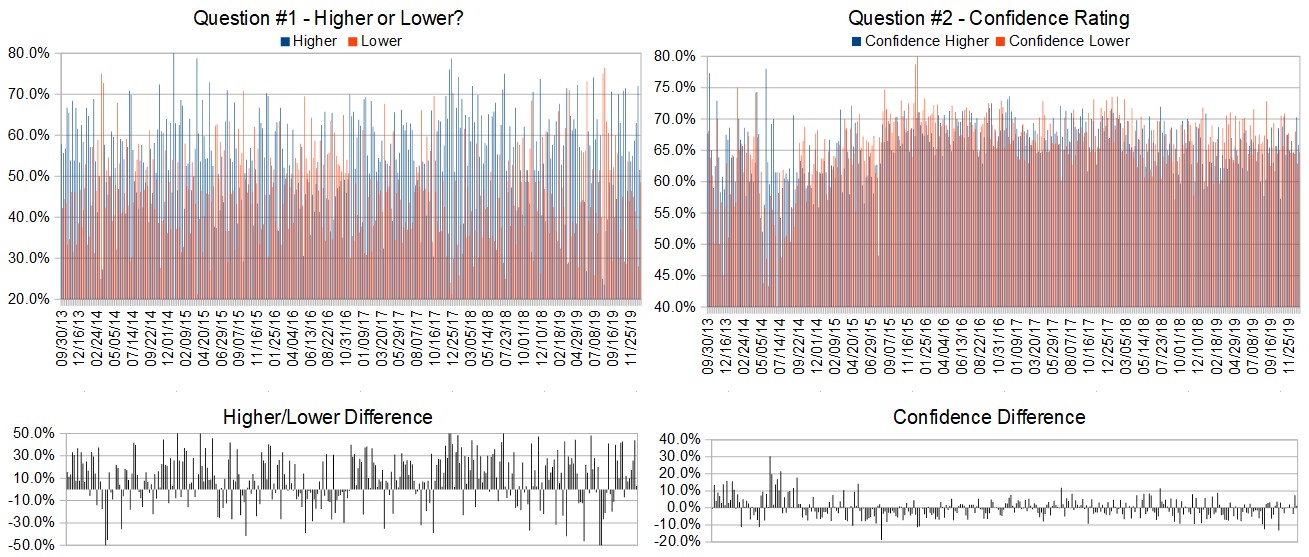

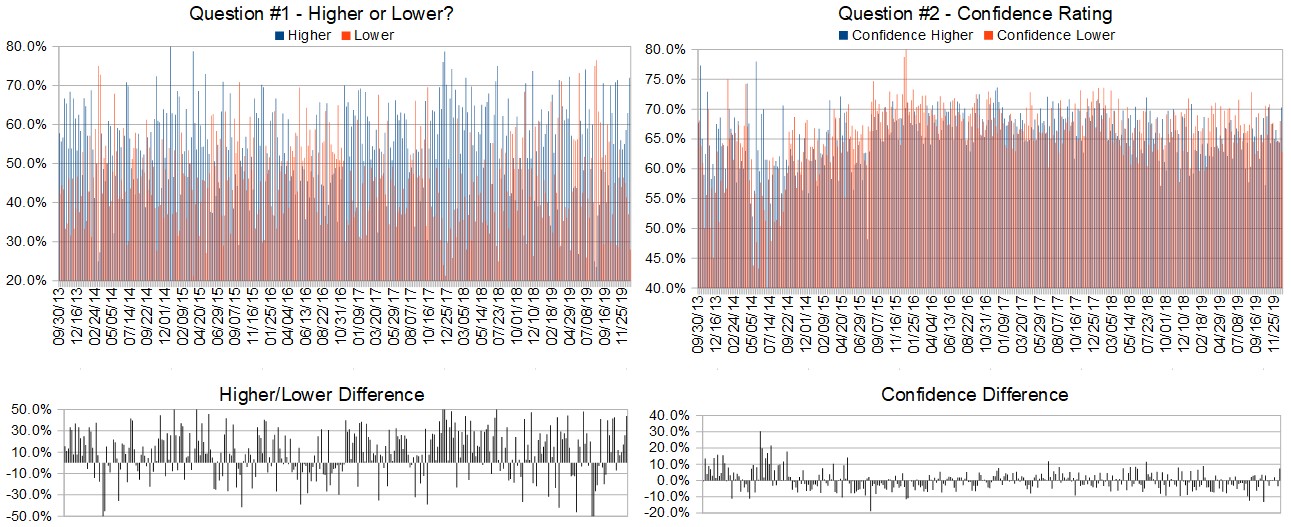

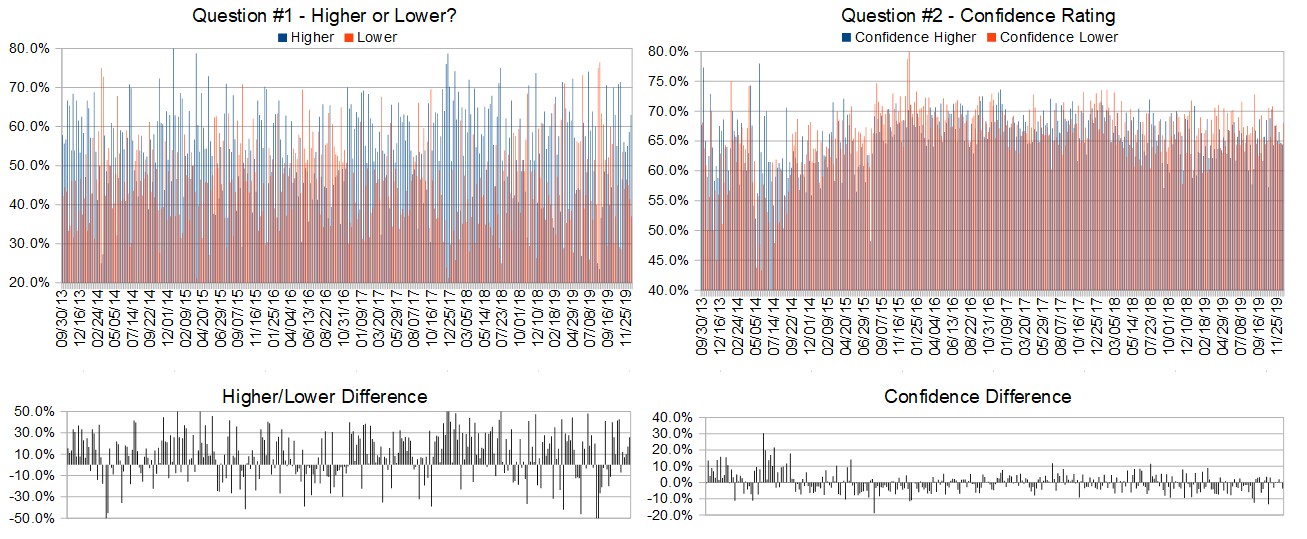

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 6th to 10th)?

Higher: 65.5%

Lower: 34.5%

Higher/Lower Difference: 31.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.6%

Average For “Higher” Responses: 64.5%

Average For “Lower” Responses: 76.5%

Higher/Lower Difference: -12.0%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 33.5

TimingResearch Crowd Forecast Prediction: 52% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.5% predicting Higher, and the Crowd Forecast Indicator prediction was 64% chance Higher; the S&P500 closed 0.16% Lower for the week. This week’s majority sentiment from the survey is 65.5% predicting Higher with a much greater average confidence from those who are predicting Lower. Similar conditions have occurred 25 times in the previous 327 weeks, with the majority sentiment (Higher) being correct only 52% of the time but with an average S&P500 move of 0.51% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 52% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] • eBook: NVDA Options (Free Strategy Guide for Options Traders)

