- Home

- Crowd Forecast News Reports

Crowd Forecast News Report #283

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport022419.pdf

Full web version of the report available below the ad.

Smooth Markets Never Made a Skilled Investor

I see a lot of panicked traders and worried investors right now. And with good cause because we’re not convinced that the turbulence in the markets isn’t set to continue for a while.

But there’s one guy we know, Jeff, who looks pretty relaxed right now. You see, Jeff’s investing approach can pinpoint stocks and profit from them no matter whether the market is soaring or nose-diving.

Crowd Forecast News Report #283:

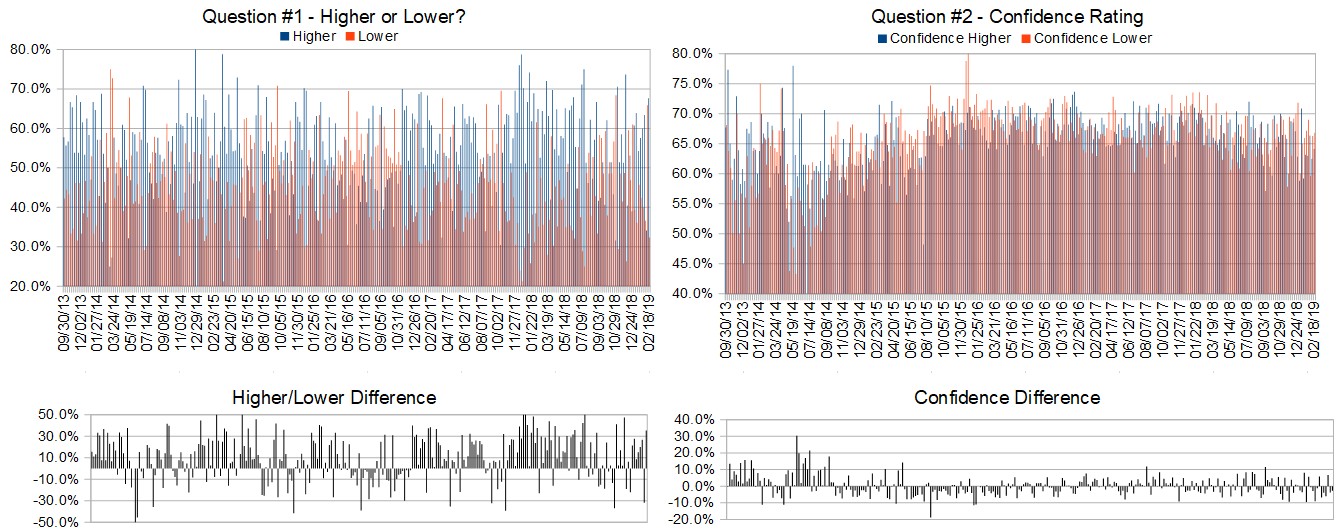

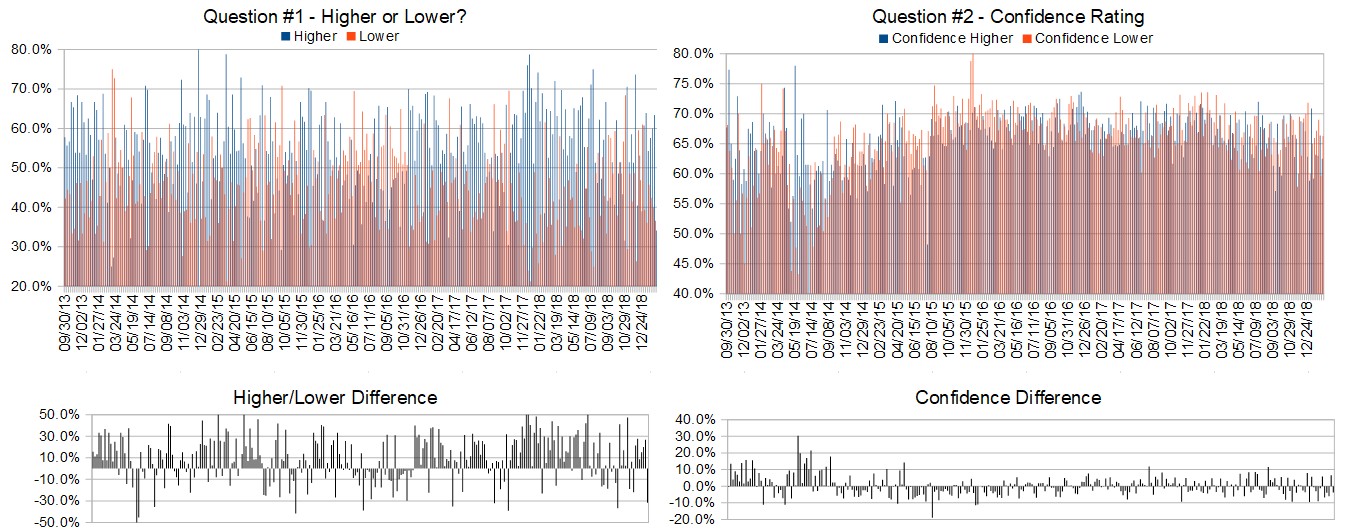

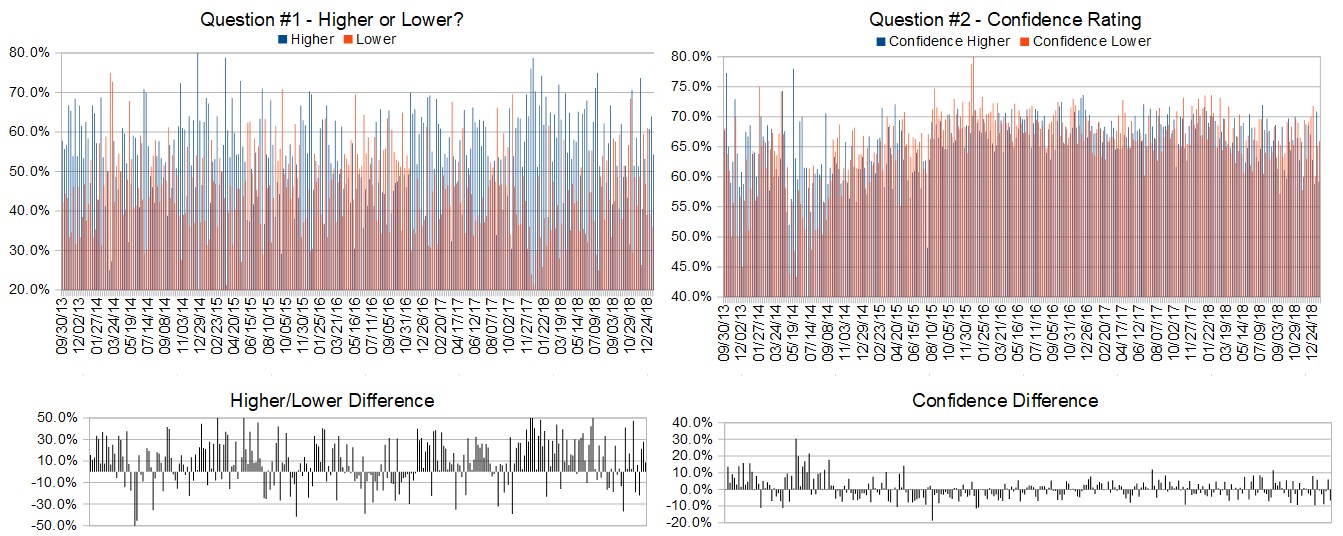

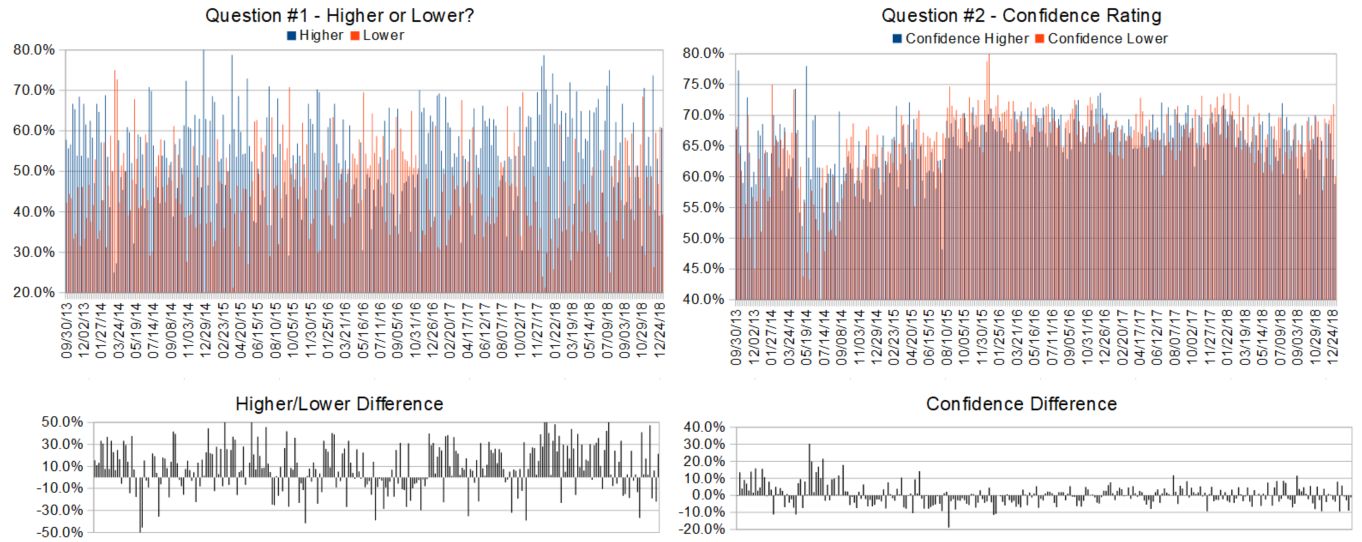

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 25th to March 1st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 52.8%

Lower: 47.2%

Higher/Lower Difference: 5.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.4%

Average For “Higher” Responses: 68.7%

Average For “Lower” Responses: 59.7%

Higher/Lower Difference: 9.0%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 41.1

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 67.6% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.84% Higher for the week. This week’s majority sentiment from the survey is 52.8% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 101 times in the previous 282 weeks, with the majority sentiment being correct 60% of the time and with an average S&P500 move of 0.29% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

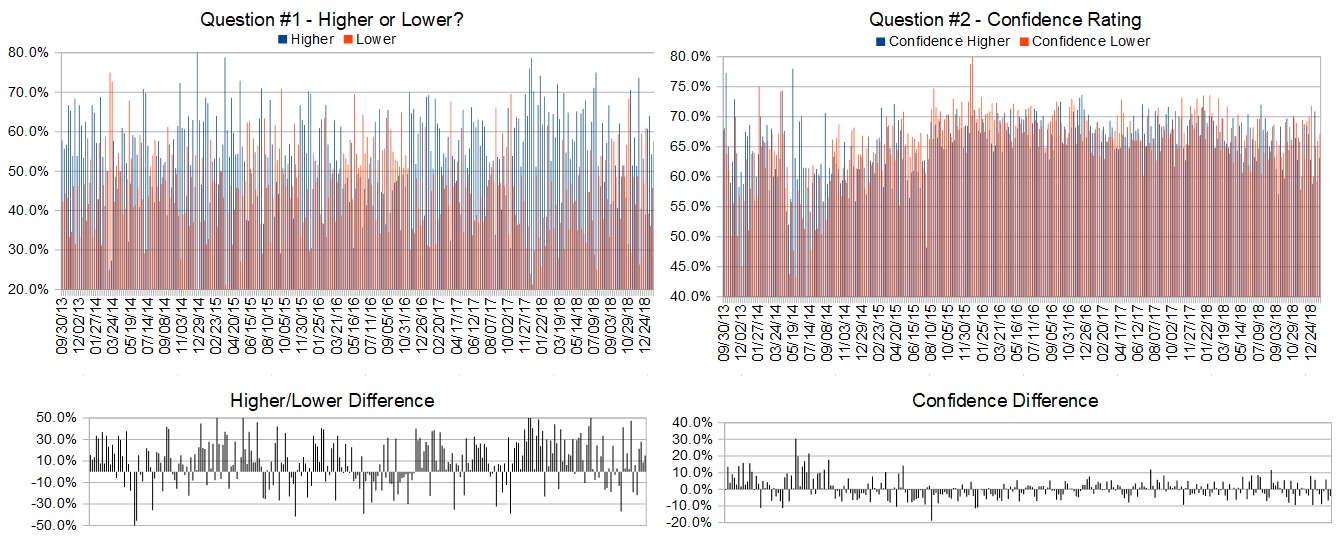

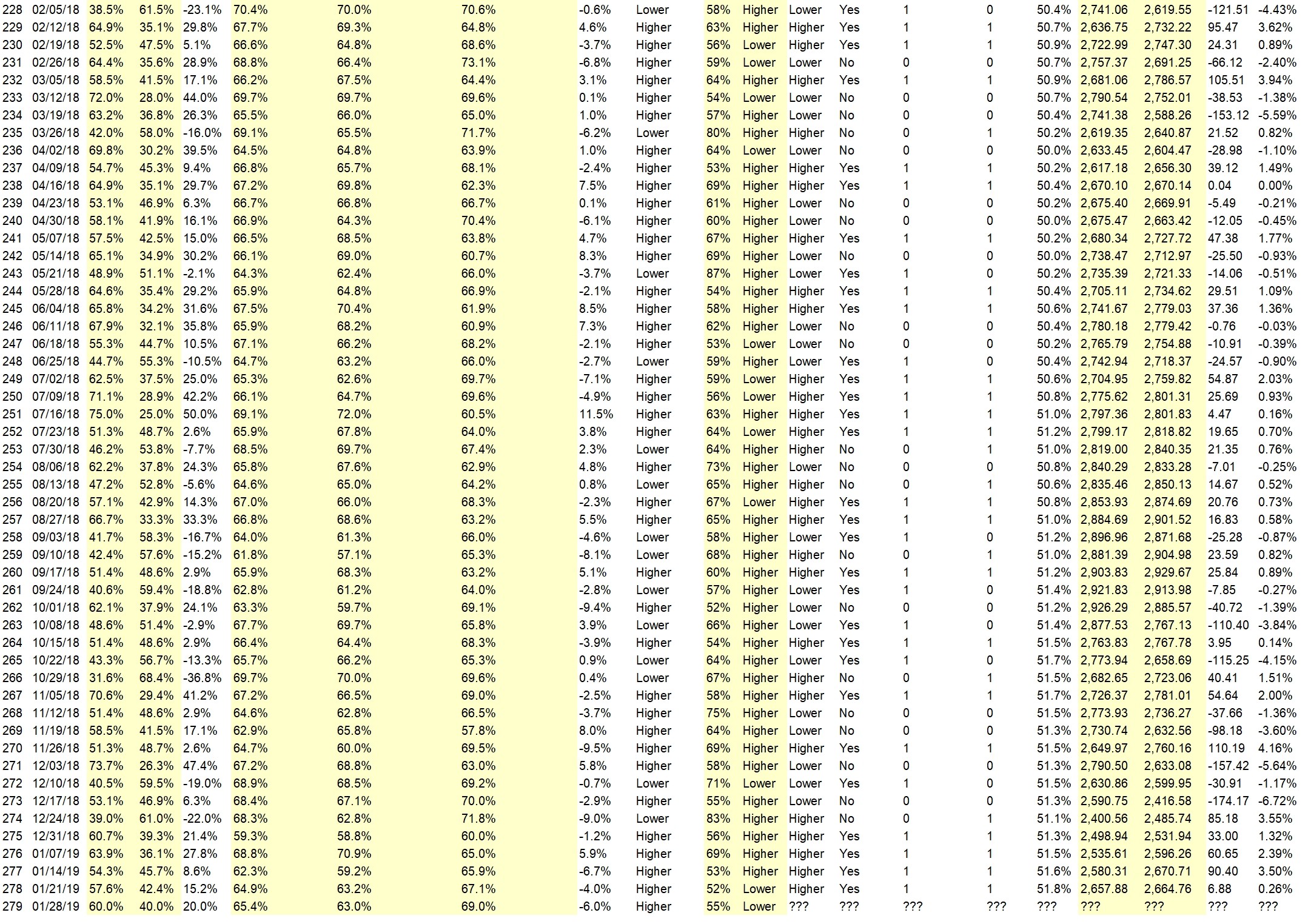

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: Need more capital to trade? Click here.

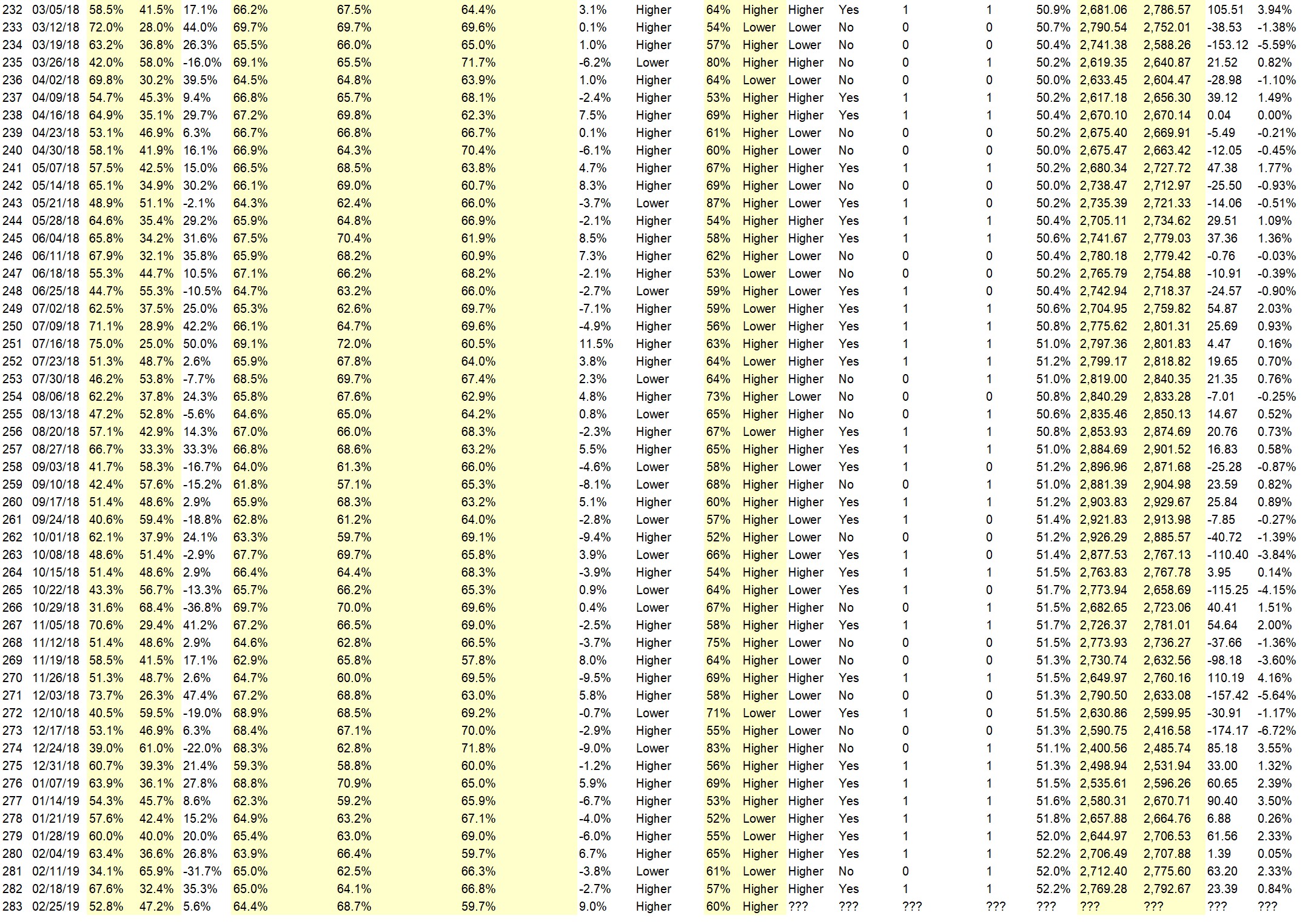

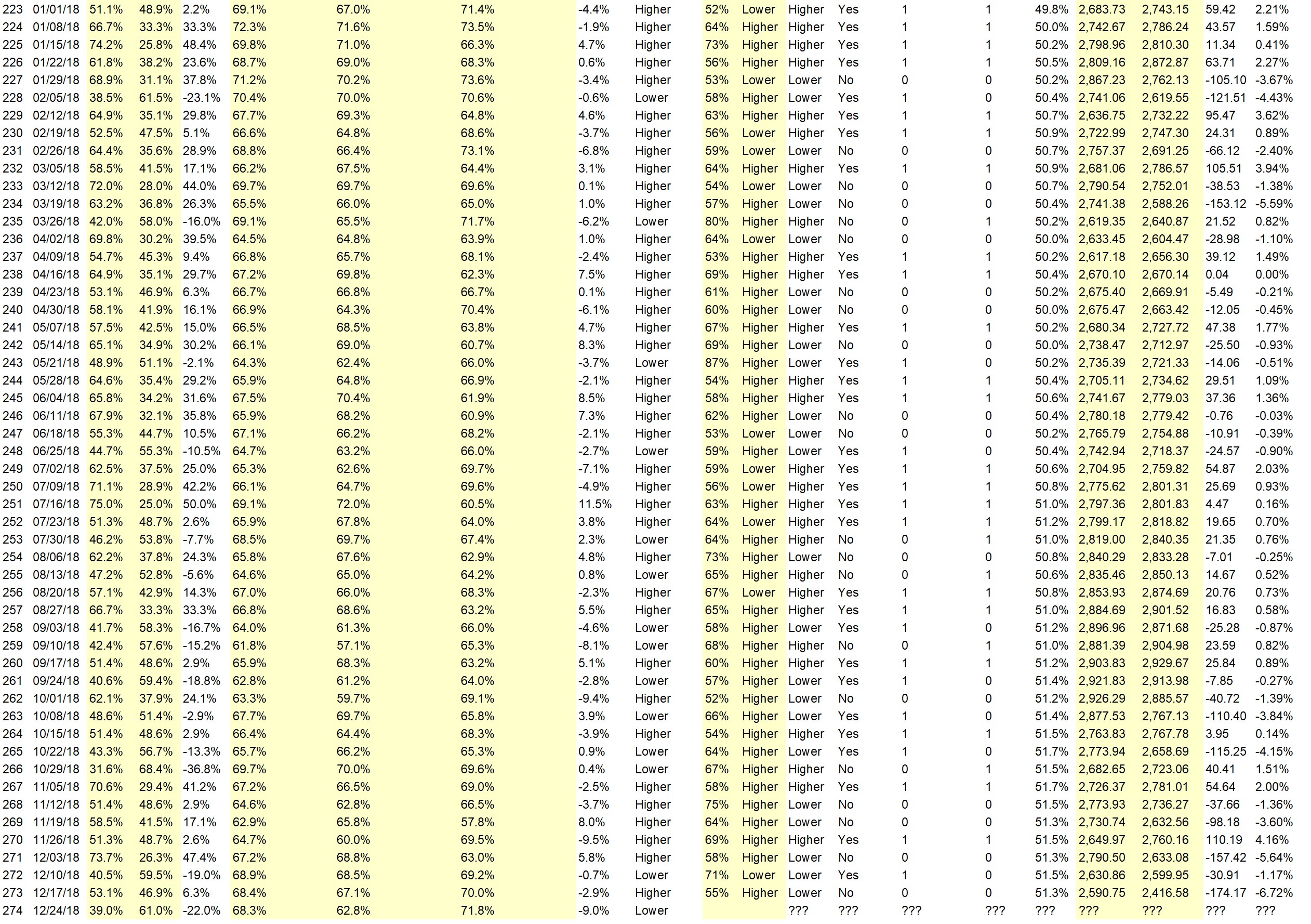

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.2%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• time to go bull

• china issue will be avoided

• Follow the trend

• Momentum and the Fed kicking the can down the road

• Momentum

• because I have some puts on.

