0

AD: A “hidden” trade setup finally revealed.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081119.pdf

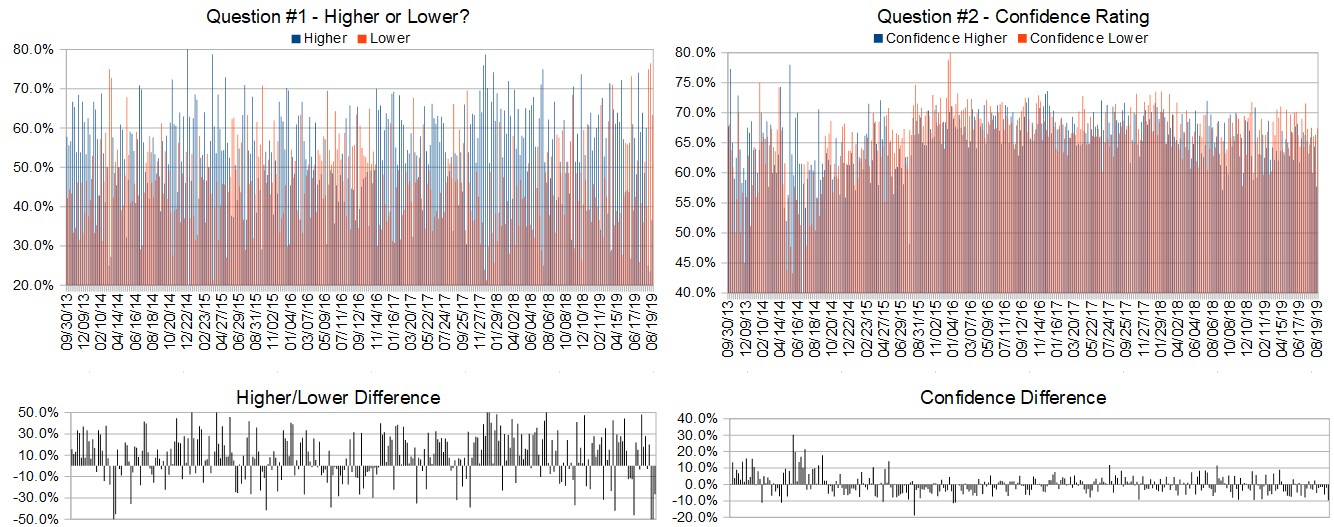

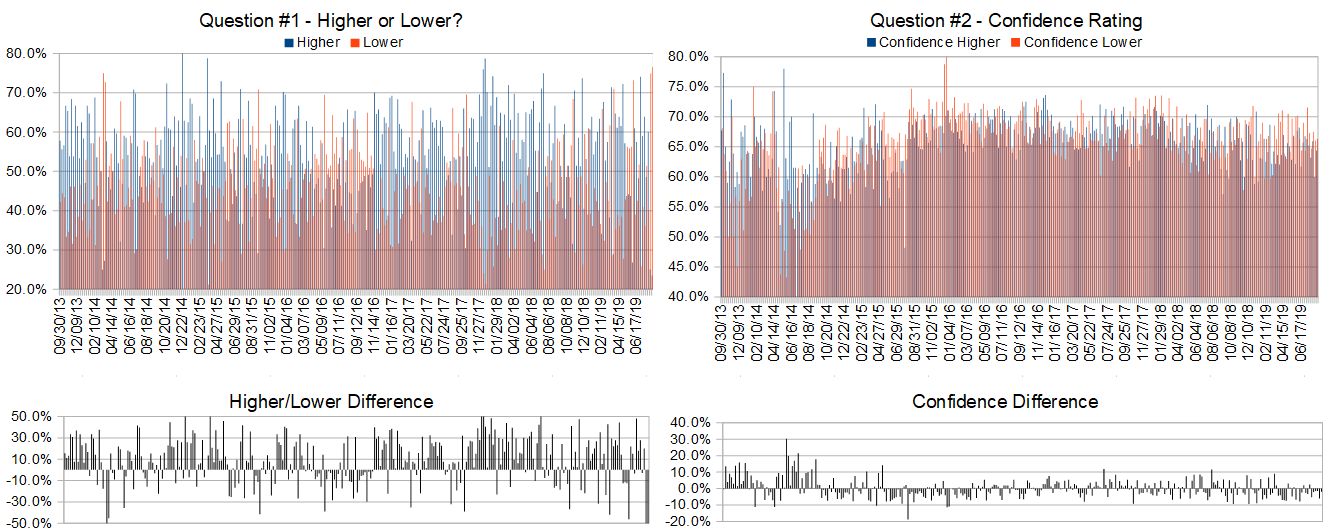