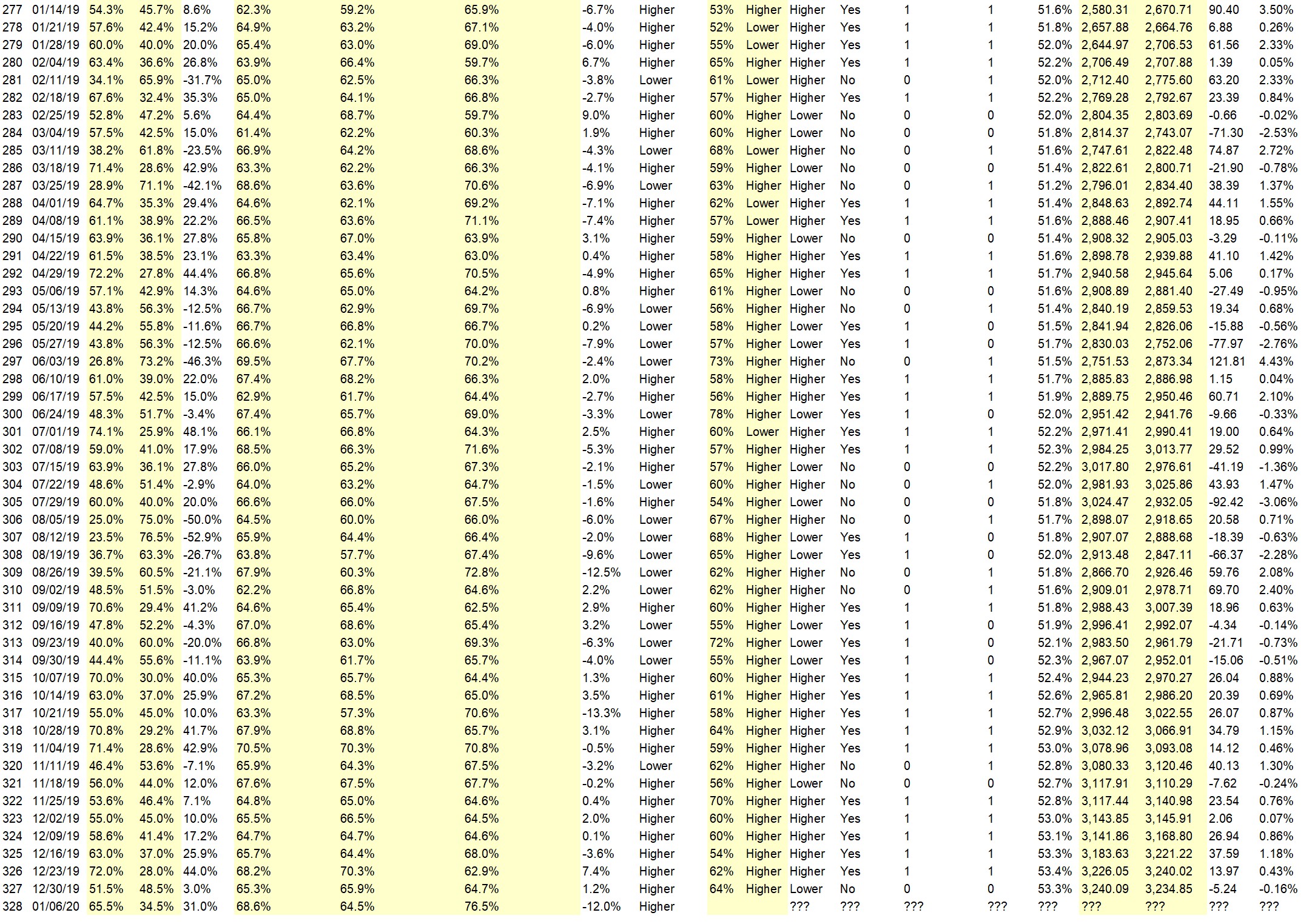

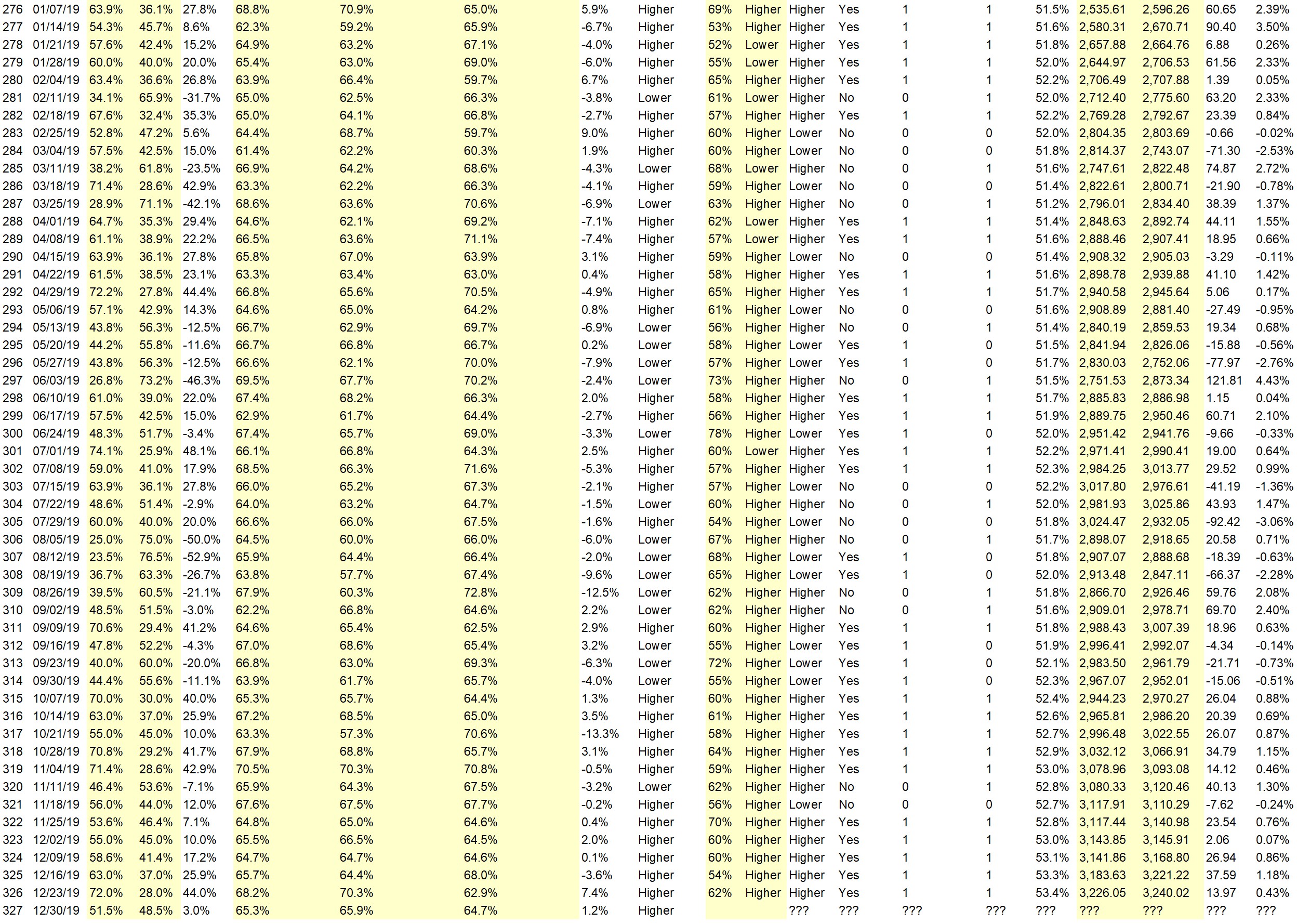