• momentum

• The market appears healthy as it nears 2800. If the China trade talks look positive, a move above 2800 is expected to hold, and continue to resistance at 2880+.

• China deal will be done which will be favorable to the S&P.

• improved momentum R2K

• Public attitude seems “at ease.”

• Looks like we broke through the 200 & 50 dma and new highs may continue.

“Lower” Respondent Answers:

• fridays jump left a gap to fill

• pullback

• It is at a critical Resistance level

• Volatility appears to ready to break to the upside, which will most likely precipitate a drop in the S&P 500.

• elliott wave

• Market is overbought. Lack of Chinese agreement will result in selling disappointment.

• Overbought @ resistance retest 200dma

• Market momentum slowing

• Market overbought. New employment numbers this week may dissappoint due to adverse weather events. Also we are up against resistance at 200 day averages

• Back to some resistance

• Lot of news is awaited, and markets will be volatile

• This very unusual buy climax can’t last forever.

AD: Need more capital to trade? Click here.

Question #4. What indicator influences your trading the most?

• Trade. Oil

• Stochastics

• FED

• Price of SPY

• RSI

• MAs

• pivot points

• macd

• world events

• MACD

• I should just find one or two and stick with it!

• elliott wave

• Price activity

• Channels; Support/Resistance

• Volume

• trix

• S&P resistance and support levels, as well as resistance and support levels of individual stocks.

• Contrarian

• Moving averages Especially the 200Day and 50 Day

• Wave 2 to the upside. Next…wave 3 down

• 200 day EMA

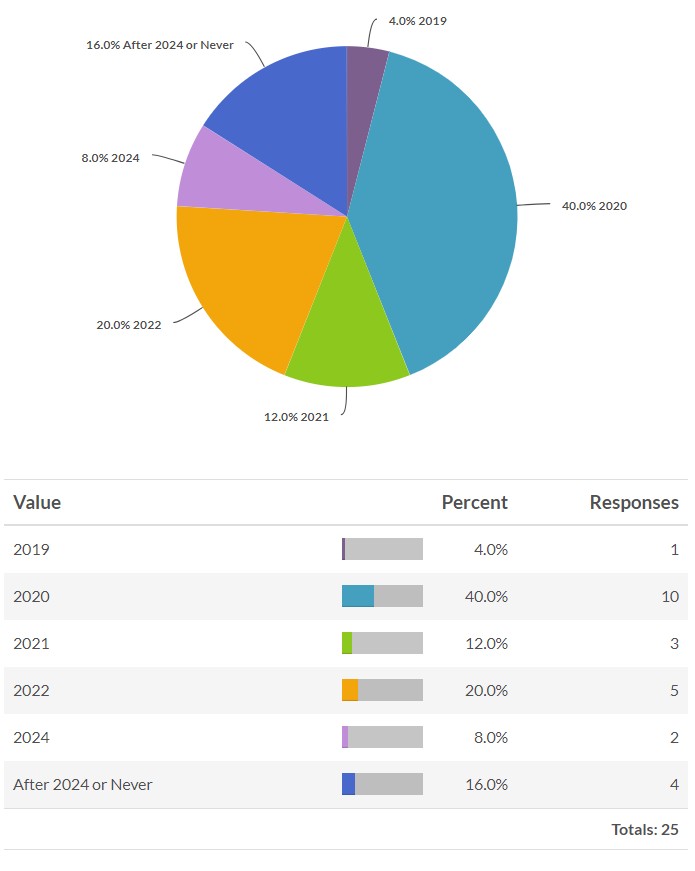

BONUS: What year do you think recreational cannabis use will be federally legalized in the United States?

Question #5. Additional Comments/Questions/Suggestions?

• How about a table of who is making the best predictions.

• Unless the dumb o rats take control

AD: Need more capital to trade? Click here.

Join us for this week’s shows:

Crowd Forecast News Episode #214

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, February 25th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– Gary Dean of SentimentTiming.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #67

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, February 26th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Jerremy Newsome of RealLifeTrading.com

– John Thomas of MadHedgeFundTrader.com

AD: Need more capital to trade? Click here.

Crowd Forecast News Report #282

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport021819.pdf

AD: Need more capital to trade? Click here.

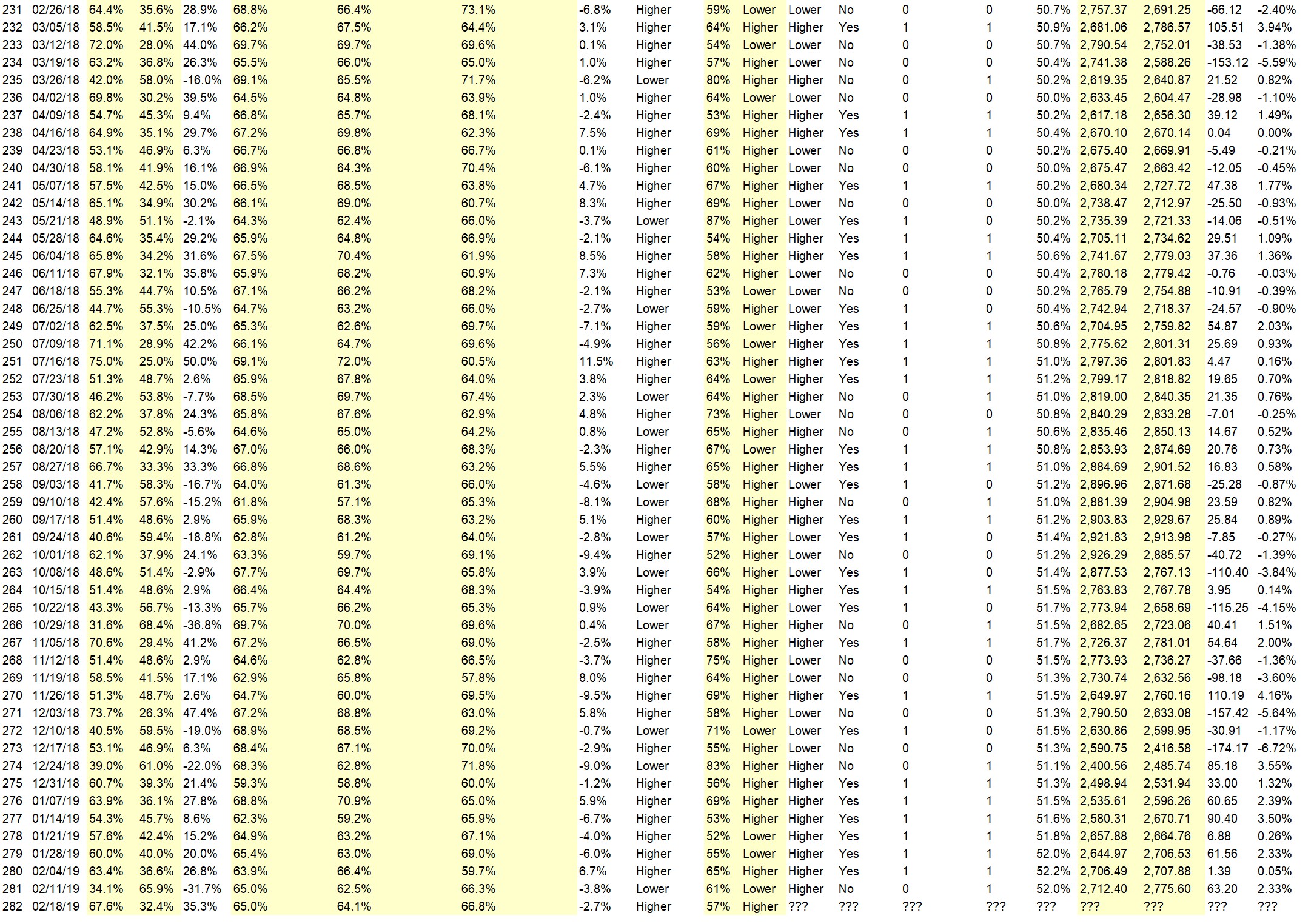

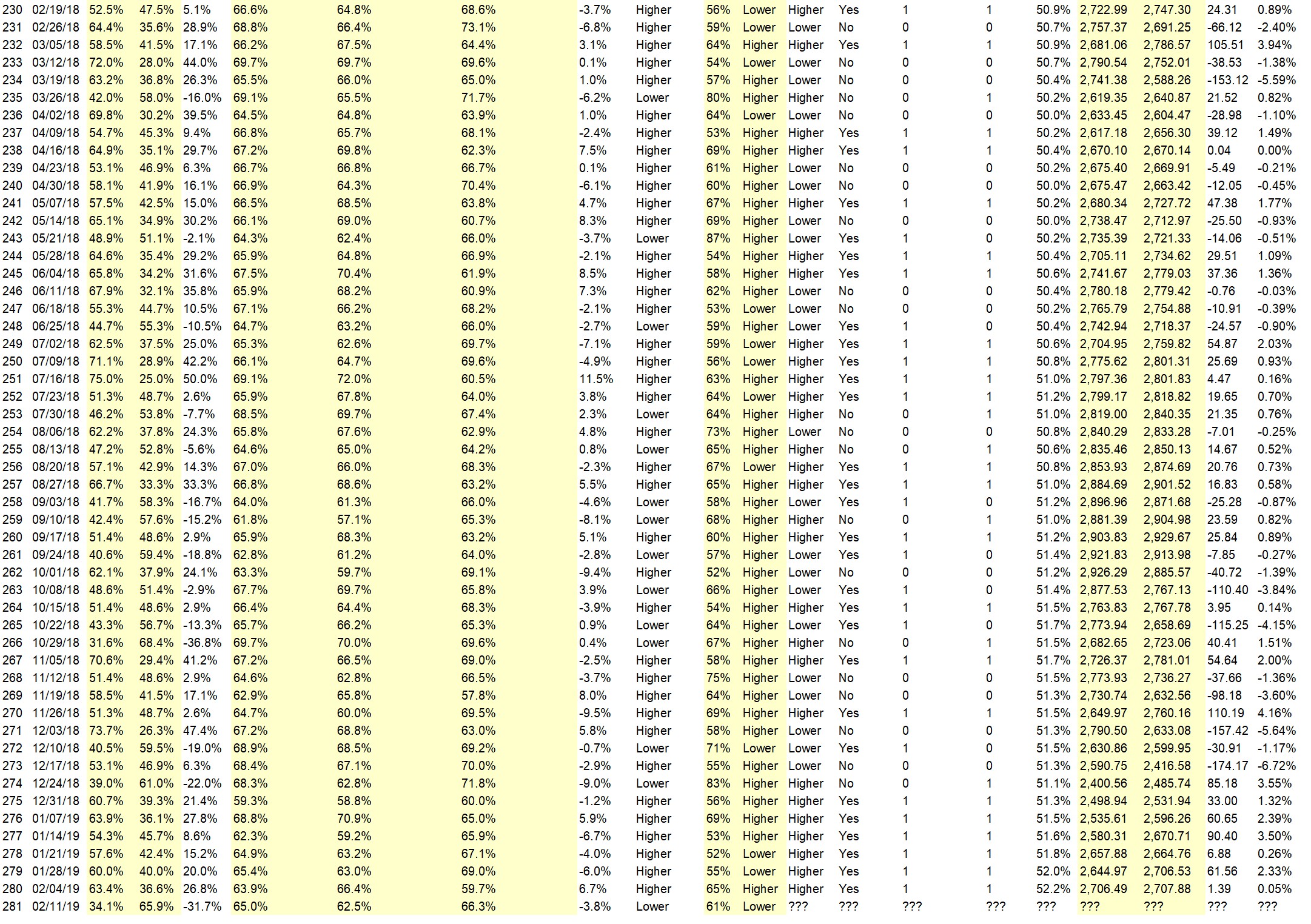

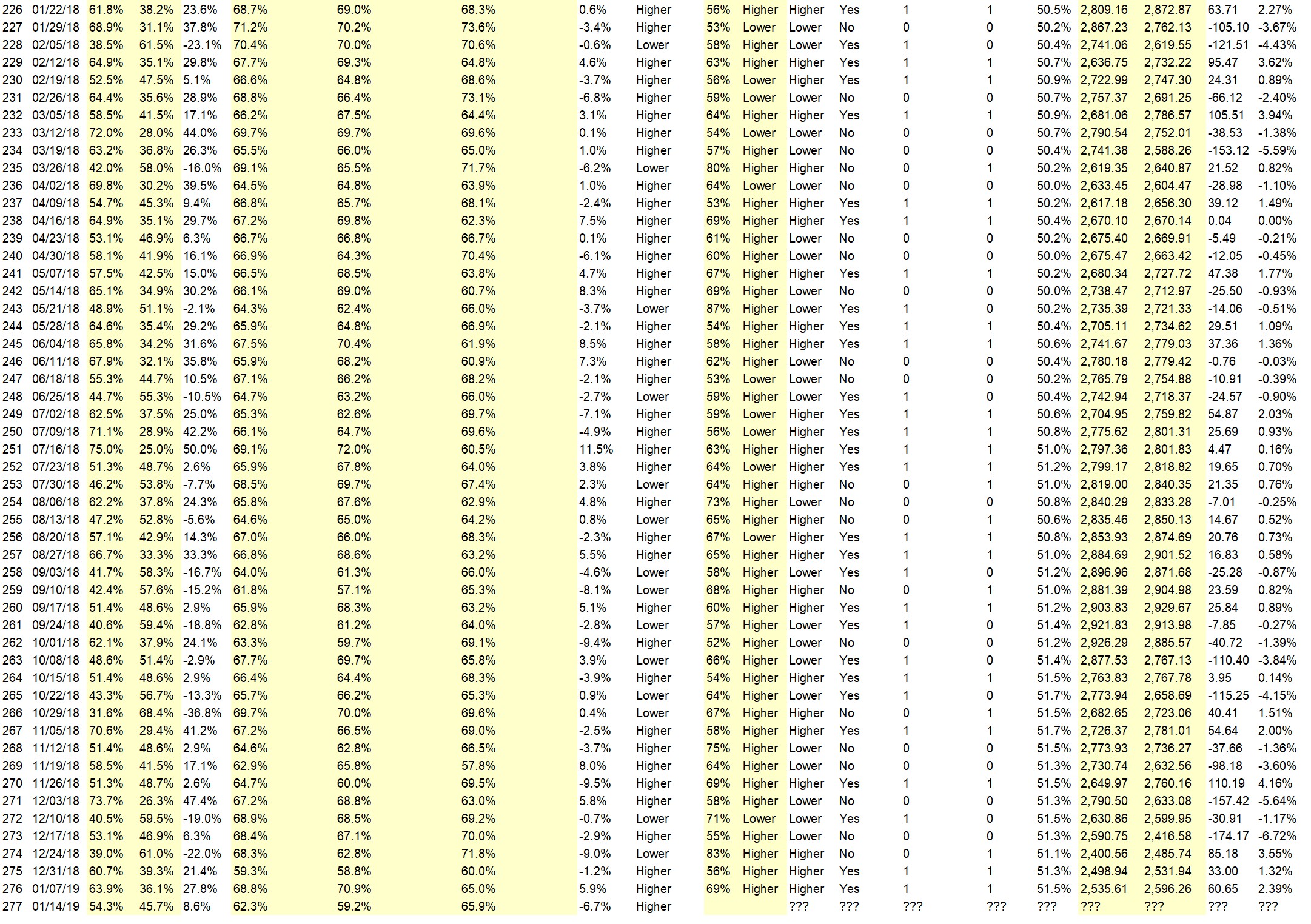

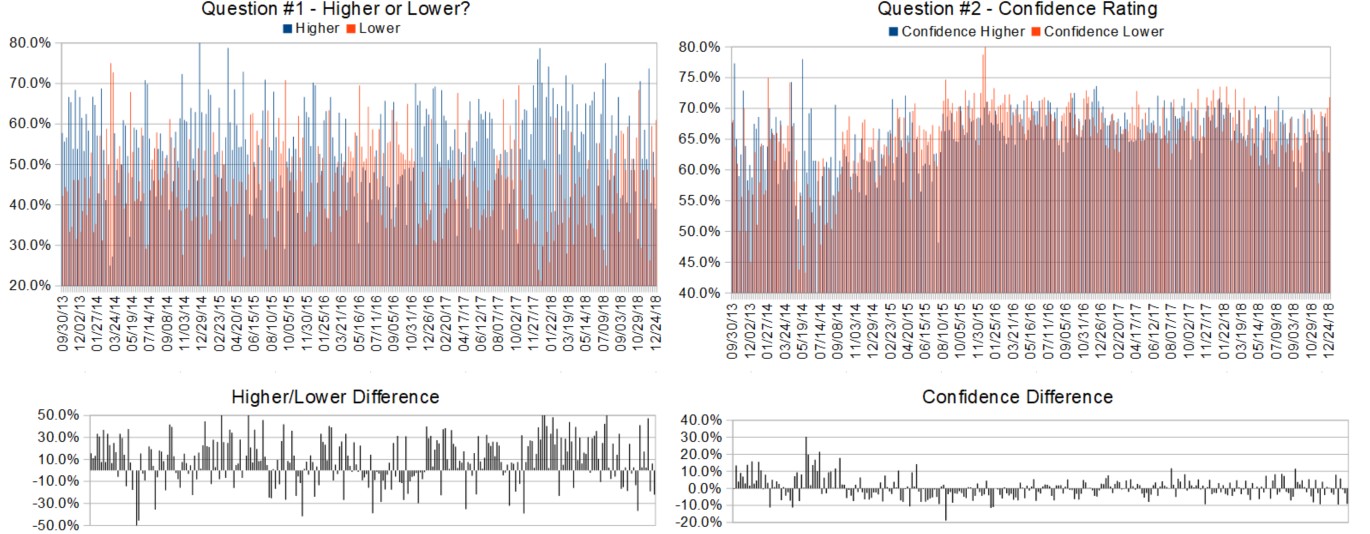

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (February 19th to 22nd)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 67.6%

Lower: 32.4%

Higher/Lower Difference: 35.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.0%

Average For “Higher” Responses: 64.1%

Average For “Lower” Responses: 66.8%

Higher/Lower Difference: -2.7%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 41.3

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 65.9% Lower, and the Crowd Forecast Indicator prediction was 61% Chance Lower; the S&P500 closed 2.33% Higher for the week. This week’s majority sentiment from the survey is 67.6% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 28 times in the previous 281 weeks, with the majority sentiment being correct 57% of the time and with an average S&P500 move of 0.02% Lower for the week (one of those circumstances where there have been more moves higher but the overall average move is lower). Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

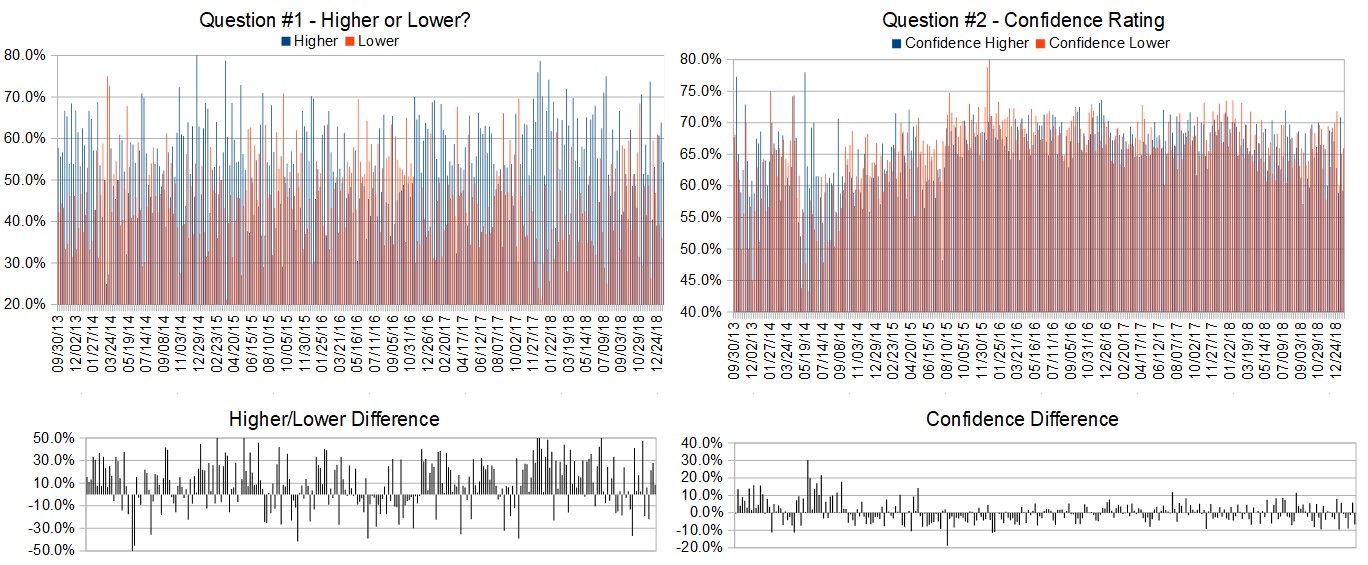

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: Need more capital to trade? Click here.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• optimistic about fundamentals

• European hedgefunds moving to American markets.

• Momentum

• China deal hopes

• Renewed optimism.

• trend

• Closer to possible USA/China Deal

• 1.Seasonality- Feb – May usually bullish. 2. tariff war abating ? 3. Even stupidity runs out of steam !

• continued belief in trade deal

• The trend will be up until it isn’t

• Border Security

• This week ends with momentum Market building a top

• trend up continues

• Trend and support now establishef

• News, seemingly China trade favorable.b

• China talks looking more positive

• Major indexes crossing above 200DMA

• trade talks still optimistic. cash from Brexit coming to US stocks

“Lower” Respondent Answers:

• Post seasonality correction

• Resistance at 2810.

• overbought

• Need to see all 4-indices ,not 3 breaking out . Like to see a pullback . Reversion to the mean

• elliott wave

• Market is now overbought. Some backing and filling would be helpful.

• The market is balancing negative reports on retail sales and industrial production with hopes of US/China trade deal. The S&P is extended, and 2800 looks like strong resistance. If we get there, the drop could be steeper than the run up.

• Many time pivots favor selling.

AD: Need more capital to trade? Click here.

Question #4. Who would you most like to see as a guest on one of the TimingResearch shows?

TimingResearch Response: Thank you for the suggestions!

• Price Headley of Big Trends Dave Meckenburg Spelling ? of Tiger Shark Trading AJ Brown of Trader Training

• No 1 can think of

• Constance Brown

• Tom Bowley

• Daytradingradio host john cursico.

• Chris breacher

• Warren Buffet

• sector analysis rotation info

• Mary Ellen

• Kevin Davey and Marvin Arpel of System & Forecast

Question #5. Additional Comments/Questions/Suggestions?

• Expert in trading small caps

Join us for this week’s shows:

Analyze Your Trade Episode #66

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, February 19th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

– Anka Metcalf of TradeOutLoud.com (moderator)

Crowd Forecast News Episode #214

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, February 25th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– Jim Kenney of OptionProfessor.com

– Gary Dean of SentimentTiming.com

AD: Need more capital to trade? Click here.

Crowd Forecast News Report #281

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport021019.pdf

AD: Need more capital to trade? Click here.

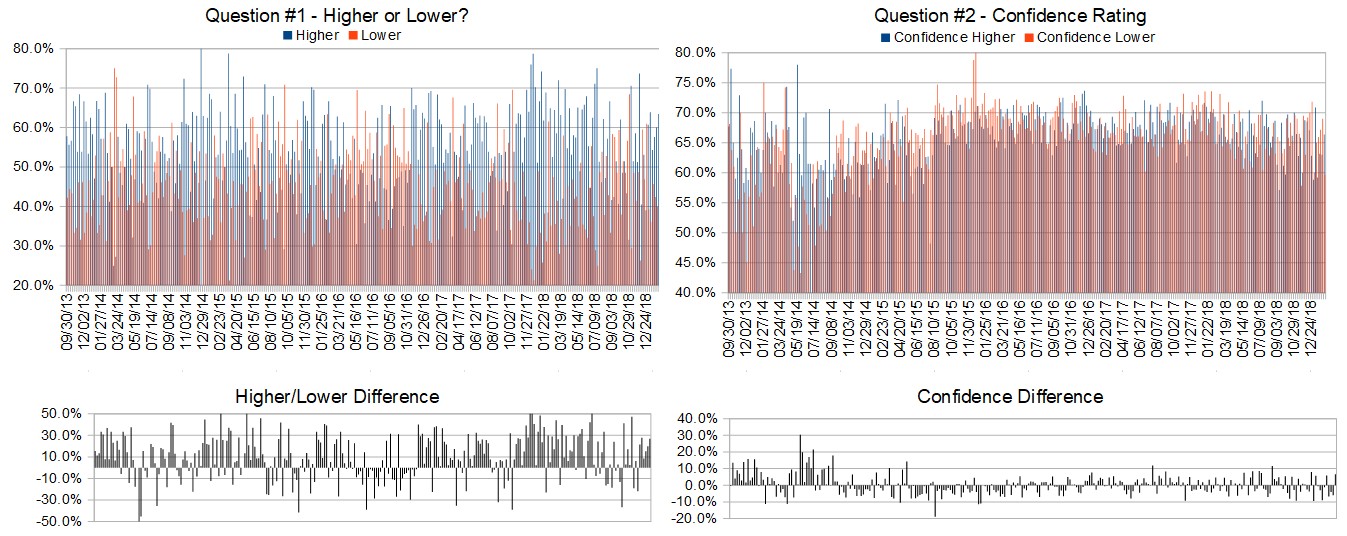

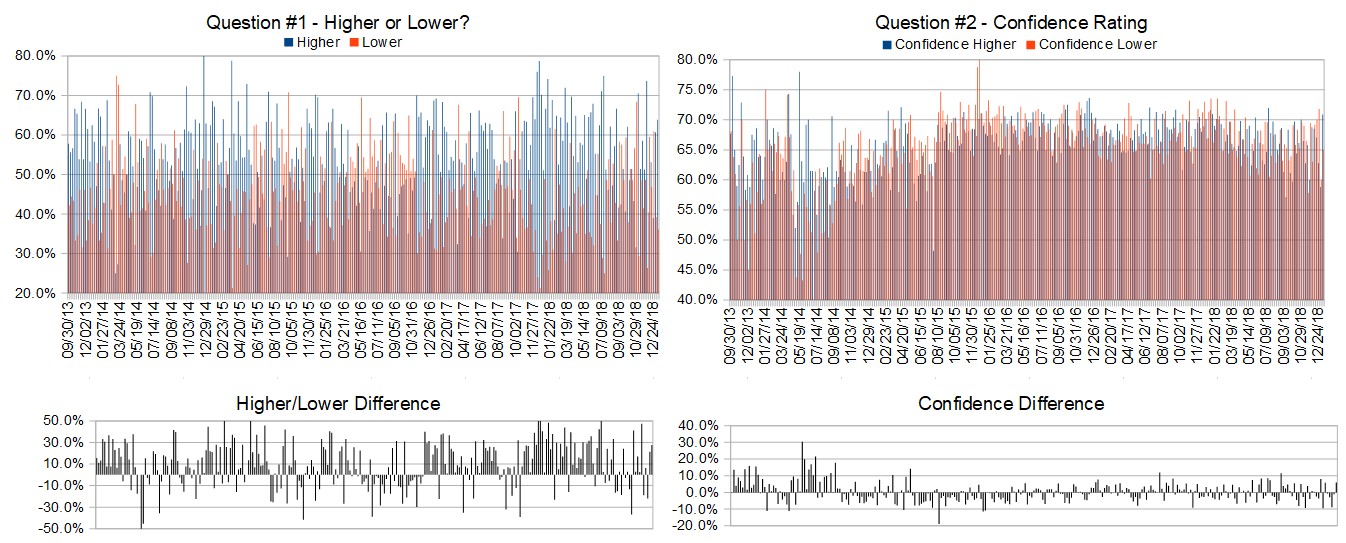

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 11th to 15th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 34.1%

Lower: 65.9%

Higher/Lower Difference: -31.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.0%

Average For “Higher” Responses: 62.5%

Average For “Lower” Responses: 66.3%

Higher/Lower Difference: -3.8%

Responses Submitted This Week: 43

52-Week Average Number of Responses: 41.7

TimingResearch Crowd Forecast Prediction: 61% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.4% Higher, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 0.05% Higher for the week. This week’s majority sentiment from the survey is 34.1% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 31 times in the previous 280 weeks, with the majority sentiment being correct 61% of the time and with an average S&P500 move of 0.17% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

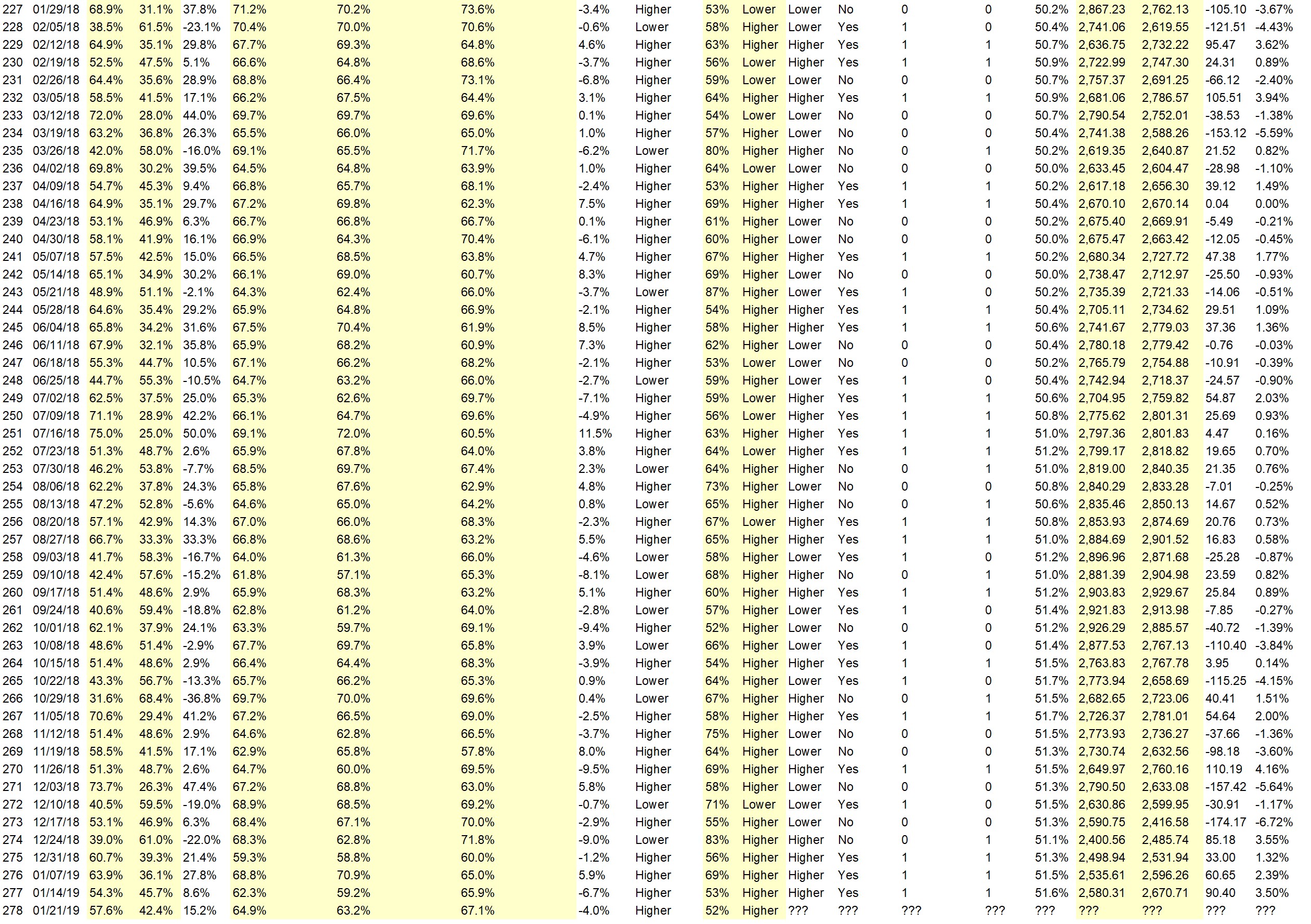

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: Need more capital to trade? Click here.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.2%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• The Bulls seem to be fighting hard to continue melt up

• Seasonality is very favorable this week. Money keeps being pulled from the stock market.

• Best six months of year historically

• China trade talks look positive Meeting w/ NO Korea Trump wants to avoid government shutdown

• technical analysis

• dow stocks DIS FB MSFT held steady to up for week up next week

• Trend of the market remains positive

• history

• Dips are being bought. With the uncertainty, rallies could be sold, so upside appears to be limited.

“Lower” Respondent Answers:

• Topping out

• Government will shut down again

• Vix and order flow

• Reality catches up with algorithmic traders

• Resistance at 200 Day MA

• we hit a reistance area ,spx 2704–rejected now revert back down to thw mean.

• consolidating below 200 day smh

• elliott wave

• Resistance levels will continue to hold. Failure of Congress to deal with China and/or Government Shutdown will weigh on prices.

• overbought

• weak internals, momentum, MACD

• uncertainty over gov’t shut down on 2/15

• Its over

• trade war

• Mkts going to be more range bound

• dynamic yield curve set up (at stock charts.com) With the low vol. in the s&p500 last week . with the crazy news. it seems like is stuck at 2650 2700. . . I see it at 2550. to 2600

• No spectacular earnings.

• Expecting markets to revert to the mean, 50 day moving average

• Down we go. . Stochastics have turned

• Sentiment indicators (fear vs greed) are showing net greed.

AD: Need more capital to trade? Click here.

Question #4. Who have you learned the most from about trading or investing? What about their teaching style or method made them more effective?

• my self . then mostly by far CHAT with TRADERS Aaron Fifield all 167 eps. then Mr. Mike Pisani. . on youtube Rayner Teo. . also The 20 habits of a successful trader. and you all of course

• Trend following turned my p/l

• Keep expectations low

• Al Brooks. He shows, on the chart, what the bulls are thinking and what the bears are thinking. He doesn’t have indicators except for trendlines and a moving average. He emphasizes probability and always has stops.

• Lot of online resources and self study

• Gerald Appel candor, integrity

• I learned that there are many counter intuitive moves and that explanations of market moves often don’t make sense.

• ZIAD JASANI

• Jim Cramer.

