- Home

- Crowd Forecast News Reports

Crowd Forecast News Report #252

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport072218.pdf

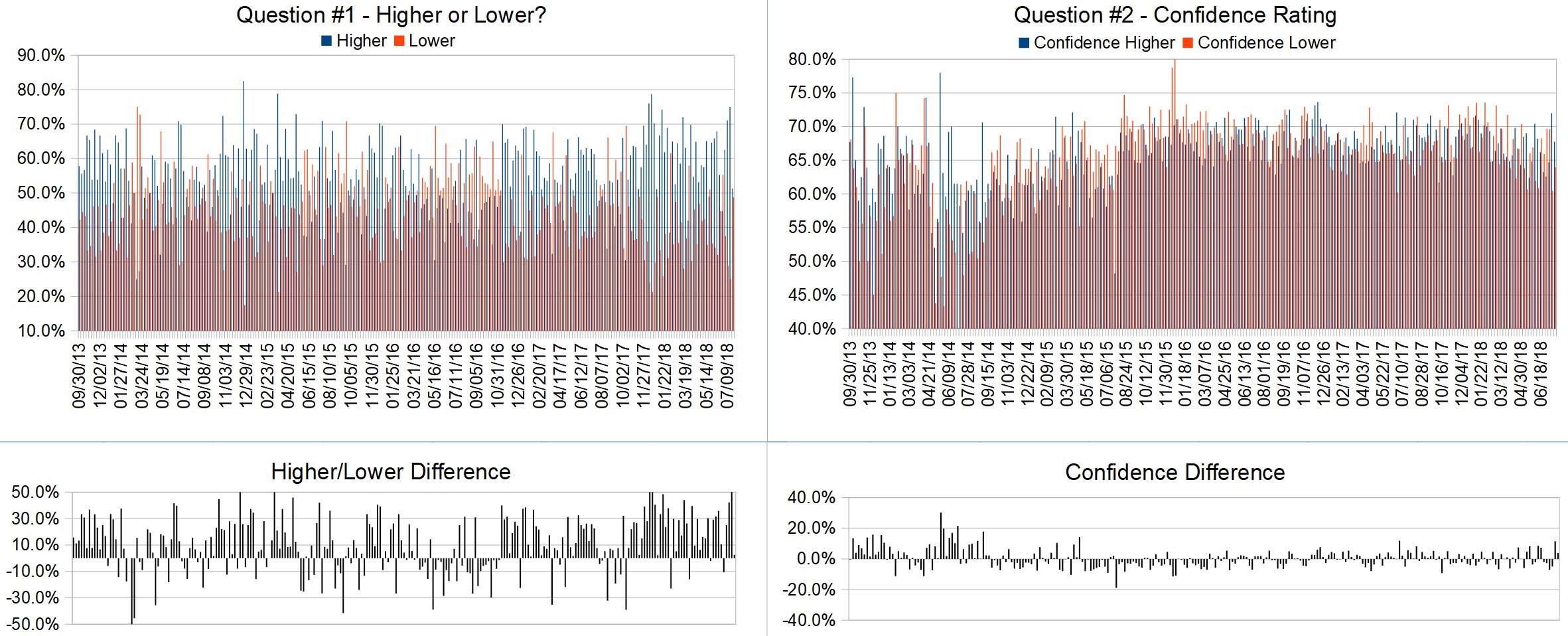

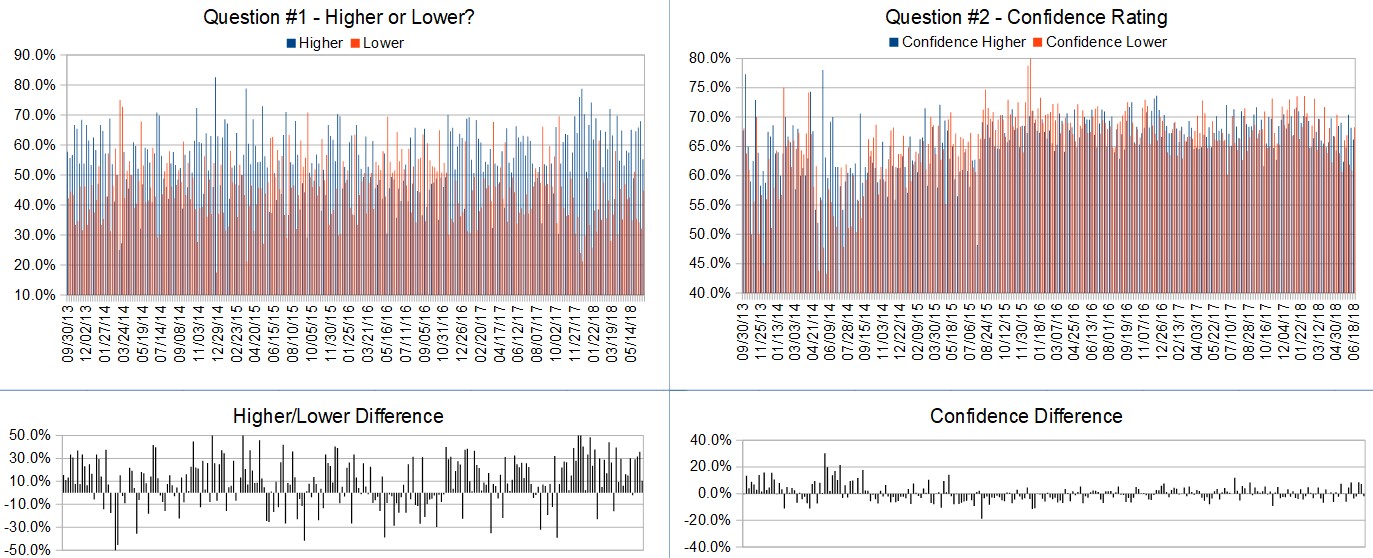

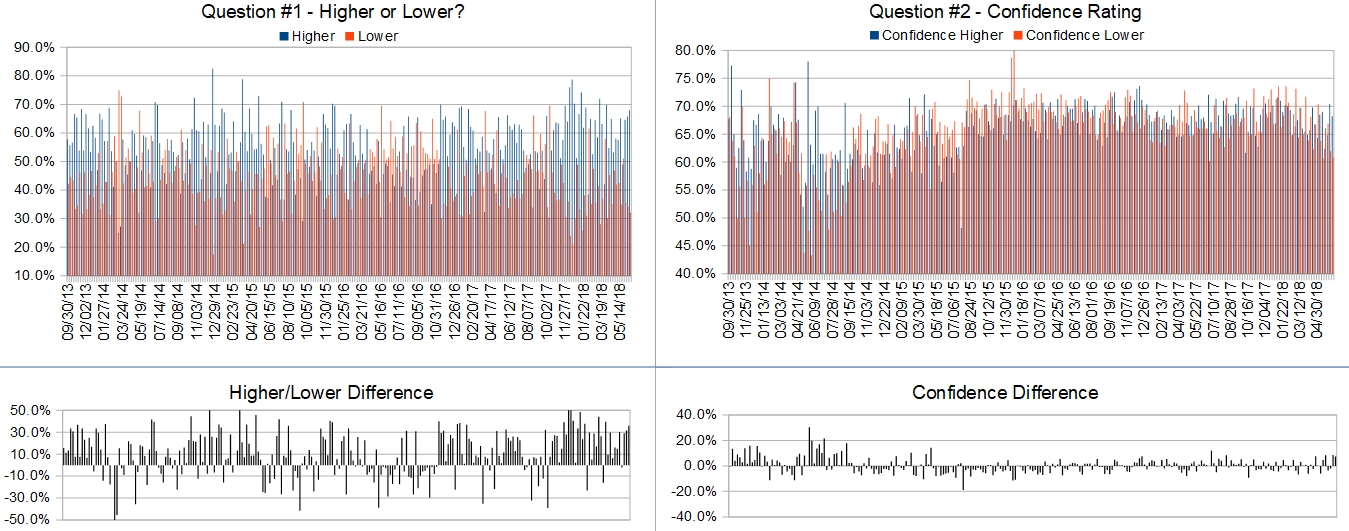

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 23rd to July 27th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

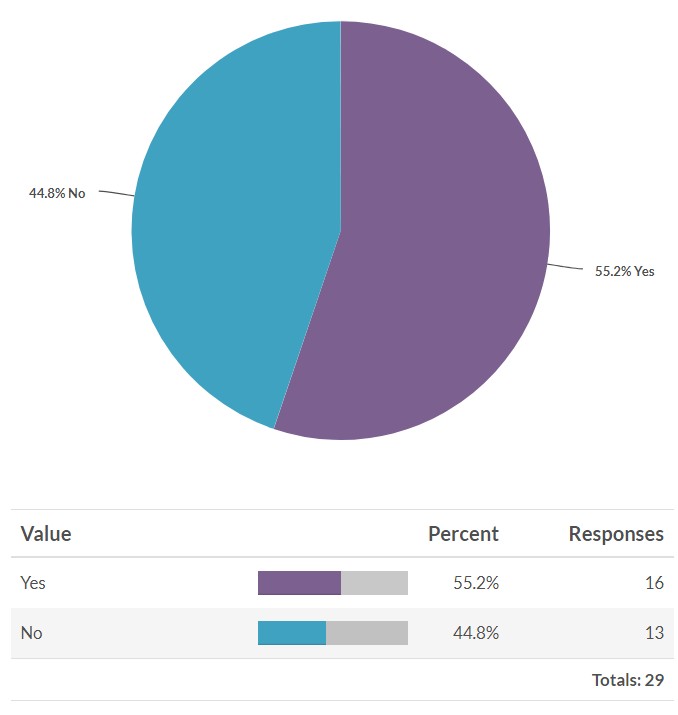

Higher: 51.3%

Lower: 48.7%

Higher/Lower Difference: 2.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.9%

Average For “Higher” Responses: 67.8%

Average For “Lower” Responses: 64.0%

Higher/Lower Difference: 3.8%

Responses Submitted This Week: 41

52-Week Average Number of Responses: 50.5

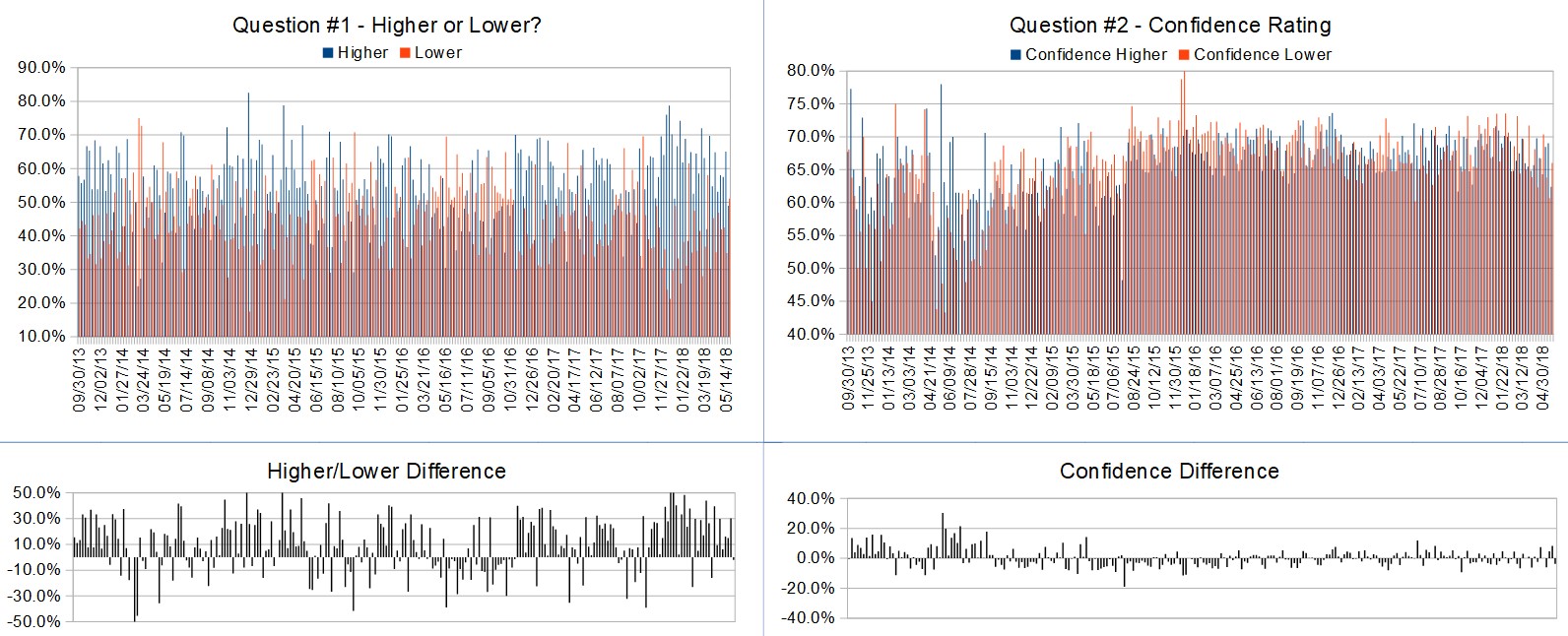

TimingResearch Crowd Forecast Prediction: 64% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 75.0% Higher, and the Crowd Forecast Indicator prediction was 63% Chance Higher; the S&P500 closed 0.45% Higher for the week. This week’s majority sentiment from the survey is 51.3% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 22 times in the previous 251 weeks, with the majority sentiment being correct 64% of the time, with an average S&P500 move of 0.69% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 64% Chance that the S&P500 is going to move Higher this coming week.

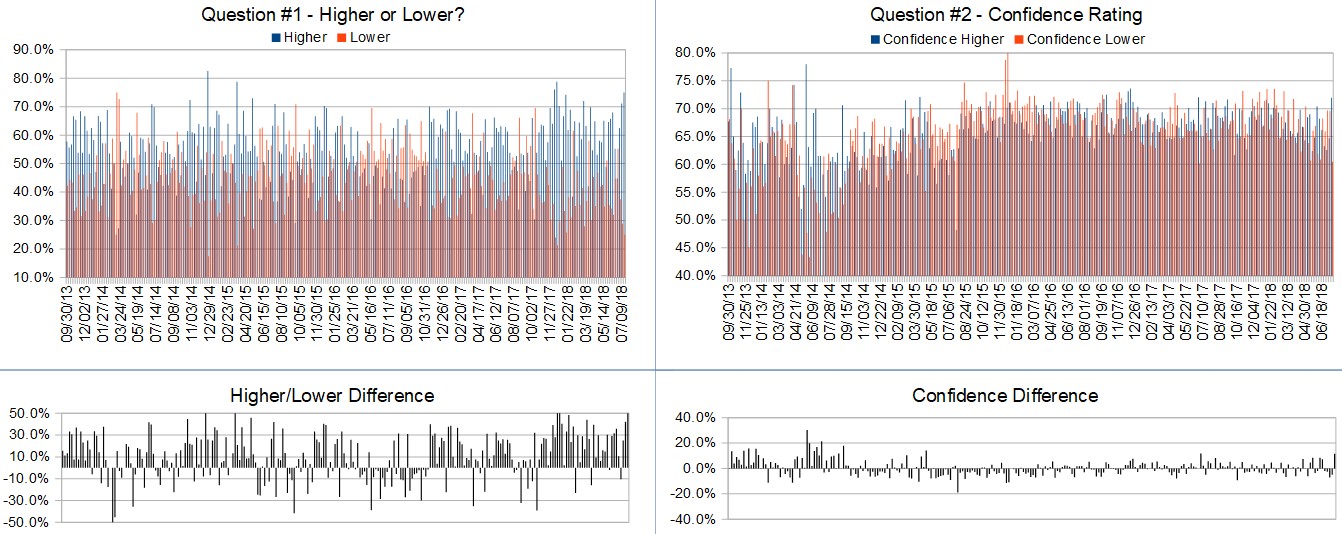

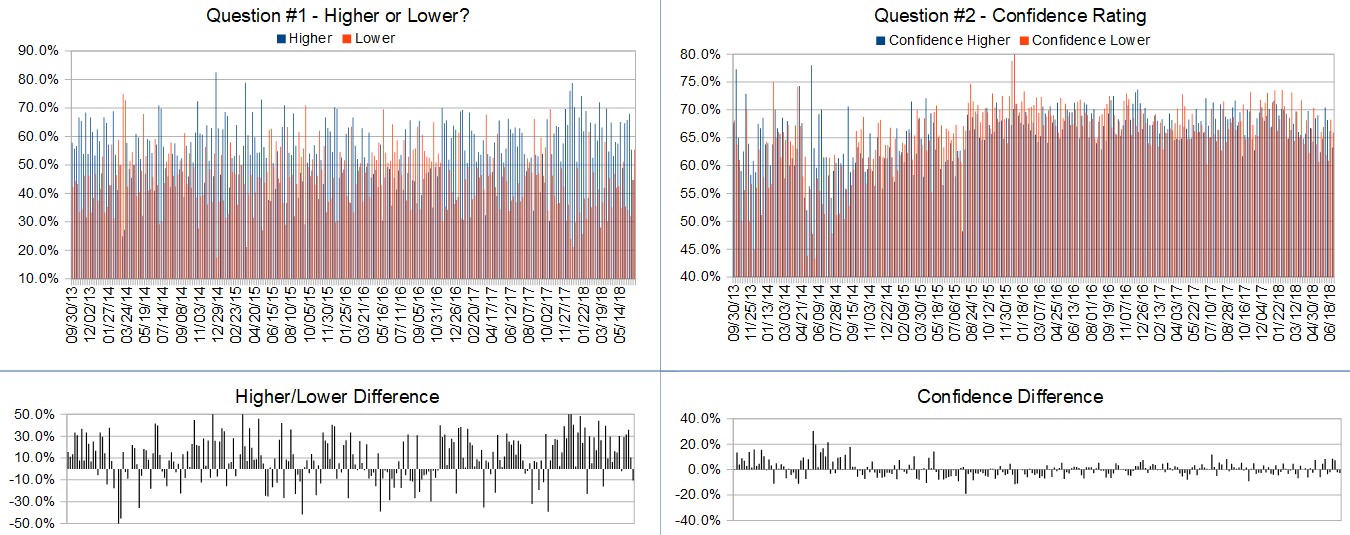

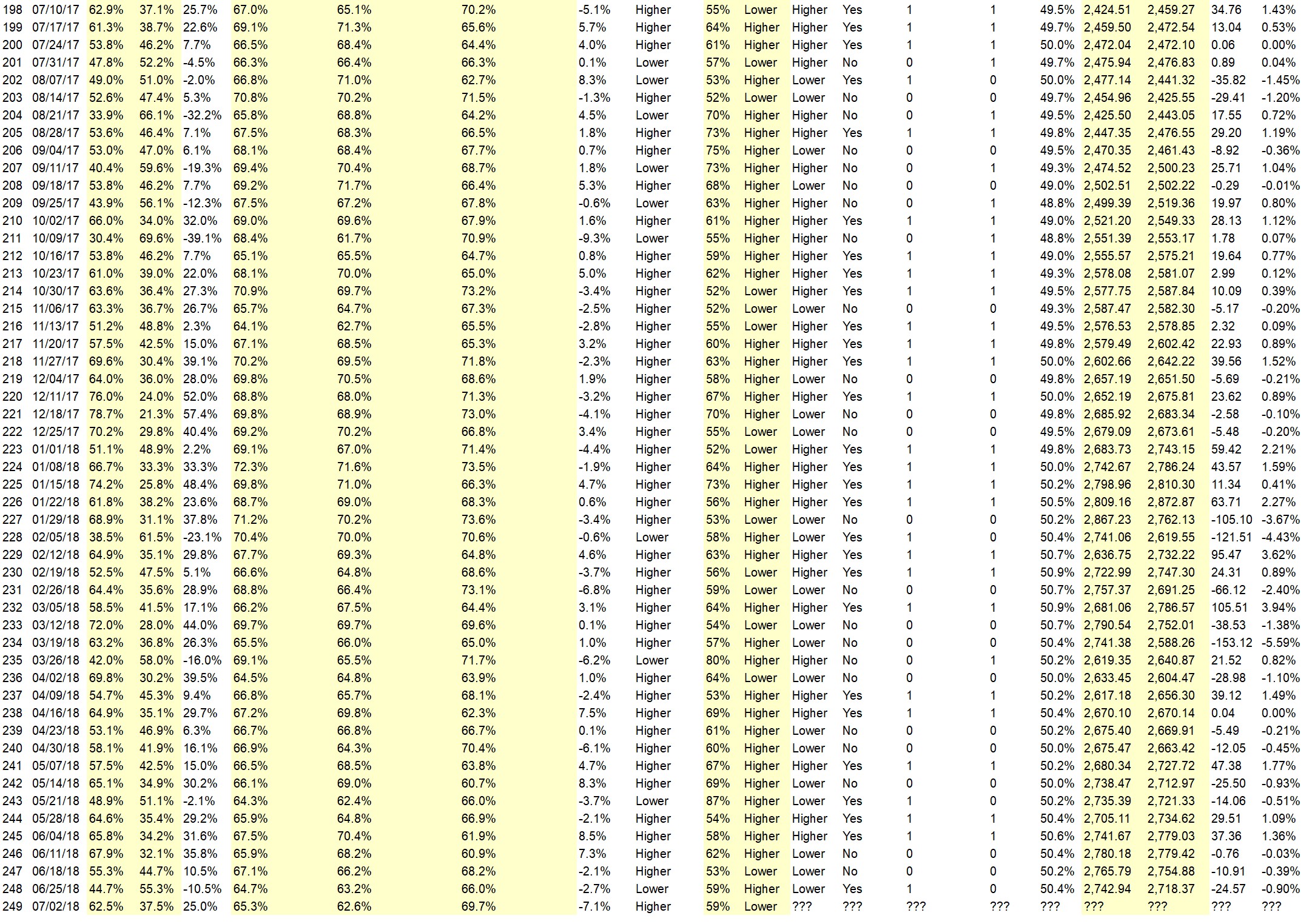

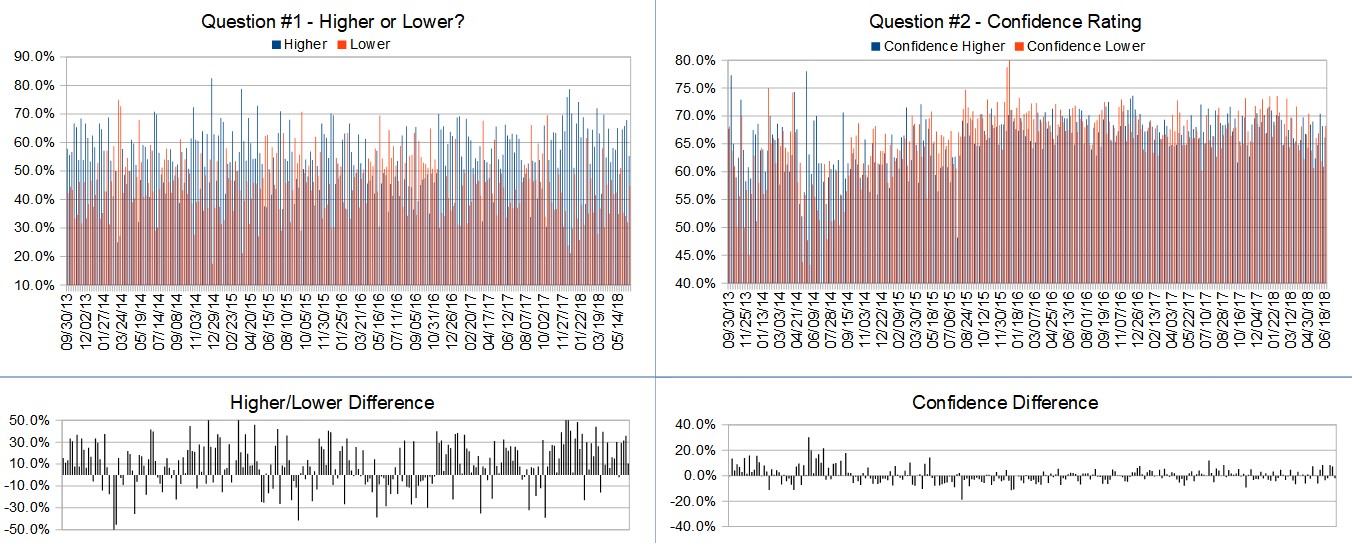

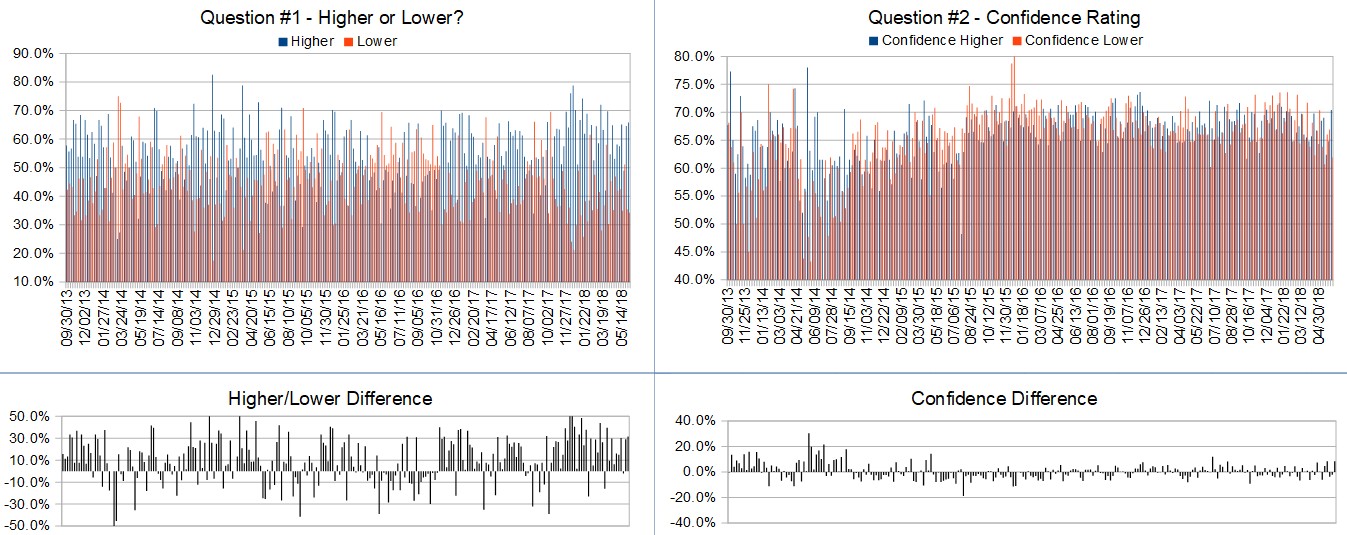

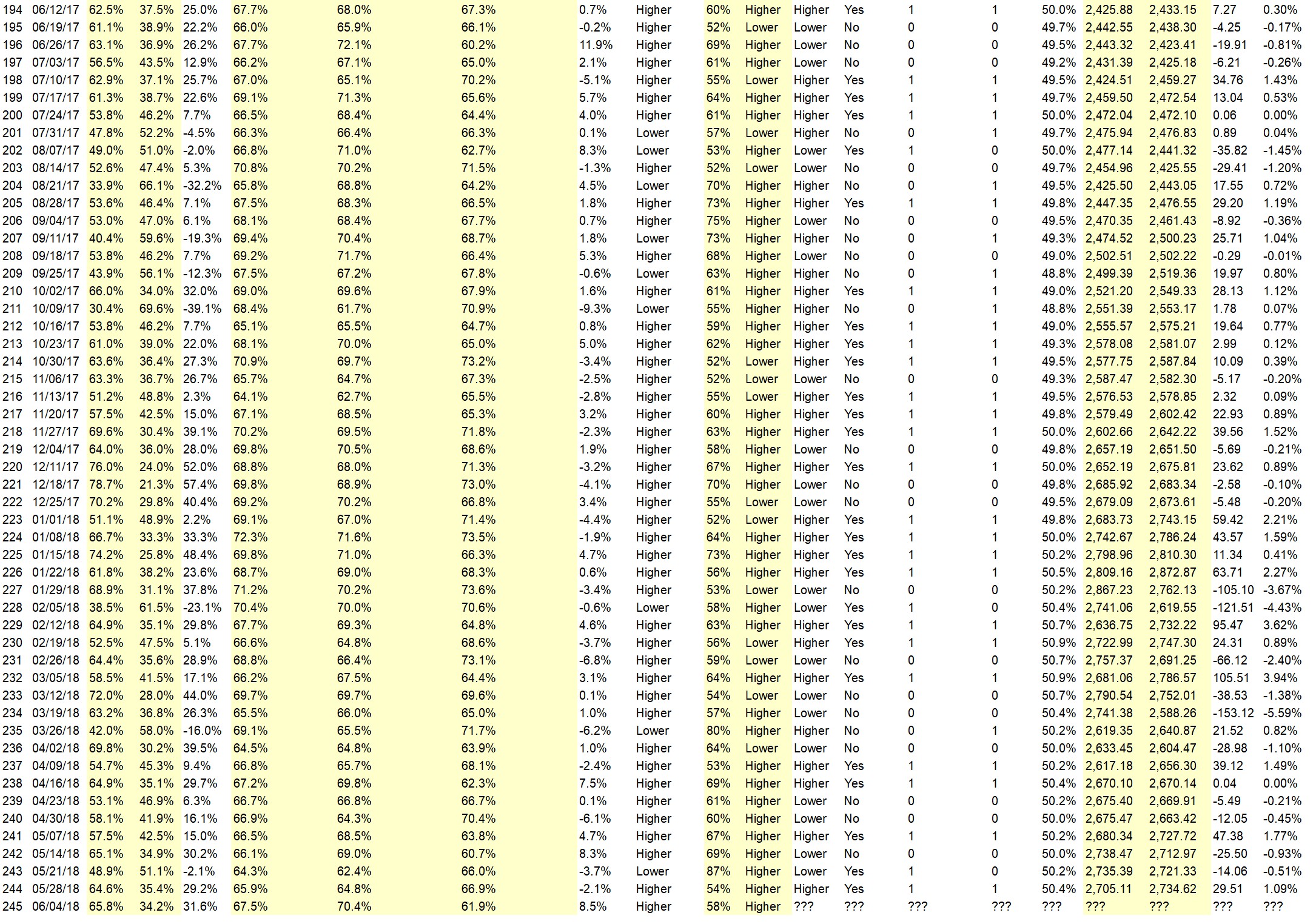

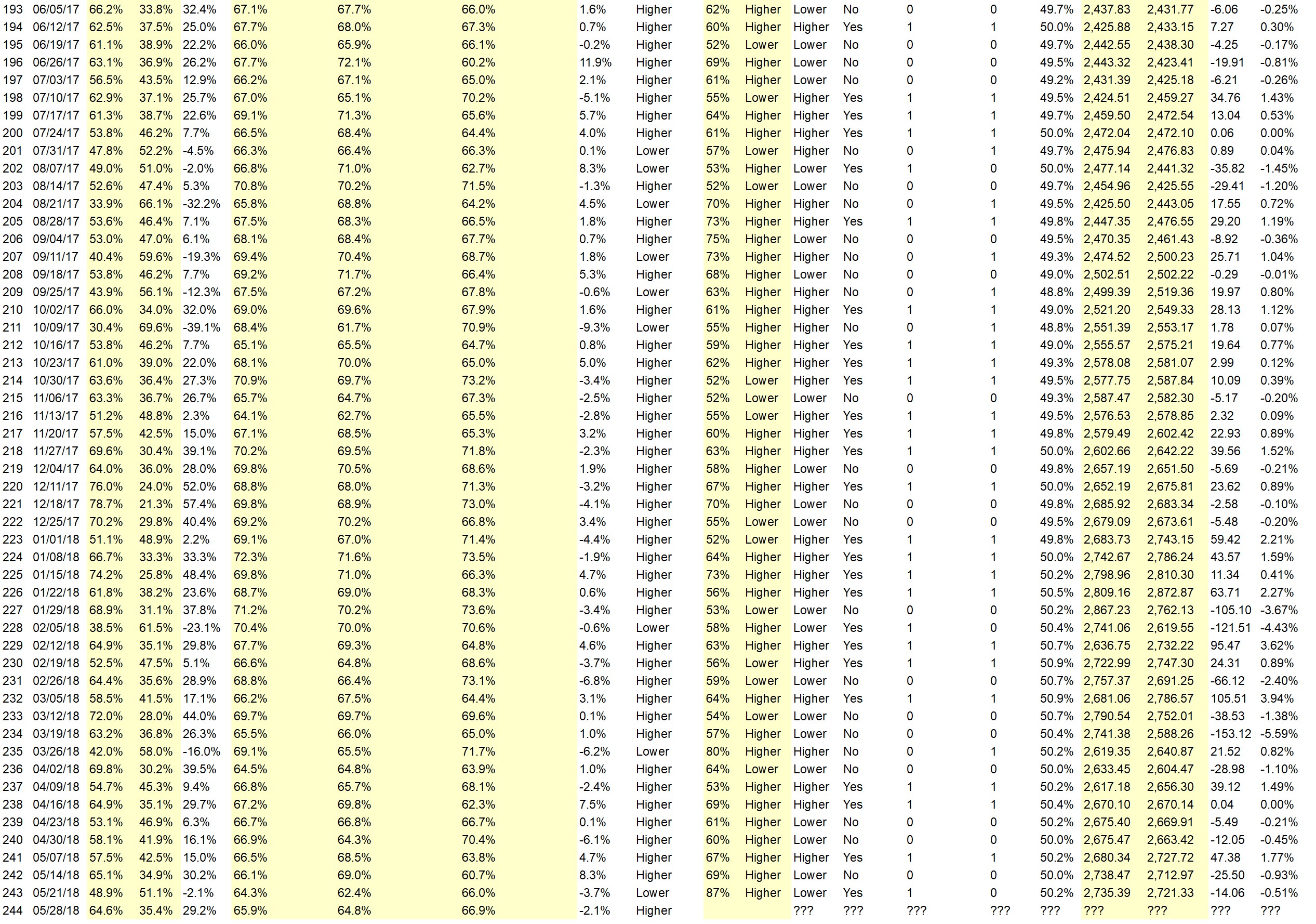

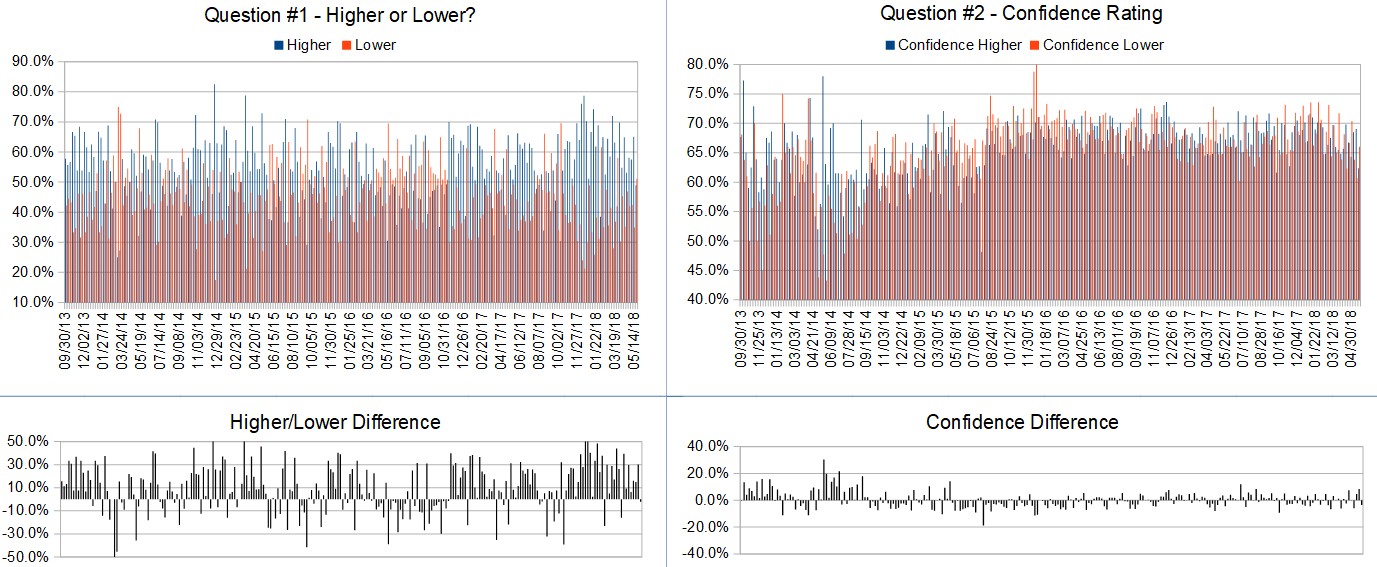

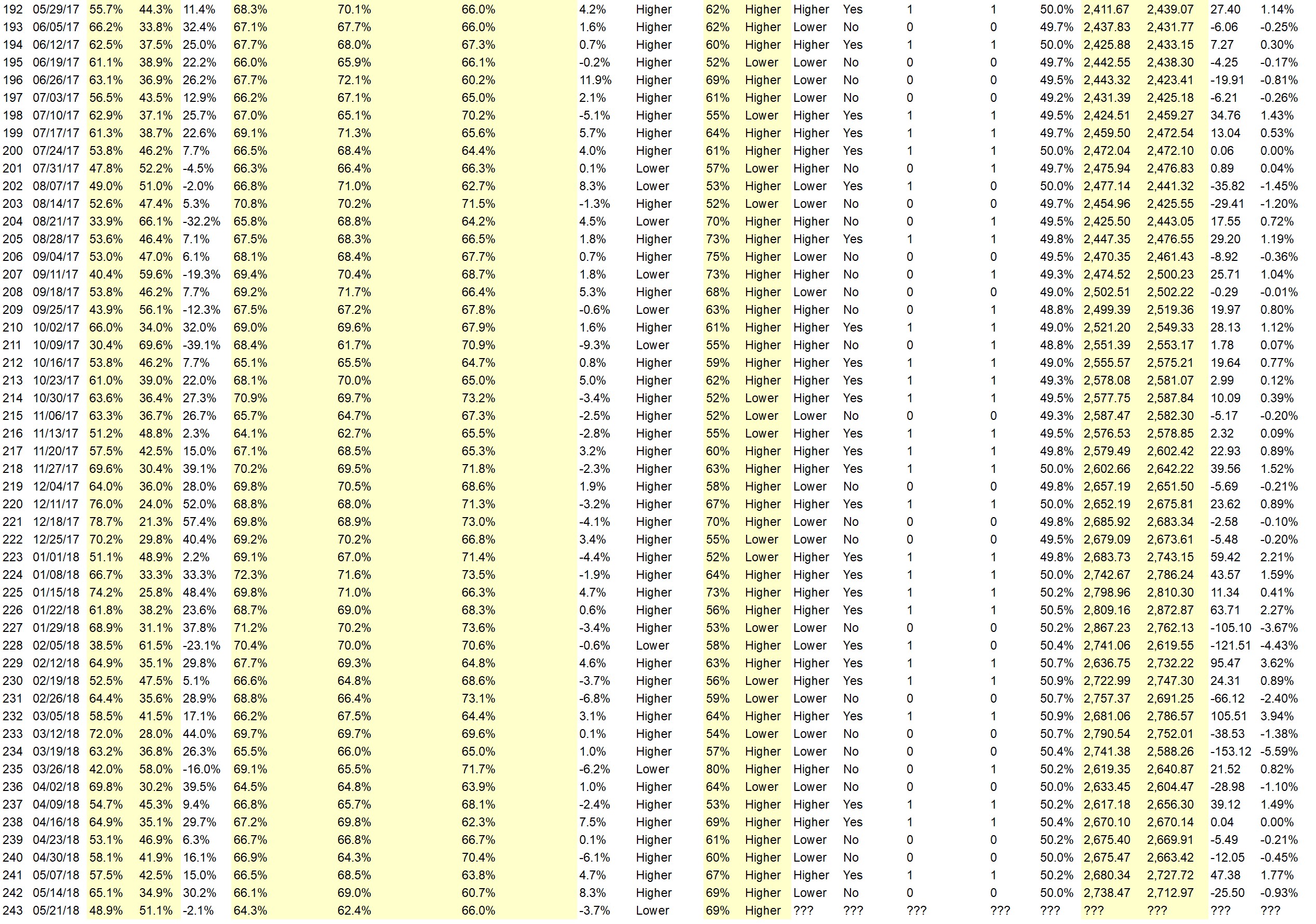

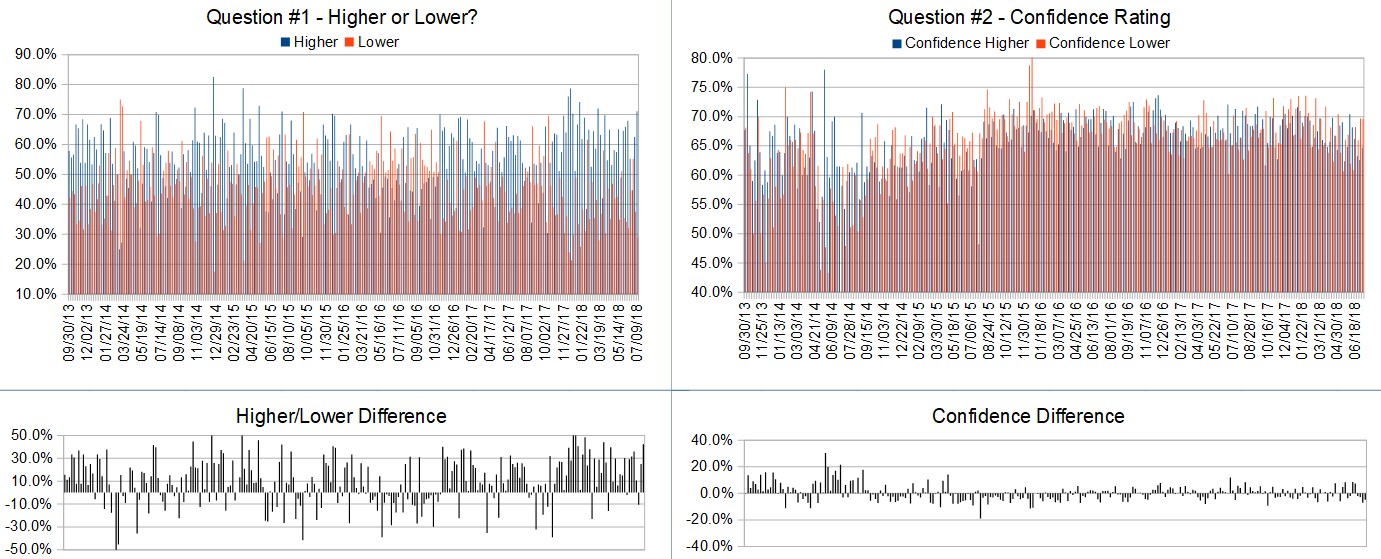

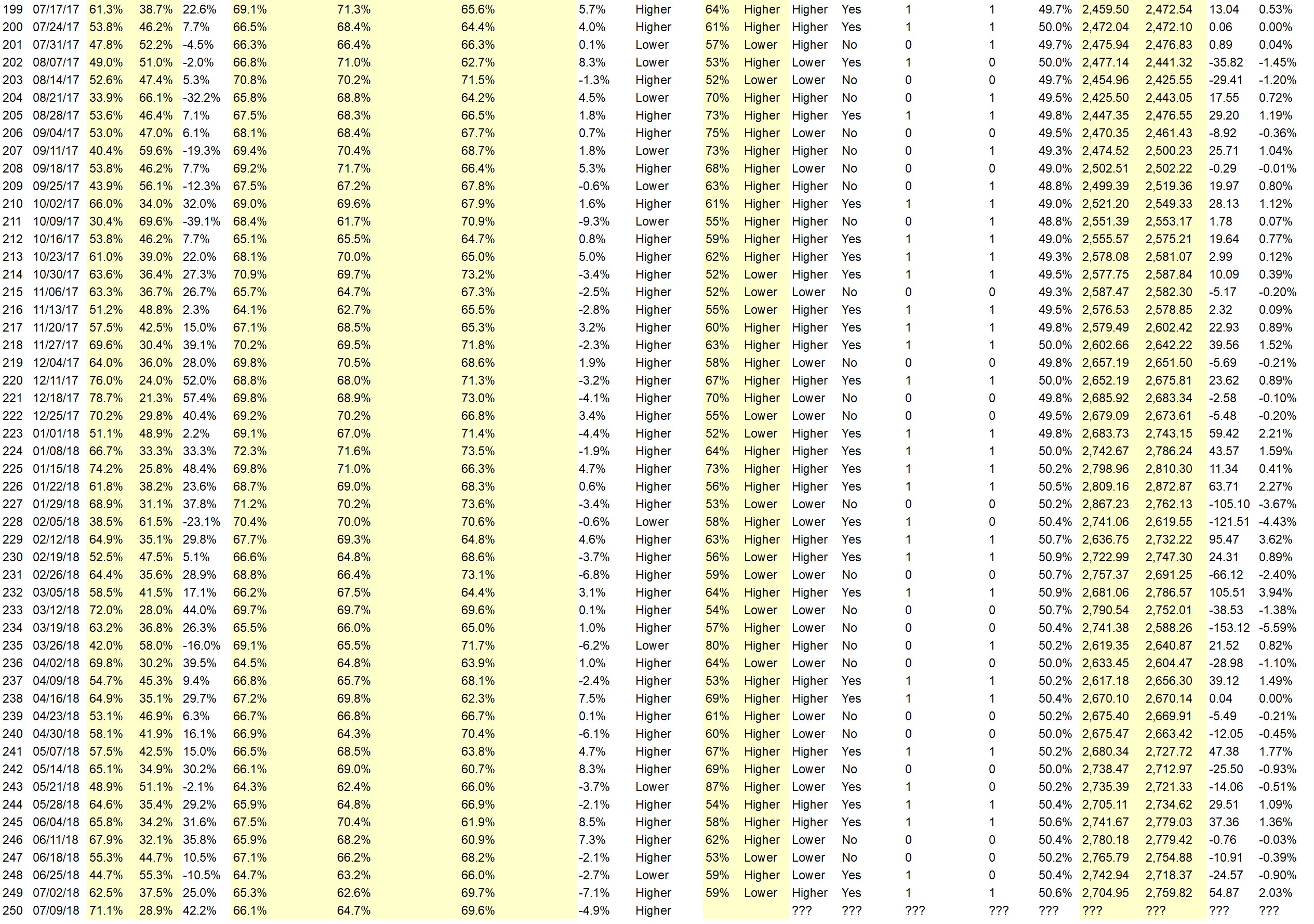

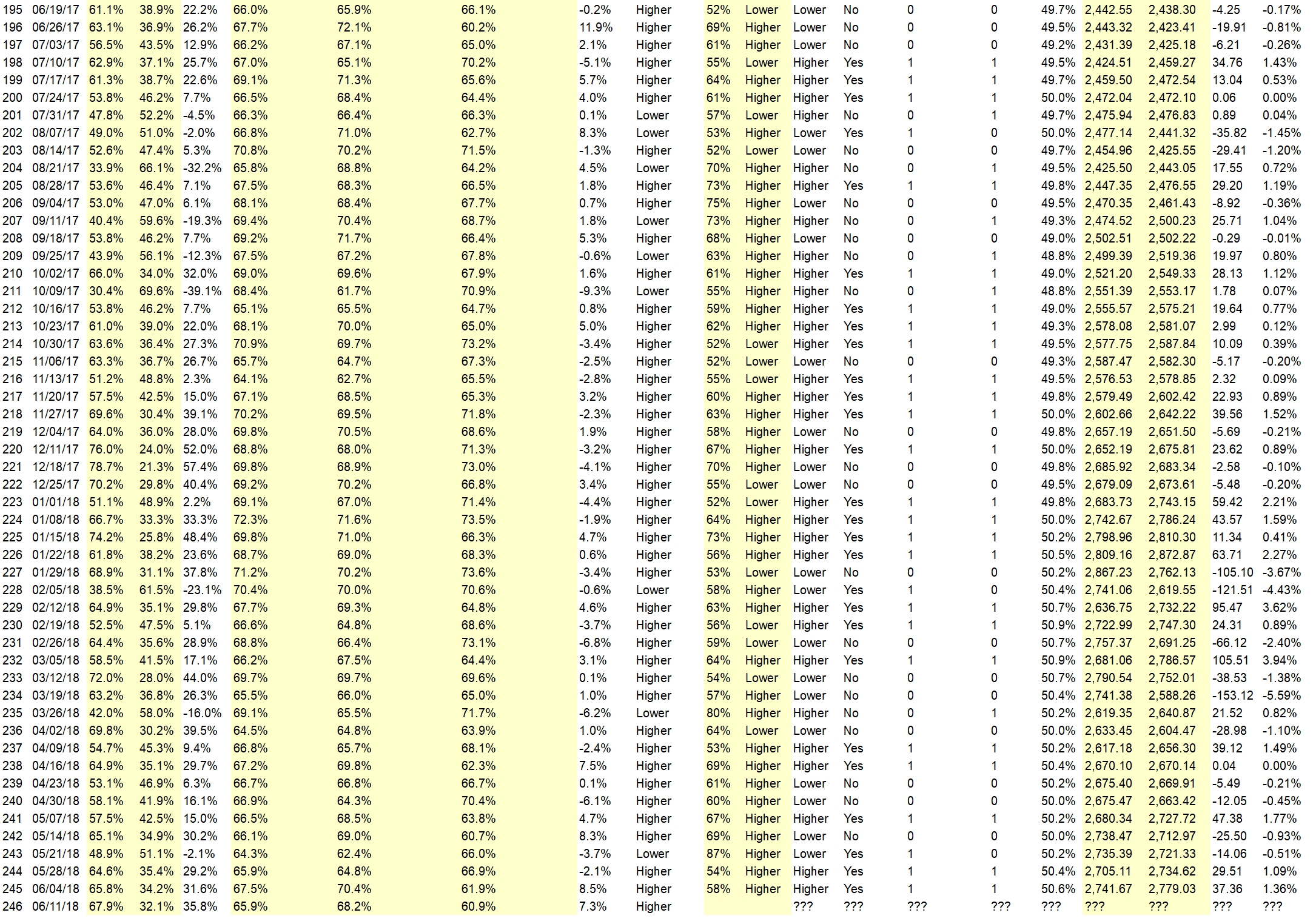

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.0%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Big names reporting this week with strong earning’s reports expected. Underlying market internals looking strong (adv/dec, stocks > 50d ma, etc.). Last couple of weeks have been flat, appearing to establish a baseline (support) for further advancement into earnings.

• Conservative Supreme Court Justice Kavanaugh confirmed today according to the Heretage Foundation email

• less talk of trade war

• Positive Earnings Reports

• Contrary reaction to the latest news.

• good corporate earnings

• History

• Market went sideways this past week after hitting new highs, i.e. no sell-off. Earnings have been strong.

• Earnings

• economyisgreat

• I’m still of the opinion that higher earnings will move the averages a little higher.

• Week should be weak but market will pick up later to end slightly higher

• It’s earnings season

“Lower” Respondent Answers:

• Currency war, trade war, shooting next?

• Rising rates

• sems like topping action

• tariffs

• The weakness to overcome the 2820. From Wednesday’s decline suggests a slight correction for next week

• big peak on Thursday and immediate selloff

• It is over bought

• Weekly bearish divergence in the S&P emini. Also reached the time and price targets for a wave c completion.

• cycles

• low vix

• Elliott

• Market continues to deteriorate except for the dozen or so favorite stocks.

• potential currency war

• rising interest rates the good news is out

• Trend is short term down. Stochastics falling.

Question #4. Between methodology, money management, and psychology which do you think is most important and why?

• MONEY MANAGEMENT!!! A true believer after painful evidence in the past of being 75% correct over a month & still not being profitable. After becoming more disciplined; have had months where I was only around 50% correct (42% one month); but was still profitable.

• Psychology

• probably the only one you can control as an indidividual

• Money Management. No one can predict what the next trade will do. Money management keeps you in the game.

• They are all very important. None can be ignored!

• psychology

• Methodology – primarily, need to have a plan for generating profits.

• Right now I think psychology is having more of an influence on the market. Good corporate earnings help, but there are a lot of other factors weighing on the market. Biggest of which is tariffs. How much of an effect is that going to have on future earnings?

• Methodology and money risk management are both ruled by our psychological make up. Weak on any of these factors we lose so we need all 3 but method and modus is the most critical part.

• Psychology

• Methodology. With the right program, the only money management you need is how to spend it all. That should make you happy.

• Money mgmt lives to fight another day

• money management, no money, no future

• Psychology!!!

• methodology. use what works.

• Methodology. It is a start, then money management

• money management.

• Money Management because if you don’t limit your losses, you will be out of the game.

• psychology – people worried about their money

• money mangement methodology are both essential

• Money management is the main skill needed for continuation of trading.

Question #5. Additional Comments/Questions/Suggestions?

• Market is never overbought.

• Always stay put

• best seasonal indicators?

• What is in it for me?

Join us for this week’s shows:

Crowd Forecast News Episode #189

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 23rd, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– John Thomas of MadHedgeFundTrader.com

– Roy Swanson of SteadyTrader.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

Analyze Your Trade Episode #42

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 24th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Larry Gaines of PowerCycleTrading.com

– Christian Fromhertz of TribecaTradeGroup.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #251

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport071518.pdf

Audio explanation of this report is available in the following video as well as in podcast form through iTunes, Podbean, Stitcher, Spotify, and more.

Crowd Forecast News Report #251 Full Report:

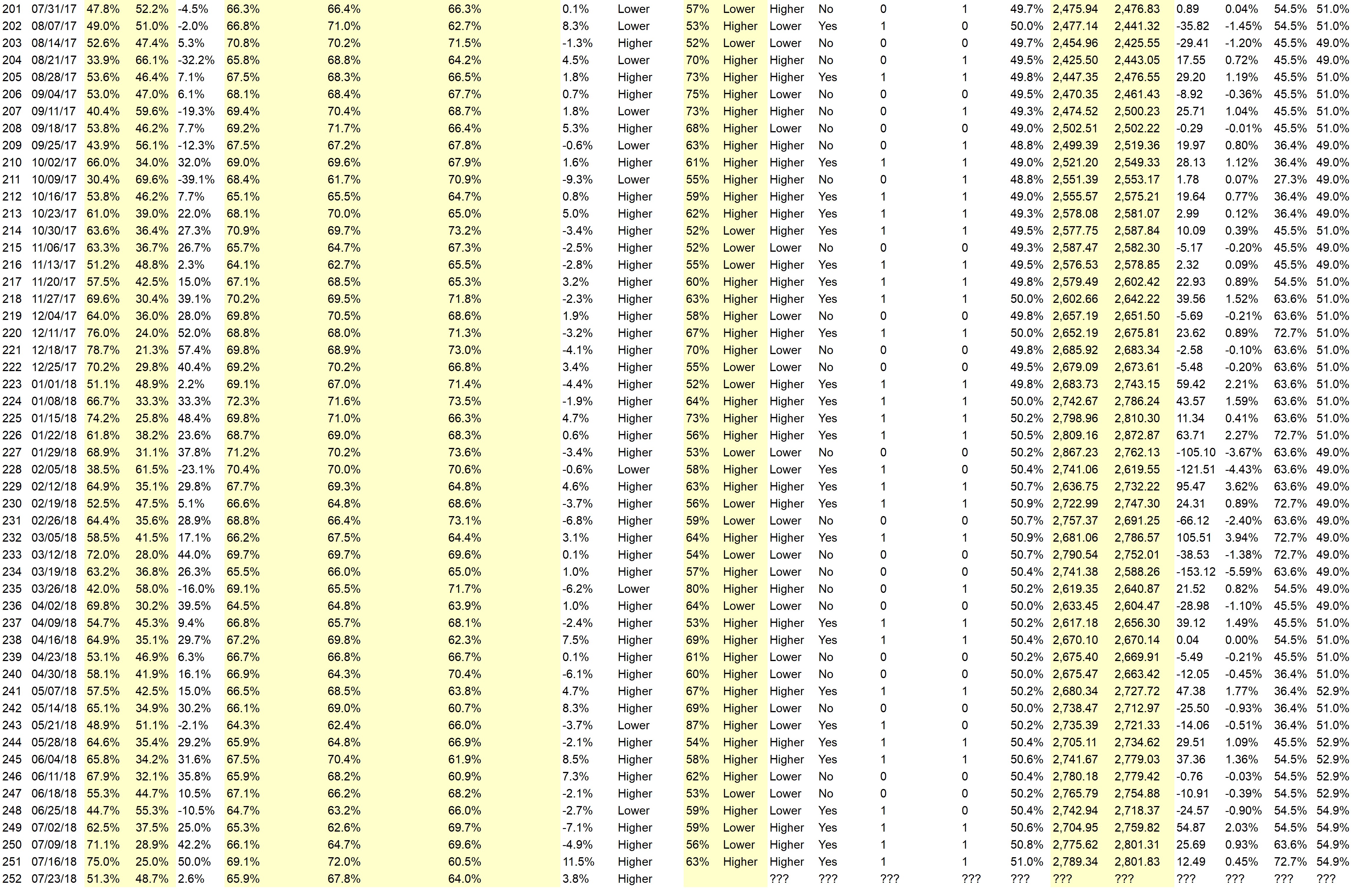

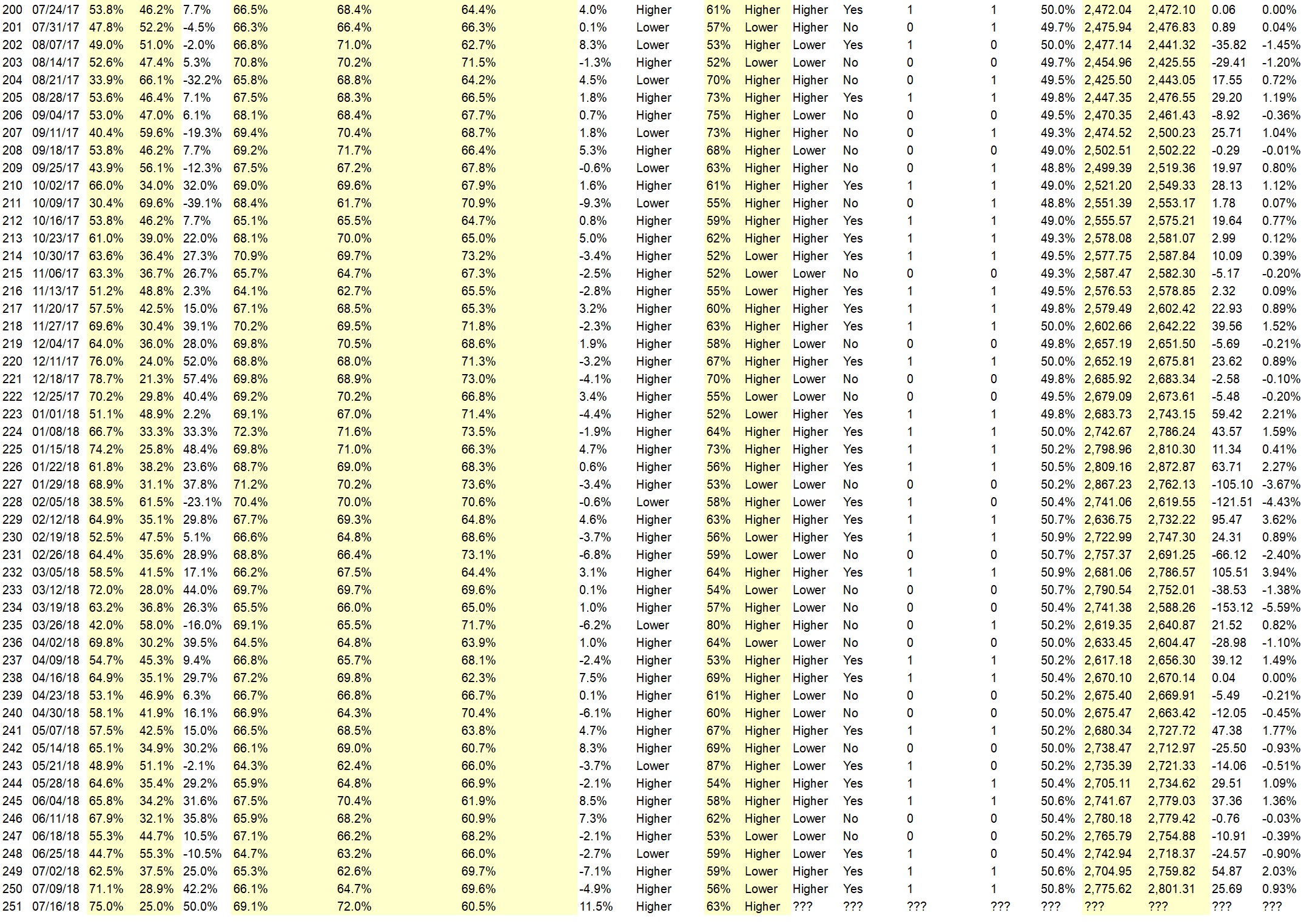

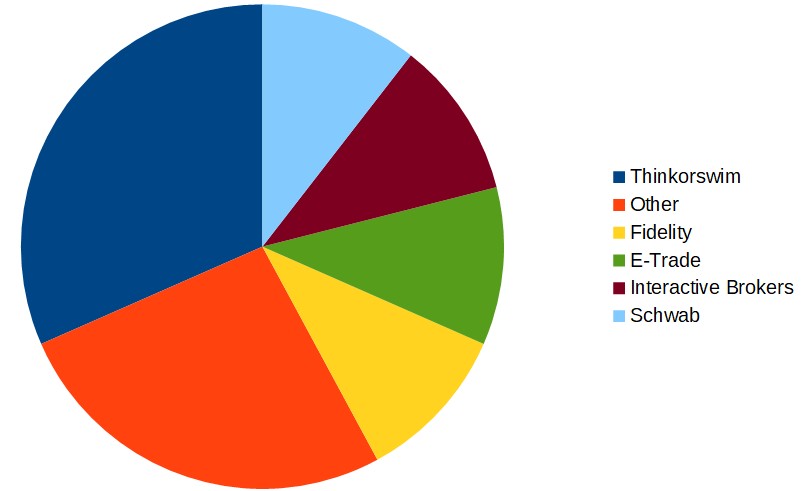

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 16th to July 20th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 75.0%

Lower: 25.0%

Higher/Lower Difference: 50.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 69.1%

Average For “Higher” Responses: 72.0%

Average For “Lower” Responses: 60.5%

Higher/Lower Difference: 11.5%

Responses Submitted This Week: 47

26-Week Average Number of Responses: 48.4

TimingResearch Crowd Forecast Prediction: 63% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 71.1% Higher, and the Crowd Forecast Indicator prediction was 56% Chance Lower; the S&P500 closed 0.93% Higher for the week. This week’s majority sentiment from the survey is 75.0% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 19 times in the previous 250 weeks, with the majority sentiment being correct 63% of the time, with an average S&P500 move of 0.29% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 63% Chance that the S&P500 is going to move Higher this coming week.

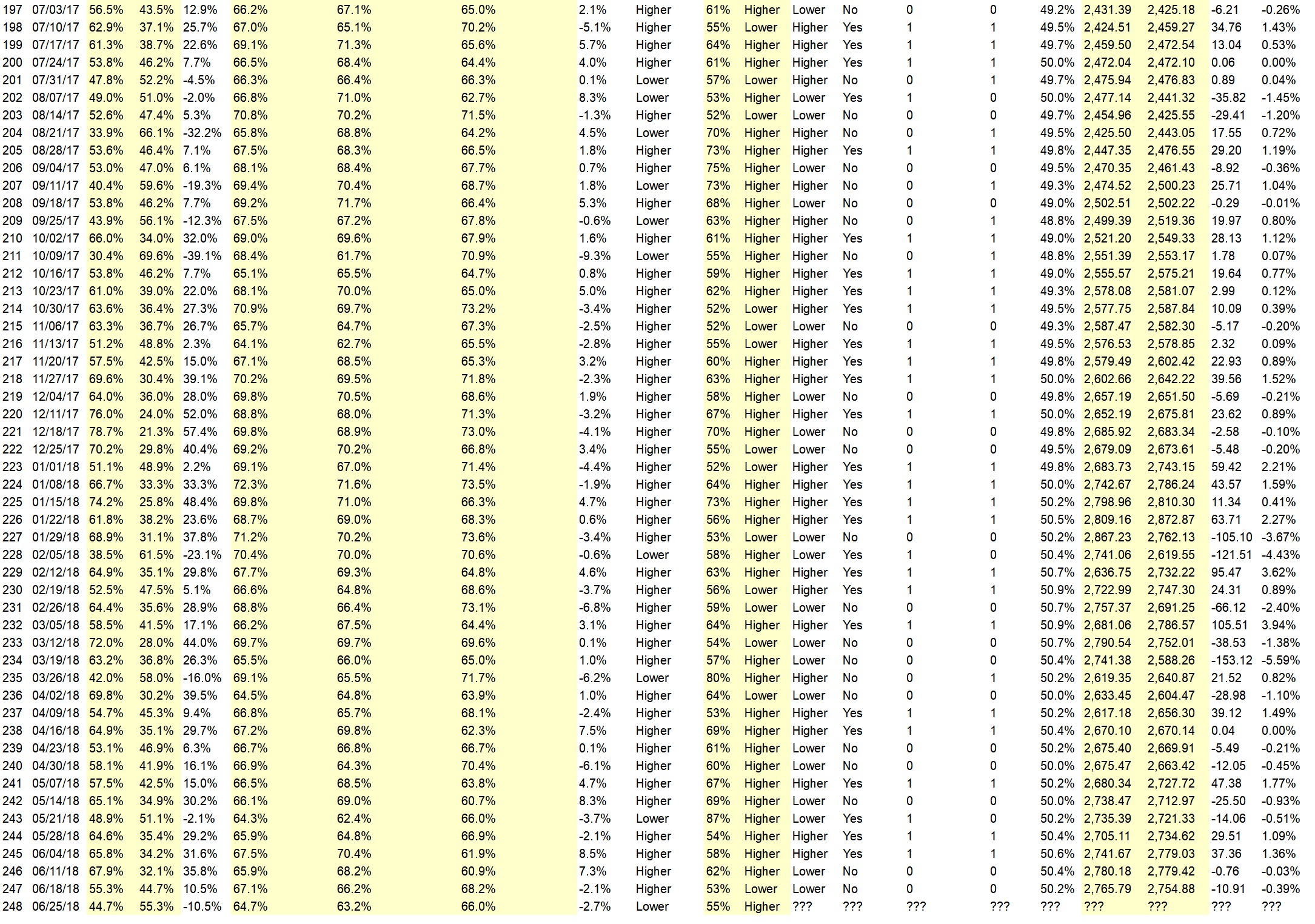

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.8%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• bull market

• Breakout

• Good 3M price today to 201.50$ is a leader in the past of strength in stocks on the Dow Jones Indistrial Average or others

• long term bullish unless its breakdown 50 day moving average support. Monthly advance /decline is tilted towards the advance

• Tariffs and trade concerns will disturb the trend until uncertainty subsides but the trend is up as long as earnings satisfy & the outlook is carefully worded in a positive direction. But for trade uncertainty, the market would be up at least another 10% or more so the market is counting on an outcome that is not negative. Sadly, the FAANG’s are disproportionately screwing the market up but if rotation occurs & if the Financials participate, we will see dynamically positive action sometime soon.