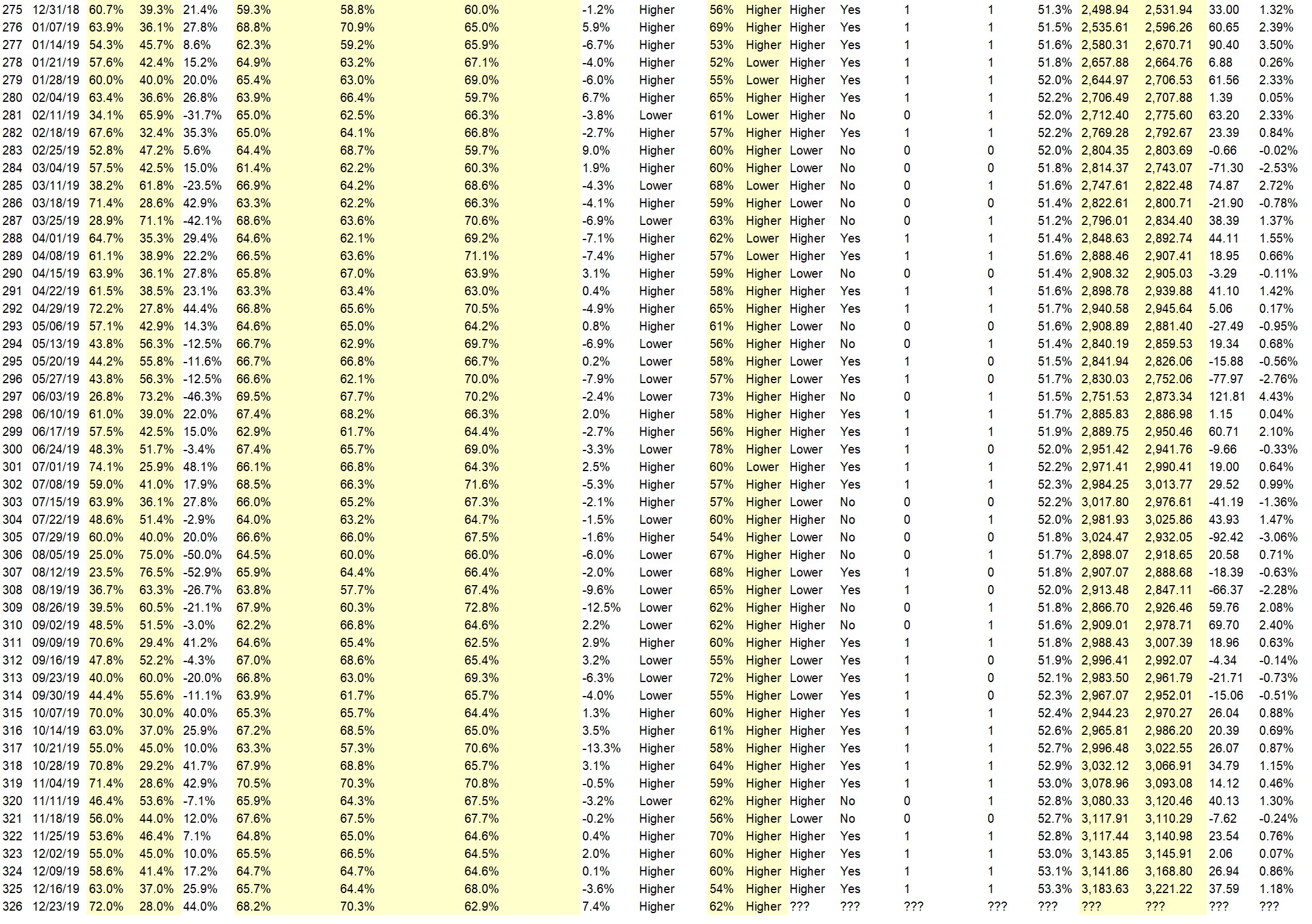

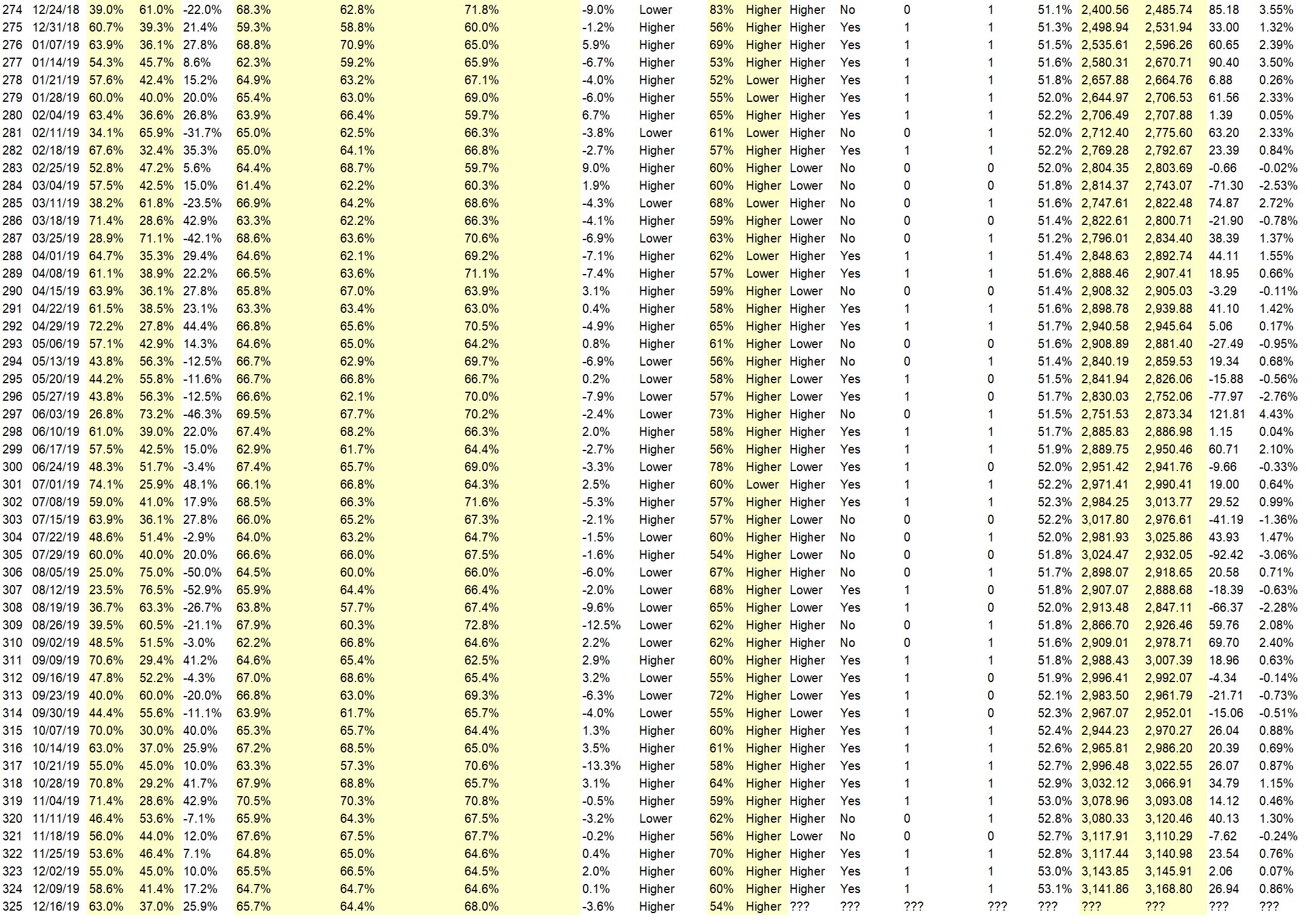

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.3%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Most indicators are positive and I believe that the Iran issue will not be a factor since it didn’t effect the market this last Friday.