• Follow big money flows and interest rates

• Myself

• Friends live on line

• William O’Neil. Follow through days, cutting losses & letting winners run!

• Patience

Question #5. Additional Comments/Questions/Suggestions?

• Keep up the good work. don’t bet on the S&p on my opinion

Join us for this week’s shows:

Crowd Forecast News Episode #213

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, February 11th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Bennett McDowell of TradersCoach.com

– Damon Pavlatos of FuturePathTrading.com

– Mark Sachs of RightLineTrading.com

– Anka Metcalf of TradeOutLoud.com (moderator)

Analyze Your Trade Episode #65

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, February 12th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– George Papazov of TRADEPRO Academy

– Jim Kenney of OptionProfessor.com

– Michael Filighera of LogicalSignals.com (moderator)

AD: Need more capital to trade? Click here.

Crowd Forecast News Report #280

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport020319.pdf

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

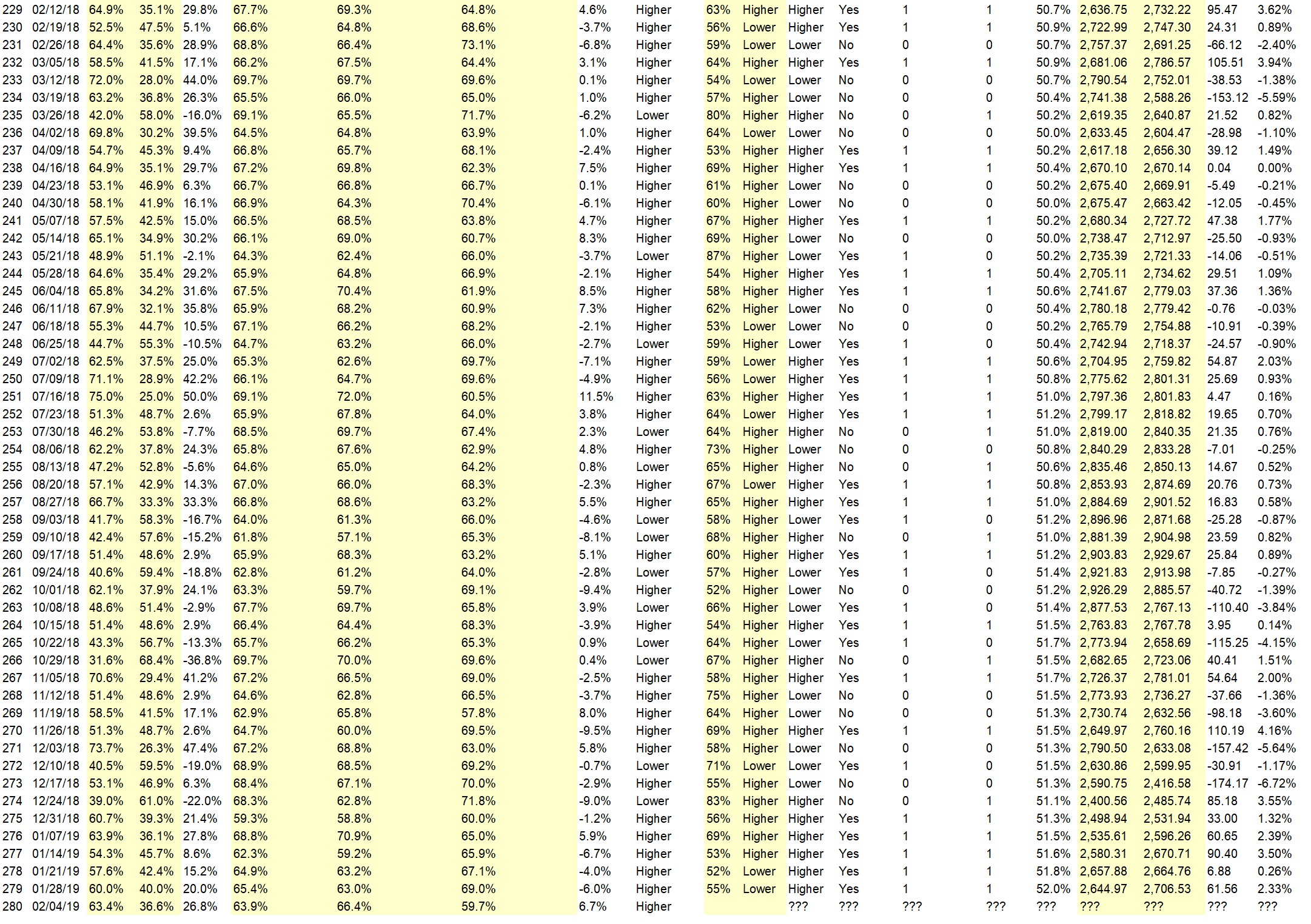

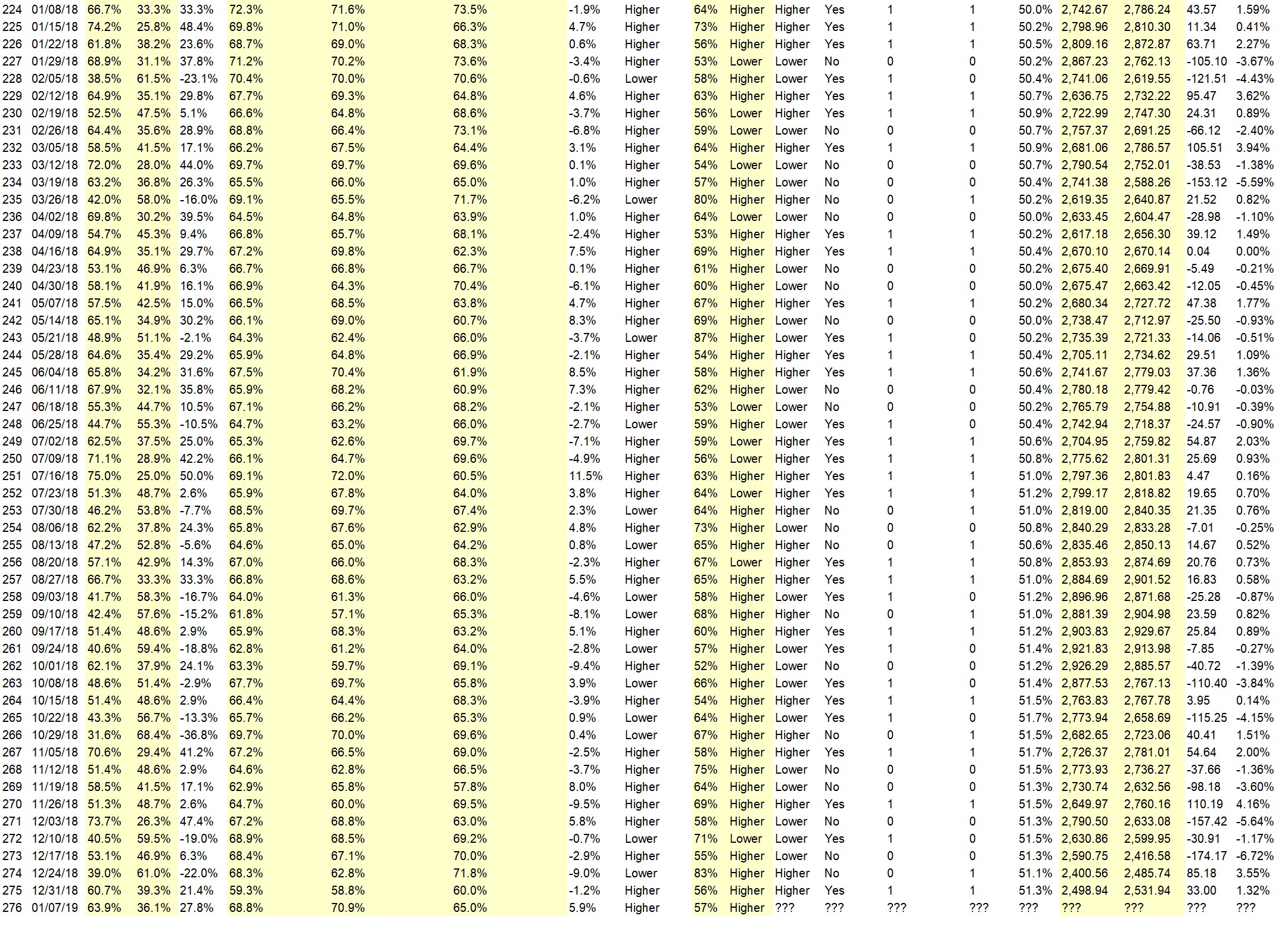

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 4th to 8th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.4%

Lower: 36.6%

Higher/Lower Difference: 26.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.9%

Average For “Higher” Responses: 66.4%

Average For “Lower” Responses: 59.7%

Higher/Lower Difference: 6.7%

Responses Submitted This Week: 43

52-Week Average Number of Responses: 42.0

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 60.0% Higher, and the Crowd Forecast Indicator prediction was 55% Chance Lower; the S&P500 closed 2.33% Higher for the week. This week’s majority sentiment from the survey is 63.4% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 23 times in the previous 279 weeks, with the majority sentiment being correct 65% of the time and with an average S&P500 move of 0.13% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Higher weekly highs, positive week historically, The Fed is on the side of bulls

• Earnings and Presidential speech

• Tariffs resolved

• earnings have been fair to good [ altho guidance down ]

• Fed Oil workers 3 Yr. agreement Trump’s move against OIL fr. venezuela should cause oil prices to rebound over the next 3 or 4 months. That should draw the mkt. up.

• inverse reticulation of adverse momentum

• Momentum

• Too much talk that it is going down.

• relative strength charts

• chart pattern

• China deal getting coser

• The market moved up strongly last week, with some good earnings reports, and with good breadth, and a more dovish fed. Expecting a continuation now.

• MO

• Momentum of trend and earnings

• the distress in Europe and abroad and the encouragement of our political affairs as well as a generally good economy despite the talking heads of doom

• Wall Street/Washington TV chatter.

• good earnings

• Can see only 3 waves up so far from 2624 to 2717. Still need a wave 4 down (maybe already completed) and then a brief new high this coming week to higher than 2717. I don’t even believe Elliott wave stuff and I’m pretty sure the algos don’t use it. But it’s become so popular that it might be worth mapping.

“Lower” Respondent Answers:

• Oh it’s coming now Inflation rising layoffs here recession begun Not A recovery but a short lived rebound

• High gold oil Huge layoffs Market building a top

• This is the 4th try for S&P to close a move 200dma.

• Technical

• slowing momentum

• Technical analysis

• 2710 to 2720 strong resistance

• Resistance levels to continue to hold. Earnings forecasts continue to be soft.

• possibly weekly over bought ?