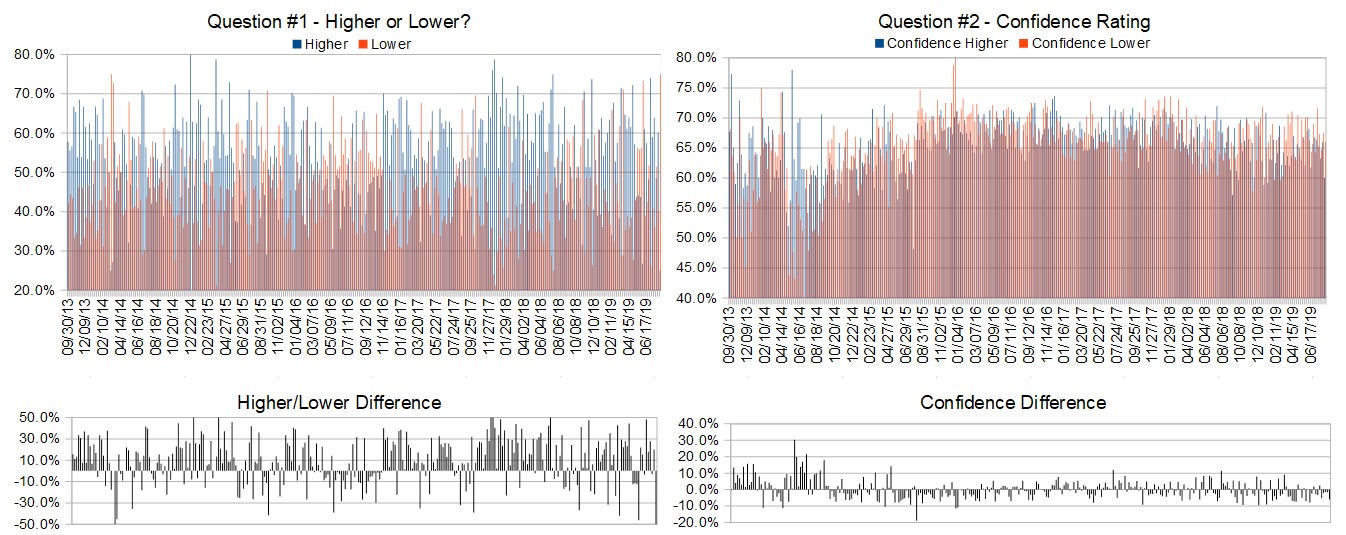

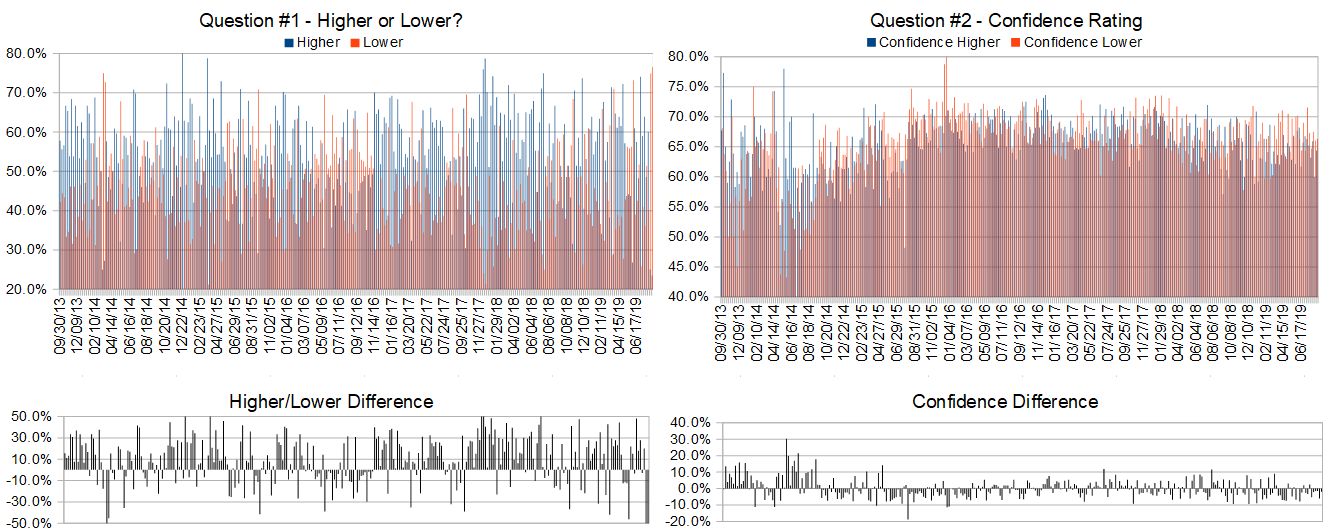

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 12th to 16th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

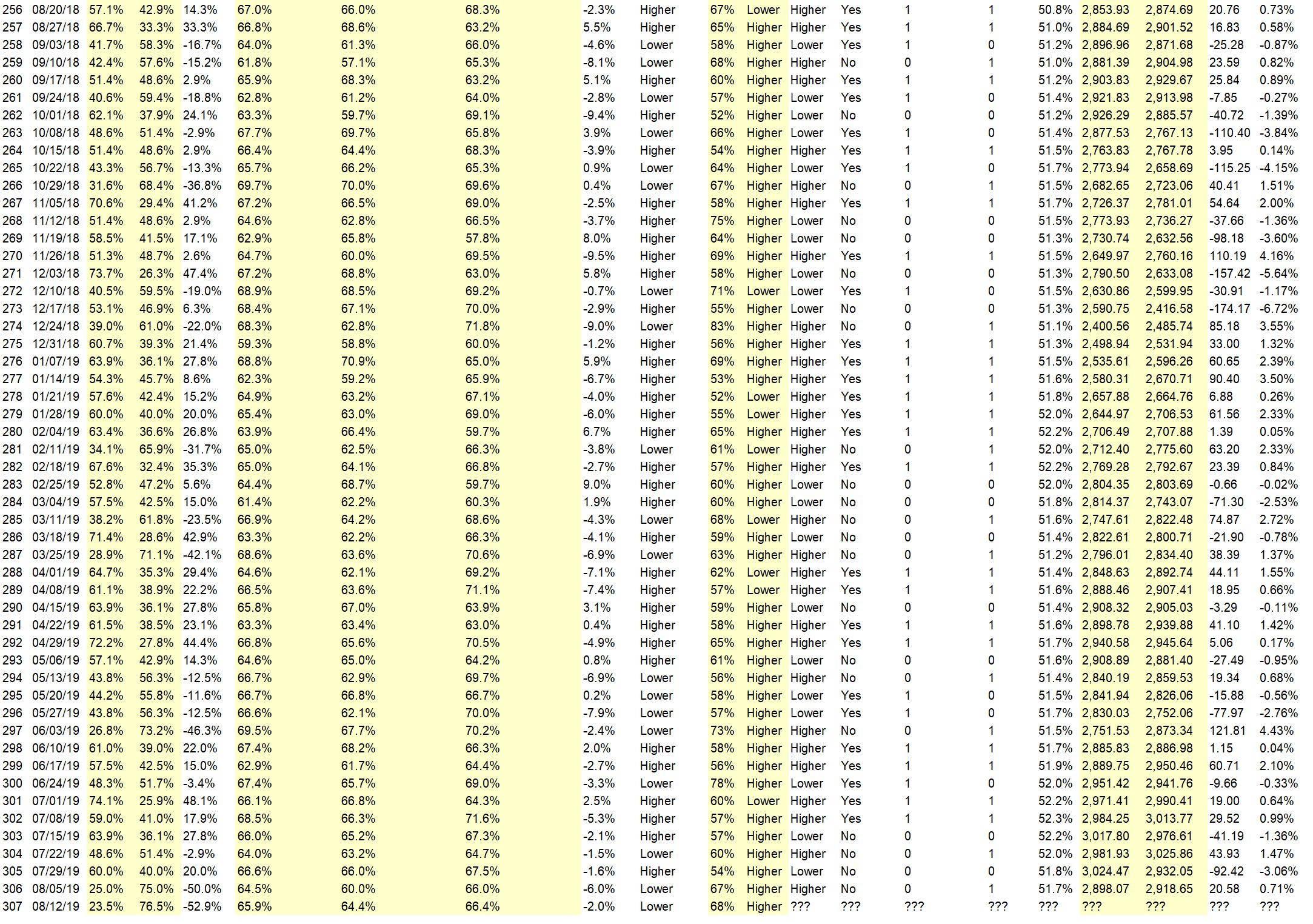

Higher: 23.5%

Lower: 76.5%

Higher/Lower Difference: -52.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.9%

Average For “Higher” Responses: 64.4%

Average For “Lower” Responses: 66.4%

Higher/Lower Difference: -2.0%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 36.9

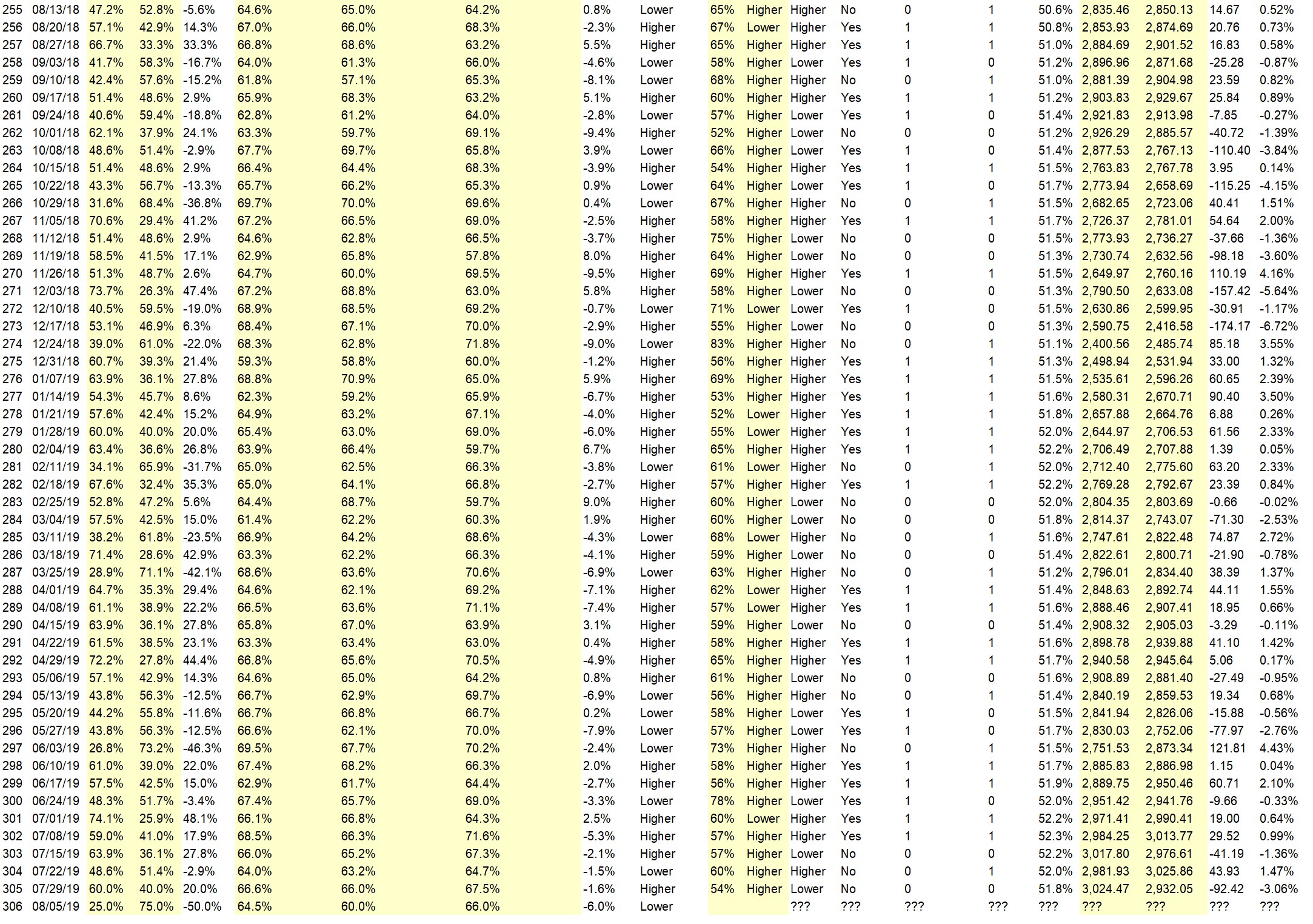

TimingResearch Crowd Forecast Prediction: 68% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 75.0% Lower, and the Crowd Forecast Indicator prediction was 67% Chance Higher; the S&P500 closed 0.71% Higher for the week. This week’s majority sentiment from the survey is 76.5% Lower with a greater average confidence from those who responded Lower (for the 2nd week in a row, this is the highest ever percentage of respondents predicting Lower in the history of this survey). Similar conditions have occurred 19 times in the previous 306 weeks, with the majority sentiment (Lower) being correct only 32% of the time and with an average S&P500 move of 0.51% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 68% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: A “hidden” trade setup finally revealed.

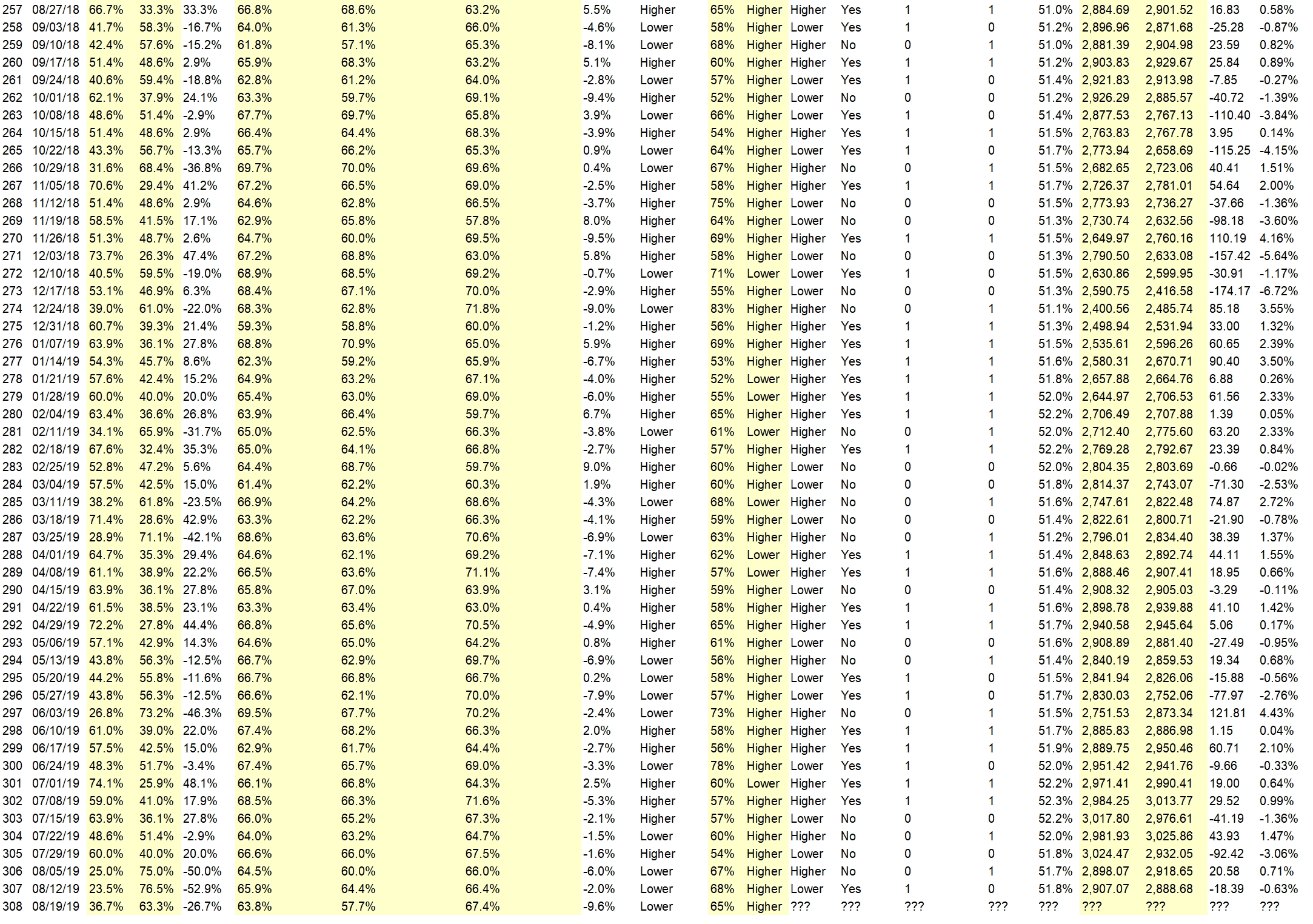

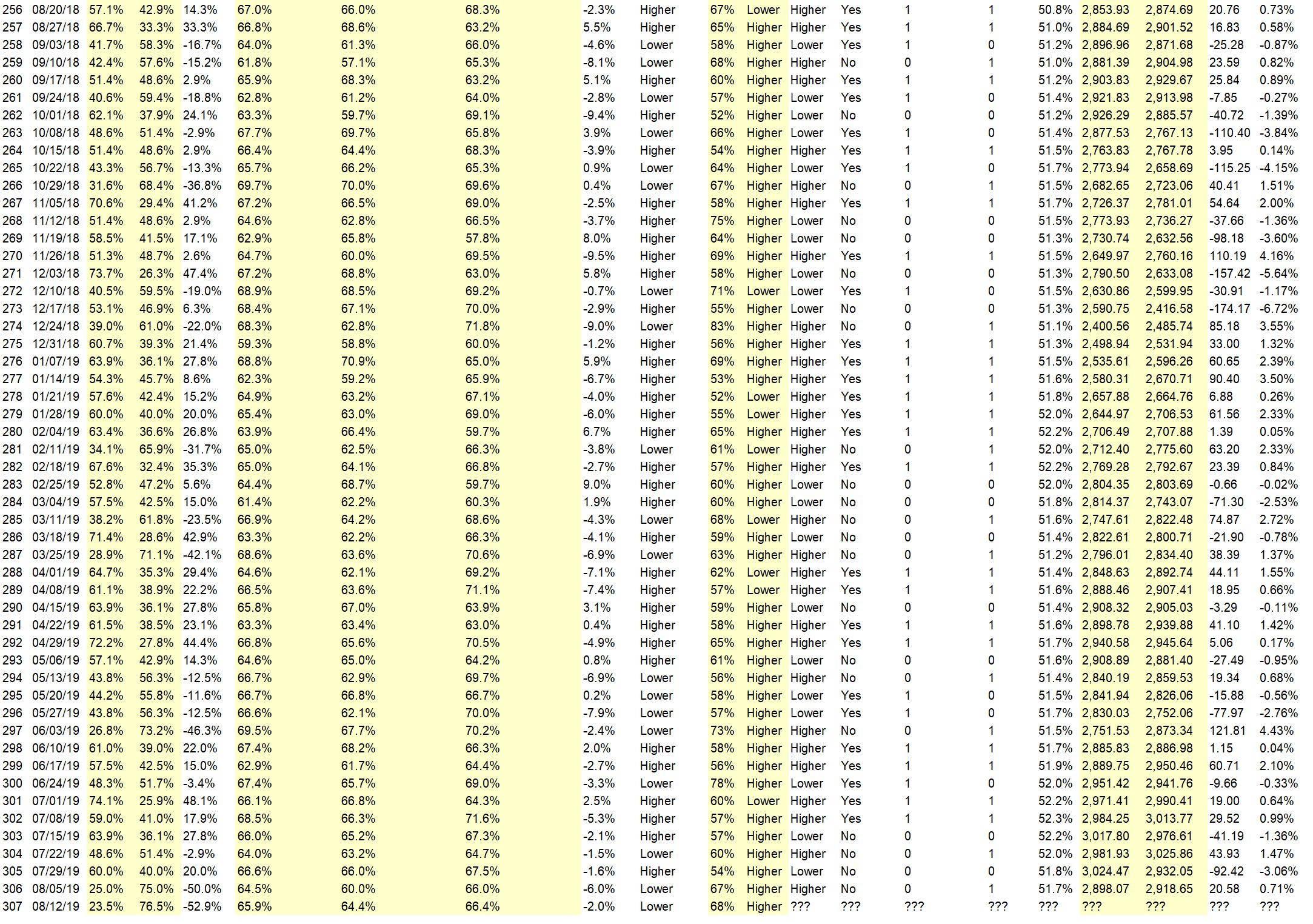

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• A crisis was averted rates are low nowhere else for money to go as bonds are t00 l0w

• Republican primary

• History

“Lower” Respondent Answers:

• Due to the tariffs imposed to China and President Trumps’ extension to China there is no telling which way the market will go. I play the SPY only with calls and puts and personally I don’t care which way the market goes.

• Heading into minor then major pullback

• Need to keep the public scared for a longer period of time than usual! Funnel top formation on monthly chart, weak Andrew’s pitchfork reaction on weekly chart and 50% retrace on daily! Long-term much higher because of hyperinflation by the world central banks! XRP, USLV, DBA and BRZU all will appreciate hundreds of percent long-term, while using leverage well over a thousand percent!

• I am evenly divided at 50%. Currently, uptrend on the hourly time frame Index charts, but neutral to lower on the daily over the next week

• tech analysis

• S&P to much high

• charts show further correction and seasonal rise not till october

• seasonality

• 200 day sma should be tested

• return to end of wave 4

• The downside correction continues. More pain and suffering needed to complete the final flush.