• trend

• The general direction up to elections is higher. However Brexit, China-trade and other possibilities with countries may create choppy waves. Professional and institutional traders are back from vacations so they’ll be looking for the next big buys.

• Best six months of year historically

• Trump is in the White House!

• I think the Sp500 needs to be high

• 5G

• wave 5 still continues

• The world will understand that we are not the same country Obama ruined, but rather one “that does what it says it will do.”

• Technicals

• Jan affect

• rebound

“Lower” Respondent Answers:

• Trend up continues

• MiddleEasturest

• conflict with Iran

• Threats from Iran and other middle eastern terrorists create market uncertainty. Perhaps a retaliatory strike against the US or allies ratchets up the possibility of a more heated conflict.

• tension in golf

• Unease with geopolitical situation re: Iraq/Iran/USA

• Trend in US D0llar d0wn

• Iran and weak nations complaining.

• It was a fine leg up from early October to very recently. Now, it’s time for some retracing, given all the uncertainty, an appropriate time for profit-taking, and a MACD negative divergence.

• world in turmile

[AD] • eBook: NVDA Options (Free Strategy Guide for Options Traders)

Question #4. Which trading platforms or brokers do you like the best for executing your trades?

• I like platforms better

• tastyworks,thikorswim

• Schwab

• Fidessa platform, my broker is ADMISI

• TradeStation

• Think ir swim

• ThinkOrSwim

• etrade

• Fidelity and TOS

• They ALL aren’t good

• TD AMERITRADE

• TOS

• TC2000

• Any of the discount brokers, as I am trying to learn the ropes. // Big names have to get nimble … the pace of trading is accelerating exponentially as the civilized world becomes more fragmented. Soon, the crypto’s will overtake the establishment ,, and they all will suffer. // The day of the fat cat is coming to a close >> I’m guessing within 10 months you’ll see an answer emerge.

• E-Trade

Question #5. Additional Comments/Questions/Suggestions?

• I think the trades is going to be good

• Will be an exciting 1st week i suspect :)

• I predict a new breed of criminal is developing, and they no longer wear white collared shirts. Though, those criminals do still exist > they will be forced to submit, once nobody is interested in their game anymore. /// We are changing fields/venues >> and the old guard is not invited. Glad they could skim our billions while it was working, but now nobody wants to listen to their bought politicians. // Just read where John McAffee wants to put jerseys on them, representing the corporations they are beholden to >> just like Nascar does. I think this all hilarious >> and I hope someone read through this diatribe for the fun of it. // In reality, I don’t think there’s 40 years left ..we’ve spoiled what was given to us, all in the name of pride and greed. Thanks!!

We’re back to the normal schedule of shows for the next few weeks! Join us for these upcoming TimingResearch events:

Crowd Forecast News Episode #250

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 6th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Neil Batho of TraderReview.net

Analyze Your Trade Episode #108

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 7th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Anka Metcalf of TradeOutLoud.com

Synergy Traders Event #9

Join us for this event. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time:

– Saturday, January 11th, 2020

– 9AM-3PM ET (6AM-12PM PT)

Moderator and Guests:

– 9AM ET: Harry Boxer of TheTechTrader.com

– 10AM ET: Price Headley of BigTrends.com

– 11AM ET: Mark Sachs of RightLineTrading.com

– 12PM ET: Andrew Keene of AlphaShark.com

– 1PM ET: Jim Kenney of OptionProfessor.com

– 2PM ET: Anka Metcalf of TradeOutLoud.com

[AD] • eBook: NVDA Options (Free Strategy Guide for Options Traders)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies