- Home

- Crowd Forecast News Reports

Crowd Forecast News Report #263

Partner Offer: Wealth365 starts Monday! Top Financial Speakers Share Strategies Online.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport100718b.pdf

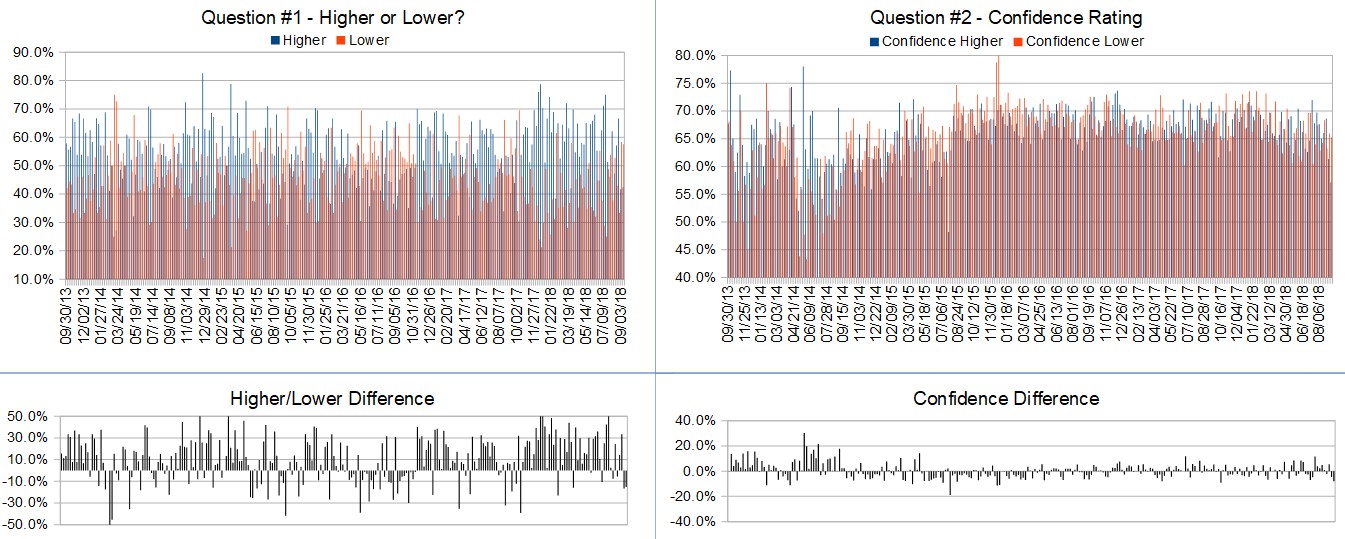

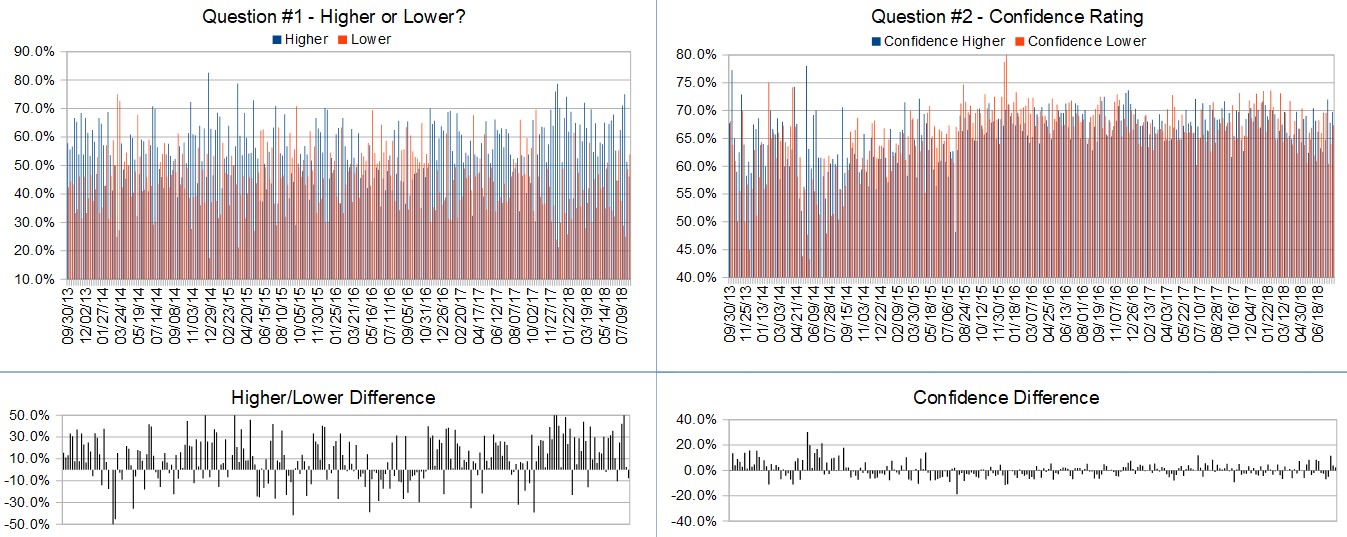

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 8th to October 12th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 48.6%

Lower: 51.4%

Higher/Lower Difference: -2.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.7%

Average For “Higher” Responses: 69.7%

Average For “Lower” Responses: 65.8%

Higher/Lower Difference: 3.9%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 46.8

TimingResearch Crowd Forecast Prediction: 66% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details :Last week’s majority sentiment from the survey was 62.1% Higher, and the Crowd Forecast Indicator prediction was 52% Chance Higher; the S&P500 closed 1.39% Lower for the week. This week’s majority sentiment from the survey is 51.4% Lower with a greater average confidence from those who responded Higher. Similar conditions have been observed 35 times in the previous 262 weeks, with the majority sentiment being correct 34% of the time, and with an average S&P500 move of 0.18% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 66% Chance that the S&P500 is going to move Higher this coming week.

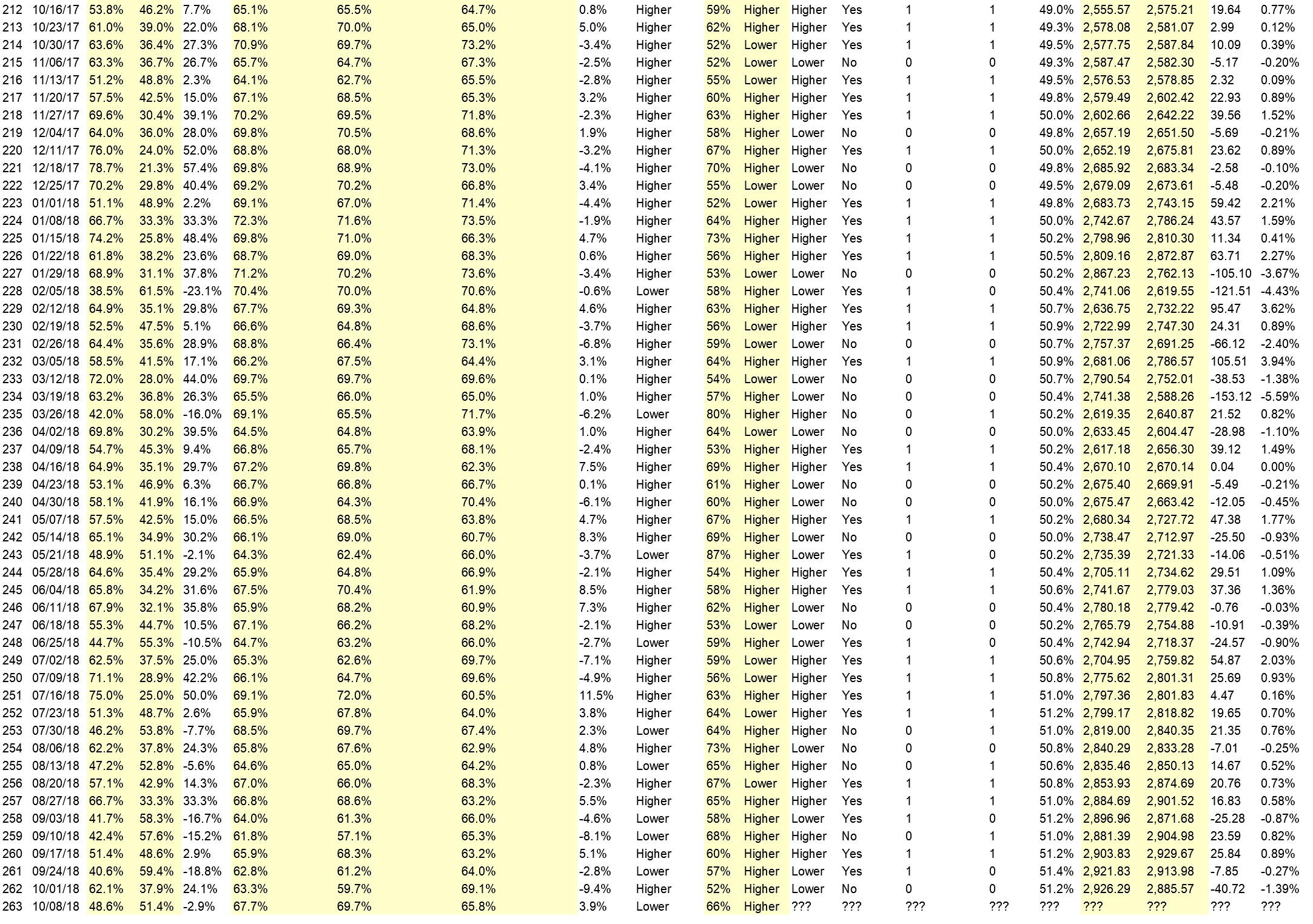

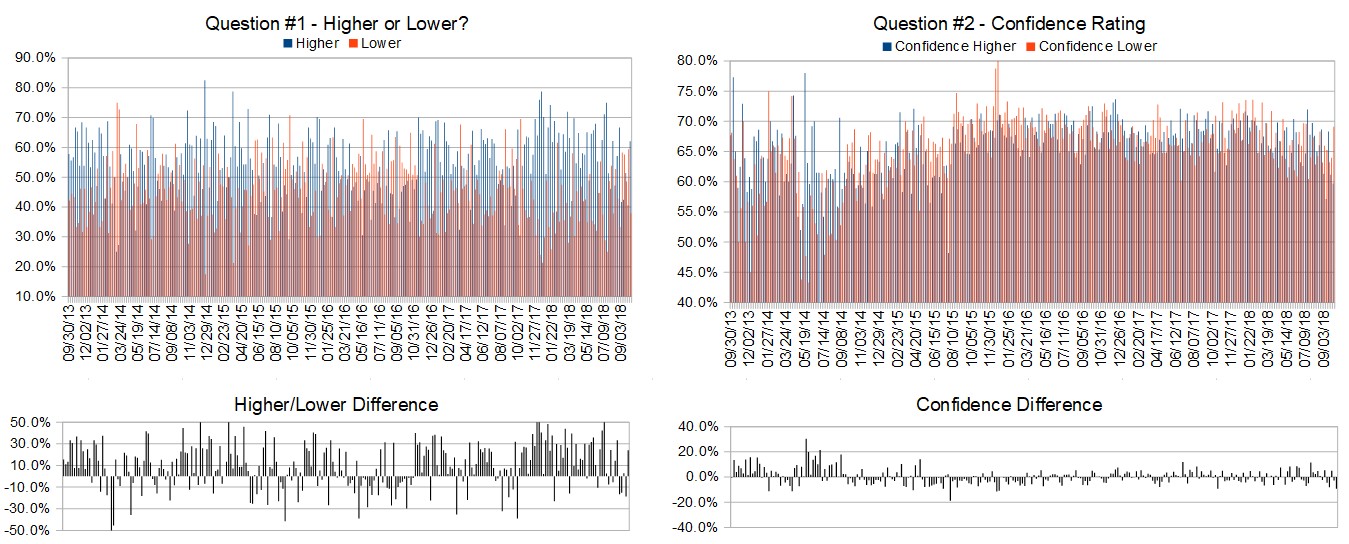

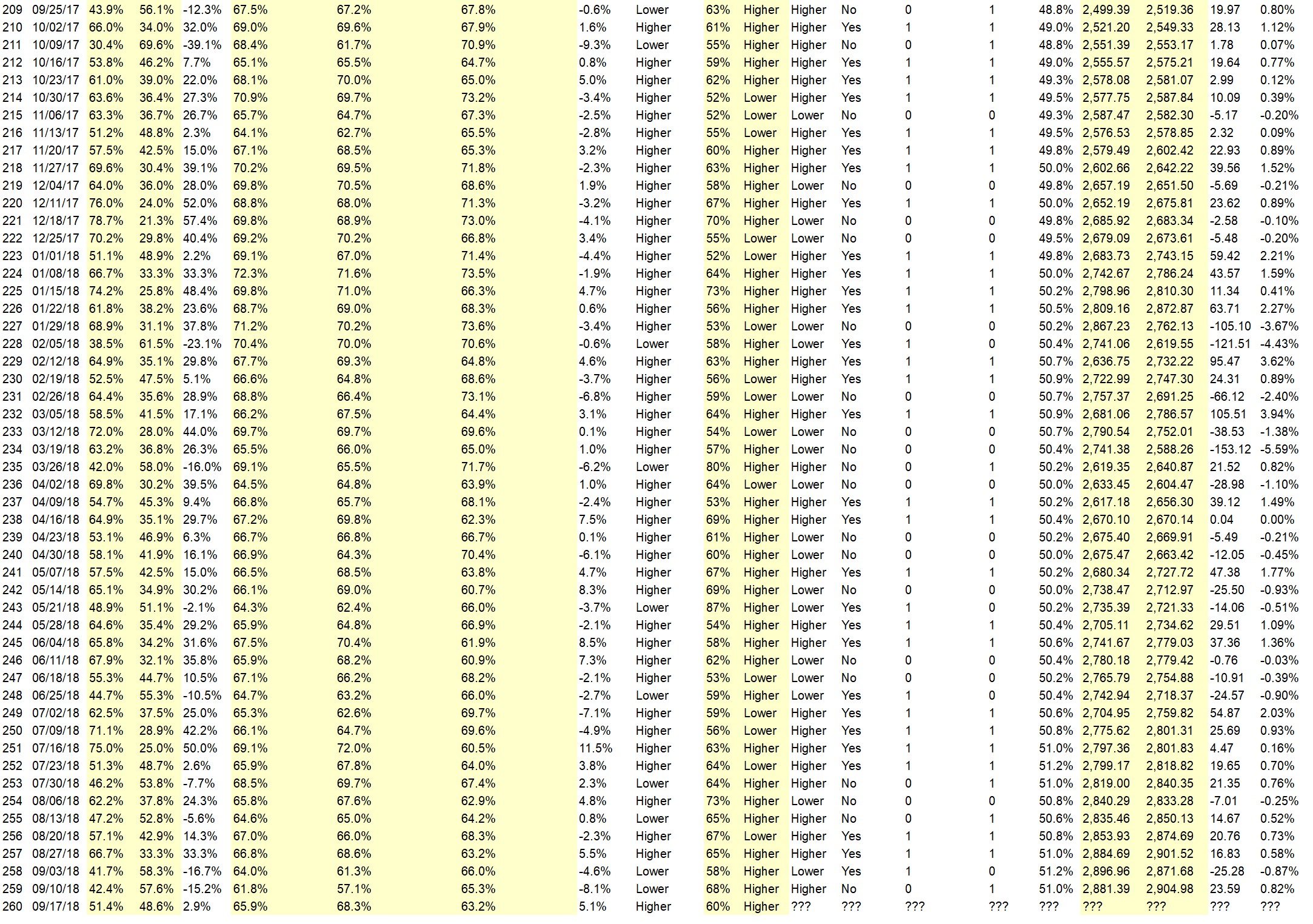

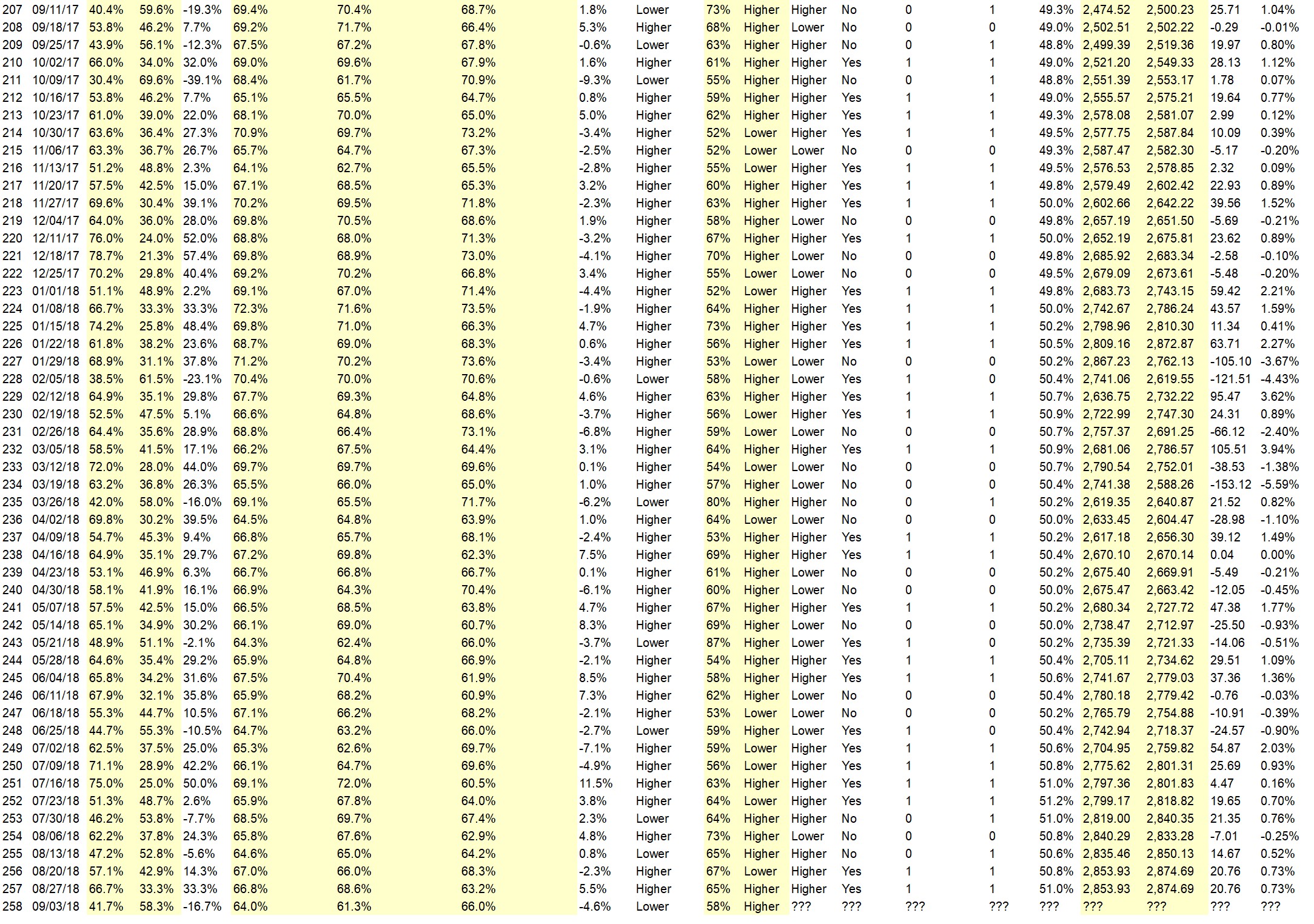

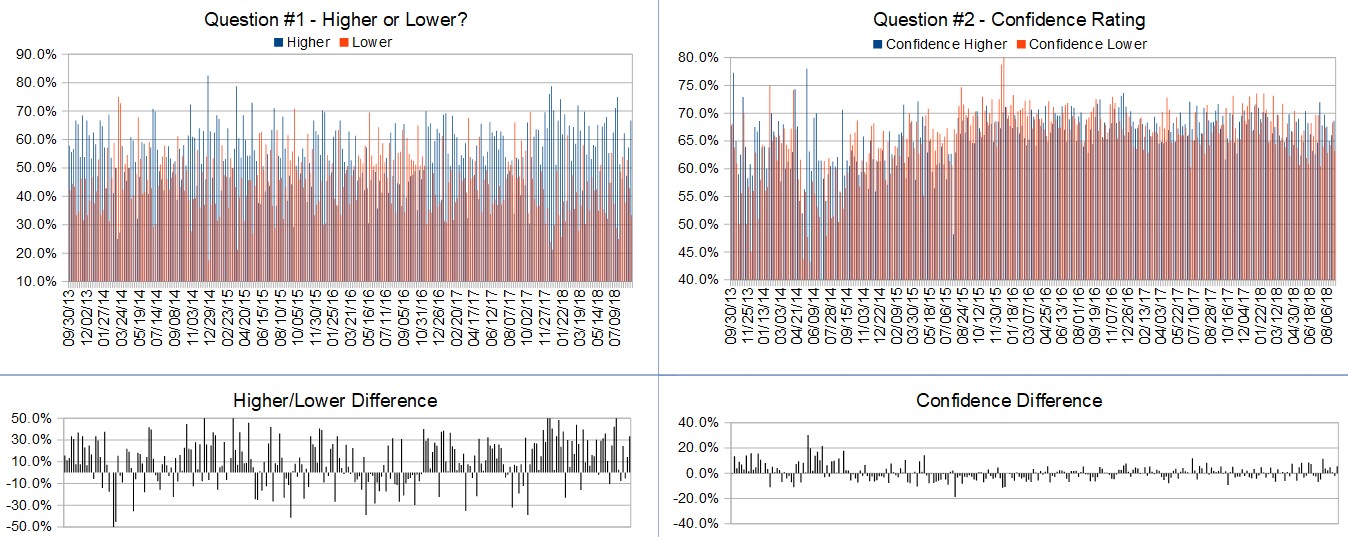

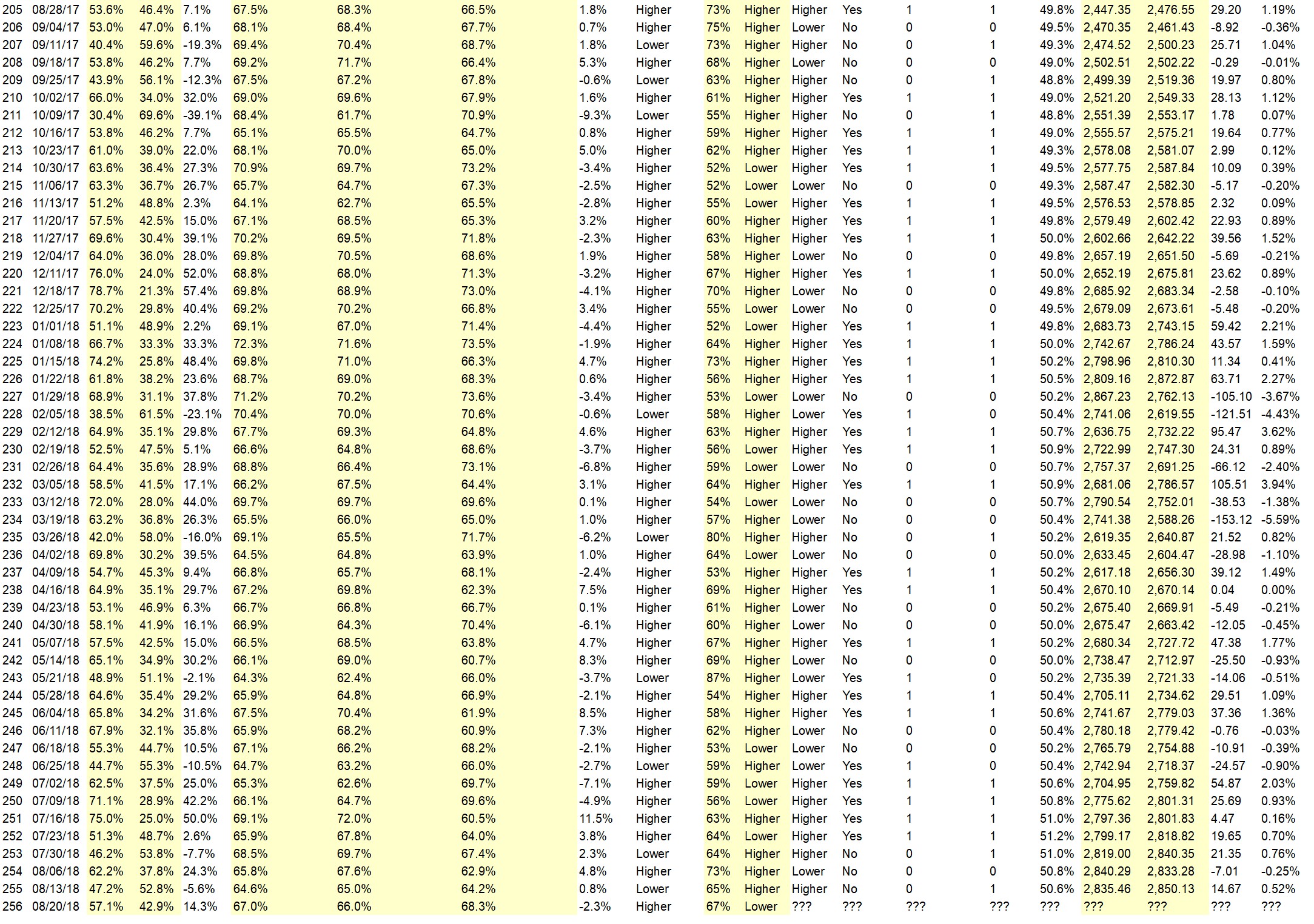

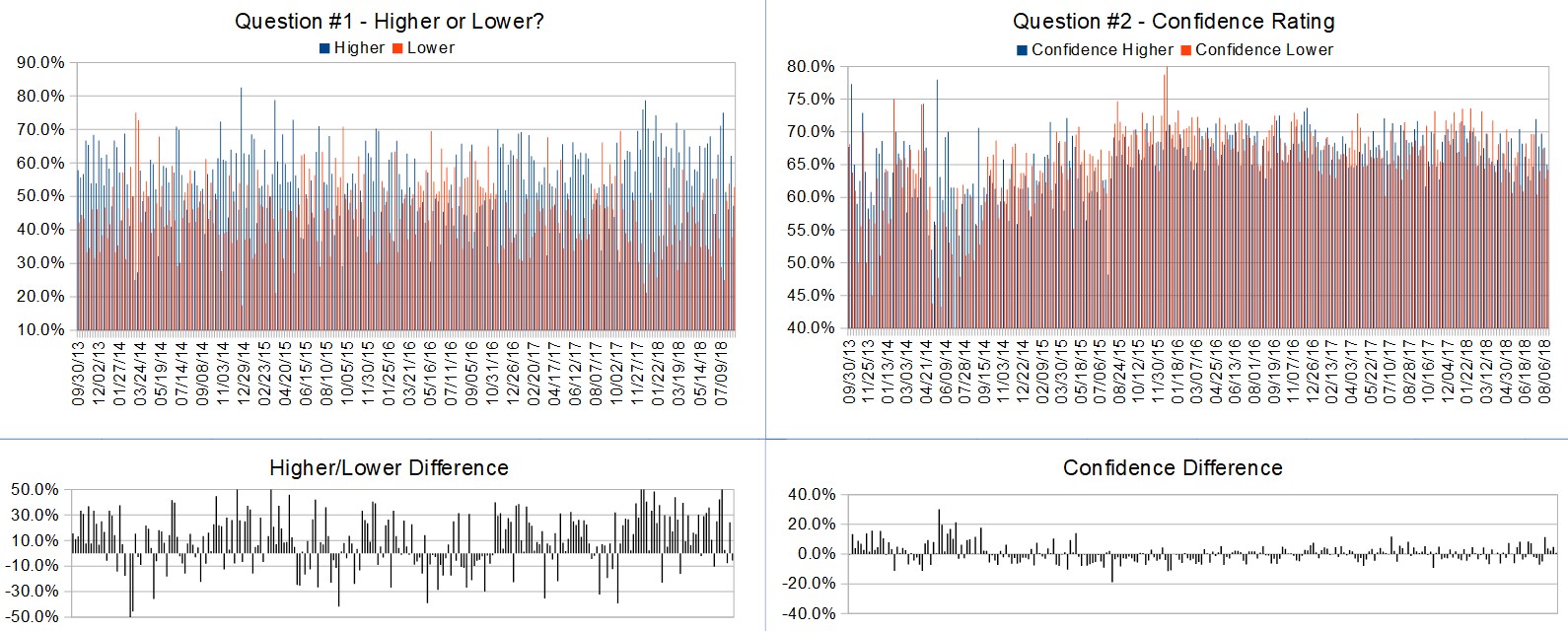

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

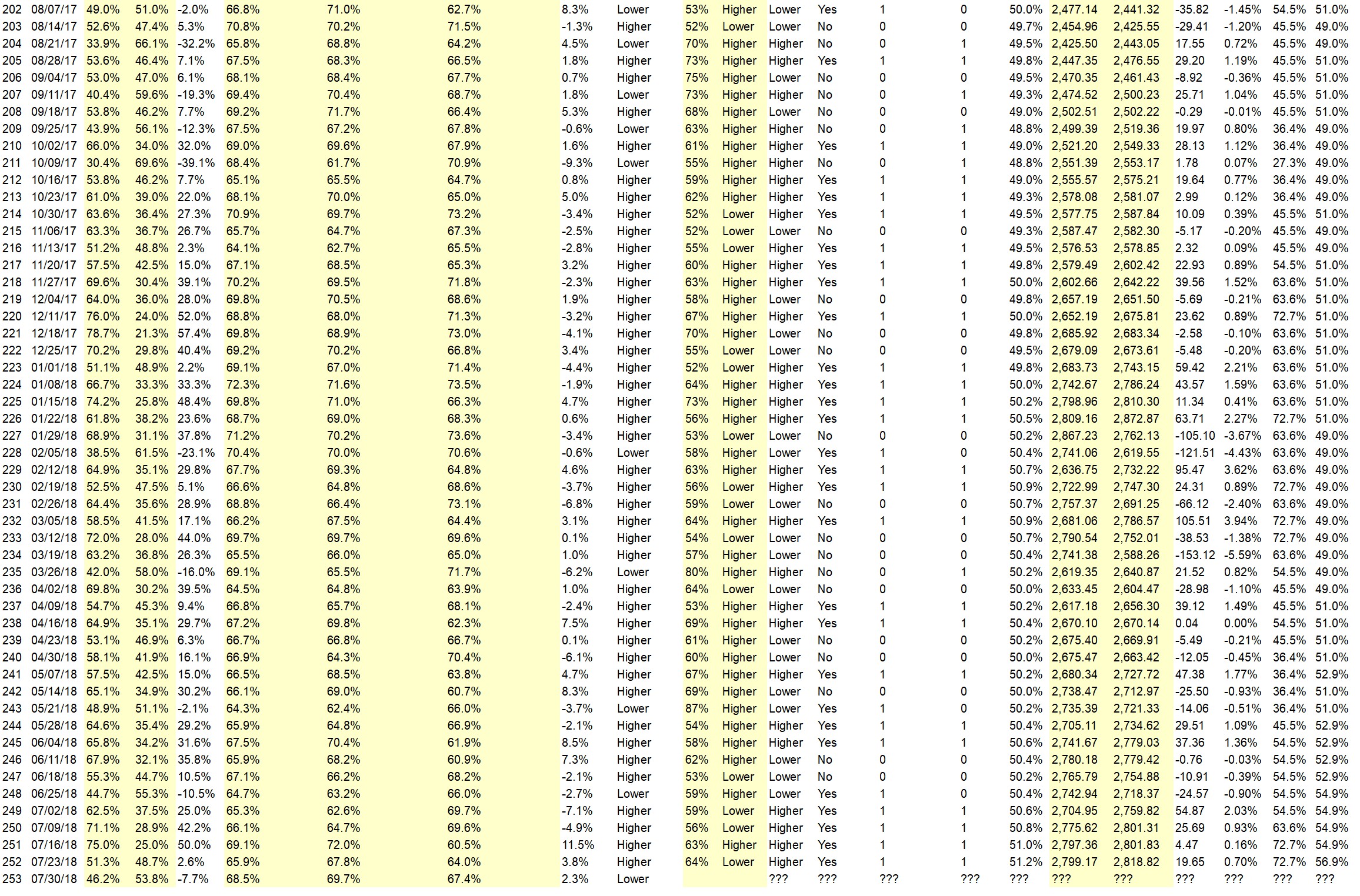

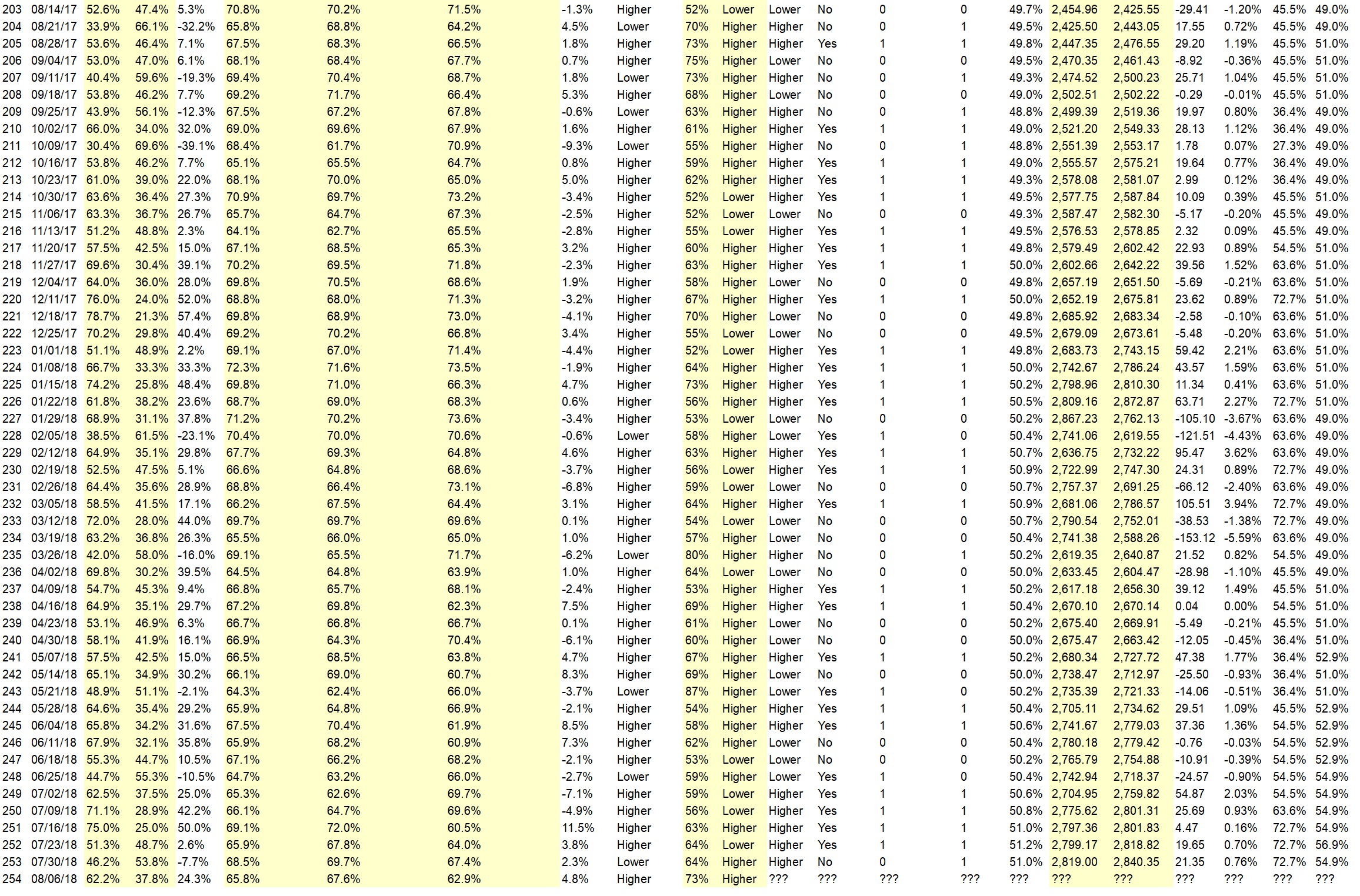

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.2%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Equities still best place

• Market is oversold from last week sell off.

• Kava nomination complete

• Seasonality

• bounce back

• still buying

• good earnings

• based on everything that i see

• hit 50dma and bounced

• Correction is underway but it may find a bottom shortly ending the week slightly higher

• Any excuse to continue this upward blowoff. Latest news is Kavanaugh.

“Lower” Respondent Answers:

• lying Donald Trump

• Rising interest rates.

• The market reached a peak on Wednesday with the Presidential tweet warning and has gone on the defensive ever since. The moving averages are being tested and broken.

• Interest rates appear to be destined to rise more. This becomes a problem for those in debt, including the US Govt and many companies. Even bank stocks, which theoretically gain with higher interest rates, are looking weak.

• Told ya

• Seasonal likelihood.

• Gut

Partner Offer, the TimingResearch shows are off this week, check out this instead:

Join thousands of fellow traders for the online-only Wealth365 Summit October 8-13th where you’ll be exposed to more speakers, new topics and hundreds of thousands of dollars worth of free prizes from top wealth experts.

Question #4. What trading-related skills do you want to learn or improve over the next few months? How are you planning on doing this?

• Timing portfolio management

• being to see exactly every 15 minutes what is going to happen

• option spreads.

• follow stop losses

• TIming on exiting positions.

• Gold projections – no plan

• Everything fails if we do not follow some system

Question #5. Additional Comments/Questions/Suggestions?

• i do well but i would like to do better

Partner Offer, the TimingResearch shows are off this week, check out this instead:

The TimingResearch shows are off this week, check out this instead:

Join thousands of fellow traders for the online-only Wealth365 Summit October 8-13th where you’ll be exposed to more speakers, new topics and hundreds of thousands of dollars worth of free prizes from top wealth experts.

Crowd Forecast News Report #262

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport093018.pdf

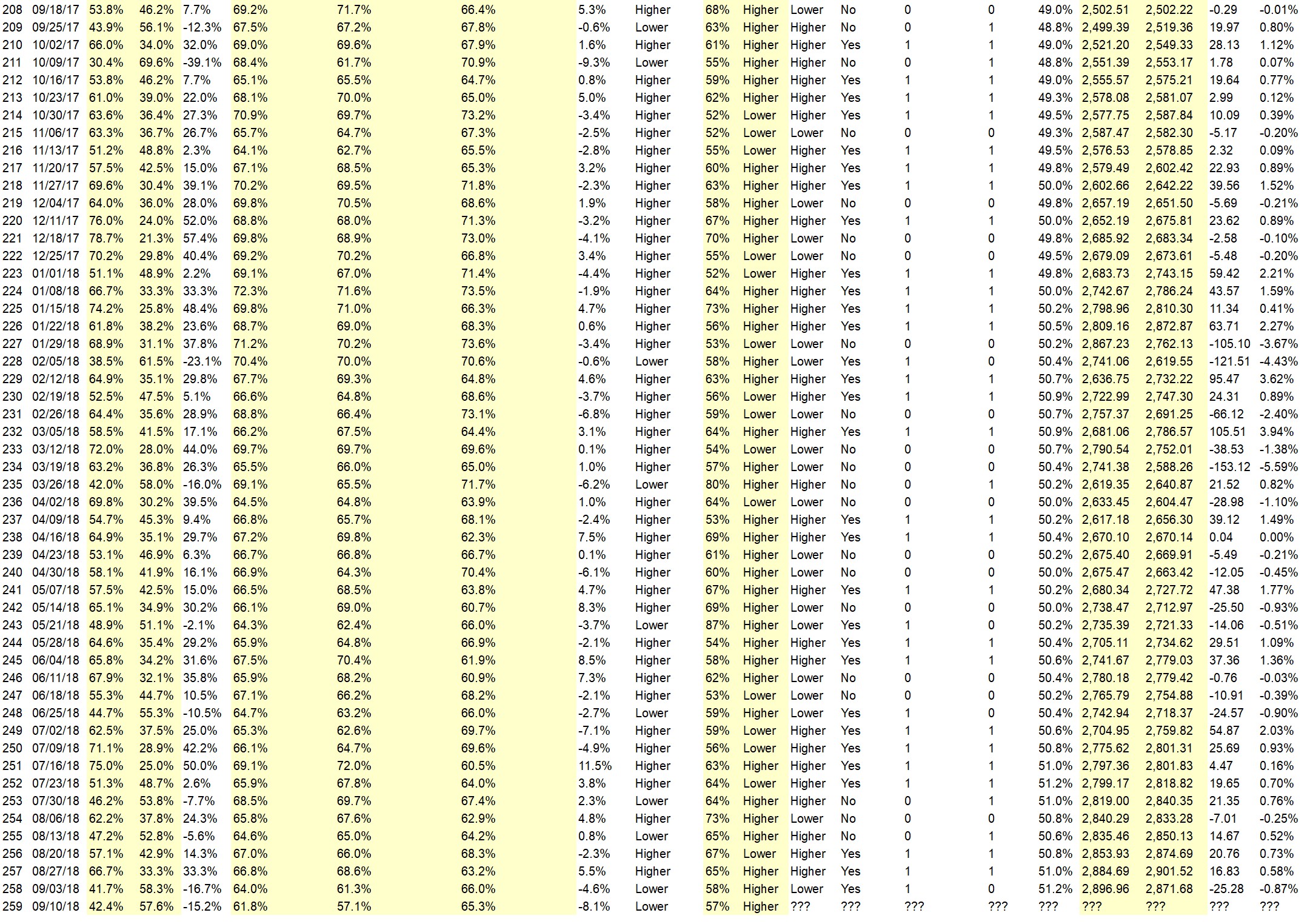

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 1st to October 5th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 62.1%

Lower: 37.9%

Higher/Lower Difference: 24.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.3%

Average For “Higher” Responses: 59.7%

Average For “Lower” Responses: 69.1%

Higher/Lower Difference: -9.4%

Responses Submitted This Week: 31

52-Week Average Number of Responses: 46.8

TimingResearch Crowd Forecast Prediction: 52% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 40.6% Higher, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 0.27% Lower for the week. This week’s majority sentiment from the survey is 62.1% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 77 times in the previous 261 weeks, with the majority sentiment being correct 52% of the time, but with an average S&P500 move of 0.12% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 52% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.4%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I like Donald

• It’s a bull market!

• Bounce off of daily 20 period EMA & higher low.

• 50 d ma and 20 day ma up, at bottom of upward channel

• Holding the 50% retracement long in the S&P at $2905

• Mid-term elections.

• history.

• still buying

• The S&P was in consolidation the previous week, which provides a good setup for a rise this week. Also, a nice GDP increase and good earnings expectations should help.

• Elliott wave pattern.

• Large volume trades show more selling. Low volume trades still show buying. I don’t know whether “the top” is in yet, but I’m sure not going to buy the dips.

“Lower” Respondent Answers:

• Overbought markets. 3rd qtr ended – sellers should return.

• Tariffs

• Current white administration is bringing too much controversy and distrust

• Due to the Presidents nonsense position size

• Its ending pullback in all my s tocks

• Tarriffs!

Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• position size, stops, sometimes scaling

• I try to keep position sizes of relatively the same size.

• Mental stops

• I don’t know

• start small, 8% loss stops, take off profits 35%

• Scaling in.

• Daily loss limit, weekly loss limit, # of stops per day.

• Position size

• Position size, stops, market direction.

• Scaling

• stops

• Proper stops, no scaling, support & resistance, use of trailing stops if trending

• Position sizing used with various strategies. All in all out also used depending on strategy used. Stops are very important and honoring them is critical in maintaining risk management.

• position size

• Algorithmic

Question #5. Additional Comments/Questions/Suggestions?

• seasonality is against my answers.

• Is there a better and close too 100% certainty to read the market in the USA??

Join us for this week’s shows:

Crowd Forecast News Episode #198

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, October 1st, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Tim Racette of EminiMind.com (first time guest!)

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

– Norman Hallett of TheDisciplinedTrader.com

– John Thomas of MadHedgeFundTrader.com

– Neil Batho of TraderReview.net

Analyze Your Trade Episode #51

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 2nd, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Christian Fromhertz of TribecaTradeGroup.com

– Hima Reddy of HimaReddy.com

Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.

Crowd Forecast News Report #260

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport091618.pdf

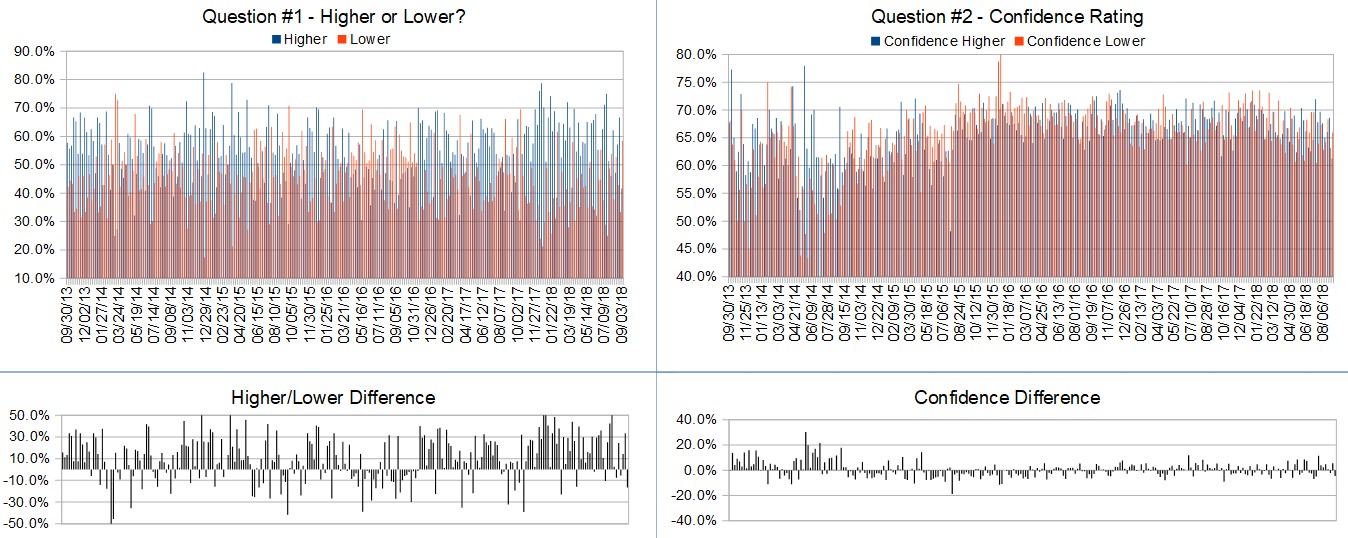

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (September 17th to September 21st)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 51.4%

Lower: 48.6%

Higher/Lower Difference: 2.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.9%

Average For “Higher” Responses: 68.3%

Average For “Lower” Responses: 63.2%

Higher/Lower Difference: 5.1%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 47.6

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 57.6% Lower, and the Crowd Forecast Indicator prediction was 68% Chance Higher; the S&P500 closed 0.82% Higher for the week. This week’s majority sentiment from the survey is 51.4% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 96 times in the previous 259 weeks, with the majority sentiment being correct 60% of the time, with an average S&P500 move of 0.37% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

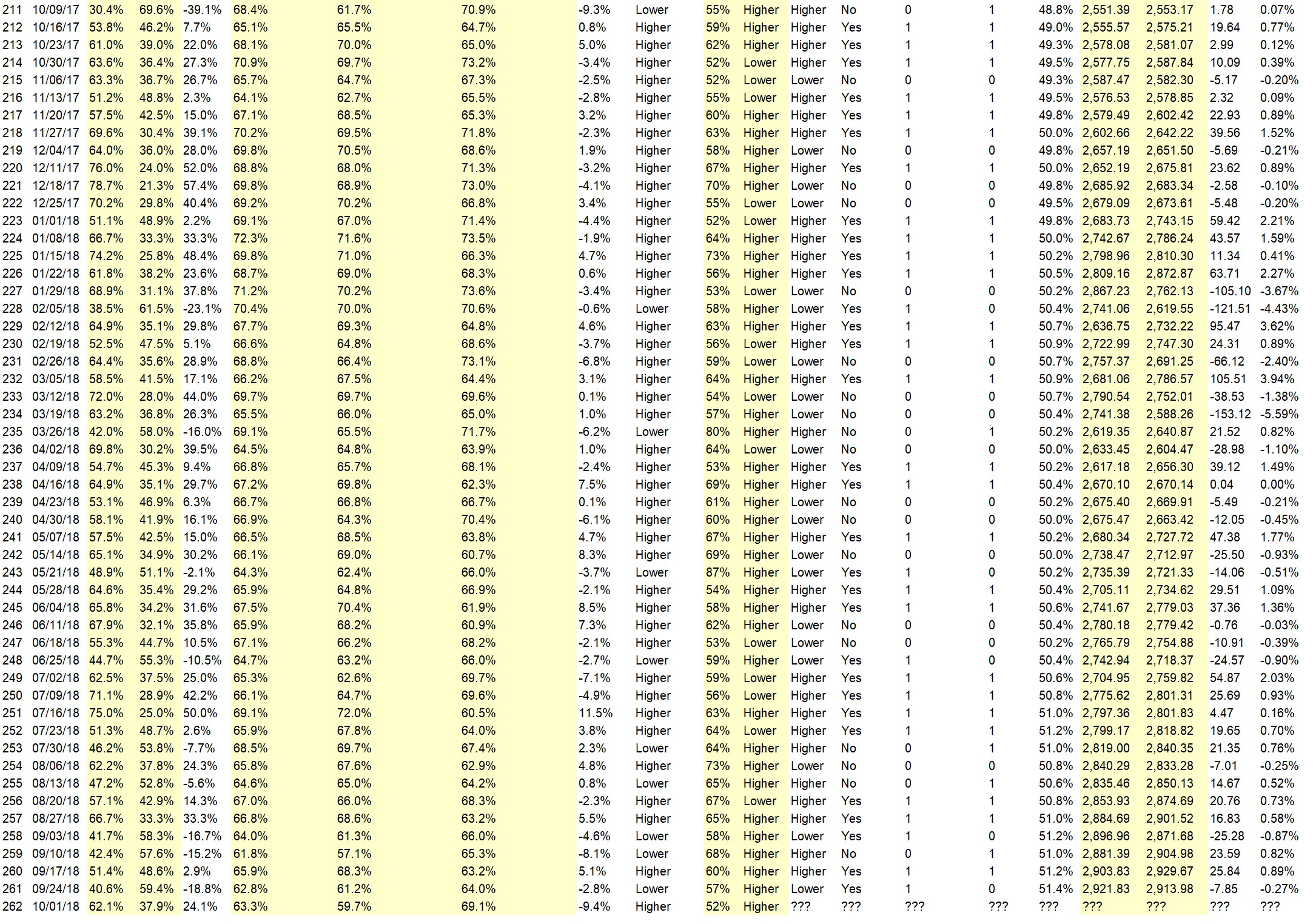

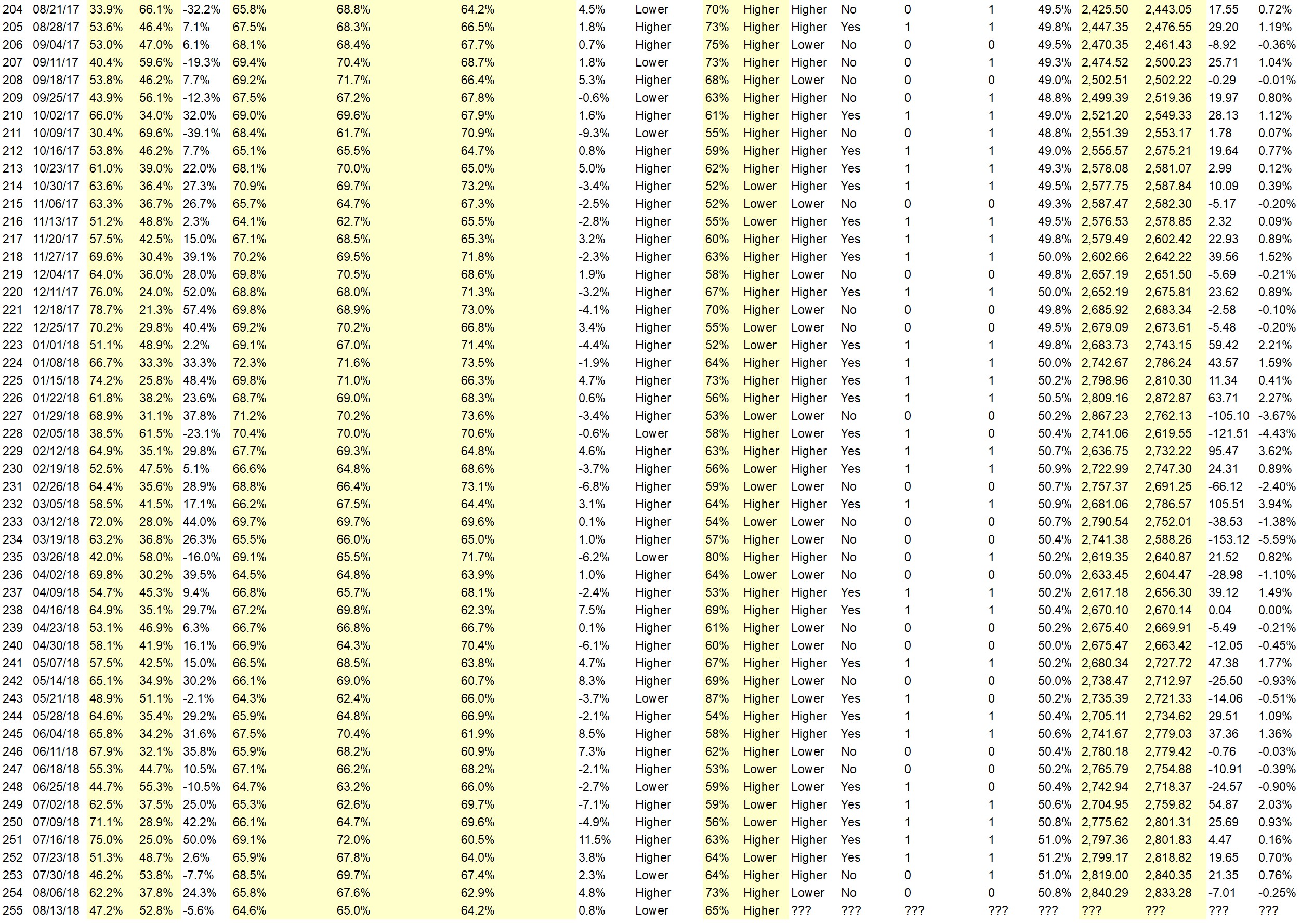

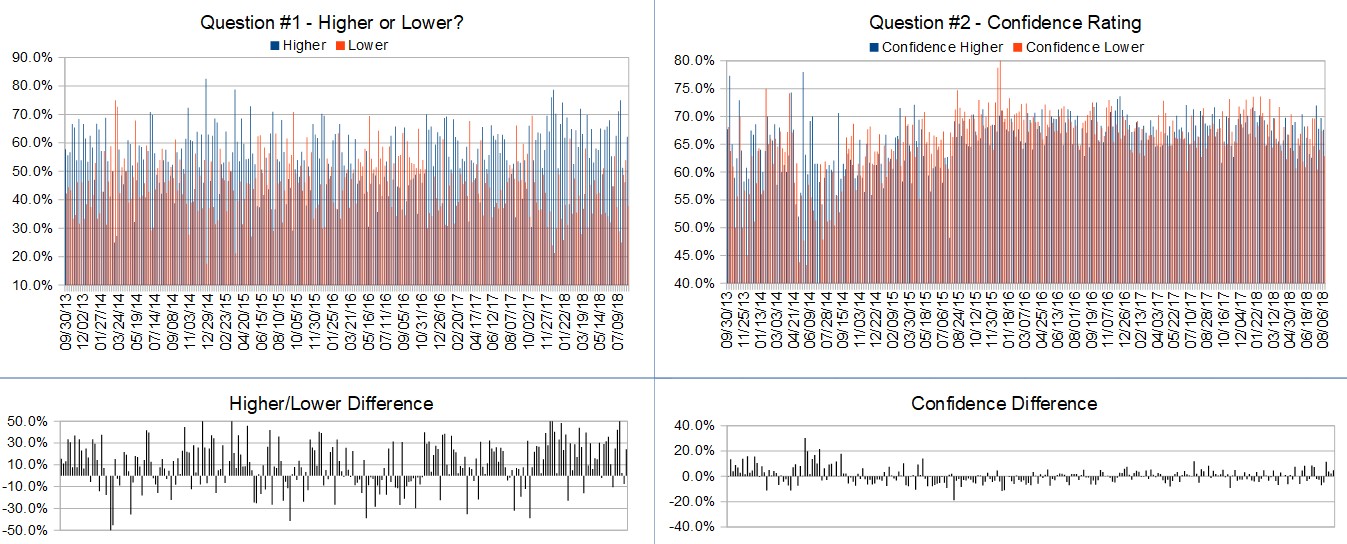

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.2%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Banking is stable for now maybe according to Ole Miss

• Tariffs & trade are keys to the degree & direction but the market wants to go up even when it sells off a little because of anticipated strong earnings & a strong economy in spite of hurricane aftermath. With monthly option expiration, triple witching, FED announcements, it’s like getting answers to this current chapter relieving some uncertainty. The economy is growing, the market is rising, you don’t want to miss the bus & soon we’ll have an even more divided govt which the market likes..

• Yes

• usa earnings remain robust

• history

• Going with continuation of last week’s move up. The 50-day moving avg has been offering good support.

• Friday was triple witching, with that behind us, trade talks are progressing albeit slowly, no real earnings or major news releases we should start the final climb to the end of the year. The election in November will create more distraction but the big event is not that Republicans lose control but new financially responsible ind. may breathe fresh air into the stagnant halls. Also with Canada charging to legal sells of cannabis and many more states voting to approve, things sb interesting

• more $$$ fowing back into the markets

• Trend continues

• Charts don’t look finished to upside. S&P previous all-time high is a magnet. BUT I’m only 60% confident – because all the fundamentals say it’s already way too high. Long-term the fundamentals eventually matter. Don’t they??

“Lower” Respondent Answers:

• Market overbought

• tariffs

• Uncertainty caused by Trump’s trade war.

• The S&P is again reaching overbought as it makes a push towards new highs. The week may start higher as new highs are achieved but without substantial reasons for the move it will likely attract major profit taking.

• trade wars

• lower since I’m long

• EW

• Seasonal downturn continues. September will be unforgiving.

• Worst six months historically

• Market topped over summer Oct selloff

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• Follow your own research

• Profit to liquid asset maybe I guess

• stops and the reason for the trade? Do not lose money.

• No need to trade everyday.

• Accept that the market is the boss, is unforgiving and that your intuition is probably wrong. Accept the consequences of every trade and trade small enough that you can deal with the results. Always know why you’re making a trade, have a plan and a backup plan. Remember that a long-term trade is often a short-term trade gone wrong. Get enough education to trade effectively. If hope and prayer are parts of your strategy, stop trading and get a better job.

• patience and perseverence

• Don’t panic

• For me, it’s to take a small loss before it turns into a large loss. And then to move on. Don’t try to make the next trade make up for the previous loss. Instead, just trade your system.

• patience

• Be observant. Act on facts. Charts and news rule .

• learn how to make a decision.

• money managment

• Most importantly, don’t let emotion take hold.

Question #5. Additional Comments/Questions/Suggestions?

• Make more by trading less.

• All panelists should be on camera.

• show in table form and graphically how predictions compare to actual market performance. THIS IS A MUST!

Join us for this week’s shows:

Crowd Forecast News Episode #196

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 17th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Adrienne Toghraie of TradingOnTarget.com (first time guest!)

– Dave Landry of DaveLandry.com (moderator)

– Jody Samuels of FXTradersEdge.com

– Simon Klein of TradeSmart4x.com

– John Thomas of MadHedgeFundTrader.com

Analyze Your Trade Episode #49

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, September 18th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Oliver Schmalholz of NewsQuantified.com

– Jim Kenney of OptionProfessor.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #259

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport090918.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (September 10th to September 14th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 42.4%

Lower: 57.6%

Higher/Lower Difference: -15.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 61.8%

Average For “Higher” Responses: 57.1%

Average For “Lower” Responses: 65.3%

Higher/Lower Difference: -8.1%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 47.7

TimingResearch Crowd Forecast Prediction: 68% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 58.3% Lower, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.87% Lower for the week. This week’s majority sentiment from the survey is 57.6% Lower with a greater average confidence from those who responded Lower. Similar conditions have been observed 25 times in the previous 258 weeks, with the majority sentiment being correct only 32% of the time, with an average S&P500 move of 0.42% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 68% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.2%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Donald Trump enthusiasm

• The line on the chart says it all. The trend continues higher after a short hiatus. Inflation from jobs data now solidly will influence the equity markets and gold higher.

• up week following a down week

• Recent history.

• People returning from vacation

• momentum

“Lower” Respondent Answers:

• Ouverbought Market.

• tariffs

• Tariffs are inflationary and are providing a level of uncertainty that is particularly motivating the market to take profits and window dress institutional portfolios for the end of the 3rd qtr although it’s pretty early to do that now. The Fed is going raise interest rates soon and give a press conference that will be a market mover perhaps contributing to the uncertainty. Political and geopolitical hostilities are increasing adding to uncertainty in spite of good economic news otherwise.

• NASDAQ is still jittery and likely to continue down pulling the S&P and eventually the Dow with it.

• There is no reason to create new records in September

• inflation

• TrAde talk/war

• Reality will over take the status quo as the trend remains in the early stages of transitioning from bullish to bearish.

• The market strength is weakening. The September seasonal weakness is getting a grip.

• Since the high on Aug 29, the S&P has been trending down. This trend is likely to continue, especially with the Chinese tariff situation.

• September

• Now the trend is down

• momentum failing support

• It could go anywhere during this volatile season. So I’m simply not going to trade.

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• Annual returns compared

• past history averages

• comparison of results to goals

• I keep a journal but it’s not like a diary. More like unexpected surprises that I should be ready for next time. And new possible ideas for what-if scenarios. Because I trade options, there are lots of what-if’s.

• Acct bal.

• bank account

• increase in overall portofolio

• I keep records

• Profit and Loss Statements.

• Look at net worth

• Still the same procedure – evaluating equity over time

• credit balance

• Profit

• Performance

• When I am successful, I am like a cheetah attaching an injured lamb. When I am unsuccessful, I AM the injured lamb.

• Reviewing of and adherence to my risk management rules.

Question #5. Additional Comments/Questions/Suggestions?

• The political left is so insecure in their beliefs that they feel the need to shut down free speech and an exchange of other ideas through violence like spoiled 2-year-olds. You don’t often see similar behavior from the right even when they are in the minority and don’t get their way. So who do you think is more likely to take away your freedom? Separately, Nike is misguided and is insulting so I will peacefully buy products from its competitors. I’ll just do that instead!

Join us for this week’s shows:

Crowd Forecast News Episode #195

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 10th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

– Fausto Pugliese of CyberTradingUniversity.com

– Anka Metcalf of TradeOutLoud.com

– Jim Kenney of OptionProfessor.com

AYT is off this week but will be back on September 18th!

Analyze Your Trade Episode #49

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, September 18th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Oliver Schmalholz of NewsQuantified.com

– Jim Kenney of OptionProfessor.com

Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.

Crowd Forecast News Report #258

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport090318.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (September 4th to September 7th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 41.7%

Lower: 58.3%

Higher/Lower Difference: -16.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.0%

Average For “Higher” Responses: 61.3%

Average For “Lower” Responses: 66.0%

Higher/Lower Difference: -4.6%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 48.1

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 66.7% Higher, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 0.58% Higher for the week. This week’s majority sentiment from the survey is 58.3% Lower with a greater average confidence from those who responded Lower. Similar conditions have been observed 45 times in the previous 257 weeks, with the majority sentiment being correct only 42% of the time, with an average S&P500 move of 0.15% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

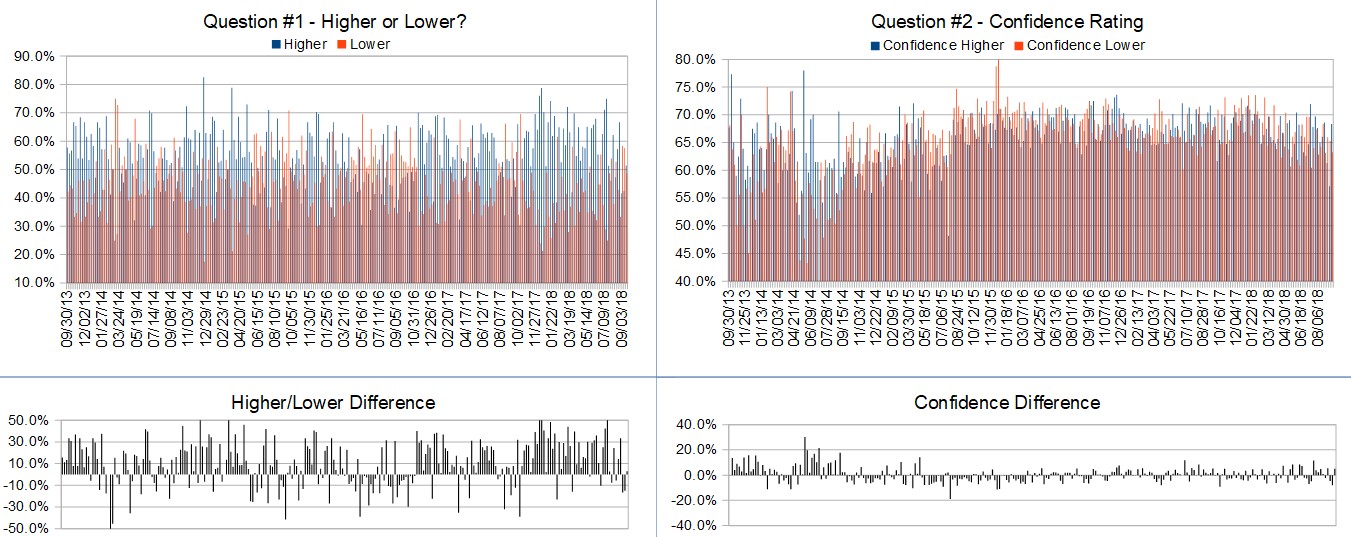

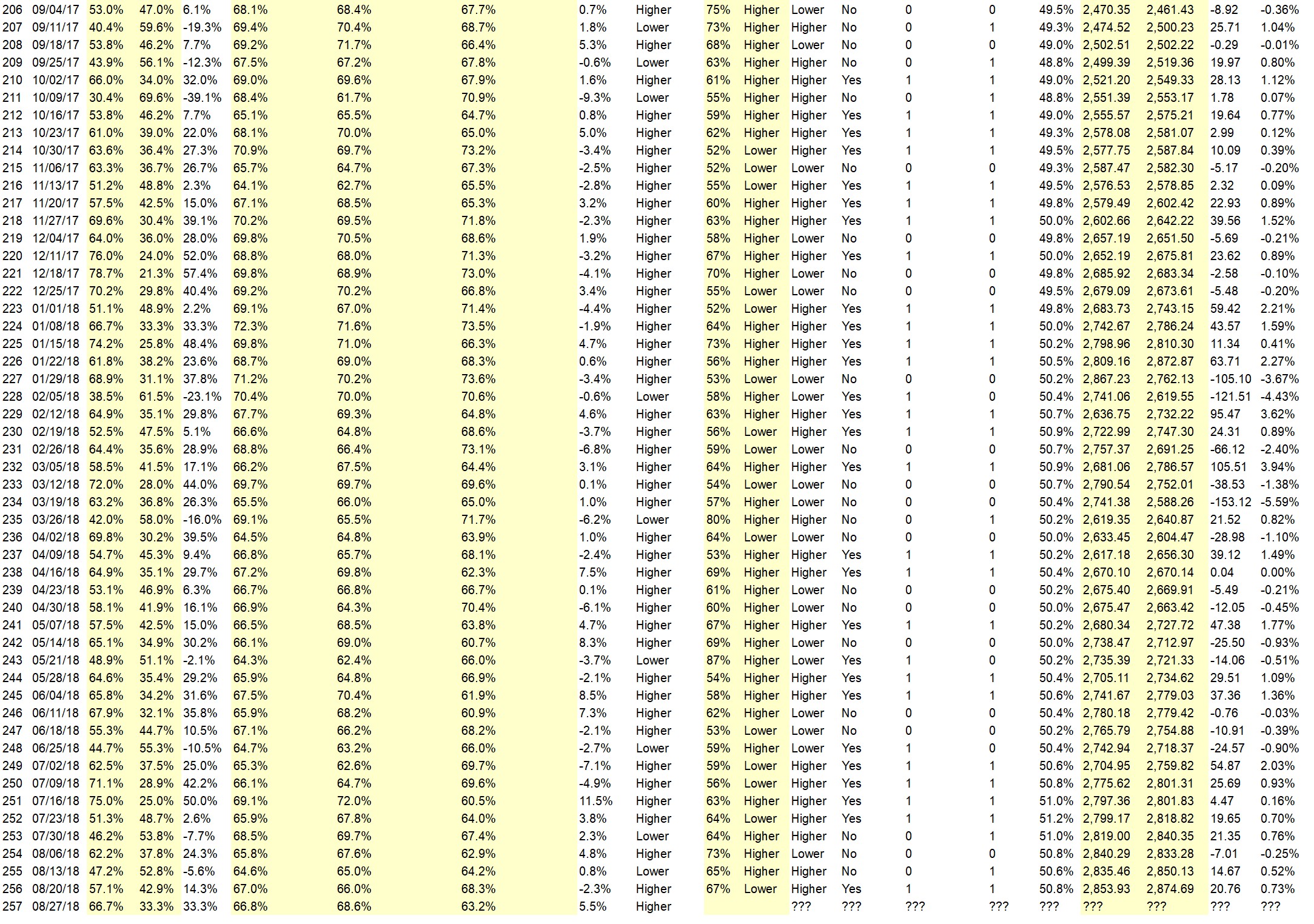

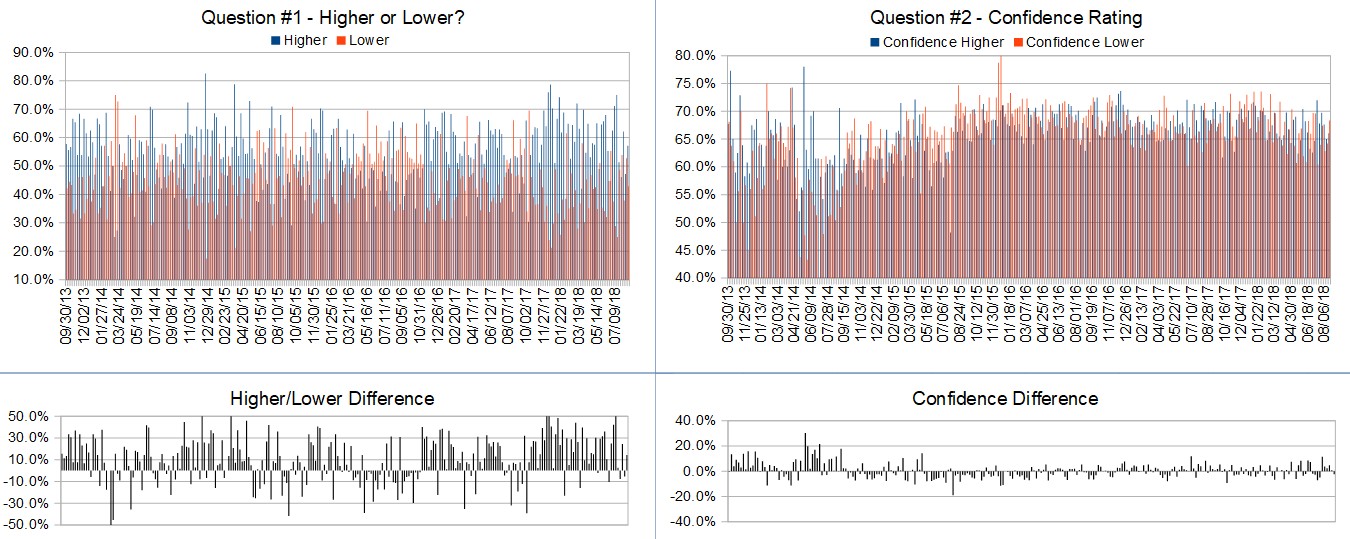

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.0%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• It will dip from tues thru thursday and rally by end of day Friday

• guess

• The market doesn’t seem to want to go lower

• New high in Aug, currently just above resistance

• Momentum and seasonality

• vacation is over

• In recent weeks, dips have been bought. Momentum is positive.

• 50% chance

“Lower” Respondent Answers:

• Labor day signals a sell

• High market could be a resistance line mire sells no than buying maybe I guess

• S&P peaking stchastics >80%

• Market is very ouverbought..

• tariffs

• Higher on the week but lower than Tuesday’s open because the pent up demand after a 3-day weekend should mean that Tues will open up strong especially now that Mexico is on board & Canada is soon to follow. The NFP will be OK but it’s hard to believe that it will be extraordinary. Scary Sept & Oct will retard buying but institutions will be buying back on Tuesday the issues that they sold last week. Still a bullish week but not compared to Tuesday’s open. FAANGs will continue to carry the load.

• Continued uncertainty associated with trade issues with Canada, China, Europe, Etc.

• Don’t fight the Fed

• Overbought

• Testing Support

• I think the market is peaking at new resistance and is due for a rest and some consolidation.

• It is virtually impossible to predict week to week where the S&P ends up each week. What I’m really saying with my routine “lower” and “50%” response isn’t so much what will happen tby this time next wee.. What I am saying is this market is going to turn down and that is the next important event that will inevitably occur and reset the levels at more realistic levels. I will not really bother with being right week to week as a result. I know I’ll get it right in the end.

• The market is overbought and due for a downside correction. September is usually a weak month for stock prices.

• I have certain technical; indicators that I follow and they say we are heading south – but I’m first to say this is a likelihood of happening – that’s all.

• Instability

• Current high and negativity of the Trade negotiations.

• I don’t know where the heck the market is going and therefore rated my confidence at only 50%. Everybody knows it’s “overpriced” whatever that means. Yet most seem to believe it will go up to at least 3000. And everybody has trailing stops or buys protective puts or whatever. So it seems everybody is protected even if there’s a 20% correction. But it seems nothing can stop this uptrend – unless it’s something really drastic and unexpected – maybe. I dunno.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on September 10th.)

• Entry/exit strategies

• All guests should indicate how long they have been professional advisers and what their annual results have been for the period that they have been advising. They also should indicate what makes them superior.

• Isolation of some markets

• options pricing, instead of buying stock, using options to take bull/bear position.

• Competing with algorithmic firms when trading.

• Profit

• Position Size / Money Management

• seasonality and momentum

• fundamental analysis

Question #5. Additional Comments/Questions/Suggestions?

• A lot of people like to say that the definition of insanity is doing the same thing over again and expecting different results and if that’s true, we have have a lot of people in this country promoting socialism who must therefore be insane.

• Will the economy be better because of a new policy o behalf of TYrump?

• Have all panelists on camera.

Join us for this week’s shows:

CFN is off this week but will be back on September 10th! AYT is still on (details below).

Crowd Forecast News Episode #195

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 10th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

– Fausto Pugliese of CyberTradingUniversity.com

– Anka Metcalf of TradeOutLoud.com

Analyze Your Trade Episode #48

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, September 4th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Larry Gaines of PowerCycleTrading.com

– Jim Kenney of OptionProfessor.com

Partner Offer:

Did you ever think that becoming a professional trader is out of reach? Think again.

Click here to learn how.

TopstepTrader has funded more than 1,800 traders just like you with live trading capital. They take all the risk. You keep the first $5,000 in profits and 80% thereafter.

Crowd Forecast News Report #257

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport082618.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 27th to August 31st)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 66.7%

Lower: 33.3%

Higher/Lower Difference: 33.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.8%

Average For “Higher” Responses: 68.6%

Average For “Lower” Responses: 63.2%

Higher/Lower Difference: 5.5%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 48.7

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 57.1% Higher, and the Crowd Forecast Indicator prediction was 67% Chance Lower; the S&P500 closed 0.73% Higher for the week. This week’s majority sentiment from the survey is 66.7% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 20 times in the previous 256 weeks, with the majority sentiment being correct 65% of the time, with an average S&P500 move of 0.28% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 66.8%

Overall Sentiment 52-Week “Correct” Percentage: 68.6%

Overall Sentiment 12-Week “Correct” Percentage: 63.2%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Donald Trump ideas maybe help

• going with the trend

• In this final week of AUG, institutions will be re-balancing & window dressing their portfolios & SPX will grind higher to confirm the breakout & anticipate 1st week of Sept trading and 7 Sept NFP. With so many predicting a down Aug & an annual correction in Sept/Oct, the market is bound to go up instead. Seasonal predictions have turned out to be crap & if they happen, they are very temporary. I like all the talk about recession and fear. That is very bullish. USA will win the trade war!

• Weed stocks will continue to push it up

• Risky not to buy

• All the industry indexes are positives :-)

• Momentum and seasonality.

• dovish fed talk

• trending

• Last week, dips were being bought, especially on Friday. Looks like the up move will continue.

• The market (SPX) has broken out of the ATH resistance. Now the path of least resistance is higher into 2900 area.

• This week

• Its toppy folks!

“Lower” Respondent Answers:

• Not good at working out where market goes

• Trade debate, political uncertainty, vacations

• I think that the global situation with chinese tariffs and Iran and Turkey are all coming to a head.

• A topping formation is almost forming a slide down is due any day, likely Tue or even Monday.

• SEP..

• Back to school positive action. Retail traders can only help the continued momentum. Previous gold bottom ended up being a basement to a sub basement. The yellow metal may once again start its wall of worry rise even though Powell and crew say inflation is tame.

Question #4. Which trading platform or broker do you like the best for executing your trades?

• fidelity

• Stocks to trade platform Etrade for a broker

• TOS but it’s not the bat you use, it’s the person using the bat. It’s not the cost of the commissions, it’s the positions and money management for your trades that should be the focus. JPM may start commission free trades but how many errors are you going to make learning a new platform?

• TD

• Yours

• Profit able one if possible

• Interactive Brokers

• TOS

• Trade Station

• TD

• TD

• E*Trade

• There are lot of good trading platforms such as StreetSmart Edge (Schwab), Trade Station, Think or Swim, etc. It is up to a trader to chose his trading platform.

• tastyworks

• IG Index ans Saxo bank

• Ninjatrader Firetip of Ironbeam

• none they all have weaknesses that marginalize strengths

• Tastyworks.

Question #5. Additional Comments/Questions/Suggestions?

• A candidate can legally contribute unlimited amounts of his own money for his own election campaign even to obtain NDA’s. Trumps payments to the kiss and tellers are totally legal. If the DEM’s take the House, impeachment will not be brought and if brought will fail in the House and if passed will fail in the Senate. The DEM’s are afraid that Trump is too successful. Tariffs are tough to endure but his actions are the right ones. Shame on all his predecessors who were too cowardly to do it.

• Oil surprisingly keeping a lid even though ability to withstand supply disruption is tight.

• I like your great survey and I request you to expand to more real traders to get their views.

Join us for this week’s shows:

Crowd Forecast News Episode #194

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 27th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

– Damon Pavlatos of FuturePathTrading.com

Analyze Your Trade Episode #47

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 28th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com (moderator)

– Christian Fromhertz of TribecaTradeGroup.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #256

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081918.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 20th to August 24th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.1%

Lower: 42.9%

Higher/Lower Difference: 14.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.0%

Average For “Higher” Responses: 66.0%

Average For “Lower” Responses: 68.3%

Higher/Lower Difference: -2.3%

Responses Submitted This Week: 44

52-Week Average Number of Responses: 49.1

TimingResearch Crowd Forecast Prediction: 67% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 52.8% Lower, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 0.52% Higher for the week. This week’s majority sentiment from the survey is 57.1% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 9 times in the previous 255 weeks, with the majority sentiment being correct 33% of the time, with an average S&P500 move of 0.63% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• momentum still there

• put call ratio

• trade talks usa and china

• Traders Commitment

• positive news on trade sparks test of new high.

• Momentum Economic growth Trade parity with China

• Contrarian view

• The declines have been lessening.

• still buying

• Tarriff will be negated

• I think it will be another slow week for stocks.

• We are not seeing lack of demand at highs over the past few weeks.

• bargain before September

• Pivotal week? Lower by weekend?

• I can’t help wondering if it’s manipulated. After all, banks buy stocks don’t they.

“Lower” Respondent Answers:

• Resistance should be looked at as a possibility as more selling pressure than buying could happen maybe

• I have bad record and lost money. This makes me last person should say where market is going.

• Tariffs

• topping out in Wave 2

• slowing momentum and global uncertainty

• yes

• still within the “Sell in May and go away” period

• Elliott wave 4

• The downside correction in most major stocks continues. The FANG stocks are showing major technical problems.

• The S&P is near an all-time high. ButTech stocks are weak; retail stocks have been strong, but have no reason to move higher.