• losing momentum, may peak early in week

• time for a pb

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

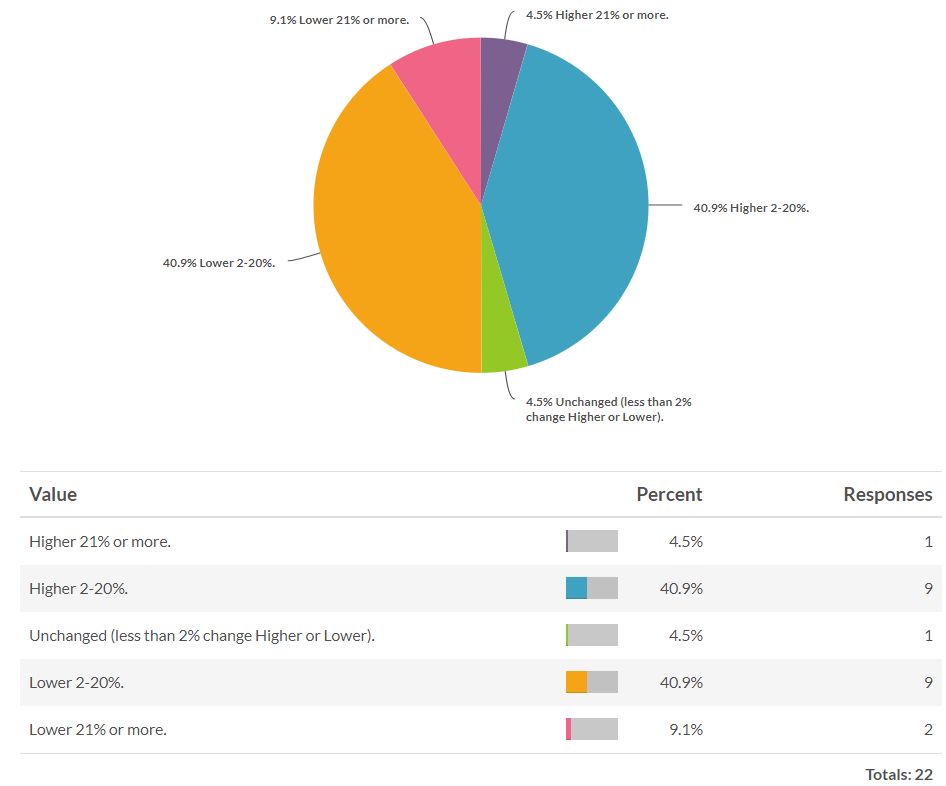

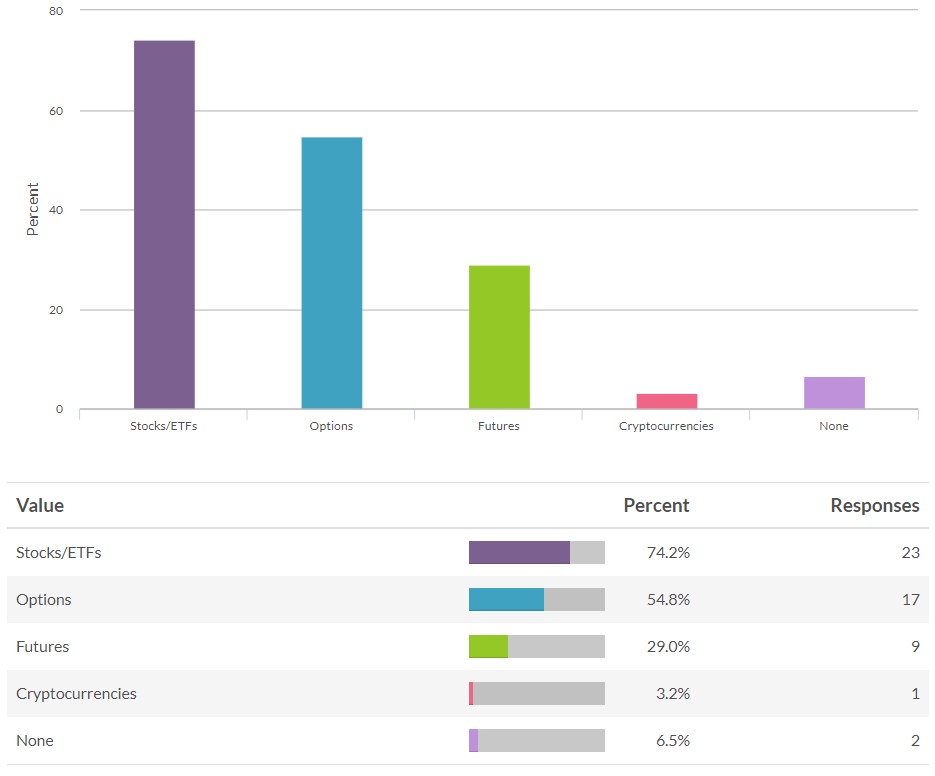

Question #4. What type(s) of trading do you specialize in or focus on? How did you come to that decision?

• Options

• Forex and SP500

• spy aapl options

• stocks and options

• Arbitrage

• Swing trading.

• Swing trades on stocks. My schedule doesn’t allow good access to day-trading.

• Growth

• Long term etfs only

• options

• Stocks, options

• options – small account

• option swing trading

• put spreads higher returns

• day

• fundamental as well as charts

• options months to weeks

• worm casting futures

• Swing

• Sell out-of-money ES index options. Why? Because don’t have to bite fingernails.

• Options- calls, puts, verticals earns a greater percentage than buying and selling stocks without the high risk associated

• options and stocks. Greed !!!!

• options & futures

• See Above

• options

• options

Question #5. Additional Comments/Questions/Suggestions?

• love it

Join us for this week’s shows:

Crowd Forecast News Episode #212

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, February 4th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Glenn Thompson of PacificTradingAcademy.com

– Simon Klein of TradeSmart4x.com

– Rob Hanna of QuantifiableEdges.com (moderator)

Analyze Your Trade Episode #64

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, February 5th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Christian Fromhertz of TribecaTradeGroup.com

– Dean Jenkins of FollowMeTrades.com (moderator)

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

Crowd Forecast News Report #279

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport012719.pdf

ADVERTISEMENT

Go Full Throttle with Top Gun Options! Top Gun Options is Kicking Off the INDUSTRY Leading Full Throttle Market Briefs starting LIVE Tuesday January 29th at 1 PM

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 28th to February 1st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 60.0%

Lower: 40.0%

Higher/Lower Difference: 20.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.4%

Average For “Higher” Responses: 63.0%

Average For “Lower” Responses: 69.0%

Higher/Lower Difference: -6.0%

Responses Submitted This Week: 25

52-Week Average Number of Responses: 42.2

TimingResearch Crowd Forecast Prediction: 55% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 57.6% Higher, and the Crowd Forecast Indicator prediction was 52% Chance Lower; the S&P500 closed 0.26% Higher for the week. This week’s majority sentiment from the survey is 60.0% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 11 times in the previous 278 weeks, with the majority sentiment being correct only 45% of the time and with an average S&P500 move of 0.69% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 55% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.8%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Momentum

• Tourism is still ok I think there are full travel areas still like Florida and ski areas

• General mood is upbeat

• Best six months of the year historically

• Government shutdown finished.

• Earnings surprises

• Manipulation

• The shutdown is over for a few weeks and I think trade with China will get something done

• Seems like the market has a little momentum behind it now. the temporary truce in Washington and federal workers back to work should help too.

• sidewise to up while overbought, good consolidation, a/d, and momentum

• Earnings reports mostly positive, end of shutdown…for now.

“Lower” Respondent Answers:

• too much unstable things like china trade, iran, oil, etc

• gov spending gov open

• reaching resistance areas,

• need to re-test , plus big week for earnings could disrupt up move /

• Resistance will hold and the market will react to the numerous earnings reports this week.

• Overbought

• Data won’t be reailable

• End of month.

ADVERTISEMENT

Go Full Throttle with Top Gun Options! Top Gun Options is Kicking Off the INDUSTRY Leading Full Throttle Market Briefs starting LIVE Tuesday January 29th at 1 PM

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• Watch market daily

• Profit

• Watch general trends using candlestick and fibonacci techniques

• Rise in net worth

• Advance decline ratio

• Risk/reward ratio

• Watch them hourly.

• technical

• total return

• price/profit

• technical and seasonality

• 200day ma -we are still below 200 ma –and look for stacked ma,s ..8 over the 20 over the 50.heading up

• accounting

• Return on capital

• Simple quantitive method and time accuracy measurement.

Question #5. Additional Comments/Questions/Suggestions?

• For long term look at the Death Cross. Be inverse during bear markets and profit with this next bear.

• The question whether we will take a trade or not the upcoming week, I’m sure it shows a lot.

• Watch for first quarter early announcements

Join us for this week’s shows:

Crowd Forecast News Episode #211

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 28th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com

– John Thomas of MadHedgeFundTrader.com

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #63

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 29th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– TBA

ADVERTISEMENT

Go Full Throttle with Top Gun Options! Top Gun Options is Kicking Off the INDUSTRY Leading Full Throttle Market Briefs starting LIVE Tuesday January 29th at 1 PM

Crowd Forecast News Report #278

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport012118.pdf

ADVERTISEMENT

Many former TimingResearch show guests and other trading experts will be speaking at the biggest and best online-only Wealth365 Summit taking place January 21-26th. Speakers have agreed to make sure to focus on actionable content and real wealth education during the presentations to make sure your time is well spent with us. This is the biggest online-only wealth show in the world so don’t miss out. It’s where you need to be to kick of 2019 right!

Click HERE to learn more and register!

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (January 22nd to 25th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.6%

Lower: 42.4%

Higher/Lower Difference: 15.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.9%

Average For “Higher” Responses: 63.2%

Average For “Lower” Responses: 67.1%

Higher/Lower Difference: -4.0%

Responses Submitted This Week: 42.6

52-Week Average Number of Responses: 34

TimingResearch Crowd Forecast Prediction: 52% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 54.3% Higher, and the Crowd Forecast Indicator prediction was 53% Chance Higher; the S&P500 closed 3.50% Higher for the week. This week’s majority sentiment from the survey is 57.6% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 29 times in the previous 277 weeks, with the majority sentiment being correct only 48% of the time and with an average S&P500 move of 0.47% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 52% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.6%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Post holiday euphoria, maybe.

• Earnings

• INDICATORS

• January effect

• up trend

• Todays performance.

• Going with continuation of the recent uptrend. Some resistance at 2730; strong resistance at 2800-10.

• Economic outlook.

“Lower” Respondent Answers:

• Political behaviors from the executive and legislative branches are becoming detrimental to the economy and the trust of investors. The working class is going through lots of stress with lower income and cos of living increasingly expanding to areas previously stable; instead of one job nowadays 1 FT and 1 PT. Medical and other work benefits increasingly more expensive and often no longer available with their jobs.- America slowing become a third world economy!!!

• Market has been straight up for several days and the earnings reports were not impressive.

• A Stansberry Research email suggests a pullback, possibly a retest of the Dec. 24th lows before the uptrend continues. Market Trend Signal gave a general market “sell” signal on Dec. 21st. This is only the 5th “sell” signal in the last 20 years! The prior “buy” signal was on June 8th, 2016!

• due for a correction

• Markets need a bit of rest from the dramatic rally from the December lows.

• exhaustion of momentum

• Resistance levels will hold and downside action will follow.

• Al Brooks analysis. Its over for the S&P

• It has been up non stop with two very tiny Pullbacks but market needs to have some selling to remain sane n to entice buyers

• Too many up days

• RSI hour and Hour 4 Are up high with room to drift lower.

• Too much uncertainty. This recent upmove is climactic and therefore unsustainable.

ADVERTISEMENT

Many former TimingResearch show guests and other trading experts will be speaking at the biggest and best online-only Wealth365 Summit taking place January 21-26th. Speakers have agreed to make sure to focus on actionable content and real wealth education during the presentations to make sure your time is well spent with us. This is the biggest online-only wealth show in the world so don’t miss out. It’s where you need to be to kick of 2019 right!

Click HERE to learn more and register!

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on January 28th.)

• The value if multilateral free trade.

• When you sell put or call options how many days to expiration one should place the orders in general (no earnings play)?

• How effective is Elliot Wave Theory?

• Market timing and finding long term trends on all Time Frames

• Why and How Short term traders and investors are made to lose almost always. 2. How to trade or invest with majority of transactions by algos.

• How safe is to invest in foreign markets that are more aggressive than ours? How to limit the impact of taxation; federal and state levels? Could we have or have access to a good investment template/ strategies to have whether new or savvy investor.

Question #5. Additional Comments/Questions/Suggestions?

• I like the experts showing the chart during the discussion, for it’s much easier to understand the point of view. Thank you very much.

• Big question is Can small short term traders and investors stay and continue fight with computer trading? I think most small investors and traders will not be able to win against the 70% of trades done by comupters

• What would America be in the next 10 years ? How do we change our priorities in regard to educating our children instead of expending our money keeping people in prison? ( FYI: USA spend on average child education $9,000/yr while keeping 1 person in prison $58,000/yr- Is this a smart way to invest in our future as a nation?