• Indexes run higher a bit longer but most gains are made. Market may correct by midweek on.

• Economic optimism will continue in the third quarter

• break above the MAs

• Lower taxes

• good earnings reports

• Momentum and OPEX

• The economy is good and getting better.

• still buying

• The dip in the S&P during the week was shallow; and buyers swooped in. Tech stock momentum is strong. This market wants to go higher.

• The market seems to have digested the news about additional tariffs against China. It did rally from its support off of 2690 last week. Unless this administration announces additional tariffs, the stocks should be moderately higher at the end of the week. Earnings are likely to have some positive impact.

• I think the market will move higher in response to higher earnings. Most companies in the S&P 500 should beat estimates.

• MOMO

• Earnings Tech momentum

• Flations of all kinds together. Consumer down, it commodity up. Gold goes down to a base. Oil marches higher as sanctions kicking in . Eventually, really the growth story will solidify. Markets already anticipating it. Thus ES moves higher. Higher on the week end is my assessment with over 80% confidence.

• It’s the EverReady Bunny.

“Lower” Respondent Answers:

• Tough call for me this week. Mixed signals; but appearing short term overbought. Looking for NFLX earnings to disappoint; but MSFT to beat. Therefore leaning towards unchanged to just slightly lower.

• Markets have topped

• tariffs

• Political rhetoric.

• The downside correction will continue until the public says just get me out.

• much uncertainty over trade wars/tariffs

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on July 23rd.)

• Why/when will the market breakdown( effect of trade tariffs, inflation 10 year treasury interest rate, bull run of 10 years is the longest

• I like profit in cash

• money management

• Funding. Are there any real funding firms out there for ES futures traders? Or do they all involve paying for an expensive course first?

• High probability trading

• Use of covered calls to generate race he in higher moving markets. Strangles?

• Market reaction to news events.

• technical indicators

• Hedging ones portfolio

• I have no questions about the people I do not consider as experts in any case !!!

• dividends and monthly income

• I would like to know your team’s thoughts on the long term effects of Trump’s trade war and tariffs might have on US economy.

• List the indicators that are 80% reliable if any. Without an 80% edge, flipping a coin is just as good.

Question #5. Additional Comments/Questions/Suggestions?

• keep’ em coming

• This crowd forecast survey is a great idea!

• My call For Hire gold is being delayed but I still anticipate it moving higher before the beginning of the 4th quarter

• It’s difficult enough to predict the move in the market from Friday’s close to Friday’s close but it is a fool’s errand to predict Friday’s close from Monday’s unknown open. This prediction format needs to be changed since anything can happen on Monday.

◦ TimingResearch Response: That would be interesting but ultimately useless since you can’t go back in time and put positions on before Friday’s close. Hypothetically, having a good prediction of what the market will do from Monday’s open to Friday’s close (in the future, relative to this report being published on Sundays) is the only way that this would be of any use to anyone. That’s what this experiment is trying to accomplish.

Join us for this week’s shows:

Crowd Forecast News Episode #189

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 23rd, 2018

– 1PM ET (10AM PT)

Lineup:

– Jim Kenney of OptionProfessor.com

– John Thomas of MadHedgeFundTrader.com

Analyze Your Trade Episode #42

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 24th, 2018

– 4:30PM ET (1:30PM PT)

Lineup:

– Larry Gaines of PowerCycleTrading.com

– Dean Jenkins of FollowMeTrades.com

Partner Offer:

Join me for the online-only Wealth365 Summit July 16th-21st where you’ll be exposed to more speakers, new topics and hundreds of thousands of dollars worth of free prizes from top wealth experts.

Crowd Forecast News Report #250

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport070818.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 9th to June 13th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 71.1%

Lower: 28.9%

Higher/Lower Difference: 42.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.1%

Average For “Higher” Responses: 64.7%

Average For “Lower” Responses: 69.6%

Higher/Lower Difference: -4.9%

Responses Submitted This Week: 48

26-Week Average Number of Responses: 49.0

TimingResearch Crowd Forecast Prediction: 56% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 62.5% Higher, and the Crowd Forecast Indicator prediction was 59% Chance Lower; the S&P500 closed 2.03% Higher for the week. This week’s majority sentiment from the survey is 71.1% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 18 times in the previous 249 weeks, with the majority sentiment being correct 44% of the time, with an average S&P500 move of 0.83% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Summation indexes turning up & market breadth improving. After Friday’s strong movement on low volume; expecting weakness early week, declining to moving averages, and then strengthening into week’s end.

• July up

• A new conservative constitutional Supreme Court nominees bee maybe

• Technicals see rising trend

• Even though all logic is to the contrary, all my momentum and sentiment indicators are not only bullish, they are very bullish so I’m going with the flow. With tariffs, geo-political conflicts, currency problems, emerging market weakness, interest rates rising, this could be a fake move but I think that the market is about to break out anticipating strong earnings on Friday and beyond. Weak hands have been severed and strong market moving hands are in control.

• Positive Earnings

• Tax cut

• The economy is booming, low unemployment.

• still buying

• The S&P was up this past week, showing immunity to all the trade war chatter. So it could very well continue. Next resistance about 2800.

• The current positive market momentum should continue in the coming week. However, there are likely a couple of down days mainly because of tariff war.

• Q’s and Techs are recovering as are small caps.

• got good fundamentals. trade tariffs easing..

• trade war is a good reason to buy the market apparently.

• Trade wars heat up. But Murica’ is self sufficient consumption. Just going to cost a bit more for imports. Who cares…. print it up! Good for the markets!

• Banks own stocks.

• Major negatives have already been priced into a market that has greater than 4% GDP predicted growth.

“Lower” Respondent Answers:

• Tariffs

• Trade war becomes very real with o resolution in sight

• yeses

• tradevwar intensifies

• International Trade Negotiations with China are going poorly for President Trump

• The downside correction will continue until the public says just get me out.

• trade war

• momentum and second derivative of momentum weak

• From High early next week a low should be formed around Friday the 13th

Question #4. What sort of hedging or portfolio protection strategies do you implement in your trading or investing?

• Sell covered calls

• Futures

• I took some profits today as well as yesterday. I hope to keep this cash ready when I see some good opportunities. Hopefully I will not miss these opportunities.

• I will put an option hedge on the VXX

• yes

• actual hedging and options

• options on futures positions vs. stops

• option spreads

• I have recently increased my % in JNUG Gold ETFs

• leveraged inverse etfs

• I am holding a few short ETF funds currently in case market goes back to a downtrend.

• Stops based on technical chart pattern

• Longer term options to help keep portfolio close to delta neutral.

• I closely watch the market and act accordingly.

• VXX, SPY puts and futures.

• use of the VIX.

• inverse etf

• Stop Loss Orders

• SPY puts and/or VIX calls

• I don’t

• Sell covered calls

• Selling OTM puts for issues and products I want to own. Going long option spreads in the directions I’m thinking. Having trailing stops combined with limit orders after I take a position. Keeping 1/3 to 1/2 of my accounts in cash until the market makes an extreme move down for me to take advantage of much lower prices. Listen to a wide range of advice but trust NO ONE! Take responsibility for all trades you make.

Question #5. Additional Comments/Questions/Suggestions?

• Unreliable markets all around the world. hanging by a thread

• Tariffs and trade war are completely unnecessary. Economic growth would have continued just fine.The economic advisor Kudlow had previously during Reagan administration seen the negative impact of such tariffs on American economy. Yet he is now willingly agreeing with the current administration on this. I suspect we retail investors/general public are in the dark of much of what is happening, sadly. It is extremely upsetting to see market gyrations, especially if one is not into day trading.

• yes

• Gold to benefit from the ‘flation’. Up we go. The giant H&S target is +320 points from the shoulder.

• Hmm… I like the concept of the system for market decisions !

• Our DOJ looks like it’s patterned out of a “Banana Republic” and why Trump does not order it to comply with the demands of Congress, I do not know and can’t imagine why. At least the new Supreme Court will be committed to following the Constitution and not re-writing it.

Join us for this week’s shows:

Crowd Forecast News Episode #188

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 9th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Dave Landry of DaveLandry.com

– Kirk Du Plessis of OptionAlpha.com (first time guest!)

– Simon Klein of TradeSmart4x.com

– Neil Batho of TraderReview.net

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

Analyze Your Trade Episode #41

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 10th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com

– Christian Fromhertz of TribecaTradeGroup.com

– Jim Kenney of OptionProfessor.com

– Larry Gaines of PowerCycleTrading.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #249

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport07018.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 2nd to July 6th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 62.5%

Lower: 37.5%

Higher/Lower Difference: 25.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.3%

Average For “Higher” Responses: 62.6%

Average For “Lower” Responses: 69.7%

Higher/Lower Difference: -7.1%

Responses Submitted This Week: 44

26-Week Average Number of Responses: 49.2

TimingResearch Crowd Forecast Prediction: 59% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 44.7% Higher, and the Crowd Forecast Indicator prediction was 59% Chance Higher; the S&P500 closed 0.90% Lower for the week. This week’s majority sentiment from the survey is 62.5% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 17 times in the previous 248 weeks, with the majority sentiment being correct 41% of the time, with an average S&P500 move of 0.65% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.4%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Holiday

• Commodities looked higher somewhat in corn maybe a little in terms of the future I guess

• Cosr

• start of the quarter, new money from mutual funds

• Funds buying to invest the new money coming in at the start of a new quarter

• Low Holiday Volume. Tame or absence of news on trade war.

• Good earnings ahead

• New tax laws are suppose to work for industries and for individuals. So more money going through market.

• Market’s will slide sideways as it’s a holiday week.

• Most investors are more sophisticated that they monitor specific trends of their own portfolio and known the likelihood of ups or downs barring incidental world problems..IT will be really up to keep the republican seats.Any deviant means those in power will all go out to flip hamburger at restaurants

• trump renegotiates the tariffs

• If Dow rises above 50dma we could see a new rally (?)

• Banks still own so many stocks.

“Lower” Respondent Answers:

• I believe there is a slight probability that markets remain at current levels or slightly lower until earnings kick into gear with some of the big banks reporting on Friday the 13th. I’m looking for the S&P to retest support again around 2700, before heading higher.

• Oil price rise

• When the market can go down 50 points in a day & go up 25 for a couple of days only to give it all back by the close, the sellers have the upper hand & down is the path of least resistance. The algos are playing with investors & the light trading that will take place during the 4th of July week will show daily volatility with little permanent upside. NFP may provide an added boost on Friday but this market action is definitely a “piss-you-off-market.” Possible serious upside is 2 weeks away.

• technical deterioration

• Politics.

• Holiday week

• The downside correction is occurring in the rotation out of the go-go stocks, the industrials and the FANG stocks.

• weak buying

• Two factors: (1) The financials are weak. After bank stocks gapped up on Fri morning following the stress test news, they declined badly into the close. (2) Funds have every reason the dump their tech winners after the end of the quarter.

• sell in may a big crash is coming

• Sell in June and go away?? LOL

Question #4a. What has been your BEST experience so far as a trader?

• When one of my companies was taken out by a merger.

• Profit

• Feel like I am in control, even though making money has been a challenge !!

• I have always beat all the indexes but this JUNE has been my waterloo.tariff retaliation

• Being disciplined enough to reverse an erroneous trade and re-submit with the original direction.

• I regard as something do like work. Not good experience.

• S ur ovine 40 years

• learning from a master trader

• Arbitraging indiviual stocks on bad news.

• Recently, my short of RHT into their earnings went well, as they declined 13%.

• Took profits in Preferred shares

• Making consistent profits.

• Make my profits by buying stock on upward momentum/trend.

• selling options

• Selling out-of-money puts on a down day.

• intraday trading – Equity cash management

• Trading NVDA.

• Learning from the Online Trading Academy about supply zones and demand zones where the real selling and buying take place . Also, selling puts at demand zones where I haven’t had a loss in 5 years. I do miss the big winners because I don’t buy at demand zones but that takes more courage my “bird-in-the-hand” put selling.

Question #4b. What has been your WORST experience so far as a trader?

• When Bethlehem Steel went bankrupt.

• Trades not working in my favor.

• Trade wars

• Having the broker reverse a trade based on a rule at the exchange where I would have been in profit had it been maintained.

• Blow up accounts. Lose money. Getting kicked off webinars because don’t keep paying money out my visa account. Some sites that have six people create accounts on mail servers and abuse me then close accounts so don’t see normal email.

• Getting subpar returns

• CHF crash really scared me

• Being unaware of a major news item or earnings report.

• My stocks suffered badly after the Sept 2001 terrorist attack on the World Trade Center & Pentagon.

• Fat. Gastar

• Big gap downs overnight.

• Losing a lot of money on speculative biotech stocks. Never again!

• futures

• Using fundamentals as a reason to sell.

• Trading BA.

• Investing with Chuck Hughes and following his trades. Also, being talked out of making investments by “market professionals” that went up dramatically afterwards and being talked into making investments by “market investments” that were big losers.

Question #5. Additional Comments/Questions/Suggestions?

• Hoping to get better success rate.

• I have learned not to pay attention to experts,and stay on the following sectors ( TECH,HEALTH,CONSUMER (STAPLES/DISCRETIONARY) don’t move out of those areas

• Gold bottoms. Seems to be too negative given the global risks. still target 1375.

• Please share your opinion about where S&P (SPY) and Nasdaq are headed. What do we expect in the short term till earning season starts.

• Way back to the Mayflower Compact, early settlers agreed to go by the will of the majority and our Constitution provides for that same principle. The LEFT is in violation of the Constitution by disavowing that principle. Obviously, the left must be ignorant or stupid or evil since they also object to peaceful assembly, quiet enjoyment and freedom of speech except for themselves. The left has embraced Fascism and anarchy as demonstrated by their behavior.

Join us for this week’s shows:

Crowd Forecast News Episode #187

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 2nd, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com

AYT will be off this week but back on July 10th!

Analyze Your Trade Episode #41

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 10th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com

– Christian Fromhertz of TribecaTradeGroup.com

– Jim Kenney of OptionProfessor.com

– Larry Gaines of PowerCycleTrading.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #248

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport062418.pdf

The following video is a brief explanation of this week’s report, you can also listen to this as an audio-only podcast through iTunes, Podbean, Stitcher, Spotify, TuneIn, Google Play Music, or Blubrry.

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 25th to June 29th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 44.7%

Lower: 55.3%

Higher/Lower Difference: -10.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.7%

Average For “Higher” Responses: 63.2%

Average For “Lower” Responses: 66.0%

Higher/Lower Difference: -2.7%

Responses Submitted This Week: 41

26-Week Average Number of Responses: 49.5

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 55.3% Higher, and the Crowd Forecast Indicator prediction was 53% Chance Lower; the S&P500 closed 0.39% Lower for the week. This week’s majority sentiment from the survey is 55.3% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 44 times in the previous 247 weeks, with the majority sentiment being correct 59% of the time, with an average S&P500 move of 0.17% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.2%

Overall Sentiment 52-Week “Correct” Percentage: 52.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Good economic indicators like gross national product could go up with Donald Trump in office

• Traditional end of quarter window dressing especially after the down week last week.

• Seasonality and technical

• Am the proverbial monkey throw’g the dart. Look who is steering the world-ship ! Someone w/ the impulse control of a two-year old.

• Elliott

• history

• It’s the trend

• still buying

• risk back on? Draghi forever?

• At bottom of ascending channel

“Lower” Respondent Answers:

• Expecting continued profit taking at end of strong earnings this quarter & before the beginning of next quarter’s earning reports. Also: – S&P 500 closing below or at its 20d ema for the last two days – Summation indexes for the S&P 500, NASDAQ, NYSE, & DOW all turning lower – Negative divergence on the NYSE AD Line index

• Downtrend continues. About over per stochastics.

• tarrifs

• It’s only the FAANGs that are holding up the market while tariffs are pulling it down for now. With favorable trade talks, the market will respond well but good news is not at hand nor will it be until we get closer to the elections. Even if earnings, 3 weeks away, are good, the response will be muted by forward guidance prospects since CEO’s will be happy to blame their conservative guidance on trade talks in case they don’t meet expectations. It’s always safe to blame someone else if you can.

• Adjusting of accounts for end of quarter. Uncertainty about effect of tariffs.

• SPY is nearing oversold territory

• Trump Tariffs – Fed removing liquidity

• political turmoil

• The market is overbought and due for a downside correction.

• The S&P in June couldn’t reach up to the March high before starting to fall. There’s no upward momentum. Then there are trade wars with the USA versus China, EU, Canada, and Mexico. Doesn’t look promising.

• Dow moving below 12 week EMA

• dead cat Friday poor momentum

• The environment is such that not much buying interest. Sell the highs perhaps the best deal. Most likely a low may be made on Wed Thur.

• on going trade conflict US with rest of the world

Question #4. What are the most important trading or investing-related lessons you have learned so far in 2018?

• risk management. if you account is in the ‘black ‘ you still in the trading game.

• Make a profit in cash

• In the world of options, research simple, not- too many legged options; practice in sim-trade on TOS, If a strategy is profitable, use it often along w/ proper position sizing.

• sell premium see value of covered writes / poor man covered calls

• the value of options

• Protect your positions. Limit losses.

• management of existing positions is more important than finding new positions

• If it goes your way increase position.

• There are a lot of traps out there; be careful.

• The power / ability to identify & effectively trade high reward-to-risk opportunities (always committing to planned stop losses & profit targets), with proper position sizing has been paramount to my success so far this year.

• No major bad news

• Be careful.

• Ignore the news

• portfolio protrection

• For intraday focused day traders one must look at longer time frames or you lose all and everything. Medium and longer term projections, guidance is critical to not get burnt.

• Trade small and take profits often.

• Tight well defined stops below strong support levels.

• make no assumptions

• Don’t over trade so you can be ready to take advantage of a correction and swings low when they happen. The FAANGs should have their own index and not be included in any other index since they disproportionately screw the appearance of any index of which they are a part. Don’t believe anyone who says to sell FB or avoid FB when it shows weakness.

Question #5. Additional Comments/Questions/Suggestions?

• Thank you for kind survey and hope more people can benefit from your good intent and great project, May you all be successful and content dear friends.

• One tweet makes a difference in today’s price, but otherwise economy great. Fear is still low but rising some.

• When I was a child, the editorial portion of the news occupied a very small part of the news. Today, the editorial portion of the news takes up almost all of the news with very few actual facts being presented. The worst difference is that the editorial portion of the today’s news is presented as though it is fact instead of editorial points of view. Mark Twain said, “If you don’t read the newspaper, you’re uninformed. If you do read the newspaper, you’re misinformed.” It’s even worse today!

Join us for this week’s shows:

Crowd Forecast News Episode #186

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 25th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com

– Jim Kenney of OptionProfessor.com

– Glenn Thompson of PacificTradingAcademy.com

– Lance Ippolito of AlphaShark.com & TradingCoachLance.com

Analyze Your Trade Episode #40

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 26th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Oliver Schmalholz of NewsQuantified.com

– Larry Gaines of PowerCycleTrading.com

– Steven Place of InvestingWithOptions.com

– Roy Swanson of SteadyTrader.com

Partner Offer:

Crowd Forecast News Report #247

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061718.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 18th to June 22nd)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 55.3%

Lower: 44.7%

Higher/Lower Difference: 10.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.1%

Average For “Higher” Responses: 66.2%

Average For “Lower” Responses: 68.2%

Higher/Lower Difference: -2.1%

Responses Submitted This Week: 41

26-Week Average Number of Responses: 49.9

TimingResearch Crowd Forecast Prediction: 53% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 67.9% Higher, and the Crowd Forecast Indicator prediction was 62% Chance Higher; the S&P500 closed 0.03% Lower for the week. This week’s majority sentiment from the survey is 55.3% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 15 times in the previous 246 weeks, with the majority sentiment being correct 47% of the time, with an average S&P500 move of 0.31% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 53% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 52.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• 1 Cost 2 0.25 rate done

• Overall bullish attitude of the market

• Trade war smade war? Gold core ts into a buy zone. Why is silver on fire?

• Had a pull back and found support @ the 257.60 level, by the end of week should be about 285.00 level.

• History, and the economy.

• Low – High then a mid week low and then BTD ending slightly up

• Continued grind higher

• Dovish Draghi

• Breadth

“Lower” Respondent Answers:

• Markets short term overbought & history suggests there is a > 50% probability that the market will be lower the week after triple witching.

• After obtaining “clarity” from FOMC, ECB, BOJ & G-7, we are still left wondering what it really means. After talks with NK, the imposition of tariffs by the US & others, we are wondering where this will go for earnings even if Q2 earnings coming up are good. The VIX is low but uncertainty is high.Tech supported the SPX last week so if it pauses, the SPX is certain to drop a little as it consolidates. There is little inspiration until NFP & earnings weeks away. M&A will help, otherwise down.

• The trade war is heating up and I think that every day will hold a negative surprise as a result.

• Whitehouse nincompoopery prevails.

• elliott wave

• sell in May and stay away

• weak buying

• The S&P couldn’t make it up to the March peak before it started to fade. The financials lack energy, and the tech stocks appear to be close to a peak.

• Trade war BS is totally counter productive and will hurt US industry and slow down the economy.

• The market is overbought and needs to have a downside correction.

• Tariffs Bollinger band snap back candlestick

• summer top fed will raise again

• Fear of trade tariffs and retaliation. That situation is volatile and can change at any moment.

• Trends down to support then up we go.

• trade war

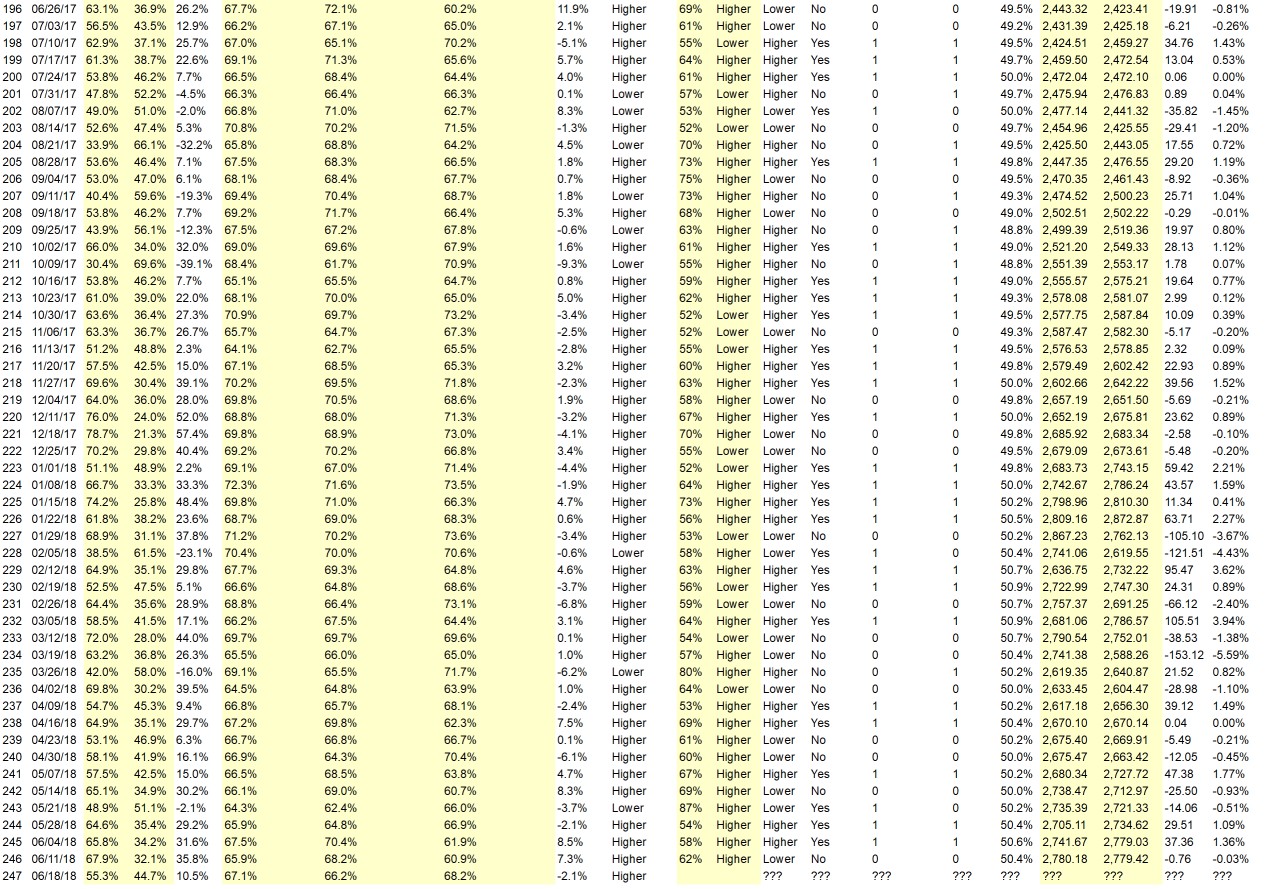

Question #Which trading platform or broker do you like the best for executing your trades?

• TOS

• Still looking. Most suck for options traders.

• thinkorswim

• Trade Station

• Schwab for stocks and options

• Bookmap

• TOS

• TOS

• Fidelity

• schwa

• i am unhappy with all of my brokers ALL OF THEM

• profitable ones

• e*trade

• Interactive Broker for my stock trades (can set up trades & go away) & tastyworks for options (best & most cost effective options trading platform out there).

• Sink or swim

• I like Fidelity but haven’t tried others

• E-Trade

• Interactivebrokers

• TOS

• Ninja Trader & Firetip

Question #5. Additional Comments/Questions/Suggestions?

• The FBI IG report was incomplete. For example, Attorney #1 wasn’t named. I guess it was Horowitz himself. If not, name the parties. I give the writing a D- and that is generous. This is another example of the corrupt FBI. It’s like an episode of “24” where the bad guys are in power and there is nothing you can do, no place you can go to get justice.

• This is the week which which can be bearish but despite all bearishness it will end up higher even if it is not much.

Join us for this week’s shows:

Crowd Forecast News Episode #185

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 18th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Dave Landry of DaveLandry.com

– Simon Klein of TradeSmart4x.com

– Neil Batho of TraderReview.net

Analyze Your Trade Episode #39

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 19th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com

– Jim Kenney of OptionProfessor.com

– Todd Mitchell of TradingConceptsInc.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

Crowd Forecast News Report #246

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061018.pdf

NEW! Watch a brief explanation of this report in the video below or listen in podcast format.

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 11th to June 15th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 67.9%

Lower: 32.1%

Higher/Lower Difference: 35.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.9%

Average For “Higher” Responses: 68.2%

Average For “Lower” Responses: 60.9%

Higher/Lower Difference: 7.3%

Responses Submitted This Week: 57

26-Week Average Number of Responses: 50.1

TimingResearch Crowd Forecast Prediction: 62% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 65.8% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 1.36% Higher for the week. This week’s majority sentiment from the survey is 67.9% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 13 times in the previous 245 weeks, with the majority sentiment being correct 62% of the time, with an average S&P500 move of 0.23% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting an 62% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 52.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• According to research done by tastytrade; the S&P performs positively 63% of the time during triple witching. This along with current market strength & the market’s current penchant to ignore the possibility for increased rates & tariffs, seems to indicate a higher close by week’s end.

• Trump getting better trade deals.

• Dividends of 3M Apple were good I think

• Chart pattern suggests /ES will trade above 2807

• potential good new about north korea

• The ECB & BOJ will maintain a loose money policy. The FOMC will raise interest rates the expected amount & will be dovish in their economic assessment. Singapore will go well but only be a political show. Monthly options will expire. Since the market will get some answers that will provide more certainty than it previously had, although still uncertain, the market will react bullishly to the increased level of Central Bank clarity. Amidst the price action, the market will continue to rise.

• Market momentum.

• Fear money leaving Europe .

• The summit that is happening right now and the positive upswing the economy is in.

• elliot wave

• Elliott Wave 5

• S&P closed Friday at its weekly high; momentum still looks upward. Financials look ready to move upward, which would help the S&P.

• Economy currently is doing alright. The stock market traditionally looks at positive side of the state of affairs, while overlooking negative side. The stock market also overlooks any potential negative long term effects of economic policies. The market definitely has a optimistic bias toward events.

• investors are watching the world political leaders with anticipation hopeful that the outcome will be positive for global economy with united states leading

• Just below resistance, but bullish weekly candle last week closing at its high.

• Good news.

• Momentum towards earnings. Interest rate hike factored in.

• Markets are coming off from a lower low and trying to hit all time highs

• should be a volatile week

• Martin Armstrong

• Uptrend cintinues..

• Oil starts heading up. So up goes the markets. Watching 2750 support and expecting break up and out of 2780 to continue. Oil co tinues its basing and moves towards 66.80

“Lower” Respondent Answers:

• tariffs

• Poor reaction to the G-7 outcome and a disappointment from the meeting with North Korea

• graph shows top of channel for now. must hedge all trades

• Seasonality and technical.

• cautious optimism

• Bad news from G7 meeting and N. Korea summit

• Market is currently overbought and needs to back and fill.

• Market up major stocks down

• Summer building a top

• It looks like exhausted and profit taking

• dd

Question #4. What are your primary trading and/or investing goals for the 2nd half of 2018?

• Bullish trading

• Make money

• To make an income

• stocks and to beat S&P

• options hedging puts and calls

• 20%

• Consistancy

• To recuperate losses of FEB March

• Safty

• —-Monthly income thro’ options —-dividend growth stocks w/ 2-4 investment term — learn more about short term trading- using more complex orders to capture shorter term gains & stop loss limits for limiting losses.

• make money

• Profit

• Avoid drawdowns..

• Continued ~3.5% gains / month

• Being positive

• Continue successful growth.

• 2% RISE

• With the market rising now on the same news that caused it to fall previously, my goal is to reevaluate how much risk I want to take prior to the next manic depressive move. I’ve trimmed my expectation now to only 40% of the gains that I thought were possible in January.

• Beat the S&P.

• income investment

• Continue to do as during the 1st half. Cntinue to learn and reduce mistakes more.

• Preserve capital in front of volatile announcements or happenings.

• Be in the market and try to make use of fundamentals with use of technical direction

• Make the plan. Stick to the plan. Lose the bad habits!

• To sell a stock I’ve owned since last summer

• Minimum 30% up.

• I am cautiously optimistic so I will maintain about 65% in options and the rest in cash.

• Take profits more often

• I plan to add funds a little at a time any time the market is down, because I feel confident that eventually it will up and I can get returns on the invested funds.

• Avoiding any significant drawdowns

• Increase daily PnL target by $200

• Broaden trading strategies.to be better able to adapt to changing circumstances be it the market, health or personal life style choices.

Question #5. Additional Comments/Questions/Suggestions?

• Make money with survey

• There may be a more equitable distribution of wealth in the world. some countries dump and dump their products into poor countries thereby killing infant indigenous industries in its infancy. Spreading wealth.does not decrease prosperity of the rich. it rather increases consumption of the poor thereby bringing social harmony and political unity

• Thanks great service brother

• What sectors are going to gain in 2H. What resources do U use to trade/invest more profitably ? What options strategies do U use most often & why ?

• Silver wowed last week. COT looks bullish. May drag gold along.

• I hope that the FBI IG reveals the details and the proof of what has been obvious for the last two years and that AG Sessions goes back to work. We all are sorry that Charles Krauthammer is near death and will be gone soon. His lust for life, his courage, his dignity dealing with his misfortune, and his intellect are an inspiration to us all and should underscore how lucky we are to be sound of body and to see what is possible if we don’t give up.

• The midterm elections will tell a lot. Hedge your investments.

• Re: #4: It not just about the money. Some traders seek to maximize profits while others may seek to minimize the need for adjustments.Both approaches have value. However, combining the two is the real goal! zzz

Join us for this week’s shows:

Crowd Forecast News Episode #184

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 11th, 2018

– 1PM ET (10AM PT)

Guests:

– Jim Kenney of OptionProfessor.com

– Jane Gallina of SeeJaneTrade.com

Moderator:

– Michael Filighera of LogicalSignals.com

Analyze Your Trade Episode #38

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 12th, 2018

– 4:30PM ET (1:30PM PT)

Guests:

– Christian Fromhertz of TribecaTradeGroup.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

Moderator:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

Partner Offer:

See The Hottest Stocks For Free

Did you expect Adobe (ADBE) & Netflix (NFLX) to start roaring higher once the new year began?

Financhill did. Click here to learn more.

Crowd Forecast News Report #245

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060318.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 4th to June 8th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 65.8%

Lower: 34.2%

Higher/Lower Difference: 31.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.5%

Average For “Higher” Responses: 70.4%

Average For “Lower” Responses: 61.9%

Higher/Lower Difference: 8.5%

Responses Submitted This Week: 42

26-Week Average Number of Responses: 50.0

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 64.6% Higher, and the Crowd Forecast Indicator prediction was 54% Chance Higher; the S&P500 closed 1.09% Higher for the week. This week’s majority sentiment from the survey is 65.8% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 12 times in the previous 244 weeks, with the majority sentiment being correct 58% of the time, with an average S&P500 move of 0.13% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting an 58% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 67.5%

Overall Sentiment 52-Week “Correct” Percentage: 70.4%

Overall Sentiment 12-Week “Correct” Percentage: 61.9%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• first week of the month whem401k money flows in.

• On Weekly Chart Timeframe, I see an uptrend doji candlestic pattern at level of support

• Trade war is fake news at its obvious peak. The back and forth will continue to swing higher and lower wit a mean of generally higher. Gold and oil doing their dance for now.

• break above resistance

• I feel like the strength of the market has overcome a myriad of systemic obstacles

• good economic statistics

• Employment figures

• S&P bounced, and closed near its week’s high on Friday, helped by a positive jobs report. The momentum favors the bulls at this point.

• The good news that turned the market around last week will have a small but positive carry thru this coming week

• constructive pause, higher lows

• Weekly averages (DOW and S&P) have been moving slowly in an up direction.

• The market will never go down

• DIA trending turns up…

“Lower” Respondent Answers:

• S&P500 is at the top of its recent range (~2700 – ~2740). If it breaks to the upside, then further gains can be expected. However, with trade war rhetoric back in focus, I’m looking for the S&P500 to stay range bound this week.

• Summer sell off began 2 weeks ago

• Trade Wars. US economy overheating and will cause oversupply.

• Sell in May and go away.

• The downside correction will not be complete until there is a selling climax. Just get me out.

• Erraticness of Administrations policies is starting to sink in andf it is NOT good for the markets

• poor momentum and breadth

• I believe the international trade conflict could have a bearish effect on the S&P

• Trump’s tariffs

• trading war

Question #4. Which indicator influences your trading the most?

• EMA

• No one indicator on its own influences my trading. However, if I had to pick & use only one; I’d probably go with Stochastics.

• Volume

• RSI

• Price action

• Fibonacci ratios

• News and earnings.

• Rsi7 and the nyse tick

• previous day’s change along with volume, particularly institutional

• elliott wave theory

• Elliott Wave

• Dow and other indictors up or down.

• volume

• Price action; also support/resistance areas.

• ADX

• Gold

• the oil stocks

• PRICE ACTION

• MACD

• Moving averages and volume.

• chaikin oscillator

• adx

• volume

• Slow stochastics

BONUS #1: Do you regularly listen to or watch any financial, investing, or trading-related web shows or podcasts (besides the TimingResearch shows)?

BONUS #2: Which shows or podcasts do you watch or listen to?

• tastytrade

• Cnbc. Tfnn

• MacroVoices

• https://Investing.com

• TimingResearch, Jim Craemer, BNN

• Fox.

• CNBC——all day

• depends

• cnbc in morning and power lunch

• TheoTrade nightly update

BONUS #3: Which platforms or apps do you use to watch or listen to the shows (e.g. YouTube, Stitcher, iTunes, etc.)?

• IPAD / Bob the Trader

• Youtube

• iTunes

• https://Investing.com

• Google, youtube, wherever they’re forecast.

• Ninja Trader with Decision Trader

• youtube

• tv

• You Tube

Question #5. Additional Comments/Questions/Suggestions?

• Price is King

Join us for this week’s shows:

Crowd Forecast News Episode #183

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 4th, 2018

– 1PM ET (10AM PT)

Guests:

– Anka Metcalf of TradeOutLoud.com

– Neil Batho of TraderReview.net

– John Thomas of MadHedgeFundTrader.com

Moderator:

– Rob Hanna of InvestiQuant.com

Analyze Your Trade Episode #37

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 5th, 2018

– 4:30PM ET (1:30PM PT)

Guests:

– Larry Gaines of PowerCycleTrading.com

– Jim Kenney of OptionProfessor.com

Moderator:

– Dean Jenkins of FollowMeTrades.com

Partner Offer:

See The Hottest Stocks For Free

Did you expect Adobe (ADBE) & Netflix (NFLX) to start roaring higher once the new year began?

Financhill did. Click here to learn more.

Crowd Forecast News Report #244

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport052818.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (May 29th to June 1st)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 64.6%

Lower: 35.4%

Higher/Lower Difference: 29.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.9%

Average For “Higher” Responses: 64.8%

Average For “Lower” Responses: 66.9%

Higher/Lower Difference: -2.1%

Responses Submitted This Week: 51

26-Week Average Number of Responses: 50.4

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.1% Lower, and the Crowd Forecast Indicator prediction was 87% Chance Higher; the S&P500 closed 0.51% Lower for the week. This week’s majority sentiment from the survey is 64.6% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 24 times in the previous 243 weeks, with the majority sentiment being correct 54% of the time, with an average S&P500 move of 0.40% Lower for the week (one of those rare circumstances where the S&P500 moved higher more frequently but the overall average was negative). Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting an 54% Chance that the S&P500 is going to move Higher this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.2%

Overall Sentiment 52-Week “Correct” Percentage: 51.0%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%