• No upside left

• dead cat bounce this week

• seasonal drop

• Trade talks will not produce results

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• don’t get too greedy

• Profit

• Total zero. Don’t think.. Just price is king

• Patience

• confidence in what they are doing and listen to no one else when you have your plan that works

• learn how to loose

• patience, discipline and managing risk

• yes

• patience

• Patience & Consistency

• patience

• Fearlessness, apathy, resiliency

• Let go of loses Do not let loses control your emotions Don’t try to get even with a stock you just a lot money trading

• Flexability.

• Discipline is key—-stick to the plan that your system dictates.

• Don’t get emotionally attached to a stock or sector.

• Read Traders Kryptonite for answers

• Watch the earnings

• calm focus

• Discipline of sticking to a trading plan, avoiding overtrading and taking losses at predetermined levels or in response to a change in sentiment.

• patient

• education, not psyche, is what makes a trader

• Patience and clear thinking. Decisiveness.

• Set buy and sells and stick with them

• Gotta keep your sense of humour. Don’t trade if you’ve just had an argument with your mom — even if you think you’ve put it out of your mind.

Question #5. Additional Comments/Questions/Suggestions?

• buy American

Join us for this week’s shows:

Crowd Forecast News Episode #193

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 20th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Norman Hallett of TheDisciplinedTrader.com (first time guest!)

– Lee Harris of EmojiTrading.com (first time guest!)

– Damon Pavlatos of FuturePathTrading.com (first time guest!)

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #46

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 21st, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Jim Kenney of OptionProfessor.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #255

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081218.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 13th to August 17th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 47.2%

Lower: 52.8%

Higher/Lower Difference: -5.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.6%

Average For “Higher” Responses: 65.0%

Average For “Lower” Responses: 64.2%

Higher/Lower Difference: 0.8%

Responses Submitted This Week: 39

52-Week Average Number of Responses: 49.4

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 62.2% Higher, and the Crowd Forecast Indicator prediction was 73% Chance Higher; the S&P500 closed 0.25% Lower for the week. This week’s majority sentiment from the survey is 52.8% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 34 times in the previous 254 weeks, with the majority sentiment being correct 65% of the time, with an average S&P500 move of 0.17% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.8%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I’m not good on market direction.

• There is a law ? rule ? that the direction the market is in , it is MOST LIKELY to stay in that direction.

• I think stocks will remain close to unchanged as it was this week. About 0.34% higher. Too many geopolitical events in the world to rock the market. And August is usually a very slow month for stocks. I look for better things in September and October.

• The past couple days S&P took a slight pullback so Next week will rally up

• Economic job indicators are ok still maybe alittle or not really bad now

• The S&P500 & other major indices are holding their support & 10/20d ema levels during pullbacks. This, along with strong earnings continuing to be reported, lead me to look for continued strength in the markets.

• S&P 500 Looks like a test of all time high is coming.

• Uptrend has been too powerful to end so quickly. This recent pullback is just a pullback in an uptrend.

• Trend is your friend oil on the way up. Gold Joins in.

“Lower” Respondent Answers:

• Market peaked out

• Volatility, foreign markets

• fridays selloff

• Elliott Wave 4

• late summer doldrums

• Tariffs

• falling momentum

• Turkish Lira issues impacting European banks Increasing trade tensions

• Earnings calls are over. Interest rates are rising. Yield curve is inverting. Trade and shooting wars are in the air. Hardly a time to invest.

• more than likely world events will push mkt down…

• The downside correction will continue. The institutional favorites and looking to top out. Retail stocks should show weakness this week.

• Reality returning to the overvalued tech sector.

• History of the market

• Price may be high by mid week but it should then sell and be down at close of the week

Question #4. Which do you think is best, trading one methodology or system all the time or trading multiple strategies that adapt to the markets? Why?

• Multiple strategies to mitigate the risk

• You need as some one that makes lots money. That is not me.

• trend following works for me

• the 2nd. That way you are always trading with the trend direction.

• multiple

• multiple strategies that best fit the current market conditions

• A stop loss

• Adapt to market or be swallowed up in losses.

• I think it’s best to trade one methodology that adapts to the markets. :-)

• Sentiment from headlines

• Multiple strategies. Attempting to trade against the prevailing trend is most often like holding back the tide.

• The latter. There should be a different strategy for an uptrend and a different strategy for a downtrend. Because one is not simply the mirror image of the other. Markets behave differently in uptrends than in downtrends. For example, V bottoms are common but we don’t see V tops very often. Instead we see rounded tops.

• Adapt to market. You have to trade what the market gives you.

• multiple strategies, because if the set up is not right for one, maybe it’ll be right for others…

• Multiple strategies. Markets CHANGE!

• I still believe in trading one methodology/system but one that does adapt to the markets gyrations.

• Option trading

• Subject to time frame and style of trading.

Question #5. Additional Comments/Questions/Suggestions?

• None

Join us for this week’s shows:

Crowd Forecast News Episode #192

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 13th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Dave Landry of DaveLandry.com (moderator)

– Jim Kenney of OptionProfessor.com

– Lance Ippolito of AlphaShark.com & TradingCoachLance.com

Analyze Your Trade Episode #45

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 14th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

– Anka Metcalf of TradeOutLoud.com

– Christian Fromhertz of TribecaTradeGroup.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #254

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport080518.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 6th to August 10th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 62.2%

Lower: 37.8%

Higher/Lower Difference: 24.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.8%

Average For “Higher” Responses: 67.6%

Average For “Lower” Responses: 62.9%

Higher/Lower Difference: 4.8%

Responses Submitted This Week: 41

52-Week Average Number of Responses: 49.8

TimingResearch Crowd Forecast Prediction: 73% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 53.8% Lower, and the Crowd Forecast Indicator prediction was 64% Chance Higher; the S&P500 closed 0.76% Higher for the week. This week’s majority sentiment from the survey is 62.2% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 26 times in the previous 253 weeks, with the majority sentiment being correct 73% of the time, with an average S&P500 move of 0.42% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 73% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.0%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• The S&P500 continued to hold support at 2800 last week & market internals remain positive. As long as 2800 holds, chances are good for continued gains. Overwhelmingly positive earnings & the strong economy seem to be minimizing the threats of a possible trade war & other geopolitical issues.

• Trump agenda

• We are on the war path. Mid East tensions in hormuz good for markets and oil.

• Potential for easing of some trade tensions

• After disaster , food is high price ….structure will re-new able. most of those countries will back home

• Tested support at 2800. Time for a rally to new highs at 2875.

• Technical analysis

• Earnings season is about over. Elections aren’t yet. Tariffs, or media misinterpretation of tariffs, is major predictable challenge.

• The market bounced off a gap down on Thurs morning, and moved up. It ignored the payrolls report and China trade news; and continued up on Friday. Staying with the trend for the new week.

• My biggest reason for stocks moving slightly upward is good earnings. I think we will have a repeat of the last two weeks where stocks only make a slight upward move.

• easy money from europe and japan

• Banks buy stocks

“Lower” Respondent Answers:

• Market inexes topping.

• Pattern recognition, market is overbought,

• Much talk about high valuations for fang and similar stocks Increase in interest rates will be a factor

• tariffs

• Seasonality and general market atmosphere and price actions.

• Elliott wave

• The downside correction in stocks will continue. The institutional favorites are breaking down.

• It is almost at its peak and I expect it go down before end of next week. Also VIX started its upward trend at around 1:30 PM today, August 3.

• Do your own research

• We should see a drastic drop 2 of the first 4 days if some of my long term studies work. A BIG LOW potential around end of the week.

Question #4. What advice would you give and/or what resources would you recommend to someone who is new to trading?

• Know the days, hours and 15 min trend and follow a shorter time frame. Resist dumb & impulsive entries

• Don’t pick tops or bottoms, just follow trend.

• Play with the technical indicators until you find one or two that prove reliable to you.

• Profit only

• Test EVERY idea with paper-trading before betting the rent money on it.

• don’t

• Start by reading a lot and trading without real money. Watch out for email offers promising to make you rich.

• be careful use stops for hedge with put contracts if you have big positions

• read, don’t pay for advice

• Don’t

• Adopt some trading rules. Especially position size & risk limits per trade. Then stick to your rules.

• Mind focus. The rest is academic.

• Learn charting. Go slow. Learn position sizing.

• food securities for earth disappear

• Read Elder’s latest edition of “Trading for a Living” (whether planning on trading for a living or not) to understand the necessary requirements & and an idea of realistic expectations to successfully trade for the long term.

• Learn to paper trade and attend experts’ webinars.

• Test everything!

• Start with a sufficient amount of capital.

• Practice on fake accounts before putting your money into the investments

Question #5. Additional Comments/Questions/Suggestions?

• A significant rotation should be coming in next days and weeks.

• Is it time to go to all cash? I’m at 60% and feel like I would be better out than in. Problem i went to big cash early

• Gold floor and basing ready for liftoff!

• Everything will conflict within stomach and chemical food

Join us for this week’s shows:

Crowd Forecast News Episode #191

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 6th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– John Hoagland of TopStepTrader.com (first time guest!)

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

– Anka Metcalf of TradeOutLoud.com

– Neil Batho of TraderReview.net

– Simon Klein of TradeSmart4x.com

Analyze Your Trade Episode #44

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 7th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Larry Gaines of PowerCycleTrading.com

– TBA

Partner Offer:

While SHOP dropped less than 6% that day, Jeff was able to show his members how he made over 70%, or a whopping $41,400 from that move. He’s putting his money where his mouth is.

Click here to learn more.

Crowd Forecast News Report #253

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport072918.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 30th to August 3rd)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 46.2%

Lower: 53.8%

Higher/Lower Difference: -7.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.5%

Average For “Higher” Responses: 69.7%

Average For “Lower” Responses: 67.4%

Higher/Lower Difference: 2.3%

Responses Submitted This Week: 43

52-Week Average Number of Responses: 50.0

TimingResearch Crowd Forecast Prediction: 64% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.3% Higher, and the Crowd Forecast Indicator prediction was 64% Chance Lower; the S&P500 closed 0.45% Higher for the week. This week’s majority sentiment from the survey is 53.8% Lower with a greater average confidence from those who responded Higher. Similar conditions have been observed 33 times in the previous 252 weeks, with the majority sentiment being correct 36% of the time, with an average S&P500 move of 0.15% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 64% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.0%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Despite a good pullback in the SPX on Friday, and the NASDAQ & RUSSELL getting whacked, market internals (stocks > their 50d ma & advance/decline, etc.) are still positive. Also, while the S&P broke below it’s 10d ema, it ended up closing above it – another positive sign. Overall, most companies are still easily beating earnings expectations, so looking for more of the same next week.

• Earning

• High momemtum

• The nomination of Judge Kavanaugh and proceedings might influence a positive move maybe I guess

• Expect general bullish trend to continue based on anticipated positive earning reports and other news.

• slight positive momentum

• earnings

• Because I did all anyone can do and took a guess. Hopefully I’m right but it doesn’t really matter to me as long as there is movement in one direction or the other

• Good economy

• GDP 4.1%

• Trump is winning. His style is getting results even if the mainstream media hates it. No more excuses now that economic data is showing positive results. All that could happen is to have oil sky rocket too fast it’s on its way up as a result of global economic growth.

• I’m clueless this week!

“Lower” Respondent Answers:

• Tougher earnings season.

• Tariffs

• My technical indicators are down reacting to the mixed to down response to tech earnings & guidance. The Fed this week will say nothing that will be encouraging & XLF will sell off. AAPL will disappoint & the NFP will be less strong than last month. End of month & beginning of month portfolio adjustments will confuse the situation further. However, the VIX & IV is saying that there is nothing to worry about yet but they are not bullish either. For now, momentum is down & it’s time to raise cash.

• too many stocks selling off

• Over bought. Retracement needed. Seasonal slow down. Bearish news out there

• wave

• Technical and tired mkt even good news is getting sold Few names have pulled it higher now they’re failing

• Elliott Wave