• Down move overdue.

• The move down that ended on Aug 5 was on the highest volume of 2019. This appears to be the primary trend. The current bounce could establish a lower high soon.

• erratic movement

• It finally may be that time where traders and investers may have begun to question the loftiness of the stock market and realize an adjustment downward is the only realistic trend setting up. Now, if only D Trump would stop trying to manipulate the market higher. Past efforts on his part are beginning to backfire because for all his exxagerated claims, you simply can’t trust anything he says and all he ends up doing is setting the market up to correct ever so often. Investor’s are wising up

• Last week action market rotation will continue until next FED cut

• DCB over

• Consolidation then a fall at the end of the week

• general risk-on conditions

• We were left at an inflection point last Friday. Daily RSI is falling, H4 RSI was the retrace last week. As the H4 RSI turns lower the same direction as the Daily we will head lower with more speed in Price action

• bear trap, divergence in market internalj

AD: A “hidden” trade setup finally revealed.

Question #4. Which trading platforms or brokers do you like the best for executing your trades?

• TC 2000

• USAA & Fidelity

• TOS

• Lightspeed

• MT4

• Etrade

• saxo

• my UK CFD provider ADM who provide me with the Fidessa platform

• tradestation

• Ninja trader 8

• ThinkorSwim

• IB

• Trade Dystion

• Lightspeed

• Oanda Capital Gain FXChoice GFF Brokers

• E*trade for the win!!!

• Fidelity, USAA

• TOS, mt4, IcMarkets, E*trade, FxGlory, ExpertOptions, Saigon Securities, Evolve.Markets, CryptoGt.

• E-Trade

Question #5. Additional Comments/Questions/Suggestions?

• Have great weekend.

• nil

• i like protective puts on all buys of stock

• Don’t forget to look at the larger picture, like the weekly charts. It is easy to run in the smaller time frames and get the rug pulled out from you.

• none

AD: A “hidden” trade setup finally revealed.

Join us for this week’s shows:

Crowd Forecast News Episode #234

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 12th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jake Wujastyk of TrendSpider.com (first time guest!)

– Jeffrey Hirsch of StockTradersAlmanac.com (first time guest!)

– Erik Gebhard of Altavest.com

– Anka Metcalf of TradeOutLoud.com

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

Analyze Your Trade Episode #89

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 13th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

AD: A “hidden” trade setup finally revealed.