Join us for this week’s shows:

Crowd Forecast News Episode #211

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 28th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com

– John Thomas of MadHedgeFundTrader.com

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #62

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 29th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– TBA

ADVERTISEMENT

Many former TimingResearch show guests and other trading experts will be speaking at the biggest and best online-only Wealth365 Summit taking place January 21-26th. Speakers have agreed to make sure to focus on actionable content and real wealth education during the presentations to make sure your time is well spent with us. This is the biggest online-only wealth show in the world so don’t miss out. It’s where you need to be to kick of 2019 right!

Crowd Forecast News Report #277

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport011318.pdf

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 14th to 18th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 54.3%

Lower: 45.7%

Higher/Lower Difference: 8.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.3%

Average For “Higher” Responses: 59.2%

Average For “Lower” Responses: 65.9%

Higher/Lower Difference: -6.7%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 43.0

TimingResearch Crowd Forecast Prediction: 53% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.9% Higher, and the Crowd Forecast Indicator prediction was 69% Chance Higher; the S&P500 closed 2.39% Higher for the week. This week’s majority sentiment from the survey is 54.3% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 30 times in the previous 276 weeks, with the majority sentiment being correct 53% of the time and with an average S&P500 move of 0.07% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 53% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Good FOMC maybe now group

• In the first part of the week the correction to 2550, until the end of the week penetration rates in 2600

• Looks like we’re rebounding

• Temporary upswing

• Mean reversion and gut feeling

• Market pulling back drawing in more longs.

• China NewYear

• We are at a decision point !!! Either direction can apply. The weekly RSI is dropping, the Day RSI has turned up. The tricky part is the H4 RSI is nearing a high with the H1 RSI being confused. The H4 will either pull back Monday, Tuesday and then continue Long or it will fail and retest 2500 area.

• Index stochastics (daily chart) are in reversal range.

• Honestly I dunno where the heck it’s going!

“Lower” Respondent Answers:

• fragile and reduced buying

• Magic 8 ball

• we are now up at key resistance spx 2600 and dow 24k -time to re-test .

• continued government shutdown

• Recent rally stops at resistance. This weeks earnings reports will put a damper on recent rally.

• Bank earnings this week; expecting uncertainty as they look to the future. Financial sector uncertainty with gov shutdown and future growth expectations can hold back the S&P.

• No resolutions to the 2 primary problems and earnings forecast will be lower

• Short term overbought condition combined with corresponding decline in A/D volume.

• hit the resistance

• volume is low

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #4. What do you think are the main reasons why most traders are not successful and consistent? What could the average trader do to improve consistency?

• If I knew the answer I’d still be trading and doing it successfully.

• Do NOT trade where you think it’s going. Instead, have a plan with stops based on risk/reward/probability. Assume probability is 40-60%.

• lack of a plan and discipline

• Poor money and risk management

• psychological

• fear

• Everything is a trap. If you haven’t seen it, you are in it. If it looks obvious it’s a trap. Wait for the play and then enter.

• Be patient

• Many traders jump into trades carelessly and pay too much attention to bad advice and news headlines.

• You must look at all TF’s and look from the top down as I have in Question #1 If the direction is not clear, do not trade, wait for that clear direction.

• Market Volatility induced by exogenous events.

• too many institutions with more money in the market speculating

• They do not lose losses until they are small. They too believes in their own infallibility.

• Discipline. Trade your plan.

• Stop sells at purchase price

• get better at interpreting candlesticks

• Knowledge needed of trends and market behavior. Few gain the knowledge.

Question #5. Additional Comments/Questions/Suggestions?

• No, thank you, you are the expert.

• The more you learn the more you earn. Never ever give up! you will get it in time.

• Not Sure

• political gridlock

Join us for this week’s shows:

Crowd Forecast News Episode #210

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 14, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #62

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 15th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Christian Fromhertz of TribecaTradeGroup.com

– Oliver Schmalholz of NewsQuantified.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Crowd Forecast News Report #276

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport010619.pdf

Partner Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals. You’ll see how on this online training.

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 7th to 11th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.9%

Lower: 36.1%

Higher/Lower Difference: 27.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.8%

Average For “Higher” Responses: 70.9%

Average For “Lower” Responses: 65.0%

Higher/Lower Difference: 5.9%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 43.5

TimingResearch Crowd Forecast Prediction: 69% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 60.7% Higher, and the Crowd Forecast Indicator prediction was 56% Chance Higher; the S&P500 closed 1.32% Higher for the week. This week’s majority sentiment from the survey is 63.9% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 29 times in the previous 275 weeks, with the majority sentiment being correct 69% of the time and with an average S&P500 move of 0.19% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 69% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.3%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• cause up

• New lows have disappeared and this week is historically up

• Some of the technicals (Fibonacci levels) indicate that next week will be up

• 1. Oversold last 2-3 months 2 Solution of China tax issues 3.January reinvestment/new funds 4. Easing of potential interest rate increase

• Historically best six months

• measured move down with a reversal up accompanied by 10 times up volume to down volume

• Market structure tells we are in a down trend. The market has already come down a lot so any upward move now is a short-term pullback.

• Blue chips have hit several times book value, the mark of bear market bottoms. Value buyers are coming in.

• momentum

• random up week in a down market

• Still looking for a move up to the next resistance of 2575 or a bit higher, before the market turns back down.

• volume

• Upmove was very strong I don’t think it’s over yet even if this might be just a bear market upmove.

“Lower” Respondent Answers:

• Sell programs

• Major down trend

• The reasons for the markets decline have not changed. The hope for change created strong short covering. The reality of “no” change will drive the markets lower again.

• We closed high on Friday and on Saturday we have a Solar Eclipse and Uranus goes direct, this normally means a reversal in the market not a continuation. Friday next week the Sun and Pluto goe into a conjunction often meaning a bottom.

• we hit the 20ema and feel we will head back down to re-test

• The downside correction continues until the public says “Just let me out”.

• market overbought

• needs to consolidate

• Downtrend continues

Partner Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals. You’ll see how on this online training.

Question #4. What advice would you give and/or what resources would you recommend to someone who is new to trading?

• Learn about seasonality, market cycles, and sentiment.

• Learn skills first, then test them, then test them again.

• go in slowly-no rush unless you are sure and nobody is sure!

• finviz.com-investopedia.com–vixcentral.com-

• be a forever student

• go with your gut

• Study price action on twitter.

• Cut losses short

• McClellan oscillator don’t count on Santa

• coin flip

• Test everything thoroughly!

• Don’t get too influenced by news headlines. Learn candlestick charting.

• Learn how to read charts before you trade, especial candlesticks.

• There are way too many gurus out there. Just find some indicators you like (they don’t have to be unusual ones) and draw trendlines and look at support and resistance areas and keep your stops.

• Study the fundamentals first then the technicals

• Have a trading plan, always honor stops, and don’t exceed a preset daily loss limit

• study charts voraciously brush up math if needed go slow paper trade like you mean it open a small account – take real trades 1 lots so if it costs you commission so what, did you get you degree for free or even if scholarship, someone paid for it no pain no gain.enjoy it or do not bother-if its torture find a business you like and do that with the same described focus and attention.. this paragraph is copyrighted please do not use it publish it.. i will find it online ‘nopainnogain not included

• Stop trading

Question #5. Additional Comments/Questions/Suggestions?

• Study study study and sim trade for a long long long time to get the feel . Read some of the best books on investing and trading. Turn off the TV. Learn to read price action and order flow. Key in on the market forces that move prices and measure them.

• It may take longer than you think, but don’t give up.

• no

• thanks for your interest.

Both shows are back this week!

Crowd Forecast News Episode #209

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 7th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– John Hoagland of TopstepTrader.com

– Jim Kenney of OptionProfessor.com

– Simon Klein of TradeSmart4x.com

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

Analyze Your Trade Episode #61

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 8th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– TBA

Partner Offer:

The Alpha Fibonacci Method works on any instrument, any time frame, and any platform with ultimate accuracy at trend inception and trend reversals. You’ll see how on this online training.

Crowd Forecast News Report #275

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport123018.pdf

Scroll down for the full web version of the report.

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 31st to January 4th)?

Higher: 60.7%

Lower: 39.3%

Higher/Lower Difference: 21.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 59.3%

Average For “Higher” Responses: 58.8%

Average For “Lower” Responses: 60.0%

Higher/Lower Difference: -1.2%

Responses Submitted This Week: 30

52-Week Average Number of Responses: 43.8

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 61.0% Lower, and the Crowd Forecast Indicator prediction was 83% Chance Higher; the S&P500 closed 3.55% Higher for the week. This week’s majority sentiment from the survey is 60.7% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 27 times in the previous 274 weeks, with the majority sentiment being correct 56% of the time and with an average S&P500 move of 0.07% Lower for the week (one of the rare circumstances where the market went up more frequently but the overall average move was negative for these weeks). Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.1%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Republicans majority

• best six months of the year historically

• Because the RSI and the Fast Stockastic are very low with inclinations to go up. The MACD IS ALSO with inclinacion to go UP.

• Value buyers thinking the market will try to protect against the possibility that the selling will subside somewhat before any considerable big down days again appear.

• momentum and volatility trends

• start monday higher or lower but end of week will slightly higher. hedge all trades to make money

• New Year rally

• With the market oversold, looking for a move up to the 2575-2600 range of resistance.

• Selling in the market seems to have slowed a little.

• Which direction will confuse people the most? Higher will confuse us.

“Lower” Respondent Answers:

• Sell programs

• higher thru tuesday then drop , but not sure if it will go below this week low

• All the things that tanked the markets are still in play but it is oversold enough for some good positive days to happen until it becomes overbought and drops again.

• Govt. shutdown.

• The downside correction will continue until the public says “Just get me out”.

• trend is down and the bear rally is over

• Relief rally over(?)

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #4. What are you hoping to learn more about, or change, or improve related to your trading or investing in 2019?

• cut losses short

• EM

• swing trading

• Profit

• Bonds 3 percent opens plans to start a bond portfolio

• I want to receive a list of stocks to BUY and stocks to SELL when experts using a very complex computer program can decide when is the right time. I do not want to read lots of information about many companies when some one can provide me the list of stocks already found by experts.

• To get a better picture of the thinking of the big fund managers relative the the recent trading activity.

• money management ,, how to use stop loss on new platform

• Fewer trades. More smarter trades.

• Be more patient about jumping into trades.

• Get better understanding of option spreads.

• keep better records

BONUS: Where do you think the S&P500 will close for 2019 (relative to where it will close for 2018)?

Question #5. Additional Comments/Questions/Suggestions?

• I wish to have the right recomendations with you using the right tools to decide what to BUY and what to SELL and the right time. VECTORVEST is a program that can do it.

• keep up the informative viewpoints

The shows are off this week but join us again on January 7th!

Crowd Forecast News Episode #209

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 7th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– John Hoagland of TopstepTrader.com

– Jim Kenney of OptionProfessor.com

– Simon Klein of TradeSmart4x.com

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

Analyze Your Trade Episode #61

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 8th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Crowd Forecast News Report #274

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport122318.pdf

Scroll down for the full web version of the report.

Partner Offer:

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 24th to 28th)

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 39.0%

Lower: 61.0%

Higher/Lower Difference: -22.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.3%

Average For “Higher” Responses: 62.8%

Average For “Lower” Responses: 71.8%

Higher/Lower Difference: -9.0%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 44.2

TimingResearch Crowd Forecast Prediction: 83% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 53.1% Higher, and the Crowd Forecast Indicator prediction was 55% Chance Higher; the S&P500 closed 6.72% Lower for the week. This week’s majority sentiment from the survey is 61.0% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 12 times in the previous 273 weeks, with the majority sentiment being correct only 17% of the time and with an average S&P500 move of 0.67% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 83% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.3%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.